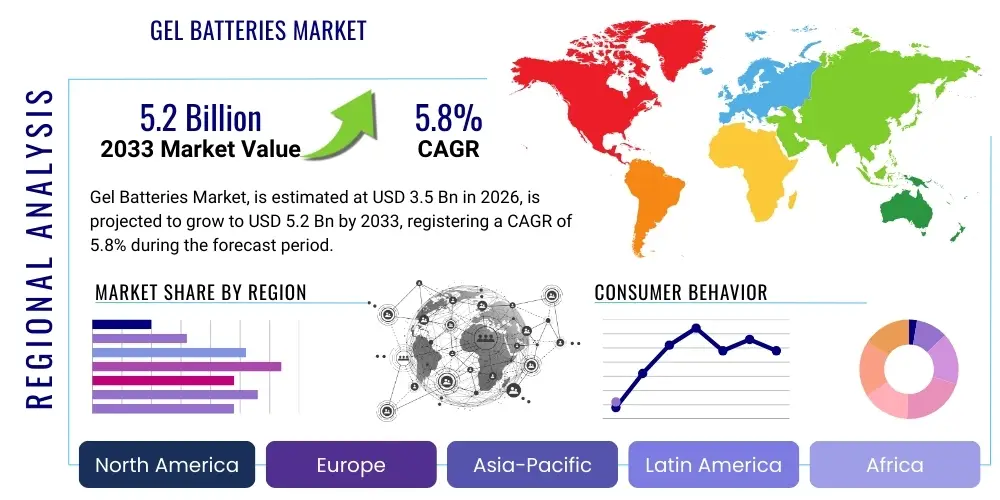

Gel Batteries Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438333 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Gel Batteries Market Size

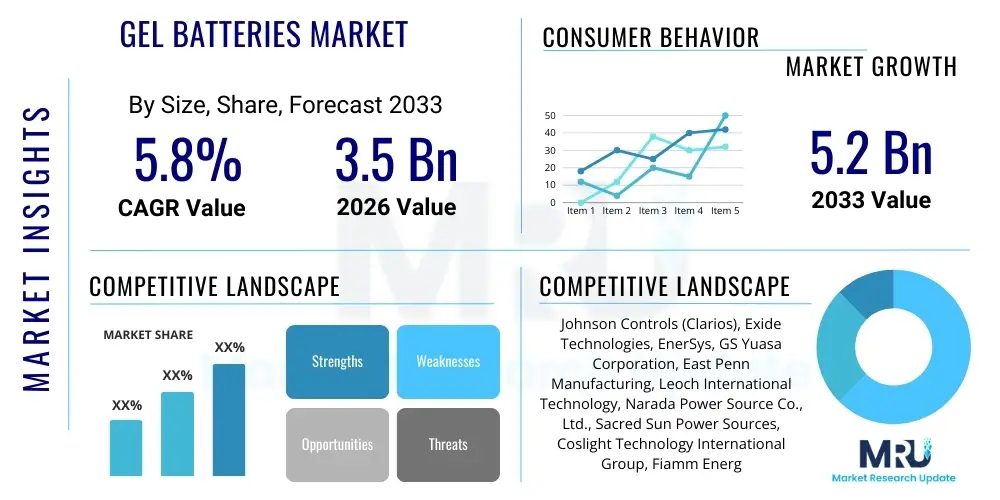

The Gel Batteries Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033. This steady growth trajectory is primarily underpinned by increasing global investments in resilient energy storage solutions for telecommunications infrastructure, renewable energy systems, and critical uninterrupted power supply (UPS) applications, particularly in regions prone to grid instability. The market size reflects the specialized nature of gel technology, which offers superior deep-cycle performance and enhanced resistance to extreme temperatures compared to traditional flooded lead-acid variants, thereby justifying its higher initial cost in mission-critical applications.

Gel Batteries Market introduction

The Gel Batteries Market centers on Valve Regulated Lead Acid (VRLA) batteries that utilize a thixotropic gel electrolyte, created by mixing sulfuric acid with fumed silica. This unique composition immobilizes the electrolyte, preventing stratification, reducing water loss, and minimizing the risk of thermal runaway, making them highly suitable for deep-cycle applications and environments with high ambient temperatures. Gel batteries are essential components in various demanding sectors, including standby power for telecom towers, large-scale uninterruptible power supplies (UPS) protecting data centers and medical facilities, and robust storage solutions for off-grid and grid-tied renewable energy systems such as solar and wind farms.

Key applications driving the market demand include remote communication systems where maintenance is difficult, marine and recreational vehicle (RV) power due to their spill-proof design, and electric mobility solutions requiring reliable deep discharge capabilities. The primary benefits of gel technology encompass extended cycle life, exceptional vibration resistance, zero maintenance requirements, and safety due to minimal gassing and being completely sealed. These inherent advantages position gel batteries as a durable and reliable option, particularly where operational longevity and safety compliance are paramount, even though they face intense competition from advanced lithium-ion chemistries in certain high-energy-density applications.

Driving factors for sustained market expansion include aggressive government initiatives supporting rural electrification, which relies heavily on off-grid solar solutions powered by dependable storage; the pervasive expansion of 5G and fiber-optic networks requiring robust standby power; and the increasing need for grid stabilization and peak shaving in developed economies. Furthermore, the inherent longevity and the stable global supply chain associated with lead-acid technology contribute significantly to the market’s stability, providing a reliable alternative to newer, potentially volatile supply chains associated with other battery types, thereby ensuring continuous adoption in established industrial segments.

Gel Batteries Market Executive Summary

The global Gel Batteries Market is characterized by resilient demand driven by the proliferation of decentralized power generation, mandatory standby power requirements across critical infrastructure, and continuous technological refinements extending cycle life and performance. Business trends highlight a strategic focus among manufacturers on improving lead alloy purity and optimizing silica particle size distribution to enhance charge acceptance and deep discharge recovery, effectively bridging the performance gap with lithium alternatives in specific power-to-weight ratio applications. Consolidation within the manufacturing sector is observed, aimed at leveraging economies of scale and securing raw material supply chains, especially lead and specialized silica, ensuring cost competitiveness in major industrial procurement contracts, while simultaneously addressing environmental concerns related to lead recycling.

Regionally, Asia Pacific (APAC) dominates the market, fueled by massive infrastructure projects, rapid urbanization, and extensive deployment of telecommunications and renewable energy assets, particularly in China and India, which serve as both major consumption centers and global manufacturing hubs for VRLA technology. Europe and North America maintain significant market share, driven primarily by stringent regulatory standards for safety (e.g., in medical devices and data centers) and the persistent need for reliable UPS systems in an increasingly digitized economy. The regional dynamics are also influenced by evolving recycling mandates, which favor lead-acid batteries due to their established, high-efficiency recovery processes, supporting the circular economy principles that are central to Western industrial policies.

Segmentation trends indicate that the 12V segment holds the largest volume share, predominantly used in small to medium-sized UPS units and remote lighting systems, while the 2V segment shows robust growth, being favored for large-scale, long-duration energy storage systems (ESS) requiring maximum longevity and modularity. Applications in the renewable energy sector are exhibiting the fastest growth due to the intermittency challenges inherent in solar and wind power, positioning gel batteries as a reliable, cost-effective intermediate solution for balancing generation and demand. Furthermore, deep cycle gel batteries are gaining traction in leisure and mobility segments (e.g., golf carts, forklifts) where consistent, extended discharge cycles are essential for operational continuity and productivity.

AI Impact Analysis on Gel Batteries Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Gel Batteries Market frequently revolve around optimizing battery performance, extending lifespan, predicting failure, and enhancing manufacturing efficiency. Common themes include how AI can manage complex energy storage systems (ESS) incorporating gel batteries, whether AI-driven predictive maintenance can reduce total cost of ownership (TCO) for telecom operators, and how automation and machine learning (ML) are being utilized in the highly standardized production processes of VRLA technology. Users are keen to understand if AI can compensate for the performance limitations of gel batteries relative to newer chemistries by optimizing their operational profile and integration within hybrid energy systems, viewing AI primarily as an operational intelligence tool rather than a replacement for material science advancements.

The application of AI and ML models significantly influences the operational phase of gel batteries by enabling highly sophisticated Battery Management Systems (BMS) that leverage historical data, real-time usage patterns, and environmental conditions to maximize battery longevity. AI algorithms can precisely control charging and discharging cycles, preventing the deep over-discharging or over-charging that typically degrades gel electrolyte performance and reduces capacity over time. This capability is critical in remote solar applications and complex grid-tie systems where inconsistent power flows necessitate dynamic state-of-charge (SOC) management, ensuring the battery operates within its optimal electrochemical window, thereby translating directly into measurable performance gains and extended asset life.

In the manufacturing sector, AI integration enhances quality control and process repeatability, crucial for minimizing variations in internal resistance and capacity across large batches of batteries, which is vital for system integration consistency. Predictive analytics deployed on the assembly line identify potential defects in sealing, gelling consistency, or plate formation early, reducing scrap rates and improving overall product reliability before deployment. Furthermore, AI-powered demand forecasting optimizes inventory management for essential raw materials like lead, sulfuric acid, and specialized silica, allowing manufacturers to respond rapidly to fluctuations in market demand from key sectors such as telecom expansion and government ESS tenders, thus streamlining the entire supply chain workflow.

- AI-driven optimization of charge/discharge cycles maximizes the functional lifespan of gel batteries in demanding ESS environments.

- Machine learning models predict potential cell failure based on voltage, temperature, and impedance data, enabling proactive maintenance.

- AI enhances manufacturing precision, ensuring uniform gel consistency and reducing variability in internal resistance.

- Predictive analytics optimize raw material procurement and inventory management for lead, silicon dioxide, and acid components.

- AI facilitates the seamless integration of gel batteries within complex hybrid energy storage architectures, managing power flow alongside renewables and generators.

DRO & Impact Forces Of Gel Batteries Market

The dynamics of the Gel Batteries Market are shaped by powerful synergistic and opposing forces encompassing robust drivers, structural restraints, strategic opportunities, and immediate impact variables that dictate market velocity and strategic investment decisions. The key drivers are centered around the global mandate for critical power reliability, especially the burgeoning demand for uninterruptible power supply (UPS) solutions in burgeoning data centers and the aggressive global rollout of 5G infrastructure, both requiring stable, high-reliability standby power. Simultaneously, the restraints primarily stem from intense competition from alternative, higher-energy-density technologies, particularly lithium-ion batteries, which offer a compelling value proposition in space-constrained and weight-sensitive applications, forcing gel battery manufacturers to continuously innovate on TCO and longevity.

Opportunities for growth are concentrated in emerging economies and niche applications where the inherent characteristics of gel technology provide distinct advantages, such as remote off-grid solar deployments, specialized marine applications requiring shock resistance, and specific industrial handling equipment (e.g., forklifts) where deep discharge stability is non-negotiable and regulatory adherence to established lead-acid recycling infrastructure is a bonus. The interplay of these factors creates significant impact forces: the increasing cost volatility of lead, driven by environmental regulation and mining output, directly affects manufacturing margins, while the global push for renewable energy integration provides a sustained, high-volume demand floor for reliable, long-duration storage capacity, thereby stabilizing market outlook despite competitive pressures.

Strategic maneuvering within the market focuses heavily on technological enhancements, specifically maximizing recombination efficiency and minimizing gassing to further extend battery life and reduce maintenance costs, targeting a lower lifetime TCO relative to lithium-ion solutions, thereby preserving market share in traditional industrial sectors. The impact of regulatory policy, especially concerning mandatory recycling quotas and the establishment of battery safety standards in key consuming regions, also acts as a critical force multiplier, intrinsically favoring the highly recyclable lead-acid chemistry. Manufacturers are strategically partnering with solar integrators and telecom providers to secure long-term supply contracts, locking in demand and leveraging the established logistical efficiencies of the lead-acid supply chain to maintain market resilience against disruptive technologies.

Segmentation Analysis

The Gel Batteries Market is meticulously segmented across multiple dimensions, including voltage rating, application type, and design type, reflecting the diverse end-user requirements for power output, cycle life, and operational environment. This segmentation is crucial for manufacturers to tailor product specifications and for market participants to accurately gauge demand pockets. The voltage segmentation (e.g., 2V, 6V, 12V) directly correlates with system size, with 2V cells dominating large-scale ESS projects due to their modularity and longevity, while 12V batteries remain the workhorse for smaller UPS units and specialized vehicle applications. The application segmentation distinguishes between sectors demanding standby power (Telecom, UPS, Grid Support) and sectors requiring deep cycling (Renewables, Marine, Mobility), each imposing specific design constraints on plate thickness and electrolyte consistency.

A key focus within the segmentation strategy is the differentiation between deep cycle and standard gel batteries; deep cycle variants, optimized for repeated discharge and recharge cycles, command a premium and are indispensable in off-grid solar and electric vehicle markets, whereas standard gel batteries are preferred for standby applications where they primarily remain fully charged. Geographic segmentation further highlights the varying adoption rates, with APAC dominating consumption due to rapid infrastructure growth and extensive off-grid penetration, while North America and Europe prioritize high-reliability standby power for sophisticated data centers and healthcare infrastructure. Understanding these layered segments allows suppliers to optimize production capacity and distribution networks to effectively meet global demand heterogeneity.

The inherent performance characteristics—such as superior tolerance to partial state-of-charge (PSoC) operation and high resistance to temperature fluctuations—drive the persistent demand within these specific segments, distinguishing gel batteries from both flooded and AGM technologies. Manufacturers often invest heavily in R&D tailored to niche segments, for example, developing high-temperature gel formulations specifically for telecom shelters in equatorial regions, or ultra-long life 2V cells designed for 20+ year service intervals required by utilities for substation backup power. This targeted segmentation strategy ensures that gel batteries maintain a strong competitive foothold where safety, resilience, and operational longevity outweigh energy density concerns.

- By Voltage:

- 2V

- 6V

- 12V

- Other Voltages (24V, 48V Systems)

- By Application:

- Telecom & Communication Systems

- Uninterruptible Power Supply (UPS)

- Renewable Energy Storage (Solar/Wind)

- Electric Mobility (Golf Carts, Forklifts)

- Marine & Recreational Vehicles (RV)

- Medical Devices & Healthcare

- Other Industrial Applications

- By Design Type:

- Standard Gel Batteries

- Deep Cycle Gel Batteries

- By Capacity Rating:

- Less than 100 Ah

- 100 Ah to 200 Ah

- Above 200 Ah

Value Chain Analysis For Gel Batteries Market

The Gel Batteries Market value chain is a complex, capital-intensive structure starting with the procurement of critical raw materials, extending through specialized manufacturing processes, and concluding with sophisticated distribution and end-user integration. Upstream analysis focuses predominantly on lead mining, refining, and recycling, as lead constitutes the primary weight and cost component of the battery. The stability of lead prices and the efficiency of secondary lead recovery (recycling) significantly influence manufacturing costs. Other vital upstream inputs include specialized high-purity sulfuric acid, fumed silica (responsible for the gelling agent), and proprietary lead alloy additives that enhance mechanical strength and corrosion resistance of the grids. Suppliers of these materials operate within consolidated markets, often necessitating long-term supply agreements to ensure cost stability and material quality consistency for battery manufacturers.

The midstream phase involves the core manufacturing process, which is highly sensitive to quality control, encompassing plate pasting, curing, cell assembly, and the critical step of electrolyte gelling. Manufacturers differentiate themselves through process optimization, focusing on proprietary plate designs (e.g., tubular plates for deep cycle) and precise control over the gelling reaction to ensure uniform electrolyte distribution and stability. Downstream analysis is concerned with the efficient movement of heavy, volatile products to the point of use. Distribution channels are bifurcated into Original Equipment Manufacturer (OEM) sales, where batteries are integrated directly into systems like UPS units, telecom rectifiers, or electric forklifts, and the aftermarket segment, which caters to replacement demand and smaller retail purchases for marine or RV use.

Direct distribution often dominates large industrial and utility sales, facilitating technical support and integration services critical for high-capacity systems. Indirect distribution relies on a network of specialized industrial distributors, wholesale electrical suppliers, and niche retail channels to reach diverse end-users globally. The high cost of shipping due to battery weight, combined with specific hazardous materials handling requirements, necessitates a well-managed logistics network capable of ensuring product safety and timely delivery. The efficiency of the lead recycling loop is also integral to the value chain, as it provides a sustainable, cost-effective source of secondary lead, which is environmentally preferable and economically advantageous for manufacturers operating under stringent environmental regulations, thereby closing the loop and reducing reliance on primary lead mining.

Gel Batteries Market Potential Customers

The potential customer base for the Gel Batteries Market is highly diverse, spanning critical infrastructure, industrial logistics, and consumer leisure sectors, primarily unified by the requirement for reliable, deep-cycling, and low-maintenance power solutions. Major institutional buyers include telecommunication service providers (Telcos) who require highly robust standby power for remote base transceiver stations (BTS) and centralized switching offices, where environmental robustness and minimal site visits are paramount. Data center operators and large corporations heavily investing in IT infrastructure represent another core customer segment, relying on gel-based Uninterruptible Power Supplies (UPS) for instantaneous backup to prevent data loss and system downtime, favoring gel for its sealed, non-gassing characteristics suitable for controlled indoor environments.

The expanding renewable energy sector, encompassing utility-scale solar farms and residential off-grid installations, constitutes a rapidly growing pool of buyers. These customers necessitate storage solutions capable of handling irregular charging inputs and deep daily discharge cycles over many years, an area where deep-cycle gel batteries excel due to their superior resistance to stratification and capacity retention under long-term partial state-of-charge conditions. Furthermore, the industrial logistics and material handling sector, specifically operators of electric forklifts, pallet jacks, and automated guided vehicles (AGVs), represent high-volume buyers seeking durable batteries that can withstand intense operational cycling, vibrations, and high utilization rates characteristic of warehouse environments.

Niche customer segments include marine vessel operators (boats and yachts) and recreational vehicle (RV) users, who value the spill-proof nature and maintenance-free operation of gel batteries, ensuring safety and convenience during long trips or specialized operations. Government and military entities also remain significant buyers, utilizing gel technology in tactical communication equipment, remote surveillance systems, and critical emergency lighting systems where reliability under harsh, varied climatic conditions is a non-negotiable prerequisite. The enduring preference across all these buyer groups is driven by the Gel battery’s established reputation for safety, reliability, and low total cost of ownership in applications prioritizing longevity over peak energy density performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Controls (Clarios), Exide Technologies, EnerSys, GS Yuasa Corporation, East Penn Manufacturing, Leoch International Technology, Narada Power Source Co., Ltd., Sacred Sun Power Sources, Coslight Technology International Group, Fiamm Energy Technology, NorthStar Battery (EnerSys), C&D Technologies, Ritar Power Corporation, Hoppecke Batterien, HBL Power Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gel Batteries Market Key Technology Landscape

The technology landscape for the Gel Batteries Market, while rooted in the established lead-acid platform, continues to evolve through subtle but critical advancements focused on enhancing cycle life, improving thermal management, and optimizing charge efficiency. A major area of focus is the refinement of lead alloy composition, transitioning towards high-ppurity, low-antimony, or pure lead-calcium alloys to minimize gassing, reduce water consumption, and decrease self-discharge rates. These metallurgical improvements directly address the primary limitations of traditional lead-acid batteries, specifically targeting the durability and longevity required for deep-cycle applications in remote and often harsh environments, ensuring that the batteries remain truly maintenance-free throughout their projected service life.

Another crucial technological development involves the continuous optimization of the fumed silica additive, specifically controlling particle size and surface area to achieve a perfectly homogeneous and stable thixotropic gel structure. This structural perfection prevents acid stratification—a common failure mode in flooded batteries—and ensures uniform current distribution across the plates, which is fundamental to achieving high deep-cycle counts. Coupled with this is the use of specialized carbon additives (e.g., carbon black or graphene derivatives) in the negative plate active material. These additives significantly improve the battery’s ability to accept charge rapidly and mitigate the sulfation that typically occurs under partial state-of-charge (PSoC) conditions, substantially enhancing performance in solar and hybrid systems where PSoC operation is frequent.

Furthermore, significant focus is placed on enhancing the gassing recombination efficiency within the Valve Regulated Lead Acid (VRLA) architecture. Advanced ventilation and sealing designs ensure that the oxygen generated at the positive plate is effectively recombined with hydrogen at the negative plate to reform water, thus minimizing electrolyte loss and extending operational life. These technical refinements are often integrated with increasingly sophisticated proprietary Battery Management Systems (BMS) for larger installations, although unlike lithium-ion, gel BMS primarily focus on monitoring state-of-health (SOH), temperature equalization, and charge voltage regulation rather than complex cell balancing, leveraging the inherent robustness and uniformity of the VRLA cell structure for simpler system management.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, manufacturing footprint, and competitive landscape of the Gel Batteries Market, reflecting varying levels of infrastructural development, environmental regulations, and energy policy. Asia Pacific (APAC) stands out as the undisputed leader in both production and consumption, driven by massive domestic markets in China and India, coupled with rapid infrastructure deployment across Southeast Asia. The intense build-out of 4G and 5G telecom networks necessitates vast quantities of reliable standby power, predominantly utilizing gel technology due to its superior performance in hot climates. Furthermore, ambitious government schemes promoting solar energy and rural electrification in the region drive high demand for deep-cycle storage solutions.

North America and Europe represent mature markets characterized by replacement demand and strict regulatory environments favoring high-quality, long-life products. In North America, demand is heavily concentrated in critical infrastructure (data centers, telecom central offices, and utility substations) where safety certifications and compliance with seismic and thermal standards are mandatory. The European market sees strong uptake driven by stringent environmental regulations that favor the high recyclability of lead-acid batteries, alongside demand from specialized industrial segments and the growing electric forklift and material handling sector, particularly in Germany and the Benelux countries. Both regions prioritize the Total Cost of Ownership (TCO) and rely on established distribution channels for premium brands.

The Middle East and Africa (MEA) and Latin America regions exhibit high growth potential, primarily fueled by energy access initiatives and the proliferation of remote, off-grid power solutions. High temperatures in MEA make gel technology particularly advantageous due to its thermal stability and low maintenance requirement, reducing operational expenditure in remote installations. Latin America’s market growth is linked to mining operations, oil and gas infrastructure, and increasing investment in telecom backbone networks. While these regions often prioritize cost-effectiveness, the need for robust batteries capable of surviving grid intermittency and extreme conditions strongly favors the reliability offered by quality gel battery manufacturers, positioning them favorably against lower-cost, less durable alternatives.

- Asia Pacific (APAC): Dominates global manufacturing and consumption; characterized by high demand from telecom (5G rollout) and renewable energy integration projects (solar off-grid). Key players benefit from proximity to raw material supply and large domestic markets in China and India.

- North America: Focus on high-reliability standby power for mission-critical applications (data centers, hospitals, utilities); replacement market driven by strict regulatory standards and emphasis on long asset life.

- Europe: Driven by strong industrial applications, strict recycling mandates, and specialty electric vehicle (forklift, mobility scooter) sectors; high adoption of premium-grade, long-duration 2V cells for grid support.

- Latin America (LATAM): Emerging demand tied to infrastructural investment, particularly in remote telecom sites and utility backup; cost sensitivity is balanced by a strong need for rugged, reliable power solutions.

- Middle East & Africa (MEA): Rapid growth due to rural electrification projects and expansion of telecom infrastructure in challenging thermal environments; gel technology is preferred for its temperature tolerance and low maintenance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gel Batteries Market.- Johnson Controls (Clarios)

- Exide Technologies

- EnerSys

- GS Yuasa Corporation

- East Penn Manufacturing

- Leoch International Technology

- Narada Power Source Co., Ltd.

- Sacred Sun Power Sources

- Coslight Technology International Group

- Fiamm Energy Technology

- NorthStar Battery (EnerSys)

- C&D Technologies

- Ritar Power Corporation

- Hoppecke Batterien

- HBL Power Systems

- Midac S.p.A.

- Trojan Battery Company

- Amara Raja Batteries Ltd.

- Shoto Group

- Zibo Torch Energy Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Gel Batteries market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Gel, AGM, and Flooded Lead-Acid batteries?

The primary difference lies in the electrolyte. Flooded batteries use liquid electrolyte requiring regular maintenance. AGM (Absorbent Glass Mat) uses fiberglass mats to suspend the electrolyte. Gel batteries use fumed silica to create a thick, immobilized, thixotropic gel electrolyte, offering superior deep-cycle performance and heat tolerance, with zero maintenance requirements.

In which applications do Gel Batteries maintain a competitive edge over Lithium-ion batteries?

Gel batteries maintain an advantage in applications requiring extremely high safety standards, lower initial capital cost, robust deep-cycle stability, inherent tolerance to partial state-of-charge operation, and established, high-efficiency recycling infrastructure. They are preferred in remote telecom, specific industrial logistics (forklifts), and essential critical infrastructure where longevity and established reliability are paramount over energy density and weight reduction.

How is the lifespan of Gel Batteries impacted by temperature variations?

Gel batteries exhibit better thermal stability than AGM or flooded versions, particularly in high ambient temperatures, due to the immobilized electrolyte which minimizes water loss and prevents thermal runaway. However, like all lead-acid chemistries, prolonged exposure to high temperatures accelerates corrosion and reduces overall life, though their sealed nature helps mitigate the internal impact of heat compared to traditional batteries.

What drives the increased demand for Gel Batteries in the Renewable Energy Sector?

The increased demand stems from their suitability for deep-cycle applications and their tolerance for irregular charging profiles inherent in solar and wind power systems. Gel batteries resist acid stratification caused by incomplete charging (PSoC), making them reliable for long-term energy storage in off-grid and hybrid installations where cycle durability is more important than rapid charging capability.

What are the current key technological advancements being made in Gel Battery manufacturing?

Key advancements focus on improving lead alloy purity (pure lead and low-calcium alloys) to reduce gassing, optimizing the fumed silica additive for perfect gel consistency and thermal performance, and incorporating carbon additives into the negative plate to enhance charge acceptance and mitigate sulfation under partial discharge conditions, ultimately extending battery cycle life.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager