Garbage Sorting Robot Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438198 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Garbage Sorting Robot Market Size

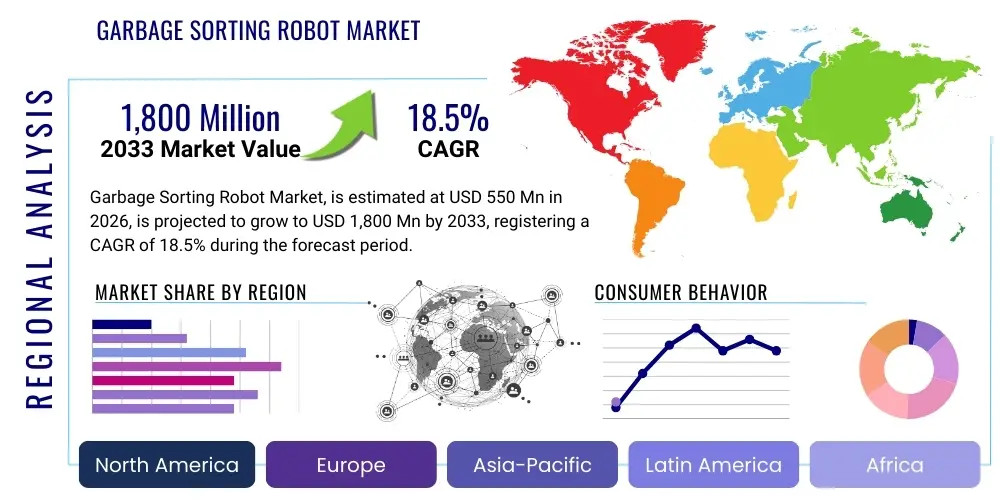

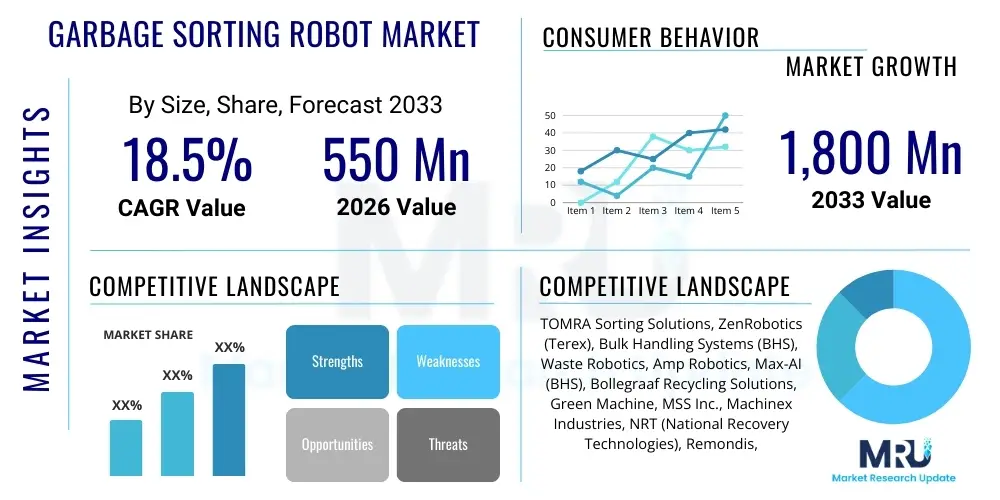

The Garbage Sorting Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 1,800 Million by the end of the forecast period in 2033.

Garbage Sorting Robot Market introduction

The Garbage Sorting Robot Market is fundamentally transforming the waste management industry by introducing highly efficient, automated solutions for separating mixed municipal solid waste (MSW) and specialized industrial waste streams. These robots utilize sophisticated technologies, primarily combining artificial intelligence (AI), machine vision (specifically deep learning models for object recognition), and advanced robotic grippers, to identify, pick, and sort materials at speeds and accuracies unattainable by human labor. The primary goal is to enhance resource recovery, reduce landfill dependency, and improve the overall economics and safety of Material Recovery Facilities (MRFs) and recycling centers globally. The increasing stringency of global environmental regulations, coupled with national goals for achieving circular economies, serves as a powerful foundational driver for the widespread adoption of these robotic systems, moving the industry away from manual, inefficient sorting methods.

Garbage sorting robots are deployed across various stages of the waste stream. Their product description centers around modular, high-throughput systems capable of operating 24/7 in harsh environments. Major applications span municipal waste sorting (separating plastics, metals, paper, and glass), construction and demolition (C&D) waste sorting, and specialized electronic waste (e-waste) processing. These systems offer tangible benefits, including significant reductions in operational costs, improved purity rates of recovered materials (leading to higher commodity values), mitigation of safety risks associated with manual sorting, and enhanced scalability of processing operations. The integration of advanced sensing technologies, such as near-infrared (NIR) spectroscopy and hyperspectral imaging, allows these robots to accurately differentiate complex, co-mingled materials, thereby increasing overall recovery yield and material quality.

Driving factors fueling this market expansion include the global shift towards automation to combat rising labor costs and shortages in the waste sector, massive investments in recycling infrastructure upgrades, and technological breakthroughs in AI and robotics that have significantly lowered the total cost of ownership (TCO) while boosting performance. Furthermore, increased public and governmental awareness regarding the environmental crisis stemming from poor waste management, particularly concerning plastic pollution, necessitates high-speed, accurate sorting capabilities to meet ambitious recycling targets. The ongoing miniaturization and increased computational power of edge-computing devices allow for faster decision-making processes within the robotic systems, enabling real-time classification and sorting of diverse waste items, which is critical for maximizing efficiency in high-volume waste processing environments. This confluence of regulatory push, economic necessity, and technological maturity positions the garbage sorting robot market for sustained, aggressive growth throughout the forecast period.

Garbage Sorting Robot Market Executive Summary

The Garbage Sorting Robot Market is characterized by intense technological competition and robust growth, driven by global mandates for sustainable waste management and circular economy initiatives. Current business trends indicate a strong move towards subscription-based models (Robots-as-a-Service, RaaS) rather than outright purchase, lowering the barrier to entry for smaller MRFs and ensuring continuous software updates and performance improvements. Major market players are focusing on developing hybrid sorting solutions that combine robotic pickers with traditional mechanical separation methods (e.g., screens, eddy currents) to optimize overall facility performance. Furthermore, there is a distinct trend toward integrating deep learning architectures specifically trained on local waste streams, allowing robots to adapt quickly to regional variations in garbage composition and contamination levels, thereby increasing sorting purity and operational adaptability.

Regional trends highlight North America and Europe as early adopters, primarily due to high labor costs and stringent regulatory frameworks mandating high recovery rates. These regions are seeing significant capital expenditure in upgrading existing MRFs with AI-powered systems. The Asia Pacific (APAC) region, however, is projected to exhibit the highest growth rate, fueled by rapid urbanization, enormous volumes of generated waste, and governmental push in countries like China, Japan, and India to modernize nascent recycling infrastructures. APAC's sheer volume potential and the increasing investment in waste-to-energy and high-value material recovery projects make it a critical future growth engine. Latin America and MEA are lagging but showing increasing interest, typically driven by international development funding aimed at addressing environmental pollution challenges.

Segmentation trends reveal that the use of Vision-Based Sorting Robots dominates the market by technology due to their high accuracy in recognizing complex geometries and textures, essential for mixed MSW. However, the adoption of specialized technologies like Near-Infrared (NIR) Spectroscopy robots is growing rapidly, particularly for distinguishing between different types of plastics (e.g., PET, HDPE, PVC). By application, Municipal Solid Waste (MSW) remains the largest segment, but the Industrial and Commercial Waste (I&C) segment, including sorting specialized streams like e-waste and construction debris, is witnessing substantial growth due to the higher intrinsic value of the materials recovered. The capacity segmentation indicates a strong preference for high-capacity systems (processing over 50 tons per hour) in industrialized markets, focusing on maximum throughput efficiency.

AI Impact Analysis on Garbage Sorting Robot Market

Analysis of common user questions regarding AI's influence reveals key themes centered around reliability, adaptability, and economic justification. Users frequently ask: "How accurate is AI when dealing with highly contaminated or novel waste items?", "Can the AI system be easily retrained for my specific regional waste stream?", and "What is the long-term cost savings compared to manual labor?" These inquiries underscore user concerns about the robustness of AI vision systems in real-world, dynamic environments, which often feature dirty, broken, or oddly shaped objects that challenge traditional computer vision models. Expectations are high for AI to deliver near-perfect purity rates (above 98%) while maintaining high throughput. Furthermore, there is significant interest in predictive AI maintenance capabilities that monitor robot performance and anticipate mechanical failures, thereby maximizing operational uptime and overall return on investment (ROI).

The core impact of Artificial Intelligence, specifically deep learning and computer vision, is its ability to transition waste sorting from a largely mechanical and stochastic process to a precise, data-driven operation. AI algorithms process massive amounts of visual and spectral data from cameras and sensors in milliseconds, enabling robots to distinguish between thousands of unique objects, including materials that are indistinguishable by conventional mechanical sorters (e.g., recognizing different colored plastics or composite materials). This capability radically improves the quality of sorted output, which is crucial for meeting the stringent material requirements of modern recycling markets. The continuous learning capabilities of these AI models mean the robotic fleet improves its sorting proficiency over time as it encounters more data, providing a scalable and future-proof solution against the constantly changing composition of the global waste stream.

Furthermore, AI extends beyond simple object recognition to optimize the entire facility workflow. Advanced AI systems manage robotic fleet coordination, predict inflow composition changes based on facility metrics, and dynamically adjust sorting priorities to maximize profitability based on real-time commodity pricing. This holistic approach transforms a MRF into a smart factory, where every action is data-informed. The rapid development of neural networks and specialized hardware (GPUs/TPUs) facilitates edge computing directly on the sorting line, minimizing latency and enabling crucial high-speed decision-making (up to 80 picks per minute per robot arm), making AI the single most critical technological differentiator in the garbage sorting robotics market and solidifying its role as the backbone of next-generation waste recovery infrastructure.

- AI enables highly accurate classification of co-mingled and contaminated waste items through deep learning models.

- Predictive maintenance algorithms utilize AI to forecast mechanical failures, significantly reducing downtime and operational costs.

- Real-time material composition analysis optimizes facility throughput and maximizes the economic value of recovered materials.

- AI-driven sensor fusion (combining visual, NIR, and hyperspectral data) ensures robust sorting performance across diverse waste streams.

- Enhanced adaptability allows robots to quickly learn and recognize new or regionally specific waste types, improving purity rates.

DRO & Impact Forces Of Garbage Sorting Robot Market

The Garbage Sorting Robot Market's trajectory is primarily shaped by a powerful confluence of regulatory drivers and technological advancements, counterbalanced by significant capital expenditure requirements and integration complexities. The core driver is the escalating global focus on the Circular Economy, manifested through Extended Producer Responsibility (EPR) schemes and legislative mandates for minimum recycled content in products, directly increasing the demand for high-quality, segregated secondary materials. Technological readiness, specifically the maturity and decreasing cost of AI vision systems and high-speed robotic actuation, makes automated sorting an economically viable alternative to manual labor, especially in high-wage economies. These forces exert substantial upward pressure on market adoption, transforming sorting facilities from cost centers into potentially profitable material feedstock suppliers.

Restraints, however, pose significant challenges. The initial capital investment required for installing a robotic sorting line is substantial, creating a financial hurdle, particularly for smaller, municipally-owned facilities that operate on tight budgets. Furthermore, integrating new robotic systems with legacy infrastructure in older MRFs often involves complex retrofitting and extended downtime, deterring immediate adoption. A crucial operational restraint is the variability of the waste stream itself; high levels of moisture, dirt, and unknown composite materials can still degrade the performance of even advanced AI vision systems, requiring continuous calibration and maintenance. This variability necessitates highly localized training data for the AI, which can be time-consuming and expensive to acquire.

Opportunities for market growth are vast, predominantly focusing on underserved waste streams and novel service models. The opportunity to expand into specialized high-value sorting markets, such as textiles, batteries, and complex e-waste, where the recovered materials fetch premium prices, is significant. The development of modular and smaller-footprint robotic sorters tailored for decentralized collection points or small-scale recycling operations in developing markets presents another major avenue for expansion. The impact forces indicate that the substitution threat from traditional mechanical sorters is decreasing due to the superior purity achieved by robots, while the bargaining power of customers (MRFs and waste contractors) is moderate, seeking customizable, high-reliability solutions. Overall, the market momentum is strongly positive, driven by environmental necessity and technological feasibility.

Segmentation Analysis

The Garbage Sorting Robot Market segmentation provides a granular view of the diverse technologies, applications, and operational capacities driving market dynamics, allowing stakeholders to identify niche opportunities and investment priorities. The market is primarily broken down by Technology (Vision-Based, Sensor-Based, and Integrated Systems), Application (Municipal Solid Waste, Industrial Waste, and Construction & Demolition Waste), and Capacity (Low, Medium, and High Throughput). Understanding these segments is crucial for manufacturers to tailor product development and for operators to select systems that maximize efficiency based on their specific waste stream volume and composition. The rapid evolution of sensing technologies and AI capabilities is continually blurring the lines between these segments, fostering the development of highly integrated, multi-modal sorting solutions that leverage the strengths of various sensor types.

The dominance of the Municipal Solid Waste (MSW) application segment is structurally supported by high population density and governmental oversight, demanding large-scale, automated solutions to handle heterogeneous household waste volumes. Within the Technology segment, Vision-Based systems, leveraging 3D cameras and deep learning, maintain market leadership due to their ability to recognize object shape and context, crucial for general waste sorting. However, the fastest growth is observed in Sensor-Based technologies, particularly those incorporating Near-Infrared (NIR) or X-Ray Transmission (XRT) to analyze chemical composition and density, offering superior separation of homogeneous materials like different plastic resins or heavy metals. Geographically, segmentation analysis emphasizes the need for regionally customized solutions, as waste composition, regulatory pressures, and labor costs vary significantly across continents, influencing the adoption rate of specific capacity classes.

The High Throughput Capacity segment (typically exceeding 50 tons per hour) is witnessing accelerated adoption in established markets like North America and Europe, driven by the desire to consolidate operations and achieve economies of scale. Conversely, the Medium Capacity segment (10-30 tons per hour) is ideal for retrofitting existing facilities or serving decentralized smaller municipalities, offering a balanced mix of efficiency and affordability. The complexity of material streams continues to push innovation toward hybrid solutions—integrating both visual identification (for shape and color) and spectral analysis (for chemistry)—which are emerging as a distinct and highly valuable segment, promising the highest purity rates and flexibility for future waste management challenges.

- By Technology

- Vision-Based Sorting Robots (Deep Learning/2D/3D Vision)

- Sensor-Based Sorting Robots (NIR, XRT, Metal Induction)

- Integrated/Hybrid Sorting Systems

- By Application

- Municipal Solid Waste (MSW)

- Industrial and Commercial Waste (I&C)

- Construction & Demolition (C&D) Waste

- Electronic Waste (E-Waste)

- By Capacity

- Low Capacity (Up to 10 TPH)

- Medium Capacity (10 TPH to 30 TPH)

- High Capacity (Above 30 TPH)

- By End-Use Component

- Robotic Arms/Actuators

- Vision Systems & Sensors

- AI & Software Platforms

Value Chain Analysis For Garbage Sorting Robot Market

The value chain for the Garbage Sorting Robot Market is characterized by highly specialized upstream component manufacturing, sophisticated integration processes, and a downstream focus on long-term maintenance and software support. Upstream analysis focuses on the suppliers of core robotic components: high-speed industrial robotic arms (often leveraging advanced pneumatic or servo-electric actuators), complex vision sensors (including specialized cameras, NIR scanners, and LiDAR), and, most critically, the underlying computational hardware (GPUs/FPGAs) necessary for real-time AI processing. Suppliers in this segment, particularly those providing specialized AI chips and robust industrial arms designed for harsh environments, wield significant bargaining power due to the stringent performance and durability requirements necessary for waste management applications. Innovation at this stage, particularly miniaturization and cost reduction of sensing systems, directly influences the final cost and capability of the sorting robot.

The midstream involves the core activities of the system integrators and robot manufacturers. This stage includes the crucial process of software development, focusing heavily on training proprietary deep learning models using vast datasets of heterogeneous waste materials. Manufacturers integrate the robotic arms, vision systems, and proprietary AI software into cohesive, standardized, or modular sorting units. The distribution channel in this specialized market is typically direct, involving close collaboration between the manufacturer and the End-User (the Material Recovery Facility or waste operator). Direct sales ensure customized integration, extensive testing tailored to the facility's specific waste stream profile, and comprehensive technical training. Some players utilize indirect channels through regional distributors who specialize in waste management machinery, offering local sales support and quicker response times for maintenance contracts.

Downstream analysis highlights the critical role of post-installation services. This phase is characterized by long-term service agreements encompassing predictive maintenance, remote monitoring, and continuous software updates. Given the evolving nature of waste, the software platform requires frequent updates to recognize new product packaging or material compositions. Therefore, the long-term value capture in this market shifts significantly toward the service and optimization contracts, ensuring the robot maintains high sorting accuracy and uptime. The efficiency gains delivered downstream directly influence the revenue streams of the MRF operators, making the reliability and continuous performance improvement provided by the robot vendor a crucial competitive differentiator throughout the entire value chain.

Garbage Sorting Robot Market Potential Customers

Potential customers and end-users of Garbage Sorting Robots span the entire waste management ecosystem, ranging from large private corporations managing regional recycling infrastructure to public sector municipal waste authorities focused on regulatory compliance. The primary buyers are operators of Material Recovery Facilities (MRFs), both single-stream and dual-stream, who seek to replace costly, inefficient, and unsafe manual labor with high-throughput automated systems. These customers require systems capable of handling large volumes of mixed municipal solid waste while achieving high purity rates necessary to meet the demanding specifications of commodity markets. Their purchasing decisions are heavily influenced by the robot's ability to demonstrate a clear and rapid Return on Investment (ROI) through reduced operating expenses and increased material value.

A rapidly expanding customer base includes specialized recycling facilities focusing on complex, high-value waste streams. This includes processors of Electronic Waste (e-waste), where robots are essential for safely and accurately dismantling components and recovering precious metals, and Construction & Demolition (C&D) waste processors, who use robots to sort heavy, irregular, and often hazardous materials like wood, concrete, and metals. These end-users prioritize sorting specificity and durability, requiring robust robotic systems capable of operating reliably in abrasive, non-standardized material environments. Furthermore, industrial manufacturers that generate large, segregated volumes of uniform waste (e.g., specific plastic scraps from manufacturing processes) are increasingly adopting these robots to handle their internal waste streams before disposal or sale.

Finally, governmental bodies and public waste management agencies represent a significant and stable customer segment. Driven by ambitious sustainability targets and legislative pressures, these entities invest in robotic systems to modernize aging infrastructure and fulfill their mandated recycling quotas. These customers often procure through large-scale public tenders, prioritizing system reliability, long-term service contracts, and proven performance metrics. Emerging markets and developing economies, often funded through international environmental grants, represent a growing cohort of potential customers eager to leapfrog traditional waste management techniques and implement advanced, AI-driven sorting technologies directly, thereby creating a diverse global demand structure across both public and private sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 1,800 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TOMRA Sorting Solutions, ZenRobotics (Terex), Bulk Handling Systems (BHS), Waste Robotics, Amp Robotics, Max-AI (BHS), Bollegraaf Recycling Solutions, Green Machine, MSS Inc., Machinex Industries, NRT (National Recovery Technologies), Remondis, Everest Labs, KUKA AG (Robotics Division), T-Tomi, Recycleye, Sadako Technologies, RoviSys, VEX Robots, Fanuc Robotics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Garbage Sorting Robot Market Key Technology Landscape

The technological landscape of the Garbage Sorting Robot Market is highly dynamic, centered on the convergence of industrial automation, sophisticated sensor fusion, and cutting-edge artificial intelligence. The foundational technology relies heavily on robust, high-speed delta or articulated robotic arms capable of rapid and repetitive movements in dusty and humid environments. However, the true innovation lies in the perception systems. Modern sorting robots employ multi-modal sensor arrays, integrating 3D visual cameras, which provide depth and spatial data, with Near-Infrared (NIR) or Hyperspectral Imaging (HSI) sensors. NIR/HSI is critical as it analyzes the chemical fingerprint of materials, allowing robots to distinguish between different polymer types (e.g., PET vs. HDPE) that might look visually identical. This fusion of vision and spectroscopy enables unparalleled accuracy in material identification.

At the heart of the system is the AI platform, typically utilizing deep convolutional neural networks (CNNs) trained on millions of images and spectral profiles of waste materials. These AI models are optimized for high-speed edge computing, allowing the system to process data, identify an object on the fast-moving conveyor belt, calculate the optimal trajectory, and actuate the robotic arm—all within milliseconds. The shift to cloud-based data aggregation and reinforcement learning allows deployed robots to continuously send data back for model refinement. This iterative learning process ensures that the robot fleet improves its performance over time and can quickly adapt to new packaging materials or contamination levels, a concept vital for maintaining long-term sorting efficiency and competitive advantage.

Emerging technologies further shaping the landscape include advances in gripping mechanisms and specialized handling tools. While traditional vacuum grippers are common, innovative solutions involving compliance control, specialized end-of-arm tooling (EOAT), and soft robotics are being developed to handle delicate or irregularly shaped items, minimizing damage and maximizing recovery rate. Furthermore, the increasing integration of Internet of Things (IoT) technologies allows for seamless communication between various equipment within the MRF—screens, conveyors, balers, and robots—creating a fully interconnected, optimized sorting facility (Industry 4.0). This technological ecosystem, driven by high precision, speed, and continuous self-optimization, defines the competitive edge in the modern Garbage Sorting Robot Market.

Regional Highlights

Regional dynamics play a crucial role in shaping the adoption and growth rate of the Garbage Sorting Robot Market, reflecting variations in environmental policies, labor economics, and existing waste management infrastructure maturity.

- North America (NA): This region is characterized by high labor costs and substantial investment in modernization of single-stream MRFs. The U.S. and Canada are significant early adopters, driven by the need to manage massive volumes of MSW and the increasing difficulty in securing markets for low-purity recycled commodities. Regulatory pressure, coupled with private investment from large waste management corporations (e.g., Waste Management, Republic Services), ensures continuous demand for high-capacity, high-accuracy sorting robots, particularly for recovering plastics and fiber. The market penetration rate is currently high, focusing on expanding robotic applications beyond sorting to quality control and pre-sorting stages.

- Europe: Europe is a mature market heavily influenced by strict EU directives such as the Circular Economy Package and ambitious recycling targets. Countries like Germany, Sweden, and the Netherlands lead the adoption curve, prioritizing purity and resource efficiency. The emphasis here is often on specialized recovery, including plastics sorting (distinguishing various polymer types) and complex commercial/industrial waste streams. European demand is driven less by labor replacement and more by regulatory necessity and the high intrinsic value placed on high-quality secondary raw materials, fostering innovation in NIR and hyperspectral sensor technology.

- Asia Pacific (APAC): APAC represents the fastest-growing region globally, primarily due to rapid urbanization, increasing per capita waste generation, and significant infrastructural investment, particularly in China, India, and Southeast Asia. Governments in these nations are prioritizing waste management modernization to address severe environmental pollution issues. While initial costs remain a barrier, the sheer scale of waste volume and the technological ambition of economies like China and South Korea are accelerating adoption. The market here focuses on scalable, robust systems capable of handling highly variable and often wet waste streams, representing massive long-term potential.

- Latin America (LATAM): Market adoption in Latin America is nascent but developing. Growth is constrained by inconsistent regulatory enforcement and economic factors but is spurred by international funding and private sector partnerships targeting environmental sustainability. Key applications initially focus on diverting waste from overflowing landfills and improving basic recovery rates. Brazil and Mexico are emerging as regional hubs, characterized by a demand for modular and flexible robotic solutions that can be easily integrated into developing waste infrastructure frameworks.

- Middle East and Africa (MEA): MEA is currently the smallest market but shows substantial future potential, particularly in the GCC countries (UAE, Saudi Arabia) which are investing heavily in futuristic, sustainable urban centers and have high capital budgets for advanced technologies. The focus is often on high-tech solutions for specialized industrial waste and construction debris management, reflecting major infrastructure projects. Africa's market development is slower, reliant on government policy changes and external aid, with demand centered on scalable, robust, and low-maintenance sorting technology suitable for extreme climates and resource recovery projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Garbage Sorting Robot Market.- TOMRA Sorting Solutions (A Division of TOMRA Systems ASA)

- ZenRobotics (A Terex Brand)

- Bulk Handling Systems (BHS)

- AMP Robotics

- Max-AI (A BHS Company)

- Bollegraaf Recycling Solutions

- Waste Robotics Inc.

- Machinex Industries Inc.

- NRT (National Recovery Technologies)

- Green Machine Sales Inc.

- Everest Labs

- FANUC Corporation (Robotics Division)

- KUKA AG (Robotics Division)

- ABB Ltd. (Robotics & Discrete Automation)

- Sadako Technologies

- Recycleye Ltd.

- SUEZ Group

- Remondis SE & Co. KG

- T-Tomi Co., Ltd.

- Clear Path Recycling (Integrator Focus)

Frequently Asked Questions

Analyze common user questions about the Garbage Sorting Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical Return on Investment (ROI) period for installing a garbage sorting robot system?

The ROI period for garbage sorting robots generally ranges from 18 to 36 months, heavily depending on regional labor costs, the volume of waste processed, and the resulting purity increase in recovered materials. Higher purity levels directly translate to increased commodity revenue, accelerating the payback period significantly, especially in facilities operating 24/7 where labor savings are maximized.

How accurately can AI vision systems differentiate between different types of plastics, such as PET and HDPE?

Modern AI-driven sorting systems achieve high accuracy, often exceeding 95% for common materials. This precision is attained through the integration of deep learning algorithms with advanced sensors, notably Near-Infrared (NIR) spectroscopy, which analyzes the chemical composition rather than just visual features, enabling accurate differentiation between polymer types and colors essential for high-quality recycling.

Are robotic sorting systems adaptable to regional differences in waste composition and contamination levels?

Yes, adaptability is a core feature. Advanced vendors offer systems with AI models that can be retrained and fine-tuned using localized data from the customer’s specific waste stream. Continuous cloud connectivity allows the robots to update their recognition capabilities, ensuring performance remains high despite seasonal changes or evolving consumer packaging trends.

What are the primary operational requirements and maintenance challenges for these robots in a harsh MRF environment?

Operational requirements include robust dust mitigation and standardized conveyor speeds. Maintenance challenges revolve around keeping sensors clean (requiring automated cleaning cycles) and managing wear and tear on robotic end-of-arm tooling (grippers). Predictive maintenance, often managed by the AI software, is crucial for maximizing uptime and minimizing reactive repairs in the abrasive MRF environment.

How do Garbage Sorting Robots contribute to achieving global Circular Economy goals?

Robots are essential enablers of the Circular Economy by drastically increasing the purity and quantity of secondary raw materials recovered from the waste stream. Their high efficiency allows recyclers to meet stringent quality standards for plastics, metals, and fibers, ensuring these materials can re-enter the manufacturing loop, thereby reducing dependence on virgin resources and supporting legislated recycling mandates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager