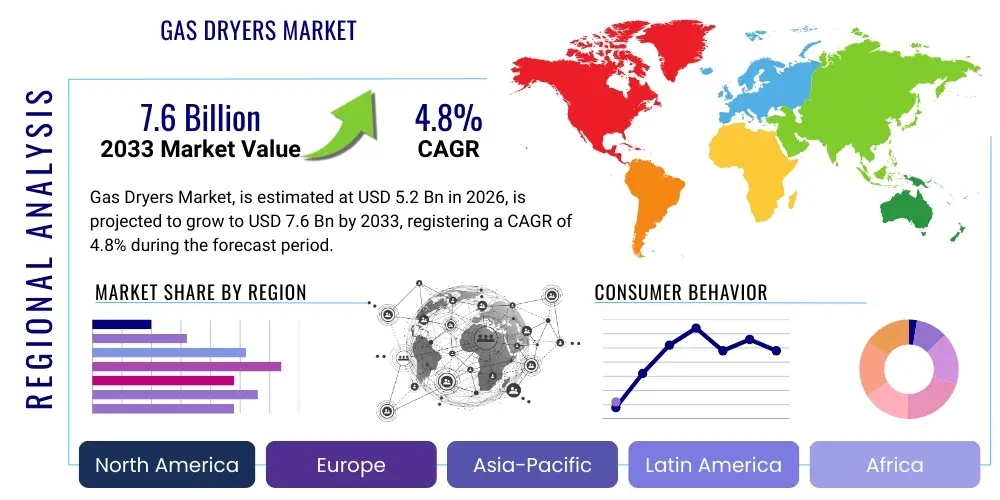

Gas Dryers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437517 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Gas Dryers Market Size

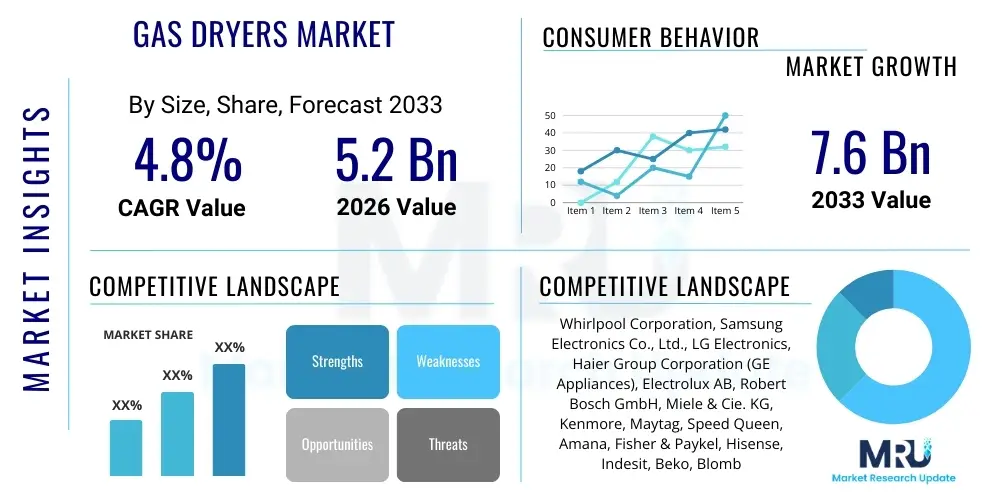

The Gas Dryers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.6 Billion by the end of the forecast period in 2033.

Gas Dryers Market introduction

The Gas Dryers Market encompasses the manufacturing, distribution, and sale of clothes drying appliances that utilize natural gas or propane as their primary heat source. These appliances are favored in many regions due to their superior energy efficiency compared to traditional electric resistance dryers, leading to lower operating costs over the appliance's lifespan, a crucial factor for both residential consumers and high-volume commercial laundry operations. The core function of a gas dryer involves igniting a burner to heat air, which is then circulated through the drum to evaporate moisture from the clothes, subsequently venting the moist air outdoors. Product descriptions emphasize rapid drying times, high-capacity models, and the integration of advanced features such as moisture sensors, steam cycles, and smart connectivity capabilities, which are becoming standard expectations within premium segments.

Major applications of gas dryers span the spectrum from high-density residential housing and single-family homes to large-scale commercial entities. In the residential sector, they are a staple appliance, particularly in regions with established natural gas infrastructure, offering long-term cost savings despite a typically higher initial purchase price than electric counterparts. Commercially, gas dryers are indispensable for laundromats, hotels, hospitals, and multi-family residential complexes where continuous, heavy-duty usage and energy efficiency are paramount operational concerns. The shift towards sustainable energy practices and stricter regulatory standards concerning appliance efficiency (such as Energy Star ratings) further solidifies the demand structure for modern, high-efficiency gas dryer models capable of minimizing energy consumption and environmental footprint.

The market growth is fundamentally driven by several converging factors, including sustained global population growth requiring increased appliance penetration, continuous innovation in thermal efficiency technology, and favorable natural gas pricing relative to electricity in major developed economies. Benefits derived by end-users include reduced utility bills, shorter drying cycles which increase productivity (especially in commercial settings), and enhanced fabric care features like precise temperature control. Moreover, the replacement cycle for major home appliances, coupled with new housing construction rates, consistently provides a stable foundation for market expansion. Key driving factors include utility incentives promoting gas appliance adoption and continuous advancements in exhaust and heat exchange mechanisms designed to meet evolving energy standards and consumer expectations for performance.

Gas Dryers Market Executive Summary

The Gas Dryers Market is experiencing robust expansion driven primarily by consumer preference for energy-efficient appliances, stringent government regulations mandating higher efficiency standards, and stable infrastructure supporting natural gas distribution globally. Current business trends indicate a strong focus on smart integration, with manufacturers rapidly incorporating IoT capabilities, remote diagnostics, and cycle optimization features accessible via mobile applications, catering to tech-savvy demographics. Furthermore, the commercial segment is witnessing significant investment in large-capacity, heavy-duty gas dryers that promise maximal throughput and minimal downtime, crucial for institutional laundry services. Competitive strategies are increasingly centered on optimizing the heat transfer mechanism to accelerate drying speed while simultaneously reducing overall BTU consumption, leading to a dynamic market focused on innovation in burner technology and drum design.

Regional trends reveal that North America holds a dominant market share due to its well-established natural gas infrastructure, high consumer adoption rates for major appliances, and a culture prioritizing fast drying times for larger loads. The European market, while historically favoring condensing and heat pump electric dryers due to less ubiquitous gas infrastructure, is slowly adopting high-efficiency gas models in certain commercial and multi-family residential sectors where localized gas supply is economically viable. Asia Pacific (APAC) represents the fastest-growing region, fueled by rapid urbanization, increasing disposable income, and the expansion of residential real estate projects that incorporate modern laundry facilities. Market penetration in emerging APAC economies is supported by manufacturers offering entry-level, yet energy-efficient, standard gas dryer models.

Segment trends highlight the dominance of the residential application segment, which accounts for the largest volume of sales, although the commercial segment commands higher average selling prices (ASPs) due to specialized features and durability requirements. Regarding product segmentation, vented gas dryers remain the standard, high-performance choice, especially in regions like North America. However, there is growing interest in specialized sub-segments such as ventless gas dryers, which, while niche, offer flexibility for installation in urban environments where traditional venting is challenging or impossible, often utilizing catalytic combustion technology. Capacity-wise, the trend leans toward large-capacity units (over 8.0 cu. ft.) to accommodate larger families and reduce the frequency of loads, aligning with modern consumer convenience demands and maximizing energy efficiency per pound of laundry dried.

AI Impact Analysis on Gas Dryers Market

Analysis of common user questions regarding AI's impact on the Gas Dryers Market reveals key themes centered on predictive maintenance, optimization of drying cycles, and smart integration within the broader smart home ecosystem. Users are highly interested in whether AI can prevent costly repairs by forecasting component failure (such as igniter or thermistor issues) and self-ordering parts. They also frequently inquire about the feasibility of AI learning personalized drying habits, optimizing energy consumption based on local utility rates and load type detection, ensuring maximum AEO. The primary concerns revolve around data privacy, the cost implications of integrating AI hardware and software, and the complexity of troubleshooting AI-driven systems. Expectations are high regarding the system's ability to truly minimize energy usage and enhance garment longevity through precise, adaptive heat management, moving beyond basic moisture sensing to real-time fabric analysis.

AI integration is fundamentally transforming gas dryer operations by moving appliance control from static presets to dynamic, adaptive management. Predictive algorithms monitor motor vibrations, gas valve actuation timing, and temperature fluctuation patterns to detect subtle anomalies that signal impending mechanical failures, significantly reducing unexpected downtime in high-utilization commercial settings. This shift from reactive repair to proactive maintenance enhances operational efficiency and lifecycle profitability for commercial operators. For residential users, AI-powered systems refine the user experience by simplifying complex settings; for instance, a dryer might use computer vision or acoustic sensors combined with machine learning models to accurately estimate the load size, fabric composition (e.g., cotton vs. synthetic blend), and then automatically select the optimal combination of heat level, tumble speed, and cool-down period, ensuring energy is only used precisely as needed for perfect dryness and minimizing garment damage.

The role of AI extends significantly into the realm of energy management and utility interaction. AI-enabled gas dryers can interface directly with smart grid systems and residential energy management platforms. By analyzing real-time variable gas pricing or demand charges, the dryer can automatically shift or pause operation to leverage off-peak hours, dramatically reducing the cost per load without requiring direct user intervention. This level of optimization, enabled by deep learning and vast datasets on energy consumption profiles, positions gas dryers as key components in a sustainable smart home. Furthermore, natural language processing (NLP) is facilitating easier user interaction, allowing users to initiate cycles and receive status updates through voice commands or sophisticated chatbot interfaces, improving accessibility and user satisfaction across various demographic groups.

- AI enhances predictive maintenance by analyzing operational data patterns to forecast component failure.

- Machine learning algorithms optimize drying cycles by accurately detecting load composition, size, and remaining moisture content.

- Smart scheduling driven by AI allows dryers to operate during optimal off-peak utility pricing periods, maximizing cost savings.

- AI facilitates seamless integration into smart home ecosystems, enabling centralized energy monitoring and voice control.

- Advanced sensor fusion and real-time fabric analysis minimize garment wear and tear while ensuring optimal dryness.

- Natural language processing improves user interfaces, enabling intuitive interactions and remote troubleshooting assistance.

DRO & Impact Forces Of Gas Dryers Market

The dynamics of the Gas Dryers Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which are magnified by key Impact Forces such as technological advancements and regulatory shifts. The primary drivers revolve around the inherent energy efficiency of gas appliances compared to electric resistance alternatives, leading to lower long-term operating costs and increased appeal in markets where natural gas supply is cost-competitive. Furthermore, the rapid drying speed offered by gas dryers remains a critical factor, particularly in institutional and commercial laundries where throughput efficiency directly correlates with profitability. Technological advances, especially in sensor technology and smart features, elevate the consumer experience and justify premium pricing for advanced models, thereby expanding the market value.

However, significant restraints temper the market's trajectory. The most notable constraint is the initial higher purchase price of gas dryers compared to standard electric models, creating a barrier to entry for budget-conscious consumers. Furthermore, installation requirements are inherently more complex, demanding dedicated gas lines and proper ventilation systems, which adds to the total cost of ownership and limits installation flexibility, especially in older buildings or multi-unit dwellings not originally configured for gas appliances. Safety perceptions related to gas usage, including concerns about carbon monoxide (CO) exposure and potential fire risks (despite rigorous safety standards), occasionally deter consumers. The environmental movement promoting full electrification and heat pump technology, which eliminates the need for gas combustion, poses a structural, long-term challenge to the market.

The most compelling opportunities lie in expanding market penetration in developing regions where urbanization and household appliance adoption are accelerating, coupled with the potential for replacing aging, inefficient dryer fleets in developed economies. Developing specialized, highly efficient ventless gas dryer technology (catalytic gas drying) offers a unique opportunity to overcome the installation restraints associated with traditional vented models, opening up new urban apartment markets. Key impact forces include fluctuating natural gas prices, which can temporarily erode the cost advantage over electricity, and evolving government energy efficiency standards (like those imposed by the Department of Energy in the U.S.), which force continuous innovation but also stabilize market quality. The force of competitive dynamics compels manufacturers to heavily invest in advanced heat exchanger designs and IoT connectivity to maintain relevance and market share.

Segmentation Analysis

The Gas Dryers Market is primarily segmented based on the mechanism of heat management, operational capacity, and end-user application, providing a granular view of consumer demands and operational requirements across different sectors. Understanding these segments is crucial for manufacturers tailoring product lines and for investors assessing market potential and penetration strategies. The segment analysis highlights key divergence points, such as the preference for large-capacity units in the North American residential market versus a focus on space-saving, highly efficient units in dense European urban environments. Furthermore, the market differentiates sharply between residential consumers focused on convenience and aesthetics and commercial buyers prioritizing durability, high utilization metrics, and minimal operational downtime.

By application, the split between Residential and Commercial end-users defines most volume and value dynamics. The Residential segment is characterized by a high volume of sales of standard and smart home models, typically emphasizing features like steam refresh cycles and quiet operation. Conversely, the Commercial segment includes laundromats, hotels, hospitals, and military installations, demanding robust, industrial-grade machinery designed for near-continuous operation, requiring specialized components capable of handling extreme stress and cycle demands, justifying substantially higher ASPs. Capacity segmentation directly correlates with application, with high-capacity models dominating commercial and large-family residential sales, while smaller, compact units cater to urban living and niche markets.

The technological segmentation primarily focuses on the method of exhaust, notably differentiating between Vented and Non-Vented (Ventless) gas dryers. Vented models, which are the traditional and most common design, offer superior performance and efficiency through direct exhaust of moisture-laden air outside the structure. The emerging ventless segment, often relying on complex heat exchange or catalytic combustion technology, offers installation flexibility critical for markets lacking external venting infrastructure, albeit sometimes at the cost of slightly extended cycle times or higher appliance complexity. This segmentation is vital for geographical strategy, as building codes and infrastructure availability heavily influence the dominant product type in any given region, driving differentiated manufacturing focus among major market participants.

- Segmentation by Product Type:

- Vented Gas Dryers (Standard exhaust mechanism, dominant globally)

- Non-Vented (Ventless) Gas Dryers (Catalytic combustion models, specialized for urban installations)

- Segmentation by Capacity:

- Small Capacity (Below 6.5 cubic feet)

- Medium Capacity (6.5 to 8.0 cubic feet)

- Large Capacity (Above 8.0 cubic feet, dominant in high-load markets)

- Segmentation by Application:

- Residential (Single-family homes, multi-family units)

- Commercial (Laundromats, Hotels, Hospitals, Industrial Laundries)

Value Chain Analysis For Gas Dryers Market

The Value Chain for the Gas Dryers Market begins with the upstream procurement of essential raw materials and specialized components, followed by manufacturing, distribution, and ultimately, sales and after-sales service. Upstream analysis focuses on suppliers of key input materials, including steel (for drums and chassis), plastics (for control panels and housings), advanced heating elements (igniters, burner assemblies), and sophisticated electronic controls (microprocessors, sensors). Manufacturers seek reliable, cost-effective suppliers capable of meeting stringent quality standards, particularly concerning safety components like gas valves and pressure regulators. Price volatility in base metals, such as steel and aluminum, often dictates manufacturing cost structures and final appliance pricing, necessitating robust supply chain risk management strategies to maintain stable profit margins across the industry.

The manufacturing stage involves complex assembly processes, rigorous safety testing, and quality control, often utilizing highly automated production lines to achieve economies of scale. Direct channel distribution involves sales through manufacturer-owned stores or dedicated online portals, allowing for direct control over pricing, branding, and customer experience, particularly beneficial for premium or high-tech models. However, the majority of volume sales are handled through indirect channels, primarily comprising large retail chains (e.g., Home Depot, Lowe's, Best Buy in North America), appliance specialty stores, and independent regional dealers. These indirect channels leverage extensive warehousing capabilities, established consumer trust, and dedicated installation services, which are critical for gas appliance sales given their specialized setup requirements.

Downstream activities are dominated by logistics, retail sales, installation services, and critical post-sales support. Effective logistics management is crucial due to the bulky nature of the product, requiring specialized handling and last-mile delivery. The availability and quality of certified installation and repair technicians significantly impact brand reputation and customer satisfaction, particularly as smart and complex gas systems become standard. Commercial distribution often utilizes specialized B2B channels that provide tailored financing, maintenance contracts, and bulk ordering capabilities tailored to the high operational demands of laundromats and hospitality clients. The efficiency of this downstream network, encompassing rapid response to warranty claims and technical support, is a primary differentiator in maintaining long-term customer loyalty and market competitiveness.

Gas Dryers Market Potential Customers

Potential customers for the Gas Dryers Market are broadly categorized into residential end-users and diverse commercial entities, each possessing distinct purchasing criteria and volume requirements. Residential buyers represent the largest volume segment, typically comprising new homeowners, individuals undertaking home renovations, or those replacing existing, end-of-life appliances. These consumers prioritize a balance between initial cost, long-term energy savings, and advanced features such as moisture sensing, Wi-Fi connectivity, and aesthetic design. The decision-making process is often influenced by energy efficiency ratings (like Energy Star) and manufacturer reputation for reliability and quiet operation, ensuring the appliance integrates seamlessly into the modern home environment while minimizing utility expenses.

The commercial segment encompasses several high-value customer groups whose purchasing decisions are dictated by performance metrics, durability, and total cost of ownership (TCO). This includes laundromats (coin-operated laundry services), which require heavy-duty, high-throughput machines with robust mechanical components capable of running dozens of cycles daily without breakdown. Similarly, the hospitality industry (hotels and resorts) and healthcare facilities (hospitals and nursing homes) demand industrial-grade dryers that can handle massive, continuous loads of bedding and linens, focusing on maximum energy efficiency per load and minimizing maintenance downtime. These commercial buyers typically purchase in bulk and prioritize long-term service contracts and energy guarantees over aesthetic appeal.

Furthermore, property developers and multi-family residential complex managers constitute a growing group of potential customers. These buyers often equip entire apartment buildings or housing tracts, requiring standardized, reliable, and space-efficient gas dryer models. Their focus is on minimizing long-term operational costs for the property owner and ensuring high tenant satisfaction through reliable appliance performance. Utility providers, while not direct end-users, are often influential potential customers through rebate and incentive programs that subsidize the purchase of highly efficient gas dryers, encouraging market adoption and fulfilling regulatory requirements for energy conservation, thereby indirectly driving demand among residential consumers seeking subsidized appliance upgrades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.6 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Whirlpool Corporation, Samsung Electronics Co., Ltd., LG Electronics, Haier Group Corporation (GE Appliances), Electrolux AB, Robert Bosch GmbH, Miele & Cie. KG, Kenmore, Maytag, Speed Queen, Amana, Fisher & Paykel, Hisense, Indesit, Beko, Blomberg, Asko, Sub-Zero Group, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Dryers Market Key Technology Landscape

The technological landscape of the Gas Dryers Market is defined by continuous innovation aimed at enhancing energy efficiency, improving safety features, and integrating smart functionalities. Core technology revolves around highly efficient burner systems and optimized heat exchangers, which maximize the transfer of thermal energy to the air while minimizing gas consumption. Modern gas dryers employ modulating gas valves that can precisely adjust the flame intensity in real-time, moving beyond simple on/off heating cycles. This modulation, often coupled with advanced electronic ignition systems (like silicon nitride igniters), ensures rapid heat-up times and sustained, uniform temperature delivery, which is essential for both performance and energy savings, positioning these appliances favorably against older electric models.

A critical area of technological advancement is the integration of sophisticated moisture sensing systems. Contemporary gas dryers utilize multiple sensors (often resistive or conductive strips) placed strategically within the drum or exhaust path to measure the remaining moisture level in the clothes with high accuracy. This precise feedback loop allows the electronic control unit to automatically terminate the drying cycle immediately upon reaching the desired dryness level, preventing over-drying (which damages fabric and wastes energy) and significantly improving cycle efficiency. Furthermore, advanced thermal management systems now include multiple redundant high-limit thermostats and flame sensors, far surpassing minimum regulatory requirements, thereby mitigating the safety concerns historically associated with gas appliances and bolstering consumer confidence in the technology.

The emergence of connectivity features, driven by IoT protocols (Wi-Fi, Bluetooth), represents a paradigm shift in user interaction and maintenance. Key technologies include microprocessors capable of running complex algorithms for cycle optimization, remote diagnostic tools that allow manufacturers to troubleshoot issues without a physical service call, and integration with home energy management systems. Specialized gas dryer innovations include catalytic combustion technology used in ventless models. This technology uses a catalyst to burn natural gas at a lower temperature, creating heat without producing large volumes of combustion byproducts, thus eliminating the need for complex external venting, a crucial technological breakthrough for highly dense urban residential markets globally. These interconnected technologies define the current competitive edge in the high-end gas dryer market.

Regional Highlights

Regional dynamics significantly influence the adoption and segmentation of the Gas Dryers Market, primarily dictated by infrastructure, energy costs, and prevailing consumer habits.

- North America (United States and Canada): This region dominates the global Gas Dryers Market both in volume and value, largely due to extensive and reliable natural gas infrastructure coverage, favorable regulatory environments promoting natural gas usage, and high consumer preference for large-capacity appliances that offer rapid drying times. The market here is mature but consistently driven by replacement sales and new housing starts. The U.S. market is characterized by fierce competition among major domestic and international brands, focusing heavily on smart technology integration and maximum energy efficiency ratings (e.g., ENERGY STAR Most Efficient).

- Europe: The market for gas dryers in Europe is smaller and more fragmented compared to North America, traditionally favoring electric heat pump dryers due to the lower prevalence of residential gas infrastructure in many countries and strict environmental policies favoring electric appliances for decarbonization efforts. However, commercial laundries and large institutions in countries like the UK, Germany, and Italy where gas supply is feasible utilize high-efficiency gas dryers for cost-effective, high-volume operation. Opportunities exist in the specialized ventless gas dryer segment to overcome venting limitations in high-density urban housing.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, propelled by rapid economic development, urbanization, and a swelling middle class with increasing disposable income. Countries such as China, India, and Southeast Asian nations are witnessing massive growth in multi-family residential construction, driving demand for modern laundry solutions. While many areas lack established gas pipelines, regional market growth is supported by propane-fueled models and, increasingly, by the installation of necessary infrastructure in high-end developments. Focus is often on compact, high-efficiency models suitable for smaller living spaces.

- Latin America (LATAM): Market adoption is moderate, constrained by varying levels of natural gas infrastructure penetration and economic instability in certain countries. Demand is concentrated in key urban centers like Brazil and Mexico, where commercial applications (hotels, large residential towers) drive stable sales for reliable, robust gas appliances. The residential market is highly price-sensitive, with energy efficiency becoming an increasingly important factor as local utility costs rise.

- Middle East and Africa (MEA): This region represents a niche but growing market, particularly in the Gulf Cooperation Council (GCC) countries, where high-end residential developments and luxury hospitality sectors require advanced appliance technology. The presence of ample, often subsidized, natural gas supplies in producer nations favors the operational cost-effectiveness of gas dryers. Market growth is sporadic and largely dependent on large-scale construction projects and luxury segment penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Dryers Market.- Whirlpool Corporation

- Samsung Electronics Co., Ltd.

- LG Electronics

- Haier Group Corporation (GE Appliances)

- Electrolux AB

- Robert Bosch GmbH

- Miele & Cie. KG

- Kenmore

- Maytag

- Speed Queen

- Amana

- Fisher & Paykel

- Hisense

- Indesit

- Beko

- Blomberg

- Asko

- Sub-Zero Group, Inc.

- Alliance Laundry Systems

Frequently Asked Questions

Analyze common user questions about the Gas Dryers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary energy efficiency advantages of gas dryers over electric dryers?

Gas dryers typically offer superior energy efficiency because natural gas burns hotter and requires less time to achieve the necessary drying temperature compared to standard electric resistance coils. This results in significantly faster cycles and lower operational costs per load, providing substantial long-term utility bill savings, particularly for high-volume users.

How is smart technology enhancing the performance and safety of modern gas dryers?

Smart technology, including Wi-Fi connectivity and integrated AI, allows for remote monitoring, cycle optimization based on real-time load detection, and predictive maintenance alerts. Safety is enhanced through sophisticated electronic ignition systems and continuous monitoring of gas flow and exhaust temperatures, ensuring compliance and immediate shutoff in case of anomalies.

What major regulatory factors are influencing the design and sales of gas dryers?

Government agencies, notably the U.S. Department of Energy (DOE) and equivalent international bodies, impose stringent Minimum Energy Performance Standards (MEPS) requiring manufacturers to continuously improve energy factor ratings and thermal efficiency. These regulations drive innovation toward modulating burners and advanced sensor controls to meet AEO requirements.

What is the difference between vented and non-vented gas dryers and which is more prevalent?

Vented gas dryers, which require a direct exhaust path outside, are the most common type, offering maximum efficiency and performance. Non-vented (ventless) gas dryers use catalytic combustion technology to mitigate exhaust needs, offering installation flexibility in urban environments, though they represent a smaller, specialized segment of the market.

Which geographical region exhibits the strongest current market dominance for gas dryers?

North America (the United States and Canada) holds the strongest current market dominance. This is attributed to the extensive existing natural gas infrastructure, established consumer preference for gas appliances, competitive gas pricing, and a strong market demand for high-capacity, high-throughput residential and commercial units.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager