Gas Cabinets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432536 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Gas Cabinets Market Size

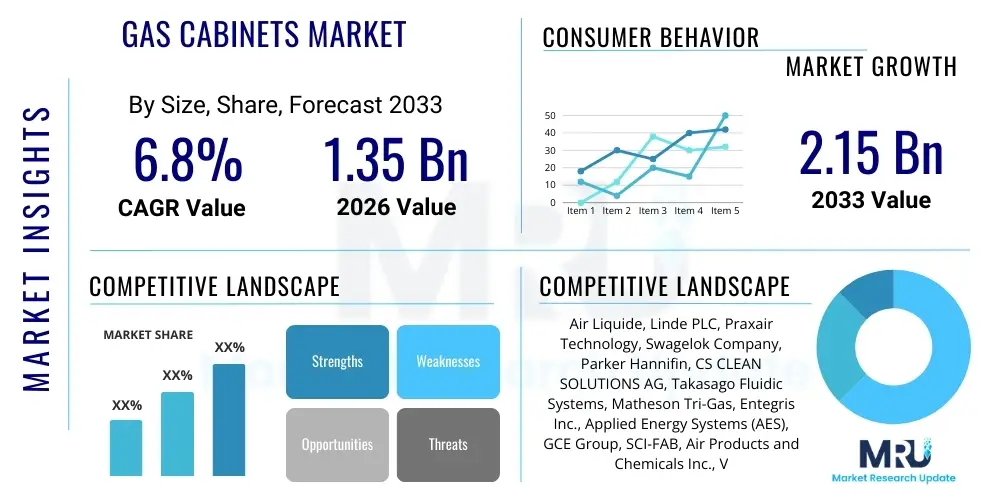

The Gas Cabinets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.35 billion in 2026 and is projected to reach USD 2.15 billion by the end of the forecast period in 2033.

Gas Cabinets Market introduction

Gas cabinets are essential safety and delivery systems designed to house, monitor, and control high-purity, corrosive, toxic, or pyrophoric specialty gases used in various sophisticated manufacturing and research environments. These enclosures provide a crucial barrier between hazardous gases and the operating environment, ensuring the safety of personnel and protecting processes from contamination. The primary function of a gas cabinet involves secure cylinder storage, continuous leak monitoring, automatic shutoff mechanisms, and proper ventilation/exhaust integration, aligning strictly with stringent industrial safety standards such as SEMI S2 and NFPA requirements. Given the critical nature of the gases handled—often utilized in semiconductor fabrication, pharmaceutical synthesis, and advanced material processing—reliability and precision engineering are paramount.

The market expansion is fundamentally driven by the exponential growth of the global semiconductor industry, particularly the push toward smaller node sizes and 3D stacking technologies, which necessitates the use of complex and highly toxic precursor gases. Furthermore, the increasing demand for specialized medical gases and the expansion of R&D activities in areas like photovoltaics and LED manufacturing contribute significantly to market acceleration. Benefits derived from modern gas cabinets include enhanced operational safety through fail-safe designs, minimization of gas waste via precise delivery control, and simplified compliance with complex environmental health and safety (EHS) regulations. The integration of advanced automation and sensor technology is further bolstering the utility and efficacy of these systems in high-throughput facilities.

Major applications of gas cabinets span across microelectronics fabrication (etching, deposition), biotechnology (fermentation, purification), chemical processing (synthesis), and various analytical laboratories. Driving factors encompass stricter regulatory frameworks globally regarding the handling of hazardous materials, the continuous innovation cycle within electronics necessitating new specialized gases, and the increasing investment in developing resilient, explosion-proof, and fire-rated gas handling infrastructure. The inherent risks associated with high-pressure, hazardous specialty gases make gas cabinets indispensable infrastructure components for ensuring process integrity and preventing catastrophic safety incidents.

Gas Cabinets Market Executive Summary

The global Gas Cabinets Market is characterized by robust growth, primarily fueled by sustained capital expenditure in the semiconductor and flat-panel display manufacturing sectors across Asia Pacific. Business trends indicate a strong move towards fully automated, integrated gas management systems featuring predictive maintenance capabilities and remote diagnostics. Manufacturers are focusing on modular designs that allow for flexible configurations (e.g., single-station, dual-station, multi-cylinder setups) and improved internal components, such as high-purity orbital welding and enhanced purge systems, to minimize contamination risks, crucial for ultra-high purity (UHP) gas applications. Consolidation among major suppliers is driving innovation in sensor technology and system integration, emphasizing safety certification and operational efficiency as key competitive differentiators.

Regionally, the Asia Pacific (APAC) market dominates revenue share due to the concentration of semiconductor foundries, particularly in Taiwan, South Korea, and mainland China. Government initiatives supporting local electronics manufacturing and significant foreign direct investment into advanced fabrication facilities (fabs) are propelling demand for high-specification gas cabinets. North America and Europe demonstrate mature market demand, driven largely by regulatory compliance requirements and expansion in the pharmaceutical and specialty chemicals sectors. These regions are prioritizing highly customized, low-volume systems suitable for complex R&D applications, focusing heavily on safety features tailored to highly volatile or reactive gases.

Segment trends reveal that the Automatic Gas Cabinets segment is experiencing faster growth compared to manual systems, driven by the need for reduced human error and enhanced precision in industrial settings. By application, the Semiconductor & Electronics segment remains the largest consumer, though the Healthcare & Biotechnology segment is showing accelerated adoption due to increasing standardization in medical gas handling. Furthermore, the market for gas cabinets optimized for corrosive gases, such as hydrogen chloride and boron trichloride, is expanding due to their necessity in advanced semiconductor etching processes. The shift toward incorporating advanced connectivity protocols (IoT) for real-time monitoring represents a significant technological segment trend.

AI Impact Analysis on Gas Cabinets Market

User inquiries regarding AI's influence on the Gas Cabinets Market primarily center on predictive safety mechanisms, optimization of gas consumption, and autonomous system management. Key themes include the feasibility of integrating machine learning algorithms to forecast potential component failures (like valves, regulators, or purifiers), thus minimizing unplanned downtime, and the use of AI to analyze historical leak data to identify systemic risks proactively. Users are also concerned about how AI can enhance the efficiency of complex purge cycles, thereby reducing inert gas usage, and whether autonomous control systems can truly meet stringent safety interlock requirements without human oversight. Expectations are high for AI to transform reactive maintenance into predictive operational strategies, significantly improving the overall safety profile and operational throughput of specialized gas handling infrastructure within highly sensitive manufacturing environments.

- Enhanced Predictive Maintenance: AI algorithms analyze real-time sensor data (pressure, temperature, flow rates, vibration) to predict component wear and failure (e.g., solenoid valves, pressure transducers), scheduling preventative maintenance before safety or operational compromise occurs.

- Optimized Gas Consumption and Purge Cycles: Machine learning models optimize gas usage by analyzing process requirements and dynamically adjusting purge frequencies and durations, reducing the consumption of expensive specialty gases and inert carrier gases like nitrogen.

- Advanced Leak Detection and Anomaly Identification: AI processes continuous monitoring data from leak detectors (e.g., infrared, electrochemical) to differentiate genuine leaks from transient noise or calibration drift, enhancing detection reliability and speed.

- Automated Safety Protocol Enforcement: AI systems can cross-reference operational parameters with safety standards and automatically initiate emergency shutdown procedures (E-Stop) faster and more accurately than traditional PLC-based interlocks when unusual or high-risk conditions are detected.

- Improved Regulatory Compliance Documentation: AI assists in automatically logging, analyzing, and summarizing operational data relevant to regulatory compliance (e.g., vent flow rates, exposure limits), streamlining reporting required by OSHA, SEMI, and regional EHS bodies.

- Remote Diagnostics and Troubleshooting: AI-powered diagnostic tools guide technicians through complex troubleshooting protocols, analyzing fault history and suggesting probable causes, thereby reducing mean time to repair (MTTR).

DRO & Impact Forces Of Gas Cabinets Market

The Gas Cabinets Market is significantly influenced by a confluence of accelerating industry growth, rigid safety mandates, and complex technological challenges. Drivers include the substantial global investment in semiconductor fabrication, particularly the establishment of new large-scale fabs requiring hundreds of specialized gas cabinets, and the regulatory environment that continually imposes stricter safety requirements for handling toxic and flammable process gases. Opportunities arise from the transition towards UHP (Ultra-High Purity) applications, demanding highly sophisticated materials and automated systems, and the emerging markets in advanced battery manufacturing and hydrogen energy infrastructure, which require specialized gas delivery solutions. Conversely, restraints involve the high initial capital investment required for these systems, the extended certification and qualification processes, and the shortage of highly skilled technicians capable of maintaining complex high-ppurity installations.

Impact forces acting upon the market are generally positive and stabilizing. The technological imperative force is strong, demanding continuous innovation in material compatibility, leak detection sensitivity, and automation integration to meet the evolving demands of sub-10nm semiconductor processes. Regulatory compliance acts as a powerful barrier to entry for smaller, less certified players, concentrating market share among established suppliers known for meeting rigorous safety standards. Furthermore, the macroeconomic force related to global supply chain dependencies (especially for high-purity components like specialized valves and regulators) introduces volatility, although this is being partially mitigated by dual-sourcing strategies.

The crucial balance lies between enhancing safety features, which often increases cost, and meeting manufacturing throughput requirements. The inherent safety culture within the semiconductor and specialty chemical industries ensures sustained demand for premium, certified gas cabinets. However, the cyclical nature of the electronics industry, which impacts capital expenditure, remains a short-term constraining force that requires careful strategic planning by manufacturers. Overall, the long-term outlook is exceptionally favorable due to the irreversible global trend towards advanced electronics manufacturing and stringent safety regulation.

- Drivers: Accelerated semiconductor manufacturing capacity expansion; Increasing implementation of stringent industrial safety regulations (OSHA, SEMI); Rising demand for Ultra-High Purity (UHP) gas delivery systems; Growth in R&D activities across specialized chemicals and biotechnology.

- Restraints: High acquisition and installation costs of certified, high-purity cabinets; Complex and time-consuming regulatory qualification and compliance processes; Reliance on highly specialized supply chains for critical components; Shortage of skilled technical personnel for maintenance and operation.

- Opportunities: Development of customized gas cabinets for emerging sectors like green hydrogen and advanced battery manufacturing; Integration of IoT and AI for predictive maintenance and remote monitoring; Market penetration in developing economies scaling up manufacturing capabilities; Demand for specialized corrosive and pyrophoric gas handling solutions.

- Impact Forces: Technological Force (High requirement for system purity and automation); Regulatory Force (Continuous enforcement of strict safety standards); Economic Force (Capital expenditure cycles in electronics manufacturing); Competitive Force (Focus on component quality and system reliability).

Segmentation Analysis

The Gas Cabinets Market is extensively segmented based on several critical parameters, including the type of operation (manual vs. automatic), the enclosure configuration (single, dual, multi-cylinder), the type of gas managed (toxic, corrosive, flammable, inert), and the primary end-use application. Understanding these segments is crucial for manufacturers to tailor product specifications to specific industry demands, especially concerning purity levels, throughput capacity, and regulatory adherence. The segment breakdown highlights the market shift toward automated systems that offer superior control and integration capabilities, essential for modern, highly automated fabrication environments. Configuration segmentation assists in determining the space optimization and redundancy requirements of various manufacturing sites.

The application segmentation clearly indicates the dominance of the microelectronics sector, which requires the highest standards of gas purity and safety due to the sensitivity of semiconductor processes. However, fast-growing sectors like pharmaceuticals and specialized chemical production are increasingly adopting advanced gas cabinets to ensure compliance with cGMP (current Good Manufacturing Practice) guidelines and manage complex reaction pathways. Geographic segmentation remains vital, reflecting varied regional regulatory environments and capital investment cycles, particularly distinguishing the high-volume, high-density demand of APAC from the sophisticated, customized requirements typically found in North American and European R&D institutions.

- By Operation Type:

- Manual Gas Cabinets

- Automatic Gas Cabinets

- By Configuration:

- Single-Cylinder Gas Cabinets

- Dual-Cylinder Gas Cabinets (for continuous operation via automatic switchover)

- Multi-Cylinder Gas Cabinets (for manifold systems or high volume users)

- By Gas Type:

- Toxic Gases (e.g., Arsine, Phosphine)

- Corrosive Gases (e.g., HCl, BCl3)

- Flammable Gases (e.g., Silane, Hydrogen)

- Inert Gases (High Purity Nitrogen, Argon)

- By End-Use Application:

- Semiconductor & Electronics Manufacturing

- Pharmaceutical & Biotechnology

- Chemical Processing

- Research & Development Laboratories

- Automotive & Aerospace

- Energy (e.g., Photovoltaics, Fuel Cells)

Value Chain Analysis For Gas Cabinets Market

The Gas Cabinets Market value chain begins with the upstream sourcing of specialized materials and components, which are critical for the system's overall performance and safety. Upstream analysis focuses heavily on suppliers of high-purity stainless steel (316L VIM/VAR), highly engineered valves, regulators, flow meters, pressure transducers, and specialty purification materials. The reliance on orbital welding technology and UHP component suppliers necessitates strict quality control at this stage, as the integrity of the gas path determines the operational performance in ultra-sensitive environments like semiconductor fabs. Key competitive advantages are secured through stable, certified relationships with component providers that guarantee material traceability and consistency, especially for corrosive gas applications.

The midstream involves the core manufacturing process, including design, fabrication, system integration, and rigorous testing (e.g., helium leak testing, pressure decay testing). Manufacturers specializing in gas cabinets must possess deep expertise in regulatory standards (SEMI S2/S6, NFPA 58) and ensure that every unit is fully certified before shipment. Distribution channels are typically a mix of direct sales teams servicing large-scale industrial projects (e.g., new fabrication plant construction) and indirect distribution through specialized industrial gas and equipment distributors. These distributors often provide localized support, installation, and initial maintenance services, acting as crucial technical liaisons between the manufacturer and the end-user, particularly for smaller R&D labs.

Downstream analysis focuses on end-user integration, installation, commissioning, and subsequent maintenance and service contracts. Given the hazardous nature of the gases handled, ongoing preventative maintenance and sensor calibration are indispensable revenue streams for manufacturers and service providers. Direct engagement with large end-users (e.g., TSMC, Samsung, Intel) allows manufacturers to gain immediate feedback for product customization and innovation, maintaining a competitive edge. The complexity of the product and its critical safety role ensure that the distribution strategy remains highly technical and often requires specialized training for channel partners to effectively serve the diverse application base, reinforcing the importance of indirect channels for regional reach and rapid technical support.

Gas Cabinets Market Potential Customers

Potential customers for Gas Cabinets are concentrated within industries that rely on precise, safe handling of high-purity, reactive, or hazardous specialty gases for manufacturing or research purposes. The largest segment of buyers consists of major semiconductor manufacturers (foundries) and integrated device manufacturers (IDMs) globally, who utilize these cabinets extensively for processes such as chemical vapor deposition (CVD), etching, and ion implantation. These customers demand the highest specifications regarding purity, automation, safety interlocks, and compliance with SEMI standards, often placing bulk orders for large facility rollouts and requiring custom-engineered solutions tailored to specific gas recipes.

Another significant customer base includes pharmaceutical and biotechnology companies, particularly those involved in sterile synthesis, fermentation processes, and specialized drug manufacturing where ultra-clean medical gases and process gases are essential. These buyers prioritize cGMP compliance, material traceability, and robust systems capable of handling corrosive cleaning agents or inert gases critical to maintaining sterile environments. Additionally, academic and private research laboratories, specialized chemical producers, and emerging technology sectors like advanced solar cell manufacturing (photovoltaics) and fuel cell development represent niche but growing customer groups, typically requiring smaller, highly flexible systems for R&D applications and small-batch production runs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Air Liquide, Linde PLC, Praxair Technology, Swagelok Company, Parker Hannifin, CS CLEAN SOLUTIONS AG, Takasago Fluidic Systems, Matheson Tri-Gas, Entegris Inc., Applied Energy Systems (AES), GCE Group, SCI-FAB, Air Products and Chemicals Inc., Versa-Gas Systems, DK-Lok Corporation, SEMIFAB, SilPac, Keling Technology, Taiyo Nippon Sanso Corporation, Ultra Clean Technology (UCT). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Cabinets Market Key Technology Landscape

The Gas Cabinets Market is defined by a reliance on highly sophisticated and specialized technologies focused on maximizing safety, minimizing contamination, and ensuring precise gas delivery. A cornerstone technology is Ultra-High Purity (UHP) component integration, which involves the use of high-grade 316L stainless steel, electropolishing, and specialized mechanical components engineered to prevent particulate generation and outgassing, thereby preserving the integrity of process gases (purity often required up to 99.9999999%). Orbital welding is the standard joining technique, crucial for maintaining smooth, crevice-free interior surfaces that eliminate potential entrapment points for contaminants, a necessity for processes like advanced semiconductor etching.

Modern gas cabinets incorporate advanced sensor and monitoring technology. This includes highly sensitive gas leak detectors, often employing infrared, electrochemical, or flame ionization principles, configured for continuous monitoring of toxic or flammable gases both within the enclosure and in the exhaust plenum. Furthermore, integration with Programmable Logic Controllers (PLCs) and Supervisory Control and Data Acquisition (SCADA) systems is standard, providing automated process control, real-time data logging, and immediate activation of emergency protocols such as nitrogen purging, automatic cylinder shutoff, and exhaust fan activation. This automation is pivotal for adherence to SEMI S2 safety standards and reducing reliance on manual intervention.

Finally, connectivity and modularity are driving current technological upgrades. The move toward Industry 4.0 necessitates IoT-enabled gas cabinets that can communicate performance data remotely, allowing for cloud-based monitoring and implementation of AI-driven predictive maintenance strategies. Manufacturers are also focusing on modular gas panels and standardized footprint designs, allowing customers to easily adapt cabinets for different gas types or process needs without extensive modification. Specialized purification systems (point-of-use purifiers) integrated directly within the cabinet further extend the purity of the delivered gas, which is vital for emerging applications using highly reactive or sensitive precursors.

Regional Highlights

- Asia Pacific (APAC): APAC holds the dominant market share due to its status as the global hub for semiconductor manufacturing (Taiwan, South Korea, China) and flat-panel display production. The region benefits from substantial government subsidies and massive capital expenditure (CapEx) in building new, large-scale advanced fabrication facilities (fabs). Demand is characterized by high volume procurement of automated, UHP-compliant gas cabinets required for 5G, IoT, and AI infrastructure development. The rigorous expansion plans of global chipmakers in this region ensure sustained growth, making it the fastest-growing market globally.

- North America: This region represents a mature market characterized by stringent safety regulations (OSHA) and a focus on high-specification, custom-engineered gas cabinets for R&D and specialized chemical manufacturing. While volumes may be lower than in APAC, the average selling price (ASP) is typically higher due to the demand for highly customized, fail-safe systems used in advanced materials research, aerospace, and high-tech defense applications. Recent legislative efforts to boost domestic chip production (e.g., CHIPS Act) are expected to drive significant infrastructure investments starting in the mid-forecast period.

- Europe: The European market is driven by strong regulatory compliance (REACH) and significant investments in pharmaceutical, biotechnology, and specialized automotive sectors. Demand centers on modular, safety-certified systems for handling medical gases and process gases in controlled environments. Germany and Ireland are key hubs, focusing on high standards of quality and traceability. Growth is steady, supported by established industrial safety protocols and continuous modernization of aging manufacturing infrastructure to meet contemporary UHP standards.

- Latin America (LATAM): LATAM is an emerging market, primarily driven by growth in specialized chemical production and localized industrial manufacturing expansion. The market size is smaller but shows potential, particularly in countries like Brazil and Mexico, which are integrating into global supply chains. Demand is currently focused on standard, reliable dual-cylinder cabinets suitable for medium-purity industrial applications, with gradual adoption of higher specification systems as local electronics manufacturing matures.

- Middle East and Africa (MEA): The MEA region’s demand is concentrated around the oil and gas sector (petrochemical research), water treatment, and limited but growing pharmaceutical manufacturing, particularly in the UAE and Saudi Arabia. Market growth is heavily dependent on infrastructure spending and diversification away from primary energy sources. Demand is generally focused on robust, explosion-proof, and corrosion-resistant cabinets suitable for harsh operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Cabinets Market.- Air Liquide

- Linde PLC

- Praxair Technology

- Swagelok Company

- Parker Hannifin

- CS CLEAN SOLUTIONS AG

- Takasago Fluidic Systems

- Matheson Tri-Gas

- Entegris Inc.

- Applied Energy Systems (AES)

- GCE Group

- SCI-FAB

- Air Products and Chemicals Inc.

- Versa-Gas Systems

- DK-Lok Corporation

- SEMIFAB

- SilPac

- Keling Technology

- Taiyo Nippon Sanso Corporation

- Ultra Clean Technology (UCT)

Frequently Asked Questions

Analyze common user questions about the Gas Cabinets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of a Gas Cabinet in semiconductor manufacturing?

The primary role is to ensure the safe and precise delivery of hazardous, corrosive, or flammable specialty gases (such as silane or arsine) into the process tool while providing a secure, ventilated enclosure that contains leaks and allows for automated emergency shutdown procedures, complying strictly with SEMI safety standards.

Which factors are primarily driving the growth of the Automatic Gas Cabinets segment?

The Automatic Gas Cabinets segment growth is driven by the need for enhanced operational safety, reduced human error, higher gas purity maintenance, and the seamless integration of gas delivery systems into highly automated, Industry 4.0-compliant manufacturing environments, particularly within large-scale semiconductor fabrication plants (fabs).

How do regulatory standards like SEMI S2 impact Gas Cabinet design?

SEMI S2 mandates strict design criteria for gas cabinets, requiring features such as dual exhaust ventilation systems, automatic cylinder switchover functionality, robust seismic restraints, fire suppression capabilities, and integrated fail-safe interlocks controlled by PLCs, ensuring the highest level of operator and environmental protection.

What are the key technical differences between Gas Cabinets for toxic versus corrosive gases?

Cabinets for toxic gases focus primarily on redundant leak detection, high exhaust flow rates, and immediate emergency shutdown/purge capabilities. Cabinets for corrosive gases, however, must additionally utilize internal components made from highly resistant materials (like specialized alloys or specific coatings) to prevent internal component degradation and maintain ultra-high purity over time.

Why is the Asia Pacific region the largest market for Gas Cabinets?

The Asia Pacific region is the largest market due to the high concentration of global semiconductor manufacturing capacity and rapid expansion of electronics production facilities (fabs) in countries like China, Taiwan, and South Korea, which necessitate massive infrastructure investment in high-purity, safety-critical gas handling systems.

What role does predictive maintenance play in modern Gas Cabinet management?

Predictive maintenance utilizes AI and IoT sensors to continuously monitor system performance metrics (pressure fluctuations, valve cycle counts) and forecast potential component failures before they occur. This prevents unplanned downtime, minimizes the risk of safety incidents, and optimizes the lifecycle and efficiency of high-cost components like regulators and purifiers.

What are the challenges associated with handling pyrophoric gases like Silane (SiH4) in a Gas Cabinet?

Pyrophoric gases ignite spontaneously upon exposure to air, requiring cabinets designed with extremely tight enclosures, continuous inert gas blanketing (typically nitrogen), robust fire detection and suppression systems, and specialized materials compatible with the explosive nature of the gas, demanding higher levels of automation and monitoring than standard systems.

How does the Gas Cabinets market intersect with the growing green hydrogen economy?

The intersection occurs in R&D and pilot manufacturing facilities focused on fuel cells and electrolysis. These applications require specialized gas cabinets for safely handling high-pressure, flammable hydrogen and precursor gases used in catalyst or membrane development, driving demand for heavy-duty, certified hydrogen systems.

Are modular gas cabinets gaining preference over fixed configurations?

Yes, modular gas cabinets are gaining preference, particularly in flexible manufacturing or R&D environments. Modularity allows end-users to easily swap out or upgrade internal gas panels and components, enabling adaptation to different process gases or future technology requirements without replacing the entire enclosure infrastructure.

What are the upstream supply chain vulnerabilities for Gas Cabinet manufacturers?

Vulnerabilities include reliance on a limited number of specialized global suppliers for UHP components such as high-purity valves, regulators, and advanced flow controllers. Disruptions in the supply of these critical, certified components can lead to manufacturing delays and increased costs for the final cabinet assembly.

How is contamination risk mitigated within UHP Gas Cabinets?

Contamination risk is mitigated through stringent manufacturing practices, including orbital welding of all tubing, using electro-polished stainless steel (316L), incorporating high-efficiency point-of-use purifiers, and rigorous testing methods such as helium leak testing and particle counting to ensure the internal gas path remains pristine and ultra-clean.

What impact does the transition to smaller semiconductor nodes have on Gas Cabinet technology?

Smaller semiconductor nodes (e.g., sub-10nm) require an even higher level of gas purity and introduce more complex process gases. This forces Gas Cabinet manufacturers to develop systems with enhanced purging capabilities, more sensitive leak detection, and advanced material compatibility to prevent process deviation and yield loss.

In the Value Chain, what is the importance of the downstream service and maintenance segment?

The downstream service and maintenance segment is highly important due to the safety-critical nature of the equipment. It ensures continuous operational integrity through regular calibration of sensors, preventative replacement of consumables (filters, seals), requalification of pressure components, and immediate emergency response, representing a crucial, high-margin revenue stream.

What security measures are integrated into modern Gas Cabinet PLC systems?

Modern PLC systems integrate multi-level password protection, secured network communication protocols, physical key lockouts for unauthorized access prevention, and redundancy in safety interlocks (e.g., dual solenoid valves) to prevent accidental or malicious tampering with gas flow and emergency shutdown parameters.

How do Gas Cabinets handle liquid precursors commonly used in CVD processes?

While traditional gas cabinets handle cylinders, specialized liquid precursor delivery systems (LPDS) or cabinets modified for vaporizer units are used for liquid precursors. These systems manage temperature control, pressure regulation, and vapor delivery, ensuring the liquid is converted efficiently and safely into a high-purity gas phase before entering the process tool, often requiring similar safety enclosures and ventilation as standard gas cabinets.

What is the forecasted trend for Dual-Cylinder Gas Cabinets versus Single-Cylinder types?

Dual-Cylinder Gas Cabinets are forecasted to grow faster, primarily driven by the increasing demand for continuous, high-volume production in semiconductor and advanced manufacturing. Dual systems allow for automatic switchover from an active cylinder to a reserve, eliminating process interruption and maximizing uptime, which is critical in high-cost fabrication environments.

Which material is predominantly used for the tubing and components inside UHP Gas Cabinets?

Ultra-High Purity (UHP) Gas Cabinets predominantly use electropolished 316L stainless steel tubing and components. This specific material grade offers superior corrosion resistance and an exceptionally smooth internal surface finish, which minimizes particle adhesion and outgassing, thereby maintaining the required high purity level of specialty process gases.

How are R&D laboratories different from manufacturing facilities in their Gas Cabinet procurement needs?

R&D laboratories typically require smaller, more flexible, and multi-functional gas cabinets suitable for experimental work with varied gases and lower flow rates. In contrast, manufacturing facilities require large-scale, highly standardized, fully automated cabinets designed for continuous, high-throughput operation with specific, stable gas recipes.

What differentiates a standard exhaust system from a toxic or pyrophoric gas exhaust system?

Exhaust systems for toxic or pyrophoric gases require significantly higher air exchange rates, often utilize redundant exhaust fans with fail-safe power backups, and incorporate specialized scrubbing or abatement systems downstream to neutralize harmful effluents before release, ensuring zero exposure risk to personnel or the environment.

What is the current primary investment focus area for Gas Cabinet manufacturers?

The primary investment focus is currently centered on integrating advanced digital technologies, specifically IoT connectivity and AI-driven predictive maintenance platforms, aimed at increasing system uptime, enhancing remote diagnostic capabilities, and ensuring proactive safety management in line with Industry 4.0 principles.

What is the typical lifespan and depreciation cycle for a certified Gas Cabinet?

A certified, well-maintained Gas Cabinet typically has an operational lifespan of 15 to 20 years. However, due to rapid technological advancements and evolving regulatory standards (especially in semiconductor manufacturing), components often require upgrades or system requalification occurs every 5 to 7 years to ensure compliance with the latest process safety requirements.

How do manufacturers ensure material compatibility when designing a cabinet for multiple gas types?

Manufacturers utilize strict materials selection protocols based on the corrosivity, toxicity, and reactivity of the specific gas. For cabinets designed to handle a range of gases, components are typically specified to meet the requirements of the most aggressive gas in the potential mix, often involving specialized high-nickel alloys or inert polymers for seals and diaphragms to prevent chemical attack.

What market restraint is most challenging for manufacturers operating in Europe?

The most challenging market restraint in Europe is navigating the complex and divergent national regulations concerning pressure equipment and hazardous materials handling, which often require extensive local certification processes in addition to broader European standards (e.g., PED certification), leading to longer time-to-market for new products.

How is the risk of cross-contamination managed in a Multi-Cylinder Gas Cabinet setup?

Risk of cross-contamination is managed through dedicated, physically segregated manifolds and gas panels within the cabinet, utilizing check valves to prevent backflow, and implementing robust, automated purge cycles with inert gas between cylinder changes or system maintenance, ensuring the integrity of each individual gas line.

What is the significance of the shift toward automated purge sequences in market dynamics?

The shift towards automated purge sequences is highly significant as it enhances safety by eliminating human error during cylinder changeouts, drastically reduces non-productive time, and ensures a cleaner, more efficient use of expensive high-purity gases and inert purging agents, directly impacting operational costs and overall yield.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager