Gastrointestinal & GI Stent Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433075 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Gastrointestinal & GI Stent Market Size

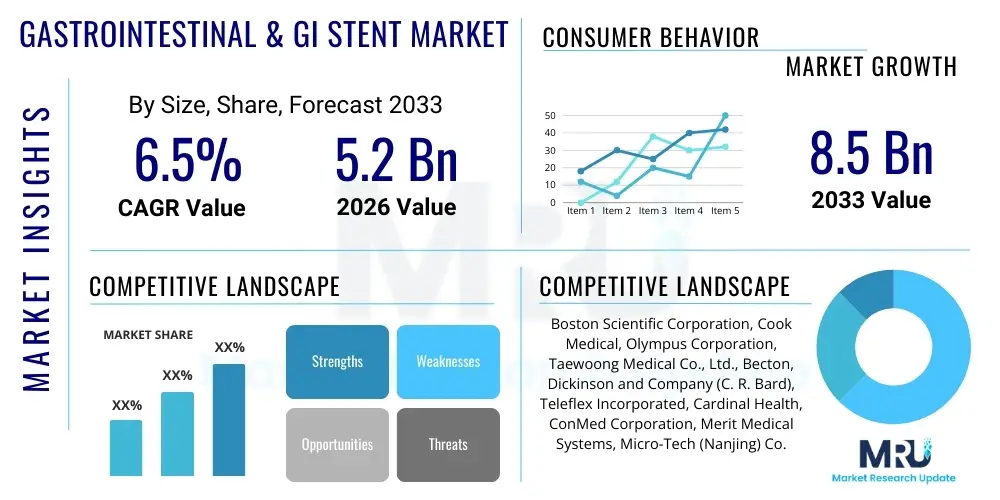

The Gastrointestinal & GI Stent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $8.5 Billion by the end of the forecast period in 2033.

Gastrointestinal & GI Stent Market introduction

The Gastrointestinal (GI) Stent Market encompasses a range of minimally invasive medical devices utilized primarily to treat obstructions in the digestive tract, including the esophagus, duodenum, colon, and biliary ducts. These obstructions are typically caused by malignant tumors, such as pancreatic or colorectal cancer, or benign strictures resulting from inflammatory conditions, peptic ulcers, or post-surgical scarring. The primary function of a GI stent is palliation, aiming to restore luminal patency, alleviate symptoms like dysphagia or jaundice, and improve the quality of life for patients who may not be candidates for surgical resection. Key product types include Self-Expandable Metallic Stents (SEMS), which offer superior radial force and flexibility, and plastic stents, often used for temporary drainage or benign strictures. The continuous development of specialized materials, coating technologies, and advanced delivery systems underscores the market’s responsiveness to complex clinical needs, driving adoption in endoscopic procedures worldwide.

The core application landscape of GI stents is dominated by the management of biliary and esophageal strictures. Biliary stenting, often performed via Endoscopic Retrograde Cholangiopancreatography (ERCP), addresses obstructions caused by bile duct cancers or stones, serving as a critical step in decompression prior to definitive treatment or as long-term palliation. Similarly, esophageal stenting provides immediate relief for patients suffering from dysphagia due to advanced esophageal cancer. The benefits of using GI stents are profoundly related to their minimally invasive nature; they reduce hospital stays, lower complication rates compared to open surgery, and allow for quicker patient recovery. This procedural shift aligns perfectly with modern healthcare preferences for outpatient and non-surgical interventions, substantially contributing to the market’s steady expansion across developed and emerging economies.

Driving factors for sustained market growth include the escalating global incidence of lifestyle-related gastrointestinal diseases and GI cancers, notably pancreatic, colorectal, and esophageal cancers, particularly within the aging global population which requires less invasive therapeutic options. Furthermore, technological advancements leading to improved stent design—such as the introduction of drug-eluting stents to prevent tumor ingrowth, anti-reflux designs, and fully covered SEMS to mitigate migration—are broadening the clinical utility and safety profile of these devices. Increased awareness among gastroenterologists regarding the efficacy of endoscopic stenting techniques, coupled with supportive reimbursement policies in major healthcare markets, further cements the pivotal role of GI stents in modern palliative and interventional gastroenterology practices.

Gastrointestinal & GI Stent Market Executive Summary

The Gastrointestinal & GI Stent Market is characterized by robust expansion driven primarily by the rising prevalence of chronic GI malignancies and the clinical preference for minimally invasive endoscopic intervention over traditional surgical methods. Business trends highlight intense competition centered on innovation in material science, particularly the shift towards advanced covered and biodegradable stents designed to minimize complications such as migration and tissue hyperplasia. Leading manufacturers are focusing on strategic acquisitions and partnerships to gain access to cutting-edge delivery system technologies and expand their geographical footprints, especially in high-growth areas like the Asia Pacific region where the burden of GI diseases is rapidly increasing. Furthermore, regulatory landscapes are evolving, emphasizing enhanced safety and long-term efficacy data for novel stent designs, pushing R&D investment towards clinical validation and post-market surveillance.

Regionally, North America maintains its dominance due to high procedural volumes, advanced healthcare infrastructure, and favorable reimbursement structures supporting expensive metallic stents. However, the fastest growth trajectory is observed in the Asia Pacific (APAC) market, fueled by expanding medical tourism, rapid improvements in healthcare access, and large, undiagnosed patient populations requiring cancer palliation. European markets show stable growth, driven by standardization of endoscopic procedures and increased adoption of specialized stents for benign strictures. Global market penetration strategies increasingly focus on providing specialized training for endoscopists in emerging markets to ensure the safe and effective deployment of complex GI stent technologies, thereby unlocking new revenue streams and addressing unmet clinical needs.

Segmentation trends reveal that Self-Expandable Metallic Stents (SEMS) remain the highest revenue-generating segment due to their application in malignant obstructions requiring high radial force and long-term patency. Within application segments, biliary stenting continues to hold the largest share, although esophageal and duodenal stenting segments are witnessing accelerated adoption driven by improved device maneuverability and anti-reflux mechanisms. A significant emerging trend is the development of fully biodegradable stents, which offer a compelling solution for benign conditions by eliminating the need for a second procedure for stent removal, potentially transforming the treatment paradigm for patients with non-malignant strictures. This emphasis on bioresorbable technology represents a key area for future investment and differentiation among market competitors seeking to capture long-term growth opportunities.

AI Impact Analysis on Gastrointestinal & GI Stent Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the GI Stent market frequently revolve around questions concerning procedural efficacy, diagnostic accuracy, and personalized device selection. Key themes emerging from these inquiries include the potential for AI to automate lesion detection during endoscopy, guide precise stent placement, and predict the risk of stent-related complications such as obstruction or migration based on patient-specific anatomical data and physiological factors. Users express concerns about integrating complex AI algorithms into existing endoscopic workflows and the need for validated datasets to ensure AI-driven recommendations are clinically reliable. The overarching expectation is that AI will minimize human error during placement, optimize device sizing, and ultimately improve long-term patency rates and patient outcomes, thus enhancing the overall value proposition of GI stent procedures.

- AI-powered image recognition systems assist in the real-time identification and characterization of strictures and tumors during endoscopic procedures, ensuring optimal target localization for stent deployment.

- Predictive modeling utilizes machine learning to analyze patient-specific factors (e.g., tumor stage, stricture length, tissue elasticity) to recommend the most appropriate stent type (covered vs. uncovered) and size, reducing the incidence of migration or occlusion.

- Robotic-assisted endoscopy, often guided by AI navigation systems, enhances the precision and stability of stent delivery, particularly in difficult-to-reach or angulated anatomical locations within the biliary and pancreatic ducts.

- AI algorithms monitor post-procedure imaging and patient data to provide early warnings regarding potential stent dysfunction, such as the onset of hyperplastic tissue ingrowth or sludge formation, enabling timely intervention.

- Streamlining clinical trial analysis and regulatory documentation by using natural language processing (NLP) and machine learning to accelerate the development and market introduction of novel GI stent materials and designs.

- Personalized treatment pathways based on AI analysis of genetic and physiological biomarkers optimize the scheduling of follow-up care and the selection of drug-eluting stent formulations for individual patients.

DRO & Impact Forces Of Gastrointestinal & GI Stent Market

The market trajectory is powerfully shaped by several interconnected drivers, restraints, and opportunities (DRO). A primary driver is the accelerating shift towards minimally invasive procedures, preferred by both clinicians and patients due to lower morbidity, reduced hospital stays, and faster recovery times, making endoscopic stenting the gold standard for palliation of malignant GI obstructions. The rising global incidence of upper and lower GI cancers, including esophageal, colorectal, and pancreatic carcinomas, particularly in populations aged 65 and above, creates a continuously expanding patient base requiring palliative interventions to manage strictures and improve nutrient intake. Furthermore, continuous technological advancements, such as the introduction of biodegradable polymers and stents with enhanced anti-migration features, significantly improve device efficacy and safety profiles, encouraging wider clinical acceptance across various indications. These market forces collectively exert a positive impact, continually expanding the scope and adoption of GI stent technologies.

However, significant restraints temper the market’s aggressive growth. The high cost associated with advanced Self-Expandable Metallic Stents (SEMS) and specialized delivery systems, coupled with limited reimbursement in certain developing regions, poses a barrier to broader market penetration. Another major challenge is the occurrence of post-procedure complications, including stent migration, tissue ingrowth or overgrowth leading to re-obstruction (occlusion), and the risk of perforation, which necessitates re-intervention and increases overall healthcare costs. Stringent regulatory approval processes for novel materials and drug-eluting coatings also delay product commercialization, demanding substantial investment in long-term clinical data to demonstrate superior outcomes and safety compared to existing devices, thus constraining immediate innovation cycles.

Opportunities for exponential growth are concentrated in the development of novel solutions for benign strictures and chronic pancreatitis. Specifically, biodegradable stents represent a major opportunity, as they offer the possibility of temporary support without requiring a subsequent removal procedure, thereby reducing procedural burden and patient risk. The untapped potential in emerging markets, characterized by rapidly developing healthcare infrastructure and increasing affordability of advanced medical devices, presents a lucrative geographical opportunity. Furthermore, the integration of smart stent technologies, incorporating sensors for monitoring luminal pressure or pH levels, could revolutionize patient management by providing real-time data on stent function and early detection of complications, transforming the GI stent from a simple mechanical device into an intelligent diagnostic and therapeutic tool. Manufacturers focusing on these advanced capabilities are positioned for significant market share gains.

Segmentation Analysis

The Gastrointestinal & GI Stent market is systematically segmented based on product type, application, end-user, and geographic region, allowing for a granular assessment of growth dynamics and market potential. Segmentation by product type clearly differentiates between metallic and plastic stents, with metallic variants dominating revenue due to their application in critical malignant obstructions requiring high radial strength and durability. Application-based segmentation reveals the dominance of biliary stenting, closely followed by esophageal stenting, reflecting the high prevalence of cancers in these anatomical sites. Understanding these segments is crucial for manufacturers to tailor R&D investments toward areas with the highest clinical demand and potential for premium pricing, particularly in innovative segments like biodegradable stents and drug-eluting technologies.

- By Product Type:

- Self-Expandable Metallic Stents (SEMS)

- Fully Covered SEMS

- Partially Covered SEMS

- Uncovered SEMS

- Plastic Stents

- Biodegradable Stents

- By Application:

- Biliary Strictures (Malignant and Benign)

- Esophageal Strictures (Malignant and Benign)

- Duodenal/Pyloric Strictures

- Colorectal Strictures

- Pancreatic Duct Strictures

- By Procedure:

- Endoscopic Retrograde Cholangiopancreatography (ERCP)

- Endoscopic Ultrasound-Guided Procedures (EUS)

- Percutaneous Transhepatic Cholangiography (PTC)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

Value Chain Analysis For Gastrointestinal & GI Stent Market

The value chain for the GI Stent market begins with upstream activities focused on the sourcing and processing of specialized raw materials. Critical components include high-grade nitinol (nickel titanium alloy) for metallic stents, which requires precise thermomechanical processing to achieve superelasticity and shape memory, and various biocompatible polymers (e.g., polyethylene, polyurethane, or PLLA/PGA for biodegradable options). Manufacturers must maintain stringent quality control over these inputs, as material integrity directly dictates the stent's radial force, flexibility, and anti-corrosion properties. Suppliers in this segment specialize in advanced medical-grade material production and often face high regulatory barriers, creating strong leverage for specialized material vendors. This early stage of the chain is characterized by capital-intensive R&D to optimize material performance and ensure biological compatibility for internal use.

The mid-stream segment encompasses manufacturing and assembly, where device design, precise laser cutting, surface finishing (e.g., electropolishing), and the integration of specialized coatings (drug-eluting or anti-migration) occur. This stage is highly proprietary, requiring specialized clean-room environments and complex assembly processes for the delivery systems, which include catheters, guidewires, and sophisticated deployment mechanisms designed for accurate placement under endoscopic or fluoroscopic guidance. Strict adherence to quality management systems (e.g., ISO 13485) and compliance with regulatory bodies like the FDA (U.S.) and CE Mark (Europe) are non-negotiable. Successful companies differentiate themselves through streamlined, high-yield manufacturing processes and robust intellectual property protection surrounding proprietary stent designs and drug formulations.

Downstream activities involve specialized distribution channels, marketing, and end-user deployment. Due to the technical nature of GI stenting, distribution is predominantly direct or through highly specialized medical device distributors who possess expertise in interventional procedures and maintain cold chain storage for certain products. Sales cycles often involve intensive clinical education and training for gastroenterologists, oncologists, and interventional radiologists on the proper use of advanced delivery systems. Hospitals and Ambulatory Surgical Centers (ASCs) are the primary end-users, with purchasing decisions heavily influenced by clinical efficacy, cost-effectiveness, and established relationships with key opinion leaders. The indirect distribution route via distributors is crucial for penetrating smaller clinics and international markets, while direct sales often handle key large accounts and academic medical centers where ongoing collaboration on research and training is vital.

Gastrointestinal & GI Stent Market Potential Customers

The primary customer base for the GI Stent market comprises specialized medical professionals and the institutions employing them, centered around the diagnosis and treatment of complex gastrointestinal and oncological conditions. Gastroenterologists, particularly those specializing in interventional and therapeutic endoscopy, represent the most frequent and high-volume purchasers. These specialists rely heavily on advanced GI stents for treating malignant biliary, esophageal, and duodenal obstructions, often preferring the latest generation of SEMS with anti-migration features and enhanced maneuverability. Their purchasing decisions are driven by clinical performance metrics, ease of deployment, and the overall reduction in re-intervention rates, which directly impact departmental efficiency and patient throughput. Manufacturers must therefore prioritize training and clinical evidence demonstrating superior short- and long-term outcomes to secure this critical customer segment.

Oncologists and interventional radiologists form the secondary, yet highly influential, customer segment. Oncologists often determine the overall treatment strategy for cancer patients, selecting palliative care pathways that necessitate stenting. Interventional radiologists utilize stenting for biliary access via percutaneous approaches when endoscopic methods fail, especially in complex cases. These specialists demand high-quality, reliable devices that integrate well with existing imaging guidance systems (fluoroscopy, ultrasound). Institutional buyers, specifically procurement departments and administrative bodies within major Hospitals, tertiary care centers, and specialty cancer treatment centers, are also key customers. Their focus lies on standardization, volume discounts, and alignment of device costs with institutional budget constraints and established reimbursement codes, requiring manufacturers to offer compelling economic value propositions alongside clinical superiority.

Ambulatory Surgical Centers (ASCs) are emerging as significant potential customers, particularly for elective or benign stenting procedures where reduced overhead costs make them an attractive setting for patients and payers. As procedural complexity in ASCs increases, there is growing demand for cost-effective, easy-to-use stent systems suitable for non-malignant strictures, such as plastic stents or the newer generation of biodegradable devices which do not require prolonged hospital monitoring. Gaining access to ASC formularies requires manufacturers to demonstrate that their products improve efficiency and reduce the overall cost of care compared to inpatient hospital procedures. Therefore, the customer base requires a multi-faceted marketing approach targeting clinical specialists, institutional administrators, and specialized outpatient facility managers, emphasizing quality, training, and total cost of ownership.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $8.5 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boston Scientific Corporation, Cook Medical, Olympus Corporation, Taewoong Medical Co., Ltd., Becton, Dickinson and Company (C. R. Bard), Teleflex Incorporated, Cardinal Health, ConMed Corporation, Merit Medical Systems, Micro-Tech (Nanjing) Co., Ltd., M.I.Tech Co., Ltd., GIMMI GmbH, PENTAX Medical (HOYA Group), Ella-CS s.r.o., Hobbs Medical, Inc., Endogastric Solutions, Inc., S&G Biotech Co., Ltd., JINSHAN Science & Technology, Medtronic plc, Terumo Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gastrointestinal & GI Stent Market Key Technology Landscape

The technological landscape of the GI Stent market is rapidly evolving, driven by the persistent need to minimize complications like stent migration, tumor ingrowth, and reflux, while enhancing deployment accuracy. The most significant advancement lies in material science, particularly the refinement of nitinol alloys for Self-Expandable Metallic Stents (SEMS). Modern SEMS feature optimized braiding patterns and laser-cut designs that provide a highly precise balance between radial expansive force and flexibility, allowing the stent to conform to tortuous anatomy while resisting external compression from malignant tissue. Furthermore, the development of fully and partially covered stents utilizing polymer membranes (e.g., silicone or polyurethane) has significantly reduced tissue ingrowth, although it introduces challenges related to mucous blockage and increased migration risk. Consequently, manufacturers are focusing intensely on developing enhanced fixation mechanisms, such as customized flanges, flared ends, and textured outer surfaces, to improve stent retention, particularly in high-motility areas like the esophagus and duodenum.

A transformational technology segment is the emergence and commercialization of bioabsorbable or biodegradable stents, typically manufactured from materials like poly-L-lactic acid (PLLA) or polydioxanone (PDO). These stents are designed specifically for benign strictures, offering temporary mechanical support that gradually degrades over a period of months, eliminating the necessity for a secondary endoscopic removal procedure. This innovation addresses a major pain point in the management of non-malignant conditions, promising lower procedural risks and reduced costs over the patient’s treatment cycle. While biodegradable stents currently possess lower radial strength compared to metallic stents, ongoing research is focused on enhancing their structural integrity and dissolution kinetics to broaden their applicability, potentially including palliative use in patients with very limited life expectancy where long-term management is not the primary goal.

Beyond the stents themselves, significant technological improvements are concentrated in the stent delivery systems. Modern delivery catheters are becoming smaller in diameter (low-profile systems), highly flexible, and equipped with enhanced visualization features, allowing for easier navigation through tight or tortuous strictures under endoscopic or fluoroscopic guidance. Precision deployment mechanisms, often utilizing single-operator control, ensure accurate, step-wise release of the stent, minimizing the risk of misplacement. Furthermore, the burgeoning field of drug-eluting stents (DES) for GI applications involves applying anti-proliferative agents (e.g., paclitaxel) to the stent surface to locally inhibit tumor ingrowth or benign hyperplasia, thereby extending stent patency. This integration of pharmacology and engineering represents the pinnacle of current R&D efforts, aiming to make GI stenting a more durable and definitive palliative solution.

Regional Highlights

- North America: North America, particularly the United States, represents the largest market share for GI stents, characterized by high adoption rates of advanced technologies, favorable and extensive reimbursement coverage for high-cost metallic stents, and a mature healthcare system capable of handling high volumes of complex endoscopic procedures. The region benefits from a high prevalence of esophageal and colorectal cancers, coupled with a proactive approach toward early diagnosis and minimally invasive treatment options. Key drivers include the strong presence of major market players and substantial investments in clinical trials validating new stent designs and delivery mechanisms, ensuring the region remains at the forefront of technological integration and procedure standardization.

- Europe: The European market demonstrates steady growth, driven by unified healthcare standards across the European Union and increasing geriatric populations susceptible to chronic GI conditions. While growth is stable, the market is highly competitive, focusing heavily on proven efficacy and adherence to strict regulatory guidelines (CE Mark). Germany, France, and the UK are key contributors, emphasizing the use of high-quality metallic stents for malignant obstructions. The trend in Europe is leaning towards increasing utilization of specialized stents for benign strictures and a growing acceptance of bioabsorbable devices as clinical evidence mounts regarding their long-term effectiveness and patient benefits.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market during the forecast period. This rapid expansion is primarily attributed to vast, underserved patient populations, increasing healthcare expenditure, and substantial improvements in medical infrastructure and endoscopic expertise in countries like China, India, and Japan. The rising incidence of stomach, liver, and esophageal cancers in the region fuels the demand for palliative care devices. Local manufacturers are gaining prominence by offering cost-effective stent solutions, driving market expansion, although quality assurance and standardization of procedures remain key challenges that advanced manufacturers are addressing through focused educational initiatives.

- Latin America (LATAM): The LATAM market is characterized by moderate growth, primarily centered in economic powerhouses like Brazil and Mexico. Market penetration is often constrained by economic volatility and uneven distribution of advanced healthcare resources. However, as medical tourism increases and private healthcare systems expand, there is a growing demand for premium GI stent products. Manufacturers typically employ indirect distribution models through strong local partners to navigate complex import tariffs and regulatory variations across different countries in the region, focusing on basic and semi-covered metallic stents for common malignant indications.

- Middle East and Africa (MEA): The MEA region offers niche market opportunities, particularly in high-income Gulf Cooperation Council (GCC) countries which possess state-of-the-art medical facilities. Growth in this region is primarily driven by centralized government investments in specialized oncology and gastroenterology departments. In contrast, the African subcontinent presents a vast, untapped market where growth is hindered by limited access to basic healthcare and low affordability. However, improving infrastructure and focused health initiatives aimed at cancer management are slowly paving the way for gradual, sustained adoption of essential GI stenting devices, especially cost-effective plastic stents for temporary relief.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gastrointestinal & GI Stent Market.- Boston Scientific Corporation

- Cook Medical

- Olympus Corporation

- Taewoong Medical Co., Ltd.

- Becton, Dickinson and Company (C. R. Bard)

- Teleflex Incorporated

- Cardinal Health

- ConMed Corporation

- Merit Medical Systems

- Micro-Tech (Nanjing) Co., Ltd.

- M.I.Tech Co., Ltd.

- GIMMI GmbH

- PENTAX Medical (HOYA Group)

- Ella-CS s.r.o.

- Hobbs Medical, Inc.

- Endogastric Solutions, Inc.

- S&G Biotech Co., Ltd.

- JINSHAN Science & Technology

- Medtronic plc

- Terumo Corporation

Frequently Asked Questions

Analyze common user questions about the Gastrointestinal & GI Stent market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between fully covered and uncovered metallic GI stents?

Fully covered metallic stents are encapsulated in a polymer membrane, preventing tissue ingrowth through the mesh and making them easier to remove, thus making them suitable for benign strictures. Uncovered stents integrate into the surrounding tissue, minimizing migration risk but increasing the likelihood of tissue ingrowth and making removal challenging; they are primarily used for malignant obstructions.

How does the rising incidence of gastrointestinal cancers drive the demand for GI stents?

As GI cancer incidence, particularly pancreatic, biliary, and esophageal, increases globally, the need for palliative care to relieve life-threatening obstructions (strictures) also rises. GI stents offer the fastest, least invasive method to restore patency, manage symptoms, and improve patient quality of life when curative surgery is not feasible, directly increasing market demand.

What major technological advancement is expected to revolutionize the GI stent market?

The widespread clinical adoption of biodegradable stents is expected to revolutionize the market, particularly for treating benign strictures. These stents eliminate the requirement for a secondary removal procedure, significantly reducing overall healthcare costs and procedural risks, thereby establishing a new standard of care for non-malignant conditions.

Which region currently holds the largest share in the GI Stent market, and why?

North America holds the largest market share due to its advanced healthcare infrastructure, high procedural volumes, early adoption of premium Self-Expandable Metallic Stents (SEMS), and extensive, supportive reimbursement framework that facilitates access to complex and expensive interventional procedures.

What are the key complications associated with GI stent placement that manufacturers are trying to resolve?

The primary complications manufacturers are addressing include stent migration (especially with fully covered stents), tissue ingrowth (which causes re-occlusion, particularly with uncovered stents), and post-procedure pain. Innovations focus on developing anti-migration mechanisms and drug-eluting coatings to enhance long-term patency and reduce patient morbidity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager