Garbage Cans Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433291 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Garbage Cans Market Size

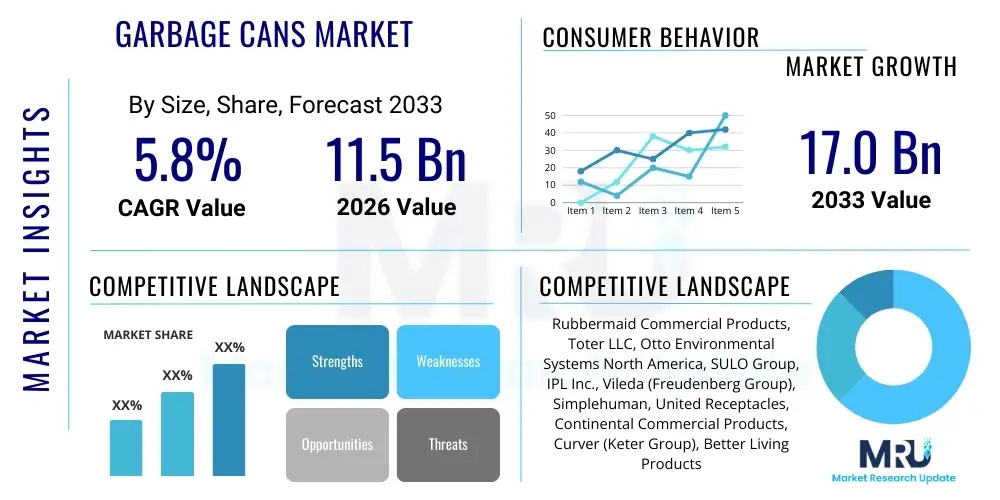

The Garbage Cans Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $11.5 Billion USD in 2026 and is projected to reach $17.0 Billion USD by the end of the forecast period in 2033.

Garbage Cans Market introduction

The Garbage Cans Market encompasses the global trade of containers specifically designed for the collection, temporary storage, and transportation of waste materials. These essential products, ranging from small residential pedal bins to large municipal wheeled carts, are fundamental components of modern waste management infrastructure. Product innovation is heavily focused on improving durability, enhancing aesthetics, integrating smart technology for optimization, and promoting sustainability through recycled or biodegradable materials. The primary function remains waste containment, crucial for hygiene and public health, but evolving consumer and regulatory demands are pushing manufacturers toward higher-quality, specialized solutions for sorting and recycling.

Major applications of garbage cans span the entire socioeconomic landscape, including high-density residential complexes, sprawling commercial enterprises such as retail malls and corporate offices, robust industrial facilities requiring specialized hazardous waste containment, and extensive municipal collection systems. The benefits derived from these products are multi-faceted: they improve sanitation standards, facilitate source separation of recyclables, reduce environmental contamination risks, and significantly optimize the efficiency of waste collection routes when equipped with identification and tracking technologies. The market is characterized by a balance between cost-effectiveness for mass adoption and premium pricing for advanced, technologically integrated models.

Key driving factors accelerating market expansion include rapid global urbanization leading to increased municipal solid waste (MSW) generation, stringent governmental regulations enforcing mandatory waste separation programs, and a growing consumer awareness regarding environmental sustainability and proper disposal practices. Furthermore, technological advancements, particularly the proliferation of sensor-equipped and automatic/touchless bins, are enhancing user convenience and hygiene standards, especially post-pandemic. Infrastructure development in emerging economies, coupled with significant investment in automated waste collection systems, further cements the positive outlook for sustained market growth throughout the forecast period.

Garbage Cans Market Executive Summary

The Garbage Cans Market is poised for robust expansion, driven primarily by globalization of smart waste solutions and infrastructural modernization in emerging economies. Business trends indicate a strong shift towards durable, long-life products made from recycled content, aligning with the circular economy paradigm, while premiumization is observed in the residential segment due to demand for aesthetically pleasing, technologically advanced (sensor-operated) units. Regional trends highlight Asia Pacific as the fastest-growing market, propelled by rapid urbanization and large-scale government investment in municipal solid waste collection infrastructure. North America and Europe maintain dominance in terms of technology adoption, particularly in implementing smart bins equipped with IoT sensors for fill-level monitoring and route optimization, significantly improving operational efficiency for waste management contractors.

Segment trends reveal that the Wheeled Cans product type dominates the municipal and commercial sectors due to their large capacity and compatibility with automated lift systems, offering superior ergonomic and operational benefits. The Material segment sees Plastic (Polyethylene and Polypropylene) maintaining the largest share, favored for its cost-effectiveness, lightweight nature, and resistance to corrosion, though stainless steel retains its premium status in high-traffic commercial and medical environments where superior hygiene and fire resistance are paramount. The End-Use analysis confirms that the Residential sector contributes substantially to volume, whereas the Commercial and Municipal sectors drive value growth through the bulk purchase of higher-specification, durable containers.

Strategic insights suggest that manufacturers are increasingly focusing on mergers and acquisitions to consolidate market share and leverage specialized technologies, particularly in the realm of smart waste integration. Compliance with evolving environmental legislation, such as extended producer responsibility (EPR) schemes, is mandatory for sustained competitive advantage. The market remains competitive, with established players focusing on supply chain resilience and product diversification, ensuring they cater effectively to the divergent demands of low-cost, high-volume segments and specialized, high-margin smart waste solutions.

AI Impact Analysis on Garbage Cans Market

User queries regarding AI's influence in the Garbage Cans Market predominantly center on the potential for autonomous waste sorting, predictive maintenance for smart bins, and the overall optimization of waste collection logistics. Key concerns revolve around the cost of implementing AI-enabled infrastructure, data privacy issues associated with IoT sensors, and the tangible return on investment (ROI) for municipal entities adopting such sophisticated systems. Users are keenly interested in how AI algorithms can transform static garbage cans into proactive components of a smart city ecosystem, specifically through volume forecasting, identification of illegal dumping patterns, and dynamic route adjustments based on real-time fill-level data. The consensus expectation is that AI integration, particularly machine learning applied to sensor data, will significantly reduce operational costs and enhance sustainability outcomes by minimizing unnecessary collections and preventing overflow.

- AI-Powered Fill-Level Prediction: Utilizing machine learning algorithms on IoT data to accurately forecast when bins will reach capacity, enabling dynamic, need-based collection scheduling.

- Autonomous Waste Sorting Guidance: AI vision systems integrated into advanced recycling bins to identify material types and provide instant user feedback or automatic internal separation.

- Optimized Logistics and Routing: Implementing AI software to minimize collection routes, reducing fuel consumption, labor hours, and vehicular emissions.

- Predictive Maintenance: Analyzing sensor performance data to predict potential hardware failures in smart bins, reducing downtime and maintenance costs.

- Behavioral Data Analysis: Identifying waste generation trends across different demographics or commercial zones to inform better city planning and resource allocation strategies.

- Enhanced Security and Anomaly Detection: Using AI to monitor bins for unauthorized use, illegal dumping, or thermal anomalies (fire risk).

DRO & Impact Forces Of Garbage Cans Market

The Garbage Cans Market is fundamentally shaped by a critical balance of intrinsic demand drivers, logistical restraints, burgeoning technological opportunities, and macro-environmental impact forces. Drivers primarily revolve around increased global municipal solid waste generation, stringent regulatory mandates for waste segregation, and heightened urbanization rates. These factors create sustained, non-negotiable demand for efficient and compliant waste containment solutions. However, the market faces restraints such as the volatility in raw material prices, particularly plastics and metals, which impacts manufacturing margins, and the significant initial capital investment required for implementing sophisticated smart waste infrastructure, especially in cost-sensitive emerging markets. The competitive landscape characterized by the proliferation of low-cost, unbranded products also exerts downward pressure on pricing in standard segments.

Opportunities for growth are heavily vested in the ongoing integration of Internet of Things (IoT) technologies into bins, transforming them into smart receptacles that optimize collection logistics and contribute valuable data to city management systems. Furthermore, the global push towards sustainability offers substantial opportunities for manufacturers focusing on developing products made from certified recycled plastics, bio-based polymers, or durable modular designs suitable for repair and extended life. Government procurement contracts focusing on large-scale smart waste deployment represent a lucrative channel, encouraging innovation in connectivity and data management services bundled with the hardware.

The overarching impact forces influencing the market include global climate change mitigation efforts, which necessitate improved recycling rates and reduced landfill dependency, making high-quality sorting bins indispensable. Socio-political impact forces include mandatory public health regulations that drive demand for hygienic, touchless disposal solutions, a trend significantly amplified by recent global pandemics. Economic impact forces, specifically infrastructure spending and public sector budgets allocated to environmental services, determine the pace of smart bin adoption. Collectively, while raw material costs pose a short-term barrier, the long-term imperative for sustainable waste management strongly favors market expansion and technological sophistication.

Segmentation Analysis

The Garbage Cans Market segmentation provides a granular view of diverse product requirements across various end-use environments, reflecting different capacity, material, and technological needs. The market is fundamentally segmented by Product Type, Material, Capacity, and End-Use, each category exhibiting unique growth trajectories and competitive dynamics. This structural analysis is critical for manufacturers to tailor their product lines, marketing strategies, and distribution channels, ensuring optimal penetration into residential, commercial, and municipal segments. The increasing complexity of waste streams mandates specialized containers, driving the growth of high-specification and multi-compartment units designed explicitly for source separation and improved recycling efficiency, particularly in highly regulated Western markets.

- By Product Type:

- Standard (Manual Lift)

- Wheeled Cans/Carts

- Step-On (Pedal) Cans

- Sensor/Automatic (Touchless) Cans

- Recycling Stations/Multi-Compartment Bins

- By Material:

- Plastic (Polyethylene, Polypropylene)

- Metal (Stainless Steel, Galvanized Steel)

- Others (e.g., Wood, Composite Materials)

- By Capacity:

- Small (Under 10 Gallons / 40 Liters)

- Medium (10–30 Gallons / 40–120 Liters)

- Large (Over 30 Gallons / 120 Liters)

- By End-Use:

- Residential

- Commercial (Office, Retail, Hospitality, Healthcare)

- Industrial

- Municipal/Public Spaces

Value Chain Analysis For Garbage Cans Market

The value chain for the Garbage Cans Market begins with the upstream sourcing of raw materials, primarily various grades of plastic polymers (HDPE, LLDPE, PP) and metals (steel, stainless steel). Upstream analysis focuses on efficient procurement strategies, ensuring material quality, and managing supply chain risk associated with fluctuating commodity prices. Manufacturers specializing in high-quality wheeled carts (e.g., Toter, SULO) often integrate complex rotational molding or injection molding processes. The trend toward using recycled polymers necessitates establishing robust supplier relationships with recyclers to ensure a steady supply of post-consumer recycled (PCR) content, which is a key differentiator in environmentally conscious procurement bids.

Midstream activities involve core manufacturing, assembly (especially for wheeled and automatic units), quality control, and the integration of specialized components like pedal mechanisms, sensor units, and IoT communication devices. Large, multinational manufacturers benefit from economies of scale and standardized production lines. Crucially, branding, adherence to regulatory standards (e.g., EN 840 for mobile waste containers in Europe), and investment in durable, weather-resistant designs add significant value at this stage. The shift towards smart bins introduces technology developers and software providers as essential midstream partners, supplying the necessary embedded hardware and connectivity solutions.

Downstream analysis highlights the complexity of distribution channels, which vary significantly by end-use segment. For municipal and large commercial customers, direct sales and long-term procurement contracts are standard, often involving tenders and competitive bidding processes. Residential and small commercial distribution relies heavily on indirect channels, including major retail chains (both physical and e-commerce platforms like Amazon and specialized home goods retailers), institutional distributors, and wholesale suppliers. E-commerce has grown exponentially, favoring brands that offer aesthetic appeal and product convenience (e.g., Simplehuman). Logistics optimization is paramount due to the bulkiness of the finished product, making local manufacturing or regional warehousing critical for cost-effective delivery.

Garbage Cans Market Potential Customers

Potential customers for garbage cans are ubiquitous across all economic sectors, categorized primarily into four major segments: residential users, commercial enterprises, industrial entities, and governmental/municipal bodies. Residential buyers typically prioritize aesthetics, convenience (e.g., touchless operation, soft-close lids), and smaller capacity bins, often purchased through retail channels. The shift toward source separation necessitates multi-compartment bins for this segment. Commercial customers, including offices, restaurants, hotels, and retail outlets, require durable, fire-resistant, and frequently decorative or high-capacity containers that comply with specific health and safety codes.

The most substantial volume and value purchasers are often municipal and governmental bodies responsible for public waste collection and management infrastructure. These entities procure high volumes of standardized, robust wheeled carts designed for compatibility with automated collection vehicles (automated or semi-automated lifting mechanisms). Their purchasing decisions are heavily influenced by regulatory compliance, long-term durability (life cycle cost analysis), sustainability metrics (recycled content), and increasingly, integration capabilities with smart city technologies like RFID tags and IoT sensors. Industrial buyers require specialized containers capable of handling heavy-duty, often hazardous, or unique waste streams, emphasizing safety and regulatory compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $11.5 Billion USD |

| Market Forecast in 2033 | $17.0 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rubbermaid Commercial Products, Toter LLC, Otto Environmental Systems North America, SULO Group, IPL Inc., Vileda (Freudenberg Group), Simplehuman, United Receptacles, Continental Commercial Products, Curver (Keter Group), Better Living Products, Alpine Industries, iTouchless Housewares & Products, ZHEJIANG SENXING HOLDING GROUP, Suncast Corporation, Witt Industries, Geesinknorba Group, EKO Europe, Sterilite Corporation, Nexera, Rehrig Pacific Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Garbage Cans Market Key Technology Landscape

The technology landscape of the Garbage Cans Market has evolved beyond simple containment to focus intensely on connectivity, automation, and material science. The dominant technological advancement is the integration of Internet of Things (IoT) sensors, often ultrasonic or infrared, embedded in the bins to monitor fill-levels, track location via GPS, and detect parameters like temperature or material composition. This technology is foundational for smart waste management systems, enabling dynamic collection scheduling and significant operational cost reduction for municipalities. Adoption is highest in developed regions like Western Europe and North America, where regulatory pressure and labor costs necessitate efficiency gains through automation.

Furthermore, automation extends to the user interaction level through the proliferation of sensor-operated or "touchless" garbage cans, particularly prominent in residential and high-hygiene commercial environments such as healthcare and food service. These mechanisms utilize proximity sensors to automatically open and close lids, minimizing physical contact and enhancing sanitation standards, a trend that gained significant momentum following global health crises. Material science innovations are equally important, focusing on developing highly durable plastics (often virgin HDPE or PCR materials) that resist UV degradation, chemical damage, and extreme temperatures, thereby maximizing the asset lifespan necessary for municipal procurement contracts.

Another crucial technological development involves data management and communication protocols. Smart bins utilize low-power wide-area networks (LPWAN) like LoRaWAN or NB-IoT for cost-effective, long-range data transmission to centralized waste management platforms. This infrastructure allows for the application of advanced data analytics and AI algorithms to optimize collection routes in real-time. Moreover, the integration of Radio-Frequency Identification (RFID) and NFC tags into wheeled carts is standard practice, allowing municipalities to uniquely identify each bin, track collection frequency, and implement usage-based billing systems, thus promoting accountability and fairness in waste management services.

Regional Highlights

- North America: Characterized by high technological adoption and a strong focus on smart waste solutions. The US and Canada are major markets, driven by investment in automated collection systems and high demand for residential touchless and stainless steel bins. Regulations mandating specific bin standards (e.g., ANSI standards for wheeled carts) ensure a high-quality product requirement.

- Europe: This region is defined by rigorous environmental regulations, particularly regarding waste segregation and recycling mandates, driving strong demand for multi-compartment and specialized recycling bins. European countries, led by Germany, France, and the UK, are frontrunners in implementing large-scale smart bin networks and adhering to the EN 840 standard for mobile waste containers.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid urbanization, massive infrastructural development, and increasing governmental focus on modernizing archaic waste disposal systems, particularly in China, India, and Southeast Asia. While cost-effectiveness dominates standard segments, emerging smart cities are becoming significant adopters of sensor technology and automated systems.

- Latin America: Growth is steady, driven by urbanization and improving economic conditions, leading to greater disposable income and subsequent consumption, necessitating better waste collection. Market penetration of smart solutions is still nascent but accelerating through partnerships between local governments and international waste technology providers.

- Middle East and Africa (MEA): Marked by significant disparity. The GCC countries (e.g., UAE, Saudi Arabia) are investing heavily in futuristic, smart city projects, leading to high-value contracts for premium, technologically advanced waste receptacles. Conversely, parts of Africa face infrastructure limitations, where demand remains focused on basic, durable plastic containers for essential sanitation purposes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Garbage Cans Market.- Rubbermaid Commercial Products (Newell Brands)

- Toter LLC (Wastequip)

- Otto Environmental Systems North America

- SULO Group

- IPL Inc. (Suez)

- Vileda (Freudenberg Group)

- Simplehuman

- United Receptacles

- Continental Commercial Products

- Curver (Keter Group)

- Better Living Products

- Alpine Industries

- iTouchless Housewares & Products

- ZHEJIANG SENXING HOLDING GROUP

- Suncast Corporation

- Witt Industries

- Geesinknorba Group

- EKO Europe

- Sterilite Corporation

- Nexera

- Rehrig Pacific Company

- Schaefer Systems International (SSI SCHAEFER)

- Container Systems (Contenur)

- Cimco-Optegra

Frequently Asked Questions

Analyze common user questions about the Garbage Cans market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Smart Garbage Cans Market?

The primary drivers include the implementation of smart city initiatives globally, the imperative for municipalities to reduce operational collection costs, and regulatory mandates promoting efficiency and environmental sustainability through real-time waste monitoring and route optimization facilitated by IoT sensors and AI integration.

How significant is the adoption of recycled materials in garbage can manufacturing?

The adoption of recycled materials, particularly Post-Consumer Recycled (PCR) plastic content, is highly significant, especially in Europe and North America. It is becoming a prerequisite for many large municipal procurement tenders, aligning the market with circular economy goals and offering manufacturers a sustainable competitive edge.

Which segment holds the largest market share by End-Use, and why?

The Municipal segment typically accounts for the largest share in terms of volume and consistent contractual value, driven by the constant need for large-capacity, highly durable wheeled carts necessary for universal, standardized residential and public space collection infrastructure across cities.

What major technological advancement is impacting garbage can design for residential use?

The major technological advancement for residential use is the widespread adoption of sensor or touchless operation mechanisms. These mechanisms utilize infrared technology to enhance hygiene and convenience, fulfilling increasing consumer demand for hands-free sanitary solutions, especially post-2020.

What are the key differences between plastic and metal garbage cans in the commercial sector?

Plastic (HDPE/PP) commercial cans are favored for durability, low weight, weather resistance, and cost-effectiveness. Metal (Stainless/Galvanized Steel) cans are preferred where fire resistance, superior aesthetics, high sanitation standards (e.g., hospitals, luxury hotels), and resistance to harsh industrial environments are critical requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager