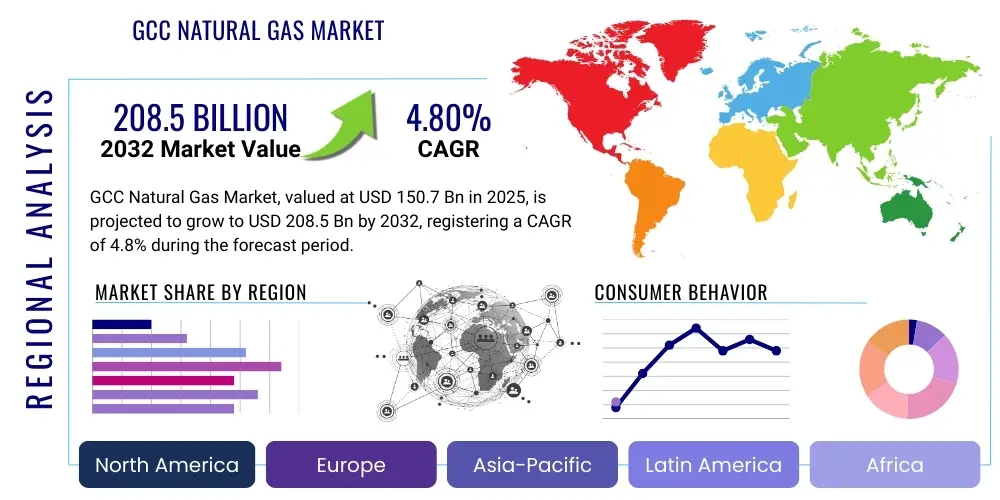

GCC Natural Gas Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439706 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

GCC Natural Gas Market Size

The GCC Natural Gas Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.2% between 2026 and 2033. The market is estimated at USD 185.3 Billion in 2026 and is projected to reach USD 265.1 Billion by the end of the forecast period in 2033.

GCC Natural Gas Market introduction

The GCC natural gas market plays a pivotal role in the global energy landscape, driven by the region's vast hydrocarbon reserves and strategic investments in infrastructure. This market encompasses the exploration, production, processing, transportation, and distribution of natural gas, primarily for domestic consumption and increasingly for international export, particularly in the form of Liquefied Natural Gas (LNG). Natural gas is a cleaner-burning fossil fuel compared to oil and coal, making it a preferred choice for countries aiming to balance energy security with environmental objectives.

Major applications of natural gas within the GCC include power generation, industrial feedstock for petrochemicals, desalination plants, and various manufacturing processes. The robust demand from rapidly expanding industrial sectors and growing populations across the Gulf states significantly underpins market growth. Key benefits of natural gas utilization in the region include reduced greenhouse gas emissions relative to other fossil fuels, enhanced energy efficiency, and its critical role in supporting economic diversification efforts away from crude oil dependency. The readily available abundant reserves ensure long-term supply stability, contributing to the energy security of the region and its trading partners.

Several driving factors propel the GCC natural gas market forward. These include ongoing industrialization, which necessitates reliable and affordable energy sources, increasing demand for electricity due to urbanization and economic development, and governmental initiatives promoting natural gas as a bridge fuel in the energy transition. Furthermore, the strategic focus on expanding LNG export capacities, driven by global demand for cleaner energy and energy security concerns, represents a significant growth avenue for GCC producers. Investments in gas processing facilities and pipeline networks are continually being made to optimize production and distribution efficiencies across the region.

GCC Natural Gas Market Executive Summary

The GCC natural gas market is characterized by robust business trends centered on enhancing domestic supply, expanding export capabilities, and integrating advanced technologies. Major investments are being channeled into upstream exploration and production, particularly in non-associated gas fields, to meet soaring industrial and power generation demands. Companies are also focusing on optimizing existing infrastructure, investing in gas processing plants, and developing large-scale LNG liquefaction and export projects to capitalize on burgeoning global gas demand. Strategic partnerships with international energy firms are common, facilitating technology transfer and market access.

Regional trends indicate a clear pattern of increased intra-GCC cooperation for gas supply and a concerted effort by individual nations to solidify their positions as major global gas suppliers. Qatar continues to lead in LNG exports with ambitious expansion plans, while Saudi Arabia and the UAE are significantly increasing domestic gas production to reduce reliance on liquid fuels for power generation and industrial feedstock. Oman is emerging as a regional gas trading hub, and Kuwait and Bahrain are focused on securing long-term gas supplies to fuel their growing economies. This regional focus on self-sufficiency and export diversification highlights a strategic shift towards gas as a cornerstone of future economic growth and energy security.

Segmentation trends reveal significant growth across various end-use sectors. The power generation segment remains the largest consumer, driven by continuous infrastructure development and population growth. The petrochemicals sector is experiencing substantial expansion, with natural gas serving as a crucial feedstock for high-value products, underpinning industrial diversification strategies. Furthermore, there is an increasing emphasis on developing natural gas infrastructure for commercial and residential applications, albeit at a smaller scale compared to industrial uses. The ongoing transition towards cleaner energy sources also positions natural gas favorably as a primary fuel in the region's long-term energy mix.

AI Impact Analysis on GCC Natural Gas Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the GCC Natural Gas Market, specifically regarding operational efficiency, cost reduction, and environmental stewardship. Common questions revolve around AI's capabilities in optimizing exploration, enhancing drilling precision, enabling predictive maintenance for critical infrastructure, improving supply chain logistics, and ensuring worker safety. There is a strong interest in understanding how AI can contribute to more sustainable practices, such as methane leak detection and carbon footprint reduction, as well as its role in market forecasting and strategic decision-making in a volatile global energy market. Concerns also surface about data security, integration challenges with legacy systems, and the need for a skilled workforce to leverage these advanced technologies effectively.

The integration of AI in the GCC natural gas sector is seen as a crucial step towards achieving higher levels of productivity and competitiveness. AI-powered analytics can process vast amounts of geological and seismic data much faster than traditional methods, leading to more accurate reservoir characterization and optimized drilling locations, thereby reducing exploration risks and costs. In the production phase, AI algorithms can monitor well performance in real-time, predict equipment failures, and suggest optimal operational parameters, minimizing downtime and maximizing output. This shift from reactive to proactive management significantly enhances asset integrity and extends the operational life of critical infrastructure.

Furthermore, AI plays a transformative role in downstream operations and strategic planning. By analyzing market data, demand fluctuations, and geopolitical factors, AI can provide advanced forecasting models that enable better trading decisions and optimize LNG shipping routes, leading to improved profitability. In terms of environmental impact, AI-driven sensor networks can detect and localize methane leaks rapidly, allowing for quicker repairs and substantial reductions in greenhouse gas emissions. Overall, the expectation is that AI will unlock new efficiencies, drive innovation across the value chain, and empower decision-makers with deeper insights, ultimately strengthening the GCC's position in the global natural gas market while supporting its sustainability goals.

- AI-driven seismic data analysis for enhanced exploration accuracy and reduced drilling risks.

- Predictive maintenance for gas pipelines, compressors, and processing units, minimizing downtime and operational costs.

- Real-time optimization of gas production and processing plants for maximum efficiency and yield.

- Advanced analytics for supply chain management, optimizing logistics for LNG and pipeline gas distribution.

- Automated methane leak detection and monitoring systems to improve environmental performance and compliance.

- Intelligent well management systems to maximize recovery rates and extend reservoir life.

- AI-powered market forecasting for better trading strategies and risk management in a dynamic global market.

- Digital twin technology for virtual simulation and optimization of entire gas facilities.

DRO & Impact Forces Of GCC Natural Gas Market

The GCC Natural Gas Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the key impact forces. Driving factors primarily include the accelerating industrialization and urbanization across GCC nations, leading to a relentless demand for electricity and industrial feedstock. Government policies actively support the expansion of gas infrastructure and incentivize cleaner energy adoption, bolstering natural gas's role as a primary energy source. Furthermore, the region's vast proven natural gas reserves and strategic geographical location provide a strong foundation for sustained production and global export, particularly for LNG, catering to growing international demand for energy security and decarbonization efforts.

However, significant restraints temper the market's growth trajectory. Volatility in global natural gas prices, influenced by geopolitical events and supply-demand imbalances, introduces financial uncertainties for producers and investors. The high capital expenditure required for exploration, production, and liquefaction infrastructure presents a substantial barrier, especially for large-scale projects. Competition from rapidly advancing renewable energy sources, coupled with increasing global pressure for complete decarbonization, poses a long-term challenge to the dominance of fossil fuels, including natural gas. Additionally, the need for advanced technologies to extract unconventional gas resources and manage environmental impacts adds to operational complexities and costs within the region.

Amidst these challenges, considerable opportunities exist for market expansion and diversification. The development of blue hydrogen, utilizing natural gas with Carbon Capture, Utilization, and Storage (CCUS) technologies, presents a promising avenue for low-carbon energy production, aligning with global climate objectives. Expanding intra-GCC pipeline networks can enhance regional energy security and create integrated gas markets. Furthermore, technological advancements in gas processing, liquefaction, and digitalization offer scope for improving operational efficiencies and reducing costs. The increasing global demand for LNG as a transition fuel provides a sustained export opportunity, allowing GCC nations to diversify their energy exports and solidify their strategic importance in the international energy landscape.

Segmentation Analysis

The GCC natural gas market is comprehensively segmented to provide granular insights into its structure and growth dynamics. This segmentation typically dissects the market based on various criteria, including the end-use industry, the type of gas, and its application, reflecting the diverse ways natural gas is utilized across the region. Understanding these segments is crucial for stakeholders to identify key demand drivers, emerging trends, and strategic investment opportunities, enabling targeted market approaches and informed decision-making within the dynamic GCC energy sector. Each segment experiences unique growth rates and influences from regional economic development and policy frameworks, highlighting the diverse landscape of natural gas consumption.

- By End-Use Industry

- Power Generation

- Industrial Feedstock (e.g., steel, aluminum, cement)

- Petrochemicals

- Residential & Commercial

- Others (e.g., transportation fuel, desalination)

- By Type of Gas

- Associated Gas

- Non-Associated Gas

- Shale Gas (Emerging)

- By Application

- Electricity Generation

- Industrial Heating & Processes

- Chemical & Fertilizer Production

- LNG Exports

- Pipeline Distribution

Value Chain Analysis For GCC Natural Gas Market

The value chain for the GCC Natural Gas Market is a complex and capital-intensive network, beginning with extensive upstream activities crucial for resource discovery and extraction. Upstream analysis involves geological surveys, seismic imaging, exploration drilling, and the subsequent development of gas fields. This phase requires significant technological expertise and investment to locate and extract both associated gas (found with oil) and non-associated gas (found independently) from diverse geological formations. The GCC region possesses vast conventional and increasingly unconventional gas reserves, necessitating advanced drilling techniques, reservoir management, and production optimization technologies to maximize recovery and ensure long-term supply sustainability.

Following extraction, the downstream analysis encompasses the processing, liquefaction, transportation, and distribution stages. Raw natural gas often contains impurities and natural gas liquids (NGLs) that must be removed through gas processing plants to produce pipeline-quality dry gas or feedstock for petrochemicals. For export markets, a significant portion of natural gas undergoes liquefaction at LNG terminals, chilling it to approximately -162°C, which reduces its volume by 600 times for efficient sea transport. The transportation phase involves extensive pipeline networks for domestic and regional distribution, as well as specialized LNG carriers for intercontinental exports, each requiring rigorous safety and operational standards.

Distribution channels for GCC natural gas are diverse, serving both domestic and international markets through direct and indirect means. Domestically, gas is often distributed directly from processing plants via large-diameter pipelines to major end-users such as power generation plants, industrial complexes, and petrochemical facilities. Local distribution networks managed by utility companies then supply gas to residential and commercial sectors. Internationally, LNG exports constitute a primary direct channel, where long-term contracts are established with importing nations, or gas is sold on spot markets. Indirect distribution may involve regional pipeline interconnections, where gas is sold to neighboring countries, which then distribute it within their own markets. The efficiency and reliability of these distribution channels are paramount for maintaining market stability and maximizing revenue generation across the entire value chain.

GCC Natural Gas Market Potential Customers

The GCC Natural Gas Market serves a broad spectrum of potential customers, spanning both the domestic and international arenas, all driven by the need for reliable, efficient, and increasingly cleaner energy sources. Domestically, the primary end-users are large-scale industrial consumers such as power generation plants, which rely heavily on natural gas to meet the region's rapidly growing electricity demand. These power plants are crucial for powering urban development, industrial expansion, and extensive desalination facilities, making them foundational customers. Heavy industries, including aluminum smelters, steel mills, and cement manufacturers, also represent significant consumers, utilizing natural gas as a fuel for their energy-intensive processes due to its cost-effectiveness and relatively lower environmental impact compared to other fossil fuels.

Beyond heavy industry, the petrochemical sector stands as another major customer segment, leveraging natural gas as a critical feedstock for producing a wide array of chemicals, plastics, and fertilizers. The GCC's ambitious diversification strategies increasingly emphasize the growth of value-added downstream industries, which in turn fuels demand for natural gas as a raw material. Commercial establishments, including hotels, shopping malls, and large institutional complexes, also constitute potential customers for heating, cooling, and power generation, albeit with smaller individual consumption profiles compared to industrial giants. Residential consumers form a smaller but growing segment, utilizing natural gas for cooking, water heating, and space heating, driven by urbanization and improved infrastructure access.

Internationally, the market's most prominent potential customers are countries with significant energy demands and a strategic interest in diversifying their energy mix away from coal or oil, particularly through Liquefied Natural Gas (LNG) imports. Nations in Asia (e.g., Japan, South Korea, India, China) and Europe are key destinations, seeking secure and flexible energy supplies to support their economic growth and carbon reduction targets. These international buyers often enter into long-term contracts with GCC producers, ensuring stability for both supply and demand. Furthermore, the emerging market for blue hydrogen production, which uses natural gas combined with carbon capture technologies, presents a future segment of customers, including industrial users and transportation sectors seeking low-carbon energy solutions globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.3 Billion |

| Market Forecast in 2033 | USD 265.1 Billion |

| Growth Rate | 5.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saudi Aramco, ADNOC (Abu Dhabi National Oil Company), QatarEnergy, Kuwait Oil Company (KOC), Petroleum Development Oman (PDO), Bahrain National Gas Company (Banagas), Dolphin Energy, Mubadala Energy, Dragon Oil, ExxonMobil, Shell, TotalEnergies, BP, Occidental Petroleum, Eni, Chevron, Sinopec, CNPC, Equinor, Mitsui O.S.K. Lines |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

GCC Natural Gas Market Key Technology Landscape

The GCC Natural Gas Market is undergoing a significant technological evolution, with a focus on enhancing efficiency, optimizing production, and minimizing environmental impact across the entire value chain. In the upstream sector, advanced seismic imaging techniques, including 3D and 4D seismic surveys, are crucial for more accurate reservoir characterization and identifying new gas reserves, particularly for complex unconventional gas formations. Horizontal drilling and hydraulic fracturing technologies are increasingly employed, albeit selectively for specific geological contexts, to unlock difficult-to-reach gas resources, thereby expanding the region's accessible reserve base and improving recovery rates from mature fields. This necessitates continuous investment in specialized drilling rigs and subsurface diagnostic tools.

In the midstream and downstream segments, the technological landscape is dominated by innovations aimed at optimizing processing, transportation, and liquefaction. State-of-the-art gas processing technologies are being implemented to efficiently remove impurities and extract valuable natural gas liquids (NGLs), maximizing product yield. For LNG production, advanced liquefaction processes, such as mixed refrigerant and cascaded liquefaction cycles, are being adopted to improve energy efficiency and reduce operational costs at large-scale LNG plants. Digitalization, encompassing the Internet of Things (IoT), Big Data analytics, and Artificial Intelligence (AI), is transforming operations by enabling real-time monitoring of pipelines and facilities, predictive maintenance, and optimized supply chain logistics, thereby enhancing reliability and safety.

Furthermore, sustainability-driven technologies are gaining prominence. Carbon Capture, Utilization, and Storage (CCUS) technologies are critical for reducing the carbon footprint of natural gas operations, especially in conjunction with blue hydrogen production initiatives, positioning natural gas as a cleaner transition fuel. Methane emission detection and reduction technologies, including advanced sensors and drone-based monitoring, are being deployed to minimize fugitive emissions, aligning with global climate goals. The adoption of digital twin technology allows for virtual simulation and optimization of entire gas fields and processing plants, fostering innovation and enabling proactive decision-making. These technological advancements collectively drive the GCC natural gas market towards greater operational excellence, economic competitiveness, and environmental responsibility.

Regional Highlights

- Qatar: As a global leader in LNG production and exports, Qatar continues its ambitious expansion plans, notably with the North Field Expansion project set to significantly boost its liquefaction capacity. The nation's strategic focus is on maximizing its vast non-associated gas reserves, ensuring long-term supply for international markets while supporting domestic industrial growth. Qatar's robust investment in new LNG trains and associated infrastructure solidifies its position as a reliable and dominant player in the global gas trade.

- Saudi Arabia: The largest economy in the GCC, Saudi Arabia is vigorously pursuing increased domestic natural gas production to fuel its rapidly expanding industrial base and power generation needs, aiming to reduce its reliance on crude oil for electricity. Significant investments are being made in developing unconventional gas resources, such as shale gas, and expanding existing conventional gas fields. The Kingdom's gas strategy is central to its Vision 2030, emphasizing economic diversification and environmental sustainability through cleaner energy.

- United Arab Emirates (UAE): The UAE is strategically focused on enhancing its natural gas self-sufficiency, particularly through the development of sour gas and unconventional gas projects. Abu Dhabi National Oil Company (ADNOC) is leading major initiatives to unlock significant gas resources, aiming to meet rising domestic demand for power generation, petrochemicals, and industrial applications. The UAE also plays a pivotal role in regional gas supply through projects like Dolphin Energy, demonstrating its commitment to energy security and diversification.

- Oman: Oman is increasingly positioning itself as a regional gas hub, capitalizing on its strategic location and growing gas production from both conventional and tight gas fields. The country is expanding its LNG export capabilities and developing gas-intensive industries, including petrochemicals and industrial ventures. Oman's progressive energy policies and open approach to foreign investment contribute to its emergence as a dynamic player in the GCC gas market.

- Kuwait: Faced with rapidly increasing domestic energy consumption, Kuwait is investing heavily in enhancing its natural gas production to reduce reliance on imported gas and meet its growing power generation requirements. Efforts are concentrated on developing complex non-associated gas fields and exploring unconventional resources. The country is also exploring regional gas import options to bridge its supply-demand gap in the interim, ensuring energy security for its national development plans.

- Bahrain: Bahrain, while having smaller gas reserves compared to its GCC neighbors, is focused on optimizing its domestic production and securing stable gas supplies to support its industrial development, particularly in aluminum smelting and petrochemicals. The nation is exploring offshore gas fields and implementing advanced recovery techniques to maximize its existing resources. Bahrain's strategy also involves leveraging regional pipeline connections to ensure consistent gas availability for its economic growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the GCC Natural Gas Market.- Saudi Aramco

- ADNOC (Abu Dhabi National Oil Company)

- QatarEnergy

- Kuwait Oil Company (KOC)

- Petroleum Development Oman (PDO)

- Bahrain National Gas Company (Banagas)

- Dolphin Energy

- Mubadala Energy

- Dragon Oil

- ExxonMobil

- Shell plc

- TotalEnergies SE

- BP p.l.c.

- Occidental Petroleum Corporation

- Eni S.p.A.

- Chevron Corporation

- Sinopec Group

- China National Petroleum Corporation (CNPC)

- Equinor ASA

- Mitsui O.S.K. Lines, Ltd.

Frequently Asked Questions

What is the primary driver for natural gas demand in the GCC?

The primary driver for natural gas demand in the GCC is the rapidly increasing need for electricity generation to support industrialization, urbanization, and population growth, alongside its crucial role as a feedstock for the expanding petrochemical sector.

How are GCC countries balancing domestic natural gas needs with export ambitions?

GCC countries are balancing domestic needs with export ambitions by significantly investing in increasing their natural gas production capacities, particularly from non-associated and unconventional gas fields, to ensure both self-sufficiency and robust LNG export volumes.

What role does LNG play in the GCC natural gas market strategy?

LNG plays a crucial role by enabling GCC nations, particularly Qatar, to monetize their vast gas reserves through international exports, diversifying revenue streams, and solidifying their position as key global energy suppliers amidst evolving energy transition dynamics.

What are the major technological advancements influencing the GCC natural gas sector?

Key technological advancements include advanced seismic imaging, horizontal drilling, AI and IoT for operational optimization and predictive maintenance, and Carbon Capture, Utilization, and Storage (CCUS) for emissions reduction and blue hydrogen production.

What are the environmental sustainability efforts within the GCC natural gas industry?

Environmental sustainability efforts include the deployment of CCUS technologies, methane leak detection and reduction programs, and investments in cleaner gas processing to minimize greenhouse gas emissions and align with global climate objectives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager