Gas Cutting Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433002 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Gas Cutting Machinery Market Size

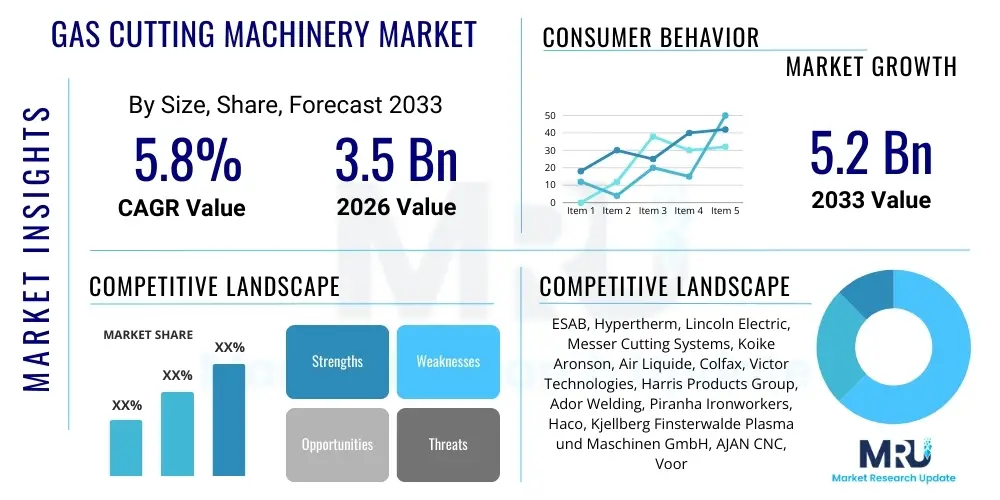

The Gas Cutting Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Gas Cutting Machinery Market introduction

The Gas Cutting Machinery Market encompasses specialized equipment designed for thermal cutting processes, primarily relying on the controlled combustion of fuel gases (such as acetylene, propane, or natural gas) combined with oxygen to sever metal workpieces. These machines range from simple manual torches (oxy-fuel cutting) used in maintenance and repair operations to sophisticated Computer Numerical Control (CNC) automated systems capable of cutting thick steel plates with high accuracy, often utilizing advanced plasma technologies that leverage inert or semi-inert gases. The core function of this machinery is facilitating high-speed, precision material processing across heavy industrial sectors, providing essential capabilities for shaping raw metals into components needed for complex manufacturing and infrastructural projects.

Key products within this market include manual oxy-acetylene torches, portable gas cutting carriages, semi-automatic profile cutting machines, and fully integrated CNC gantry systems. While traditional oxy-fuel cutting remains crucial for extremely thick ferrous metals (often exceeding 150mm), the market has seen significant integration of plasma cutting technology, which utilizes an ionized gas stream for faster cutting speeds and better edge quality on thinner to medium-thickness materials. Major applications span structural steel fabrication, pipeline construction, shipbuilding, automotive component manufacturing, and general metal fabrication workshops. The versatility and robustness of gas cutting processes, particularly in demanding industrial environments where high material thickness is common, continue to drive steady demand.

The primary benefits offered by gas cutting machinery include exceptional portability in manual setups, the ability to cut extremely thick metals where other methods like laser cutting falter, and relatively low initial capital investment compared to high-power fiber laser systems. Driving factors supporting market growth include massive investments in global infrastructure projects (roads, bridges, energy facilities), the revitalization of shipbuilding activities, and increasing demand from the heavy engineering sector, particularly in emerging economies undergoing rapid industrialization. Furthermore, technological advancements focusing on automation, improved safety features, and enhanced process control are ensuring the continued relevance and efficiency of modern gas cutting equipment.

Gas Cutting Machinery Market Executive Summary

The global Gas Cutting Machinery Market is experiencing moderate yet stable growth, primarily fueled by robust activity in the global construction and energy sectors, which necessitate high-volume processing of thick steel plates. A significant business trend involves the shift toward automated and integrated CNC solutions. While manual oxy-fuel equipment maintains its niche in repair and field work due to portability and low entry cost, end-users are increasingly adopting sophisticated gantry-style CNC plasma and oxy-fuel hybrid cutters to achieve higher throughput, repeatable accuracy, and reduced labor dependency. This trend is pushing manufacturers to develop advanced software interfaces and integrated nesting capabilities that maximize material utilization and streamline operational workflows, driving premium segment growth despite fluctuating raw material costs.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, India, and South Korea, exhibits the highest growth potential, largely due to explosive infrastructure development, vigorous shipbuilding activity, and extensive manufacturing base expansion. These regions serve as global hubs for heavy fabrication and consequently require substantial installations of heavy-duty cutting machinery. North America and Europe, characterized by high labor costs and stringent quality standards, are focusing on the adoption of high-definition plasma cutting systems and integrating advanced robotics with gas cutting processes to enhance precision and efficiency, thereby maintaining market stability through technological upgrades rather than sheer volume expansion.

Segment trends indicate that automatic and semi-automatic systems are cannibalizing market share from purely manual operations, reflecting the overarching industry demand for automation. By product type, high-definition plasma cutting equipment, which falls under the broader category of gas cutting due to gas usage, is seeing accelerated adoption owing to its superior cut quality and speed compared to traditional oxy-fuel, although oxy-fuel remains essential for ferrous materials above 100mm thickness. The shipbuilding and heavy equipment fabrication end-user segments are expected to show dominant growth, requiring specialized, high-capacity machinery that can reliably handle large plates and complex contours, thus sustaining the demand for robust, high-power gas cutting solutions throughout the forecast period.

AI Impact Analysis on Gas Cutting Machinery Market

Common user questions regarding AI's impact on the Gas Cutting Machinery Market frequently revolve around how artificial intelligence can enhance cut quality, reduce waste, and predict maintenance needs in automated systems. Users are concerned about whether AI can truly optimize cutting paths for both oxy-fuel and plasma systems, considering material inconsistencies and thermal distortion challenges. Key themes emerging from these inquiries highlight an expectation for AI to transform reactive maintenance into predictive maintenance, improve operator safety by monitoring machine deviations, and automate the complex process of nesting and scheduling jobs, especially in high-mix, low-volume fabrication shops. Users seek assurance that AI integration will not lead to overly complex interfaces but rather simplify the operational burden while delivering measurable improvements in efficiency and material yield.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally changing the operational landscape of high-end gas cutting machinery, primarily through enhanced process control and predictive maintenance protocols. AI algorithms are being trained on vast datasets of cutting parameters, material properties, and environmental conditions to dynamically adjust gas flow rates, cutting speeds, and torch height in real-time. This dynamic optimization is crucial, especially in plasma cutting, where slight variations can dramatically affect bevel angle and dross formation. By using sensor data feedback, AI minimizes common cutting defects, leading to superior edge quality, reduced need for secondary finishing, and ultimately, significant cost savings in labor and material waste. Furthermore, AI-powered computer vision systems are starting to inspect completed cuts automatically, ensuring quality compliance at high speeds.

Beyond the cutting process itself, AI is proving invaluable in supply chain optimization and operational efficiency. ML models are deployed within manufacturing execution systems (MES) integrated with cutting machinery to optimize material inventory management and scheduling. These systems predict the necessary plate stock based on upcoming job orders and dynamically generate optimal nesting layouts, reducing material scrap rates significantly. Predictive maintenance, arguably the most impactful application, uses AI to analyze vibration, temperature, and electrical load data from key machine components (such as gantry drives, torch assemblies, and gas mixing stations). This enables the system to forecast potential equipment failure hours or days in advance, allowing for planned maintenance interventions rather than costly, unscheduled downtime, thereby drastically improving overall equipment effectiveness (OEE) across fabrication plants globally.

- AI-driven real-time cutting parameter adjustment for optimal quality control.

- Predictive maintenance analytics reducing unexpected machine downtime by forecasting component failure.

- Optimized nesting algorithms utilizing ML to maximize material yield and minimize scrap.

- Integration of computer vision systems for automated cut quality inspection and defect detection.

- AI-enhanced robotic automation for complex 3D cutting and beveling tasks.

- Improved operator safety protocols based on AI monitoring of operational anomalies.

DRO & Impact Forces Of Gas Cutting Machinery Market

The dynamics of the Gas Cutting Machinery Market are dictated by a balanced interplay of accelerating industrialization (Drivers), intense competitive pressure from alternative technologies (Restraints), and the strategic adoption of advanced automation (Opportunities). Global infrastructure development and the increasing complexity of heavy engineering projects mandate the use of robust cutting solutions capable of handling large dimensions and extreme thickness, strongly driving the demand for both oxy-fuel and heavy-duty plasma systems. However, the market faces significant restraints from the growing prominence of high-precision fiber laser cutting in thinner gauge applications, coupled with heightened environmental regulations regarding gas storage and usage, pushing manufacturers toward more energy-efficient and safer systems. The impact forces are currently skewed toward modernization, compelling incumbent companies to invest heavily in smart, networked, and multi-process machinery to maintain relevance against newer, faster cutting techniques.

Drivers: Significant global industrial expansion, particularly in emerging economies, remains the primary propellant. The rapid growth in energy exploration (oil & gas, renewables), coupled with massive investments in maritime infrastructure, mandates reliable, high-capacity machinery for processing structural components. Furthermore, the inherent capability of oxy-fuel cutting to handle materials exceeding 100mm—a thickness profile often outside the practical or economical range of standard plasma or laser systems—secures its critical role in heavy fabrication. The low initial capital outlay for manual and semi-automatic oxy-fuel equipment makes it accessible for smaller fabrication shops and maintenance operations worldwide, ensuring continuous demand across various economic tiers.

Restraints: Key restraints include intense competition from advanced cutting technologies, particularly high-power fiber lasers, which offer superior speed and precision on materials up to 30mm, diminishing the market share of gas cutting in mid-range thickness applications. Moreover, gas cutting processes, especially oxy-fuel, are inherently slower and produce a wider kerf and larger heat-affected zone (HAZ) compared to plasma and laser, often requiring more secondary finishing work. Operational costs related to consumable gases and safety concerns associated with handling pressurized flammable gases also act as headwinds. Economic volatility affecting capital expenditure budgets in end-user industries further dampens growth projections, especially for high-value automated systems.

Opportunities: Opportunities are largely centered on technological evolution and geographical expansion. The integration of CNC automation, multi-process heads (combining plasma and oxy-fuel on one gantry), and advanced software for beveling and complex geometry cutting presents significant avenues for value addition. The adoption of high-definition plasma technology, which utilizes gas-based processes but delivers near-laser quality cuts, captures the high-performance segment of the market. Furthermore, expanding infrastructure and manufacturing bases in underserved regions of Africa and Southeast Asia offer new geographical markets for both entry-level and automated machinery sales. Developing safety-enhanced, energy-efficient equipment with minimal fume generation is a crucial strategic opportunity for market differentiation and compliance with stricter regulatory environments.

Segmentation Analysis

The Gas Cutting Machinery market is comprehensively segmented based on technology type, level of automation, end-user industry, and key components. The segmentation reflects the diverse range of applications, from small, mobile repair setups requiring simple manual torches to large, static fabrication facilities utilizing multi-axis CNC gantries. Analyzing these segments helps stakeholders understand the varying demand drivers and technological preferences across different industrial environments. The dominance of the End-User segment (Shipbuilding and Heavy Equipment) underscores the market's reliance on large-scale infrastructural and manufacturing activities globally, while the technology segment highlights the ongoing transition towards higher-precision, gas-based plasma cutting over traditional oxy-fuel methods for speed and quality enhancements.

- By Product Type (Technology):

- Oxy-Fuel Cutting Machinery (Manual Torches, Portable Carriages, CNC Gantries)

- Plasma Cutting Machinery (Conventional Plasma, High-Definition Plasma, Precision Plasma)

- Multi-Process Hybrid Systems (Oxy-Fuel and Plasma Combination)

- By Operation Type (Automation Level):

- Manual

- Semi-Automatic

- Automatic (CNC Controlled)

- By Material Thickness:

- Thin Plate Cutting (Under 10 mm)

- Medium Plate Cutting (10 mm to 50 mm)

- Heavy Plate Cutting (Above 50 mm)

- By End-User Industry:

- Shipbuilding and Marine

- Automotive and Transportation

- Construction and Infrastructure

- Heavy Equipment and Machinery Manufacturing

- Oil & Gas and Energy

- General Fabrication and Job Shops

Value Chain Analysis For Gas Cutting Machinery Market

The value chain for the Gas Cutting Machinery Market begins with the upstream suppliers of raw materials and specialized components, extending through manufacturing, distribution, and finally, reaching the end-users. Upstream activities involve sourcing precision components such as CNC controllers, specialized gas handling systems (regulators, valves), proprietary torch technologies, and high-quality raw materials (steel, electronics). Suppliers of advanced software for nesting and automation play a crucial supplementary role, influencing the overall technological capability of the final product. Key risks upstream include volatile commodity prices and reliance on specialized electronic components, which can impact manufacturing costs and lead times. Manufacturers focus intensely on research and development to integrate superior process control software and enhance torch reliability, aiming for higher cut quality and operational longevity.

The manufacturing stage involves the precision assembly of gantry systems, integration of motion control systems, and rigorous testing of gas delivery and combustion mechanisms to ensure safety and performance standards are met. Midstream activities are dominated by Original Equipment Manufacturers (OEMs) who differentiate themselves based on system size, automation level, software integration capabilities, and after-sales service quality. Distribution is critical, often relying on a robust network of specialized industrial distributors and dealers who provide local sales support, installation, training, and maintenance services. The nature of the machinery—being heavy, complex, and requiring specific technical knowledge—necessitates a strong indirect distribution channel capable of handling logistical complexity and technical customer support.

Downstream analysis focuses on the end-user adoption and aftermarket services. Direct sales channels are typically reserved for large-scale, highly customized CNC gantry systems sold directly to major shipbuilding or heavy manufacturing corporations. Conversely, standard manual torches and portable plasma units are often sold through dealers, industrial supply houses, and increasingly, specialized e-commerce platforms targeting job shops and smaller fabricators. The aftermarket segment, including the supply of consumables (nozzles, electrodes, tips), replacement parts, service contracts, and gas supplies (which often involve partnerships with industrial gas companies like Air Liquide or Linde), represents a significant and stable revenue stream, often sustaining profitability even during cyclical downturns in capital equipment sales. Effective post-sales support and readily available consumables are essential competitive factors in this market.

Gas Cutting Machinery Market Potential Customers

The primary customers for Gas Cutting Machinery are enterprises engaged in heavy fabrication, material processing, and critical infrastructure development, where the handling of thick metal plates is standard operating procedure. These customers prioritize machine robustness, reliability under high operational intensity, and the ability to process extremely thick materials efficiently and economically. Given the capital-intensive nature of automated gas cutting systems, purchasing decisions are typically long-term investments driven by the need for increased production capacity, enhanced material utilization, and compliance with high-quality welding and construction standards. The customer base spans multinational corporations and large public sector entities down to small-to-medium enterprises (SMEs) engaged in local fabrication work.

In the heavy industrial segment, key buyers include major international shipbuilding yards, which require gantry systems capable of cutting vast quantities of hull plates with precise beveling capabilities for welding preparation. Similarly, manufacturers of heavy construction equipment, such as excavators, cranes, and mining vehicles, are significant consumers, as their products rely heavily on thick, durable steel components shaped by high-capacity plasma and oxy-fuel cutters. The structural steel sector, supporting commercial building and bridge construction, also constitutes a vital customer segment, purchasing semi-automatic and automatic systems to prepare beams and columns according to engineered specifications. These customers frequently require integration with advanced CAD/CAM software to manage complex project drawings and specifications efficiently.

Moreover, the Oil & Gas and Energy sectors, including companies involved in pipeline construction, pressure vessel manufacturing, and wind turbine fabrication, represent customers requiring machinery with high levels of process documentation and stringent safety compliance. General fabrication workshops and job shops, although smaller in scale, form the broad base of demand for manual torches and portable plasma cutters, relying on these tools for versatility in repair, maintenance, and small batch production. The emerging market for decommissioning aging industrial facilities, particularly in the nuclear and maritime sectors, also presents a specialized, albeit periodic, customer base for high-capacity, heavy-duty gas cutting equipment designed for complex demolition and recycling operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ESAB, Hypertherm, Lincoln Electric, Messer Cutting Systems, Koike Aronson, Air Liquide, Colfax, Victor Technologies, Harris Products Group, Ador Welding, Piranha Ironworkers, Haco, Kjellberg Finsterwalde Plasma und Maschinen GmbH, AJAN CNC, Voortman Steel Machinery, ITW Welding, GCE Group, Thermacut, Bug-O Systems, Hornet Cutting Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Cutting Machinery Market Key Technology Landscape

The core technology in the Gas Cutting Machinery Market revolves around the precise control of exothermic reactions and gas dynamics to achieve material separation. Traditional oxy-fuel technology utilizes the heating of ferrous material to its ignition temperature followed by a high-pressure oxygen stream to rapidly oxidize and blow away the molten metal and slag. Technological evolution focuses on optimizing gas mixers, developing advanced multi-jet nozzles for faster preheating, and integrating height sensing mechanisms to maintain consistent stand-off distance, which is critical for achieving a square, clean cut. Furthermore, modern systems incorporate safety shut-off valves and automated ignition sequences to enhance operator safety and reduce setup time, moving beyond rudimentary manual torch operations toward robust, reliable processes essential for heavy industry applications where large plate inventories are managed.

The contemporary technological landscape is heavily influenced by the rise of high-definition (HD) plasma cutting, a gas-based technology that achieves cutting speeds significantly faster than conventional oxy-fuel and delivers cut quality comparable to laser systems on mild steel up to 30mm. HD plasma utilizes tightly controlled, high-flow gas mixtures (such as nitrogen, H35, or air) combined with optimized nozzle and electrode designs to compress the arc plasma column, resulting in minimal dross, smaller kerf width, and excellent angularity, crucial for subsequent automated welding operations. Manufacturers are focusing on developing consumables that maximize lifespan and systems that seamlessly switch between various plasma gases (e.g., oxygen plasma for mild steel, nitrogen/argon-hydrogen for stainless steel) to cater to diverse material requirements within a single fabrication job.

A major advancement driving capital expenditure is the integration of advanced CNC controls and proprietary process software. These systems feature multi-axis control (e.g., 5-axis beveling heads) allowing the precise cutting of complex contours, slots, and weld preparation bevels in a single pass, eliminating the need for separate milling or grinding operations. Furthermore, the networking capabilities (Industry 4.0 readiness) of new machines allow for remote diagnostics, production monitoring, and seamless data transfer between the shop floor and enterprise resource planning (ERP) systems. This focus on connectivity, precision motion control, and multi-functional torch heads—often allowing a quick changeover between oxy-fuel and plasma on the same gantry—defines the competitive edge in today's high-performance gas cutting machinery market, demanding highly sophisticated electronics and software engineering capabilities from market leaders.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand patterns and technological adoption rates within the Gas Cutting Machinery Market. Market maturity levels vary significantly, affecting the preference for manual versus automated systems and the rate of integration of advanced plasma technologies. Economic drivers such as infrastructure investment and local regulatory environments surrounding industrial gas handling also contribute to regional market characteristics.

- Asia Pacific (APAC): APAC dominates the global market both in terms of production and consumption volume. Driven by robust economic growth, massive infrastructural projects in China, India, and Southeast Asia, and the world's largest shipbuilding industry (South Korea, China), the demand is high for heavy-duty CNC plasma and oxy-fuel gantries. The region is rapidly moving away from purely manual methods towards automated systems to meet increasing production quotas and rising quality expectations.

- North America: This region is characterized by high operational costs and a strong focus on high-precision and high-productivity solutions. The market here favors high-definition plasma cutting systems and multi-process machines that offer superior cut quality, reduced finishing time, and advanced automation features. The emphasis is on efficiency and integrating machines into digital factory ecosystems (Industry 4.0), particularly in the aerospace, automotive, and heavy equipment fabrication sectors.

- Europe: The European market is mature and highly quality-driven, placing significant emphasis on safety, environmental compliance, and energy efficiency. While growth is slower than APAC, the demand is strong for technologically advanced, specialized cutting systems, often integrating sophisticated automation for precise beveling and complex component manufacturing. Germany, Italy, and the UK are key markets, focusing on utilizing high-performance gas mixtures and consumables for optimal results in highly regulated industries.

- Latin America (LATAM): Market growth in LATAM is closely tied to commodity prices and investments in the oil & gas and mining sectors. Brazil and Mexico are primary consumers. Demand tends to focus on reliable, sturdy, semi-automatic machinery, often balancing cost-effectiveness with performance requirements for heavy steel construction and pipeline fabrication.

- Middle East and Africa (MEA): This region exhibits significant potential, fueled by massive ongoing energy infrastructure projects (e.g., petrochemical plants, gas pipelines) and diversification efforts in countries like Saudi Arabia and the UAE. Demand is strong for durable, reliable machinery suitable for harsh operating environments, with initial preference for traditional oxy-fuel for primary construction, followed by increasing adoption of automation for complex fabrication tasks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Cutting Machinery Market.- ESAB

- Hypertherm

- Lincoln Electric

- Messer Cutting Systems

- Koike Aronson

- Air Liquide

- Colfax Corporation (Victor Technologies)

- Harris Products Group

- Ador Welding Ltd.

- Piranha Ironworkers

- Haco

- Kjellberg Finsterwalde Plasma und Maschinen GmbH

- AJAN CNC

- Voortman Steel Machinery

- ITW Welding

- GCE Group

- Thermacut

- Bug-O Systems

- Hornet Cutting Systems

- C&G Systems

Frequently Asked Questions

Analyze common user questions about the Gas Cutting Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference in application between oxy-fuel and plasma cutting machinery?

Oxy-fuel cutting machinery is optimally used for cutting extremely thick mild steel (typically over 100mm) where its thermal process efficiency is unmatched. Plasma cutting machinery, which also utilizes gases, is favored for higher speed, superior cut quality, and versatility across ferrous and non-ferrous metals, primarily in the thin to medium thickness range (up to 50mm for heavy-duty systems).

How is CNC automation impacting the traditional gas cutting machinery market?

CNC automation is transforming the market by improving precision, repeatability, and efficiency. Automated systems minimize human error, enable complex operations like precise bevel cutting, optimize material use through advanced nesting software, and allow for high-volume production crucial for sectors like shipbuilding and heavy equipment manufacturing.

Which end-user industry is expected to drive the highest demand for gas cutting machinery?

The Shipbuilding and Heavy Equipment manufacturing sectors are projected to drive the highest demand. These industries consistently require the processing of extremely thick steel plates, a requirement where the high-capacity and cost-effectiveness of heavy-duty plasma and traditional oxy-fuel cutting systems remain indispensable.

What role does Artificial Intelligence (AI) play in modern gas cutting operations?

AI is primarily utilized for process optimization and predictive maintenance. AI algorithms analyze real-time operational data to dynamically adjust cutting parameters (gas flow, speed, height) for improved cut quality, and ML models forecast component failures, significantly reducing unscheduled downtime and improving overall equipment effectiveness (OEE).

What restraints are currently challenging the growth of the gas cutting machinery market?

The primary restraints include intense competition from high-speed fiber laser cutting systems in the thin-gauge segment, the relatively larger heat-affected zone (HAZ) produced by thermal cutting compared to laser, and the operational constraints and costs associated with handling pressurized industrial gases.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager