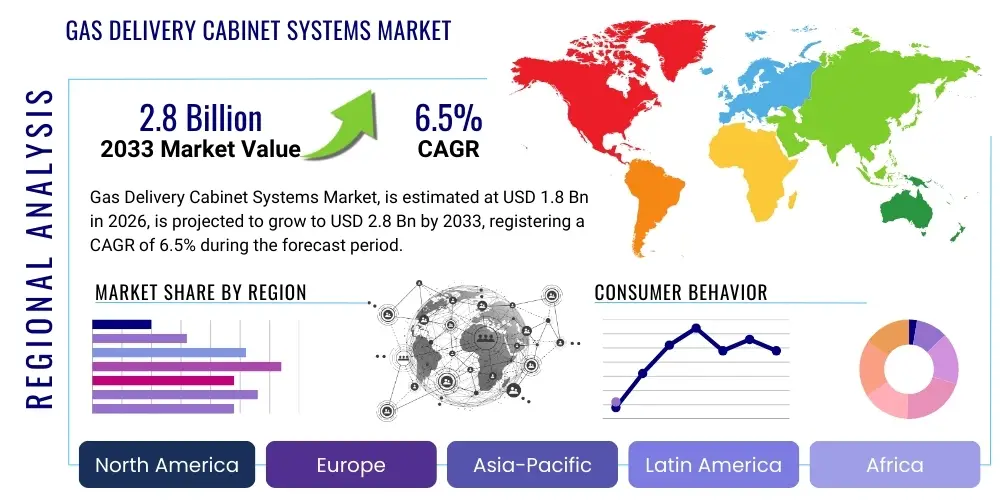

Gas Delivery Cabinet Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435333 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Gas Delivery Cabinet Systems Market Size

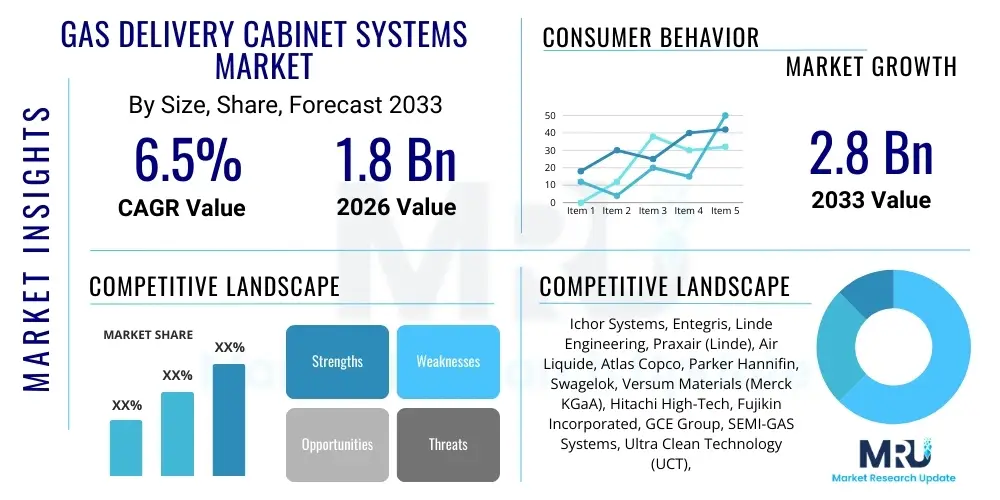

The Gas Delivery Cabinet Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Gas Delivery Cabinet Systems Market introduction

Gas Delivery Cabinet Systems are highly engineered safety enclosures designed to provide a secure and controlled environment for the storage, handling, and delivery of high-purity, corrosive, toxic, or pyrophoric process gases used primarily in advanced manufacturing industries. These systems are crucial components in maintaining product yield and ensuring personnel safety, particularly in environments requiring ultra-high purity (UHP) gas streams, such as semiconductor fabrication. The primary function involves protecting the gas cylinder, regulating pressure, filtering impurities, and providing automatic shutdown capabilities in case of leaks or overpressure events. The demand for these sophisticated systems is intrinsically linked to the expansion of industries requiring precision material deposition and etching processes, including microelectronics and photovoltaic manufacturing.

The product description encompasses various configurations, ranging from single-station cabinets designed for low-volume specialty gas use to multi-station systems handling bulk gases under stringent regulatory guidelines. Key features include integrated purging capabilities, automatic changeover mechanisms, internal ventilation systems, leak detection sensors, and complex programmable logic controllers (PLCs) for remote monitoring and control. These cabinets must adhere to rigorous international standards, such as SEMI S2 and NFPA, reflecting the critical safety role they play. Manufacturers are constantly innovating to minimize contamination risk through improved component materials, seamless orbital welding, and enhanced internal surface finishes, ensuring the integrity of process gases down to parts-per-trillion purity levels.

Major applications of Gas Delivery Cabinet Systems span the entire advanced technology manufacturing ecosystem. The semiconductor industry remains the largest consumer, utilizing these cabinets for delivering dopants, etchants, and inert gases essential for wafer fabrication steps like chemical vapor deposition (CVD) and atomic layer deposition (ALD). Other significant applications include the production of Flat Panel Displays (FPDs), solar cells (photovoltaics), Light Emitting Diodes (LEDs), and specialized medical gas handling. Driving factors for market growth include the global push for digitalization, leading to increased investment in new semiconductor fabs (fabs), coupled with stringent environmental, health, and safety (EHS) regulations mandating superior containment technologies for hazardous materials.

Gas Delivery Cabinet Systems Market Executive Summary

The Gas Delivery Cabinet Systems Market is characterized by robust growth, driven primarily by exponential investments in the global semiconductor industry, particularly in the Asia Pacific region. Business trends indicate a strong move toward highly automated, smart gas delivery solutions integrating Internet of Things (IoT) sensors and predictive maintenance capabilities to maximize uptime and minimize human exposure to dangerous gases. Key market participants are focusing on vertical integration and strategic partnerships to offer complete, customized gas management solutions, moving beyond just hardware supply to include installation, validation, and continuous monitoring services. Furthermore, geopolitical shifts encouraging domestic semiconductor manufacturing (e.g., the CHIPS Act in the US and similar initiatives in Europe) are creating significant opportunities for localized market expansion and technological collaboration, ensuring resilient supply chains for critical manufacturing inputs.

Regional trends distinctly highlight Asia Pacific, led by Taiwan, South Korea, China, and Japan, as the dominant and fastest-growing market due to the massive concentration of foundry operations and memory chip manufacturing facilities. This region benefits from continuous capital expenditure (CapEx) in leading-edge process technologies, which require larger volumes and higher specifications for specialty gases. North America and Europe, while mature, are experiencing revitalized growth driven by governmental policy incentives aiming to onshore high-tech manufacturing, emphasizing the need for state-of-the-art, compliance-heavy gas delivery infrastructure. The Middle East is emerging as a niche market, focusing on developing localized solar and high-purity industrial sectors, gradually increasing demand for localized gas safety solutions.

Segment trends confirm that the Semiconductor and Electronics application segment retains the overwhelming market share, particularly systems designed for ultra-high purity (UHP) gas handling. Regarding type, dual-station cabinet systems, which allow for seamless cylinder changeover without interrupting the process line, are widely preferred for high-volume manufacturing environments, ensuring continuous production flow. There is a perceptible shift towards modular, configurable cabinet designs that can be rapidly deployed and adapted to fluctuating production requirements, offering scalability and reduced lead times. Moreover, enhanced focus on corrosive and toxic gas handling within the Specialty Gas segment is driving innovation in material science for internal components, emphasizing materials like stainless steel 316L and specialized polymer seals to ensure longevity and purity.

AI Impact Analysis on Gas Delivery Cabinet Systems Market

Users commonly inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the fundamental safety and efficiency aspects of gas delivery cabinet operations. Specific questions revolve around the use of AI for predictive leak detection, optimizing cylinder changeover schedules, improving asset utilization, and achieving autonomous fault diagnostics within complex gas systems. The central theme emerging from user expectations is the shift from reactive maintenance models, which rely on scheduled inspections or failure events, to proactive, intelligent monitoring systems that leverage data from thousands of sensors embedded within the cabinet systems. Users seek proof points demonstrating that AI can significantly reduce downtime, lower operational risks associated with hazardous gases, and ensure compliance reporting is instantaneous and auditable.

AI is set to revolutionize the operational management of Gas Delivery Cabinet Systems by integrating advanced analytics with real-time operational data streams. By processing historical pressure, temperature, flow rates, and sensor readings, AI algorithms can establish precise baseline operating norms and detect subtle anomalies far earlier than human operators or standard alarm systems. This capability is crucial for identifying incipient component failures, such as slow valve leaks or regulator degradation, allowing maintenance to be scheduled precisely before production quality is impacted or a safety event occurs. Furthermore, AI optimization algorithms can predict the exact consumption rate of specialty gases based on production forecasts, intelligently managing inventory and minimizing expensive gas waste.

The application of AI extends significantly into enhancing operational compliance and supply chain resilience. AI systems can automatically generate detailed audit trails, verifying adherence to purity specifications and safety protocols, reducing the manual effort required for regulatory documentation. In terms of supply chain, ML models can analyze external factors, such as raw material availability and geopolitical stability, to recommend optimal stocking levels for high-purity gases and replacement parts, ensuring that high-volume fabs maintain continuous, uninterrupted operation. This shift towards smart, AI-driven cabinets transforms them from simple containment units into intelligent, network-connected assets contributing directly to overall factory efficiency (OEE).

- AI-driven Predictive Maintenance (PdM) reduces unplanned downtime by forecasting equipment failures (valves, regulators).

- Enhanced Leak Detection utilizing ML algorithms to analyze sensor data patterns and identify micro-leaks instantaneously.

- Optimized Gas Consumption Management through AI forecasting, minimizing expensive specialty gas waste and inventory costs.

- Automated Compliance Reporting and Audit Trail generation ensuring adherence to strict industrial safety standards (SEMI, NFPA).

- Remote Diagnostics and Autonomous Fault Resolution leveraging AI to triage issues and guide operators through corrective actions.

- Improved Supply Chain Resilience by predicting necessary stock levels of UHP gases based on factory production schedules.

DRO & Impact Forces Of Gas Delivery Cabinet Systems Market

The Gas Delivery Cabinet Systems market dynamics are strongly influenced by the dual forces of technological progression in microelectronics and mandatory safety regulations governing the use of hazardous process materials. The primary driver is the accelerating global demand for semiconductor devices, particularly those manufactured using advanced nodes (7nm, 5nm, and below), which necessitates extremely precise and contaminant-free gas delivery. This drives up the requirement for sophisticated, high-cost UHP cabinet systems. Conversely, the high initial capital investment required for these complex systems, coupled with stringent and continuously evolving international safety standards (which necessitate frequent system upgrades), acts as a significant restraint, especially for smaller market players. However, the opportunity lies in integrating smart technologies like IoT and AI to develop cabinets that offer superior data logging, remote management, and predictive capabilities, thereby addressing the high maintenance costs and operational complexities currently faced by end-users. These intertwined forces shape the competitive landscape and investment priorities within the market.

Drivers:

The proliferation of semiconductor manufacturing capacity worldwide stands as the most critical driver for this market. The continuous shrinking of feature sizes in integrated circuits demands process gases of exceptional purity, requiring gas delivery systems that can maintain integrity down to the point of use. Major chip manufacturers are engaged in extensive CapEx cycles to build new fabrication facilities (fabs) globally, each requiring hundreds of specialized gas delivery cabinets to handle the myriad of toxic, flammable, and inert gases essential for advanced processes like lithography, etching, and deposition. The push toward 3D NAND and advanced logic chips further intensifies the need for systems capable of handling novel, complex precursor materials and corrosive gases with unparalleled safety and precision, ensuring high yield rates are maintained during multi-billion dollar manufacturing runs.

Furthermore, the increasingly rigorous global regulatory environment concerning industrial safety and environmental protection mandates the adoption of state-of-the-art containment technology. Organizations such as SEMI (Semiconductor Equipment and Materials International) continuously update standards (like SEMI S2, S6, S8) governing the design, safety features, and performance requirements of gas delivery equipment. Compliance with these standards often necessitates replacing older, less secure systems with modern, fully automated cabinet systems that include redundant safety features, seismic restraints, enhanced gas detection mechanisms, and automatic shut-off valves. This regulatory pressure acts as a consistent replacement and upgrade cycle driver across all relevant application industries, ensuring a steady baseline demand for compliant, certified products.

- Exponential Growth of the Semiconductor Industry and Global Fab Expansion.

- Increasing Demand for Ultra-High Purity (UHP) Gas Handling in Advanced Nodes (5nm, 3nm).

- Stringent and Evolving Industrial Safety and Environmental, Health, and Safety (EHS) Regulations (SEMI, NFPA).

- Rising Adoption of Sophisticated Deposition and Etching Techniques Requiring Hazardous Specialty Gases.

- Governmental Incentives (e.g., CHIPS Act) Encouraging Domestic High-Tech Manufacturing and Infrastructure Investment.

Restraints:

One primary restraint is the significant initial capital expenditure (CapEx) required for high-specification gas delivery cabinet systems. Due to the complexity of the components—including high-purity orbital welding, specialized materials (316L Stainless Steel), integrated PLCs, advanced sensor technology, and mandatory third-party certifications—these systems carry a substantial upfront cost. This financial barrier can impede rapid adoption, particularly among emerging manufacturers or research facilities operating under tighter budget constraints. Additionally, the extended lead times often associated with custom-built, highly certified gas delivery equipment, stemming from global supply chain dependencies on high-purity component manufacturers, can slow down the deployment timelines of new manufacturing facilities.

Another significant restraint is the operational complexity and the associated high cost of maintenance and skilled labor. Maintaining UHP gas integrity requires specialized expertise for installation, preventive maintenance, and calibration of sensitive pressure and flow control components. Mismanagement or improper handling can lead to catastrophic safety failures or severe product contamination, resulting in multi-million dollar yield losses. Finding and retaining personnel trained in orbital welding techniques, system purging protocols, and hazardous gas handling adds substantial operating expenditure (OpEx) for end-users. Furthermore, the limited shelf life of certain internal components, such as filters and sensors, necessitates continuous replacement and recalibration, adding to the total cost of ownership (TCO).

- High Initial Capital Investment and Total Cost of Ownership (TCO) for UHP Systems.

- Complex Maintenance Requirements and Scarcity of Specialized Skilled Labor.

- Extended Lead Times for Custom and Certified Gas Delivery Equipment Due to Supply Chain Constraints.

- Risk of Catastrophic Yield Loss or Safety Incidents Due to System Failure or Contamination.

- Continuous Need for System Upgrades to Comply with Evolving Safety and Purity Standards.

Opportunities:

The most compelling opportunity lies in the integration of smart factory concepts, leveraging IoT and Industrial Internet of Things (IIoT) technologies into gas delivery systems. Developing cabinets that offer advanced connectivity, edge computing capabilities, and compatibility with centralized factory monitoring systems allows manufacturers to achieve higher levels of automation, predictive maintenance, and optimized resource allocation. Offering systems as part of a service model (Gas-as-a-Service or Equipment-as-a-Service) that includes comprehensive remote monitoring, guaranteed uptime, and automatic compliance reporting presents a high-value proposition, especially to large, global semiconductor corporations seeking to minimize operational variability across their worldwide fabs.

Furthermore, the diversification of end-use applications presents robust growth avenues outside traditional semiconductor fabrication. The rapid expansion of the Photovoltaic (PV) solar energy market, particularly thin-film solar cell production, and the growth in advanced battery manufacturing require customized, safe handling of process gases such as silane and phosphine. Similarly, the increasing complexity of pharmaceutical and biotechnology research, which often utilizes specialized high-purity gases for synthesis and calibration, opens new niche markets for smaller, more modular gas delivery systems tailored to laboratory and pilot-scale operations. Addressing these emerging high-growth sectors with standardized, yet configurable, safety solutions will be key to unlocking untapped revenue potential in the coming decade.

- Integration of IoT, IIoT, and AI for Smart Monitoring, Predictive Maintenance, and Remote Operation.

- Expansion into Emerging High-Growth Sectors, including Advanced Photovoltaics, LED, and Specialized Biotechnology.

- Development of Modular, Highly Configurable Systems for Faster Deployment and Scalability.

- Offering Value-Added Services such as System Validation, Continuous Monitoring, and Compliance Management.

- Focusing on Sustainable Manufacturing Practices and Energy-Efficient Gas Purging Systems.

Impact Forces:

The impact forces analysis reveals that technological imperative and regulatory stringency exert the most profound and immediate influence on the market. As semiconductor process nodes continue to shrink, the tolerance for gas impurities approaches zero, forcing manufacturers to continuously invest in research and development to improve component purity, welding techniques, and filtration efficiency. This technological race accelerates innovation cycles, rendering older equipment obsolete quickly. Simultaneously, the non-negotiable nature of safety compliance acts as a powerful barrier to entry for new competitors and mandates capital reinvestment for established players, ensuring that quality and certification remain the primary differentiators over price. The combined effect of these forces drives up both the complexity and the ultimate selling price of the products, solidifying the market position of experienced, certified providers capable of meeting these ultra-demanding specifications.

- Technological Innovation: Continuous advancement in microchip design requiring stricter UHP gas management standards.

- Regulatory Compliance: Mandatory adherence to international safety protocols (SEMI S2/S8) dictates product design and replacement cycles.

- Supply Chain Vulnerability: Dependencies on a limited number of specialized high-purity component suppliers affect lead times and costs.

- Industrial Automation Trend: The shift toward fully automated fabs necessitates fully integrated, networked gas delivery control systems.

Segmentation Analysis

The Gas Delivery Cabinet Systems Market is segmented primarily based on the Type of configuration (governed by usage intensity), the Gas Type handled (dictated by chemical properties), and the Application End-User (determined by manufacturing sector). The segmentation reflects the diverse requirements of modern fabrication facilities, ranging from low-volume, highly toxic specialty gas handling in research labs to high-volume, bulk gas delivery in mega-fabs. The differentiation in specifications across segments is highly pronounced; for instance, cabinets designed for pyrophoric gases require significantly more robust inert purging capabilities and fire suppression features than those used for inert gases. Understanding these segment-specific requirements is essential for market players to tailor product development and strategic sales efforts effectively.

By Type, the market is broadly divided into Single-station, Dual-station, and Multi-station cabinets. Dual-station systems, which enable automatic changeover between active and standby gas cylinders, dominate the high-volume production environment as they ensure uninterrupted supply, crucial for minimizing process interruptions and maximizing expensive equipment utilization. Single-station cabinets remain prevalent in research and development settings or facilities with lower throughput requirements for specific, specialty gases. The transition to more automation is driving increased demand for modular, multi-station units that can be centrally controlled and monitored, optimizing floor space utilization within high-value cleanroom environments.

Application-wise, the Semiconductor and Electronics sector represents the largest and most dynamic segment. Growth within this segment is driven by the density of advanced fabrication technologies and the sheer volume of capital expenditure directed towards expanding global chip manufacturing capacity. The second significant segment, Photovoltaics and Solar Manufacturing, is experiencing accelerated growth due to global renewable energy mandates, necessitating safe delivery systems for materials like Silane and Germanium. Other crucial segments include specialized applications in medical and healthcare (laboratory calibration and sterile processing) and defense aerospace, where ultra-reliable, high-purity gas delivery is non-negotiable for specialized material production.

- By Type: Single-station, Dual-station, Multi-station/Centralized Systems.

- By Gas Type: Inert Gases, Flammable Gases, Toxic Gases, Corrosive Gases, Pyrophoric Gases, Specialty Gases.

- By Operation Mode: Manual Systems, Semi-Automatic Systems, Fully Automatic Systems.

- By Application/End-User: Semiconductor & Electronics (Foundry, IDM, OSAT), Photovoltaics (Solar Cells), LED & Flat Panel Displays (FPD), Medical & Healthcare, Research & Laboratories, Aerospace & Defense.

Value Chain Analysis For Gas Delivery Cabinet Systems Market

The value chain for Gas Delivery Cabinet Systems is complex, originating from specialized upstream material suppliers and culminating in installation and post-sales maintenance services at the end-user facility. Upstream activities are dominated by specialized material vendors providing ultra-high purity components, including 316L stainless steel tubing, high-integrity valves, pressure regulators, specialized filters (point-of-use purifiers), and advanced sensor arrays. The reliance on orbital welding techniques and stringent material traceability mandates that only a few highly qualified suppliers can participate in this initial stage. Midstream manufacturing involves the assembly, integration, programming (PLC setup), testing, and third-party safety certification (e.g., SEMI S2/S8 compliance) of the complete cabinet system, requiring significant engineering expertise and cleanroom assembly capabilities.

Distribution channels for these systems are primarily categorized into direct and indirect methods. Due to the high value, technical complexity, and requirement for customization, the direct sales model is dominant, especially for large, global semiconductor clients. Manufacturers engage specialized application engineers who work closely with the fab design teams (A&E firms) and facility managers to ensure the cabinet specifications meet exact process gas requirements and cleanroom integration standards. Indirect distribution involves working through specialized equipment distributors or regional system integrators who handle the last-mile logistics, installation, and localized support in geographically diverse markets, particularly in emerging industrial hubs.

Downstream activities center on installation, commissioning, validation, and long-term service contracts. Commissioning involves critical activities such as leak testing, high-purity purging, and final performance verification, which must be executed by certified personnel. Post-installation, the value chain extends into comprehensive maintenance services, including calibration, component replacement, and software updates. Given the safety-critical nature of these systems, manufacturers often offer full-service agreements, generating significant recurring revenue streams and strengthening customer loyalty. Effective management of the downstream service network, particularly in ensuring rapid response times for fault resolution, is a key competitive differentiator in this highly sensitive market.

Gas Delivery Cabinet Systems Market Potential Customers

The primary end-users and buyers of Gas Delivery Cabinet Systems are organizations engaged in manufacturing processes that utilize high-purity, often hazardous, process gases for material modification and deposition. The most critical customer segment comprises Integrated Device Manufacturers (IDMs) and pure-play foundries in the semiconductor industry, such as TSMC, Samsung, Intel, and Micron. These customers drive the highest volume and demand the most stringent specifications due to the high sensitivity of wafer fabrication processes to contamination and interruption. Their purchasing decisions are heavily influenced by equipment reliability, certification, long-term support, and proven ability to handle new, complex precursor materials required for sub-micron fabrication nodes.

A secondary, yet rapidly growing customer base includes manufacturers in related advanced technology fields. This encompasses companies producing Flat Panel Displays (FPDs) for consumer electronics, manufacturers of high-efficiency Photovoltaic (PV) solar cells (requiring safe Silane handling), and those involved in the production of high-brightness LEDs. These customers prioritize high throughput and robust safety features to manage moderately high volumes of specialty gases. Furthermore, large research institutions, government laboratories focused on materials science, and universities running semiconductor fabrication research pilot lines represent a key segment requiring flexible, modular systems suitable for varied gas experimentation and smaller scale operations.

Lastly, specialty segments such as advanced chemical manufacturers producing high-purity precursors and pharmaceutical/biotechnology firms also constitute potential customers. The latter group utilizes specialized gas delivery for processes like synthesizing high-purity therapeutic agents or managing inert atmospheres during sensitive reactions. For these customers, compliance with Good Manufacturing Practices (GMP) and extreme traceability is paramount, often requiring tailored cabinet solutions that integrate seamlessly with pharmaceutical facility standards. The purchasing process for all these segments is lengthy and involves multiple stakeholders, including EHS officers, facilities engineers, and process manufacturing managers, underscoring the necessity for detailed technical specifications and robust safety documentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ichor Systems, Entegris, Linde Engineering, Praxair (Linde), Air Liquide, Atlas Copco, Parker Hannifin, Swagelok, Versum Materials (Merck KGaA), Hitachi High-Tech, Fujikin Incorporated, GCE Group, SEMI-GAS Systems, Ultra Clean Technology (UCT), CEODEUX, CollabraTech Solutions, Critical Process Systems (CPS), Applied Energy Systems (AES). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Delivery Cabinet Systems Market Key Technology Landscape

The core technology landscape for Gas Delivery Cabinet Systems is currently defined by advancements in ultra-high purity component design, integrated sensor technology, and enhanced safety automation. Modern systems heavily rely on orbital welding techniques to ensure seamless, crevice-free flow paths, minimizing particulate generation and maximizing resistance to corrosive gases. This ensures gas integrity down to the parts-per-trillion level required by advanced lithography and deposition processes. Key components include advanced diaphragm valves and pressure regulators manufactured from specialized alloys (e.g., Hastelloy, specialized stainless steels) to prevent corrosion and leaching, thereby maintaining the purity of specialty process gases and maximizing product yield in the cleanroom environment.

A significant technological shift involves the robust integration of smart monitoring and control systems. Contemporary cabinets are equipped with sophisticated Programmable Logic Controllers (PLCs) and touch-screen Human-Machine Interfaces (HMIs) that manage automatic changeover, execute complex purging sequences, and provide detailed data logging. The adoption of smart sensors, including micro-acoustic leak detectors and advanced mass flow controllers (MFCs), enables real-time volumetric monitoring and rapid detection of minute leaks, surpassing the capabilities of traditional pressure drop methods. Furthermore, integration with factory-wide SCADA and MES systems via industrial Ethernet protocols (e.g., EtherCAT, Profinet) facilitates remote diagnostics and centralized safety management, aligning with Industry 4.0 principles.

The industry is also focusing intensely on safety-critical innovations, particularly in handling highly pyrophoric and toxic gases like Silane, Arsine, and Phosphine. This includes the development of self-extinguishing cabinet materials, enhanced ventilation designs to ensure negative pressure containment, and advanced gas abatement technologies integrated downstream. The ongoing drive toward miniaturization and modularity allows for the creation of smaller, highly localized point-of-use gas delivery units, minimizing the distance hazardous gases travel across the fab floor and improving overall facility safety ratings. Future developments are focused on solid-state gas storage and delivery methods to eliminate the risks associated with high-pressure gas cylinders entirely.

Regional Highlights

Regional analysis confirms that the Asia Pacific (APAC) region is the undisputed leader in the Gas Delivery Cabinet Systems Market, holding the largest market share and demonstrating the highest growth trajectory. This dominance is directly attributable to the overwhelming concentration of semiconductor foundry operations, memory chip manufacturing, and assembly, testing, and packaging (ATP) facilities across key nations like China, Taiwan, South Korea, and Japan. Massive capital expenditures announced by major chipmakers in these regions to expand production capacity and transition to sub-5nm nodes are continually fueling the demand for highly advanced, UHP gas delivery infrastructure. Localized manufacturing advantages and a robust supply chain ecosystem further solidify APAC's leading position, making it the central hub for advanced gas system deployment.

North America represents the second-largest market, characterized by significant R&D spending, technological innovation, and a revitalization trend driven by government incentives. Countries like the United States are seeing substantial investment in new greenfield fabs (e.g., in Arizona and Ohio) following initiatives like the CHIPS and Science Act, aiming to secure domestic semiconductor supply chains. This regional market emphasizes the highest safety standards and often drives the adoption of cutting-edge automation technologies, including AI integration for predictive maintenance. Demand here is characterized by a preference for customized, vertically integrated solutions provided by established, certified global suppliers.

Europe, while mature, is poised for strong growth, particularly in Germany, France, and Ireland, due to the European Chips Act aiming to double the region's global chip production market share by 2030. This initiative necessitates modernization and expansion of existing facilities, focusing on highly energy-efficient and modular gas delivery solutions that adhere strictly to demanding EU directives (e.g., ATEX for explosion safety). Latin America and the Middle East and Africa (MEA) currently hold smaller market shares, primarily serving niche industrial, solar, and research sectors. However, MEA, particularly the GCC nations, shows potential as they invest heavily in developing local high-tech and renewable energy manufacturing capabilities, gradually expanding the necessity for specialized gas handling equipment.

- Asia Pacific (APAC): Dominant market share and highest growth rate due to unparalleled concentration of semiconductor manufacturing (Taiwan, South Korea, China).

- North America: Strong demand driven by government-backed incentives (CHIPS Act) and focus on leading-edge R&D and advanced automation integration.

- Europe: Growth accelerating due to the European Chips Act, emphasizing compliant, energy-efficient, and safety-focused gas delivery infrastructure.

- Latin America & MEA: Emerging markets with potential expansion fueled by investments in solar power (PV) and localized industrialization efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Delivery Cabinet Systems Market.- Ichor Systems

- Entegris

- Linde Engineering (including Praxair technologies)

- Air Liquide

- Atlas Copco

- Parker Hannifin

- Swagelok

- Versum Materials (now part of Merck KGaA)

- Hitachi High-Tech

- Fujikin Incorporated

- GCE Group

- SEMI-GAS Systems (a division of Applied Energy Systems)

- Ultra Clean Technology (UCT)

- CEODEUX (Rotarex)

- CollabraTech Solutions

- Critical Process Systems (CPS)

- Applied Energy Systems (AES)

- CVD Equipment Corporation

- Nihon Filter Co., Ltd.

- Global Process Systems

Frequently Asked Questions

Analyze common user questions about the Gas Delivery Cabinet Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key safety standards governing Gas Delivery Cabinet Systems?

The primary safety standards are those mandated by SEMI (Semiconductor Equipment and Materials International), specifically SEMI S2 (Safety Guidelines for Semiconductor Manufacturing Equipment) and SEMI S8 (Ergonomics). Compliance with NFPA (National Fire Protection Association) codes and local industrial safety regulations is also essential, ensuring containment, seismic stability, and fire suppression capabilities.

How does the Gas Delivery Cabinet Market contribute to semiconductor manufacturing yields?

Gas delivery cabinets ensure ultra-high purity (UHP) gas integrity by eliminating contamination sources (particles, moisture) through specialized components and seamless welding. Maintaining gas purity is critical, as even minute impurities can cause defects in microchip structures, directly reducing fabrication yields. Reliable, uninterrupted gas flow also minimizes costly process downtime.

What is the role of automation (PLC and sensors) in modern gas cabinet design?

Automation manages complex and hazardous operations, such as automatic cylinder changeover, purging sequences, and emergency shutdowns, minimizing human interaction with dangerous gases. Integrated PLCs and smart sensors enable real-time remote monitoring, data logging for compliance, and provide inputs for advanced predictive maintenance systems, significantly enhancing operational safety and uptime.

Which application segment drives the highest demand for advanced gas cabinet systems?

The Semiconductor and Electronics manufacturing segment drives the highest demand. This is due to the exponential capital expenditure in new fabrication plants (fabs) globally, the necessity for handling increasingly toxic and pyrophoric gases, and the stringent purity requirements for manufacturing advanced logic and memory chips (e.g., 5nm and 3nm nodes).

What differentiates a single-station system from a dual-station system?

A single-station system accommodates one gas cylinder and requires manual shutdown and replacement when empty. A dual-station system holds two cylinders (one active, one standby) and automatically switches the gas supply when the active cylinder depletes, ensuring continuous process operation without interruption. Dual-station systems are standard in high-volume production environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager