Garden Shredders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433863 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Garden Shredders Market Size

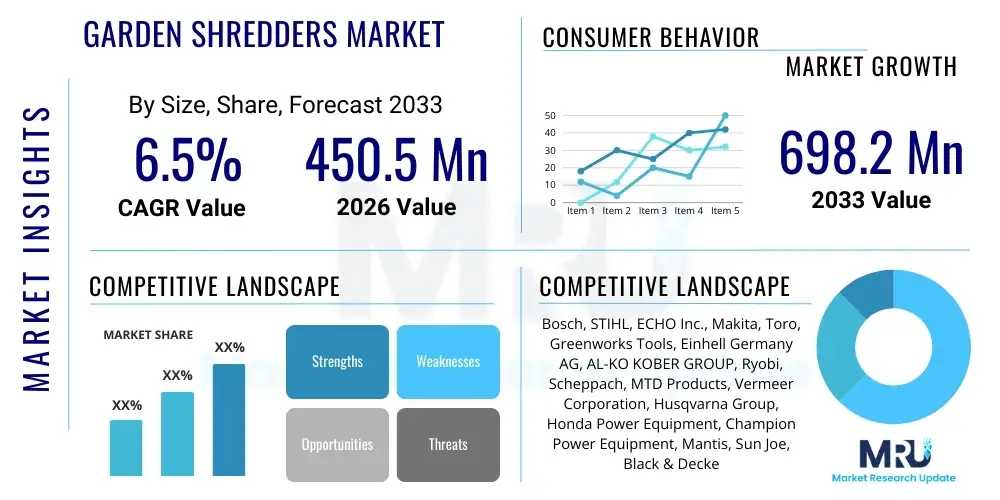

The Garden Shredders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.45% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 698.2 Million by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the increasing focus on sustainable gardening practices, the rising adoption of composting technologies among homeowners, and stringent environmental regulations promoting organic waste reduction across developed economies. The increasing demand for efficient waste management solutions in both residential and professional landscaping sectors further solidifies the market's robust expansion.

Garden Shredders Market introduction

The Garden Shredders Market encompasses the production and distribution of machinery designed to reduce bulky garden waste, such as branches, clippings, and leaves, into manageable mulch or compost material. These devices, ranging from compact electric models suitable for residential use to powerful petrol-driven machines for commercial applications, play a crucial role in efficient horticultural waste management. Major applications include preparing feedstock for composting, reducing the volume of waste requiring disposal, and creating protective mulches for garden beds, thereby enhancing soil health and reducing reliance on chemical fertilizers. The primary benefits derived from garden shredders include environmental sustainability, cost savings on waste removal, and improved garden aesthetics. Key driving factors propelling market growth involve the global movement toward zero-waste initiatives, the proliferation of specialized landscaping services, and continuous technological advancements resulting in quieter and more robust shredding mechanisms, particularly in the electric segment.

Garden Shredders Market Executive Summary

The global Garden Shredders Market is characterized by intense competition driven by technological innovation and strategic regional expansion. Business trends indicate a strong shift towards battery-powered and cordless shredders, catering to the residential segment's demand for portability and lower noise pollution, aligning perfectly with evolving consumer preferences for sustainable and convenient tools. Regionally, Europe currently dominates the market due to stringent governmental policies regarding green waste disposal and a highly engaged gardening culture, while the Asia Pacific region is expected to exhibit the highest CAGR, primarily fueled by rapid urbanization, increasing disposable income, and the subsequent growth in private gardening and professional landscaping services. Segment-wise, the electric-powered category, specifically impact shredders, remains the leading segment due to their affordability and suitability for processing soft green waste, although professional users are increasingly investing in durable petrol-powered roller shredders designed for high-capacity, heavy-duty applications, signaling a bifurcated growth strategy across different end-user segments.

AI Impact Analysis on Garden Shredders Market

User queries regarding AI integration in the Garden Shredders Market primarily revolve around concepts such as autonomous operation, predictive maintenance, and optimized shredding performance based on material input. Consumers are interested in whether AI can enable shredders to automatically identify the type and density of input material (e.g., dry wood versus wet leaves) and dynamically adjust the motor speed and blade rotation for optimal efficiency, minimizing jamming and power consumption. Furthermore, there is significant interest in using AI-driven sensors and IoT connectivity to monitor machine health, schedule maintenance proactively, and provide real-time data on material throughput and energy usage. The key expectations center on making shredders 'smarter,' safer, and significantly more energy-efficient, ultimately improving the user experience and extending the product lifecycle through intelligent management.

- AI-powered sensor integration for automatic material recognition and optimized shredding configuration.

- Implementation of predictive maintenance algorithms to anticipate mechanical failures, reducing downtime and service costs.

- IoT connectivity enabling remote monitoring of performance metrics and energy consumption tracking.

- Development of semi-autonomous or robotic shredding systems for large commercial landscaping operations.

- Enhanced safety features through AI recognition of foreign objects or improper material insertion.

- Optimization of blade design and durability testing using machine learning simulations.

DRO & Impact Forces Of Garden Shredders Market

The market trajectory is primarily driven by the imperative for sustainable waste management and environmental compliance, balanced by challenges related to product durability and high initial investment costs for professional-grade equipment. Opportunities arise significantly from the growing trend of smart gardening and integration with battery technology, while the entire market structure is influenced by intense competitive pricing and fluctuating raw material costs. These elements collectively shape the strategic decisions of manufacturers and influence consumer purchasing behavior across residential and commercial sectors. The continuous enforcement of regulations limiting landfill use for organic waste acts as a major driver, compelling both private households and municipal services to adopt effective volume reduction technologies like garden shredders, thereby ensuring sustained demand growth.

Drivers: The increasing global emphasis on composting and recycling programs is a core driver. As local and national authorities mandate or incentivize the diversion of green waste from landfills, the utility of shredders for creating compostable material grows exponentially. Furthermore, the rising popularity of DIY gardening and home landscaping projects, particularly in North America and Europe, increases the consumer base for medium-capacity electric shredders. Technological advancements focusing on producing quieter, more powerful, and easier-to-use models—especially those utilizing advanced brushless motors and robust cutting systems—further stimulate replacement cycles and new market penetration, overcoming previous hurdles related to noise and operational complexity.

Restraints: Significant restraints include the high initial cost associated with premium, high-capacity shredders, which often deters small-scale residential users or businesses with limited capital. Operational complexities, such as frequent jamming when processing damp or fibrous material, remain a key user frustration point, potentially leading to negative product perceptions. Additionally, the maintenance requirements, including the need for regular blade sharpening or replacement, add to the total cost of ownership (TCO). Market saturation in mature Western European economies means future growth relies heavily on replacement sales and expansion into emerging markets, which are sensitive to pricing pressures and lack the established waste infrastructure prevalent in developed regions.

Opportunities: Major opportunities reside in developing and commercializing hybrid and fully battery-powered shredders, aligning with the broader trend toward cordless outdoor power equipment (OPE). The focus on smart garden technology allows for the integration of IoT features, offering users optimized usage insights and predictive maintenance alerts. Expansion into commercial and agricultural sectors with specialized, large-throughput machines designed for specific biomass applications (e.g., preparing feedstock for bioenergy or animal bedding) represents an untapped vertical market. Furthermore, manufacturers can leverage the circular economy trend by offering durable, repairable products with readily available replacement parts, appealing to environmentally conscious consumers and supporting extended product lifecycles.

Impact Forces: The market is significantly impacted by competitive pressure, particularly from Asian manufacturers offering low-cost alternatives, forcing established brands to differentiate through quality, safety, and superior warranty programs. Regulatory changes regarding noise pollution (especially in urban environments) and battery safety standards influence product design and development costs. Economic volatility affecting housing starts and consumer spending directly impacts residential tool purchases. The availability and cost of raw materials, particularly steel for blades and specialized plastics for housing, influence manufacturing margins, requiring dynamic supply chain management strategies to mitigate price fluctuations and ensure product supply continuity across global distribution channels.

Segmentation Analysis

The Garden Shredders Market is analyzed based on product type, power source, mechanism type, end-user, and capacity, providing a granular view of market dynamics and identifying high-growth segments. Product type segregation, primarily between electric and petrol models, reflects the fundamental split between residential and professional use. The mechanism type, whether impact or roller (crushing), determines the suitability for processing specific types of garden waste—impact shredders excel with soft, leafy material, whereas roller shredders are preferred for thicker, harder branches due to their quieter operation and lower risk of jamming. Understanding these segment dynamics is crucial for manufacturers developing targeted marketing strategies and optimizing product portfolios to capture maximum market share across varied end-user requirements.

- By Product Type:

- Electric Garden Shredders

- Petrol Garden Shredders

- Battery-Powered (Cordless) Garden Shredders

- By Mechanism Type:

- Impact Shredders (Chipper Blade)

- Roller Shredders (Crushing)

- Turbine Shredders

- By End-User:

- Residential Users (Home Gardening)

- Commercial Users (Landscaping Professionals, Arborists)

- Municipal and Institutional Users

- By Capacity (Infeed Diameter):

- Low Capacity (Up to 35 mm)

- Medium Capacity (35 mm to 45 mm)

- High Capacity (Above 45 mm)

Value Chain Analysis For Garden Shredders Market

The value chain for the Garden Shredders Market starts with the sourcing of critical raw materials and extends through manufacturing, distribution, and post-sale service. Upstream activities involve acquiring specialized steel alloys for cutting blades, high-performance plastics for casings, and advanced motors (electric or internal combustion engines). Efficiency in the upstream segment, particularly procurement of specialized, durable components, directly dictates the final product quality and manufacturing cost structure. Downstream activities are highly reliant on effective distribution channels, encompassing large retail chains, specialized gardening centers, e-commerce platforms, and direct-to-business (D2B) sales for commercial models. Success in the downstream market hinges on robust inventory management, effective marketing campaigns demonstrating product safety and efficiency, and providing comprehensive after-sales support and spare parts availability, ensuring consumer satisfaction and brand loyalty.

The manufacturing phase is critical, involving precision engineering for the shredding mechanism, motor integration, and rigorous quality control to ensure compliance with international safety standards (e.g., CE, UL). Manufacturers focus on optimizing assembly processes to reduce labor costs and lead times. The distribution landscape is bifurcated into direct and indirect channels. Direct sales often cater to professional users or municipalities seeking customized high-capacity solutions, allowing manufacturers to maintain higher margins and direct customer relationships. Indirect channels, which include major hardware stores (like Home Depot, B&Q) and online marketplaces (like Amazon), dominate the residential segment, leveraging these platforms' extensive reach and logistical capabilities, requiring strong brand partnerships and efficient supply chain logistics to handle fluctuating seasonal demand patterns effectively.

Garden Shredders Market Potential Customers

The primary end-users and buyers of garden shredders span a diverse range, fundamentally segmented into residential consumers, professional landscapers, and institutional bodies, each possessing distinct purchasing drivers and equipment needs. Residential buyers are primarily focused on convenience, safety, noise level, and ease of storage, preferring affordable, light-duty electric or battery-powered models for routine maintenance of small to medium-sized gardens. These consumers purchase through retail stores and online channels, prioritizing user reviews and brand reputation. Conversely, professional landscapers, tree service companies, and arborists constitute the commercial segment, demanding high-capacity, robust petrol or heavy-duty electric models with exceptional durability and throughput capabilities, often purchasing directly from specialized equipment dealers or manufacturers to ensure service agreements and access to rapid maintenance support.

A rapidly growing segment comprises institutional and municipal users, including parks departments, universities, housing associations, and waste management organizations. These entities require industrial-grade, often trailer-mounted or highly mobile shredding and chipping units capable of continuous operation and processing large volumes of diverse waste materials. Their procurement decisions are heavily influenced by regulatory compliance, total cost of ownership (TCO), fuel efficiency, and long-term service contracts. Furthermore, agricultural businesses, particularly those engaged in horticulture, vineyard management, or bioenergy crop processing, represent a specialized B2B customer base seeking customized shredding solutions for biomass preparation. Targeting these diverse segments requires manufacturers to offer a comprehensive product range supported by specialized sales and service networks tailored to each customer group's unique operational demands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 698.2 Million |

| Growth Rate | CAGR 6.45 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, STIHL, ECHO Inc., Makita, Toro, Greenworks Tools, Einhell Germany AG, AL-KO KOBER GROUP, Ryobi, Scheppach, MTD Products, Vermeer Corporation, Husqvarna Group, Honda Power Equipment, Champion Power Equipment, Mantis, Sun Joe, Black & Decker, Titan Pro, Feider. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Garden Shredders Market Key Technology Landscape

The technological landscape of the Garden Shredders Market is rapidly evolving, driven primarily by the need for greater efficiency, safety, and reduced environmental impact. Core innovations center around the shredding mechanism itself, focusing on developing cutting systems that handle diverse material types (hardwood, wet leaves, green clippings) with minimal jamming and maintenance. Roller and turbine technologies are increasingly favored over traditional impact blades, especially in the premium segment, due to their quieter operation, superior crushing power, and reduced propensity for blade wear. Furthermore, motor technology is transitioning significantly, with electric and battery-powered brushless DC motors dominating the residential sector, offering high torque, longer lifespan, and optimal energy efficiency compared to older brushed designs, thereby meeting strict consumer demands for cordless convenience and sustainability.

A critical area of development involves material processing intelligence and safety features. Modern shredders incorporate advanced sensors to monitor motor load and automatically reverse the rotation or adjust speed when jamming is detected, significantly enhancing operational reliability and reducing user intervention. Safety mechanisms are also becoming highly sophisticated, including complex interlocking systems and optimized hopper designs that prevent accidental contact with moving parts, complying with evolving global safety directives. For petrol-powered commercial shredders, manufacturers are investing in technologies that improve fuel efficiency, reduce emissions (meeting Tier 4 and Euro V standards), and enhance mobility through specialized, easy-to-tow trailer mounts, ensuring professional contractors can operate efficiently in various terrains and regulatory environments.

The integration of digital technology, while still nascent, is beginning to influence the market. High-end professional models are being equipped with telematics and IoT capabilities, allowing fleet managers to track location, monitor usage hours, and proactively schedule preventative maintenance via cloud-based platforms. For residential users, the focus is on integrating battery ecosystems, where a single battery platform powers multiple outdoor tools (e.g., shredder, lawnmower, trimmer), maximizing utility and reducing overall consumer investment. This shift toward modularity and interconnected smart gardening systems represents a significant technological trend that will define future product differentiation and market leadership in the medium to long term.

Regional Highlights

The Garden Shredders Market demonstrates varied growth patterns and maturity levels across different geographical regions, heavily influenced by localized gardening traditions, waste management regulations, and economic development. North America and Europe currently hold the largest market shares, but the Asia Pacific region is rapidly emerging as the strongest growth engine, promising significant opportunities for market penetration. Regional strategies deployed by leading manufacturers are highly customized, addressing the specific consumer requirements and infrastructure differences inherent in each major market cluster, ranging from the preference for cordless tools in suburban North America to the adherence to strict noise limits in densely populated European cities.

Europe: Europe represents the most mature and dominant market for garden shredders, driven by extremely strict environmental regulations that prohibit or heavily tax the disposal of green waste in landfills. Countries such as Germany, the UK, and the Netherlands have a deeply ingrained culture of home composting and recycling, fostering high consumer awareness and adoption rates. The European market exhibits a strong preference for quiet roller and turbine shredders, catering to dense urban and suburban populations where noise restrictions are paramount. The sustained growth is supported by robust replacement cycles and a continuous demand for higher-efficiency electric and battery models that align with the EU’s Green Deal initiatives. Furthermore, the strong presence of major European manufacturers ensures continuous product innovation tailored to regional standards.

North America: The North American market, comprising the U.S. and Canada, is characterized by large property sizes, a prevalent DIY culture, and a strong preference for high-power equipment. While electric and battery shredders are gaining ground, particularly in suburban areas, heavy-duty petrol-powered chipper shredders remain essential for managing significant volumes of woody debris generated in expansive yards and rural settings. Market growth is stimulated by the boom in home improvement activities and the expanding commercial landscaping sector, which demands durable, reliable, and high-capacity machinery. Key market dynamics include the rapid uptake of professional-grade battery systems that rival the power of smaller gasoline engines, enhancing maneuverability and reducing operational emissions for commercial contractors.

Asia Pacific (APAC): The APAC region, including high-growth economies like China, India, Japan, and Australia, is projected to register the fastest growth rate throughout the forecast period. This surge is attributed to rapid urbanization, increasing per capita disposable income leading to greater investment in private gardens and landscaping, and the developing infrastructure for organized waste management. While currently dominated by low-cost, low-capacity electric shredders in the residential sector, the demand for sophisticated professional equipment is accelerating due to the fast expansion of commercial landscaping services and institutional parks management. Challenges remain regarding establishing robust distribution networks and educating consumers in newly emerging markets about the benefits of specialized garden tools, but the sheer size of the potential customer base makes APAC a critical focus area for global market expansion.

Latin America and Middle East & Africa (MEA): These regions represent emerging opportunities, currently holding smaller market shares but possessing significant long-term potential. In Latin America, market growth is gradually increasing, driven by agricultural applications and municipal waste processing needs, with a preference for durable, mid-capacity petrol shredders due to varying access to reliable electricity infrastructure. The MEA market growth is more localized, concentrated in affluent Gulf nations with extensive landscaping needs and increasing governmental investment in green infrastructure projects. Market expansion in both regions is heavily dependent on economic stability, increasing foreign investment in infrastructure development, and the eventual implementation of widespread regulatory frameworks supporting organic waste recycling.

- Europe: Market leader driven by strict environmental regulations, high consumer adoption of composting, and preference for low-noise roller technology. Key focus areas include Germany, UK, and France.

- North America: Strong market for high-capacity petrol and emerging large-format battery chipper shredders, fueled by DIY culture and robust commercial landscaping services, primarily in the U.S.

- Asia Pacific (APAC): Fastest-growing region, stimulated by urbanization, rising disposable incomes, and increasing infrastructure development, with major growth nodes in China and India.

- Latin America: Emerging market focusing on agricultural and municipal applications, prioritizing robust, often petrol-powered, mid-capacity equipment.

- Middle East & Africa (MEA): Niche growth driven by specific governmental and private sector landscaping projects in urban centers and high-income regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Garden Shredders Market.- Robert Bosch GmbH (Bosch)

- STIHL Group

- Husqvarna Group

- The Toro Company (Toro)

- Makita Corporation

- ECHO Inc.

- Greenworks Tools (Globe Tools Group)

- Einhell Germany AG

- AL-KO KOBER GROUP

- Ryobi (Techtronic Industries Co. Ltd. - TTI)

- Scheppach GmbH

- MTD Products (recently acquired by Stanley Black & Decker)

- Vermeer Corporation

- Honda Power Equipment

- Champion Power Equipment

- Mantis (Schiller Grounds Care, Inc.)

- Sun Joe (Snow Joe, LLC)

- Black & Decker (Stanley Black & Decker)

- Titan Pro

- Feider

Frequently Asked Questions

Analyze common user questions about the Garden Shredders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between impact and roller garden shredders?

Impact shredders use fast-spinning blades suitable for shredding soft green waste, small twigs, and leaves efficiently, often operating at higher noise levels. Roller (crushing) shredders use a slow-rotating geared mechanism to crush and compress woody material up to medium thickness, offering significantly quieter operation and minimizing jamming, making them ideal for woody branches and suburban use.

Are battery-powered garden shredders powerful enough for heavy-duty use?

While historically less powerful, modern professional-grade battery-powered shredders, utilizing high-voltage systems (e.g., 80V or commercial 4Ah+ packs), now offer sufficient torque and run time to manage medium to heavy-duty residential and light commercial woody debris, bridging the performance gap with smaller petrol models and offering zero emissions and reduced noise.

Which geographical region holds the largest market share for garden shredders?

Europe currently holds the largest market share, driven by a deeply established recycling culture and stringent government regulations concerning the disposal of organic waste. This market dominance is supported by high consumer adoption of composting and strong replacement cycles for advanced, low-noise electric and roller shredding equipment.

How is the adoption of IoT and AI impacting the design of new garden shredders?

IoT and AI are influencing the design by enabling smart functionalities such as predictive maintenance alerts, automatic material recognition for optimized speed adjustment, and remote fleet management capabilities, primarily in high-end commercial models, aiming to enhance safety, efficiency, and machine longevity through intelligent operation.

What are the key factors driving the projected high growth rate in the Asia Pacific market?

The rapid urbanization across countries like China and India, coupled with rising disposable incomes, is leading to increased investment in residential landscaping and professional gardening services. This expansion, combined with emerging environmental awareness and developing infrastructure for green waste management, is accelerating the adoption of garden shredders across APAC.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager