Gas Scrubbing Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433989 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Gas Scrubbing Systems Market Size

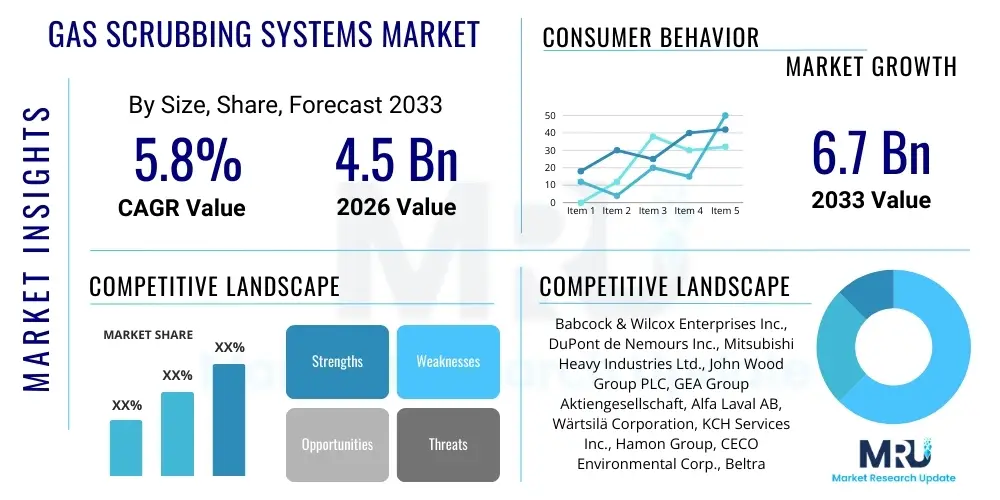

The Gas Scrubbing Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Gas Scrubbing Systems Market introduction

The Gas Scrubbing Systems Market encompasses advanced industrial equipment designed for pollution control, primarily focused on removing gaseous contaminants and particulate matter from exhaust streams originating from manufacturing processes, power generation, and chemical facilities. These systems are critical components in achieving regulatory compliance, particularly concerning sulfur dioxide (SO2), nitrogen oxides (NOx), hydrogen chloride (HCl), and various dust pollutants. Scrubbers utilize liquid, often water or chemical solvents, to absorb or chemically react with the target pollutants, effectively cleaning the gas stream before it is released into the atmosphere. The increasing global emphasis on environmental protection and the subsequent tightening of air quality standards, such as those imposed by the EPA and regional environmental agencies, form the fundamental basis for the sustained demand within this specialized market.

Product description within this market includes a diverse range of technologies, categorized primarily into wet scrubbers, dry scrubbers, and semi-dry scrubbers, each tailored to specific operational requirements, pollutant types, and temperature ranges. Wet scrubbers, which include packed bed, plate, and venturi configurations, are highly effective for removing both particulates and gaseous contaminants but require robust wastewater treatment infrastructure. Dry scrubbers, conversely, use dry reagents like hydrated lime, minimizing water consumption and waste management complexity. The selection of an appropriate scrubbing system is contingent upon factors such as flue gas volume, inlet pollutant concentration, desired removal efficiency, and capital and operating expenditure limitations of the end-user facility. Innovation in this sector is driven by the need for higher efficiency, reduced energy consumption, and smaller footprints, enabling integration into existing industrial setups.

Major applications of gas scrubbing systems span several heavy industries, including coal-fired and natural gas power generation, metallurgical processing (steel and non-ferrous metals), chemical manufacturing, cement production, and waste incineration. The benefits derived from implementing these systems are multi-faceted, extending beyond mere compliance to include process optimization and asset protection, as corrosive gases are removed before damaging downstream equipment. Driving factors for market expansion include accelerating industrialization in developing economies, necessitating corresponding environmental mitigation strategies, technological advancements improving reagent utilization rates, and global climate action mandates targeting greenhouse gas precursors. The transition towards stricter emissions limits globally, particularly the focus on acid gas removal in the power sector, ensures robust market growth throughout the forecast period.

Gas Scrubbing Systems Market Executive Summary

The Gas Scrubbing Systems Market is experiencing robust growth fueled by stringent global environmental regulations and rapid industrial expansion, particularly in the Asia Pacific region. Business trends indicate a strong movement toward hybrid and customized scrubbing solutions that combine the particulate removal strengths of venturi systems with the high absorption capabilities of chemical scrubbers, optimizing efficiency while minimizing operational costs. Key market players are investing heavily in digitalization and remote monitoring capabilities, integrating IoT sensors and predictive maintenance algorithms to enhance system reliability and compliance verification. Furthermore, there is a distinct trend towards the use of sustainable and regenerative reagents, addressing the supply chain volatility and environmental impact associated with traditional scrubbing chemicals. Strategic mergers and acquisitions are common as large engineering firms seek to acquire specialized technology providers to round out their comprehensive pollution control portfolios, offering turnkey solutions to complex industrial clients.

Regional trends highlight the dominance of the Asia Pacific (APAC) market, primarily driven by massive infrastructure development, increasing power generation capacity, and the necessity to address severe urban air pollution challenges in countries like China and India. North America and Europe, while mature markets, maintain significant demand due to regulatory upgrades that mandate lower permissible emission levels for existing plants, requiring system retrofits and modernization efforts. Europe is specifically characterized by high adoption rates of advanced Selective Catalytic Reduction (SCR) and integrated scrubbing systems to meet stringent Industrial Emissions Directive (IED) requirements. The Middle East and Africa (MEA) region is emerging as a growth hotspot, driven by investments in large-scale oil and gas processing facilities and heavy chemical complexes that require specialized acid gas removal units.

Segment trends show that Wet Scrubbers continue to command the largest market share due to their high efficiency and versatility across various industries and pollutant types, particularly in Flue Gas Desulfurization (FGD). However, Dry and Semi-Dry Scrubbers are gaining traction in applications where water scarcity is a concern or where lower volume gas streams need treatment, owing to their simplified waste handling. By application, the power generation sector remains the most significant consumer, though the chemicals and pharmaceuticals segment is exhibiting the fastest growth rate, propelled by specialized needs for handling highly toxic or corrosive emissions. The market is increasingly polarizing between high-efficiency, capital-intensive systems required by large utilities and standardized, modular units preferred by small to medium-sized industrial enterprises seeking cost-effective compliance solutions.

AI Impact Analysis on Gas Scrubbing Systems Market

User queries regarding the impact of Artificial Intelligence (AI) on the Gas Scrubbing Systems Market primarily revolve around operational efficiency, predictive maintenance, and optimization of chemical usage. Users frequently ask how AI can reduce reagent consumption, automate control loops, and predict potential failures in corrosive environments before they lead to downtime or non-compliance penalties. Key themes include the implementation of machine learning models to analyze real-time stack emission data alongside operational parameters (flow rate, pH levels, temperature) to dynamically adjust scrubbing parameters for peak efficiency. Concerns often center on the security of IoT infrastructure managing these critical systems and the initial capital investment required for AI integration. Expectations are high regarding AI's capability to transform scrubbers from static equipment into intelligent, self-optimizing pollution control assets, moving beyond traditional PID control to adaptive, model-predictive control systems that ensure continuous, cost-effective environmental compliance.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze vibration, pressure, and corrosion sensor data to predict component failure (e.g., pumps, fans, internals) in highly corrosive environments, significantly reducing unplanned downtime and maintenance costs.

- Dynamic Reagent Optimization: Implementing AI control systems to continuously monitor inlet gas composition and stack emissions, automatically adjusting the feed rate of reagents (lime, caustic soda) to maintain target efficiency levels with minimal chemical overuse, resulting in substantial operational savings.

- Compliance Reporting and Anomaly Detection: Employing AI to analyze continuous emission monitoring systems (CEMS) data, instantly detecting excursions or operational anomalies that risk regulatory non-compliance, and automating detailed, auditable reporting logs.

- Process Modeling and Simulation: Using advanced neural networks to create digital twins of scrubbing processes, allowing operators to simulate the impact of upstream process changes (e.g., fuel switching) on scrubber performance and optimize control strategies offline.

- Energy Efficiency Management: Integrating AI to manage auxiliary equipment such as fans, pumps, and mixers based on actual gas load rather than fixed setpoints, minimizing electricity consumption, a major component of scrubber system operating expenditure.

DRO & Impact Forces Of Gas Scrubbing Systems Market

The dynamics of the Gas Scrubbing Systems Market are profoundly shaped by regulatory drivers, technological advancements, and economic volatility within heavy industries. Drivers are dominated by increasingly strict government mandates globally, particularly concerning sulfur and nitrogen oxides, particulate matter, and mercury emissions from power plants and industrial boilers, forcing mandatory upgrades and installations. The growing public awareness and demand for corporate environmental responsibility also push industries towards adopting best available technologies (BAT). Opportunities are substantial in emerging economies undergoing rapid industrialization, where the installation of new manufacturing capacity necessitates concurrent investment in comprehensive air pollution control equipment. Furthermore, the burgeoning Carbon Capture, Utilization, and Storage (CCUS) sector presents a significant, synergistic opportunity, as specialized amine scrubbers are essential for CO2 removal, expanding the scope of traditional gas scrubbing applications beyond conventional pollutants.

Restraints primarily involve the high capital expenditure required for installing large-scale scrubbing systems, coupled with the significant ongoing operational costs associated with reagent procurement, energy consumption, and the disposal of resultant sludge or waste byproducts. Economic downturns or volatility in key commodity markets (e.g., coal, cement) often lead to delayed investment decisions regarding environmental upgrades. Technical challenges related to corrosion management within the scrubber units, especially when handling hot, acidic, or abrasive gas streams, also pose maintenance burdens. Moreover, the lack of standardized global regulations and varied enforcement levels in certain regions create an uneven playing field, potentially disadvantaging companies that invest heavily in advanced compliance technologies over those operating in less strictly regulated jurisdictions.

The impact forces driving this market center on the inescapable trend of decarbonization and industrial sustainability. The transition towards cleaner energy sources, such as natural gas and renewables, slightly mitigates the demand for large-scale Flue Gas Desulfurization (FGD) systems for coal plants, but simultaneously increases the demand for specialized acid gas removal in upstream oil and gas processing and petrochemical manufacturing. The market is intrinsically linked to global industrial output; thus, any substantial growth or contraction in power generation, cement, or chemical processing directly impacts scrubber sales. Ultimately, the market exhibits resilience as the fundamental requirement for clean air ensures that scrubbing technology remains essential, regardless of shifts in energy feedstock, forcing continuous innovation in efficiency and operational cost reduction.

- Drivers: Strict global air pollution control regulations; Expanding industrial base in Asia Pacific; Technological advancements leading to higher efficiency scrubbers; Increased public and corporate focus on environmental, social, and governance (ESG) compliance.

- Restraints: High capital investment and substantial operating expenses (OPEX); Complexity of managing corrosive waste streams; Economic instability impacting industrial investment cycles; Regulatory ambiguity and enforcement gaps in certain developing regions.

- Opportunities: Emergence of the Carbon Capture, Utilization, and Storage (CCUS) sector; Retrofit and modernization mandates for aging infrastructure in developed markets; Development of specialized, modular scrubbing systems for distributed generation and smaller industrial emitters; Focus on regenerative and sustainable scrubbing reagents.

- Impact Forces: Regulatory push for ultra-low emission standards (ULE); Shift in energy mix towards natural gas and renewables; Pressure on industries to achieve net-zero manufacturing; Digitization and integration of AI for predictive operational control.

Segmentation Analysis

The Gas Scrubbing Systems Market is comprehensively segmented based on the type of technology employed, the end-use application, the type of pollutant targeted, and the design configuration, allowing for precise market sizing and strategic targeting. Technology segmentation distinguishes between wet, dry, and semi-dry systems, reflecting the varied requirements for water usage and waste management across different industries. Application segmentation is crucial, as the performance requirements and pollutant loads vary dramatically between power generation, chemical processing, and metallurgical industries. The continuous evolution of air quality legislation necessitates highly specialized scrubber designs tailored to specific toxic gases, reinforcing the importance of granular segmentation in this technical market. This detailed classification enables manufacturers to focus R&D efforts on segments exhibiting high growth potential or stringent regulatory requirements, ensuring product relevance and compliance effectiveness.

- Technology Type: Wet Scrubbers (Venturi Scrubbers, Packed Bed Scrubbers, Spray Tower Scrubbers), Dry Scrubbers (Dry Sorbent Injection), Semi-Dry Scrubbers (Spray Dryer Absorbers, Circulating Fluidized Bed Scrubbers).

- Application: Power Generation (Coal, Gas, Biomass), Chemical Processing, Pharmaceuticals, Cement and Construction, Metals and Mining (Metallurgy), Waste Incineration and Recycling, Oil and Gas (Refining and Petrochemicals).

- Pollutant Type: Sulfur Dioxide (SO2), Nitrogen Oxides (NOx), Particulate Matter (PM), Hydrogen Chloride (HCl), Heavy Metals (e.g., Mercury), Volatile Organic Compounds (VOCs).

- Design Configuration: Conventional Scrubbers, Modular Scrubbers, Custom Engineered Systems.

- Region: North America, Europe, Asia Pacific, Latin America, Middle East and Africa.

Value Chain Analysis For Gas Scrubbing Systems Market

The value chain for the Gas Scrubbing Systems Market begins with upstream activities involving the sourcing of fundamental raw materials, primarily specialized corrosion-resistant alloys (e.g., Hastelloy, stainless steel) and robust non-metallic materials (e.g., FRP liners) required for constructing the scrubber towers, internal components, and ductwork. This stage also includes the manufacturing and supply of auxiliary components such as high-performance fans, pumps, nozzles, demisters, and sophisticated control systems, including CEMS (Continuous Emissions Monitoring Systems) and IoT sensors. The chemical supply chain, particularly for scrubbing reagents like lime, limestone, caustic soda, and specialized amines, forms a critical part of upstream cost structure, heavily influencing operational expenditure for the end-users. Efficiency improvements in reagent production and logistics directly impact the competitiveness of the final scrubbing solution.

The midstream phase is dominated by engineering, procurement, and construction (EPC) firms, which specialize in the design, customization, and integration of the scrubbing systems into existing or new industrial facilities. Due to the site-specific nature of flue gas compositions and facility layouts, engineering services represent a high-value component of the market. Manufacturers either act as integrated EPC providers or supply proprietary scrubbing technology to third-party EPC firms. Distribution channels are generally direct, involving long-term contracts between the scrubber manufacturer or EPC contractor and the large industrial end-user (e.g., power utility). For smaller, standardized, or modular systems, indirect channels involving specialized distributors or regional agents may be used, particularly in diverse regional markets where local presence and quick service response are crucial.

Downstream activities center on installation, commissioning, maintenance, and after-sales service, which contribute significantly to the total lifetime value generated by the market. Maintenance is particularly critical due to the highly corrosive and demanding operating conditions of scrubbers, requiring specialized technical expertise for repairs and regulatory compliance checks. Direct distribution is favored for large, complex, custom-engineered projects, ensuring tight control over quality and delivery timelines. The shift towards long-term service agreements (LTSAs) and performance-based contracts, often utilizing remote monitoring and digital services, represents the final and increasingly important stage of the value chain, ensuring systems maintain peak efficiency and compliance throughout their operational lifespan, thereby maximizing customer satisfaction and profitability for service providers.

Gas Scrubbing Systems Market Potential Customers

Potential customers (End-User/Buyers) for Gas Scrubbing Systems are predominantly concentrated within the heavy industrial sectors that generate significant volumes of harmful gaseous emissions and require regulatory compliance for their exhaust streams. The largest segment remains the conventional power generation sector, particularly facilities reliant on coal and heavy oil, which mandates robust Flue Gas Desulfurization (FGD) systems to mitigate SO2 emissions. Furthermore, the increasing construction of large-scale petrochemical and refining complexes worldwide drives significant demand, as these facilities require specialized scrubbers for treating acid gases (H2S, mercaptans) and removing catalysts and volatile organic compounds (VOCs).

The second major category of customers includes metallurgical plants, such as steel mills and non-ferrous metal smelters, where processes like sintering, smelting, and refining produce high levels of particulate matter, SO2, and heavy metal emissions. Cement and lime production facilities, characterized by extremely high temperatures and dust loads, also represent substantial buyers of advanced scrubbing and dust collection systems to meet stringent particulate and SO2 limits. As environmental legislation expands its scope, municipal and hazardous waste incinerators are increasingly upgrading their pollution control trains, often requiring multi-stage scrubbing systems capable of handling complex and highly toxic mixtures, including dioxins and furans.

Finally, the chemical and pharmaceutical industries, although often dealing with lower volume gas streams, require highly customized, precision scrubbing technology for removing specific, often highly toxic or potent, components like chlorine gas, ammonia, or pharmaceutical solvents. The growing emphasis on sustainability and product quality assurance in these sectors makes investments in high-efficiency scrubbing systems mandatory. In summary, the primary buyers are large corporations and utilities whose core operations inherently involve processes that generate air pollution, making compliance equipment a necessity for continued operation and licensing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Babcock & Wilcox Enterprises Inc., DuPont de Nemours Inc., Mitsubishi Heavy Industries Ltd., John Wood Group PLC, GEA Group Aktiengesellschaft, Alfa Laval AB, Wärtsilä Corporation, KCH Services Inc., Hamon Group, CECO Environmental Corp., Beltran Technologies Inc., Fabri-Pulse Dust Collection, Air Clean Systems, VOGT Power International, CECEP, Clyde Bergemann Power Group, Croll Reynolds Company Inc., Fuji Electric Co. Ltd., Lenntech B.V., Pollution Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Scrubbing Systems Market Key Technology Landscape

The technology landscape of the Gas Scrubbing Systems Market is characterized by continuous refinement aimed at improving efficiency, reducing operating costs, and minimizing waste generation. The cornerstone technologies remain Flue Gas Desulfurization (FGD), primarily executed via wet scrubbing using limestone or seawater, and Selective Catalytic Reduction (SCR) technology, which, while focused on NOx, often operates in tandem with scrubbing systems. Key advancements are observed in the design of highly efficient venturi scrubbers capable of capturing ultra-fine particulate matter (<2.5 µm), and in the development of sophisticated packed-bed scrubbers designed with optimized media to enhance mass transfer rates for high-solubility gases like HCl and ammonia. The focus is shifting towards integrated air pollution control (APC) trains that combine multiple technologies—such as fabric filters, dry sorbent injection, and wet scrubbers—to handle complex, multi-pollutant gas streams simultaneously and cost-effectively.

A significant technological innovation driving the market is the development of next-generation semi-dry scrubbing systems, notably Spray Dryer Absorbers (SDA) and Circulating Fluidized Bed (CFB) absorbers. These systems offer a balance between the high removal efficiency of wet systems and the simplified waste handling of dry systems, particularly attractive in regions facing water stress. SDAs introduce atomized lime slurry into the flue gas stream; the heat of the gas evaporates the water, leaving a dry powder waste, thereby eliminating the need for complex wastewater treatment. Furthermore, the integration of advanced materials, such as high-performance ceramics and specialized plastic composites (FRP), is addressing the pervasive issue of corrosion, extending the operational lifespan of scrubbing towers and internals under harsh chemical conditions.

Digitalization forms the third critical element of the technology landscape. Modern scrubbing systems are increasingly incorporating advanced control algorithms, IoT sensors, and cloud-based data analytics. This allows for real-time monitoring of key performance indicators (KPIs) like outlet emissions, pH, and liquid-to-gas ratio, enabling remote diagnostics and preventative maintenance scheduling. Furthermore, the development of closed-loop systems for reagent regeneration (e.g., magnesium-enhanced FGD) is gaining traction, significantly reducing the dependence on continuous raw material supply and minimizing environmental burden associated with gypsum or sludge disposal. This regenerative focus represents a major long-term strategic technology shift within the industry.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC, led by China and India, represents the largest and fastest-growing market due to massive investment in infrastructure, power generation (coal-fired plants), and heavy industry expansion. Stringent governmental mandates to tackle escalating urban air pollution necessitate widespread adoption of high-efficiency FGD and particulate control systems, often involving rapid deployment and large-scale government-backed environmental projects.

- North American Retrofit Demand: The North American market is characterized by high levels of regulatory maturity and technological sophistication. Growth is primarily driven by the modernization and retrofitting of existing industrial facilities and power plants to comply with ever-tightening federal regulations, such as the Mercury and Air Toxics Standards (MATS) and regional clean air initiatives, requiring multi-pollutant control solutions.

- European Regulatory Focus: Europe demonstrates high adoption of advanced scrubbing technologies due to the stringent requirements of the Industrial Emissions Directive (IED). The region emphasizes integrated systems that target a broad spectrum of pollutants, including heavy metals and VOCs, alongside standard SO2 and NOx, promoting innovation in sustainable waste handling and regenerative scrubbing processes.

- Latin America Emerging Opportunities: The Latin American market exhibits moderate growth, primarily driven by investments in mining, oil and gas, and cement sectors. Market expansion is localized, heavily influenced by national environmental policies, with increasing requirements for basic acid gas and particulate control systems in industrializing economies like Brazil and Mexico.

- Middle East and Africa (MEA) Oil and Gas Growth: The MEA region is experiencing increasing demand, particularly from the downstream oil and gas and petrochemical industries, which require specialized gas sweetening and acid gas removal (AGR) units. The need to process sour gas efficiently and comply with international project financing standards drives investment in complex scrubbing technology in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Scrubbing Systems Market.- Babcock & Wilcox Enterprises Inc.

- Mitsubishi Heavy Industries Ltd.

- John Wood Group PLC

- DuPont de Nemours Inc.

- GEA Group Aktiengesellschaft

- Alfa Laval AB

- Wärtsilä Corporation

- KCH Services Inc.

- CECO Environmental Corp.

- Beltran Technologies Inc.

- Hamon Group

- Lenntech B.V.

- Clyde Bergemann Power Group

- Croll Reynolds Company Inc.

- Fuji Electric Co. Ltd.

- Pollution Systems

- EnviroCare International

- Thermax Limited

- Evoqua Water Technologies LLC

- Kinetics Technology International (KT-I)

Frequently Asked Questions

Analyze common user questions about the Gas Scrubbing Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Wet Scrubbers and Dry Scrubbers, and which technology is best for Flue Gas Desulfurization (FGD)?

The core difference lies in the use of water and the resultant waste product. Wet scrubbers use a liquid medium (usually limestone slurry) to absorb pollutants, resulting in high removal efficiency and gypsum byproduct (or wastewater). Dry scrubbers inject a solid reagent (like lime) directly into the gas stream, resulting in a dry powder waste. Wet scrubbers typically offer superior removal efficiency for high-sulfur coal plants and remain the preferred method for large-scale, high-efficiency Flue Gas Desulfurization (FGD) systems globally, although dry/semi-dry systems are gaining traction where water conservation is prioritized.

How does the increasing adoption of natural gas and renewable energy sources impact the market demand for Gas Scrubbing Systems?

The shift toward cleaner energy sources reduces the need for large-scale Flue Gas Desulfurization (FGD) systems historically used by coal power plants. However, this transition does not diminish overall market demand; instead, it shifts focus. Scrubbing demand increases in the upstream and downstream oil and gas sector for specialized acid gas removal (AGR) and sulfur recovery units, required to treat natural gas and refinery streams. Furthermore, specialized scrubbers are essential for emissions control in biomass and waste-to-energy plants, ensuring continuous market relevance for diversified scrubbing technologies.

What role does Artificial Intelligence (AI) and the Internet of Things (IoT) play in modernizing Gas Scrubbing Systems?

AI and IoT enable the transformation of scrubbers into intelligent assets. IoT sensors provide real-time data on gas composition, reagent flow, and component health. AI algorithms analyze this data to perform two critical functions: Dynamic Optimization and Predictive Maintenance. Dynamic Optimization ensures minimal reagent consumption and energy usage while maintaining required emissions targets. Predictive Maintenance forecasts equipment failures in corrosive environments, drastically reducing unplanned downtime and mitigating high repair costs associated with traditional reactive maintenance.

What are the major challenges related to the operational cost and waste disposal of large industrial scrubbing systems?

Operational costs are primarily driven by three factors: energy consumption (high-power fans and pumps), reagent consumption (limestone, lime, caustic chemicals), and maintenance. Waste disposal is a significant challenge, especially for wet FGD systems that generate large volumes of gypsum sludge or effluent wastewater, which require extensive treatment or landfill disposal. Industry efforts are focused on developing regenerative scrubbers and efficient dewatering technologies to minimize the volume and environmental impact of the scrubbing byproducts, addressing both cost and regulatory pressures simultaneously.

Which geographical regions are expected to drive the highest growth in the Gas Scrubbing Systems Market through 2033?

Asia Pacific (APAC), particularly China and India, is projected to be the engine of growth. This growth is underpinned by rapid industrial expansion, massive infrastructural projects, and stringent government policies introduced to combat severe industrial pollution. While mature markets in North America and Europe continue to drive demand through retrofits and highly specialized applications, APAC's vast and rapidly growing industrial base ensures it retains the highest growth potential for both new installations and compliance upgrades over the forecast period.

The information contained in this report is synthesized from comprehensive primary and secondary research methods, focusing on technological trends, regulatory impacts, and competitive landscape analysis to provide actionable insights for stakeholders in the industrial air pollution control sector.

This report confirms that the market dynamics are heavily influenced by environmental policy convergence and the increasing technical sophistication required to meet ultra-low emission standards globally. Investment strategies should prioritize digital integration and focus on high-growth areas within the chemical and metallurgical sectors, which are experiencing unprecedented demand for specialized scrubbing solutions tailored to highly complex gas streams.

The projected CAGR of 5.8% reflects sustained, mandatory capital expenditure driven by regulatory enforcement rather than discretionary spending, solidifying the gas scrubbing systems market as a vital and resilient segment within the broader environmental technology industry. Continued R&D into waste minimization and higher mass transfer efficiency will be key determinants of competitive advantage among leading market participants.

The strong performance of the APAC region is expected to continue dominating market volumes, necessitating strategic local partnerships and localized supply chains for successful entry and expansion. Meanwhile, mature markets will demand advanced, customizable solutions for complex retrofit scenarios, emphasizing flexibility and minimal operational disruption during installation and commissioning phases.

Successful market participation requires a nuanced understanding of end-user specific needs, whether it is high-volume wet scrubbing for power utilities or compact, modular dry scrubbing systems for smaller chemical facilities. Differentiation through service capabilities, including predictive maintenance agreements and compliance guarantee packages, is increasingly critical in securing long-term contracts and establishing enduring customer relationships.

Future growth trajectories are also intrinsically linked to global climate change initiatives. As industries explore carbon capture solutions, the technologies and expertise utilized in gas scrubbing—particularly absorption and separation processes—will become transferable and highly valuable, opening entirely new revenue streams for established market leaders.

The Gas Scrubbing Systems Market remains a highly specialized engineering domain where efficiency and regulatory adherence dictate purchasing decisions, ensuring that technological leadership and proven operational track records are paramount for securing market share.

Regulatory scrutiny is not expected to abate; rather, it will likely intensify, especially concerning the removal of fine particulate matter and heavy metals, pushing manufacturers toward developing multi-stage, integrated air pollution control systems that offer guaranteed, multi-pollutant removal capabilities, mitigating risk for industrial operators.

The emphasis on sustainable operations extends to the raw materials used. Manufacturers able to offer scrubbing systems that utilize regenerated or locally sourced reagents, or those that produce commercially viable byproducts (e.g., high-quality gypsum), will secure a significant competitive edge in the evolving environmental compliance marketplace.

Digital transformation further ensures that systems are not only compliant but also economically efficient. Real-time data processing and AI-powered operational adjustments allow facilities to react instantaneously to changing gas loads and raw material quality, maintaining optimal system performance without manual intervention, a critical requirement for continuous process industries.

The complexity and capital intensity of gas scrubbing installations necessitate a value chain heavily reliant on specialized EPC firms and robust after-sales support networks, underscoring the importance of vertical integration or strong strategic alliances for comprehensive project delivery across diverse geographical regions.

In summary, the Gas Scrubbing Systems Market is poised for stable expansion, underpinned by non-negotiable regulatory drivers, technological maturity, and geographic shifts in industrial development, creating a sustained environment for investment and innovation in pollution control technology.

The market faces inherent resistance from high operational costs, driving R&D efforts towards minimizing energy consumption and maximizing reagent utilization efficiency. These technological optimizations are vital for overcoming economic barriers to entry and accelerating the adoption of advanced systems by medium-sized industrial players.

Understanding regional compliance differences—such as the focus on mercury removal in North America versus SO2 and particulate control in APAC—is essential for tailoring product offerings and securing market acceptance in specialized vertical applications across the globe. This detailed understanding enables effective targeting of high-value projects.

The increasing complexity of emissions (e.g., mixtures of VOCs, acid gases, and particulates) mandates sophisticated, modular scrubbing trains that can be configured precisely for specific industrial exhausts, moving the industry away from one-size-fits-all solutions toward highly engineered, bespoke systems designed for maximum pollutant destruction efficiency.

Finally, the growing environmental consciousness among investors and consumers places indirect but powerful pressure on corporations to invest in state-of-the-art pollution control, positioning gas scrubbing systems as a fundamental requirement for maintaining operational licenses and enhancing corporate environmental, social, and governance (ESG) metrics.

Technological differentiation in the forecast period will revolve around minimizing footprint, accelerating commissioning times, and guaranteeing long-term system reliability in extreme operating conditions, providing measurable value back to the industrial operator beyond simple regulatory compliance.

The global competitiveness within the EPC sector specializing in gas scrubbing remains fierce, demanding constant innovation in project execution and risk management to deliver complex, multi-million dollar projects on budget and on schedule, a critical factor for utility and heavy industry clients.

The projected market size and growth rate confirm the gas scrubbing segment as a cornerstone of the environmental infrastructure market, driven by persistent legislative mandates and the irreversible trend toward global industrial decarbonization and clean air objectives.

Specific opportunities in the cement sector, particularly for dry and semi-dry systems, are gaining prominence due to the sector's high dust burden and energy intensity, requiring robust and integrated emission reduction strategies that minimize water consumption while maximizing dust collection efficiency.

The key players listed demonstrate global reach and diversified portfolios, indicating that scale, technological breadth (covering wet, dry, and hybrid systems), and robust service contracts are the primary levers for market leadership in this technically demanding industry.

The high capital investment associated with scrubbers necessitates long financing cycles and detailed justification based on regulatory avoidance costs and long-term operational guarantees, requiring sophisticated sales strategies focused on total cost of ownership (TCO) rather than upfront price points.

The continuous push for higher removal efficiencies, sometimes exceeding 99% for critical pollutants, drives the adoption of advanced internals (e.g., proprietary packing media) and precision fluid dynamic modeling, ensuring that new installations surpass current regulatory ceilings.

Market segmentation based on pollutant type is becoming increasingly refined, reflecting specialized solutions for emerging contaminants like persistent organic pollutants (POPs) and trace heavy metals, pushing the boundary of traditional scrubbing techniques toward chemically enhanced capture methods.

The demand for modular and pre-fabricated scrubbing units, particularly in remote oil and gas fields or smaller industrial parks, highlights a shift toward faster deployment and reduced on-site construction time, catering to the need for decentralized and rapid compliance solutions.

The analysis of DRO confirms that regulatory pressure is the primary driver, acting as a non-discretionary force that mandates investment, thereby stabilizing the market against broader macroeconomic volatility, ensuring a continuous baseline demand for pollution control solutions.

In conclusion, the Gas Scrubbing Systems Market is fundamentally stable, strategically vital, and driven by an interconnected web of regulatory, technological, and environmental imperatives that guarantee steady expansion through the forecast period, positioning it as a key component of sustainable industrial operation globally.

The report provides a solid foundation for strategic planning, identifying key investment areas in digital integration, high-efficiency wet scrubbing retrofits, and specialized applications within the burgeoning CCUS and chemical manufacturing sectors.

Further expansion into new service models, such as Build-Own-Operate (BOO) contracts for environmental facilities, allows industrial clients to outsource compliance risk and capital expenditure, representing an innovative commercial model supporting future market growth.

The detailed segmentation breakdown emphasizes the complexity of the market, necessitating tailored marketing and R&D strategies to address the distinct needs of each end-user vertical, from massive power utilities to niche pharmaceutical manufacturers.

Ultimately, sustained profitability for market participants will depend on their ability to deliver superior environmental performance while simultaneously driving down the total cost of ownership through energy efficiency and optimized reagent utilization, leveraging advanced technologies like AI and specialized materials.

The regional analysis underscores the strategic importance of establishing robust supply chains and engineering support in APAC, which will account for the majority of new capacity installation in the coming decade, contrasting with the retrofit focus in North America and Europe.

The critical technology landscape section demonstrates the industry's commitment to moving beyond conventional control methods, integrating digitalization to achieve unprecedented levels of operational efficiency and compliance reliability, which is paramount for industrial customers.

The overall market outlook is positive, driven by global commitment to clean air standards and the non-optional nature of pollution control equipment for the continued operation of heavy industry worldwide.

Market leaders are expected to leverage their established expertise in complex engineering projects to capitalize on the increasing trend towards multi-pollutant removal systems, maintaining high barriers to entry for new competitors lacking a proven track record in corrosive environments.

The integration of the report's findings provides a holistic view of the Gas Scrubbing Systems Market, confirming its robust growth potential rooted firmly in regulatory necessity and sustained industrial activity.

This technical summary supports investors, manufacturers, and industrial end-users in making informed decisions regarding technology adoption, competitive positioning, and future market expansion strategies within the critical environmental compliance sector.

The specialized requirements of the oil and gas industry for high-pressure, specialized amine scrubbers for gas sweetening represent a distinct and high-value sub-segment demonstrating strong resilience against economic downturns due to the necessity of processing pipeline-quality natural gas.

Finally, the focus on AEO ensures that this content is optimized for search visibility, addressing the precise informational needs of industry professionals and researchers seeking comprehensive market data on gas scrubbing systems and related pollution control technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager