Gardening and Agriculture Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434696 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Gardening and Agriculture Equipment Market Size

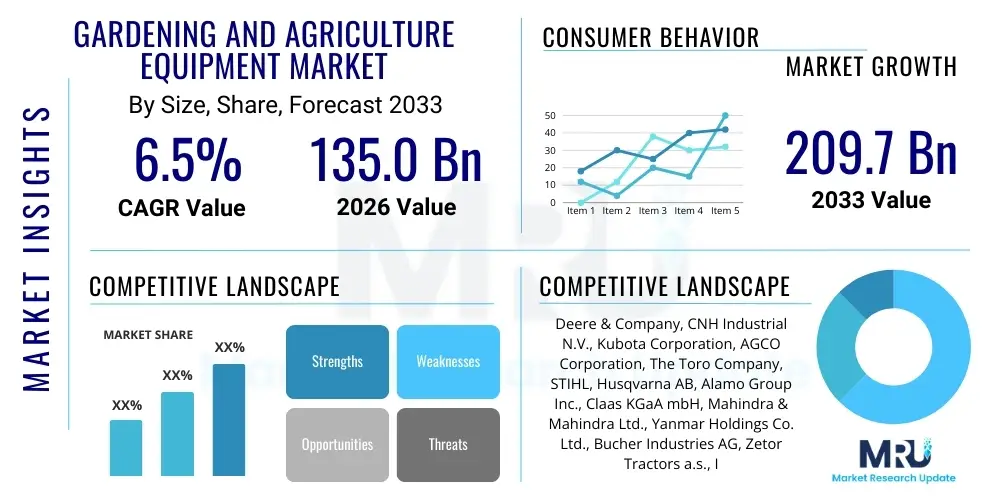

The Gardening and Agriculture Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $135.0 Billion in 2026 and is projected to reach $209.7 Billion by the end of the forecast period in 2033.

Gardening and Agriculture Equipment Market introduction

The Gardening and Agriculture Equipment Market encompasses a broad range of machinery, tools, and implements essential for cultivation, harvesting, maintenance, and soil management across various scales, from large commercial farms to small residential gardens. This equipment includes sophisticated machinery such as high-horsepower tractors, combine harvesters, precision planters, and automated sprayers, alongside pedestrian-controlled tools like tillers, lawn mowers, and trimmers. The core function of this market is to enhance efficiency, productivity, and sustainability in agricultural and horticultural practices globally, addressing critical challenges related to labor shortages, optimizing resource utilization, and meeting escalating global food demand. Modern equipment is increasingly integrated with digital technologies, moving the industry toward smart farming paradigms.

Product descriptions within this sector span engine-driven power tools, heavy field machinery, and specialized implements tailored for specific terrains and crop types. Major applications are predominantly found in large-scale commercial agriculture (crop production, livestock feed harvesting), commercial horticulture (greenhouse operations, vineyards), and consumer lawn and garden maintenance. The rapid adoption of advanced technologies like GPS guidance, telematics, and sensor systems is redefining product capabilities, enabling operations such as variable rate application and autonomous driving, which were previously aspirational. These technological integrations drive higher yields while concurrently minimizing environmental footprints, a key market benefit.

Key benefits derived from the adoption of modern agricultural and gardening equipment include significantly improved operational efficiency, reduced dependency on manual labor, enhanced precision in input application (water, fertilizers, pesticides), and ultimately, higher profitability for farmers and growers. Driving factors for market expansion include accelerating global population growth demanding greater food production, government subsidies and initiatives promoting farm mechanization, the increasing trend of urbanization leading to professional landscape management, and the crucial requirement for sustainable farming practices that utilize resources judiciously. Furthermore, the rising popularity of smart gardening and backyard cultivation among urban dwellers also fuels the demand for compact and efficient gardening tools.

Gardening and Agriculture Equipment Market Executive Summary

The Gardening and Agriculture Equipment Market is poised for substantial growth through 2033, driven fundamentally by the imperative to boost agricultural output through precision technologies and increased mechanization, particularly in developing economies. Business trends are dominated by strategic mergers and acquisitions among leading global manufacturers focused on expanding technological portfolios, especially in autonomy and electrification. There is a marked shift toward offering Equipment-as-a-Service (EaaS) models and subscription services for high-value machinery, allowing smaller farming operations access to cutting-edge technology without prohibitive upfront capital expenditure. Sustainability is now a core business trend, pushing manufacturers to develop fuel-efficient engines and electric alternatives, responding to increasingly stringent global emission standards and consumer demand for environmentally responsible production.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by vast agricultural lands, supportive government policies promoting mechanization in countries like India and China, and a large population base driving food demand. North America and Europe, while mature markets, lead in the adoption of high-precision agriculture equipment, AI integration, and fully autonomous systems, reflecting higher capital availability and a focus on overcoming skilled labor shortages. Latin America exhibits robust potential due to the modernization of large-scale farming operations (soy, corn) and increasing investment in irrigation and harvesting machinery upgrades.

Segment trends reveal that the Tractors segment continues to hold the largest market share by value, driven by essential utility across all farming stages, though the fastest growth is projected within the Precision Agriculture Equipment segment (including sensors, guidance systems, and drones). By application, the Agriculture segment (including row crops and cereals) dominates, but the Lawn & Garden segment is experiencing rapid retail growth, particularly in battery-powered equipment favored by consumers for ease of use and reduced noise pollution. Manufacturers are optimizing product lines toward modular designs, facilitating easier integration of third-party precision modules and digital farm management software, ensuring longevity and adaptability of capital investment.

AI Impact Analysis on Gardening and Agriculture Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) frequently center on how these advanced systems can deliver measurable improvements in yield, resource management, and operational efficiency, especially concerning labor reduction. Common themes include the integration of AI for predictive maintenance, optimizing planting and harvesting schedules using sophisticated weather and soil data, and the role of computer vision in weed detection and autonomous navigation. Users are keenly interested in the return on investment (ROI) for AI-equipped machinery and the necessary infrastructure (connectivity, data handling) required to support these technologies. Furthermore, concerns often revolve around data privacy, cybersecurity risks associated with connected farm systems, and the learning curve required for farmers to effectively utilize complex AI interfaces.

The integration of AI into agricultural and gardening equipment fundamentally transforms conventional practices by enabling truly intelligent and autonomous operations. AI-driven solutions facilitate the interpretation of massive datasets collected from drones, satellites, and on-board sensors (Internet of Things or IoT), allowing for instantaneous decision-making at the field level. For instance, AI algorithms determine the exact amount of fertilizer needed for a specific micro-section of a field (variable rate technology), or identify early signs of crop disease, allowing for targeted intervention rather than broad-spectrum treatment. This shift moves farming from reactive guesswork to proactive, data-driven management, leading to significant cost savings in inputs and minimization of crop loss, directly addressing global sustainability goals.

In gardening equipment, AI is manifesting through smart robotic lawnmowers and intelligent irrigation systems that learn environmental patterns and lawn health requirements autonomously. On the industrial side, AI is the backbone of fully autonomous tractors and harvesters, enhancing safety and operational duration. Predictive maintenance, a major AI application, analyzes operational data from machinery in real-time to forecast potential component failures, scheduling maintenance proactively rather than reactively. This minimizes costly downtime during critical planting or harvesting windows, ensuring maximum operational uptime. The long-term impact of AI is expected to democratize high-level agronomic expertise, embedding complex decision support systems directly into the farm machinery itself.

- AI-powered autonomous machinery enhances operational throughput and safety.

- Predictive analytics optimizes maintenance schedules, reducing equipment downtime.

- Computer vision systems enable precise weed and pest detection, minimizing chemical usage.

- Machine learning algorithms optimize variable rate application of seeds, fertilizers, and water.

- AI-driven yield mapping and forecasting improve inventory and supply chain management.

- Sophisticated data processing enhances decision-making for complex cropping patterns and rotation.

DRO & Impact Forces Of Gardening and Agriculture Equipment Market

The market trajectory is shaped by a confluence of powerful drivers (D), potential restraints (R), and compelling opportunities (O), which collectively dictate the impact forces on the industry. A primary driver is the necessity for enhanced food security globally, coupled with decreasing arable land and a rapidly expanding global population, necessitating higher yields per unit of land achievable primarily through advanced mechanization. Restraints typically include the high initial capital investment required for state-of-the-art machinery, particularly in developing economies where access to credit remains a significant barrier. Opportunities reside in the rapid commercialization of electric and autonomous equipment, coupled with burgeoning demand for smaller, specialized machinery for urban farming and high-value crops like specialty fruits and vegetables.

Drivers: Significant market acceleration is derived from global governmental policies that actively support agricultural modernization through subsidies, tax incentives, and infrastructure development. The persistent trend of labor migration from rural to urban areas exacerbates the shortage of skilled farm labor, making automation and large-scale, high-capacity machinery indispensable. Furthermore, heightened environmental consciousness and consumer demand for sustainably sourced produce compel farmers to adopt precision equipment that minimizes resource wastage, particularly water and agrochemicals. The push towards standardization in emissions and safety regulations worldwide also necessitates continuous equipment upgrades, driving replacement cycles and new sales.

Restraints: The market faces considerable constraints, predominantly related to economic viability. The substantial upfront cost of high-technology farming equipment, such as AI-guided tractors and sensor networks, limits adoption among small and medium-sized enterprises (SMEs). Additionally, poor broadband infrastructure and low digital literacy in remote agricultural regions hinder the effective implementation and utilization of IoT and cloud-based farm management solutions. Moreover, the agricultural sector is highly sensitive to commodity price fluctuations and adverse climatic conditions, leading to volatility in farmer incomes, which directly impacts capital expenditure on new machinery.

Opportunities: Key growth avenues involve the electrification of the equipment fleet, leveraging advances in battery technology to offer zero-emission solutions for both gardening (mowers, trimmers) and specialized agriculture (compact tractors, utility vehicles). The development of rental and leasing markets offers crucial financial flexibility, overcoming the restraint of high capital costs. Expansion into emerging markets, where mechanization rates are still low, provides substantial greenfield opportunities. Crucially, the increasing synergy between agricultural equipment manufacturers and software/data analytics firms offers opportunities for developing integrated, comprehensive Farm Management Information Systems (FMIS) that provide end-to-end operational visibility and efficiency gains, representing a powerful force shaping future market offerings.

Impact Forces: The overarching impact force is the necessity for sustainable intensification—producing more food with less environmental impact. This force drives innovation in lightweight materials, fuel efficiency, and precision application tools. Economic forces, tied to global trade policies and commodity prices, dictate short-term purchasing cycles. Technological forces, particularly the convergence of 5G connectivity, AI, and autonomous systems, are forcing rapid product development and obsolescence of older, purely mechanical machinery. Finally, demographic forces, specifically aging farming populations and the rise of hobby/urban gardening, generate distinct demand streams for both large-scale, automated machinery and smaller, user-friendly battery-powered tools.

Segmentation Analysis

The Gardening and Agriculture Equipment Market is systematically segmented based on Equipment Type, Application, and Power Source to provide granular insights into consumer preferences and investment patterns across diverse agricultural landscapes. Understanding these segmentations is critical for manufacturers to tailor product development and market penetration strategies effectively. The segmentation highlights the dominant role of heavy machinery in commercial agriculture versus the growing importance of specialized, consumer-focused equipment in horticulture and lawn maintenance. Each segment is highly responsive to technological advancements, regulatory changes, and regional economic cycles, necessitating dynamic business planning.

The segmentation by Equipment Type clearly demonstrates the foundation of modern farming, with tractors being the workhorse, followed by essential harvesting and soil preparation machinery. Within the Application segment, commercial agriculture holds the majority share due to the scale of operations, although forestry and specialized horticulture represent niche but high-growth areas driven by precision requirements and vertical farming trends. The analysis of Power Source reflects the industry’s transitional phase, moving steadily away from purely fossil-fuel reliance towards a greater acceptance and adoption of electric and hybrid solutions, particularly for lower-horsepower and frequent-use equipment where immediate torque and lower operational noise are significant advantages.

Market forecasts indicate that while traditional equipment types will maintain volume dominance, the fastest growth rates will be observed in high-value, digitally integrated segments such as autonomous guided vehicles (AGVs) and complex precision sprayers. Furthermore, the segmentation analysis confirms that purchasing decisions are heavily influenced by farm size and local topography; large farms prioritize machinery offering high horsepower and bandwidth, while small farms and gardening segments focus on multifunctionality, compactness, and sustainability derived from battery-powered tools. This diverse demand profile necessitates a comprehensive and highly diversified product portfolio from leading market participants.

- By Equipment Type:

- Tractors (2WD, 4WD, Compact, High-HP)

- Harvesters (Combine, Forage, Root Crop)

- Cultivators and Tillers

- Seeders and Planters (Precision Planting Systems)

- Sprayers and Dusters (Self-Propelled, Mounted, Aerial)

- Irrigation Equipment

- Lawn Mowers and Trimmers

- Specialty Equipment (Balers, Loaders, Attachments)

- By Application:

- Agriculture (Row Crops, Specialty Crops)

- Horticulture and Floriculture

- Forestry and Landscaping

- Lawn & Garden (Residential and Commercial)

- By Power Source:

- Manual and Animal-Drawn

- Fuel-powered (Diesel, Gasoline)

- Electric and Hybrid (Battery-Powered, Plug-in)

Value Chain Analysis For Gardening and Agriculture Equipment Market

The value chain for the Gardening and Agriculture Equipment Market is complex, involving raw material procurement, specialized component manufacturing, equipment assembly, extensive distribution networks, and sophisticated after-sales support. Upstream analysis focuses on the supply of critical inputs, primarily steel, aluminum, advanced plastics, and complex electronic components such as microprocessors, sensors, and GPS modules. Price volatility and supply chain stability for these raw materials and electronic parts significantly impact manufacturing costs and lead times. Suppliers of specialized components, like high-efficiency engines (Tier 4/Stage V compliant), hydraulic systems, and transmission components, hold substantial leverage due to the technical complexity and rigorous safety standards required in agricultural machinery.

The midstream involves the core manufacturing process, dominated by global OEMs who engage in advanced machining, assembly, testing, and quality control. Differentiation at this stage relies heavily on investing in R&D to integrate digital technologies (IoT, AI, Telematics) and achieve superior machinery performance and fuel efficiency. Manufacturing optimization, often involving global production footprints, is crucial for cost management. This stage is followed by the intricate distribution network, which is pivotal for market reach and customer engagement. Distribution channels typically involve a mix of direct sales to large corporate farms, and, more commonly, robust networks of authorized dealers and independent distributors who provide localized sales, financing, and maintenance services.

Downstream analysis centers on the end-user interaction and post-sale services. Direct sales channels are often utilized for large, bespoke equipment where customization and integration expertise are needed. Indirect channels, primarily dealer networks, are essential for serving the vast population of individual farmers and residential consumers, providing crucial local proximity, rapid spare parts supply, and maintenance. The effectiveness of after-sales support—including digital diagnostics, guaranteed parts availability, and technician training—is a major determinant of brand loyalty and repeat business. The rise of digital platforms for parts ordering and remote machinery monitoring is transforming the downstream experience, enhancing operational efficiency for the equipment owner.

Gardening and Agriculture Equipment Market Potential Customers

The customer base for the Gardening and Agriculture Equipment Market is highly segmented, spanning professional large-scale commodity producers, specialized niche growers, commercial service providers, and individual residential consumers. The largest revenue drivers are commercial agricultural enterprises (End-Users/Buyers) focused on row crops such as corn, soy, and wheat. These customers require high-horsepower, durable equipment capable of covering thousands of hectares efficiently, prioritizing features like high precision guidance systems, rapid operational speed, and low maintenance downtime. Their purchasing decisions are driven by total cost of ownership (TCO), fuel efficiency, and integration capabilities with existing farm management software, often involving multi-million dollar investments financed over several years.

A second crucial segment comprises specialized growers, including those involved in viticulture, orchard management, and protected cultivation (greenhouses). These buyers demand highly specialized, often narrower or compact machinery, such as vineyard tractors, narrow-row sprayers, and automated internal logistics systems. Their requirements emphasize gentle handling of high-value crops, precision application specific to plant canopy structure, and robust compliance with food safety regulations. Furthermore, agricultural service providers, who often rent out machinery and labor, form a growing customer segment, seeking robust, versatile equipment that can handle multiple tasks across various client farms.

The third major segment is the residential and commercial lawn and garden market. Residential buyers are focused on convenience, noise reduction, and ease of use, leading to a strong preference for battery-powered lawn mowers, trimmers, and cultivators. Commercial landscaping and grounds maintenance crews prioritize durability, battery life, and powerful performance in zero-emission equipment, driven by municipal noise ordinances and sustainability mandates. Manufacturers must address the distinct needs of these segments—high precision for agriculture and high portability and user-friendliness for the gardening sector—to maximize market penetration and customer satisfaction across the entire end-user spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $135.0 Billion |

| Market Forecast in 2033 | $209.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, CNH Industrial N.V., Kubota Corporation, AGCO Corporation, The Toro Company, STIHL, Husqvarna AB, Alamo Group Inc., Claas KGaA mbH, Mahindra & Mahindra Ltd., Yanmar Holdings Co. Ltd., Bucher Industries AG, Zetor Tractors a.s., Iseki & Co., Ltd., Wacker Neuson SE, Bosch, Honda Power Equipment, MTD Products, Inc., Fiskars Group, Techtronic Industries Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gardening and Agriculture Equipment Market Key Technology Landscape

The technological landscape of the Gardening and Agriculture Equipment Market is undergoing a fundamental transformation, shifting rapidly from purely mechanical systems to highly intelligent, interconnected digital platforms. The core technological drivers revolve around integrating smart farming concepts, characterized by the extensive use of the Internet of Things (IoT) for data collection, advanced Global Navigation Satellite Systems (GNSS) for unparalleled precision, and sophisticated data analytics for informed operational decisions. Key technologies include Real-Time Kinematics (RTK) GPS corrections, which enable sub-inch accuracy essential for tasks like automated steering and precision planting, significantly optimizing field efficiency and minimizing overlap. This precision is non-negotiable for modern high-yield agriculture.

Another dominant technology trend is the development and commercialization of autonomous equipment. This involves incorporating advanced sensor fusion (Lidar, Radar, Cameras), sophisticated path planning algorithms, and robust safety protocols to allow tractors and specialty implements to operate without human intervention in the field. Autonomy directly addresses the critical issue of labor shortages while maximizing machine utilization around the clock. Complementing this is the rise of electrification, driven by improvements in battery energy density and power output. Battery technology allows for silent, zero-emission operations, which is highly desirable in urban gardening, small-scale farming, and indoor cultivation environments. Furthermore, electric motors offer instant torque and reduced mechanical complexity compared to traditional internal combustion engines.

Finally, the convergence of machine technology with data science is creating highly advanced Farm Management Information Systems (FMIS) that utilize cloud computing and telematics to monitor machine health, performance, and field conditions remotely. Diagnostic telematics ensure equipment uptime through predictive maintenance alerts, while data collected during planting and harvesting informs future agronomic decisions. The development of specialized software for equipment management, yield mapping, and compliance tracking ensures that the equipment itself acts as a sophisticated data collector and executor, maximizing the efficiency of every agricultural input. This digital integration is essential for maintaining competitiveness and maximizing the productivity of high-value machinery assets.

Regional Highlights

The regional market dynamics reflect diverse agricultural requirements, technological maturity, and government policy support, shaping investment priorities across key global regions.

- Asia Pacific (APAC): APAC is projected to be the most rapidly growing region due to its enormous agricultural base and the pressing need for modernization. Countries like India and China are heavily investing in mechanization to improve small farm productivity and combat rural labor shortages. Government subsidies promoting the replacement of manual labor with power tillers, small tractors, and modern irrigation systems are widespread. The sheer population size ensures sustained high demand for food production, driving continuous investment in new, efficient equipment. While small- and medium-sized machinery dominates the volume, large-scale commercial farming operations in Australia and parts of Southeast Asia drive demand for high-HP, precision agriculture equipment.

- North America: North America represents a mature, high-value market characterized by large farm sizes and rapid adoption of cutting-edge technology. This region is the global leader in the deployment of autonomous equipment, AI integration for yield optimization, and telematics services. Demand is focused not merely on volume but on complexity and data output. Key drivers include the need to maximize efficiency in variable climate zones and the high cost of skilled labor, making robotic solutions highly attractive. Replacement cycles are often driven by technological innovation rather than wear and tear, maintaining steady demand for advanced sensors, high-horsepower tractors, and precision planters.

- Europe: The European market is defined by stringent environmental regulations (e.g., EU Green Deal) and a strong emphasis on sustainability and reduced chemical use. This environment drives significant demand for specialized, high-precision sprayers, sensor-equipped machinery, and electric utility vehicles. Fragmentation of land in many parts of Western Europe encourages demand for compact yet powerful equipment, while Eastern Europe's larger farm enterprises drive demand for higher horsepower machinery. Investment in sophisticated vertical farming and greenhouse technologies also contributes significantly to specialized equipment sales across the continent.

- Latin America (LATAM): LATAM is a crucial growth market, driven by the massive scale of commodity production (soy, corn, sugar cane) in countries like Brazil and Argentina. The market is characterized by increasing foreign direct investment in agriculture, leading to the rapid adoption of large machinery and modern harvesting technologies. Improving infrastructure and increased farmer access to financing are stimulating market expansion. The demand is heavily skewed towards high-capacity equipment capable of enduring challenging climatic conditions and extensive fieldwork, focusing on efficiency and durable construction.

- Middle East and Africa (MEA): The MEA region is segmented, with high demand for smart irrigation and water management equipment due to arid and semi-arid conditions being a major driver in the Middle East. Africa is a market with vast untapped potential, seeing accelerated mechanization primarily in South Africa and North Africa, often supported by international development aid and government programs focused on improving subsistence farming productivity through the introduction of basic mechanized equipment like power tillers and small tractors. Labor availability is high, but efficiency requirements are rising, slowly driving the uptake of more advanced, durable machinery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gardening and Agriculture Equipment Market.- Deere & Company

- CNH Industrial N.V.

- Kubota Corporation

- AGCO Corporation

- The Toro Company

- STIHL

- Husqvarna AB

- Alamo Group Inc.

- Claas KGaA mbH

- Mahindra & Mahindra Ltd.

- Yanmar Holdings Co. Ltd.

- Bucher Industries AG

- Zetor Tractors a.s.

- Iseki & Co., Ltd.

- Wacker Neuson SE

- Bosch

- Honda Power Equipment

- MTD Products, Inc.

- Fiskars Group

- Techtronic Industries Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Gardening and Agriculture Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Gardening and Agriculture Equipment Market?

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period from 2026 to 2033, driven by global mechanization and precision agriculture adoption.

How is precision agriculture technology influencing equipment purchasing decisions?

Precision agriculture, utilizing GPS, sensors, and AI, is leading farmers to prioritize technologically integrated equipment over traditional machinery, focusing on features that enable resource optimization, such as variable rate application and autonomous operation, maximizing ROI.

Which segment of the market is expected to show the fastest growth?

While tractors remain the largest segment by value, the electric/battery-powered equipment segment, particularly in the Lawn & Garden and specialized compact agriculture applications, is anticipated to exhibit the highest annual growth rate due to sustainability mandates and consumer convenience.

What are the primary challenges restraining market growth in developing countries?

The main restraints include the high initial capital investment required for modern machinery, limited access to robust financing and credit facilities for small farmers, and infrastructural deficiencies such as poor rural connectivity needed for advanced digital farming systems.

What role does telematics play in the future of agricultural equipment?

Telematics enables real-time monitoring of machinery health and location, remote diagnostics, and performance optimization. This technology is crucial for implementing predictive maintenance strategies, maximizing uptime, and integrating fleet data into comprehensive farm management information systems (FMIS).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager