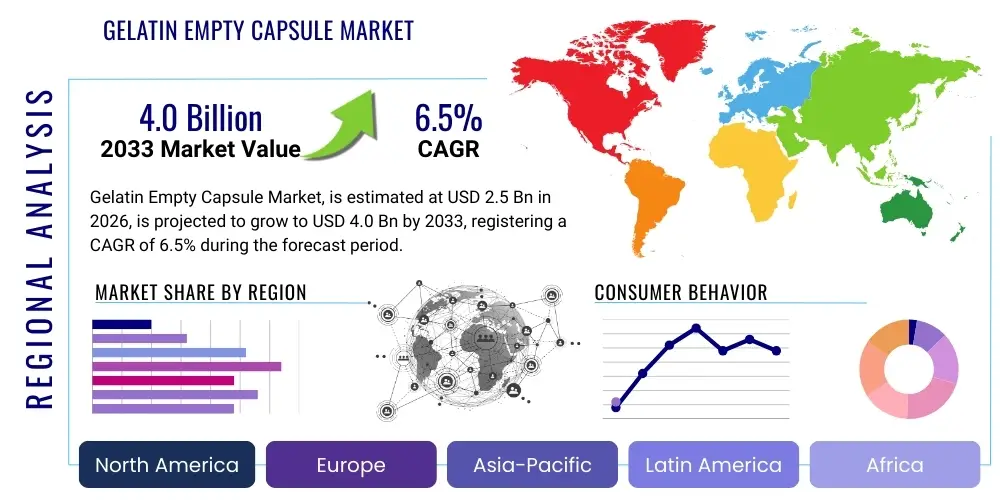

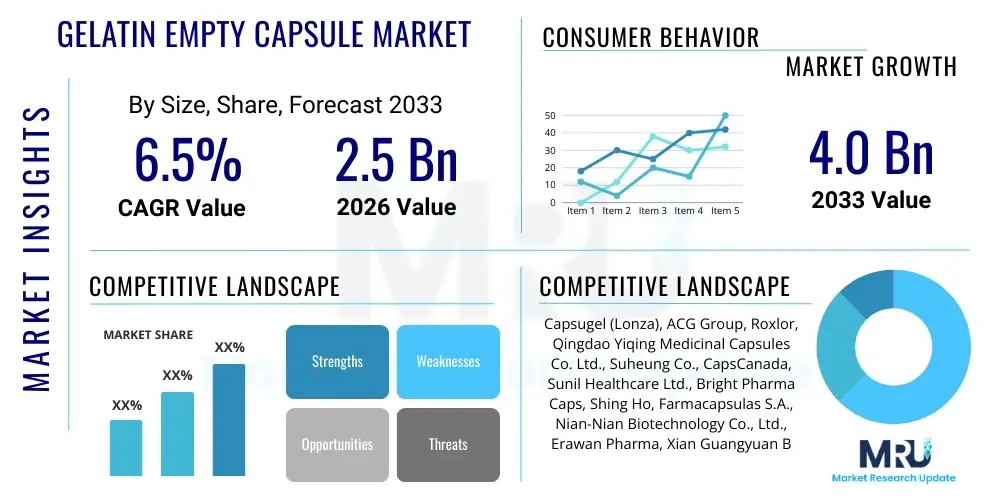

Gelatin Empty Capsule Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433130 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Gelatin Empty Capsule Market Size

The Gelatin Empty Capsule Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.45 Billion in 2026 and is projected to reach USD 3.90 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the continuous expansion of the global pharmaceutical and nutraceutical industries, which increasingly rely on gelatin capsules for precise and aesthetically pleasing dosage forms. Factors such as rising consumer awareness regarding preventative healthcare and the growing geriatric population demanding effective medicinal delivery systems further contribute significantly to this market valuation increase over the projected timeframe.

Gelatin Empty Capsule Market introduction

The Gelatin Empty Capsule Market is central to the modern drug delivery system, providing essential encapsulation solutions primarily for solid dose forms in pharmaceuticals and nutraceuticals. Gelatin capsules, derived from collagen, offer robust stability, high bioavailability, and excellent masking properties for bitter or unpleasant tasting active pharmaceutical ingredients (APIs). The primary applications encompass prescription drugs, over-the-counter (OTC) medications, and dietary supplements, where they are favored for ease of swallowing and rapid dissolution in the stomach, ensuring efficient absorption of the enclosed material.

The market encompasses two main types: hard-shelled capsules, typically used for powdered or granular substances, and soft-shelled capsules, often preferred for liquid or semi-solid formulations, particularly in vitamin and oil-based supplements. These capsules serve as versatile delivery vehicles, protecting sensitive ingredients from external factors like humidity and light, thereby extending shelf life and maintaining product efficacy. The established manufacturing technology, coupled with the natural, non-toxic properties of gelatin, continues to solidify its dominant position despite the emergence of vegetarian alternatives.

Key driving factors propelling the market include the global increase in chronic diseases necessitating ongoing medication, the exponential growth of the supplement industry fueled by wellness trends, and technological advancements in capsule manufacturing that enhance consistency and reduce defects. Furthermore, the inherent safety profile and widespread regulatory acceptance of gelatin as an excipient across major health organizations reinforce its demand across diverse geographical regions, making it a cornerstone component of the global healthcare supply chain.

Gelatin Empty Capsule Market Executive Summary

The global Gelatin Empty Capsule Market demonstrates robust growth, driven primarily by favorable business trends such as escalating R&D investments in new drug formulations and the sustained expansion of contract manufacturing organizations (CMOs) that specialize in encapsulation services. Geographically, Asia Pacific (APAC) stands out as the fastest-growing region, fueled by massive pharmaceutical industry growth in India and China, coupled with improving healthcare infrastructure and increasing disposable incomes that boost access to pharmaceuticals and supplements. North America and Europe, while mature, remain dominant in terms of market value, largely due to stringent quality standards and high consumer uptake of advanced delivery systems.

Segment trends indicate that the pharmaceutical application segment continues to hold the largest market share, driven by the sheer volume of prescription medications dispensed globally; however, the nutraceutical segment is exhibiting the highest growth trajectory, spurred by consumer demand for dietary supplements and functional foods. In terms of capsule type, hard gelatin capsules dominate the volume landscape due to their versatility in powder filling, although soft gelatin capsules are gaining traction, especially for high-value liquid formulations and fat-soluble vitamins, necessitating continuous innovation in formulation science and capsule shell durability.

Strategic movements within the competitive landscape emphasize capacity expansion, vertical integration to secure raw material supply (especially bovine and porcine sources), and product diversification to include specialized formats like enteric-coated or tamper-proof capsules. Companies are heavily investing in improving manufacturing efficiency through automation and adhering to increasingly stringent global regulatory mandates regarding raw material sourcing and purity, recognizing that quality assurance is paramount for market leadership and sustaining growth in this highly regulated industry sector.

AI Impact Analysis on Gelatin Empty Capsule Market

Common user questions regarding AI's impact on the Gelatin Empty Capsule Market typically revolve around operational efficiency, quality control, and predictive supply chain management. Users frequently inquire how AI can reduce manufacturing defects, optimize inventory levels for volatile raw materials (gelatin), and accelerate the formulation and testing phase for new encapsulations. Key concerns center on the initial investment required for AI integration and the potential displacement of skilled labor in highly automated capsule production lines. Overall, users anticipate that AI will primarily serve as an optimization tool, enhancing manufacturing precision and regulatory compliance rather than fundamentally altering the product itself, thereby increasing throughput and reducing waste across large-scale production facilities globally.

- AI-powered predictive maintenance models optimize encapsulation machinery uptime, reducing unplanned downtime and improving overall equipment effectiveness (OEE).

- Advanced image recognition and machine learning algorithms significantly enhance quality control during sorting and inspection, identifying subtle cosmetic and structural defects in real-time, surpassing human inspection capabilities.

- AI facilitates raw material sourcing optimization by predicting supply chain risks, price volatility of bovine and porcine sources, and ensuring compliance with sustainability and traceability mandates.

- Data analytics driven by AI models assist pharmaceutical formulators in predicting the stability and dissolution profiles of encapsulated APIs, thereby speeding up pre-clinical development and reducing time-to-market.

- Generative AI tools aid in simulating optimal manufacturing parameters (temperature, humidity, drying time) for new capsule formulations, minimizing costly trial-and-error procedures during scale-up.

- Automated inventory management systems, utilizing AI forecasting, ensure optimal stock levels of diverse capsule sizes and colors, reducing carrying costs and minimizing stockouts for large-volume contract manufacturers.

DRO & Impact Forces Of Gelatin Empty Capsule Market

The dynamics of the Gelatin Empty Capsule Market are shaped by powerful Drivers, structural Restraints, and transformative Opportunities, collectively known as DRO, which dictate market growth and direction. The primary driver is the accelerating shift towards encapsulated dosage forms globally, driven by improved patient compliance, enhanced bioavailability, and the rapid expansion of the health and wellness sector demanding easily consumable supplements. However, the market faces significant restraints, chiefly concerning the ethical and religious limitations associated with animal-derived gelatin, alongside persistent fears surrounding Transmissible Spongiform Encephalopathies (TSEs) and Bovine Spongiform Encephalopathy (BSE), which necessitates rigorous and costly sourcing regulations.

Opportunities for market players are abundant, particularly in developing advanced functional capsules such as liquid-filled, delayed-release, or combination-filled capsules that cater to complex therapeutic requirements. Furthermore, geographical expansion into untapped emerging economies, especially in Southeast Asia and Latin America, presents significant revenue potential as regulatory frameworks mature and healthcare spending increases. The interplay of these forces creates a moderately competitive environment where innovation in sourcing traceability and manufacturing efficiency becomes crucial for sustaining market share and ensuring product safety.

The impact forces surrounding this market, including regulatory stringency and technological disruption, exert substantial influence. Regulatory bodies such as the FDA and EMA constantly update guidelines on excipient sourcing and manufacturing standards, forcing companies to invest heavily in quality assurance and documentation, thereby increasing barriers to entry. Simultaneously, the threat posed by alternative polymer-based capsules (HPMC, pullulan) acts as a persistent impact force, compelling gelatin manufacturers to continuously refine their product offerings, focusing on cost-effectiveness and superior performance characteristics inherent to gelatin, such as high oxygen impermeability and mechanical strength.

- Drivers:

- Growing global demand for nutraceutical and dietary supplements due to heightened health awareness.

- Preference for encapsulated dosage forms among consumers due to ease of swallowing and odor masking.

- Rapid expansion of the pharmaceutical industry, particularly in generic and specialty drug manufacturing.

- Technological advancements leading to high-speed, automated capsule filling equipment.

- Restraints:

- Regulatory complexities and sourcing restrictions related to animal-derived raw materials (BSE/TSE risks).

- Volatility in the prices of gelatin raw materials (animal hides, bones).

- Increasing competitive pressure from non-gelatin alternatives (HPMC, pullulan capsules).

- Ethical and religious considerations limiting consumption in certain demographics.

- Opportunities:

- Development of specialized functional capsules (enteric coating, delayed release).

- Geographical expansion into high-growth emerging markets in APAC and LATAM.

- Focus on sustainable and traceable sourcing methods to appeal to ethical consumer trends.

- Innovation in liquid-filled and combination product capsules for enhanced drug delivery.

- Impact Forces:

- Stringent quality and purity standards imposed by global regulatory bodies (e.g., pharmacopoeia specifications).

- Pricing pressure from large-scale contract manufacturing organizations (CMOs) driving cost optimization.

- Shifting consumer preferences towards vegetarian and plant-based delivery systems.

- Technological standardization in capsule manufacturing leading to reduced differentiation among basic products.

Segmentation Analysis

The Gelatin Empty Capsule Market is comprehensively segmented based on product type, raw material, application, and end-use, providing detailed insights into specific market dynamics. The segmentation by product type, differentiating between hard and soft capsules, highlights distinct manufacturing processes and target applications, with hard capsules dominating the powder formulation segment and soft capsules commanding the liquid and oil-based delivery market. Analyzing raw materials—bovine, porcine, and others—is critical as it addresses regulatory compliance, religious constraints, and varying raw material costs, influencing manufacturer strategy regarding sourcing and production location.

Application-based segmentation divides the market into Pharmaceutical, Nutraceutical, and Cosmetics, demonstrating that while Pharmaceuticals drive volume and value due to regulatory necessity, Nutraceuticals provide the highest growth momentum, reflecting the consumer shift towards preventative health measures. Furthermore, the End-Use segmentation, distinguishing between Pharmaceutical Companies, CMOs, and Retail Pharmacies, identifies crucial distribution channels, with Contract Manufacturing Organizations (CMOs) playing an increasingly pivotal role by consolidating manufacturing expertise and driving demand for high-volume, standardized capsules across the industry.

The intricacy of these segmentations allows for a granular understanding of regional demand fluctuations and competitive strategies. For instance, regions with high vegetarian populations prioritize non-bovine gelatin or non-gelatin alternatives, whereas regions with established API manufacturing hubs exhibit higher demand for high-quality hard gelatin shells. Consequently, market participants strategically align their product portfolios and pricing structures to capitalize on the specific needs of each segment, optimizing production capacity for the most profitable and high-growth areas within the global capsule ecosystem.

- By Product Type:

- Hard Gelatin Capsules

- Soft Gelatin Capsules

- By Raw Material:

- Bovine Gelatin

- Porcine Gelatin

- Fish Gelatin

- Poultry Gelatin

- By Application:

- Pharmaceutical Industry

- Nutraceutical Industry (Dietary Supplements, Functional Foods)

- Cosmetics and Personal Care Industry

- By End-Use:

- Pharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Nutraceutical Manufacturers

Value Chain Analysis For Gelatin Empty Capsule Market

The value chain for the Gelatin Empty Capsule Market begins with the upstream procurement of specialized raw materials, primarily high-grade animal collagen derived from bovine or porcine sources, processed into pharmaceutical-grade gelatin. This initial phase is highly sensitive to regulatory oversight (e.g., TSE/BSE risk mitigation) and commodity price volatility, requiring robust sourcing strategies and quality control checks to ensure compliance and purity. Key upstream activities include rendering, purification, and hydrolysis, converting raw hides and bones into usable gelatin sheets or powders, often controlled by specialized gelatin manufacturers who supply the capsule producers.

The midstream phase involves the core capsule manufacturing process, encompassing dipping, drying, stripping, and cutting using highly automated machinery to produce standardized empty capsules. This stage demands precision engineering, sterile environments (GMP compliance), and significant capital investment in machinery. Distribution channels form the critical link between manufacturers and end-users; direct distribution is common for large pharmaceutical corporations and CMOs requiring massive volumes and specialized specifications, while indirect channels leverage specialized distributors and regional agents to service smaller nutraceutical companies and local pharmacies.

The downstream analysis focuses on the end-users, predominantly pharmaceutical companies and CMOs, who fill the empty capsules with APIs or nutritional compounds. The demand is highly inelastic and driven by the success of new drug launches and the market penetration of supplements. Direct sales strategies enable manufacturers to provide technical support, custom sizes, and tailored inventory management solutions, fostering strong, long-term relationships with key customers. Indirect distribution, while offering wider market reach, introduces margin compression and relies on the distributor's regional expertise and logistical efficiency.

Gelatin Empty Capsule Market Potential Customers

The primary customer base for the Gelatin Empty Capsule Market consists of highly regulated and quality-conscious entities involved in the production of health and wellness products. Pharmaceutical companies represent the largest and most critical segment, requiring capsules for prescription drugs, OTC medications, and clinical trials. Their purchasing decisions are primarily governed by strict adherence to pharmacopoeia standards, reliable supply chain security, batch consistency, and the availability of specialized capsule features like tamper-resistance or enteric coating needed for complex drug formulations. Relationships with pharmaceutical clients are often long-term contractual agreements focused on specialized specifications.

Contract Manufacturing Organizations (CMOs) form another rapidly expanding customer segment. CMOs offer end-to-end drug manufacturing and packaging services, serving multiple pharmaceutical and nutraceutical clients simultaneously. As the outsourcing trend gains momentum globally, CMOs demand bulk quantities, logistical efficiency, and a diversified portfolio of capsule types (sizes, colors, formulations) to meet the varied needs of their own client base. They typically seek suppliers capable of high-volume production with impeccable quality documentation and competitive pricing structures.

The nutraceutical and dietary supplement manufacturers constitute the third major group of potential customers. This segment is characterized by faster growth, lower regulatory entry barriers compared to pharmaceuticals, and a strong preference for aesthetic variety (colors, finishes) to enhance brand appeal. These customers often require both hard and soft gelatin capsules for vitamins, herbal extracts, and protein powders. While they are sensitive to price, they also value suppliers who can assist with rapid product development cycles and provide documentation supporting natural or ethical sourcing claims, aligning with contemporary consumer trends toward transparency and clean labeling.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.45 Billion |

| Market Forecast in 2033 | USD 3.90 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Capsugel (Lonza), ACG Worldwide, Qualicaps, Rousselot, Suheung Co., Ltd., CapsCanada, Sunil Healthcare Ltd., HealthCaps India Ltd., Eubio Corporation, Farmacapsulas S.A., Nipro Corporation, Medicaps Ltd., Shanxi Guangsheng Medicinal Capsule Co., Ltd., Kangbo Capsule Co., Ltd., Lefan Capsule Co., Ltd., Plasco Capsule, Patheon (Thermo Fisher Scientific), Zhejiang Guangke Pharmaceutical Capsule Co., Ltd., Hunan Er-Kang Pharmaceutical Co., Ltd., Saudi Industrial Gelatin & Capsules Co. (SIGAC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gelatin Empty Capsule Market Key Technology Landscape

The technology landscape for the Gelatin Empty Capsule Market is dominated by high-speed, precision manufacturing processes aimed at maximizing throughput while maintaining stringent quality control standards. The core manufacturing technique is the dipping method, where stainless steel pins are dipped into heated gelatin solution, followed by rotation, drying, stripping, and cutting. Recent technological advancements focus on automating and accelerating the drying and quality inspection phases, often utilizing closed-loop temperature and humidity control systems to ensure uniformity in shell thickness and moisture content, which are critical for the mechanical strength and subsequent filling efficiency of the capsules.

A significant area of technological innovation lies in the development of specialized capsule formulations and design enhancements that go beyond traditional immediate-release properties. This includes the implementation of technologies for enteric release, where specialized cross-linking or coating techniques ensure the capsule remains intact in the acidic stomach environment and only dissolves in the higher pH environment of the intestines. Furthermore, proprietary interlocking designs and precision coupling mechanisms are continuously being refined to ensure tamper-proof attributes and robust performance on high-speed filling lines, reducing the risk of accidental separation or ingredient leakage during subsequent packaging stages.

In addition to shell composition, filling technology is closely linked to capsule market dynamics. Innovations such as liquid filling and semi-solid filling (often used for soft gelatin capsules or specialized hard shells) allow for enhanced bioavailability of certain compounds, particularly poorly soluble drugs. Manufacturers are increasingly utilizing advanced spectrophotometric and laser-based inspection systems integrated into the production line. These systems use sophisticated algorithms to detect minute imperfections, color variations, or inconsistencies in size, ensuring that only capsules meeting pharmaceutical-grade specifications proceed to the final end-user, driving higher overall product reliability and lowering operational waste.

Regional Highlights

The regional analysis of the Gelatin Empty Capsule Market reveals distinct growth patterns and market maturity levels across major global areas, driven by varying regulatory environments, consumer healthcare expenditure, and local manufacturing capabilities. North America and Europe collectively represent the largest market share in terms of value, primarily due to the established presence of global pharmaceutical giants, high levels of per capita health spending, and strict quality control standards that mandate the use of high-grade encapsulated dosage forms. These regions are characterized by demand for specialized, high-margin capsules and an increasing uptake of nutraceuticals, yet they also experience strong competition from non-gelatin alternatives.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is primarily attributable to the explosive growth of generic drug manufacturing hubs in countries like India and China, coupled with improving healthcare infrastructure, substantial government investments in the pharmaceutical sector, and a massive, burgeoning consumer base for OTC and dietary supplements. Furthermore, lower manufacturing costs and increasing foreign direct investment in manufacturing capacity make APAC a critical region for both consumption and global supply.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets exhibiting promising potential, albeit from a smaller base. Growth in LATAM is spurred by increasing modernization of pharmaceutical production and rising awareness regarding preventative health. In MEA, demand is influenced by population growth, improving access to basic healthcare, and the cultural relevance of Halal-certified products, pushing local manufacturers to secure supply chains compliant with specific religious dietary laws, including certified bovine or fish gelatin sources.

- North America: Dominant market share driven by advanced pharmaceutical R&D, stringent quality standards (FDA), and high consumer demand for nutritional supplements and OTC drugs.

- Europe: Large, mature market with high demand for quality and safety. Growth is sustained by strong pharmaceutical exports and an increasing focus on specialized drug delivery systems; key markets include Germany, France, and the UK.

- Asia Pacific (APAC): Highest projected growth rate, spearheaded by manufacturing powerhouses like China and India. Growth is fueled by generic drug production, increasing healthcare access, and significant investment in regional production capacity.

- Latin America (LATAM): Emerging market characterized by regional consolidation and increasing government focus on expanding drug accessibility, driving demand for cost-effective, bulk-produced capsules.

- Middle East & Africa (MEA): Growth driven by improved healthcare spending and high demand for Halal-certified gelatin products, influencing raw material sourcing requirements and compliance standards across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gelatin Empty Capsule Market.- Capsugel (A Lonza Company)

- ACG Worldwide

- Qualicaps

- Rousselot

- Suheung Co., Ltd.

- CapsCanada

- Sunil Healthcare Ltd.

- HealthCaps India Ltd.

- Eubio Corporation

- Farmacapsulas S.A.

- Nipro Corporation

- Medicaps Ltd.

- Shanxi Guangsheng Medicinal Capsule Co., Ltd.

- Kangbo Capsule Co., Ltd.

- Lefan Capsule Co., Ltd.

- Plasco Capsule

- Patheon (Thermo Fisher Scientific)

- Zhejiang Guangke Pharmaceutical Capsule Co., Ltd.

- Hunan Er-Kang Pharmaceutical Co., Ltd.

- Saudi Industrial Gelatin & Capsules Co. (SIGAC)

Frequently Asked Questions

Analyze common user questions about the Gelatin Empty Capsule market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary raw material sources for manufacturing gelatin capsules?

The primary raw materials utilized for pharmaceutical-grade gelatin empty capsules are collagen derivatives sourced from animal by-products, predominantly bovine (cattle) bones and hides and porcine (pig) skin. Fish gelatin and poultry gelatin are also used, although less frequently, catering specifically to certain religious or dietary market niches requiring non-bovine or non-porcine certification.

How does the growth of the nutraceutical industry impact the demand for gelatin capsules?

The booming nutraceutical industry is a major demand driver for gelatin capsules. Consumers increasingly prefer capsules over tablets for dietary supplements due to perceived ease of swallowing, faster dissolution, and effective odor masking, leading to substantial volume growth, particularly in soft gelatin capsules used for vitamins and omega oils.

What are the main differences between hard and soft gelatin capsules in application?

Hard gelatin capsules typically consist of two prefabricated pieces (body and cap) and are primarily used to encapsulate dry powdered, granular, or pelletized solids. Soft gelatin capsules are single, hermetically sealed units, formed, filled, and sealed simultaneously, making them ideal for holding non-aqueous liquid or semi-solid formulations, such as oils and lipid-soluble active ingredients.

What role do Contract Manufacturing Organizations (CMOs) play in the gelatin capsule market?

CMOs are pivotal customers, driving significant bulk demand. They specialize in high-volume, cost-efficient encapsulation services for diverse pharmaceutical and nutraceutical clients, requiring robust supply chain partnerships with capsule manufacturers to ensure continuous, high-quality, and compliant capsule availability for rapid turnaround projects.

Are gelatin capsules facing competition from vegetarian alternatives?

Yes, gelatin capsules face strong competition, particularly from vegetarian alternatives like HPMC (Hydroxypropyl Methylcellulose) and pullulan capsules. While gelatin remains cost-effective and structurally superior for many applications, the vegetarian segment is growing rapidly, driven by consumer preferences for plant-based ingredients and concerns regarding animal-derived products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager