Gasoline Engine Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433969 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Gasoline Engine Oil Market Size

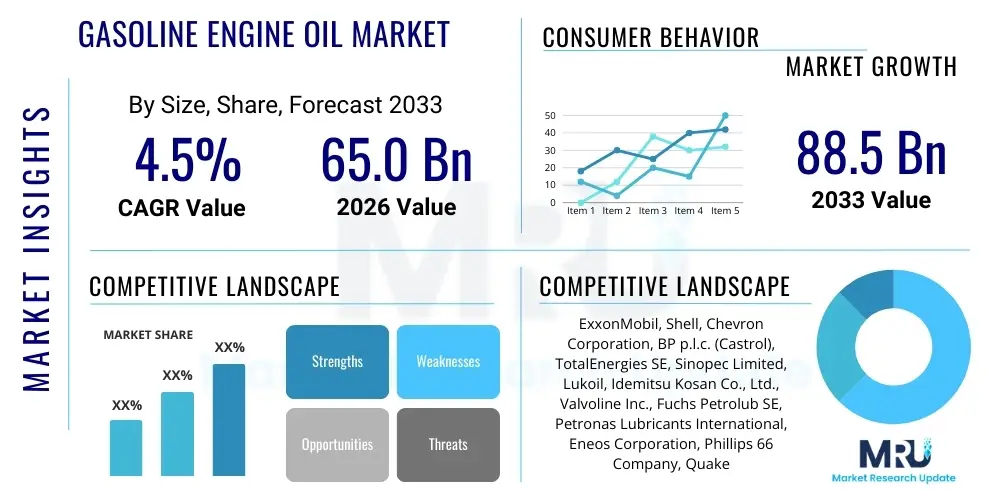

The Gasoline Engine Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 65.0 Billion in 2026 and is projected to reach USD 88.5 Billion by the end of the forecast period in 2033. This consistent growth is primarily driven by the increasing global vehicle parc, especially in emerging economies, coupled with stringent regulatory mandates requiring higher performance and fuel-efficient lubricant formulations.

Gasoline Engine Oil Market introduction

The Gasoline Engine Oil Market encompasses the production, distribution, and sale of lubricants specifically formulated for spark-ignition engines used in automobiles, motorcycles, and light commercial vehicles. These oils are complex mixtures of base oils (mineral, synthetic, or semi-synthetic) and specialized additive packages designed to perform critical functions such as reducing friction and wear, cooling engine parts, neutralizing corrosive acids, and keeping the engine clean by suspending contaminants. The primary product goal is to maximize engine efficiency and longevity while minimizing emissions, adhering to continually evolving industry standards like API SP and ILSAC GF-6.

Major applications of gasoline engine oils include passenger car motor oils (PCMO), which constitute the largest volume segment, and oils for two-wheelers and smaller motorized equipment. The benefits derived from high-quality engine oils are substantial, extending the life of sophisticated engine components such as turbochargers and catalytic converters, improving cold-start performance, and critically enhancing fuel economy through lower viscosity grades (e.g., 0W-20, 5W-30). These benefits directly align with consumer demands for lower operational costs and better environmental performance, solidifying the market's fundamental importance to the automotive ecosystem.

Driving factors propelling market expansion include the sustained growth of the global vehicle fleet, particularly in the Asia Pacific region, and the accelerated adoption of advanced engine technologies such as direct injection (GDI) and turbocharging. These modern engine designs operate under higher pressures and temperatures, necessitating premium, fully synthetic oils capable of preventing issues like Low-Speed Pre-Ignition (LSPI) and chain wear. Furthermore, the mandatory requirement for regular oil changes based on manufacturer specifications ensures a constant, recurring demand cycle for lubricants, regardless of short-term economic fluctuations in new vehicle sales.

Gasoline Engine Oil Market Executive Summary

The Gasoline Engine Oil Market is undergoing a fundamental transformation driven by technological convergence and shifting regulatory landscapes. Business trends indicate a robust strategic emphasis on synthetic and semi-synthetic oil blending, as these high-performance variants offer superior protection and meet the demands of advanced, downsized, and turbocharged gasoline engines prevalent in modern vehicles. Key players are heavily investing in R&D to develop additive technology that addresses specific engine challenges, such as mitigating LSPI and improving fuel economy beyond current standards, often collaborating directly with Original Equipment Manufacturers (OEMs) to ensure product compliance and integration.

Regionally, the market dynamics are highly heterogeneous. Asia Pacific (APAC) dominates the volume demand due to its massive and rapidly expanding vehicle parc, led by countries like China and India, which are transitioning towards stricter emission norms (e.g., China VI, Bharat Stage VI). North America and Europe, while having lower growth rates in volume, lead in value growth, driven by the immediate consumer shift towards premium, low-viscosity, fully synthetic oils mandated by sophisticated European and North American vehicle manufacturers. These regions are also setting the pace for sustainable lubricant solutions, including bio-based and re-refined oils, though their market share remains relatively niche.

Segmentation trends clearly highlight the ascendancy of the Synthetic Oil segment, which is consistently gaining market share from traditional Mineral Oils, especially in the Passenger Vehicle segment. This shift is not merely premiumization but a necessity dictated by engine hardware design and regulatory compliance. Furthermore, the Aftermarket distribution channel remains the largest revenue generator, although the OEM segment holds significant strategic importance as it drives initial product adoption and specification requirements. The continued standardization of ultra-low viscosity grades (0W-20, 0W-16) is the most impactful technical trend defining product development across all geographic and product segments.

AI Impact Analysis on Gasoline Engine Oil Market

User queries regarding AI's impact on the gasoline engine oil market primarily center on three themes: enhancing lubricant formulation speed, optimizing supply chain logistics and inventory management, and utilizing predictive maintenance for oil condition monitoring. Users are concerned about whether AI can rapidly prototype new additive chemistries to meet instantaneous regulatory changes, significantly reducing the traditionally long R&D cycle. Furthermore, there is high interest in how machine learning algorithms can predict the exact timing of oil degradation based on real-time vehicle operational data, transitioning the industry from fixed-interval maintenance to condition-based servicing. Expectations are high that AI will streamline manufacturing processes, minimize waste, and create hyper-personalized lubrication solutions based on driver behavior and environmental factors.

The application of Artificial Intelligence within the lubricant industry extends from the molecular level—where AI models predict the efficacy of novel base oil blends and additive interactions—to the consumer interface, enabling sophisticated telematics integration. In formulation, machine learning dramatically accelerates the screening of vast chemical spaces, predicting viscosity stability, shear resistance, and oxidation resistance before costly physical lab work is initiated. This capability is crucial for quickly developing oils compliant with new ILSAC and ACEA standards. For manufacturers, AI-powered demand forecasting optimizes production schedules and reduces capital expenditures associated with holding excessive raw material inventory, directly impacting profitability.

Ultimately, the impact of AI is transforming the service model of the industry. By integrating data from onboard diagnostics (OBD) systems and fleet management tools, AI algorithms can establish precise, real-time indicators of oil life. This shift allows for the development of "smart oils" that communicate their degradation status, enhancing engine protection and moving the industry towards highly efficient, individualized maintenance protocols. This predictive capability minimizes component failure, maximizes engine uptime for commercial fleets, and provides an unparalleled level of precision in maintenance scheduling for passenger vehicles, driving consumer value and reducing environmental footprint through optimized resource usage.

- Accelerated R&D through predictive modeling of additive performance and molecular stability.

- Enhanced supply chain efficiency and inventory optimization using AI-driven demand forecasting.

- Integration of predictive maintenance (CBM) via telematics to determine optimal oil change intervals.

- Improved quality control in manufacturing by utilizing machine vision and ML algorithms for fault detection.

- Development of customized lubricant formulations based on real-time engine operating data and driving patterns.

DRO & Impact Forces Of Gasoline Engine Oil Market

The dynamics of the Gasoline Engine Oil Market are governed by a complex interplay of stringent environmental regulations, rapid technological advancements in engine design, and fluctuating global economic conditions affecting crude oil prices. Key drivers include the ever-expanding global vehicle parc, especially in emerging nations where first-time vehicle ownership is rising, creating consistent demand for lubricants. Furthermore, the mandatory adoption of low-viscosity, high-performance oils (e.g., 0W-20, 0W-16) driven by fuel efficiency mandates (CAFE standards globally) compels consumers to purchase premium synthetic products, which command higher average selling prices and boost overall market value. These factors collectively establish a strong foundational demand, resilient to minor economic headwinds.

However, the market faces significant restraints, primarily stemming from the long-term trend of vehicle electrification. As Original Equipment Manufacturers (OEMs) aggressively transition towards Battery Electric Vehicles (BEVs), the eventual decline in gasoline engine production poses a structural threat to lubricant volume demand in the long run. Immediate restraints include the challenge of managing base oil price volatility, which directly impacts manufacturing costs, and the technical hurdles in formulating oils that simultaneously prevent LSPI in direct injection engines while remaining compatible with sensitive emission control systems like Gasoline Particulate Filters (GPFs) increasingly utilized in Europe and China. These regulatory and technological paradoxes impose substantial R&D expenditure on market participants.

Opportunities for growth are concentrated in the rapid commercialization of premium synthetic oils, particularly those designed to address specific new engine challenges like timing chain wear and deposit formation in turbochargers. The development of advanced Group IV (PAO) and Group V (Ester) synthetic base oils provides a strong avenue for differentiation. Moreover, the growing focus on sustainability opens niche markets for bio-lubricants and high-quality re-refined engine oils, appealing to environmentally conscious consumers and fulfilling corporate sustainability goals. The strategic expansion into high-growth Aftermarket segments in APAC and Latin America, coupled with providing specialized fluids for high-performance and classic vehicles, offers immediate commercial gains.

The impact forces within the market are predominantly driven by technological change (pushing viscosity downwards and quality upwards) and regulatory pressure (mandating lower sulfur and phosphorous content). The immediate impact of API SP and ILSAC GF-6 standards has forced a complete reformulation cycle across the industry, driving innovation in additive packages. Geopolitical instability affecting crude oil production introduces significant price volatility, which ripples through the supply chain and dictates market pricing power. The strong brand loyalty established by major international oil companies (IOCs) acts as a powerful barrier to entry for smaller or regional players, solidifying the market structure.

Segmentation Analysis

The Gasoline Engine Oil Market is comprehensively segmented based on its core components—Base Oil Type, the viscosity specifications—Viscosity Grade, the end-use application—Vehicle Type, and the route to market—Sales Channel. Analyzing these segments provides a granular view of market dynamics, revealing where premiumization is most prevalent and which technological specifications are driving purchasing decisions. The primary differentiator influencing pricing and performance remains the Base Oil Type, with synthetic oils capturing the high-value segment due to their superior thermal stability and extended drain intervals, essential for modern engine longevity.

In terms of end-use, the Passenger Vehicle segment accounts for the overwhelming majority of market volume and value, characterized by frequent oil changes and high adoption rates of the latest lubricant standards. This segment is highly sensitive to OEM recommendations, which often drive consumers towards specific branded synthetic products. Conversely, the Viscosity Grade segmentation is undergoing the most rapid change, moving away from conventional 10W-40 and 5W-40 grades towards ultra-low viscosity specifications like 0W-20 and the emerging 0W-16, mandated by OEMs to meet fuel economy targets, particularly in hybrid and start-stop equipped vehicles.

The segmentation structure reflects the dual nature of the market: a high-volume, established aftermarket supplying routine maintenance, and a strategically critical OEM channel driving technological change and initial product specification. Understanding the regional penetration of these segments is crucial; for instance, Mineral Oils still hold substantial volume in older vehicle fleets and certain developing economies (e.g., parts of Africa and Southeast Asia), whereas full synthetics dominate the new vehicle market in developed economies. This complex landscape necessitates tailored marketing and distribution strategies for each segment.

- Base Oil Type: Mineral Oil, Synthetic Oil, Semi-Synthetic Oil

- Viscosity Grade: SAE 5W-30, SAE 10W-40, SAE 0W-20, SAE 0W-16, Others (including high-performance racing grades)

- Vehicle Type: Passenger Vehicles (Sedans, SUVs, Hatchbacks), Commercial Vehicles (Light Commercial Vehicles only), Two-Wheelers

- Sales Channel: OEM/Factory Fill, Aftermarket (Retail, Workshops, Service Stations, Independent Garages)

Value Chain Analysis For Gasoline Engine Oil Market

The value chain of the Gasoline Engine Oil Market begins with the upstream procurement of raw materials, primarily crude oil refining to produce various Group I to Group V base oils, alongside the manufacturing of complex chemical additive packages, often by specialized chemical companies. The quality and cost of these inputs are highly sensitive to global petrochemical prices and the complexity of synthesizing high-purity Group III, IV (PAO), and V (Ester) base stocks. Key upstream activities include hydrocracking and isomerization processes required to produce high-quality, high-viscosity index (HVI) base oils that form the foundation of modern synthetic lubricants.

Midstream activities involve the blending and formulation process, where base oils are combined with additive packages (containing detergents, dispersants, anti-wear agents, and viscosity modifiers) to achieve the precise specifications mandated by industry standards (API, ILSAC, ACEA) and specific OEM requirements. This blending is critical and often proprietary, representing the core competitive advantage for lubricant manufacturers. After blending, the product is subjected to stringent quality control tests before being packaged into containers ranging from bulk ISO tanks to individual liter bottles. The packaging stage, involving labeling and regional compliance verification, concludes the manufacturing cycle before distribution.

The downstream segment encompasses the distribution and sales channels, which are bifurcated into Direct (OEM/Factory Fill) and Indirect (Aftermarket). Direct sales involve supplying vast quantities to vehicle assembly lines for the initial factory fill, a crucial step that establishes the preferred lubricant specification for the life of the vehicle. Indirect distribution, which generates the majority of revenue, utilizes complex networks involving distributors, large retailers, branded service stations, independent workshops, and specialized garages. Effective channel management, inventory control, and brand visibility at the point of service are paramount for maximizing downstream market penetration and influencing the end-user's repurchase decision.

Gasoline Engine Oil Market Potential Customers

The potential customers for the Gasoline Engine Oil Market are broadly categorized into four primary groups, each with distinct needs, purchasing patterns, and decision-making criteria. The largest and most visible group is the individual passenger vehicle owner, who typically purchases oil either through retail channels for DIY oil changes or, more commonly, indirectly through professional service providers such as quick lube centers, independent garages, and franchised dealership service departments. These customers prioritize brand trust, conformance to their vehicle manufacturer's specification, and often the price point, particularly in the aftermarket segment, demanding products that offer visible performance benefits such as better mileage or extended drain intervals.

The second critical customer group comprises Original Equipment Manufacturers (OEMs) such as Ford, Toyota, Honda, and Volkswagen. OEMs act as strategic buyers, demanding massive volumes of specialized engine oil for the initial factory fill of newly manufactured vehicles. Their requirements are the most stringent, focusing on proprietary specifications, consistency, supply security, and collaboration on R&D for next-generation engine designs. Securing an OEM contract is highly prestigious and strategically valuable, as it dictates replacement oil sales for years to come. The third group includes commercial fleet operators (e.g., taxi services, rental car companies, light commercial delivery fleets) that manage large numbers of gasoline-powered light commercial vehicles and prioritize total cost of ownership, maximum uptime, and predictive maintenance solutions tailored to fleet efficiency.

Finally, specialized market segments, including industrial users (e.g., power generation units, stationary engines, construction equipment using gasoline engines) and the high-performance/motorsport community, represent niche but high-value opportunities. These buyers demand ultra-high-performance synthetic formulations capable of handling extreme operating conditions, such as high shear rates and excessive heat, often purchasing highly specialized, low-volume, high-margin products. The primary driver for all these end-users remains the need for reliable engine protection and compliance with mandated service schedules to maintain vehicle warranties and operational efficiency, thereby ensuring a stable demand environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.0 Billion |

| Market Forecast in 2033 | USD 88.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Shell, Chevron Corporation, BP p.l.c. (Castrol), TotalEnergies SE, Sinopec Limited, Lukoil, Idemitsu Kosan Co., Ltd., Valvoline Inc., Fuchs Petrolub SE, Petronas Lubricants International, Eneos Corporation, Phillips 66 Company, Quaker State, Pennzoil, Motul S.A., Indian Oil Corporation Ltd., ConocoPhillips, ENI S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gasoline Engine Oil Market Key Technology Landscape

The technological landscape of the Gasoline Engine Oil Market is fundamentally defined by the ongoing necessity to formulate lubricants that enable higher power density, improved fuel efficiency, and reduced emissions in modern gasoline engines. A primary focus area is the development of advanced additive chemistries, specifically friction modifiers and anti-wear components that are low in Sulphated Ash, Phosphorus, and Sulfur (Low-SAPS). This is crucial for protecting sensitive after-treatment systems like Gasoline Particulate Filters (GPFs), which are being mandated in response to stricter particulate matter emission regulations globally. The move to Group III+ base oils, manufactured using sophisticated hydrocracking techniques, is key to achieving the necessary thermal and oxidative stability required for extended drain intervals in high-temperature, turbocharged environments.

Another significant technological shift involves viscosity modification, moving towards lower High-Temperature High-Shear (HTHS) viscosity grades (e.g., 2.6 cP for 0W-20 and potentially 2.3 cP for 0W-16). Achieving these low viscosities without compromising engine protection requires highly stable viscosity index improvers (VIIs) that resist shear degradation under extreme engine conditions. Furthermore, the formulation technology must specifically address Low-Speed Pre-Ignition (LSPI), a catastrophic phenomenon prevalent in turbocharged Gasoline Direct Injection (GDI) engines. LSPI mitigation requires carefully balanced detergent systems, often relying on calcium and magnesium ratio adjustments, to prevent premature ignition events in the combustion chamber, representing one of the most critical R&D focus points today.

The integration of digital technology, particularly in quality assurance and application, forms a rapidly evolving aspect of the landscape. Spectroscopic analysis and sensor-based monitoring are being deployed to provide real-time condition monitoring of the oil, supporting predictive maintenance models. Future technological innovation is expected to focus on bio-based synthetic esters and re-refining processes that yield Group II+ and Group III quality base oils, addressing sustainability concerns without sacrificing performance. The long-term trajectory is towards developing bespoke lubricant solutions that integrate with vehicle telematics systems, optimizing fluid performance based on actual driving behavior, further merging chemistry and digital engineering within the lubricant domain.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for volume demand, driven by massive vehicle production and sales in China, India, and Southeast Asia. The region is characterized by a high proportion of older, mineral-oil-consuming vehicles, though rapid regulatory adoption (e.g., China VI) is quickly transitioning new vehicle segments toward synthetic and semi-synthetic oils. India and Indonesia, with their substantial two-wheeler markets, also constitute a significant regional subset, demanding high-performance two-stroke and four-stroke specific engine oils. The competitive landscape is dense, featuring both international majors and strong local players.

- North America: This region is a mature, high-value market defined by swift compliance with ILSAC GF-6 and API SP standards, leading to the rapid uptake of ultra-low viscosity grades (0W-20, 0W-16). Demand is primarily focused on premium synthetic PCMOs. The regulatory environment, particularly stringent CAFE standards, directly influences product specification and drives innovation in fuel economy-focused lubricants. The U.S. aftermarket is highly competitive, emphasizing strong brand recognition and robust distribution through large retail chains and specialized lube centers.

- Europe: Europe exhibits a unique technological profile driven by ACEA specifications and the proliferation of smaller, turbocharged, direct-injection engines equipped with Gasoline Particulate Filters (GPFs). This necessitates highly specialized Low-SAPS synthetic oils (e.g., C3, C5 standards). The region is leading in sustainability efforts, with higher penetration of re-refined and bio-lubricant alternatives compared to other geographies. Despite slower overall vehicle parc growth, the value market remains high due to the premium nature and complexity of the required fluids.

- Latin America (LATAM): LATAM represents a key growth vector, characterized by improving economic stability and rising vehicle ownership rates, particularly in Brazil and Mexico. While mineral and semi-synthetic oils still hold significant market share due to economic factors and older vehicle fleets, increasing penetration of global OEMs is gradually driving demand for standardized, high-quality synthetic lubricants, creating strong opportunities for international players establishing local blending and distribution networks.

- Middle East and Africa (MEA): Demand in MEA is bifurcated; the Middle East (GCC countries) exhibits demand for high-performance oils due to extreme climate conditions and high-end vehicle imports, while Africa remains heavily reliant on affordable mineral and semi-synthetic oils catering to older vehicles and challenging operating environments. Geopolitical stability and crude oil production capacity in the Middle East heavily influence local base oil availability and pricing dynamics across the entire region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gasoline Engine Oil Market.- ExxonMobil Corporation

- Shell plc

- Chevron Corporation

- BP p.l.c. (Castrol)

- TotalEnergies SE

- Sinopec Limited

- Lukoil

- Idemitsu Kosan Co., Ltd.

- Valvoline Inc.

- Fuchs Petrolub SE

- Petronas Lubricants International

- Eneos Corporation

- Phillips 66 Company

- Quaker State (A Shell Brand)

- Pennzoil (A Shell Brand)

- Motul S.A.

- Indian Oil Corporation Ltd.

- ConocoPhillips

- ENI S.p.A.

- Repsol S.A.

Frequently Asked Questions

Analyze common user questions about the Gasoline Engine Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for synthetic gasoline engine oils?

The primary factor is the widespread adoption of modern, downsized, turbocharged Gasoline Direct Injection (GDI) engines, which operate at higher temperatures and pressures. These sophisticated engines mandate the use of fully synthetic, low-viscosity oils (like 0W-20) to ensure superior thermal stability, prevent Low-Speed Pre-Ignition (LSPI), and meet mandatory regulatory fuel economy standards (e.g., ILSAC GF-6).

How do new API SP and ILSAC GF-6 standards impact lubricant formulation?

The new API SP and ILSAC GF-6 standards require enhanced protection against LSPI, mitigation of timing chain wear, and improved fuel economy retention. This compels formulators to utilize highly robust synthetic base stocks and modify additive packages—often reducing calcium detergents and introducing magnesium—to meet these rigorous performance specifications without compromising emission system compatibility.

What role does vehicle electrification play as a restraint in the gasoline engine oil market?

Vehicle electrification (the transition to Battery Electric Vehicles or BEVs) represents a long-term structural restraint as it eventually reduces the production and use of internal combustion engines. While current market growth remains stable, the long-term forecast suggests a gradual decline in lubricant volume demand, pushing manufacturers to focus strategically on high-margin, specialized hybrid vehicle fluids and core aftermarket sales.

Which region dominates the volume consumption of gasoline engine oil and why?

The Asia Pacific (APAC) region dominates volume consumption due to its large and rapidly expanding vehicle parc, high production levels in countries like China and India, and the significant demand generated by two-wheeler and aging vehicle segments. While premiumization is accelerating, the sheer scale of the vehicle fleet ensures the highest overall lubricant volume requirement globally.

What are the typical viscosity grades mandated by modern Original Equipment Manufacturers (OEMs)?

Modern OEMs are increasingly specifying ultra-low viscosity grades to maximize fuel efficiency and optimize engine performance. The most common mandated grades today are SAE 0W-20 and SAE 5W-30, with a growing number of manufacturers, especially in Japan and North America, moving towards the emerging and extremely fuel-efficient grade of SAE 0W-16.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager