Gas Station Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434813 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Gas Station Equipment Market Size

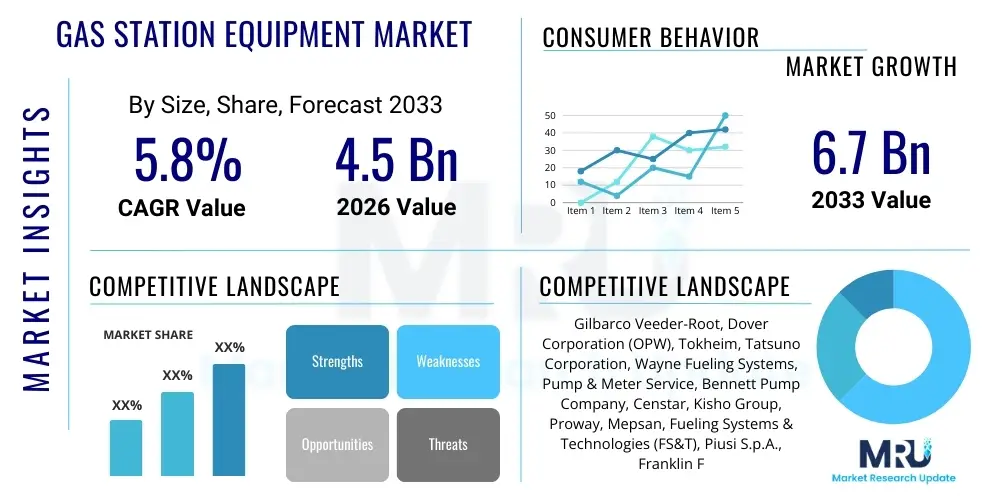

The Gas Station Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Gas Station Equipment Market introduction

The Gas Station Equipment Market encompasses all the essential hardware, software, and systems required for the storage, dispensing, and transaction processing of vehicular fuels at retail and commercial fueling locations. This includes sophisticated fuel dispensers, underground storage tanks (USTs), advanced point-of-sale (POS) systems, vapor recovery units, car wash systems, and integrated management software. The core product, the fuel dispenser, has rapidly evolved from a purely mechanical device to a highly networked smart terminal capable of multimedia advertising, contactless payment processing, and remote diagnostics. Major applications span traditional retail petrol stations, high-throughput truck stops servicing logistics fleets, private fleet fueling depots, and increasingly, integrated energy hubs that offer both conventional fuels and electric vehicle (EV) charging infrastructure.

The primary benefits driving investment in modern gas station equipment revolve around operational efficiency, regulatory compliance, enhanced customer experience, and increased security. Modern equipment significantly reduces fuel shrinkage through precise metering systems, ensures environmental safety via state-of-the-art leak detection mechanisms in storage tanks, and accelerates transaction times, thereby improving forecourt throughput. Furthermore, the integration of digital payment solutions and loyalty programs through contemporary POS systems allows operators to gather critical consumer data and personalize marketing efforts, transitioning the station from a mere refueling point to a comprehensive retail destination. Regulatory frameworks, particularly those mandating improved vapor recovery and double-walled storage tanks, continually necessitate equipment upgrades, providing a stable foundation for market growth.

Key driving factors influencing the robust expansion of this market include the global stabilization of oil prices stimulating transportation demands, the ongoing need for aging infrastructure replacement in developed economies, and aggressive expansion of retail fuel networks in rapidly industrializing regions, especially in Asia Pacific. Moreover, the transition towards multi-fuel and alternative fuel dispensing (such as CNG, LNG, and hydrogen) necessitates entirely new categories of specialized equipment, driving innovation among manufacturers. The critical integration of digital technologies, encompassing IoT sensors for inventory management and AI-driven systems for predictive maintenance, further cements the necessity for continuous capital expenditure in advanced gas station equipment.

Gas Station Equipment Market Executive Summary

The global Gas Station Equipment Market is characterized by robust technological integration and a dynamic response to the energy transition, positioning it for steady expansion throughout the forecast period. Business trends indicate a significant shift from standalone hardware sales to integrated solutions and service contracts, particularly focusing on remote monitoring and software-as-a-service (SaaS) models for forecourt management. Key industry players are consolidating their offerings, emphasizing interoperability between dispensing systems, secure payment platforms, and back-office inventory systems to provide seamless, end-to-end solutions for major oil companies and independent retailers. Capital expenditure remains concentrated on enhancing security against payment fraud (EMV compliance mandates being a major driver) and future-proofing infrastructure to accommodate diverse energy vectors.

Regional trends highlight distinct growth trajectories shaped by regulatory environments and electrification rates. North America and Europe, while characterized by mature networks, demonstrate high demand for replacement and upgrade cycles, driven by strict environmental regulations and the necessity to install multimodal energy dispensing equipment, including high-powered EV chargers co-located with traditional dispensers. Conversely, the Asia Pacific region, led by China and India, exhibits unprecedented growth driven by rapid urbanization, infrastructure development, and the establishment of vast new retail fuel networks. This region is focused heavily on the initial installation of high-volume, reliable dispensing units and underground storage systems to support burgeoning vehicle populations.

Segmentation trends reveal strong performance in the fuel dispensers segment, particularly smart dispensers featuring integrated media screens and advanced flow measurement technologies, owing to their high replacement frequency and increasing complexity. Within the application segment, the retail fuel stations category remains the dominant revenue generator, but the truck stops and commercial fleet depots segment is gaining momentum due to the implementation of automated, high-speed dispensing equipment designed for diesel and alternative fuels like LNG. The payment systems sub-segment is witnessing the fastest transformation, driven by the global adoption of contactless, mobile payment solutions, and the integration of loyalty program platforms directly into the pump interface, ensuring maximum market penetration and customer retention capabilities.

AI Impact Analysis on Gas Station Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Gas Station Equipment Market predominantly focus on three key themes: maximizing operational efficiency, improving customer flow and personalization, and enhancing preventive maintenance capabilities. Users are keen to understand how AI-driven predictive analytics can minimize equipment downtime, particularly for high-value assets like dispensers and leak detection systems. There is substantial interest in AI's role in optimizing fuel inventory levels based on real-time sales data, weather forecasts, and historical consumption patterns, thereby reducing holding costs and preventing stockouts. Furthermore, users frequently ask about the application of computer vision and machine learning algorithms for enhanced forecourt security, traffic monitoring, and personalized digital signage delivery through dispenser screens.

The primary expectation from AI integration is the ability to shift forecourt management from reactive maintenance to proactive, data-informed operations. AI algorithms analyzing sensor data from pumps (flow rates, motor temperatures, transaction patterns) can predict component failure with significant accuracy, allowing operators to schedule maintenance during off-peak hours and eliminate unplanned service interruptions. This paradigm shift minimizes lost revenue associated with "pump out of order" signs and extends the operational lifespan of expensive equipment. Moreover, AI is foundational to dynamic pricing models, enabling stations to instantly adjust fuel prices based on competitor actions and local demand elasticity, directly impacting profitability margins.

In the context of the evolving energy landscape, AI is essential for managing complex, multi-energy retail environments. When a station begins integrating EV charging, hydrogen fueling, and conventional fuel dispensing, AI systems are required to manage power loads, optimize charging schedules, and efficiently allocate resources across the entire site. This centralization of data and intelligent decision-making ensures that new, diversified equipment operates harmoniously with legacy systems, facilitating a smoother, more profitable transition for station owners who are hesitant about the capital risks associated with radical energy shifts.

- AI-driven Predictive Maintenance: Reduces equipment downtime by forecasting failures in fuel dispensers, meters, and payment terminals.

- Optimized Inventory Management: Machine learning models forecast fuel demand based on external factors, minimizing stockouts and optimizing logistics.

- Dynamic Pricing Strategies: Algorithms enable real-time price adjustments based on competitive positioning and demand fluctuations.

- Enhanced Security and Loss Prevention: Computer vision analyzes forecourt activities for potential theft, fraudulent transactions, or safety hazards.

- Personalized Customer Experience: AI tailors multimedia content and promotional offers displayed on dispenser screens based on customer profiles and purchase history.

- Integrated Energy Management: Optimizes power distribution and resource allocation in stations handling both liquid fuels and high-power EV charging.

DRO & Impact Forces Of Gas Station Equipment Market

The market for Gas Station Equipment is heavily influenced by a confluence of driving forces related to mandatory regulatory compliance, significant restraining factors stemming from the accelerating shift towards electric mobility, and substantial opportunities arising from technological integration and market expansion in developing regions. Drivers primarily center on stringent environmental protection mandates, particularly the continuous requirement for leak detection systems, vapor recovery units, and mandatory upgrades to double-walled or secondary containment underground storage tanks (USTs). Additionally, global mandates for secure payment processing, such as the deadline for Europay, Mastercard, and Visa (EMV) chip compliance at the pump, force retailers to invest in entirely new POS and dispenser interfaces, ensuring consistent market activity.

Conversely, the primary restraint challenging long-term investment cycles is the uncertainty created by the widespread adoption of Electric Vehicles (EVs) in developed markets. Station operators are hesitant to commit massive capital to conventional fueling infrastructure when the potential lifespan and return on investment are increasingly questionable due to government targets banning internal combustion engine (ICE) vehicle sales by 2035 or 2040. This hesitation leads to a focus on patch-and-repair maintenance rather than full system replacement, slowing market penetration for the newest, most expensive equipment. Labor shortages for installation and maintenance technicians, alongside high initial investment costs for advanced equipment like certified hydrogen dispensers, also act as significant barriers to entry and expansion.

Opportunities for growth are concentrated in two main areas: geographic expansion and technological diversification. Geographically, the massive infrastructure build-out occurring across Asia Pacific, Latin America, and Africa presents greenfield market opportunities where entirely new equipment is required, unburdened by legacy systems. Technologically, the transition towards multi-energy platforms opens lucrative avenues for manufacturers specializing in modular, integrated solutions that can handle gasoline, diesel, CNG, LNG, and EV charging all on one footprint. Furthermore, the adoption of IoT for remote diagnostics, integrated fuel management software, and the expansion of non-fuel retail (NFR) services integrated via the dispensing unit offer substantial long-term value creation for the market participants.

The core impact forces shaping the market are economic competitiveness, regulatory pressure, and technological disruption. Economic competitiveness mandates that operators seek equipment offering maximum throughput and minimal operational expenses, favoring systems with high reliability and low energy consumption. Regulatory pressure dictates the minimum quality and environmental compliance standards, forcing continuous innovation in safety features. Finally, technological disruption, especially from integrated payment systems and smart forecourt management software, transforms the value proposition from merely selling hardware to providing comprehensive, data-driven operational intelligence.

Segmentation Analysis

The Gas Station Equipment Market segmentation provides a crucial framework for understanding the diverse product offerings and varied application requirements across the industry landscape. The market is primarily divided based on the type of product (hardware components like dispensers and storage infrastructure versus ancillary systems like payment terminals and monitoring software) and the end-user application (retail fueling, commercial fleet operations, and governmental/private use). Analyzing these segments reveals that while core hardware remains the largest revenue contributor, the fastest growth is observed in digital and software-centric solutions that enhance security, data management, and operational efficiency across all types of fueling sites.

The core product segments, notably Fuel Dispensers and Underground Storage Tanks (USTs), continue to dominate market share due to their fundamental necessity at every fueling location and their high replacement value driven by regulatory mandates (e.g., replacement of single-wall tanks with double-wall equivalents). However, the evolution within these segments is toward higher levels of sophistication—dispensers now feature advanced metering accuracy, media capabilities, and enhanced security features, while USTs integrate sophisticated continuous leak detection and inventory management systems. This segmentation is critical for manufacturers who must balance the production of reliable, high-volume physical infrastructure with the integration of complex digital components.

The application segmentation underscores the divergence in equipment requirements between high-volume retail locations and specialized commercial depots. Retail fuel stations demand customer-facing features like intuitive payment interfaces, integrated loyalty programs, and bright, informative displays to optimize the customer journey. In contrast, truck stops and fleet operations prioritize ruggedness, high flow rates for rapid refueling of large vehicles, and robust, often unattended, fleet management authorization systems (cardlock/key system access). Understanding these distinct segment needs allows vendors to tailor sales strategies and optimize product feature sets for maximum appeal and profitability in targeted verticals.

- By Product Type:

- Fuel Dispensers (Conventional Dispensers, Smart Dispensers, High-Flow Dispensers)

- Underground Storage Tanks (USTs) and Aboveground Storage Tanks (ASTs)

- Payment Systems (POS Terminals, Card Readers, Contactless Payment Units)

- Vapor Recovery Systems

- Safety and Security Equipment (Leak Detection Systems, Emergency Shut-off Valves)

- Forecourt Control Systems and Software

- Ancillary Equipment (Air/Water Stations, Car Wash Equipment)

- By Fuel Type:

- Gasoline and Diesel

- Compressed Natural Gas (CNG)

- Liquefied Petroleum Gas (LPG)

- Hydrogen

- Electric Vehicle (EV) Charging Solutions (Integrated within station footprint)

- By Application/End-User:

- Retail Fuel Stations (Traditional Petrol Stations)

- Truck Stops and Commercial Fleet Operations

- Private and Governmental Depots

Value Chain Analysis For Gas Station Equipment Market

The value chain for the Gas Station Equipment Market initiates with the upstream supply of specialized raw materials, primarily high-grade steels, advanced polymers, complex electronic components (such as CPUs and sensors), and specialized metering technology crucial for accurate fuel dispensing. Key upstream challenges include maintaining supply chain resilience for microprocessors and ensuring compliance with strict material standards required for environmental safety, particularly in underground storage tank construction which must resist corrosion and chemical breakdown. Manufacturers often rely on highly specialized suppliers for certified components like flow meters, nozzles, and high-security payment modules, making quality control and long-term supplier relationships vital for production integrity.

The core midstream activities involve the design, manufacturing, and assembly of complex equipment units. Manufacturing centers must adhere to stringent international standards (e.g., OIML, NIST, ATEX) regarding measurement accuracy and intrinsic safety in explosive environments. Distribution channels are typically dual-layered. Direct channels involve large original equipment manufacturers (OEMs) selling complex systems and integrated software solutions directly to major global oil companies (e.g., Shell, ExxonMobil) who manage vast, standardized networks. Indirect channels utilize authorized distributors, specialized installers, and service providers who handle sales, installation, maintenance, and compliance services for independent station owners and smaller regional chains.

Downstream activities are dominated by the installation, maintenance, and post-sales servicing of the equipment. Given the regulatory complexity and safety risks, installation must be performed by certified, specialized technicians. The ongoing revenue stream generated by maintenance contracts and software updates—particularly for inventory management and POS systems—is increasingly critical to market participants, often surpassing the initial hardware sales profit. Direct servicing ensures faster response times for major clients, minimizing operational downtime, while indirect networks allow wider geographic reach, ensuring that equipment functionality and regulatory compliance are maintained across disparate sites globally, thus cementing long-term customer relationships.

Gas Station Equipment Market Potential Customers

The potential customer base for Gas Station Equipment is heterogeneous, ranging from massive, multinational oil and gas companies to small, independent, family-owned retail outlets, alongside specialized governmental and commercial fleet operators. The largest segment remains the integrated oil companies (IOCs) and national oil companies (NOCs) that own and operate vast, standardized networks of retail fueling stations globally. These large entities demand high volume, centralized management solutions, sophisticated payment security, and equipment that seamlessly integrates with their enterprise resource planning (ERP) systems and loyalty programs. Purchases from this segment are typically high-value, driven by standardization mandates and multi-year master service agreements (MSAs).

The second major customer group includes independent fuel retailers and regional chains, often operating under a franchise model or as unbranded dealers. These customers are more price-sensitive and typically prioritize reliability, ease of maintenance, and compliance with local regulations. Their buying decisions are heavily influenced by local distributors who provide financing, installation, and localized technical support. This segment is crucial for volume sales of entry-to-mid-level dispensing and storage equipment, seeking cost-effective solutions that deliver necessary functionality without the high complexity demanded by multinational corporations.

A rapidly growing segment of potential customers includes large commercial transportation companies, logistics firms, and public transport authorities that operate private fueling depots (cardlocks) for their fleets (trucks, buses, construction vehicles). These end-users require specialized, high-flow equipment designed for unattended operation, robust fleet management authorization systems, and real-time consumption tracking for operational efficiency. Furthermore, governmental agencies (military, municipal services) also constitute a steady customer base, often requiring specialized, secure, and environmentally compliant fueling infrastructure in remote or strategic locations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gilbarco Veeder-Root, Dover Corporation (OPW), Tokheim, Tatsuno Corporation, Wayne Fueling Systems, Pump & Meter Service, Bennett Pump Company, Censtar, Kisho Group, Proway, Mepsan, Fueling Systems & Technologies (FS&T), Piusi S.p.A., Franklin Fueling Systems, Husky Corporation, Veyance Technologies, Korea Entech Co., Ltd., Matrix Controls, IFSF, Tuthill Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Station Equipment Market Key Technology Landscape

The technological landscape of the Gas Station Equipment Market is characterized by a rapid shift towards digitization, integration of sophisticated sensors, and the application of secure networking protocols to create 'smart' forecourts. The most impactful technological evolution is the adoption of the Internet of Things (IoT) across dispensing and storage infrastructure. IoT sensors embedded in Underground Storage Tanks (USTs) enable continuous and highly accurate monitoring of fuel levels and temperature, facilitating automated inventory reconciliation and compliance monitoring. Simultaneously, smart fuel dispensers integrate advanced microprocessors and cloud connectivity, supporting features such as remote software updates, predictive diagnostics, and real-time transaction reporting, drastically improving operational visibility for retailers.

Furthermore, payment security and data management represent another critical technology focus. The mandate for EMV compliance worldwide has driven the deployment of new POS systems and card readers capable of processing chip cards and contactless payments (NFC), which requires high levels of data encryption and secure element technology within the dispensing unit itself. Beyond hardware security, the development of robust Forecourt Control Systems (FCS) software is essential. These systems manage the communication between the dispenser, the back-office POS, and external networks, utilizing standardized communication protocols (like IFSF) to ensure seamless, secure data exchange and central management across multiple geographically dispersed sites.

The emergence of alternative fuel infrastructure necessitates specialized technological advances. For Electric Vehicle (EV) charging integration, technology focuses on robust power management systems capable of integrating high-voltage charging units into existing site infrastructure without overwhelming local grids, alongside advanced billing and authentication systems compatible with various EV service providers. Hydrogen dispensing, though nascent, requires highly specialized, precision-engineered dispensing nozzles and compression technology capable of safely handling cryogenic temperatures and extremely high pressures. Overall, the trend is moving away from purely mechanical equipment toward complex, multi-functional, and highly networked digital devices that leverage cloud computing for optimized performance and proactive maintenance.

Regional Highlights

The regional dynamics of the Gas Station Equipment Market reflect varied stages of infrastructure maturity, environmental regulation stringency, and rates of transition to electric mobility. North America, dominated by the United States and Canada, is a mature market driven primarily by mandatory replacement cycles and regulatory upgrades, particularly the ongoing transition to EMV compliance at the pump and continuous investment in sophisticated leak detection systems for aging UST infrastructure. High labor costs and the demand for maximum efficiency also necessitate the adoption of highly automated and remotely managed equipment, leading to strong sales of smart dispensers and advanced forecourt management software.

Europe represents a technologically advanced but highly regulated market. Demand is strong for equipment compliant with strict environmental directives, especially regarding vapor recovery and advanced metering accuracy (MID compliance). However, the region is also at the forefront of the EV transition, leading to increased investment in multi-energy retail platforms. This dichotomy drives growth in modular equipment that can integrate conventional fuels with high-speed EV charging, coupled with advanced software solutions to manage complex energy loads and billing systems efficiently.

Asia Pacific (APAC) stands out as the highest growth region globally. Fueled by rapid urbanization, massive infrastructure development, and rising vehicle ownership in countries like China, India, and Indonesia, the demand is centered on establishing new fueling networks (greenfield expansion). While environmental standards are rapidly increasing, the immediate focus is on reliable, high-volume equipment like bulk storage tanks and conventional fuel dispensers to meet immediate energy demands. This region offers significant opportunities for mid-range equipment manufacturers seeking large volume contracts for initial network build-out. Conversely, Latin America and the Middle East & Africa (MEA) present a mixed landscape, characterized by robust government-led infrastructure projects (MEA) and market liberalization driving competition and investment in modernizing legacy fleets (Latin America).

- North America: Market stability driven by mandatory infrastructure replacement (UST upgrades) and regulatory pushes for EMV compliance and enhanced digital security. Focus on integration of smart, IoT-enabled dispensers for optimized inventory management.

- Europe: High demand for integrated multi-energy solutions, incorporating conventional fuels, biofuels, and EV charging. Strong regulatory emphasis on environmental compliance (vapor recovery, metering accuracy) driving technology adoption.

- Asia Pacific (APAC): Highest growth market due to massive greenfield expansion and urbanization in India, China, and Southeast Asia. Focus on basic, high-volume dispensing and storage equipment installations to meet surging vehicle population demands.

- Latin America: Gradual modernization of aging infrastructure, driven by privatization and increasing competition. Demand for cost-effective, durable equipment with basic digital capabilities.

- Middle East and Africa (MEA): Growth tied to national oil company (NOC) investments in developing standardized retail networks and high-throughput equipment to manage abundant local supply.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Station Equipment Market.- Gilbarco Veeder-Root (Dover Corporation)

- Dover Corporation (OPW)

- Tokheim (Pumps and Systems)

- Tatsuno Corporation

- Wayne Fueling Systems (Dover Corporation)

- Bennett Pump Company

- Censtar Science & Technology Corp., Ltd.

- Kisho Group

- Proway

- Mepsan A.S.

- Fueling Systems & Technologies (FS&T)

- Piusi S.p.A.

- Franklin Fueling Systems (part of Franklin Electric Co.)

- Husky Corporation

- Veyance Technologies (formerly part of Goodyear)

- Korea Entech Co., Ltd.

- Matrix Controls

- IFSF (International Forecourt Standards Forum)

- Tuthill Corporation

- Neste Engineering Solutions

Frequently Asked Questions

Analyze common user questions about the Gas Station Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for new gas station equipment?

The primary factor driving demand is regulatory compliance, specifically mandated environmental upgrades (e.g., replacement of single-wall Underground Storage Tanks or USTs with double-walled, secure containment systems) and mandatory payment security enhancements, such as the global migration to EMV chip card technology at the pump.

How is the rise of Electric Vehicles (EVs) impacting the Gas Station Equipment Market?

The rise of EVs introduces market uncertainty, potentially restraining long-term capital investment in traditional fuel equipment. However, it also creates opportunities for manufacturers specializing in integrated solutions that combine conventional fuel dispensing with high-speed EV charging infrastructure and sophisticated energy management software.

Which product segment is expected to show the highest growth rate?

The Payment Systems and Forecourt Control Software segments are projected to exhibit the highest growth rate. This is driven by the necessity for secure, contactless payment methods, integration of loyalty programs, and the adoption of AI/IoT solutions for remote monitoring, diagnostics, and optimized site management.

What role does Artificial Intelligence (AI) play in modern forecourt operations?

AI plays a critical role in enhancing operational efficiency through predictive maintenance, which reduces equipment downtime. Furthermore, AI enables dynamic fuel pricing based on real-time data analysis and optimizes inventory management by accurately forecasting demand, minimizing costs associated with holding stock.

Which geographic region offers the most significant growth opportunities for new equipment installation?

The Asia Pacific (APAC) region offers the most significant growth opportunities. This is due to extensive greenfield market development, rapid urbanization, and massive investment in building new retail fueling networks to accommodate the escalating vehicle population in countries like China, India, and key Southeast Asian nations.

What defines a 'smart dispenser' in today's market?

A smart dispenser is characterized by integrated digital capabilities beyond simple metering. Key features include high-resolution multimedia screens for advertising, embedded secure payment processors (EMV-compliant), IoT sensors for operational performance data collection, and cloud connectivity for remote diagnostics and software updates, transforming the pump into an interactive retail platform.

Why is leak detection technology crucial for Gas Station Equipment?

Leak detection technology is crucial for regulatory compliance and environmental protection. Continuous In-Tank Leak Detection (CITLD) systems and interstitial monitors ensure the integrity of underground storage tanks (USTs) and piping, preventing costly fuel loss and catastrophic environmental contamination that can result in massive remediation expenses and legal penalties.

How are oil companies standardizing their gas station equipment procurement?

Major oil companies (IOCs) are standardizing procurement through global framework agreements and master service agreements (MSAs) with Tier 1 manufacturers. This ensures uniformity across their global network regarding brand aesthetics, software integration, security standards, and operational protocols, simplifying centralized management and maintenance.

What are the primary components included in a modern forecourt control system (FCS)?

A modern FCS includes the site controller (the core hardware gateway), the point-of-sale (POS) terminal, the interfaces connecting dispensers and payment terminals, and the integrated software module responsible for managing fuel inventory, processing transactions, communicating with the back office, and controlling peripheral devices like car washes and media displays.

What challenges are associated with integrating hydrogen dispensing into existing gas stations?

Integrating hydrogen dispensing poses significant technical and logistical challenges, primarily due to the need for specialized equipment capable of handling extremely high pressure (700 bar) and low temperatures, ensuring safety protocols are met, and integrating complex on-site compression or cooling infrastructure that differs significantly from liquid fuel systems.

How does the Gas Station Equipment Market address fuel fraud and skimming?

The market addresses fraud primarily through mandated EMV compliance, which utilizes chip technology to secure transactions. Further protection is provided by utilizing hardened security enclosures, encrypted communication channels between the dispenser and POS, and implementing tamper detection features that immediately alert operators to physical security breaches at the payment terminal.

What is the difference between USTs and ASTs in terms of market dynamics?

Underground Storage Tanks (USTs) dominate the retail segment due to regulatory requirements and space constraints, driving sales in leak detection and cathodic protection. Aboveground Storage Tanks (ASTs) are more common in commercial fleet depots and bulk storage facilities, where accessibility for inspection and lower installation complexity are prioritized, though they require different types of secondary containment solutions.

What is the impact of supply chain volatility on the equipment market?

Supply chain volatility, particularly regarding microprocessors and specialized electronic components necessary for smart dispensers and POS systems, can lead to extended lead times for new equipment, increased manufacturing costs, and potential delays in critical upgrade cycles like the EMV compliance rollout across various regions.

How do manufacturers ensure the accuracy of fuel metering equipment?

Manufacturers ensure accuracy by adhering strictly to international metrology standards set by bodies like OIML (Organisation Internationale de Métrologie Légale) and national standards like NIST in the U.S. This involves rigorous calibration processes, certification of flow meters, and regular field testing of dispensing units to maintain precise volumetric output as required by law.

What are the key considerations for equipment designed for truck stops and commercial fleets?

Equipment for truck stops and commercial fleets must prioritize high flow rates (high-speed dispensing), rugged durability to withstand heavy usage, and integration with specialized unattended fleet fueling (cardlock) management systems that authenticate drivers and track fuel consumption accurately for centralized invoicing and logistics management.

How is environmental sustainability driving innovation in equipment design?

Environmental sustainability drives innovation through the development of highly efficient vapor recovery systems that capture harmful fumes, advanced secondary containment solutions for USTs to prevent ground contamination, and the design of energy-efficient components, such as LED lighting and power-optimized dispensing electronics, to reduce the station's carbon footprint.

What is the role of technology standardization bodies in the market?

Technology standardization bodies, such as IFSF (International Forecourt Standards Forum), play a crucial role by defining open standards for communication protocols between forecourt devices (dispensers, POS, payment systems). This interoperability allows retailers to mix and match equipment from different vendors, increasing competition and flexibility.

How significant is the retrofitting market compared to new installation (greenfield) market?

The retrofitting and replacement market is significantly more dominant in mature economies (North America, Europe) where networks are established and regulatory mandates drive continuous equipment upgrades. Conversely, the new installation (greenfield) market is the primary driver of growth in rapidly expanding economies within the Asia Pacific region.

What is the competitive landscape like in the global Gas Station Equipment Market?

The market is highly competitive, dominated by a few large multinational corporations (like Gilbarco Veeder-Root/Dover and Tatsuno) that offer comprehensive, vertically integrated solutions. However, niche players specializing in components (like payment systems or leak detection) and strong regional manufacturers provide competition, especially in price-sensitive developing markets.

What are the current trends in fuel inventory management solutions?

Current trends emphasize automated tank gauging (ATG) systems integrated with cloud-based inventory management software. These systems provide real-time, continuous monitoring, automatically reconcile physical inventory against sales data, detect potential theft or leaks instantly, and use predictive analytics to optimize ordering and delivery schedules.

What challenges do independent retailers face when adopting new technology?

Independent retailers often face challenges related to high initial capital investment costs for modern equipment, limited access to specialized maintenance technicians, and difficulty integrating complex new software with their existing legacy back-office systems, often preferring simpler, highly reliable, and easily maintainable solutions.

How does the Gas Station Equipment Market cater to alternative fuels beyond EVs?

The market caters to alternative fuels by developing specialized dispensing and storage units for Compressed Natural Gas (CNG), Liquefied Petroleum Gas (LPG), and Liquefied Natural Gas (LNG). This requires equipment with robust safety features, certified pressure containment systems, and metering technology specifically calibrated for gaseous or cryogenic fuels.

What role does the appearance and design of the equipment play in market adoption?

The appearance and design are increasingly important, especially for retail stations aiming to enhance the customer experience and brand identity. Modern equipment features sleeker designs, integrated multimedia displays, and user-friendly interfaces, moving away from utilitarian hardware to aesthetically pleasing, functional retail technology that encourages non-fuel purchases.

How often are fuel dispensers typically replaced in mature markets?

In mature markets, the average lifecycle for a fuel dispenser is typically between 10 to 15 years. However, technological obsolescence (driven by new payment security or regulatory mandates) often necessitates component upgrades or full replacement sooner, sometimes every 7 to 10 years, particularly for the payment and electronic metering modules.

What are the key materials used in modern Underground Storage Tanks (USTs)?

Modern USTs are predominantly constructed from fiberglass-reinforced plastic (FRP) or steel with exterior protection (such as polyurethane coating). Double-walled tanks, which include an interstitial space for continuous monitoring, are the industry standard, mandated by regulation to enhance containment security and longevity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager