Gear Cutting Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433127 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Gear Cutting Tools Market Size

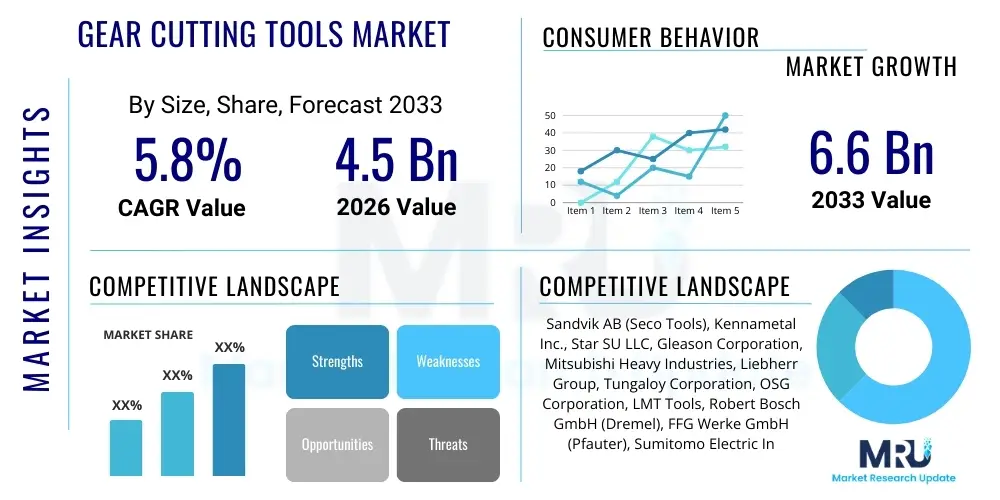

The Gear Cutting Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $6.6 Billion by the end of the forecast period in 2033.

Gear Cutting Tools Market introduction

The Gear Cutting Tools Market encompasses high-precision instruments and machinery essential for manufacturing gears used across various heavy industries, including automotive, aerospace, industrial machinery, and energy. These tools, such as hobs, shapers, shaper cutters, and broaches, are fundamental components in producing highly accurate and efficient gearing systems necessary for power transmission and motion control. The increasing complexity and demand for noise reduction and higher torque density in modern applications, particularly within electric vehicles (EVs) and sophisticated robotics, are driving innovation in tool material science, focusing on carbide, high-speed steel (HSS), and advanced coatings to enhance tool life and machining speed. Gear cutting is a critical process, and the quality of the tool directly influences the final gear geometry and performance, making precision engineering a key differentiator in this market.

Major applications of gear cutting tools span from basic transmissions in consumer vehicles to complex planetary gear systems in wind turbines and intricate gearboxes in aircraft engines. The automotive sector remains the largest consumer, driven by the persistent need for efficient internal combustion engine (ICE) transmissions and the emerging specialized gearing requirements for electric vehicle drivetrains, which demand ultra-precise, often helical or spiral bevel, gears. Furthermore, the robust growth in industrial automation and the proliferation of CNC machining centers globally necessitate constant replacement and upgrading of specialized cutting tools to maintain production efficiency and meet stringent quality control standards. The benefits derived from using advanced gear cutting tools include reduced cycle times, superior surface finishes, extended tool longevity, and lower total manufacturing costs per gear component.

Driving factors for this market include the global expansion of infrastructure projects, leading to higher demand for construction and mining equipment that rely heavily on robust gear systems. Technological advancements, particularly the shift towards dry cutting and high-performance machining techniques, are pushing manufacturers to invest in cutting-edge tool geometries and coating technologies, such as physical vapor deposition (PVD) and chemical vapor deposition (CVD) coatings. Moreover, the increasing adoption of automated and flexible manufacturing systems worldwide requires high-reliability tools capable of consistent performance under demanding production environments. This focus on maximizing throughput and precision sustains the demand cycle for premium, specialized gear cutting instruments.

Gear Cutting Tools Market Executive Summary

The Gear Cutting Tools Market is characterized by intense focus on precision engineering, material innovation, and alignment with macro industrial growth trends, particularly the electrification of transportation and the expansion of smart factory initiatives. Business trends indicate a strong move toward consolidated manufacturing processes, with leading market players investing heavily in R&D to develop multi-functional tools and specialized application-specific solutions, such as carbide hobs optimized for skiving processes. Furthermore, there is a pronounced trend toward digitalization, where tools are integrated with monitoring systems (e.g., RFID tagging, sensor integration) to enable predictive maintenance and optimize tool utilization rates, significantly reducing unplanned downtime in high-volume production lines. Mergers and acquisitions, primarily focused on securing specialized coating or material science expertise, are also shaping the competitive landscape, pushing smaller, innovative players into the portfolios of large industrial conglomerates seeking comprehensive gear manufacturing solutions.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive automotive manufacturing bases in China, India, and Southeast Asia, coupled with substantial government investment in infrastructure and defense sectors. Europe maintains a strong market presence, particularly in the high-end, complex gear segment, driven by aerospace and precision machinery manufacturing in Germany and Italy, emphasizing advanced processes like gear grinding and polishing requiring specialized finishing tools. North America, while mature, shows steady demand, largely buoyed by reshoring initiatives, growth in renewable energy installations (wind turbine gearing), and the specialized needs of the domestic aerospace and defense industries. Market expansion strategies are now heavily targeted at emerging economies within APAC and Latin America, focusing on localized distribution and technical support to capture immediate demand from rapidly industrializing sectors.

Segment trends highlight the dominance of the Hobbing Cutter segment due to its versatility and efficiency in mass production, although the Gear Shaping and Skiving segments are experiencing the highest growth rates, driven by their necessity in complex internal gear fabrication, especially relevant for EV transmissions. Material-wise, cemented carbide tools are rapidly displacing traditional High-Speed Steel (HSS) in high-production environments due to superior hardness and heat resistance, allowing for higher cutting speeds and longer tool life, which translates directly into lower cost-per-part metrics for manufacturers. The segment focusing on specialized tools for finishing operations, such as fine-pitch grinding wheels and honing tools, is also witnessing robust growth, reflecting the industry's increasing emphasis on achieving Grade 3 or higher gear quality standards essential for quiet operation in electric vehicles and sensitive machinery.

AI Impact Analysis on Gear Cutting Tools Market

User queries regarding the impact of Artificial Intelligence (AI) on the Gear Cutting Tools Market predominantly revolve around themes of automation, predictive maintenance, quality control enhancement, and design optimization. Common questions inquire about whether AI can fundamentally replace the role of skilled technicians in tool setting and sharpening, how AI-driven analytics can improve tool life prediction, and the potential for generative design algorithms to invent novel tool geometries previously impossible through traditional engineering methods. Concerns also surface about data security and the high initial investment required to integrate AI-enabled sensors and software platforms into existing CNC infrastructure. Users are seeking clarity on the realistic adoption timeline and the return on investment (ROI) associated with implementing machine learning models for anomaly detection during the gear manufacturing process. Overall, the expectation is that AI will revolutionize efficiency but concern remains regarding the accessibility and complexity of implementation for small and medium enterprises (SMEs).

AI is fundamentally shifting the operational paradigm within gear cutting by transitioning the focus from reactive maintenance to proactive, data-driven optimization. Machine learning algorithms are being trained on vast datasets of cutting parameters (speed, feed, depth of cut, vibration, temperature) and tool wear characteristics to create highly accurate predictive models. These models inform manufacturers precisely when a tool requires replacement or regrinding, minimizing unexpected failures and maximizing material utilization. This precision reduces scrap rates and ensures consistent gear quality, which is paramount in critical applications like automotive or aerospace components. Furthermore, AI contributes significantly to process optimization by suggesting optimal cutting fluid parameters, adjusting machining strategies in real-time based on material variability, and fine-tuning tool paths to reduce thermal and mechanical stress on the cutting edge, thereby extending the effective working life of expensive specialized tools.

Beyond the shop floor, AI is impacting the upstream design and engineering phases of gear cutting tools. Generative AI is capable of exploring millions of possible tool designs, analyzing performance characteristics such as stress distribution and chip evacuation efficiency, and identifying non-intuitive geometries that offer superior performance in terms of speed and surface finish. This accelerates the R&D cycle, allowing manufacturers to quickly prototype and introduce tools tailored for specific exotic materials or unique gear profiles (e.g., highly customized spur gears or advanced cycloidal drives). This integration of AI not only reduces reliance on manual iterative design processes but also democratizes access to advanced manufacturing optimization strategies, positioning AI as a critical enabler for the next generation of high-performance gear cutting instruments capable of addressing the complex demands of modern industrial machinery.

- AI-Driven Predictive Maintenance: Machine learning algorithms analyze sensor data (vibration, acoustic emission) to forecast tool wear, optimizing tool change schedules and reducing unplanned downtime by up to 30%.

- Real-Time Process Optimization: AI adjusts CNC parameters (feed rate, spindle speed) dynamically to compensate for material inconsistencies or thermal drift, ensuring stable gear quality and dimensional accuracy.

- Enhanced Quality Control (QC): Computer Vision and AI algorithms automate defect detection in finished gears and cutting tools with higher accuracy than human inspectors, particularly for microscopic surface defects and profile deviations.

- Generative Design of Tools: AI explores new, complex tool geometries (e.g., asymmetric teeth profiles for hobs) tailored for specific high-performance applications, shortening the tool development lifecycle.

- Supply Chain and Inventory Management: Predictive modeling forecasts demand for specific tool types and materials, optimizing stock levels and reducing carrying costs for high-value gear cutting consumables.

- Automated Tool Path Generation: AI creates highly efficient, collision-free machining paths, especially critical for five-axis CNC gear cutting operations, maximizing material removal rates.

- Smarter Training Simulators: Virtual reality and AI-enhanced training programs rapidly upskill technicians on complex tool setting, sharpening, and maintenance procedures.

- Material Science Integration: AI accelerates the discovery and testing of new high-performance tool coatings (e.g., superhard PVD coatings) by simulating their performance under extreme cutting conditions.

DRO & Impact Forces Of Gear Cutting Tools Market

The Gear Cutting Tools Market dynamics are heavily influenced by a delicate balance between technological necessities and economic pressures. Key drivers include the overwhelming global demand for precision components, particularly stemming from the rapid electrification of the automotive sector, which requires specialized, quiet, and highly durable gears for EV transmissions, driving demand for specialized finishing tools like skiving cutters and honing stones. Furthermore, the sustained growth in aerospace and defense sectors globally mandates increasingly stringent tolerance levels and material hardness, compelling manufacturers to invest in carbide and polycrystalline diamond (PCD) tools that can handle tough alloys efficiently. Opportunities lie in the shift towards modular tooling systems and the adoption of Industry 4.0 principles, enabling personalized and optimized tool use through connected machining processes. However, restraints such as high raw material costs (tungsten carbide, cobalt), intense price competition from emerging Asian manufacturers, and the complexity of recycling specialized tools pose significant challenges to market profitability. These factors collectively create a highly competitive environment where innovation in material science and digital services provides the primary leverage for growth.

Restraints are primarily centered on the cyclical nature of end-user industries and the inherent capital intensiveness of modern gear manufacturing. Downturns in the automotive or heavy machinery sectors can immediately depress demand for new tooling. Moreover, the sophisticated nature of premium gear cutting tools requires high-level expertise for effective deployment, resharpening, and maintenance, leading to skill shortages in many industrial regions. Counterfeit tooling, while often inferior, poses an economic threat by depressing average selling prices and eroding brand value for established high-quality manufacturers. The significant environmental compliance costs associated with manufacturing specialized cutting fluids and disposing of machining waste also impact the operational expenses of tool producers. Mitigating these restraints requires focused efforts on developing user-friendly digital solutions and establishing robust intellectual property protections globally.

Impact forces currently reshaping the market include the disruptive influence of additive manufacturing (AM) on prototype tooling and specialized component production, although AM has not yet significantly threatened high-volume conventional gear tool manufacturing. The most dominant impact force is the inexorable progression towards sustainable manufacturing practices, demanding tools that facilitate dry machining or minimum quantity lubrication (MQL) processes, thereby reducing environmental footprint and operational costs. Furthermore, the geopolitical landscape, including trade tensions and volatility in commodity pricing, significantly impacts the supply chain for critical materials like high-speed steel and carbide powders, forcing companies to diversify sourcing and increase inventory buffers. The pressure to achieve higher throughput and reduced energy consumption per part continues to accelerate R&D investments in advanced coatings, pushing the boundaries of cutting speed and tool longevity far beyond previous benchmarks.

Segmentation Analysis

The Gear Cutting Tools Market is analyzed based on product type, material, application, and end-user industry. The primary segmentation by product type reflects the diverse machining methods required for gear production, ranging from roughing operations to final finishing. Material segmentation is crucial as it dictates the tool's performance parameters, including heat resistance, hardness, and speed capability, essential factors driven by the increasing use of difficult-to-machine superalloys. Application segmentation details the specific machining operation, such as hobbing, shaping, or grinding, highlighting the dominance of high-volume gear production methods. Finally, the end-user segmentation clearly defines the primary demand sectors, emphasizing the critical role of the automotive and industrial machinery sectors in market revenue generation and growth projections. This layered analysis provides a comprehensive view of market dynamics and opportunity identification.

- By Product Type:

- Gear Hobbing Cutters (Hobs)

- Gear Shaping Cutters

- Gear Skiving Tools

- Gear Shaving Tools

- Gear Broaches

- Gear Milling Cutters

- Gear Grinding Tools (Grinding Wheels, Honing Tools)

- By Material:

- High-Speed Steel (HSS)

- Cemented Carbide

- Polycrystalline Diamond (PCD)

- Ceramics and Cermets

- By Application:

- Roughing

- Semi-Finishing

- Finishing (Grinding, Honing, Polishing)

- By End-User Industry:

- Automotive (Passenger Vehicles, Commercial Vehicles, Electric Vehicles)

- Aerospace and Defense

- Industrial Machinery (Machine Tools, Robotics)

- Power Generation (Wind Turbines, Gas Turbines)

- Construction and Mining

Value Chain Analysis For Gear Cutting Tools Market

The value chain for the Gear Cutting Tools Market is intricate, commencing with highly specialized upstream raw material processing, flowing through precision tool manufacturing, and concluding with complex distribution channels catering to globally dispersed end-users. Upstream analysis focuses on the sourcing and preparation of critical materials, primarily tungsten carbide powder, high-speed steel billets, and specialized coatings (e.g., TiAlN, AlCrN). Suppliers in this segment are characterized by high barriers to entry due to the necessity for metallurgical expertise and capital-intensive production facilities required to produce materials that meet the demanding specifications of high-performance cutting tools. Consistency in material quality is paramount, as defects at this stage severely compromise tool performance and life, leading to rigorous quality control processes and strong contractual relationships between tool manufacturers and core material suppliers, often involving long-term strategic partnerships to ensure supply stability and cost control.

The core manufacturing segment involves sophisticated processes such as sintering, CNC grinding, profile grinding, heat treatment, and specialized coating applications. Leading tool manufacturers invest heavily in state-of-the-art CNC grinding machines and advanced coating chambers to achieve nanometer-level precision and complex gear profiles. Downstream activities involve distribution, technical service, and tool reconditioning. Given the high cost and specialized nature of gear cutting tools, a robust reconditioning and resharpening service network is a non-negotiable component of the value proposition, extending tool life and reducing the Total Cost of Ownership (TCO) for end-users. Furthermore, the downstream component includes providing specialized engineering support, helping customers select optimal tooling and cutting parameters for unique applications, cementing the manufacturer's role as a solution provider rather than just a product supplier.

Distribution channels are bifurcated into direct sales and indirect distribution networks. Direct sales are preferred for high-value, highly customized tools, particularly to Tier 1 automotive suppliers or large aerospace manufacturers, where close technical consultation and proprietary process integration are required. Indirect channels, involving authorized distributors, dealers, and specialized industrial supply houses, handle standard tool offerings and high-volume consumables. The trend towards e-commerce and digitalization is increasingly impacting the distribution segment, allowing faster order fulfillment and better tracking of tool usage data, especially for standardized HSS hobs. Effective distribution relies on maintaining localized inventories and offering rapid technical support, ensuring end-users can minimize production delays arising from tool breakage or wear, thereby solidifying the critical role of distribution efficiency in maintaining market competitiveness and customer loyalty.

Gear Cutting Tools Market Potential Customers

Potential customers for gear cutting tools are organizations engaged in the manufacture, repair, and maintenance of machinery requiring power transmission systems across diverse industrial sectors. The primary buying centers reside within large automotive OEMs and their Tier 1 suppliers, who demand vast quantities of highly specific tools for producing vehicle transmissions, differentials, and axle components. These customers prioritize tools that offer maximum throughput, precision (especially crucial for reducing noise in EV gearboxes), and long tool life, making cemented carbide and advanced-coated tools essential. Their purchasing decisions are heavily influenced by performance data, certification standards, and the ability of the tool provider to deliver consistent quality across global manufacturing footprints. The shift towards modular tool holding systems is also a key buying criterion, allowing for quicker changeovers and increased production flexibility.

Another major segment comprises manufacturers of heavy industrial machinery, including producers of construction equipment (excavators, loaders), agricultural machinery (tractors, harvesters), and capital goods (large machine tools, pumps, compressors). These customers require robust, durable tools capable of cutting large-diameter, coarse-pitch gears, often made from tougher, high-tensile materials. The emphasis here is on tool reliability and resistance to shock loads during heavy-duty cutting operations. Furthermore, the power generation sector, particularly wind turbine manufacturers, represents a significant growth area, demanding specialized large-format gear cutting tools (e.g., large module hobs) suitable for manufacturing the massive planetary gearboxes essential for energy conversion. Their purchasing cycle often involves long-term contracts based on supplier capability, technical competence, and compliance with stringent quality and durability standards inherent in the energy sector.

Niche but high-value customer segments include the aerospace and defense industries, where the demand is for exceptionally high-precision, fine-pitch gears made from exotic materials like titanium and nickel-based superalloys. These applications require Polycrystalline Diamond (PCD) tools or specialized ceramic inserts for achieving aerospace-grade tolerances (AGMA Quality Level Q12 or higher). Their volume is lower, but the price point per tool is significantly higher, driven by the specialized R&D and quality assurance requirements. Additionally, the maintenance, repair, and overhaul (MRO) operations within these various industries, alongside independent gear shops specializing in one-off or customized gear production, form a crucial secondary customer base, typically relying on distributors for standard HSS tooling and specialized reconditioning services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB (Seco Tools), Kennametal Inc., Star SU LLC, Gleason Corporation, Mitsubishi Heavy Industries, Liebherr Group, Tungaloy Corporation, OSG Corporation, LMT Tools, Robert Bosch GmbH (Dremel), FFG Werke GmbH (Pfauter), Sumitomo Electric Industries, Inc., Komech Technology Co., Ltd., Nachi-Fujikoshi Corp., EZ-Cut Tool Co., KAPP Werkzeugmaschinen GmbH, Bourn & Koch Inc., Helios Gear Products, Emuge-Franken Group, Beijing No.1 Machine Tool Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gear Cutting Tools Market Key Technology Landscape

The technological landscape of the Gear Cutting Tools Market is undergoing a rapid evolution, primarily driven by the imperatives of achieving higher cutting speeds, extending tool life, and meeting the extremely tight tolerances demanded by modern applications, especially in the e-mobility sector. One of the most significant advancements is the proliferation of advanced coating technologies, utilizing methods like Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) to apply multi-layer ceramic and metallic nitride coatings (e.g., TiCN, TiAlN, AlCrN). These coatings drastically improve the tool's thermal stability and hardness, enabling dry machining operations or the use of Minimum Quantity Lubrication (MQL), which significantly reduces environmental impact and coolant costs. Furthermore, specialized coatings are now engineered with self-lubricating properties to mitigate friction and reduce built-up edge formation, which is crucial when machining sticky materials like stainless steel and aerospace superalloys. The customization of these coatings based on the material being cut represents a major technological differentiator among market leaders, offering optimized solutions for specific client needs.

In terms of tool geometry and manufacturing, the transition from traditional high-speed steel (HSS) to premium cemented carbide has necessitated equally advanced manufacturing techniques, particularly five-axis precision CNC grinding. Manufacturers are leveraging advanced CAD/CAM software to design complex, optimized tool profiles that improve chip flow, reduce cutting forces, and enhance surface finish. A key technological focus is on the optimization of tooth root profiles and helix angles for gear hobs and shaper cutters, ensuring maximum material removal efficiency without inducing tool chipping or excessive vibration. Furthermore, the rise of continuous generating processes, specifically power skiving, has spurred the development of specialized skiving cutters that combine the speed of hobbing with the flexibility of shaping, enabling the efficient mass production of internal gears, a critical requirement for planetary gear sets used in EVs. This complex technology requires extremely precise manufacturing and highly rigid tool holding systems to perform effectively.

Digital integration and metrology represent another critical technology area. The incorporation of IoT sensors directly onto cutting tools or CNC machines allows for real-time monitoring of cutting forces, temperature, and wear patterns. This data feeds into AI-driven predictive maintenance systems, maximizing utilization and minimizing tool failure. Parallel to this, advancements in non-contact optical metrology, such as laser scanning and structured light projection, are essential for the quality control of the tools themselves, ensuring that newly manufactured or reconditioned tools adhere to micron-level specifications. The ability to quickly and accurately measure complex involute profiles and tool runout is fundamental to guaranteeing the final quality of the gears produced. This technological confluence of advanced materials, complex geometry design, and smart monitoring systems defines the competitive edge in the modern Gear Cutting Tools Market, pushing manufacturers toward offering full digital service packages alongside their physical products.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC, led by China, Japan, and South Korea, is the largest and fastest-growing market due to its position as the global hub for automotive manufacturing and the massive scale of industrial and infrastructure development. China’s aggressive push into Electric Vehicles (EVs) creates intense demand for specialized, high-precision gear cutting tools, particularly skiving and shaping cutters required for EV reduction gears. Japan and South Korea, renowned for their precision engineering heritage, dominate the high-end segments, focusing on advanced technologies and superior tool materials like PCD for ultra-precise machining. The rapid expansion of local manufacturing capabilities and the establishment of global supply chains within the region further solidify its market leadership.

- North American Stability and High-Value Demand: The North American market is characterized by stable demand driven by revitalized manufacturing sectors, defense expenditures, and significant investments in renewable energy infrastructure (wind and solar). Demand for gear cutting tools is concentrated in high-value applications, including complex aerospace components (requiring superalloy machining) and heavy-duty equipment. Manufacturers here prioritize tool reliability, extensive technical support, and the integration of digital manufacturing solutions (Industry 4.0), often favoring premium, customized tooling solutions over lower-cost mass-market alternatives. The push for domestic manufacturing resilience also supports high demand for advanced, efficient tooling.

- European Precision and Innovation Hub: Europe, anchored by Germany, Italy, and Switzerland, remains a crucial market known for its emphasis on high-quality, complex machinery, and luxury automotive manufacturing. This region drives innovation in tool finishing technologies, such as advanced grinding, honing, and polishing tools, required to meet stringent noise and efficiency standards. European manufacturers are frontrunners in adopting sustainable manufacturing practices, leading to higher demand for MQL and dry-cutting optimized tools. The strong presence of global machine tool builders in Europe ensures continuous internal demand for specialized gear cutting instruments and ongoing R&D collaboration.

- Latin America Emerging Potential: The Latin American market exhibits moderate growth, primarily centered in Brazil and Mexico, fueled by recovering automotive production and ongoing expansion in mining and agriculture sectors. Demand is generally focused on reliable, cost-effective HSS and carbide tools for medium-volume production, with an increasing adoption of precision tools as global OEMs expand their regional footprint. Market penetration is challenging due to economic volatility and reliance on imported capital goods, but localized partnerships and strong distribution channels are key to unlocking the region’s long-term potential in sectors like commercial vehicle manufacturing.

- Middle East and Africa (MEA) Infrastructure Growth: The MEA region demonstrates potential linked to massive energy and infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries. The market for gear cutting tools is heavily tied to maintenance, repair, and overhaul (MRO) activities in the oil and gas sector, coupled with emerging investments in non-oil industries and defense manufacturing. While smaller in overall volume, demand for large-format, robust tools required for heavy machinery and specialized energy applications is growing steadily, primarily sourced through international suppliers focused on quality and certification standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gear Cutting Tools Market.- Sandvik AB (Seco Tools)

- Kennametal Inc.

- Gleason Corporation

- Mitsubishi Heavy Industries

- Liebherr Group

- Star SU LLC

- Tungaloy Corporation

- OSG Corporation

- LMT Tools

- Robert Bosch GmbH (Dremel)

- FFG Werke GmbH (Pfauter)

- Sumitomo Electric Industries, Inc.

- Nachi-Fujikoshi Corp.

- Komech Technology Co., Ltd.

- EZ-Cut Tool Co.

- KAPP Werkzeugmaschinen GmbH

- Bourn & Koch Inc.

- Helios Gear Products

- Emuge-Franken Group

- Beijing No.1 Machine Tool Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Gear Cutting Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the increased demand for specialized carbide gear cutting tools?

The primary driver is the global automotive industry's rapid shift towards electric vehicles (EVs). EV transmissions require high-precision, low-noise gears made from increasingly difficult-to-machine materials, necessitating the superior heat resistance and speed capabilities of cemented carbide and advanced-coated tools over traditional High-Speed Steel (HSS).

How is the adoption of Industry 4.0 influencing gear cutting tool usage and management?

Industry 4.0 integrates IoT sensors and AI-driven predictive maintenance systems into the machining process. This optimization allows manufacturers to monitor tool wear in real-time, accurately forecast tool replacement cycles, minimize unplanned downtime, and optimize cutting parameters for maximum tool longevity and efficiency.

Which gear cutting process is witnessing the highest growth rate and why is it important for EV manufacturing?

Power skiving is experiencing the highest growth rate. This continuous generating process offers highly efficient and rapid production of internal gears, which are critical components in compact planetary gear sets used extensively in EV drivetrains. Skiving combines the speed of hobbing with the flexibility needed for internal gear features.

What are the key differences between High-Speed Steel (HSS) and Cemented Carbide tools in this market?

HSS tools are cost-effective and suitable for lower-speed, general-purpose machining of softer materials. Cemented carbide tools, while more expensive, offer significantly superior hardness, thermal stability, and wear resistance, enabling higher cutting speeds, reduced cycle times, and longer tool life, making them preferred for high-volume and hard material applications.

What challenges do manufacturers face regarding the sustainable use and disposal of gear cutting fluids and tools?

Manufacturers face environmental compliance challenges related to the disposal of contaminated cutting fluids and the recycling of specialized tools containing materials like tungsten carbide and cobalt. This drives the market towards MQL (Minimum Quantity Lubrication) and dry-cutting tools, minimizing fluid use and associated waste management costs and complexities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager