Gas Odorant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432949 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Gas Odorant Market Size

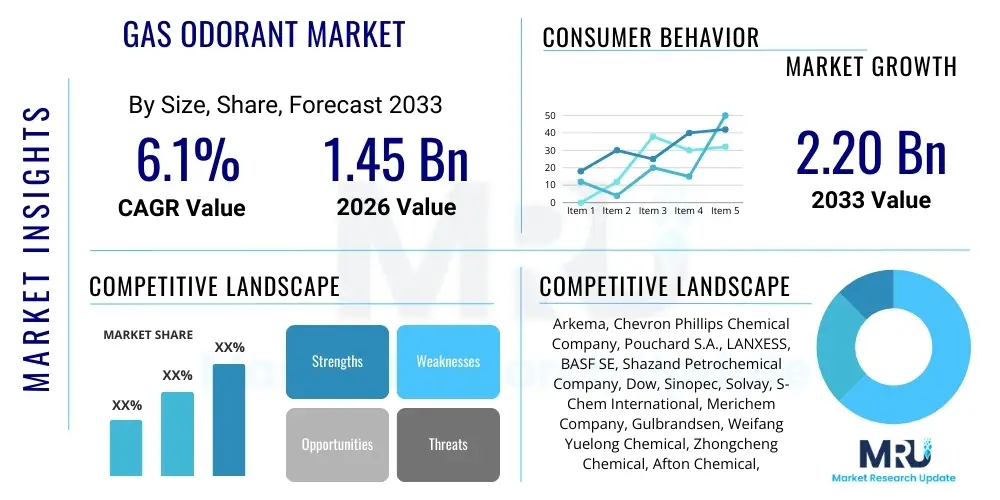

The Gas Odorant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% CAGR between 2026 and 2033. The market is estimated at $1.45 Billion USD in 2026 and is projected to reach $2.20 Billion USD by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating focus on natural gas safety regulations globally and the continuous expansion of gas pipeline infrastructure across emerging economies. Regulatory bodies, particularly in North America and Europe, mandate the use of distinctive odorants to ensure rapid leak detection, thereby minimizing public safety risks associated with odorless natural gas.

The valuation reflects the critical necessity of odorization in natural gas and liquefied petroleum gas (LPG) distribution networks. Gas odorants, primarily sulfur-containing organic compounds such as mercaptans and sulfides, provide a crucial early warning system. The market valuation is further bolstered by technological advancements in odorant delivery systems, which optimize injection rates and enhance monitoring precision, reducing waste while maintaining high safety standards. Fluctuations in raw material costs, particularly sulfur and hydrocarbon feedstocks, however, pose a challenge to pricing stability across the forecast period, influencing the overall market size calculation.

Gas Odorant Market introduction

The Gas Odorant Market encompasses the manufacturing, distribution, and utilization of chemical compounds deliberately added to typically odorless fuels—such as natural gas and propane—to give them a distinctive, easily detectable scent, ensuring prompt recognition of potentially dangerous leaks. The primary product portfolio includes Ethyl Mercaptan (EM), Tertiary Butyl Mercaptan (TBM), Methyl Mercaptan (MM), and Tetrahydrothiophene (THT), each selected based on regulatory requirements, climate conditions, and the specific application needs of the gas distribution network. These odorants are critical safety components, functioning as the first line of defense against catastrophic explosions or asphyxiation hazards associated with gas leakage in residential, commercial, and industrial settings.

Major applications of gas odorants span across vast distribution systems, including high-pressure transmission pipelines, medium-pressure distribution lines supplying cities, and localized systems such as LPG cylinders and industrial processing facilities. The core benefit derived from odorization is enhanced public safety through immediate leak detection by the end-user, often before specialized monitoring equipment can register a pressure drop. Furthermore, odorization supports regulatory compliance, as nearly all developed and rapidly developing nations enforce strict mandates requiring natural gas and LPG to be odorized to specific concentration levels that allow detection at concentrations far below the gas's lower explosive limit (LEL).

The market's persistent growth is driven by several interconnected factors, primarily the global push for adopting natural gas as a transitional fuel source, which necessitates ongoing expansion and maintenance of robust pipeline infrastructure, particularly across Asia Pacific and Latin America. Additionally, the aging infrastructure in established markets like North America and Europe requires continuous replacement and re-odorization efforts. Regulatory updates, often triggered by safety incidents, frequently lead to demands for higher quality odorants and more precise injection technology, further stimulating market demand and innovation among key manufacturers.

Gas Odorant Market Executive Summary

The Gas Odorant Market is characterized by stable demand resilience, driven primarily by non-negotiable safety regulations governing gas distribution worldwide, placing public safety and regulatory compliance at the forefront of business trends. Key industry players are focusing heavily on developing advanced, non-corrosive, and more stable odorant formulations, such as proprietary blends offering low freezing points and improved longevity in pipelines. A notable business trend involves the increased adoption of specialized odorant injection equipment that utilizes micro-dosing and telemetry, enabling precise dosage control and remote monitoring, which minimizes environmental impact and reduces operational costs for utility providers. Furthermore, consolidation within the production segment allows major chemical corporations to exert control over feedstock supply chains, influencing global pricing dynamics and supply stability for downstream users.

Regionally, North America maintains the dominant market share due to its stringent regulatory environment, the vast network of existing pipelines, and continuous investment in infrastructure maintenance and replacement. Europe follows, with demand supported by rigorous safety standards, although the region faces unique challenges related to the transition toward renewable gases (like biomethane and hydrogen), which may require new odorization strategies compatible with existing infrastructure. The Asia Pacific region is projected to exhibit the highest growth rate, fueled by rapid urbanization, significant investments in natural gas transportation infrastructure in countries like China and India, and the consequential expansion of residential and industrial gas consumption networks, driving high demand for basic and blended odorants.

Segment trends highlight the continued dominance of Ethyl Mercaptan (EM) and Tertiary Butyl Mercaptan (TBM) within the product type segment, preferred for their distinct odor profile and cost-effectiveness in natural gas applications. Tetrahydrothiophene (THT) retains strong relevance in European markets due to historical preference and specific regulatory acceptance. Application-wise, the Residential segment remains the largest consumer, reflecting the immense volume of gas passing through municipal distribution lines where immediate household leak detection is paramount. However, the Industrial sector, encompassing power generation and large manufacturing facilities, is growing steadily, demanding specialized odorant solutions tailored for high-volume, continuous flow systems, emphasizing safety without compromising process purity.

AI Impact Analysis on Gas Odorant Market

Common user questions regarding AI’s influence on the Gas Odorant Market frequently revolve around its potential to enhance leak detection accuracy, optimize odorant dosage efficiency, and predict maintenance needs within gas infrastructure. Users seek to understand if sophisticated AI-driven sensor systems (e.g., electronic noses) could eventually replace or severely reduce reliance on traditional chemical odorants, given the inherent logistical and environmental challenges associated with mercaptans. Key themes emerging from these inquiries include the feasibility of predictive maintenance scheduling based on odorant concentration decay, the integration of AI models with supervisory control and data acquisition (SCADA) systems to adjust injection rates dynamically based on flow rates and temperature, and the overall cost-benefit analysis of deploying AI for risk mitigation in gas distribution. Users are generally optimistic about AI's role in improving system management but remain cautious regarding full replacement of conventional odorization, prioritizing existing regulatory compliance and proven safety methodologies.

The incorporation of Artificial Intelligence and Machine Learning (AI/ML) is transforming the operational efficiency aspect of the gas odorant ecosystem, shifting the focus from simply adding the chemical to intelligently managing its presence and decay within the pipeline network. AI algorithms analyze massive datasets derived from flow meters, pressure sensors, weather conditions, and customer reports to calculate the optimal, minimum effective dosage of the odorant required at any given injection point. This optimization is crucial for utility companies, as it leads to substantial savings in chemical procurement and minimizes the possibility of 'odor fade'—a phenomenon where the odorant concentration drops below the regulatory threshold due to adsorption or chemical reaction within the pipes. By leveraging predictive analytics, operators can proactively adjust injection equipment settings, ensuring continuous compliance and maximizing public safety.

Furthermore, AI facilitates the development of next-generation monitoring technologies, such as advanced gas chromatography and spectroscopic sensors coupled with ML models, often referred to as 'electronic noses.' These systems are trained on odorant profiles and ambient atmospheric conditions to rapidly distinguish between different types of leaks (e.g., natural gas vs. sewer gas) and precisely locate the source. While AI does not replace the odorant itself, it fundamentally optimizes its deployment, verifies its effectiveness in real-time, and provides highly accurate data necessary for regulatory reporting and risk management strategies. This integration enhances the reliability of the entire gas safety infrastructure, making the distribution process safer, more efficient, and easier to audit, ultimately supporting the continuous, safe use of gas odorants.

- AI-driven Predictive Maintenance: Utilizing machine learning to forecast odorant concentration decay rates (odor fade) within specific pipeline sections, enabling targeted and timely re-odorization efforts.

- Optimized Injection Systems: Integration of AI with SCADA systems to dynamically adjust odorant injection rates based on real-time gas flow, pressure, temperature, and historical consumption data, ensuring precise minimum effective dosage.

- Enhanced Leak Detection: Development of AI-powered electronic nose technologies that analyze sensor data to rapidly identify, classify, and locate gas leaks, supplementing human perception.

- Supply Chain Forecasting: AI models assist in predicting future odorant demand based on infrastructural expansion projects and regional regulatory changes, optimizing procurement and inventory management.

- Regulatory Compliance Automation: Using algorithms to automatically document and report adherence to mandated odorization levels, streamlining audit processes and ensuring legal safety obligations are met consistently.

DRO & Impact Forces Of Gas Odorant Market

The Gas Odorant Market is profoundly shaped by a confluence of critical drivers, inherent restraints, promising opportunities, and overarching impact forces that dictate its operational environment and growth trajectory. The principal driver is the globally pervasive and non-negotiable governmental regulation mandating the odorization of flammable gases intended for public use, placing continuous demand on the market regardless of economic cycles. Conversely, a major restraint involves the supply chain volatility and hazardous nature of the raw materials, specifically sulfur-based organic compounds, which require complex and costly specialized handling, storage, and transportation protocols, thereby elevating operational expenditure for both manufacturers and end-users. Opportunities arise from technological advancements, particularly the development of sophisticated remote monitoring and micro-dosing systems that enhance efficiency and safety compliance. The overriding impact force is public safety perception; any major leak or incident can immediately trigger stricter regulatory review and necessitate massive, rapid infrastructure investment in improved odorization, creating demand spikes.

Drilling deeper into market dynamics, the push for replacing aging gas infrastructure, particularly across developed economies like the United States and Germany, acts as a significant long-term driver. As old metallic pipelines are replaced with newer polyethylene (PE) materials, the initial odorant injection process often requires a higher starting dose to saturate the new material, boosting temporary demand. However, the market faces strong headwinds from environmental scrutiny; as gas odorants like mercaptans are volatile organic compounds (VOCs) and possess strong, sometimes offensive, odors at high concentrations, their handling is subjected to increasing environmental agency oversight. This regulatory pressure forces manufacturers to invest heavily in low-VOC formulations and advanced containment systems, which increases production complexity and input costs, serving as a material restraint on profitability.

Potential opportunities are strongly aligned with the broader energy transition, specifically the odorization needs of renewable natural gas (RNG) and future hydrogen blends. RNG, derived from waste sources, must be rigorously odorized before pipeline injection, presenting a growing specialized market segment. Moreover, research into suitable, non-corrosive odorants for hydrogen gas blends is currently underway, representing a major future market expansion opportunity if hydrogen infrastructure scales as projected. The major impact forces are defined by the critical link between odorization effectiveness and catastrophic risk mitigation. Since failure to odorize correctly can result in deadly accidents, the market’s stability is directly proportional to its ability to maintain uninterrupted supply and technological reliability, making system redundancy and robust QA/QC procedures mandatory for all participants.

Segmentation Analysis

The Gas Odorant Market is primarily segmented based on the type of chemical composition and the application area where the odorized gas is utilized, reflecting the diverse technical requirements and regulatory regimes globally. Segmentation by product type is crucial as different odorants possess varying odor thresholds, corrosiveness levels, costs, and stability characteristics. For instance, mercaptans (like EM and TBM) are widely utilized for their immediate and recognizable scent profile and are dominant in North American natural gas distribution. Conversely, Tetrahydrothiophene (THT) is often preferred in parts of Europe due to its low sulfur content and perceived lower corrosiveness on older metallic pipeline systems, although its odor stability can be compromised under certain conditions.

The Application segmentation distinguishes between the Residential, Commercial, Industrial, and Transportation sectors, each with unique distribution characteristics and safety priorities. Residential use constitutes the largest volume consumer, driven by the massive networks delivering gas directly into homes where immediate detection by untrained individuals is paramount. Industrial applications require consistent odorization for large-volume users, such as power plants and chemical processing facilities, often necessitating higher concentrations due to greater risk exposure or larger volumes. Analyzing these segments helps market players tailor their product offerings, logistics, and technical support services to meet the specific safety and regulatory demands of each end-user group, from localized LPG bottling to continental pipeline networks.

Further granularity exists within the market structure, often addressing specific regulatory demands related to gas composition (e.g., standard natural gas vs. synthetic natural gas or specialized LPG mixes). The choice of odorant delivery system (e.g., bypass systems, wick systems, or sophisticated injection pumps) also acts as an implicit market segment driver, favoring suppliers who can provide integrated odorant and equipment solutions. Understanding these complex layers of segmentation is essential for developing precise market entry and growth strategies, focusing on high-growth regions like APAC where new infrastructure demands flexibility, or established markets like North America where optimization and compliance drive purchasing decisions.

- By Product Type:

- Ethyl Mercaptan (EM)

- Tertiary Butyl Mercaptan (TBM)

- Methyl Mercaptan (MM)

- Tetrahydrothiophene (THT)

- Blends and Specialty Formulations

- By Application:

- Residential Gas Distribution

- Commercial Use

- Industrial Applications (Power Plants, Manufacturing)

- LPG Bottling and Distribution

- Transportation and Pipeline Networks

- By Delivery Method:

- Drip/Wick Systems

- Bypass Systems

- Injection/Pulsed Systems

Value Chain Analysis For Gas Odorant Market

The Gas Odorant value chain begins with the highly specialized and capital-intensive upstream sector, centered on the sourcing and processing of core petrochemical feedstocks, primarily sulfur compounds and specific hydrocarbon derivatives. Major integrated chemical manufacturers, often possessing extensive sulfur handling capabilities, dominate this stage, producing the refined intermediates like mercaptans and thiophenes. The complexity here lies in managing the hazardous nature of these raw materials and maintaining high purity standards required for effective odorization. Supply chain stability in this upstream segment is highly susceptible to global crude oil and natural gas price fluctuations, directly impacting the final cost of the odorant product, making long-term contractual agreements essential for manufacturers.

The midstream and formulation stage involves specialized chemical synthesis, purification, and the creation of proprietary odorant blends tailored to specific climate and regulatory requirements. This stage requires rigorous quality control (QC) testing, often involving specialized analytical techniques like chromatography to ensure the odorant meets the mandated effective concentration threshold without introducing harmful contaminants. Distribution channels are highly critical and specialized due to the chemical volatility and stringent hazard class classification of odorants. The distribution network must adhere to exceptional safety standards, utilizing highly specialized transport tankers and containment systems, often involving direct sales models from the manufacturer or highly specialized third-party chemical logistics providers. Direct distribution ensures better control over handling and specialized technical support for the injection systems.

Downstream analysis focuses on the end-users, primarily large natural gas utilities, pipeline operators, and LPG distributors. Sales are often conducted through a B2B model, emphasizing long-term contracts based on reliability, technical expertise, and regulatory compliance support. Indirect distribution channels may involve regional distributors authorized to handle hazardous chemicals, particularly in geographically dispersed markets. The crucial value addition at the downstream level is the provision of technical services, including ongoing training for utility staff on safe handling, calibration of odorant injection equipment, and regular testing for odor fade, ensuring the entire system remains compliant and operational. Regulatory certification and specialized technical support are key differentiators in the final stage of the value chain.

Gas Odorant Market Potential Customers

Potential customers for gas odorants are concentrated primarily within entities responsible for the storage, transmission, and final distribution of flammable gases, where safety regulation necessitates mandatory odorization before delivery to the end consumer. The largest and most influential customer base comprises Natural Gas Local Distribution Companies (LDCs) and large regional utility providers. These entities operate the vast municipal pipeline networks that connect high-pressure transmission lines to residential and commercial meters. Their purchasing decisions are driven almost entirely by long-term reliability, adherence to precise regulatory specifications (e.g., minimum odorization concentration), and the ability of the odorant supplier to provide integrated logistical support, given the hazardous nature of the chemical inputs.

Another significant customer segment includes High-Pressure Gas Transmission Pipeline Operators. While these operators typically transport un-odorized gas across long distances in remote areas to minimize odorant degradation and pipeline corrosion, they require significant volumes of odorant at strategically located "city gate" stations or main distribution hubs where the gas is prepped for local distribution. These customers demand high-purity odorants that are stable under varying pressure and temperature conditions. Additionally, Liquefied Petroleum Gas (LPG) Bottling and Distribution Companies form a distinct customer group, requiring odorants like Ethyl Mercaptan for propane and butane mixtures, often purchased in smaller, specialized containers suitable for transfer to localized bottling facilities serving rural and residential markets.

Lastly, industrial customers running large-scale gas-fueled operations, such as petrochemical plants, power generation facilities, and large manufacturing complexes, also represent a key customer segment, particularly those requiring pipeline extensions or specialized gas storage solutions. These industrial buyers seek odorants and associated injection equipment that integrate seamlessly with complex plant safety systems. The purchasing criteria for all these customers heavily emphasize compliance documentation, emergency response capability from the supplier, and the provision of specialized training programs to ensure safe and compliant handling of these hazardous but essential chemicals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.45 Billion USD |

| Market Forecast in 2033 | $2.20 Billion USD |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arkema, Chevron Phillips Chemical Company, Pouchard S.A., LANXESS, BASF SE, Shazand Petrochemical Company, Dow, Sinopec, Solvay, S-Chem International, Merichem Company, Gulbrandsen, Weifang Yuelong Chemical, Zhongcheng Chemical, Afton Chemical, Scentech Medical, Yantai Huaxing, Wuxi Xiwang, Shanghai Mingyuan, TCI Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Odorant Market Key Technology Landscape

The technology landscape within the Gas Odorant market is rapidly evolving, moving beyond simple storage tanks and rudimentary injection systems toward highly precise, automated dosing and monitoring solutions. A fundamental technological shift involves the transition from traditional gravity-fed or bypass odorization systems to advanced, microcontroller-based injection systems. These contemporary technologies, often employing positive displacement pumps, ensure highly accurate and proportional injection of the odorant relative to the real-time volume of gas flow. This precision is vital for minimizing waste, reducing the incidence of 'over-odorization' (which can lead to customer complaints), and critically, guaranteeing that the odorant concentration never drops below the regulatory mandated minimum effective odorization level, even during periods of low flow or intermittent demand.

Another crucial technological development is the implementation of remote monitoring and telemetry. Modern odorization equipment is increasingly integrated with IoT sensors and SCADA systems, allowing utility operators to monitor odorant levels, pressure, flow rates, and operational status remotely. This technological integration facilitates predictive maintenance, identifies equipment malfunctions instantaneously, and provides continuous, auditable proof of regulatory compliance, significantly reducing the need for manual site checks. Furthermore, advancements in specialized analytical instrumentation, such as high-sensitivity portable gas chromatographs and electronic noses (e-noses), are providing highly precise methods for field testing of gas quality and odorant concentration, helping to combat the persistent problem of odor fade caused by adsorption onto pipeline surfaces.

Innovations in odorant chemistry also form a significant part of the technology landscape. Manufacturers are continually researching and formulating specialized blends—often combining mercaptans with other sulfur compounds or non-sulfur alternatives—designed to offer superior stability, reduced corrosiveness, and lower freezing points suitable for challenging climatic conditions. The goal of these chemical advancements is to develop high-performance, lower-VOC options that are easier to handle and store while maintaining the distinct, non-ambiguous odor required for leak detection. Research into developing odorants specifically compatible with future energy vectors like hydrogen gas is also accelerating, requiring new materials that resist catalytic degradation caused by hydrogen environments.

Regional Highlights

The global demand profile for gas odorants exhibits significant regional variance, heavily influenced by local regulatory frameworks, the maturity of gas infrastructure, and economic development rates. North America, encompassing the United States and Canada, stands as the largest and most technologically advanced market. This dominance is attributed to the mature and extensive natural gas pipeline network, coupled with exceptionally stringent federal and state regulations (like those enforced by the Pipeline and Hazardous Materials Safety Administration in the U.S.) that require high levels of odorization precision and documentation. The region leads in adopting sophisticated injection technologies, driving high demand for premium, high-purity odorants like TBM and proprietary blends.

Europe represents a stable but evolving market. While regulations are uniformly strict across the European Union, the product preference historically favors Tetrahydrothiophene (THT) in many regions due to existing infrastructure limitations and differing historical standards, though mercaptan blends are gaining traction. The European market is uniquely influenced by the energy transition, specifically the blending of biomethane and the planned introduction of hydrogen into existing gas grids, creating specific technological demands for odorants that are stable and effective in these new gas mixtures. Investment in pipeline maintenance and replacement drives consistent demand, mitigating potential slowdowns from overall gas consumption shifts.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid industrialization, urbanization, and massive governmental investments in expanding natural gas distribution infrastructure, particularly in emerging economies such as China, India, and Southeast Asia. The focus in APAC is on establishing initial safety standards and building out extensive networks, leading to robust demand for cost-effective and readily available odorants, primarily Ethyl Mercaptan. Latin America and the Middle East & Africa (MEA) also show strong growth potential, primarily driven by new gas discoveries, the construction of transmission pipelines, and regulatory adoption mirroring Western safety standards, albeit at a slower pace than APAC. MEA specifically sees demand linked to large-scale infrastructure projects and LPG usage growth.

- North America: Market leader due to strict regulations, mature pipeline infrastructure, and early adoption of advanced monitoring technologies (high demand for TBM and specialty blends).

- Europe: Stable growth driven by maintenance and regulatory compliance; market focus shifting towards odorization solutions compatible with biomethane and hydrogen blends (preference for THT and high-quality mercaptans).

- Asia Pacific (APAC): Highest growth rate driven by extensive new pipeline construction, rapid urbanization, and industrial expansion in China and India (strong demand for cost-effective EM).

- Latin America: Growing market fueled by energy sector investment and expanding national distribution grids (increasing regulatory standardization drives demand).

- Middle East & Africa (MEA): Growth tied to large-scale gas projects, development of regional pipelines, and high utilization of LPG for residential cooking.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Odorant Market.- Arkema

- Chevron Phillips Chemical Company

- Pouchard S.A.

- LANXESS

- BASF SE

- Shazand Petrochemical Company

- Dow

- Sinopec

- Solvay

- S-Chem International

- Merichem Company

- Gulbrandsen

- Weifang Yuelong Chemical

- Zhongcheng Chemical

- Afton Chemical

- Scentech Medical

- Yantai Huaxing

- Wuxi Xiwang

- Shanghai Mingyuan

- TCI Chemicals

Frequently Asked Questions

Analyze common user questions about the Gas Odorant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of gas odorants in pipelines?

The primary function of gas odorants is to provide a safety mechanism by adding a distinctive, pungent smell to naturally odorless gases like natural gas and LPG. This allows leaks to be detected by smell at concentrations far below the lower explosive limit, protecting public safety and assets.

Which types of odorants dominate the global market?

Mercaptan-based compounds, particularly Ethyl Mercaptan (EM) and Tertiary Butyl Mercaptan (TBM), dominate the global market, especially in North America. Tetrahydrothiophene (THT) is also widely used, especially in parts of Europe and Asia, due to regional regulatory preferences and lower sulfur content specifications.

What is 'odor fade' and how is it managed?

Odor fade is the reduction in the odorant's effective concentration over time, primarily due to the chemical being adsorbed onto the inner walls of new pipelines (especially plastic lines) or reacting with moisture and rust. It is managed through advanced injection systems, pipeline conditioning, and regular field testing using specialized analytical equipment to maintain regulatory compliance.

How do regulations drive growth in the Gas Odorant Market?

Strict safety regulations mandated by governmental bodies worldwide require that all distributed flammable gases must be odorized to specific, auditable concentration levels. These non-negotiable compliance requirements create continuous, non-cyclical demand for odorants and associated precision injection equipment, forming the market's fundamental growth driver.

How does the shift to renewable natural gas (RNG) impact odorant demand?

The integration of Renewable Natural Gas (RNG) into existing pipelines increases demand, as RNG must meet the same rigorous odorization standards as conventional natural gas. This creates new opportunities for specialized odorant suppliers who can guarantee purity and effectiveness within these evolving gas streams.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager