General Labware Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435102 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

General Labware Market Size

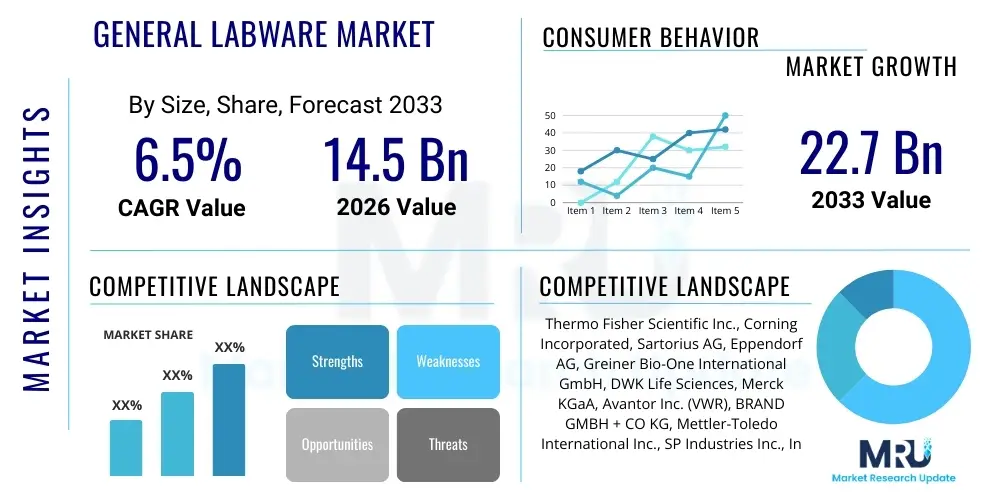

The General Labware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 22.7 Billion by the end of the forecast period in 2033.

General Labware Market introduction

The General Labware Market encompasses a diverse range of fundamental tools, equipment, and consumables essential for conducting scientific experiments, research, and routine analytical processes across various sectors. This category includes everything from high-precision volumetric glassware, standardized plastic consumables such as pipette tips and microplates, to basic items like funnels, stirring rods, and support equipment. These products serve as the foundational infrastructure for laboratories globally, enabling accurate sample preparation, measurement, handling, and storage. The fundamental role of labware in ensuring reproducibility and minimizing contamination in highly sensitive procedures underscores its perpetual demand, irrespective of specific technological advancements within the broader life sciences domain. Given the rigorous quality standards required in pharmaceutical and clinical settings, the market emphasizes products manufactured from high-grade, certified materials, ensuring inertness and chemical resistance.

Major applications of general labware span pharmaceutical drug discovery and development, clinical diagnostics, academic and government research, quality control in industrial processes (e.g., food and beverage, chemical manufacturing), and environmental testing. The inherent benefits of high-quality labware include enhanced safety through robust design, improved precision in volumetric measurements crucial for quantitative analysis, and increased efficiency in high-throughput screening environments, particularly with the adoption of automated plasticware. Furthermore, the shift towards specialized, low-binding surfaces and sterile, disposable plasticware addresses critical needs in molecular biology and cell culture applications, minimizing biological and chemical interference and drastically reducing cross-contamination risks, thereby ensuring the integrity of experimental results across complex projects.

Key driving factors propelling the growth of this market involve the sustained and increasing global investment in life sciences research, particularly evident in the rapid expansion of biotechnology and personalized medicine initiatives. The consistent need for reproducible results mandates the use of reliable, standardized labware. Moreover, the aging global population and corresponding rise in chronic diseases drive the demand for clinical diagnostic tests, which rely heavily on high-volume lab consumables. Technological innovations focusing on material science, such as the development of durable, highly heat-resistant polymers and specialized surface treatments for glass, also contribute to market evolution, offering better alternatives to traditional materials and facilitating adoption in automated workflows and sophisticated analytical instrumentation setups.

General Labware Market Executive Summary

The General Labware Market exhibits steady growth characterized by shifting material preferences, increased emphasis on sustainability, and the integration of labware within automated systems. Business trends are largely centered on supply chain resilience, post-pandemic normalization of research activities, and intensified competition leading to product diversification, particularly in specialized plasticware offerings designed for automated liquid handling systems. Leading manufacturers are investing heavily in establishing regional manufacturing hubs to mitigate geopolitical supply risks and reduce lead times, a critical factor for end-users relying on high-volume, continuous supply of disposable items. Furthermore, consolidation activities, including mergers and acquisitions, are common strategies employed by market leaders to acquire niche technology expertise, expand product portfolios, and gain deeper penetration into emerging regional markets, thereby optimizing distribution efficiencies and enhancing service offerings globally.

Regional trends indicate that North America and Europe remain the largest revenue contributors, primarily due to established pharmaceutical industries, extensive academic research infrastructure, and high regulatory standards demanding premium-quality labware. However, the Asia Pacific (APAC) region is poised to demonstrate the highest growth trajectory, fueled by significant government investments in healthcare infrastructure, the rise of domestic biotechnology firms in countries like China and India, and increasing foreign direct investment in regional contract research organizations (CROs). These emerging markets are rapidly adopting advanced laboratory practices, creating substantial demand for both basic and specialized lab consumables. The Middle East and Africa (MEA) and Latin America are also showing promising growth, albeit starting from a smaller base, driven by improving clinical laboratory capabilities and efforts to enhance localized diagnostic testing capacity.

Segment trends highlight the persistent dominance of the plasticware segment, which is experiencing accelerated growth driven by its disposability, lightweight nature, and suitability for automation and high-throughput applications, especially in genomics and proteomics research. Within material categories, specialized polymers designed for ultra-low temperature storage or high optical clarity are gaining traction. Application-wise, the diagnostic laboratories segment is expanding rapidly due to the pandemic-driven necessity for scaled-up testing infrastructure and the ongoing requirement for routine health screening. Meanwhile, the academic and research institutions segment continues to drive demand for durable, reusable glassware, particularly for basic chemical synthesis and educational purposes, necessitating a balanced portfolio management approach by vendors to cater to both high-volume disposable and high-durability reusable markets effectively.

AI Impact Analysis on General Labware Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) integration in laboratory automation will redefine the requirements for traditional labware, specifically focusing on the shift from manual processing to fully automated, data-driven workflows. Common user concerns revolve around whether standardized plasticware can meet the precision demanded by AI-guided experimentation, the necessity for labware with embedded or traceable identifiers (e.g., barcodes, RFID chips) for seamless digital tracking, and the role of AI in optimizing inventory management and reducing waste. The key theme emerging is the expectation that AI will necessitate 'smart' labware—products designed not just for physical handling but as data-rich components of an integrated digital lab ecosystem. This integration requires exceptionally consistent dimensional tolerances and material properties to minimize analytical variability that could confuse ML models, thereby raising the required quality threshold for all manufactured consumables.

- AI drives demand for geometrically precise, high-consistency labware required for robotic handling and precise positioning in high-throughput screens.

- Increased adoption of embedded tracking technologies (e.g., 2D barcodes on microplates) necessitates collaboration between labware manufacturers and LIMS providers.

- AI-powered inventory management systems reduce excessive stocking and forecast consumption patterns, optimizing labware purchasing and reducing expiration waste.

- Machine Learning algorithms utilize data from automated systems to identify subtle variations in experimental results potentially linked to labware quality, imposing stricter quality control standards on suppliers.

- AI enhances the design process for novel labware geometries, optimizing fluid dynamics and reaction conditions within microfluidic devices and specialized bioreactors.

- Automation guided by AI minimizes human error in pipetting, shifting the focus of labware design toward features that ensure perfect robotic gripper compatibility and optical flatness.

- Predictive maintenance analytics, often powered by AI, can forecast the failure or calibration needs of automated systems, indirectly impacting the lifespan and replacement cycle of integrated labware accessories.

DRO & Impact Forces Of General Labware Market

The General Labware Market is heavily influenced by a confluence of accelerating drivers, persistent restraints, and significant long-term opportunities, all shaped by internal industry dynamics and external geopolitical and health crises. The primary drivers include the escalating global R&D expenditure, particularly within the biotechnology and pharmaceutical sectors focused on emerging therapies like cell and gene therapy, which inherently demand large volumes of specialized, sterile lab consumables. This is augmented by continuous global expansion of clinical diagnostics infrastructure, necessitating standardized and disposable testing supplies. However, the market faces significant restraints, notably the intense price competition, particularly in high-volume, commodity plasticware, which pressures profit margins. Supply chain vulnerabilities, exacerbated by raw material fluctuations (especially polymers derived from petrochemicals) and geopolitical instability affecting international logistics, also constrain market performance, occasionally leading to temporary shortages of critical items.

Opportunities for growth are primarily concentrated in the realm of sustainable labware solutions, including the development of recyclable polymers, bio-based plastics, and durable, sterilizable reusable alternatives, aligning with increasing institutional commitments to environmental responsibility. Furthermore, substantial market potential lies in developing highly specialized labware tailored for advanced research domains such as organ-on-a-chip technology, sophisticated microfluidics platforms, and personalized medicine diagnostics. These high-value applications require customization, precision, and certification standards far beyond conventional labware. Impact forces driving market evolution include the regulatory environment, where stringent quality and sterility standards (e.g., GMP, ISO certifications) act as a barrier to entry for smaller manufacturers but guarantee quality for established players. Moreover, the accelerating adoption of laboratory automation necessitates a fundamental redesign of labware to ensure precise robotic compatibility, optical fidelity, and seamless integration with digital data capture systems.

The cumulative impact of these forces dictates the strategic roadmap for labware manufacturers. While mass-produced disposable plasticware drives volume and accessibility, the higher-margin, specialized segments—such as precision optics labware and certified cleanroom consumables—offer avenues for differentiation and technological leadership. Companies successfully navigating this environment are those that can concurrently manage efficient global logistics for commodity items while investing in R&D for next-generation, high-performance materials and sustainable alternatives. The necessity for dual capability—high volume, low cost, alongside low volume, high precision—defines the competitive landscape and technological priorities within the General Labware Market over the forecast period.

Segmentation Analysis

The General Labware Market is comprehensively segmented based on material, product type, end-user, and application, reflecting the diverse functional requirements across scientific disciplines. This granular segmentation is crucial for understanding specific growth pockets and tailoring product strategies, particularly as end-users increasingly demand specialized products optimized for automation and specific analytical techniques. The predominance of plasticware is a structural trend driven by the shift towards high-throughput, disposable practices to minimize cleaning costs and cross-contamination risks, especially in cell culture and clinical domains. Conversely, the market for high-quality, reusable glassware remains robust in analytical chemistry and academic research where superior chemical resistance and high-temperature tolerance are non-negotiable requirements, thereby segmenting the market based on intended use and durability expectations.

- By Product Type:

- Glassware (Beakers, Flasks, Pipettes, Burettes, Measuring Cylinders, Funnels, Vials, Test Tubes)

- Plasticware (Pipette Tips, Microplates, Petri Dishes, Centrifuge Tubes, Culture Flasks, Bottles, Bags)

- Ceramicware & Metalware (Crucibles, Tongs, Spatulas, Stands, Supports)

- Filterware (Membranes, Syringe Filters, Filtration Systems)

- Miscellaneous Tools (Stirrers, Clamps, Racks, Stopcocks)

- By Material:

- Glass (Borosilicate Glass, Quartz Glass, Fused Silica)

- Plastics (Polypropylene (PP), Polystyrene (PS), Polyethylene (PE), Polycarbonate (PC), Polytetrafluoroethylene (PTFE))

- Metal Alloys (Stainless Steel, Aluminum)

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- Clinical and Diagnostic Laboratories

- Industrial Laboratories (Food & Beverage, Chemical, Environmental Testing)

- Government and Forensic Laboratories

- By Application:

- Cell Culture and Tissue Engineering

- Microbiology and Diagnostics

- Chemistry and Analytical Testing

- Sample Storage and Preparation

- Drug Discovery and Development

- By Usability:

- Reusable Labware

- Disposable Labware

Value Chain Analysis For General Labware Market

The value chain for the General Labware Market commences with the upstream analysis, dominated by raw material procurement, specifically high-grade borosilicate glass, specialized medical-grade polymers (polypropylene, polystyrene), and purified raw chemicals necessary for specialized surface treatments. Key suppliers in this phase include large petrochemical companies and specialty glass manufacturers. This stage is crucial as the quality, consistency, and chemical inertness of the final product are directly dependent on the purity and specifications of the input materials. Fluctuations in commodity prices, particularly crude oil influencing polymer costs, significantly impact manufacturers' profitability. Successful manufacturers maintain strong relationships with multiple certified raw material suppliers to ensure supply security and quality control, often demanding detailed certificates of analysis (COA) for every batch of materials procured for critical applications.

The core manufacturing process, involving injection molding for plasticware and glass blowing/annealing for glassware, constitutes the midstream. Manufacturers invest heavily in precision machinery and cleanroom facilities (ISO certified) to achieve the tight dimensional tolerances required for modern automated systems. For specialized products like microplates or precision volumetric glassware, highly specialized tooling and advanced quality assurance protocols, often utilizing robotic vision systems, are mandatory to detect minute defects. Post-manufacturing activities include sterilization (e.g., gamma irradiation), packaging in certified clean environments, and stringent quality testing to meet regulatory compliance, especially for products intended for clinical or pharmaceutical use, adding substantial value and overhead to the production cost structure.

The downstream analysis focuses on distribution channels, which are bifurcated into direct sales and indirect channels. Direct distribution is typically employed for large institutional clients, government tenders, and key pharmaceutical accounts, allowing manufacturers greater control over pricing and customer service. Indirect distribution relies heavily on regional and global distributors (e.g., VWR, Thermo Fisher Scientific distribution arms) who handle logistics, inventory management, and technical support for smaller laboratories, academic institutions, and remote markets. The indirect channel dominates high-volume, standard labware sales due to the distributor networks’ established logistics infrastructure and their ability to bundle products from multiple manufacturers. Effective inventory management within these channels is critical to minimize product obsolescence and ensure the rapid delivery of frequently used consumables, directly impacting customer satisfaction and market share.

General Labware Market Potential Customers

The primary consumers of general labware are institutions involved in generating scientific data, diagnostics, or quality control. Pharmaceutical and biotechnology companies represent the largest and most critical customer segment, driven by continuous research cycles, massive drug screening campaigns, and process development that demands high volumes of specialized, certified-sterile disposable plasticware like bioreactor bags, cell culture flasks, and automated liquid handling consumables. These customers prioritize quality assurance, lot-to-lot consistency, and comprehensive documentation to meet rigorous regulatory filing requirements (FDA, EMA). Their purchasing decisions are often centralized and long-term, focused on vendor reliability and technical support rather than merely the lowest unit cost, reflecting the high stakes involved in their research and manufacturing processes.

Academic and government research institutions form another major customer group, characterized by decentralized purchasing through departmental budgets and reliance on both durable glassware and specialized, smaller-scale consumable orders. While cost sensitivity is higher in this segment compared to large pharma, there is a consistent demand for foundational equipment and cutting-edge materials necessary for basic scientific exploration. Grant-funded research often drives demand for innovative, specialized lab-on-a-chip or microfluidic devices. Clinical and diagnostic laboratories, conversely, are volume-driven customers, focusing heavily on standardized, certified diagnostic consumables such as blood collection tubes, sterile pipette tips, and PCR plates. Their consumption patterns are highly stable and dictated by public health needs and routine screening protocols, making supply chain efficiency and product standardization paramount requirements.

Furthermore, industrial laboratories, encompassing sectors like food and beverage quality control, environmental monitoring, and chemical manufacturing, are significant purchasers of general labware. These segments require robust, chemically resistant labware for routine analytical testing, heavy metal detection, and product quality validation. For instance, environmental testing labs rely on high-purity glass vials and sample containment vessels to prevent leaching that could skew sensitive mass spectrometry results. The defining characteristic for these customers is the need for products that offer superior resistance to harsh chemicals and extreme temperatures, ensuring the integrity and reliability of their critical quality assurance testing procedures across diverse industrial applications globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 22.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific Inc., Corning Incorporated, Sartorius AG, Eppendorf AG, Greiner Bio-One International GmbH, DWK Life Sciences, Merck KGaA, Avantor Inc. (VWR), BRAND GMBH + CO KG, Mettler-Toledo International Inc., SP Industries Inc., Integra Biosciences AG, SARSTEDT AG & Co. KG, Citotest Labware Manufacturing Co., Ltd., Gerresheimer AG, Crystalgen Inc., Kimble Chase, Kartell S.p.A., Labcon North America, LGC Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

General Labware Market Key Technology Landscape

The technological landscape of the General Labware Market is characterized by continuous advancements in material science and manufacturing precision, primarily driven by the increasing sophistication of biological assays and the pervasive trend toward laboratory automation. A critical technology is the development of ultra-low binding surfaces, achieved through specialized polymer treatments or siliconization, which minimizes the non-specific adhesion of sensitive biological molecules (like proteins and nucleic acids) to plasticware, thereby enhancing assay sensitivity and reducing sample loss, particularly vital in proteomics and genomics research. Concurrently, advancements in injection molding technologies are enabling the mass production of microfluidic components and complex 3D structures with micron-level accuracy, facilitating the miniaturization of assays and the development of sophisticated diagnostic cartridges and organ-on-a-chip platforms, pushing the boundaries of traditional labware applications into integrated systems.

Another significant technological focus involves enhancing the traceability and digital compatibility of labware. This includes the widespread adoption of laser-etched 2D barcodes on cryogenic vials and microplate bottoms, which allows for robust, instantaneous digital tracking throughout automated workflows, minimizing manual data entry errors and ensuring chain of custody. Furthermore, the integration of radio-frequency identification (RFID) tags, while more expensive, is gaining traction for high-value lab equipment and critical sample storage units, enabling automated monitoring of location, temperature exposure, and usage history. These digital technologies transform labware from mere vessels into data points within the Laboratory Information Management System (LIMS), providing a seamless interface between the physical sample and its digital metadata, a fundamental requirement for GxP regulated environments and automated discovery labs seeking maximum operational efficiency and data integrity.

The manufacturing process itself has benefited from technological integration, utilizing advanced robotics and computer vision systems for rigorous quality control. These systems perform automated dimensional checks, optical clarity assessment, and defect screening in real-time, ensuring lot-to-lot consistency that is non-negotiable for integration with automated liquid handlers (e.g., robotic pipetting stations). Furthermore, the emergence of sustainable manufacturing technologies, such as closed-loop recycling programs for high-density plastics and the exploration of bio-based or compostable polymers, represents a critical area of innovation. While material performance remains a challenge for full bio-plastic adoption, ongoing research aims to deliver environmentally friendly alternatives without compromising the chemical stability, thermal resistance, and precise geometric specifications demanded by modern scientific instrumentation, indicating a strategic shift toward ecologically responsible product lifecycles.

Regional Highlights

- North America: North America, particularly the United States, represents the largest market share holder, primarily driven by massive R&D spending by pharmaceutical and biotechnology giants and substantial funding directed towards academic life science research. The presence of world-class research institutions, coupled with a sophisticated regulatory environment that encourages the adoption of high-quality, certified labware, ensures sustained demand. The region is a key adopter of advanced automation technologies, leading to high consumption rates of high-precision disposable plasticware and complex microplates optimized for high-throughput screening. Furthermore, the robust clinical diagnostics sector, heavily reliant on continuous testing volumes, anchors the consistent demand for standardized consumables and clinical sample collection kits.

- Europe: Europe maintains a strong position, characterized by established pharmaceutical manufacturing bases in Germany, Switzerland, and the UK, and strong government support for biomedical and material science research initiatives. Stringent EU regulations (e.g., MDR/IVDR compliance) drive manufacturers to adhere to extremely high standards for medical-grade labware, favoring specialized and premium products. The regional trend is marked by a strong emphasis on sustainability, pushing manufacturers to innovate in reusable and eco-friendly labware solutions. Eastern Europe is emerging as a growth pocket due to increasing modernization of clinical laboratories and expanding local pharmaceutical production capacity, leading to accelerating procurement of new laboratory infrastructure.

- Asia Pacific (APAC): The APAC region is the fastest-growing market globally, driven by rapid industrialization, increasing governmental focus on healthcare access, and the proliferation of domestic biotech start-ups in China, India, and South Korea. Investments in clinical laboratory capacity and efforts to reduce reliance on imported pharmaceuticals are fueling high demand for basic and commodity labware. China, in particular, is a dominant force both as a manufacturing base and a consuming market, characterized by large-scale academic research projects and booming contract research and manufacturing organizations (CROs/CMOs) that require continuous supply chains. Demand here spans both basic consumables and increasingly sophisticated automated labware necessary for advanced research applications.

- Latin America (LATAM): The LATAM market growth is driven primarily by healthcare modernization efforts and expansion of clinical diagnostics services, especially in Brazil and Mexico. Economic volatility remains a restraint, but increasing government and private investment in academic research and local production of generic drugs maintain a steady, albeit price-sensitive, demand for essential labware. The focus is often on balancing cost efficiency with internationally recognized quality standards for clinical and routine testing, resulting in a strong preference for cost-effective, high-volume products.

- Middle East and Africa (MEA): Growth in the MEA region is sporadic but promising, anchored by substantial investments in healthcare infrastructure and biomedical research centers in wealthy Gulf nations (UAE, Saudi Arabia). These investments aim to diversify economies and enhance local scientific capabilities. Demand is highly concentrated on high-quality, international standard labware, often procured through large, centralized tenders. In Africa, the expansion of global health initiatives focused on infectious disease diagnostics drives a niche, but significant, requirement for specialized testing and sample collection consumables, often requiring robust, temperature-resistant designs suitable for field use.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the General Labware Market.- Thermo Fisher Scientific Inc.

- Corning Incorporated

- Sartorius AG

- Eppendorf AG

- Greiner Bio-One International GmbH

- DWK Life Sciences

- Merck KGaA

- Avantor Inc. (VWR)

- BRAND GMBH + CO KG

- Mettler-Toledo International Inc.

- SP Industries Inc.

- Integra Biosciences AG

- SARSTEDT AG & Co. KG

- Citotest Labware Manufacturing Co., Ltd.

- Gerresheimer AG

- Crystalgen Inc.

- Kimble Chase

- Kartell S.p.A.

- Labcon North America

- LGC Limited

Frequently Asked Questions

Analyze common user questions about the General Labware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the transition from reusable glassware to disposable plasticware in modern labs?

The transition is primarily driven by the rising need for high-throughput screening and automation, which favor standardized, lightweight plastic consumables. Furthermore, plasticware significantly reduces the risk of cross-contamination and eliminates the time and cost associated with washing, sterilization, and managing breakage inherent to reusable glassware in high-volume applications like cell culture and clinical diagnostics.

How does the integration of laboratory automation impact the procurement requirements for general labware?

Automation necessitates labware with extremely high geometric precision and consistent dimensional tolerance, essential for flawless robotic handling and pipetting. Laboratories prioritize products with features like embedded 2D barcodes or RFID for seamless digital traceability and integration with LIMS and robotic platforms, increasing the demand for specialized, automation-compatible consumables.

Which material segment currently holds the largest market share and why is it dominant?

The plasticware segment holds the largest market share. Its dominance stems from the high volume usage of disposable items across all major end-user sectors, especially pharmaceutical R&D and clinical diagnostics. Plastic offers versatility, cost-effectiveness, superior optical clarity, and ease of sterilization, making it ideal for contamination-sensitive and high-throughput applications.

What are the primary challenges facing the supply chain for General Labware manufacturers?

Key challenges include significant volatility in the cost and supply of raw polymeric materials, which are largely petrochemical derivatives. Additionally, global logistics bottlenecks, geopolitical instability, and the increasing complexity of certifying high-grade, medical-quality consumables across multiple international regulatory frameworks pose continuous operational and cost-management hurdles for global suppliers.

What role does sustainability play in the future development of the General Labware Market?

Sustainability is becoming a critical differentiation factor. Future development focuses on innovating products made from recyclable, bio-based, or compostable polymers to reduce the massive environmental footprint of disposable lab items. Manufacturers are actively investing in R&D to match the performance of traditional petroleum-based plastics with eco-friendly alternatives while maintaining stringent quality and safety standards required by the scientific community.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager