Garage Door Operators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434163 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Garage Door Operators Market Size

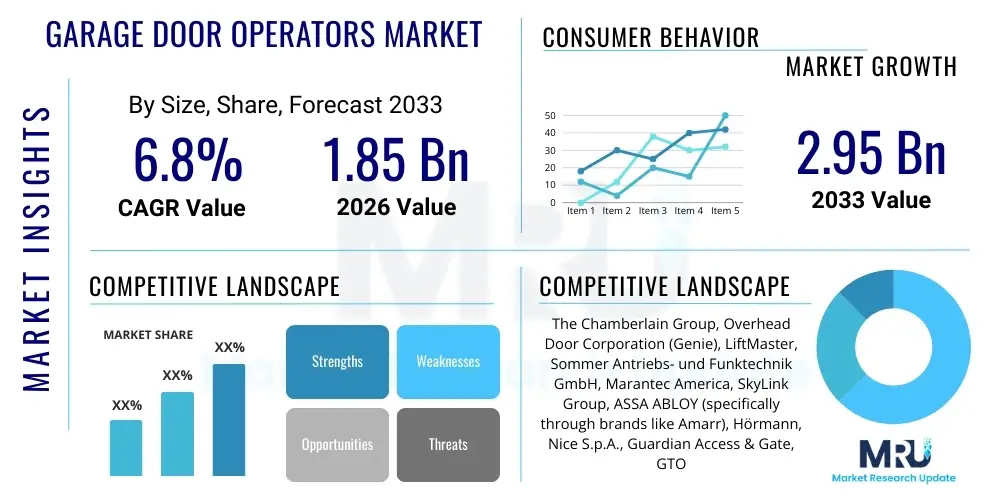

The Garage Door Operators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2033.

Garage Door Operators Market introduction

The Garage Door Operators (GDO) Market encompasses the manufacturing, distribution, and installation of motorized systems designed to automate the opening and closing of garage doors, primarily in residential, commercial, and industrial settings. These systems traditionally relied on chain drives or belt drives but have increasingly incorporated advanced technologies such as DC motors for quieter operation, sophisticated security protocols, and smart home connectivity. The fundamental shift driving market evolution is the integration of IoT and remote monitoring capabilities, transforming a simple mechanical function into a key component of modern building automation. This evolution addresses growing consumer demand for convenience, enhanced security features, and seamless integration with existing smart ecosystems, particularly in developed economies experiencing rapid adoption of connected infrastructure.

Products within this market range widely, catering to different door types, sizes, and operational requirements. Residential applications typically prioritize safety sensors, noise reduction (belt drives), and smartphone control, facilitating features like remote access granting and package delivery management. Commercial and industrial segments, conversely, focus heavily on durability, high cycle ratings, speed of operation, and robust security suitable for high-traffic environments, such as warehousing facilities and loading docks. Key applications span across new construction projects, renovation and replacement markets, and specialized industrial sectors requiring stringent access control, thereby ensuring sustained demand across various economic cycles.

The principal driving factors accelerating market expansion include stringent regulatory requirements concerning safety standards, particularly the mandated use of photoelectric sensors and auto-reverse mechanisms in many regions. Furthermore, the global proliferation of smart homes, coupled with increasing disposable incomes in emerging markets, fuels the demand for premium, feature-rich operators. The benefits associated with modern GDO systems extend beyond mere automation; they offer improved energy efficiency, heightened perimeter security through integrated encryption and rolling code technology, and considerable convenience, positioning GDOs as essential assets in contemporary property development and infrastructure planning.

Garage Door Operators Market Executive Summary

The Garage Door Operators Market is experiencing robust expansion, fundamentally driven by technological advancements that prioritize connectivity, safety, and energy efficiency. Business trends indicate a strong move toward product differentiation through smart features, leveraging cloud connectivity, integration with voice assistants, and personalized access control. Key players are focusing intensely on mergers and acquisitions to consolidate market share and acquire specialized technology firms focusing on AI-driven diagnostics and predictive maintenance capabilities. The overall market trajectory is upward, supported by steady global construction activity, particularly in residential sectors seeking automated security solutions, leading to increased investment in DC motor technology over traditional AC units due to superior performance characteristics and reduced noise profiles.

Regional trends highlight North America and Europe as mature markets characterized by high penetration rates and strong demand for premium, smart, and energy-efficient operators, adhering to stringent regional safety standards (e.g., UL standards). In contrast, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid urbanization, significant infrastructure investment, and rising middle-class disposable incomes, particularly in countries like China and India. This regional growth is characterized by a high volume demand for reliable, cost-effective solutions, though the adoption of smart features is quickly catching up, shifting the manufacturing supply chain focus toward high-volume, standardized, and increasingly connected products to meet the evolving consumer expectations across diverse geographies.

Segment trends underscore the dominance of the residential segment due to the sheer volume of new housing and replacement needs, with belt drive operators gaining prominence over chain drives due to lower noise levels. From a technology perspective, Wi-Fi and Bluetooth-enabled operators are becoming standard offerings, shifting the focus of competition from mechanical reliability to digital ecosystem integration and user experience. Commercial and industrial segments are witnessing growth driven by increased focus on logistics efficiency, demanding heavy-duty operators with advanced safety interlocks and sophisticated integration into facility management systems (FMS). The convergence of software and hardware is creating opportunities for subscription-based services related to monitoring and maintenance, influencing long-term revenue models.

AI Impact Analysis on Garage Door Operators Market

User queries regarding AI's impact on Garage Door Operators center on how artificial intelligence will enhance security, improve operational reliability, and facilitate predictive maintenance, fundamentally transforming the user-product interaction. Common questions address concerns about cybersecurity risks associated with highly connected, AI-managed devices, the practical use of machine learning for usage pattern analysis, and the potential for AI algorithms to detect safety hazards before they cause incidents. Consumers and industry professionals alike seek clarity on how AI integration justifies the higher cost of advanced operators, expecting significant improvements in longevity and personalized access management that moves beyond simple remote control functions. The analysis suggests a strong anticipation for AI to move GDOs from reactive devices to proactive, intelligent components of smart infrastructure.

The integration of AI algorithms profoundly enhances the operational efficiency and security profile of modern garage door operators. Machine learning models analyze historical operational data, including cycle counts, torque requirements, and environmental variables (temperature, humidity), enabling the operator to optimize its closing and opening speeds dynamically and adjust power consumption accordingly. This optimization reduces mechanical stress, significantly extending the lifespan of internal components such as springs, gears, and motors, translating directly into reduced maintenance costs for end-users. Furthermore, AI facilitates real-time performance diagnostics, allowing the system to flag subtle deviations in operational metrics—such as slight increases in current draw or unusual motor sounds—that indicate nascent mechanical failure, prompting proactive service alerts.

Beyond predictive maintenance, AI is critically influencing security and user experience. AI-driven video analytics, often integrated into the accompanying smartphone applications, utilize computer vision to differentiate between authorized vehicles, pedestrians, and large objects, reducing false positives from safety sensors while ensuring that the door responds correctly in emergencies. In terms of access control, machine learning can learn and verify complex user patterns and geofencing behaviors, ensuring the door only operates when a specific, verified pattern of events occurs (e.g., proximity of a specific user’s vehicle combined with a time-of-day constraint). This intelligent contextual awareness elevates security far beyond traditional rolling code encryption, making the operator a truly intelligent access point managed by complex, adaptive algorithms.

- AI-powered Predictive Maintenance: Machine learning algorithms analyze operational data (e.g., motor vibration, speed deviations) to forecast potential mechanical failures, significantly reducing unplanned downtime.

- Enhanced Security Protocols: Utilization of deep learning models for facial recognition and anomaly detection near the door, distinguishing authorized access from threats.

- Dynamic Torque Adjustment: AI optimizes motor performance based on door weight fluctuations, environmental resistance, and wear levels, ensuring smooth and energy-efficient operation.

- Contextual Access Management: Integration of geo-fencing and usage pattern analysis to automatically trigger or restrict operation based on user context, improving convenience and safety.

- Cybersecurity Resilience: AI modules detect and mitigate sophisticated cyber-attacks targeting the GDO's wireless communication interface or cloud connection points.

- Voice and Natural Language Processing Integration: Improved responsiveness and reliability when integrated with smart home voice assistants through advanced NLP techniques.

DRO & Impact Forces Of Garage Door Operators Market

The Garage Door Operators Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), significantly influenced by pervasive impact forces stemming from technological shifts and regulatory environments. The primary drivers are the expanding global smart home ecosystem, which mandates connected access solutions, and increasingly stringent global safety regulations requiring advanced photo-eye sensors and mandatory safety reversal mechanisms. These drivers compel manufacturers to invest heavily in R&D to deliver high-specification products that meet convenience demands while adhering to strict safety compliance, ensuring market acceleration.

Restraints primarily revolve around the high initial cost associated with premium, smart, and feature-rich GDOs, which can deter price-sensitive consumers, particularly in developing economies. Furthermore, the complexity of integrating advanced operators with diverse existing smart home platforms presents significant interoperability challenges, occasionally leading to poor user experience and slowing adoption rates for cutting-edge technology. Market saturation in developed regions also limits growth primarily to replacement cycles or renovations, rather than high volume new installations, necessitating constant product innovation to stimulate demand.

Opportunities for growth are abundant in leveraging the shift towards battery backup systems, driven by power outage concerns, and expanding into the vast, untapped market for commercial and industrial high-speed, high-cycle operators that require specialized automation solutions. The development of robust, secure, and easily integrated operators that utilize open-source protocols will significantly enhance market penetration. Impact forces—such as rapid decreases in sensor technology costs and the continued miniaturization of electronic components—make sophisticated features more accessible and affordable, pushing the market toward standardized smart connectivity and reinforcing the drive for continuous product improvement and market differentiation.

Segmentation Analysis

The Garage Door Operators Market segmentation provides a structured view of the diverse product landscape, differentiating market dynamics based on mechanism type, drive technology, application scope, and operational voltage. Understanding these segments is crucial for strategic planning, as it highlights variations in consumer preferences, pricing elasticity, and regional adoption rates. The market is broadly divided across residential, commercial, and industrial end-users, each demanding distinct levels of operational strength, durability, and feature sets, influencing the choice between different drive mechanisms like belt, chain, and screw drives, and voltage requirements.

Drive mechanism segmentation is key, with belt drives dominating the residential sector due to their superior noise reduction characteristics and smooth operation, justifying a premium price point. Chain drives, while noisier, remain popular in budget-conscious segments and heavy-duty applications due to their proven reliability and robust power transmission capabilities. Screw drives, often used for specific door types, represent a niche but stable market. This differentiation directly impacts manufacturing complexity and material sourcing, requiring specific supply chain management strategies for each technology.

Furthermore, segmentation by application is critical for market focus. The residential sector prioritizes aesthetic integration, smart features, and safety, while the commercial sector focuses on high cycle rating (e.g., 20+ cycles per hour) and robust security integration. The industrial sector demands heavy-duty performance, weather resistance, and integration with large-scale logistical control systems. These distinct needs necessitate specialized product development pipelines, from motor size and torque output to the robustness of the electronic control unit and communication protocols, ensuring the market caters precisely to varied functional requirements.

- By Drive Technology:

- Belt Drive Operators (Preferred for quiet residential use)

- Chain Drive Operators (Robust, heavy-duty, cost-effective)

- Screw Drive Operators (Niche market, specific door applications)

- Jackshaft/Side Mount Operators (Used where ceiling space is restricted)

- By Application:

- Residential (Focus on convenience, safety, and smart integration)

- Commercial (Focus on high cycle rating, security, and access control)

- Industrial (Focus on extreme durability, high torque, and integration with logistics systems)

- By Voltage:

- AC Operators (Traditional, cost-effective)

- DC Operators (Energy efficient, quieter, better battery compatibility)

- By Connectivity:

- Smart Operators (Wi-Fi/Bluetooth enabled, IoT compatible)

- Standard Operators (Non-connected)

Value Chain Analysis For Garage Door Operators Market

The value chain for the Garage Door Operators Market begins with upstream activities, focusing on the sourcing of critical raw materials and specialized components. This stage involves the procurement of high-grade steel and aluminum for tracks and structural components, specialized plastics and resins for housing and remote controls, and sophisticated electronic components, including microcontrollers, power transistors, sensors (photoelectric and pressure), and robust motors (AC and DC types). Effective upstream management is critical for cost control and ensuring material quality, especially given the global volatility in component prices and the necessity for certified, high-reliability safety sensors compliant with international standards, dictating long-term manufacturing resilience.

Midstream activities encompass the manufacturing, assembly, and testing processes. Manufacturers often specialize in proprietary motor and gearing designs to achieve differentiation in noise reduction and durability. The assembly phase involves integrating complex electronics (control boards) with mechanical components, followed by rigorous testing for cycle life, torque performance, and compliance with strict safety standards such as UL 325. Distribution channels represent the core downstream linkage, involving a mix of direct and indirect sales. Direct channels often target large-scale developers and commercial projects, providing customization and specialized installation services. Indirect channels utilize extensive networks of authorized dealers, professional installers, and mass retail outlets (DIY stores and home improvement centers), crucial for reaching the residential replacement market efficiently.

Distribution is strategically critical; the reliance on professional installation often means the installer or authorized dealer acts as the primary gatekeeper for product recommendation, making channel loyalty paramount. The indirect channel through installers maintains significant influence due to the technical nature of the installation and safety calibration required. Direct sales, though less frequent, are reserved for highly specialized industrial applications demanding bespoke solutions. Efficient logistics, minimizing damage during transport, and robust after-sales support—including digital diagnostics and warranty services—complete the value chain, driving customer satisfaction and ensuring long-term brand reputation and recurring revenue through replacement parts and service contracts.

Garage Door Operators Market Potential Customers

The potential customer base for the Garage Door Operators Market is highly diverse, categorized primarily across residential property owners, commercial enterprises, and industrial facility managers, each presenting unique demands and purchasing criteria. Residential end-users constitute the largest volume segment, encompassing both homeowners purchasing for replacement or upgrade purposes and new home buyers receiving integrated systems. These consumers prioritize convenience features, quiet operation (favoring belt drives), aesthetic design, and seamless integration with smart home ecosystems like Google Home, Amazon Alexa, or Apple HomeKit, often making the purchase decision based on brand reputation and installer recommendation.

Commercial potential customers include owners or managers of multi-family dwellings, small to medium enterprises (SMEs) utilizing warehouse facilities, and businesses requiring secured internal access points, such as corporate offices with dedicated underground parking structures. These buyers focus on reliability, high usage cycle ratings, robust security measures (e.g., restricted access features, heavy-duty locks), and centralized management capabilities that allow facility staff to monitor and control multiple operators remotely. For commercial applications, longevity and reduced maintenance downtime are crucial economic factors influencing procurement decisions and vendor selection.

Industrial end-users represent the most demanding segment, including logistics companies, manufacturing plants, distribution centers, and port authorities. These customers require heavy-duty, high-speed operators capable of enduring extreme environmental conditions and continuous, rapid cycling. They demand specialized safety interlocks, integration with advanced warehouse management systems (WMS), and compliance with industrial safety protocols. The purchase decision in this segment is driven by total cost of ownership (TCO), operational speed (critical for logistics efficiency), and the capability of the system to integrate flawlessly into complex industrial automation environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | CAGR 6.8 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Chamberlain Group, Overhead Door Corporation (Genie), LiftMaster, Sommer Antriebs- und Funktechnik GmbH, Marantec America, SkyLink Group, ASSA ABLOY (specifically through brands like Amarr), Hörmann, Nice S.p.A., Guardian Access & Gate, GTO Access Systems, Dalian Forsee Electric Co., Ltd., B&D Doors & Openers, Ryterna, ADAMS Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Garage Door Operators Market Key Technology Landscape

The technology landscape of the Garage Door Operators Market is rapidly evolving, moving beyond simple mechanical actuation toward highly integrated electronic and software-driven systems. A significant technological shift involves the transition from traditional AC motor technology to modern DC motors, which are inherently more energy efficient, quieter, and offer soft start/stop capabilities, significantly reducing wear and tear on mechanical components. This transition also facilitates easier integration with battery backup systems, a feature increasingly demanded by consumers for continued operation during power outages. Furthermore, rolling code technology, continuously evolving to combat sophisticated hacking attempts, remains a foundational security standard, ensuring that unauthorized remote access is minimized by generating a unique code for every operation.

Connectivity and smart integration represent the most disruptive technological advancements. Modern GDOs incorporate Wi-Fi and Bluetooth capabilities, allowing operators to be controlled, monitored, and diagnosed remotely via smartphone applications and cloud services. This connectivity facilitates crucial features such as remote access granting, status alerts (e.g., door left open notifications), and integration with broader smart home ecosystems using APIs and standard protocols like Z-Wave or Zigbee. The development of geo-fencing technology allows for automated door opening upon the user's approach, enhancing convenience while maintaining security integrity by verifying location and user identity through encrypted mobile communication.

Safety technology continues to advance, driven by regulatory mandates such as UL 325 in North America and EN 13241 in Europe. This includes sophisticated infrared photoelectric sensors that detect obstructions in the path of the closing door and pressure sensors that trigger immediate reversal upon contact. The latest innovations involve integrated video monitoring, often providing 1080p or higher resolution cameras embedded within the operator unit itself, allowing for real-time visual verification of the garage environment. Future technological breakthroughs are concentrated on applying artificial intelligence and machine learning to improve predictive maintenance algorithms and enhance the accuracy and speed of obstruction detection under varying environmental conditions.

Regional Highlights

- North America (United States and Canada): This region dominates the global GDO market in terms of technology adoption and value, characterized by high consumer spending on premium features, safety compliance, and smart home integration. The U.S. market, heavily influenced by UL 325 safety standards, exhibits strong demand for DC belt drive operators with advanced IoT features. Growth is largely sustained by replacement cycles, remodeling activities, and a high concentration of key market players ensuring competitive innovation and extensive distribution networks.

- Europe (Germany, UK, France): Europe represents a mature market focusing heavily on energy efficiency and architectural integration. Demand is strong for sophisticated operators that comply with stringent European norms (EN 13241) regarding force limits and safety features. Germany and the UK are key markets, showing a strong preference for high-quality, durable components and excellent after-sales support, with significant traction observed in jackshaft operators where ceiling space is limited.

- Asia Pacific (China, India, South Korea): APAC is projected to be the fastest-growing region, driven by rapid urbanization, massive residential and commercial construction booms, and increasing disposable incomes enabling middle-class adoption of automated solutions. While cost-effectiveness remains a consideration, the demand for smart and connected operators is accelerating, particularly in metropolitan areas. China's enormous manufacturing base also positions it as a critical component supplier and a large domestic consumer market.

- Latin America (Brazil, Mexico): The market in Latin America is driven by security concerns, leading to increased adoption of automated access control systems in both residential and multi-family structures. Growth is steady, although often constrained by economic volatility and reliance on imported technology. Demand centers on reliable, robust chain-drive systems, with a gradual uptake in basic smart features in urban centers.

- Middle East and Africa (MEA): Growth in the MEA region is segmented, with high-value construction projects in the GCC countries (e.g., UAE, Saudi Arabia) driving demand for premium, heavy-duty commercial and industrial operators resistant to extreme desert climate conditions. African markets, particularly South Africa, show foundational growth driven by basic security needs, often favoring durable, standardized products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Garage Door Operators Market.- The Chamberlain Group Inc. (LiftMaster, Chamberlain, Merlin)

- Overhead Door Corporation (Genie)

- Hörmann Group

- ASSA ABLOY Group (Amarr)

- Marantec America Corporation

- Sommer Antriebs- und Funktechnik GmbH

- Nice S.p.A.

- Guardian Access & Gate

- SkyLink Group

- Dalian Forsee Electric Co., Ltd.

- B&D Doors & Openers (Division of DuluxGroup)

- FAAC S.p.A.

- CAME S.p.A.

- GTO Access Systems

- Ryterna

- Seip UK Limited

- FlexiForce Group

- Tormax (Tormatic GmbH)

Frequently Asked Questions

Analyze common user questions about the Garage Door Operators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between Belt Drive and Chain Drive Garage Door Operators?

Belt drive operators utilize a rubber belt reinforced with steel, providing exceptionally quiet operation suitable for residential garages located near living spaces, justifying a higher price point. Chain drive operators use a metal chain, offering superior durability and lifting capacity required for heavier doors, making them ideal for high-cycle commercial use or budget-conscious residential applications, though they generate more noise during operation.

How is IoT and smart technology integrating into modern Garage Door Operators?

IoT integration allows GDOs to connect via Wi-Fi or Bluetooth to cloud services, enabling features such as remote monitoring and control via smartphone apps, real-time status alerts (e.g., door open/closed), geofencing for automated operation, and integration with voice assistants like Alexa and Google Assistant, significantly enhancing convenience and security management.

What regulatory safety standards primarily govern the Garage Door Operators Market?

In North America, the primary governing standard is UL 325, which mandates critical safety features, including auto-reverse functionality triggered by both contact (pressure sensing) and non-contact (photoelectric sensor) detection of obstructions. In Europe, the EN 13241 standard dictates force limitation, operational safety, and mechanical integrity requirements for doors and operators, ensuring public safety and reliable performance.

What are DC motors replacing AC motors in the residential GDO segment?

DC motors are replacing traditional AC motors because they offer significant benefits, including quieter operation, smoother soft start and soft stop motion which reduces component wear, enhanced energy efficiency, and inherent compatibility with battery backup systems, ensuring continued functionality during electrical power outages, a high-value feature for consumers.

How does AI contribute to the longevity and maintenance of Garage Door Operators?

AI utilizes machine learning algorithms to analyze continuous operational data, such as motor current draw and cycle timing. By detecting subtle deviations from normal performance, AI systems can predict impending mechanical failures or component fatigue (e.g., worn gears or failing springs) before they occur, enabling proactive, scheduled maintenance and maximizing the operator's total lifespan.

What is the current trend regarding security features in GDO technology?

Current security trends involve moving beyond traditional rolling code encryption to include multi-factor authentication for app access, advanced encryption standards for communication between the operator and the cloud, and integration of AI-powered video surveillance within the operator unit. These layers ensure the garage access point remains highly resistant to unauthorized remote access and physical intrusion.

Why are Jackshaft or Side Mount Operators gaining popularity in certain markets?

Jackshaft operators are gaining popularity where overhead clearance is limited or when the garage ceiling space must remain clear for storage systems, lifts, or unique architectural designs. These operators mount on the wall adjacent to the garage door torsion bar, offering a space-saving solution, particularly in European and dense urban residential markets.

What role do professional installers play in the Garage Door Operators Value Chain?

Professional installers are critical gatekeepers in the value chain, as they not only install the heavy, complex equipment but also ensure strict compliance with safety regulations (like sensor calibration). They often act as the primary recommendation source for homeowners, making their training, certification, and loyalty essential for manufacturer market penetration and brand credibility.

How does the residential replacement market differ from the new construction market?

The new construction market focuses on standardized, high-volume operator models selected by builders based on cost efficiency and basic compliance. The residential replacement market, conversely, is driven by homeowner choice, focusing on upgrades to advanced features such as smart connectivity, battery backup, extreme quietness (belt drives), and enhanced security, often leading to sales of higher-margin products.

What challenges does the Garage Door Operators Market face regarding cybersecurity?

The primary cybersecurity challenge stems from the increasing connectivity of GDOs (IoT). Highly connected devices are vulnerable to hacking, potentially allowing unauthorized remote access to the home. Manufacturers must continuously update firmware and use robust, multi-layered encryption protocols to mitigate risks associated with cloud connectivity and exposed API vulnerabilities.

What impact does the material cost volatility have on GDO manufacturing?

Material cost volatility, particularly in steel, aluminum, and crucial electronic components (microchips and sensors), directly impacts manufacturing margins and final product pricing. Manufacturers must employ robust hedging strategies and diversify their supply chains regionally to mitigate risks and maintain competitive pricing strategies across different market segments.

Describe the market potential for high-speed industrial door operators.

High-speed industrial operators represent a significant growth opportunity, particularly driven by the e-commerce boom and the need for optimized logistics and faster throughput in distribution centers and manufacturing plants. These operators require extremely high cycle ratings, precise speed control, and flawless integration with sophisticated warehouse management systems (WMS).

How are environmental concerns influencing product development in GDOs?

Environmental concerns drive development toward energy-efficient DC motors and materials sourcing that includes sustainable components. Manufacturers are also focusing on optimizing standby power consumption (phantom load) and ensuring their products meet increasingly stringent energy consumption mandates set by various governmental and international environmental agencies.

What factors are driving the strong growth of the APAC GDO market?

The APAC GDO market growth is fueled primarily by unprecedented rates of urbanization, substantial investments in residential and commercial infrastructure projects, and the rapid expansion of the middle class whose growing disposable income allows for the adoption of automated and convenient home security solutions.

What differentiates the commercial GDO market from the industrial GDO market?

The commercial market generally involves standard-sized doors requiring high cycle duty (e.g., parking garages) and focuses heavily on access control and security protocols. The industrial market, however, involves extremely large, heavy doors (e.g., loading docks, airplane hangars) demanding heavy-duty, high-torque operators engineered for resilience against harsh environmental conditions and seamless integration with complex material handling systems.

Explain the concept of 'soft start/stop' in modern garage door operators.

Soft start/stop is a feature enabled by DC motors that allows the operator to gradually accelerate the door at the beginning of the cycle and slowly decelerate it before closing or opening. This controlled motion minimizes noise, reduces mechanical strain on the door and operator components, and prolongs the lifespan of the entire system.

How important is the integration with video monitoring in new GDO models?

Integrated video monitoring is a significant differentiator, moving the GDO beyond simple access control to a comprehensive security device. It allows users to visually verify the garage status, monitor package deliveries, and record unauthorized activity, providing an essential layer of visual security confirmation directly accessible via the smartphone application.

What is the competitive landscape like concerning aftermarket services?

The competitive landscape in aftermarket services is shifting towards digital diagnostics and predictive maintenance subscriptions. Key players offer cloud-based health reports and firmware updates remotely, creating recurring revenue streams and strengthening customer loyalty through enhanced product lifespan and minimized service call frequency, moving away from purely reactive repairs.

What technological feature primarily addresses security risks related to remote controls?

Rolling code technology is the primary feature addressing remote control security risks. It ensures that the remote transmitter generates a new, unique access code every time the button is pressed. If an unauthorized individual captures the signal, that code becomes immediately useless after the intended operation, preventing code interception and replay attacks.

How does the total cost of ownership (TCO) influence purchasing decisions in the industrial segment?

In the industrial segment, TCO is far more critical than initial purchase price. Decisions are based on the operator's expected lifespan, reliability, energy consumption, and projected maintenance costs (including downtime). Industrial managers prefer systems with higher durability and lower likelihood of failure, even if the upfront capital expenditure is higher, to minimize operational disruption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager