Gear Type Couplings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435625 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Gear Type Couplings Market Size

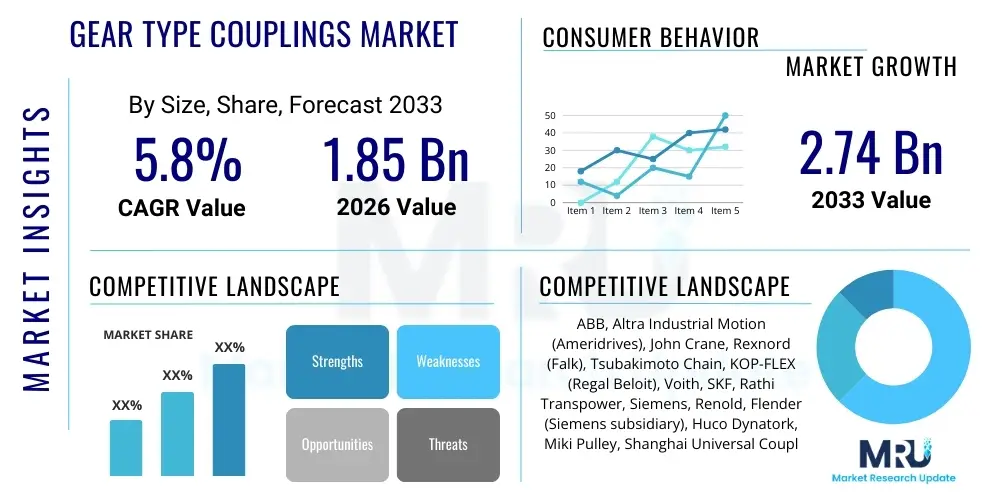

The Gear Type Couplings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.74 Billion by the end of the forecast period in 2033.

Gear Type Couplings Market introduction

Gear type couplings are mechanical components specifically designed to transmit torque between two shafts that are slightly misaligned, offering high torque density and reliability, particularly in heavy-duty applications. These couplings typically consist of two hubs with external gear teeth that mesh with internal gear teeth on a surrounding sleeve. Their fundamental design allows for angular, parallel, and axial misalignment compensation while ensuring consistent power transmission, making them indispensable across various industrial machinery. The inherent robustness of the gear design means they can handle significant shock loads and vibrations, distinguishing them from elastomeric or disc couplings in rigorous operational environments.

Major applications for gear type couplings span across critical sectors including oil and gas, power generation, mining, metal production, and heavy manufacturing. In the energy sector, they are crucial for connecting turbines to generators, managing high rotational speeds and continuous operation demands. Within the cement and mining industries, these couplings connect large mill drives and conveyor systems, where dust, high torque requirements, and potential shaft runout necessitate a durable and sealed connection mechanism. The continuous push for greater operational efficiency and reduced downtime in these capital-intensive industries directly fuels the demand for high-quality, long-lasting gear couplings capable of extended Mean Time Between Failures (MTBF).

The primary driving factors for the Gear Type Couplings Market include rapid industrialization in emerging economies, substantial investments in infrastructure projects globally, and the consistent demand for high-power density components in modernized industrial setups. Furthermore, the increasing need to replace aging coupling infrastructure with more advanced, maintenance-friendly designs—such as continuously lubricated or grease-packed versions with advanced sealing mechanisms—contributes significantly to market expansion. The key benefit of utilizing gear couplings lies in their exceptional torque-to-size ratio and their suitability for high-speed applications where minimal slip is tolerated, providing crucial mechanical integrity for critical rotating equipment.

Gear Type Couplings Market Executive Summary

Current business trends in the Gear Type Couplings Market emphasize product innovation focused on enhanced material science, improved sealing technology, and the development of couplings with higher operational flexibility, especially those designed for extreme temperature and corrosive environments. Manufacturers are increasingly integrating features that facilitate easier installation and maintenance, such as split covers and improved lubrication ports, addressing the industry's need for lower total cost of ownership (TCO). Furthermore, the consolidation of key players and strategic partnerships aimed at expanding global distribution networks and accessing specialized end-user markets are defining the competitive landscape, pushing towards standardization while catering to customized, heavy-duty requirements.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, primarily driven by massive infrastructure spending, rapid expansion of manufacturing capabilities in China and India, and significant investments in power generation capacity, including thermal and hydroelectric projects. North America and Europe maintain a mature market status, characterized by steady demand for replacement and upgrade parts in established oil and gas, chemical processing, and metals industries, focusing on compliance with stringent safety and environmental regulations. The Middle East and Africa (MEA) region shows robust growth linked to ongoing expansion in the oil and gas midstream and downstream sectors, demanding large, custom-engineered gear couplings for pipelines and refineries.

Segment trends indicate that flexible gear couplings, particularly the full-flex and flanged sleeve types, remain the most popular due to their superior ability to handle complex misalignments. By material, specialized alloy steel couplings are seeing increased adoption in highly critical applications where standard cast iron might fail under high stresses or corrosive attack. The end-user analysis confirms that the machinery manufacturing and power generation segments collectively account for the largest market share, requiring continuous, heavy-duty transmission components. The shift towards condition monitoring and predictive maintenance solutions is also influencing segment choices, driving demand for smart gear couplings equipped with sensor integration capabilities.

AI Impact Analysis on Gear Type Couplings Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Gear Type Couplings Market often center around themes of predictive maintenance, design optimization, and manufacturing efficiency. Key concerns revolve around how AI can extend coupling lifespan, detect early failure signatures through vibration analysis, and minimize unplanned downtime, which is exceptionally costly in industries like mining and power generation. Users are also interested in AI-driven design tools that can optimize tooth profile geometry and material selection for specific load conditions, minimizing material waste and maximizing torque density. The consensus expectation is that AI integration will shift the market focus from merely selling hardware to providing comprehensive, performance-based reliability services.

- AI facilitates predictive maintenance programs by analyzing sensor data (vibration, temperature) from couplings to forecast failure points, dramatically increasing operational lifespan.

- Generative Design algorithms, powered by AI, optimize coupling geometry (tooth profile, sleeve design) for weight reduction and maximum torque transmission efficiency.

- Supply Chain optimization uses AI to predict demand fluctuations for specific coupling types and manage raw material inventory, improving lead times.

- Automated Quality Control (AQC) utilizes machine vision and AI to inspect finished gear components for microscopic defects, ensuring higher quality standards than manual checks.

- AI-driven simulation tools allow end-users to model the effects of extreme misalignment and shock loads on coupling performance before deployment, reducing costly field failures.

DRO & Impact Forces Of Gear Type Couplings Market

The dynamics of the Gear Type Couplings Market are governed by powerful drivers, necessitating constraints, and lucrative opportunities that collectively exert significant impact forces on market trajectory. The primary driver is the modernization of industrial infrastructure globally, particularly in sectors such as cement, steel, and chemical processing, where obsolete machinery is being replaced or upgraded to handle higher capacity and greater efficiency, demanding robust power transmission solutions like gear couplings. Coupled with this, the rapid expansion of renewable energy generation infrastructure, especially large-scale wind turbine installations and hydroelectric plants, requires specialized, high-torque coupling solutions resistant to harsh environmental conditions, providing a sustained market stimulus.

Despite the strong drivers, the market faces restraints predominantly associated with the high maintenance requirement of traditional gear couplings, specifically the need for periodic lubrication, which can lead to contamination or grease leakage and subsequent failure if neglected. Furthermore, increased competition from advanced, low-maintenance alternatives, such as disc and grid couplings, which offer comparable torque density without the lubrication dependency, poses a substantial threat. The high initial cost and complex installation procedures associated with large, engineered gear couplings, particularly in comparison to simpler elastomer couplings, also serve as a barrier to adoption in budget-sensitive or less demanding applications.

Significant opportunities exist in the development and proliferation of sealed, permanently lubricated gear couplings, which address the primary maintenance restraint and appeal to industries focused on reducing operational expenditure (OpEx). The push towards smart manufacturing and Industrial Internet of Things (IIoT) integration presents another avenue for growth, enabling manufacturers to offer sensor-equipped couplings that provide real-time performance data and diagnostic capabilities. These opportunities, driven by technological evolution and demand for reliability, combine with the impact forces of volatile raw material prices (steel and alloys) and geopolitical instability affecting construction and infrastructure spending, ultimately shaping the market's long-term competitive dynamics and investment cycles.

Segmentation Analysis

The Gear Type Couplings Market is comprehensively segmented based on product type, material, application, and end-user industry, enabling a detailed assessment of demand patterns across diverse industrial landscapes. Product type segmentation distinguishes between flexible, rigid, and specialized high-speed couplings, reflecting variations in misalignment compensation capabilities and torque handling. The material segmentation focuses on commonly used alloys, primarily carbon steel, alloy steel, and specialized non-corrosive materials. This structured segmentation allows market participants to tailor their offerings to specific operational requirements, ranging from heavy-duty mining equipment requiring extreme robustness to precision machinery demanding high rotational accuracy.

- By Product Type:

- Flexible Gear Couplings (Flanged Sleeve, Continuous Sleeve)

- Rigid Gear Couplings

- High-Speed Gear Couplings

- Spacer Gear Couplings

- By Material:

- Steel (Carbon Steel, Alloy Steel)

- Cast Iron

- Others (e.g., Composite Materials for specific applications)

- By Lubrication Type:

- Grease Lubricated

- Oil Lubricated (Continuous Flow)

- By Application:

- High Torque Applications

- High Speed Applications

- Vertical Applications

- By End-User Industry:

- Power Generation (Turbines, Compressors)

- Oil and Gas (Pumps, Mixers, Refineries)

- Mining, Cement, and Metallurgy (Mill Drives, Conveyors)

- Chemical and Petrochemical

- Water and Wastewater Treatment

- Heavy Machinery Manufacturing

Value Chain Analysis For Gear Type Couplings Market

The value chain for the Gear Type Couplings Market begins with the upstream segment, encompassing the sourcing and processing of critical raw materials, primarily specialized high-strength steel alloys, castings, and forging inputs. Key upstream activities involve meticulous quality control and strategic procurement to manage the high volatility associated with metal commodity prices, which directly impacts the manufacturing cost of gear coupling components. Suppliers of precision machining services and specialized heat treatment facilities also constitute a crucial part of the upstream chain, as the performance and longevity of gear couplings rely heavily on the precise fabrication and material hardening processes applied to the gear teeth and sleeves.

The core manufacturing and assembly stage represents the midstream segment, where raw materials are transformed into finished gear couplings through rigorous processes, including CNC machining, hobbing, grinding, and dynamic balancing. Manufacturers add value by developing proprietary gear tooth designs (e.g., crowned gearing) that optimize torque transmission and misalignment handling. This stage also involves the integration of advanced sealing technologies and the application of specialized coatings to enhance durability and corrosion resistance. Quality assurance, compliance with international standards (such as ISO and API specifications), and product certification are essential value-adding activities performed within the midstream segment.

Downstream activities involve distribution, sales, installation, and aftermarket service. Distribution channels are bifurcated into direct sales for large, custom-engineered couplings required by EPC contractors and OEMs (Original Equipment Manufacturers), and indirect sales through a robust network of industrial distributors, specialized mechanical component suppliers, and maintenance, repair, and overhaul (MRO) providers for smaller, standard coupling units. Post-sale support, including technical consultations, on-site alignment services, and the provision of replacement parts, generates significant recurring revenue. The effectiveness of the indirect channel, particularly regional distributors with strong relationships with local end-users, is critical for market penetration and timely delivery of replacement components.

Gear Type Couplings Market Potential Customers

Potential customers for gear type couplings are concentrated in capital-intensive industries characterized by continuous operation, high power transmission requirements, and where equipment failure results in massive production losses. The primary end-users are Original Equipment Manufacturers (OEMs) who integrate couplings into complex machinery, such as industrial gas and steam turbines, large centrifugal compressors, heavy-duty pumps, and massive gearboxes used in applications like rolling mills and mine hoist systems. These institutional buyers prioritize product reliability, adherence to precise dimensional tolerances, and long-term technical support from the coupling supplier, often locking into multi-year supply agreements based on performance metrics.

Another significant segment of buyers comprises Engineering, Procurement, and Construction (EPC) firms involved in setting up new industrial facilities, power plants, or expanding refinery complexes. EPCs purchase gear couplings based on project specifications, focusing heavily on lead time, documentation compliance, and the supplier's capacity to deliver certified products across multiple units simultaneously. Their purchasing decisions are primarily driven by minimizing project risk and ensuring seamless integration with other plant components. The specification and selection process here is highly detailed, relying on specialized application engineers to match coupling characteristics with specific duty cycles and environmental conditions.

The third major customer group includes Maintenance, Repair, and Overhaul (MRO) departments and industrial service providers who purchase replacement and upgrade couplings. For MRO buyers, the critical purchasing criteria revolve around immediate availability (reducing asset downtime), compatibility with existing machinery (drop-in replacements), and cost-effectiveness. The trend toward adopting advanced condition monitoring systems in industrial plants also means these buyers are increasingly seeking smart couplings or solutions that integrate easily with their existing diagnostic infrastructure, emphasizing longevity and reduced operational complexity over the lowest initial purchase price.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.74 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Altra Industrial Motion (Ameridrives), John Crane, Rexnord (Falk), Tsubakimoto Chain, KOP-FLEX (Regal Beloit), Voith, SKF, Rathi Transpower, Siemens, Renold, Flender (Siemens subsidiary), Huco Dynatork, Miki Pulley, Shanghai Universal Coupling |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gear Type Couplings Market Key Technology Landscape

The technological landscape of the Gear Type Couplings Market is characterized by a strong emphasis on improving torque capacity within smaller envelopes, enhancing wear resistance, and simplifying maintenance procedures through advanced engineering design. A key technological trend involves the optimization of gear tooth profiles, specifically utilizing crowned or barreled tooth designs. This advanced geometry maximizes the area of contact under load while minimizing stress concentrations at the tooth edges, thereby accommodating greater angular misalignment without inducing excessive wear or localized tooth failure. This optimization allows couplings to transmit significantly higher torques than traditional straight-cut gear designs of comparable size, a critical advantage in power-dense applications like marine propulsion and turbine drives.

Material science and surface treatment technologies are also pivotal. The shift towards higher strength alloy steels (such as 42CrMo4 or equivalent) coupled with specialized heat treatment processes like nitriding or carburization substantially increases the surface hardness and core toughness of the gear components. This enhancement directly translates to improved resistance against abrasive wear, pitting, and fatigue, particularly vital in environments exposed to extreme shock loading or contaminated operating conditions like those found in the mining and cement industries. Furthermore, the development of specialized, synthetic, high-performance greases and lubricants designed to withstand high shear rates and temperature fluctuations is essential for maximizing the lifespan of continuously lubricated gear couplings, reducing the frequency of maintenance intervention.

The convergence of mechanical components with smart technology is a transformative element in the current landscape. Modern gear couplings are increasingly engineered for sensor integration, allowing for the non-intrusive monitoring of key operational parameters such as vibration, temperature, and torsional loading. Technologies like embedded MEMS sensors and wireless communication modules facilitate real-time data transmission to condition monitoring platforms. This allows for precise calculation of coupling health and remaining useful life, moving away from time-based maintenance to condition-based predictive maintenance. The adoption of these 'smart couplings' is becoming standard practice in critical, high-speed applications where catastrophic failure must be prevented through proactive diagnostic capabilities.

Regional Highlights

The global demand for Gear Type Couplings exhibits distinct regional patterns reflecting varying levels of industrial maturity, infrastructure investment cycles, and regulatory compliance requirements. Asia Pacific (APAC) leads the market in both consumption and production capacity, driven by high population density, rapid urbanization, and extensive governmental investment in power grids, transportation infrastructure, and heavy manufacturing sectors across nations like China, India, and Southeast Asian countries. The focus in APAC is often on large-volume, cost-effective solutions for new installations, coupled with increasing demand for high-quality, high-reliability couplings as industrial standards improve.

North America and Europe represent mature, high-value markets. Demand in these regions is less characterized by new factory construction and more by the replacement, retrofit, and optimization of existing capital equipment in established industries, particularly oil and gas (refineries, petrochemicals), aerospace, and heavy chemical processing. European demand is highly influenced by stringent safety and environmental standards, driving uptake of advanced, leak-proof, and high-efficiency coupling designs. North America maintains a strong requirement for large, custom-engineered gear couplings that adhere to specifications laid out by organizations like the American Petroleum Institute (API 671 standard for special purpose couplings).

Latin America (LATAM) and the Middle East & Africa (MEA) offer substantial growth potential. LATAM's growth is tied to the recovery and expansion of mining operations and the agricultural processing sector, requiring robust, reliable couplings to handle tough operating conditions. MEA growth is intrinsically linked to massive ongoing oil and gas exploration and production projects, alongside significant planned expansions in power generation capacity. The procurement requirements in MEA are often project-based and driven by global EPC contractors, favoring internationally certified suppliers capable of providing comprehensive technical support in challenging environments.

- Asia Pacific (APAC): Dominates market growth fueled by industrial expansion, particularly in China and India, focusing on cement, steel, and power infrastructure projects.

- North America: Mature market characterized by high-value sales, focusing on replacement cycles and compliance with API standards in the oil, gas, and petrochemical sectors.

- Europe: Driven by technological upgrades and regulatory pressure, strong demand for high-precision, low-vibration couplings for sophisticated manufacturing and renewable energy systems.

- Middle East & Africa (MEA): High growth potential stemming from major investments in refining, LNG projects, and pipeline infrastructure, requiring large, heavy-duty gear couplings.

- Latin America (LATAM): Growth centered on mining activities, heavy agricultural machinery, and local power generation projects, prioritizing durability and ease of maintenance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gear Type Couplings Market.- ABB Ltd.

- Altra Industrial Motion Corp. (Ameridrives Couplings)

- John Crane (A Smiths Group Company)

- Rexnord Corporation (Falk Couplings)

- Tsubakimoto Chain Co.

- Regal Beloit Corporation (KOP-FLEX)

- Voith GmbH & Co. KGaA

- SKF Group

- Rathi Transpower Pvt. Ltd.

- Siemens AG

- Renold plc

- Flender GmbH (A Siemens Company)

- Huco Dynatork

- Miki Pulley Co., Ltd.

- Shanghai Universal Coupling Co., Ltd.

- TB Wood's Incorporated

- Stromag (A Regal Beloit brand)

- KTR Systems GmbH

- Lovejoy Inc.

- Fenner Group

Frequently Asked Questions

Analyze common user questions about the Gear Type Couplings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors determine the selection of a flexible gear coupling over other coupling types?

Gear couplings are selected primarily for applications requiring the transmission of very high torque in a compact size, superior durability under shock loads, and reliable compensation for angular and parallel shaft misalignment. Unlike elastomeric couplings, they maintain high torsional stiffness, making them ideal for critical, heavy-duty machinery where consistent speed and power delivery are paramount, such as large compressors and mill drives.

What are the typical maintenance challenges associated with gear type couplings?

The main challenge is lubrication management. Traditional gear couplings require periodic relubrication (grease or oil) to prevent gear tooth wear. Failure to maintain proper lubrication schedules or the use of contaminated lubricants leads to rapid wear, pitting, and ultimately coupling failure. Modern solutions focus on sealed-for-life designs or advanced synthetic greases to mitigate these maintenance requirements.

How does the material composition impact the performance and lifespan of gear couplings?

Material composition, typically high-strength alloy or forged steel, directly determines the coupling's torque density and resistance to fatigue and shock loading. Specialized heat treatments like carburizing increase surface hardness, enhancing wear resistance. Selecting the correct material is crucial for couplings operating in high-temperature, corrosive, or heavy-impact environments to ensure required service life and safety margins.

Which end-user industry is currently the largest consumer of gear type couplings?

The Power Generation and the Mining, Cement, and Metallurgy industries collectively represent the largest end-users. These sectors rely heavily on large rotating machinery (turbines, generators, ball mills) that demand couplings capable of handling continuous, extremely high torque loads and surviving severe operating environments, making robust gear couplings the preferred choice for critical drives.

How is the integration of IIoT affecting the future design of gear couplings?

IIoT integration is driving the shift towards 'smart couplings' equipped with integrated sensors for real-time monitoring of vibration and temperature. This technological advancement allows industrial operators to implement sophisticated predictive maintenance strategies, dramatically reducing unplanned downtime and optimizing coupling performance based on actual operating conditions rather than fixed time schedules.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager