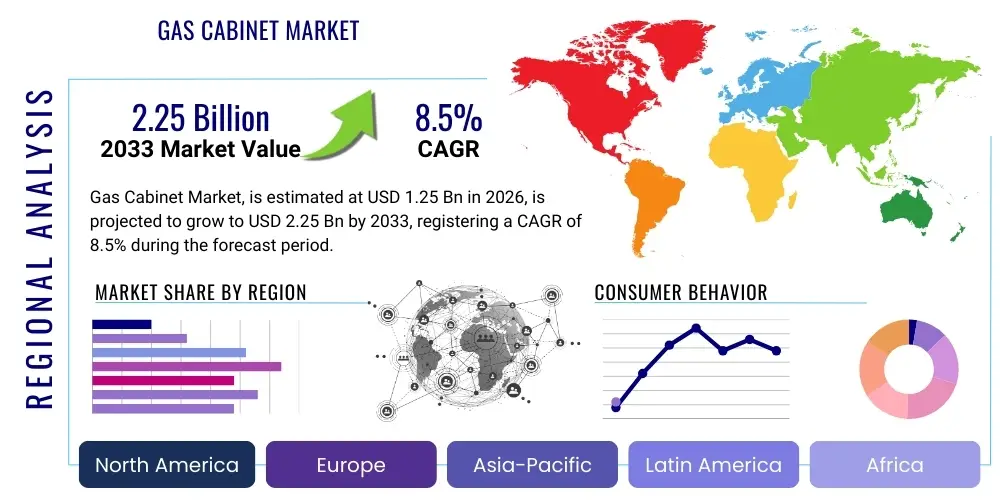

Gas Cabinet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437295 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Gas Cabinet Market Size

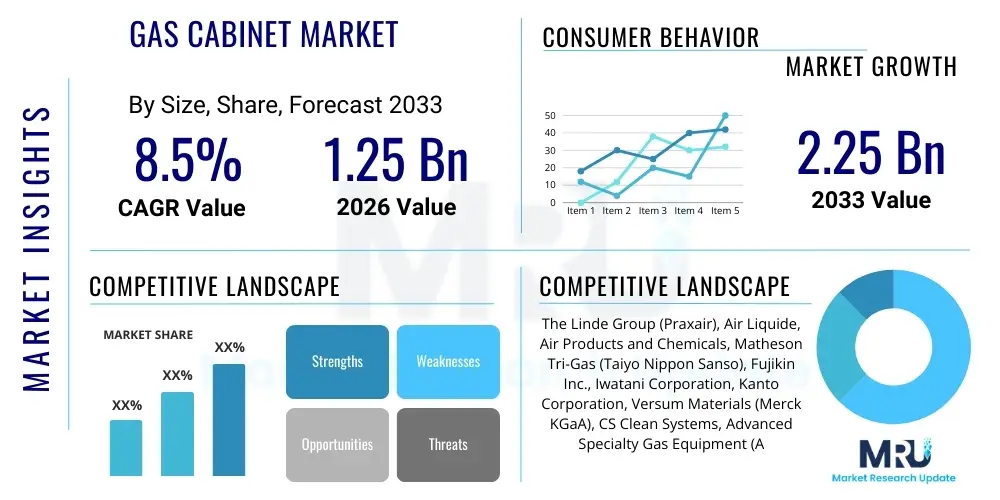

The Gas Cabinet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.25 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by escalating demand from the semiconductor manufacturing sector, which requires ultra-high purity gas delivery systems for critical processes like deposition and etching. Furthermore, the rigorous safety mandates imposed across industries handling hazardous or corrosive specialty gases necessitate the adoption of robust, compliant gas cabinet solutions, ensuring both operational efficiency and personnel safety.

Gas Cabinet Market introduction

The Gas Cabinet Market encompasses specialized enclosures designed to securely store, handle, and deliver specialty and bulk gases, particularly those that are toxic, pyrophoric, corrosive, or highly pressurized, used in high-tech manufacturing and research environments. These systems are essential components of gas management infrastructure, providing controlled environments that isolate the gas cylinders from the external facility environment, minimizing risk of leaks and exposure. Key product descriptions include single-station, dual-station, and multi-cylinder configurations, often featuring integrated safety mechanisms such as automatic purging systems, ventilation alarms, pressure monitoring, and fire suppression systems, ensuring compliance with strict industrial and governmental regulations.

Major applications of gas cabinets are predominantly found in semiconductor fabrication facilities, where precise delivery of process gases (like silane, ammonia, and chlorine) is paramount to wafer production quality and yield. Beyond semiconductors, the electronics industry utilizes them for LED and solar panel manufacturing, while pharmaceutical and biotechnology sectors rely on them for handling calibration and specialty medical gases. The primary benefits derived from using these sophisticated cabinets include enhanced operational safety through containment and automated control, improved process purity maintenance, and adherence to occupational safety standards (OSHA, SEMI F1). The consistent increase in complexity and volatility of gases used in advanced manufacturing serves as a foundational driving factor for market growth.

Gas Cabinet Market Executive Summary

The Gas Cabinet Market Executive Summary reveals robust growth anchored by global business trends emphasizing automation, safety standardization, and technological miniaturization, particularly in advanced electronics manufacturing. Business trends indicate a shift toward fully automated gas management systems (GMS) integrated with predictive maintenance capabilities, moving away from manually operated cabinets to enhance uptime and reduce human error exposure. Manufacturers are increasingly focusing on modular designs to facilitate easier installation and scalability within cleanroom environments. Supply chain pressures related to geopolitical dynamics and raw material sourcing (especially high-grade stainless steel and specialized alloys required for corrosive gas handling) are compelling key players to diversify manufacturing footprints and increase local sourcing capabilities across key industrial hubs.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of market expansion, fueled by massive investments in new fabrication facilities (fabs) in countries like China, South Korea, and Taiwan, which are global leaders in semiconductor production. North America and Europe, while mature markets, demonstrate steady demand driven by strict adherence to environmental, health, and safety (EHS) regulations and ongoing modernization projects in pharmaceutical and R&D sectors. Segment trends show a clear preference for automated gas cabinet systems over manual ones, driven by the necessity for precise flow control and instantaneous leak detection required for ultra-high purity (UHP) applications. Furthermore, the semiconductor application segment continues to command the largest market share, dictating technological advancements across the industry, particularly concerning material compatibility and advanced sensor integration.

AI Impact Analysis on Gas Cabinet Market

User queries regarding AI's influence on the Gas Cabinet Market primarily center on how artificial intelligence can enhance safety protocols, optimize predictive maintenance schedules, and improve the purity assurance of specialty gases. Users seek clarity on the viability of integrating AI algorithms with existing sensor arrays for real-time risk assessment and automated mitigation responses. There is significant interest in AI's capacity to analyze complex data streams—including pressure fluctuations, temperature variance, and minute leak signatures—to predict component failure before it occurs, thereby maximizing uptime in critical manufacturing environments. Furthermore, users are exploring how machine learning can optimize gas consumption rates within the fab, reducing waste and associated operational costs, signaling an industry expectation that AI will transition gas cabinets from passive storage units to active, intelligent components of the overall gas management infrastructure.

- AI-Powered Predictive Maintenance: Utilizing machine learning algorithms to analyze historical performance data and sensor inputs (flow rates, pressures, valve cycles) to forecast the potential failure of critical components like regulators, valves, and flow controllers, ensuring proactive replacement and minimizing costly process interruptions.

- Enhanced Safety and Risk Mitigation: Deploying AI to process and correlate data from multiple safety sensors (gas detectors, pressure alarms, ventilation monitors) in real-time, allowing for faster, more accurate identification of potential hazards and enabling automated, optimized emergency shutdown (ESD) procedures or purging sequences.

- Optimal Gas Consumption and Inventory Management: Using AI to analyze production schedules and gas usage patterns, optimizing the delivery sequence and purity monitoring to reduce gas waste, improve supply chain predictability, and automate ordering for specialty gases.

- Automated Leak Detection and Localization: Implementing deep learning models trained on acoustic and thermal signatures to identify and precisely locate minute leaks within the gas delivery system far quicker than traditional methods, maintaining ultra-high purity levels required in advanced semiconductor processes.

- Integrated Process Control Optimization: Enabling intelligent feedback loops between the gas cabinet and the manufacturing tool (e.g., CVD or PVD reactors) to dynamically adjust gas flow and pressure based on real-time process requirements, enhancing yield and consistency.

DRO & Impact Forces Of Gas Cabinet Market

The market dynamics for Gas Cabinets are shaped by a confluence of accelerating demand from high-technology sectors (Drivers), significant regulatory and technological hurdles (Restraints), and the emergence of new applications and smart technologies (Opportunities). The primary driving force remains the unprecedented global expansion of semiconductor manufacturing, requiring thousands of specialized cabinets per new fabrication plant to handle volatile process gases essential for advanced chip architecture. Simultaneously, global regulatory bodies are enforcing increasingly strict guidelines, particularly regarding the handling of highly hazardous materials, pushing industries toward certified, high-containment gas cabinet solutions that feature superior fire protection, structural integrity, and automated safety interlocks.

Conversely, the primary restraints involve the substantial initial investment cost associated with purchasing and installing ultra-high purity (UHP) cabinets, especially those designed with automated flow control and exotic material construction necessary for corrosive gases. Furthermore, the specialized knowledge required for the maintenance, calibration, and certification of these complex systems poses a significant barrier, particularly for smaller R&D laboratories or emerging market users. These factors sometimes lead users to delay upgrades or opt for less sophisticated, non-automated systems, slightly dampening the higher-end market segment growth.

The key opportunities revolve around the integration of Internet of Things (IoT) sensors and digital connectivity, allowing for remote monitoring and centralized data management across multiple facility locations, aligning with Industry 4.0 paradigms. Impact forces such as rapid technological obsolescence in the semiconductor industry—which necessitates continuous cabinet redesigns to accommodate new process gases and safety requirements—ensure that innovation remains a constant competitive factor. Furthermore, the growing use of hazardous gases in emerging sectors like advanced battery manufacturing and specialized solar technology presents new geographical and application opportunities for cabinet manufacturers, stabilizing long-term market growth despite short-term economic fluctuations.

Segmentation Analysis

The Gas Cabinet Market is systematically analyzed across several dimensions, providing granular insights into market dynamics and consumer preferences. The segmentation primarily focuses on the cabinet configuration, the level of automation, the type of gas being handled, and the end-use application. Understanding these segments is crucial for manufacturers to tailor their product offerings, focusing on material compatibility (e.g., stainless steel 316L for corrosive gases) and specific safety features mandated by different industrial users. The vertical/horizontal orientation segment addresses space constraints and accessibility requirements within crowded cleanroom environments, while the operational segment (manual vs. automated) reflects the ongoing industry shift toward precision and safety via digital control and remote monitoring.

- By Operation:

- Manual Gas Cabinets

- Automated/Semi-Automated Gas Cabinets (preferred in UHP environments)

- By Type/Configuration:

- Single Cylinder Cabinets

- Dual Cylinder Cabinets (Auto Switchover)

- Multi-Cylinder Systems (Manifolded)

- Custom Engineered Cabinets

- By Application:

- Semiconductor and Electronics Manufacturing (largest share)

- Pharmaceutical and Biotechnology

- Chemical and Petrochemical Processing

- Research Laboratories and Academia

- Automotive and Aerospace

- Solar and LED Manufacturing

- By Gas Type:

- Inert Gases (e.g., Nitrogen, Argon)

- Flammable/Pyrophoric Gases (e.g., Silane, Hydrogen)

- Corrosive Gases (e.g., Chlorine, HF)

- Toxic Gases (e.g., Arsine, Phosphine)

Value Chain Analysis For Gas Cabinet Market

The Gas Cabinet Market Value Chain begins with critical upstream analysis centered on the sourcing of high-specification raw materials and precision components. This includes the procurement of ultra-high purity (UHP) grade stainless steel (typically 316L VAR or VIM/VAR alloys) essential for the cabinet structure and internal piping, specialized pressure regulators, UHP valves, flow meters, and sensitive gas detection sensors. Key upstream suppliers include material processors, specialty valve manufacturers (e.g., Swagelok, Parker), and advanced sensor technology providers. The high barrier to entry at this stage is dictated by the stringent purity and traceability requirements, meaning suppliers must adhere to precise material and welding specifications to prevent contamination or corrosion within the UHP gas path.

Midstream activities involve the core manufacturing process, where cabinet assemblers integrate components, perform high-integrity welding (orbital welding for UHP lines), system calibration, testing, and final certification (e.g., SEMI F1 standards adherence). Distribution channel analysis reveals a mix of direct and indirect engagement. Direct channels are commonly utilized for large-scale projects, such as supplying new semiconductor fabs, where manufacturers provide custom design, installation, and commissioning services directly to the end-user. Indirect channels primarily involve specialized gas equipment distributors and large industrial gas suppliers (e.g., Air Liquide, Linde) who often bundle cabinet sales with their specialty gas supply contracts, leveraging their existing logistical networks and customer relationships to reach smaller R&D labs and regional electronics assembly plants.

Downstream analysis focuses on end-user integration, ongoing maintenance, and life-cycle support. Since gas cabinets are integral to critical processes, post-sale services—including regular leak testing, recalibration of sensors, filter changes, and certification renewals—represent a significant revenue stream. Direct engagement allows manufacturers to maintain tight control over quality assurance and service delivery, crucial for highly sensitive customers like semiconductor companies. Indirect distribution through specialized technical service partners ensures broad market penetration, particularly in geographically diverse markets, while maintaining compliance with stringent operational standards required by the highly regulated nature of the gases handled.

Gas Cabinet Market Potential Customers

The Potential Customers or primary end-users of gas cabinet systems are dominated by industries requiring the precise, safe, and contamination-free delivery of specialty process gases. The semiconductor industry represents the largest and most demanding customer segment. Companies involved in wafer fabrication (memory, logic, and analog chips) consistently purchase high volumes of automated, UHP-certified cabinets to house highly toxic and flammable gases necessary for etching, deposition, and doping processes. The criticality of these gases to the production yield means that semiconductor buyers prioritize system reliability, advanced safety features, and compliance with SEMI F1 standards above all else.

A second major customer group includes electronics manufacturers specializing in microelectromechanical systems (MEMS), solar photovoltaics, and flat panel displays (FPDs). These buyers also utilize toxic and flammable gases (though sometimes in lower flow rates than large fabs) and require robust cabinets that ensure regulatory compliance and process consistency. The pharmaceutical and biotechnology sector constitutes a growing customer base, primarily needing cabinets for storing and delivering high-purity calibration gases, medical gases, or specialized gases used in sterile environments and drug manufacturing processes, where adherence to Good Manufacturing Practices (GMP) is paramount.

Finally, academic and industrial research laboratories, along with chemical and petrochemical plants, form persistent demand pockets. Research labs typically require flexible, smaller-scale units for experimental work involving novel chemistries and specialty gases. Chemical plants use larger, more ruggedized cabinets for industrial processes, where safety and large-scale containment of hazardous materials are the primary purchasing considerations. This diverse customer base necessitates manufacturers to offer a broad portfolio ranging from standard, entry-level units to highly customized, automated UHP systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Linde Group (Praxair), Air Liquide, Air Products and Chemicals, Matheson Tri-Gas (Taiyo Nippon Sanso), Fujikin Inc., Iwatani Corporation, Kanto Corporation, Versum Materials (Merck KGaA), CS Clean Systems, Advanced Specialty Gas Equipment (ASGE), GCE Group, SEMI-GAS Systems, R&D Alarms, Labconco Corporation, SEMA GmbH, Entegris, CollabraTech Solutions, Advanced Technology Products (ATP). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Cabinet Market Key Technology Landscape

The Gas Cabinet Market Technology Landscape is rapidly evolving, driven primarily by the need for higher purity gas delivery and enhanced safety systems tailored for sub-10nm semiconductor processes. A core technological focus is the continuous improvement of materials of construction. This includes the mandatory use of high-grade, electropolished 316L stainless steel for all wetted parts to minimize particle generation and outgassing, thereby ensuring the ultra-high purity (UHP) of specialty gases. Furthermore, the reliance on high-integrity automated orbital welding techniques is standard practice to eliminate potential leak paths and maintain internal surface finish integrity, which is non-negotiable for handling highly reactive or toxic media.

A second crucial area of innovation is the integration of advanced monitoring and control software. Modern gas cabinets are moving beyond simple pressure gauges, incorporating sophisticated Programmable Logic Controllers (PLCs) and Distributed Control Systems (DCS) connectivity. These smart systems facilitate automated purging sequences (using inert gases like Nitrogen), instantaneous emergency shutdown (ESD) capabilities, and continuous real-time data logging. The use of specialized analytical sensors, such as photoionization detectors (PIDs) and infrared sensors, enables extremely sensitive detection of hazardous leaks, often capable of detecting contaminants in parts per billion (ppb) concentrations, significantly exceeding former regulatory thresholds and safety capabilities.

Finally, modular design and standardization are key technology trends. Manufacturers are developing standardized, configurable modules that can be quickly customized to specific cylinder sizes, flow rates, and gas types without requiring extensive re-engineering. This modular approach, coupled with standardized communication protocols (such as Modbus or Ethernet/IP), supports faster deployment in new facilities and simplifies maintenance and certification processes, reducing total cost of ownership (TCO) for end-users operating large fleets of gas management equipment. The constant push toward greater connectivity and digital integration defines the competitive edge in this highly technical sector.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global gas cabinet market both in volume and revenue, primarily due to the concentration of global semiconductor manufacturing hubs in countries like Taiwan, South Korea, China, and Japan. Massive governmental and private investments in new Giga-fabs (e.g., TSMC, Samsung, SK Hynix expansions) drive immense demand for UHP automated gas cabinet systems. China, in particular, is experiencing accelerated growth as it strives for self-sufficiency in chip production, creating a robust, localized demand for sophisticated gas handling solutions.

- North America: North America holds a significant market share, characterized by high regulatory standards and strong demand from the specialized R&D sector, pharmaceuticals, and established semiconductor clusters. Growth in this region is spurred by the CHIPS and Science Act, promoting domestic chip manufacturing and driving the need for state-of-the-art, compliance-intensive gas cabinets. Manufacturers here often focus on customization, advanced automation, and integration with complex facility management systems.

- Europe: The European market demonstrates stable growth, primarily driven by the stringent adoption of safety and environmental regulations (REACH, COMAH) across the chemical, automotive, and pharmaceutical industries. While semiconductor fabrication presence is smaller than in APAC, significant investment in R&D and high-value manufacturing segments (e.g., specialized medical devices and advanced materials) ensures consistent demand for high-containment, customized gas delivery solutions.

- Latin America, Middle East, and Africa (LAMEA): This region represents an emerging but rapidly expanding market. Growth is localized, concentrated around large-scale oil and gas processing facilities in the Middle East requiring specialized cabinets for calibration and process control gases, and increasing pharmaceutical manufacturing activities in countries like Brazil and Mexico. The demand is typically focused on rugged, reliable, and compliant systems suitable for challenging industrial environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Cabinet Market.- The Linde Group (Praxair)

- Air Liquide

- Air Products and Chemicals Inc.

- Matheson Tri-Gas (Taiyo Nippon Sanso Corporation)

- Fujikin Incorporated

- Iwatani Corporation

- Kanto Corporation

- Versum Materials (Acquired by Merck KGaA)

- CS Clean Systems AG

- Advanced Specialty Gas Equipment (ASGE)

- GCE Group

- SEMI-GAS Systems (Div. of Applied Energy Systems)

- R&D Alarms

- Labconco Corporation

- SEMA GmbH

- Entegris Inc.

- CollabraTech Solutions

- Advanced Technology Products (ATP)

- Critical Process Systems Group

- Air-Rite Industries Inc.

Frequently Asked Questions

Analyze common user questions about the Gas Cabinet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety features required in a modern gas cabinet?

Primary safety features include automated purging systems to remove residual hazardous gas before cylinder changeout, continuous gas leak detection sensors (often with ppb sensitivity), internal fire suppression systems, emergency shutdown (ESD) capabilities, continuous ventilation, and robust structural containment designed to meet SEMI F1 standards.

How does the Gas Cabinet Market intersect with semiconductor industry standards?

The market is critically linked to semiconductor standards, notably SEMI F1, which dictates specifications for the safe design and operation of gas delivery systems handling hazardous production materials. Compliance ensures gas purity, structural integrity, and standardized safety protocols necessary for high-yield wafer fabrication processes.

What is the main driver shifting demand from manual to automated gas cabinets?

The main driver is the increasing use of highly toxic and pyrophoric gases in advanced manufacturing (sub-10nm nodes). Automated cabinets offer precision flow control, remote monitoring, and instantaneous, failsafe emergency responses, drastically reducing human interaction with hazardous materials and improving process purity and consistency.

Which region currently leads the global market for gas cabinet sales and why?

The Asia Pacific (APAC) region leads the global market. This dominance is driven by massive investment and concentration of semiconductor manufacturing facilities (fabs) in China, Taiwan, and South Korea, which require continuous procurement of ultra-high purity gas cabinet systems for their production expansions.

What role does material selection play in gas cabinet performance?

Material selection, particularly the use of electropolished 316L stainless steel, is crucial for maintaining ultra-high gas purity. These materials resist corrosion and minimize outgassing and particle generation, preventing contamination that could critically impact sensitive manufacturing processes like atomic layer deposition (ALD) and etching.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager