Gas Pipe Fittings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431997 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Gas Pipe Fittings Market Size

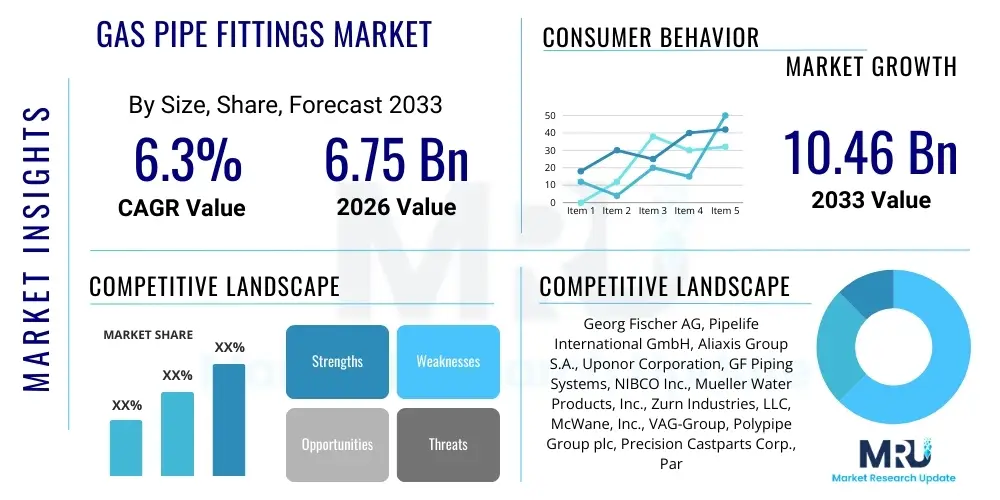

The Gas Pipe Fittings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% between 2026 and 2033. The market is estimated at USD 6.75 Billion in 2026 and is projected to reach USD 10.46 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating global transition towards natural gas as a cleaner transitional fuel source, alongside significant investments in modernizing and expanding existing gas distribution infrastructure in densely populated urban centers and rapidly industrializing regions.

Gas Pipe Fittings Market introduction

Gas pipe fittings are essential components utilized to connect, control, change the direction, or close the flow in piping systems designed for the transportation and distribution of gaseous substances, primarily natural gas, propane, and methane. These specialized fittings must adhere to stringent international standards, such as those set by ANSI, ASTM, and ISO, ensuring high levels of durability, pressure resistance, and leak integrity crucial for safe operation. Products range from simple couplers, elbows, and tees to complex specialized valves and flexible joints, manufactured using materials like carbon steel, stainless steel, polyethylene (PE), and copper, selected based on the operating pressure, temperature, and specific gas composition.

Major applications for gas pipe fittings span the entire gas supply chain, encompassing transmission pipelines, local distribution networks (LDCs), residential heating systems, commercial appliance hookups, and large-scale industrial processing facilities, including power generation plants and chemical manufacturing sites. The increasing global demand for reliable and efficient energy sources, particularly in rapidly expanding Asian and African economies, acts as a primary market stimulant. Furthermore, government initiatives focused on replacing aging metallic infrastructure with high-density polyethylene (HDPE) systems, which offer superior corrosion resistance and longevity, are bolstering demand across mature markets.

The primary benefits associated with high-quality gas pipe fittings include enhanced safety through leak minimization, reduced maintenance costs due to material longevity, and improved system efficiency. Driving factors include favorable regulatory frameworks promoting natural gas usage, ongoing urbanization necessitating new grid connections, and technological advancements in fitting designs, such as electrofusion and butt fusion techniques for plastic pipes, which ensure faster, more reliable installation. The continuous focus on infrastructure resilience and safety compliance mandates the use of certified and robust fittings, propelling market growth despite intermittent price volatility in raw materials.

Gas Pipe Fittings Market Executive Summary

The Gas Pipe Fittings Market is currently characterized by robust business trends centered on material innovation and sustainability, with a notable shift toward polymer-based solutions like high-density polyethylene (HDPE) due to their environmental profile and resistance to corrosion, particularly vital in aging city distribution networks. Market consolidation remains a key trend, where large multinational players are acquiring niche technology providers to integrate advanced manufacturing capabilities, such as sophisticated welding and non-destructive testing techniques, into their product lines. Supply chain optimization, driven by the necessity for quicker response times to major infrastructure projects and the stabilization of global steel and copper prices, is also a critical operational focus for key market participants, necessitating localized production and distribution centers in strategic regions.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, fuelled by massive gas infrastructure investments in countries like China, India, and Indonesia, aimed at expanding liquefied natural gas (LNG) receiving terminals and subsequent pipeline networks to service burgeoning industrial and residential consumer bases. North America and Europe, while mature, exhibit strong demand primarily through maintenance, repair, and overhaul (MRO) activities, focused on replacing outdated cast iron and steel pipelines with modern, safer materials under strict regulatory oversight. The Middle East and Africa (MEA) region is capitalizing on its vast natural gas reserves, initiating major cross-country pipeline projects that necessitate high-pressure, large-diameter fittings, thereby contributing significantly to the demand for specialized, heavy-duty components.

Segment trends indicate that the Material segment is heavily leaning towards HDPE fittings due to regulatory preference and superior lifecycle cost benefits, rapidly challenging traditional metallic fittings, especially in low and medium-pressure applications. By Application, the Distribution Networks segment holds the largest market share, driven by continuous expansion and rehabilitation efforts required to safely deliver gas to end-users. Within the Pressure Rating segment, medium-pressure fittings are seeing heightened adoption, balancing regulatory safety requirements with the efficiency needs of modern urban gas grids. This segmented growth trajectory underscores the necessity for manufacturers to diversify their offerings to address distinct regional infrastructure maturities and specific operational requirements.

AI Impact Analysis on Gas Pipe Fittings Market

User inquiries regarding AI's influence in the Gas Pipe Fittings Market commonly focus on how smart technologies can enhance safety, optimize maintenance schedules, and improve quality control during manufacturing. Key themes reveal user expectations for AI-driven predictive maintenance systems capable of identifying potential fitting failures (such as stress corrosion cracking or joint fatigue) before leaks occur, thereby drastically enhancing public safety and operational reliability. Users are also keen on understanding AI’s role in optimizing complex supply chain logistics, forecasting precise demand for specific fitting types based on regional construction cycles and weather patterns, and improving the efficiency of automated welding and quality inspection processes using machine vision. The primary concerns center on data privacy, the high initial investment required for sensor implementation, and the need for skilled personnel to manage and interpret the vast datasets generated by intelligent pipeline networks.

The practical application of AI primarily revolves around the integration of smart sensors into critical fittings and joints, enabling real-time monitoring of pressure, temperature, and vibration. This data feeds into machine learning models that assess the fittings' structural integrity, providing accurate remaining useful life predictions. This paradigm shift moves the industry from reactive maintenance (fixing leaks after they occur) to a proactive, condition-based strategy, dramatically reducing operational expenditure and environmental risk. Furthermore, AI algorithms are being employed in the design phase to simulate stress tolerance under various environmental conditions, accelerating the development of fittings that meet increasingly demanding operational standards.

In manufacturing, AI-powered computer vision systems are performing 100% automated inspection of fitting welds and surface finishes, identifying microscopic defects that human inspectors might miss. This enhances product consistency and minimizes costly recalls. AI also optimizes production scheduling within fabrication plants by analyzing resource availability and order backlogs, ensuring timely delivery of specialized components required for complex pipeline projects. Overall, AI is viewed less as a direct component and more as an enabling layer that integrates data from the pipeline infrastructure, enhancing decision-making across design, manufacturing, logistics, and field maintenance.

- AI-driven predictive maintenance forecasting for critical joints and connections.

- Optimization of manufacturing processes, including automated quality control via machine vision for weld integrity.

- Intelligent supply chain and inventory management based on real-time infrastructure project timelines.

- Simulation and design optimization of fitting geometries for maximum stress resistance.

- Integration with smart grid technologies to monitor and manage gas flow dynamics through specialized fittings.

- Early detection of micro-leaks or structural degradation using pattern recognition algorithms applied to sensor data.

- Enhanced regulatory compliance documentation and reporting through automated data collection and anomaly flagging.

DRO & Impact Forces Of Gas Pipe Fittings Market

The Gas Pipe Fittings Market is shaped by significant Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces influencing its trajectory. Primary drivers include the robust global push for expanding and upgrading natural gas infrastructure, particularly in developing economies where energy transition mandates the replacement of coal with gas. This is powerfully complemented by stringent global safety regulations, which require regular inspection, maintenance, and replacement of older, corrosion-prone metallic fittings with modern, safer materials like PE and advanced alloy steels. Opportunities arise significantly from technological advancements in fusion and bonding techniques, allowing for quicker and more reliable installation, alongside the growing interest in fittings designed for specialized gases, such as hydrogen blending in existing gas networks.

Conversely, the market faces notable restraints. Fluctuations in the prices of raw materials, such as steel, copper, and specialized plastics (polyethylene resins), directly impact manufacturing costs and project budgeting, creating financial uncertainty for both producers and construction contractors. Furthermore, the inherent complexity and time-consuming nature of obtaining regulatory approvals for new pipeline construction, coupled with the rising opposition from environmental activist groups against fossil fuel infrastructure development, can lead to significant project delays or cancellations. Skilled labor shortages, particularly for highly specialized welding and fusion operations required for large-diameter or complex fittings, also pose a considerable constraint on the pace of installation and maintenance activities globally.

The resulting Impact Forces demonstrate a market prioritizing safety and sustainability. The necessity to adhere to zero-leak tolerance standards drives innovation in high-integrity, leak-proof fittings (e.g., specialized ball valves and high-pressure flanges). The long-term opportunities tied to hydrogen readiness—developing fittings compatible with 100% hydrogen or hydrogen-natural gas blends—are compelling manufacturers to invest heavily in R&D, positioning this evolution as a critical future growth vector. Therefore, while regulatory hurdles and cost volatility present immediate challenges, the overarching need for safe, efficient, and future-proof energy delivery systems ensures sustained, mandatory growth in the demand for sophisticated gas pipe fittings.

Segmentation Analysis

The Gas Pipe Fittings market is comprehensively segmented based on material type, product type, pressure rating, application, and end-user, reflecting the diverse technical requirements across the natural gas value chain. This layered segmentation allows manufacturers and strategists to precisely target specific sectors, such as high-pressure transmission lines demanding specialized steel alloys, distinct from low-pressure residential distribution networks primarily utilizing durable polyethylene fittings. The product segmentation details the functional requirement, differentiating between components that alter flow direction (elbows, tees), control flow (valves), or merely connect straight sections (couplings, flanges), each possessing unique safety and certification requirements.

The complexity of gas transportation necessitates strict adherence to pressure rating standards, segmenting the market into low, medium, and high-pressure categories, with high-pressure fittings representing the premium segment due to their critical role in long-distance pipeline transmission and high-stakes industrial applications. Application analysis further delineates the demand structure, separating the robust requirements of utility distribution networks from the highly specialized needs of chemical processing and refinery operations. End-user classification (Residential, Commercial, Industrial) provides insights into volume versus value demand, with industrial applications generating higher revenue per unit due to the need for larger diameter and more technically complex components.

The ongoing trend of pipeline replacement and smart grid integration strongly influences the segmentation dynamics, particularly boosting the demand for electrofusion fittings within the HDPE segment due to their installation speed and superior joint strength. Understanding these nuances is vital; for instance, while residential consumption drives volume in distribution networks (low to medium pressure), the largest capital investment per project often resides in the industrial and transmission segments (high pressure, specialized alloys). Market participants are strategically aligning their production capabilities—investing in both mass-produced standardized connectors and custom-engineered, large-scale flanges and valves—to capture growth across all these diverse operational environments.

- By Material:

- Metallic Fittings (Carbon Steel, Stainless Steel, Cast Iron, Copper)

- Plastic Fittings (Polyethylene (PE), High-Density Polyethylene (HDPE), Polyvinyl Chloride (PVC))

- Composite Fittings

- By Product Type:

- Elbows and Bends

- Tees and Crosses

- Reducers and Couplings

- Flanges and Gaskets

- Valves (Ball Valves, Gate Valves, Plug Valves)

- Caps and Plugs

- By Pressure Rating:

- Low Pressure Fittings (Below 100 PSI)

- Medium Pressure Fittings (100 PSI to 500 PSI)

- High Pressure Fittings (Above 500 PSI)

- By Application:

- Transmission Pipelines

- Distribution Networks (LDCs)

- Industrial Processing (Refineries, Chemical Plants)

- Power Generation

- By End-User:

- Residential

- Commercial

- Industrial

- Utilities

Value Chain Analysis For Gas Pipe Fittings Market

The value chain for the Gas Pipe Fittings Market commences with the upstream segment, dominated by the procurement and processing of fundamental raw materials, primarily steel (carbon and stainless), copper, and specialized polymeric resins (PE/HDPE). Material suppliers must meet rigorous quality specifications regarding alloy composition and purity, as these directly influence the pressure rating and corrosion resistance of the final product. Key upstream activities involve complex metallurgical processes, precision casting, forging, or sophisticated extrusion techniques necessary to create the basic shapes and billets that will be machined into fittings. Fluctuations in global commodity prices for these inputs, heavily influenced by global mining and petrochemical outputs, represent the primary cost risk in this stage.

The core manufacturing stage involves converting raw materials into finished fittings through processes like CNC machining, hot pressing, welding, and advanced fusion techniques (especially for plastic fittings like electrofusion). Manufacturers invest heavily in certifications (e.g., API, ASME, ISO 9001) to demonstrate product reliability, which is paramount given the safety-critical nature of gas infrastructure. Distribution channels are complex, involving both direct and indirect routes. Direct sales are common for specialized, high-value, or custom-engineered fittings, such as large-diameter flanges and control valves, typically sold straight from the manufacturer to major pipeline construction contractors or utility companies.

Indirect channels utilize a robust network of authorized distributors, specialized wholesalers, and local supply houses. These intermediaries maintain inventory, provide regional technical support, and cater to smaller MRO contracts and residential/commercial installers, offering a crucial logistical link. The downstream market consists of the installation and end-user utilization stages: large construction projects, utility rehabilitation programs, and finally, integration into residential and commercial structures. Post-sale services, including technical training on fusion and installation standards, maintenance support, and replacement parts provisioning, complete the value chain, emphasizing long-term reliability and compliance with operational safety standards.

Gas Pipe Fittings Market Potential Customers

The potential customer base for the Gas Pipe Fittings Market is broad and highly stratified, encompassing all entities involved in the transportation, distribution, and consumption of natural and other utility gases. The most significant customer segment comprises major Gas Utility Companies and Local Distribution Companies (LDCs). These entities are responsible for managing thousands of miles of pipeline networks and are continuous buyers of fittings for infrastructure expansion, routine maintenance (MRO), and mandated replacement projects aimed at enhancing system resilience and safety. Their demand is generally volume-driven for standardized components (e.g., couplings, standard PE elbows) but also includes highly specialized, large-diameter valves and monitoring hardware.

Another crucial customer segment consists of large-scale Engineering, Procurement, and Construction (EPC) firms specializing in major pipeline projects, such as transnational transmission lines, LNG terminals, and gas compression stations. These customers demand high-pressure, specialty metallic fittings (e.g., forged steel flanges, heavy-duty ball valves) manufactured to extremely precise tolerances and supported by extensive quality documentation. Furthermore, industrial end-users, including petrochemical complexes, power generation plants (particularly gas-fired turbines), and heavy manufacturing facilities that rely on gas as a fuel or feedstock, represent premium buyers of corrosion-resistant and high-temperature-rated fittings, often requiring customized solutions to integrate seamlessly with complex processing equipment.

Finally, the residential and commercial sectors, serviced indirectly through plumbing contractors, construction developers, and specialized retailers, constitute a steady source of demand for smaller-diameter, standardized fittings used in connecting internal gas lines to appliances, heating systems, and meters. While unit volumes are high in this segment, the fitting complexity and pressure ratings are generally lower. The evolving regulatory landscape and government mandates for transitioning existing infrastructure to accommodate hydrogen blends are creating a specialized future customer segment focused on acquiring certified fittings compatible with these novel fuel mixtures, necessitating a forward-looking approach to product development.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.75 Billion |

| Market Forecast in 2033 | USD 10.46 Billion |

| Growth Rate | 6.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Georg Fischer AG, Pipelife International GmbH, Aliaxis Group S.A., Uponor Corporation, GF Piping Systems, NIBCO Inc., Mueller Water Products, Inc., Zurn Industries, LLC, McWane, Inc., VAG-Group, Polypipe Group plc, Precision Castparts Corp., Parker Hannifin Corp., Swagelok Company, MRC Global Inc., Bonney Forge Corporation, Sandvik AB, Emerson Electric Co. (Fisher Controls), Flowserve Corporation, Viking Johnson (part of Crane Co.) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Pipe Fittings Market Key Technology Landscape

The Gas Pipe Fittings Market is undergoing significant technological evolution centered on enhancing joint integrity, extending service life, and simplifying installation logistics. A key technological advancement, particularly relevant to plastic piping, is the refinement of Electrofusion (EF) and Butt Fusion welding techniques. EF technology involves integrating resistance wires into the fitting that melt the adjoining pipe ends when an electric current is applied, creating a monolithic, highly secure, and leak-proof joint vital for medium and low-pressure distribution networks. Continuous development in fusion equipment automation and monitoring ensures consistent joint quality, reducing installation errors and lifecycle costs, which is highly sought after by LDCs engaged in extensive pipeline replacement programs.

For metallic fittings used in high-pressure transmission lines, the focus is on advanced materials science and non-destructive testing (NDT). Manufacturers are developing fittings made from specialized high-strength low-alloy (HSLA) steels and corrosion-resistant alloys, capable of withstanding extreme pressures and challenging corrosive environments, including sour gas service. Technological improvements in forging and casting precision, coupled with sophisticated NDT methods like phased array ultrasonic testing (PAUT) and radiographic inspection, ensure the structural integrity of complex components like high-pressure flanges and specialized valves before they are deployed in critical infrastructure. Furthermore, the adoption of robotic welding for field installation is improving consistency and speed in laying large-diameter steel pipelines.

The rising prevalence of smart pipeline infrastructure is driving the integration of embedded sensor technology directly into critical fittings. These intelligent fittings incorporate acoustic, pressure, and temperature sensors that communicate real-time operational data via IoT platforms. This technological convergence enables proactive integrity management, leak detection, and performance monitoring, providing essential data feeds for AI-driven predictive maintenance systems. Looking forward, research into fittings compatible with high-percentage hydrogen blends—requiring specific materials to mitigate hydrogen embrittlement and higher standards for sealing capability—represents the next frontier in technological innovation for the market.

Regional Highlights

- Asia Pacific (APAC): This region dominates market growth due to massive infrastructure expansion projects driven by urbanization, industrialization, and favorable government policies promoting natural gas as a critical energy source (e.g., India's City Gas Distribution expansion and China's push for cleaner energy). Demand is exceptionally high for both HDPE fittings for new LDCs and high-pressure steel fittings for major transmission corridors connecting LNG terminals inland.

- North America: Characterized by high regulatory standards (e.g., PHMSA regulations in the U.S.), the market here is mature but robustly driven by pipeline replacement and modernization programs, focused on substituting old cast iron and bare steel lines with safer polyethylene systems. Significant investment in leak detection and repair mandates the use of highly certified, traceable fittings, boosting the market for advanced fusion technologies and specialized metering components.

- Europe: Growth is primarily fueled by the Energy Transition, specifically the decommissioning of outdated infrastructure and preparations for hydrogen integration into existing grids. This region exhibits strong demand for sophisticated valves and fittings capable of handling blended gas compositions and is at the forefront of implementing smart monitoring solutions linked to regulatory oversight.

- Middle East and Africa (MEA): This region is pivotal for large-diameter, high-pressure metallic fittings due to extensive cross-country gas transmission projects linking major production fields (e.g., Qatar, Saudi Arabia) to export hubs or internal power generation facilities. Investment is project-specific and highly sensitive to global oil and gas capital expenditure cycles, demanding specialized, high-specification components for harsh desert and offshore environments.

- Latin America: Market expansion is characterized by fluctuating demand, tied closely to government stability and foreign investment in energy infrastructure. Key activities include expanding domestic natural gas distribution in densely populated centers (e.g., Brazil and Mexico) and upgrading existing lines, leading to steady demand for standardized PE fittings and localized manufacturing capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Pipe Fittings Market.- Georg Fischer AG (GF Piping Systems)

- Pipelife International GmbH (Wienerberger AG)

- Aliaxis Group S.A.

- Uponor Corporation

- NIBCO Inc.

- Mueller Water Products, Inc.

- Zurn Industries, LLC

- McWane, Inc.

- VAG-Group

- Polypipe Group plc

- Precision Castparts Corp.

- Parker Hannifin Corp.

- Swagelok Company

- MRC Global Inc.

- Bonney Forge Corporation

- Sandvik AB

- Emerson Electric Co. (Fisher Controls)

- Flowserve Corporation

- Victaulic Company

- Wavin Group (Orbia)

Frequently Asked Questions

Analyze common user questions about the Gas Pipe Fittings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary material trends shaping the Gas Pipe Fittings Market?

The market is shifting predominantly toward High-Density Polyethylene (HDPE) fittings, favored in low- to medium-pressure distribution networks due to their superior resistance to corrosion, reduced installation time using electrofusion, and long service life. However, carbon steel and stainless steel remain essential for high-pressure transmission lines and critical industrial applications requiring maximum strength and temperature tolerance.

How is the focus on global safety regulations influencing the demand for gas pipe fittings?

Stringent global safety mandates, particularly in mature markets like North America and Europe, necessitate continuous infrastructure upgrades and the replacement of older, leak-prone materials. This drives robust demand for highly certified, high-integrity fittings and advanced joining technologies (like automated fusion), ensuring minimal leakage risk and compliance with zero-tolerance operational standards.

Which application segment holds the largest share in the Gas Pipe Fittings Market?

The Distribution Networks segment (managed by Local Distribution Companies or LDCs) currently accounts for the largest market share. This dominance is driven by persistent expansion activities in urban centers and significant ongoing MRO (Maintenance, Repair, and Overhaul) projects worldwide aimed at rehabilitating aging distribution infrastructure and ensuring reliable last-mile delivery to end-users.

What role does hydrogen readiness play in the future of gas pipe fittings?

Hydrogen readiness is a critical long-term growth opportunity. Manufacturers are actively investing in R&D to develop fittings (both metallic and polymeric) that are structurally and chemically compatible with natural gas blended with hydrogen, or even 100% hydrogen. This involves selecting materials that resist hydrogen embrittlement and designing seals capable of containing the smaller hydrogen molecule effectively, securing future demand.

How do volatile raw material prices affect the profitability of fitting manufacturers?

Price volatility, particularly in steel, copper, and specialized PE resins, significantly impacts manufacturing costs and profit margins. To mitigate this risk, manufacturers are focusing on efficient inventory management, long-term procurement contracts, and shifting production towards standardized components where economies of scale can better absorb cost fluctuations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager