General Merchandise Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436053 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

General Merchandise Market Size

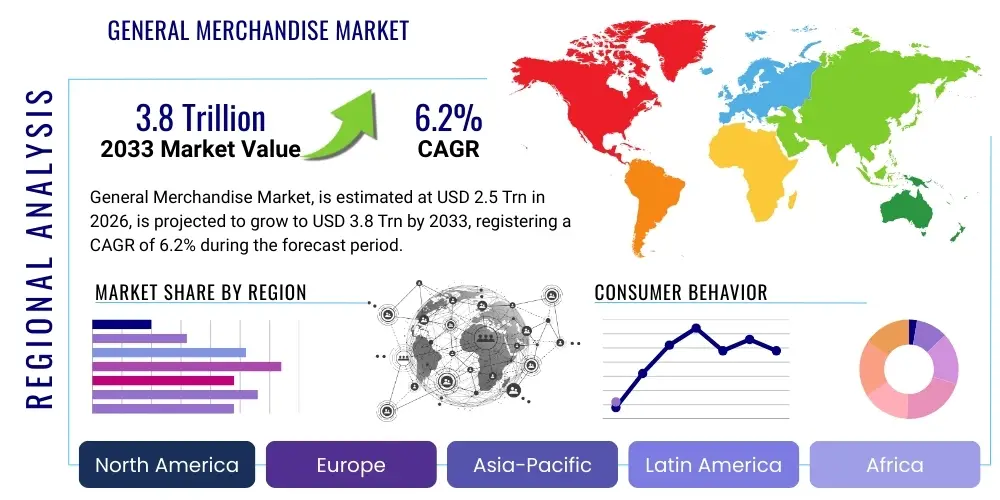

The General Merchandise Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 2.5 Trillion in 2026 and is projected to reach USD 3.8 Trillion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the accelerating digitalization of retail operations, coupled with increasing consumer demand for convenience, variety, and cross-channel shopping experiences. The market encompasses a vast array of consumer products ranging from household essentials and decorative items to apparel and electronics, serving as a critical indicator of global economic health and consumer spending patterns.

General Merchandise Market introduction

The General Merchandise Market represents the retail sector dedicated to the sale of non-food items, offering consumers an extensive assortment of goods typically categorized as durable and non-durable products, excluding grocery items. This expansive sector includes department stores, mass merchandisers, specialty retailers, and increasingly, large e-commerce platforms that integrate diverse product lines. The core product description involves items such as home décor, sporting goods, personal care appliances, toys, basic apparel, and seasonal goods. Major applications of this market revolve around fulfilling daily consumer needs, enhancing lifestyles, and supporting specialized leisure activities, making it an indispensable part of the modern retail landscape.

The sustained expansion of the market is largely attributable to significant driving factors such as rising disposable income, particularly in emerging economies, rapid urbanization leading to concentrated consumer bases, and the profound shift towards omnichannel retail strategies. E-commerce platforms have fundamentally reshaped consumer expectations, demanding seamless integration between physical and digital storefronts, which in turn necessitates significant investment in logistics, inventory management, and personalized marketing. The primary benefits offered by this market include economic accessibility to a wide variety of goods, competitive pricing facilitated by global supply chains, and the convenience of one-stop shopping offered by large format retailers and digital marketplaces.

Furthermore, technological advancements in supply chain visibility, particularly the integration of IoT and predictive analytics, are optimizing inventory levels and reducing operational costs across the sector. Retailers are increasingly focused on private-label brands and unique product differentiation strategies to capture higher margins and build consumer loyalty. The market’s dynamism requires constant adaptation to evolving fashion trends, ethical sourcing demands, and sustainability initiatives, positioning the general merchandise sector as a highly competitive and innovation-driven environment focused on maximizing customer experience and operational efficiency.

General Merchandise Market Executive Summary

The General Merchandise Market is undergoing a rapid transformation, characterized by significant business trends focused on omnichannel integration and enhanced customer personalization. Key business trends include the convergence of traditional brick-and-mortar stores with sophisticated e-commerce infrastructures, necessitating substantial investment in fulfillment centers and last-mile delivery capabilities. Regionally, Asia Pacific (APAC) is dominating growth due to expanding middle-class populations and high rates of mobile commerce adoption, while North America and Europe remain mature but innovation-heavy markets, focusing on sustainable practices and advanced retail technology implementation. Segment trends indicate robust growth in the Home Goods and Electronics categories, driven by trends toward smart homes and remote work setups, alongside the persistent pressure on traditional Apparel segments to adapt quickly to fast fashion cycles and digital storefronts.

The market faces concurrent challenges and opportunities. On one hand, inflationary pressures and supply chain volatility—highlighted globally by recent geopolitical events—continue to strain margins and disrupt inventory flows. On the other hand, the opportunity to leverage Artificial Intelligence (AI) for demand forecasting, dynamic pricing, and hyper-personalized consumer engagement presents avenues for significant competitive advantage and operational efficiency. The executive mandate across major market players is centered on building resilient supply chains that can pivot rapidly to changing consumer demands, while simultaneously optimizing the in-store experience to serve as a complementary asset to the digital storefront, thus solidifying the omnichannel presence necessary for long-term growth.

Strategic growth areas for the forecast period include the expansion of sustainable and ethically sourced product lines, responding to growing consumer awareness, and the development of direct-to-consumer (D2C) channels which bypass traditional wholesale structures, offering greater control over branding and pricing. Furthermore, the segmentation of the market based on retail format shows that dedicated large-format discounters and online marketplaces are capturing significant market share from traditional department stores, compelling established players to innovate their physical footprints, often through smaller, technology-enabled urban formats focused on experiential shopping or quick fulfillment options.

AI Impact Analysis on General Merchandise Market

User inquiries concerning the impact of AI on the General Merchandise Market predominantly revolve around three critical themes: supply chain optimization, personalized shopping experiences, and the future of labor within physical retail settings. Users frequently ask how AI can predict demand fluctuations more accurately than traditional models, especially concerning seasonal and fast-moving consumer goods. Furthermore, there is considerable interest in how AI-driven recommendation engines, virtual try-ons, and conversational commerce tools (chatbots) enhance conversion rates and customer loyalty. A key concern raised is the ethical implication of using vast consumer data for hyper-personalization and the displacement of human jobs in areas like inventory management and customer service, signaling both excitement over efficiency gains and apprehension regarding societal consequences.

The consensus among market participants is that AI is fundamentally shifting the competitive landscape from merely transactional sales to data-driven relationship management. Retailers are deploying sophisticated machine learning models to analyze colossal datasets encompassing social media trends, macroeconomic indicators, and granular purchase histories. This granular analysis permits highly precise demand forecasting, which minimizes stockouts and reduces costly overstocking, directly impacting profitability. AI algorithms are also powering dynamic pricing strategies that adjust prices in real-time based on competitor actions, inventory levels, and consumer willingness to pay, maximizing revenue potential without relying on static markdowns.

Moreover, AI is transforming the in-store experience through technologies like visual recognition for quick checkout (computer vision), optimizing store layouts based on pedestrian traffic analysis, and automating routine tasks such as shelf auditing and robotic assistance in warehouses. The future trajectory suggests AI integration will deepen, moving beyond optimization to become a core engine for product design and assortment planning. Retailers who successfully embed AI into their core operational and consumer-facing processes will secure a distinct advantage in terms of speed, cost efficiency, and customer engagement, making AI not an optional tool, but a mandatory strategic component for market survival and expansion.

- AI-driven demand forecasting significantly reduces inventory holding costs and minimizes stock-outs.

- Personalized marketing and recommendation engines increase conversion rates and customer lifetime value.

- Automated warehousing and robotic fulfillment systems enhance operational speed and accuracy.

- Dynamic pricing algorithms optimize revenue by adjusting prices in real-time based on market conditions.

- Computer vision technology facilitates cashier-less checkout systems and improves in-store security.

- Conversational AI (chatbots) handles routine customer service inquiries, improving response times.

- Predictive maintenance for retail infrastructure (HVAC, refrigeration) minimizes operational downtime.

DRO & Impact Forces Of General Merchandise Market

The General Merchandise Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all contributing to substantial Impact Forces influencing strategic decision-making. Key drivers include the exponential growth of e-commerce penetration globally, supported by robust mobile internet accessibility, which continually expands the market reach beyond traditional geographical limitations. Furthermore, rising middle-class consumer segments in emerging economies, particularly in Asia, are driving up discretionary spending on general merchandise. Restraints primarily involve persistent global supply chain disruptions, fluctuating raw material costs exacerbated by inflation, and intense price competition, especially from large-scale discount retailers and marketplace platforms that pressure profit margins across the board. Opportunities are centered around the adoption of omnichannel strategies, investment in sustainable and ethically sourced product lines to appeal to conscious consumers, and leveraging AI/ML for superior operational efficiencies and personalization, creating a highly volatile yet rewarding market environment.

Impact forces dictate the speed and direction of market evolution. The substitution force, driven by product innovation and the shifting availability of substitutes (e.g., experiential spending substituting product purchasing), compels constant product line refreshing. Competitive rivalry is extremely high, characterized by rapid price matching and aggressive promotional strategies among large retailers (e.g., Walmart, Amazon, Target). Buyer power is significant, amplified by price transparency available through digital channels, granting consumers exceptional leverage in purchasing decisions. Supplier power, while variable, is increasing in specialized categories where raw material sourcing is constrained or monopolized, forcing retailers to diversify their procurement strategies to mitigate risk and maintain cost stability in high-volume, low-margin products.

The structural forces affecting the market emphasize the need for digital agility. The threat of new entrants, particularly niche online D2C brands, remains high due to lower barriers to entry provided by platform technologies and third-party logistics (3PL). Consequently, established players must continually focus on operational excellence and unique value propositions, such as exclusive product offerings or superior loyalty programs. The overarching impact force is the necessity of customer centricity; survival is contingent upon the ability to deliver personalized, instantaneous, and seamless shopping experiences across all touchpoints, rendering investment in integrated technology and logistics infrastructure a mandatory requirement for sustaining market leadership and navigating complex macroeconomic headwinds.

Segmentation Analysis

The General Merchandise Market is segmented based on product type, distribution channel, and target end-user demographic, providing a granular view of market dynamics and consumer behavior across various sub-sectors. Analyzing these segments is crucial for strategic planning, allowing retailers to tailor inventory, marketing efforts, and logistics solutions specific to high-growth areas. The primary segmentation criteria highlight the divergent growth rates between durable goods, such as electronics and home furnishings, which often experience cyclical demand linked to economic stability, and non-durable goods, like basic apparel and seasonal items, which maintain more stable, recurring demand patterns throughout the year. The increasing dominance of online distribution channels necessitates a clear distinction in how pricing and fulfillment are managed compared to traditional brick-and-mortar sales, further emphasizing the structural shift within retail.

Growth projections vary significantly among segments. The Toys and Sporting Goods segment, for instance, exhibits strong seasonal spikes and benefits greatly from digital marketing and influencer collaborations, targeting specific consumer needs for leisure and well-being. Conversely, the Home Goods and Furnishings segment is being redefined by digital visualization tools and augmented reality (AR) applications, which help consumers confidently purchase large items online, overcoming previous logistical and trust barriers. Understanding the unique logistical requirements of each product category—from the delicate handling required for glassware to the bulk storage necessary for garden equipment—is essential for optimizing the supply chain and ensuring profitable operations across the broad spectrum of general merchandise offerings.

Furthermore, segmentation by end-user demographic reveals distinct purchasing patterns, with Millennials and Generation Z driving demand for sustainable, technologically integrated, and experiential merchandise, often prioritizing brand values and transparency. In contrast, older demographics may still favor the convenience and trust associated with traditional mass merchandisers and department stores. This bifurcation of consumer needs mandates a sophisticated, multi-channel approach where product assortment and communication strategies are finely tuned to resonate with specific demographic cohorts, ultimately optimizing inventory rotation and maximizing the overall profitability of the diverse product portfolio.

- By Product Type:

- Home Goods and Furnishings

- Apparel and Accessories (Non-specialty)

- Electronics and Appliances (Small and Mid-sized)

- Toys, Games, and Sporting Goods

- Seasonal and Holiday Merchandise

- Personal Care and Health (Non-pharmaceutical)

- Office Supplies and Stationery

- By Distribution Channel:

- Traditional Department Stores

- Mass Merchandisers (Discount Stores)

- E-commerce Platforms (Online Retailers)

- Specialty Retail Stores

- Convenience Stores and Supermarkets (General Merchandise Aisles)

- By Target Audience:

- Children and Youth

- Adults (25-55)

- Seniors

Value Chain Analysis For General Merchandise Market

The value chain for the General Merchandise Market is extensive and complex, beginning with upstream activities involving raw material procurement, manufacturing, and primary sourcing from global production hubs, primarily concentrated in Asia. Upstream analysis focuses heavily on supply chain transparency, quality control (QC), and negotiating favorable supplier contracts to manage the inherent volatility in input costs like plastics, textiles, and electronics components. Retailers often utilize complex global sourcing networks, relying on third-party vendors and original design manufacturers (ODMs) to produce private label goods, requiring stringent auditing processes to ensure compliance with quality and ethical labor standards across highly fragmented manufacturing bases.

Midstream and downstream activities are dominated by logistics, distribution, and retail execution. The distribution channel analysis is bifurcated between direct (D2C models via e-commerce or dedicated brand stores) and indirect channels (sales through large retailers, wholesalers, and marketplaces). Modern distribution relies on massive, strategically located fulfillment centers capable of handling both palletized inventory for stores and single-item orders for e-commerce, necessitating advanced warehouse management systems (WMS). The efficiency of last-mile delivery and reverse logistics (handling returns) is a significant cost differentiator in the downstream segment, directly impacting customer satisfaction and market competitiveness, pushing investment into hyperlocal delivery and automated return processing technologies.

The ultimate objective of value chain optimization is achieving speed-to-market and reducing landed costs while maintaining acceptable quality standards. For high-volume general merchandise, maintaining lean inventory through just-in-time (JIT) principles is critical, though recent global events have prompted a shift towards resilient, multi-source supply chains incorporating regionalization efforts (nearshoring/reshoring) to mitigate geopolitical and logistical risks. The digital transformation of the value chain, from initial product design utilizing 3D modeling to consumer analytics informing merchandising decisions, is continually increasing efficiency, shifting the market leverage towards retailers who can effectively integrate digital data streams across their entire operational footprint.

General Merchandise Market Potential Customers

Potential customers for the General Merchandise Market encompass virtually every consumer demographic globally, spanning households, businesses, and specialized institutions, characterized by diverse purchasing motivations and spending capacities. The primary end-users are individual consumers and households who purchase items for daily use, lifestyle enhancement, or seasonal needs, driven largely by disposable income levels and access to retail infrastructure. The customer base is highly elastic and sensitive to pricing, often seeking the best value proposition across competing retail formats, from discount stores offering bulk savings to specialty retailers providing premium, curated assortments and enhanced shopping experiences.

A significant subset of potential customers includes institutional buyers, such as small and medium-sized enterprises (SMEs), corporate offices, educational facilities, and healthcare providers, which procure general merchandise items like office supplies, basic furniture, cleaning supplies, and small electronics in volume. This business-to-business (B2B) segment often prioritizes reliability, bulk pricing, and specialized procurement services over sheer variety, demanding robust logistics and long-term contractual pricing stability. Retailers increasingly cater to this segment through specialized B2B portals and dedicated sales teams, offering tailored product catalogs and efficient invoicing systems that address corporate procurement complexities.

Moreover, the modern potential customer is highly informed and environmentally conscious. The buyer profile increasingly includes individuals motivated by sustainability metrics, ethical sourcing, and corporate social responsibility (CSR) of the retailer. This specific segment is willing to pay a premium for certified sustainable goods (e.g., Fair Trade apparel, recycled content products), pushing the market towards greater transparency in product origins and manufacturing processes. Therefore, catering to the needs of both the budget-conscious mass market and the value-driven ethical consumer requires a dual strategy involving both competitive cost structures and clear communication of product provenance and brand mission.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Trillion |

| Market Forecast in 2033 | USD 3.8 Trillion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amazon, Walmart, Target Corporation, Alibaba Group, Carrefour S.A., Costco Wholesale Corporation, Kroger Co., Home Depot, IKEA, Best Buy Co. Inc., Macy's Inc., TESCO PLC, Rakuten Group Inc., JD.com Inc., Sears Holdings Corporation, Kohl's Corporation, Auchan Holding, Inditex S.A., Metro AG, Wayfair Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

General Merchandise Market Key Technology Landscape

The General Merchandise Market relies heavily on a dynamic technology landscape that spans from back-end supply chain management to front-end customer interaction platforms. A primary technological focus is on adopting robust enterprise resource planning (ERP) systems, integrated with cloud computing capabilities, to ensure real-time inventory visibility and centralized management across global operations, crucial for executing successful omnichannel strategies. Furthermore, the use of Radio-Frequency Identification (RFID) technology is becoming standard practice for item-level tracking, drastically improving inventory accuracy within stores and fulfillment centers, thereby minimizing discrepancies and reducing labor costs associated with manual counting and auditing processes.

Another pivotal area is consumer-facing technology designed to enhance the digital shopping experience. This includes leveraging Augmented Reality (AR) and Virtual Reality (VR) applications, particularly in segments like home furnishings and apparel, allowing customers to visualize products in their own environment or virtually try on items before purchase, significantly reducing return rates. The integration of advanced data analytics and Machine Learning (ML) platforms is essential for understanding complex purchasing behaviors, enabling predictive modeling for personalized promotions, optimized merchandising layouts (both physical and digital), and highly efficient customer segmentation, moving beyond basic demographic grouping to psycho-graphic buying intent.

In the logistics realm, the market is integrating advanced automation solutions, including autonomous guided vehicles (AGVs) and sorting robotics in warehouses, alongside sophisticated route optimization software powered by geographic information systems (GIS) for efficient last-mile delivery. Blockchain technology is also gaining traction, particularly for ensuring verifiable supply chain transparency and tracking the provenance of high-value or ethically sourced goods, addressing the growing consumer demand for visibility. Collectively, these technologies are transforming the General Merchandise Market from a simple transactional exchange into a highly technologically sophisticated, data-driven ecosystem focused on minimizing friction and maximizing convenience at every consumer touchpoint, serving as the core differentiator for competitive advantage in the digital age.

Regional Highlights

- Asia Pacific (APAC) is projected to exhibit the highest growth rate, fueled by the rapid expansion of disposable incomes, particularly in countries like China, India, and Southeast Asian nations. The region benefits from a high rate of mobile-first consumption, driving immense volumes through super-apps and local e-commerce giants (e.g., Alibaba, JD.com). Urbanization trends are creating dense consumer markets, optimizing delivery logistics and supporting the proliferation of diverse retail formats, from hypermarkets to small convenience e-tailers.

- North America represents the largest market share by value, characterized by high consumer spending power and advanced retail technology adoption. The market is mature yet highly competitive, dominated by large multinational corporations focusing intensely on omnichannel excellence, speed of delivery, and sophisticated loyalty programs. Innovation here centers on integrating AI for operational efficiency and scaling sustainable retail practices, driven by robust consumer demand for convenience and competitive pricing pressures exerted by giants like Amazon and Walmart.

- Europe demonstrates stable, moderate growth, heavily influenced by regulatory pressures concerning sustainability, data privacy (GDPR), and labor ethics. Key trends include the growth of discount retailers and private label brands, and a strong pivot toward circular economy models within apparel and home goods. Western European markets prioritize digital integration, while Eastern European economies offer untapped potential as their middle classes expand and modern retail infrastructure develops further.

- Latin America (LATAM) is an emerging high-potential market struggling with varying levels of economic instability and infrastructure deficits. Despite these challenges, high mobile penetration drives fast e-commerce growth, especially in Brazil and Mexico. Retailers focus on adapting payment solutions to local preferences (e.g., installment plans) and investing in decentralized warehousing to overcome logistical hurdles posed by vast geographical distances.

- Middle East and Africa (MEA) presents a diverse landscape. The Gulf Cooperation Council (GCC) countries exhibit high per capita spending and rapid adoption of luxury and technology-driven general merchandise, supported by high internet penetration and strong government investments in digital infrastructure. Conversely, Sub-Saharan Africa faces significant infrastructural challenges, yet market growth is notable in fast-moving general goods, often facilitated by local marketplaces and cross-border trade, with increasing reliance on mobile money solutions for transactions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the General Merchandise Market.- Amazon

- Walmart

- Target Corporation

- Alibaba Group

- Carrefour S.A.

- Costco Wholesale Corporation

- Kroger Co.

- Home Depot

- IKEA

- Best Buy Co. Inc.

- Macy's Inc.

- TESCO PLC

- Rakuten Group Inc.

- JD.com Inc.

- Sears Holdings Corporation

- Kohl's Corporation

- Auchan Holding

- Inditex S.A.

- Metro AG

- Wayfair Inc.

- Dollar General Corporation

- The TJX Companies, Inc.

- Lowe's Companies, Inc.

- Woolworths Group Limited

- Etsy, Inc.

Frequently Asked Questions

Analyze common user questions about the General Merchandise market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the General Merchandise Market?

The exponential rise in global e-commerce adoption and the widespread implementation of unified omnichannel retail strategies are the primary drivers. This shift provides consumers with unparalleled convenience, variety, and cross-channel purchasing options, expanding the market reach significantly.

How is inflation affecting consumer purchasing behavior in the General Merchandise sector?

Inflationary pressures are causing consumers to become more price-sensitive and value-driven, leading to increased patronage of discount retailers and private-label brands. This behavior forces retailers to optimize supply chain costs and utilize dynamic pricing to maintain competitiveness.

What role does technology play in optimizing the supply chain for general merchandise?

Technology, particularly AI-driven demand forecasting, robotics in fulfillment centers, and advanced logistics software, plays a critical role in reducing operational friction, minimizing inventory holding costs, and accelerating last-mile delivery times, ensuring supply chain resilience.

Which geographical region holds the highest potential for General Merchandise Market expansion?

Asia Pacific (APAC) holds the highest potential for expansion due to its rapidly growing middle class, increasing levels of disposable income, and high youth population that readily adopts mobile shopping technologies and digital payment methods.

What are the major challenges facing traditional department stores in this market?

Traditional department stores face significant challenges from intense competition from large e-commerce platforms and mass discounters, requiring them to redefine their value proposition through experiential retail, curated exclusive brands, and seamless digital integration to remain relevant.

Is the General Merchandise Market adapting to sustainability trends?

Yes, sustainability is a major trend. Retailers are increasingly investing in ethical sourcing, transparent supply chains (often using blockchain), reducing packaging waste, and offering eco-friendly product lines to meet the growing demand from environmentally conscious consumers, particularly in developed markets.

How are retailers using personalized data analytics to improve sales?

Retailers utilize advanced data analytics to create hyper-personalized shopping experiences, offering tailored product recommendations, targeted promotions, and customized communication via email and in-app notifications, thereby boosting customer engagement and conversion rates across digital platforms.

What is the expected growth rate (CAGR) for the General Merchandise Market through 2033?

The General Merchandise Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033, driven largely by digital transformation and consumer spending in emerging economies.

Which product segment is expected to show the strongest growth trajectory?

The Home Goods and small electronics segments are anticipated to show strong growth, fueled by the ongoing trend of remote work, smart home technology adoption, and consumer investment in enhancing personal living spaces and digital connectivity.

What distinguishes mass merchandisers from traditional department stores in today's market?

Mass merchandisers focus on high volume, low-margin, discounted prices, and operational efficiency, often combining general merchandise with groceries. Department stores typically focus on higher-margin, branded goods, experiential shopping, and curated assortments, though many are integrating discounted digital channels.

How does the shift to D2C models impact the General Merchandise value chain?

The shift to Direct-to-Consumer (D2C) models simplifies the value chain by bypassing traditional intermediaries, giving brands greater control over pricing, inventory, customer data, and branding, but necessitates significant investment in fulfillment infrastructure and digital marketing capabilities.

Are brick-and-mortar stores still relevant in the age of e-commerce dominance?

Yes, brick-and-mortar stores are evolving into crucial components of the omnichannel strategy, serving as experience centers, showrooms, and local fulfillment hubs (e.g., buy online, pick up in store - BOPIS). Their role is changing from transactional sales points to integrated customer service and logistics nodes.

What role does social commerce play in the General Merchandise Market?

Social commerce, driven by platforms like Instagram, TikTok, and Pinterest, is crucial for driving discovery and impulse purchases, particularly among younger demographics. Retailers leverage social platforms for influencer marketing, live shopping events, and direct checkout integrations, accelerating product visibility and sales velocity.

What is the impact of geopolitical instability on the global General Merchandise supply chain?

Geopolitical instability creates significant disruptions, leading to increased shipping costs, longer lead times, and an accelerated trend towards supply chain regionalization (nearshoring) to reduce reliance on single-country manufacturing bases and mitigate risk exposure.

How is the adoption of AR/VR changing consumer purchasing habits in the market?

AR/VR technology is mitigating purchase barriers, particularly for bulky items or apparel, by allowing consumers to visualize products accurately in their context. This leads to higher confidence in online purchases and a measurable reduction in product return rates.

What are the key differences between general merchandise and specialized retail?

General merchandise retailers offer a vast, diverse assortment of products across many categories with a focus on convenience and price, typically found in mass market stores. Specialized retail focuses on depth within a specific category (e.g., electronics only or outdoor gear only), offering expertise and higher quality/niche selection.

How do large marketplaces manage the threat of counterfeit goods in general merchandise?

Major marketplaces utilize advanced machine learning algorithms, image recognition technology, and blockchain solutions to verify product authenticity, track supply origins, and swiftly remove listings identified as counterfeit, investing heavily in brand protection measures to maintain consumer trust.

What is the current trend regarding private label brand expansion?

The trend is strongly upward. Retailers are heavily expanding private label brands across general merchandise categories because they offer higher profit margins, greater control over quality, and provide unique differentiation against competing external brands, fostering increased consumer loyalty.

Which technological innovation is most critical for achieving faster fulfillment?

Automation and robotics within fulfillment centers, combined with optimized warehouse management systems (WMS) and robust local delivery networks, are the most critical innovations ensuring rapid processing and execution of customer orders, essential for meeting two-day or same-day delivery expectations.

How significant is the Latin American market to the future growth of general merchandise?

Latin America is highly significant due to its large, youthful population and rapidly improving digital infrastructure. While currently constrained by economic volatility, the long-term potential for market penetration and e-commerce growth across countries like Brazil and Mexico remains a major focus for global retailers.

What specific challenges does the General Merchandise Market face regarding labor?

The market faces labor challenges including high turnover rates, the need for specialized skills in technology integration (e.g., operating robotics and analytics tools), and competition for skilled workers in distribution and logistics, necessitating significant investment in automation and employee training programs.

How are retailers managing reverse logistics (product returns) efficiently?

Retailers are streamlining reverse logistics through automated return processing centers, use of predictive analytics to triage returned goods, and offering multiple easy return points (in-store, drop-off locations), viewing efficient returns management as a critical component of customer satisfaction and retention.

What impact does macroeconomic stability have on the demand for durable general merchandise goods?

Demand for durable goods, such as large appliances and home furnishings, is highly correlated with macroeconomic stability and consumer confidence. Economic downturns typically lead to delayed purchasing in these segments, while periods of stability drive significant increases in consumer investment.

In the context of the general merchandise segment, what is meant by "experiential retail"?

Experiential retail refers to transforming the physical store into a destination that offers engaging and memorable activities beyond simple shopping, such as workshops, product demonstrations, or interactive displays, thereby enhancing customer engagement and brand loyalty in physical locations.

How do inventory management systems adapt to seasonal merchandise fluctuations?

Modern inventory management systems use machine learning to analyze historical sales data, promotional calendars, and real-time weather information to predict seasonal demand spikes (e.g., holidays, back-to-school), optimizing stock levels and minimizing clearance markdown necessity.

What is the projected market value of the General Merchandise Market by 2033?

The General Merchandise Market is projected to reach an estimated market value of USD 3.8 Trillion by the end of the forecast period in 2033, reflecting sustained growth driven by global digitalization and increased consumer accessibility.

What distinguishes the purchasing behavior of Generation Z consumers in this market?

Generation Z buyers prioritize speed, authenticity, and visual content. They are heavily influenced by social media trends, prefer D2C brands that align with their ethical values, and are highly proficient in mobile commerce, demanding instant gratification and personalized digital experiences.

What is the primary function of blockchain in the General Merchandise sector?

Blockchain's primary function is to enhance supply chain transparency, providing immutable records of product origin, manufacturing conditions, and movement. This addresses consumer demand for ethical sourcing and helps combat the proliferation of counterfeit products.

How are discount stores maintaining their competitive advantage against large e-commerce platforms?

Discount stores maintain advantage through extremely low operating costs, high efficiency in inventory turnover, strategic locations offering local convenience, and aggressive pricing strategies on high-demand everyday essentials, focusing strictly on value maximization for the budget-conscious consumer.

What is the role of IoT (Internet of Things) devices in the retail experience?

IoT devices are used for optimizing physical store operations, including smart shelves for inventory monitoring, connected sensors for traffic analysis, and environmental controls for energy efficiency, all contributing to a more intelligent and cost-effective physical retail footprint.

What market segment faces the most disruption from digital transformation?

Traditional mid-tier department stores face the most significant disruption, caught between the price wars of mass discounters and the curated specialization of online marketplaces, compelling them to rapidly downsize physical assets and overhaul their digital presence for survival.

What specific products fall under the General Merchandise category?

General merchandise includes non-food consumer goods such as home furnishings, basic apparel, small electronics, toys, sporting goods, personal care items, and seasonal decorations, encompassing nearly all non-perishable consumer items sold outside of specialized grocery or automotive segments.

How do macroeconomic factors influence product assortment planning?

Macroeconomic factors dictate product assortment planning by influencing consumer spending priorities; during economic contraction, retailers emphasize necessities and budget items, whereas during expansion, the assortment shifts toward discretionary, high-margin, and luxury general merchandise items.

What is the current challenge regarding regulatory compliance in global sourcing for general merchandise?

The primary challenge involves navigating varied and increasingly stringent international regulations concerning labor standards, environmental impact (e.g., chemical restrictions), and product safety (e.g., toys and electronics), requiring extensive auditing and robust compliance management systems across decentralized supply chains.

How is cloud computing essential for modern general merchandise retailers?

Cloud computing provides the scalability, elasticity, and processing power required to handle massive volumes of transaction data, power AI/ML applications, and host sophisticated e-commerce platforms and unified ERP systems crucial for seamless omnichannel execution across global markets.

Which geographical region leads in the adoption of sustainable retail practices?

Europe, particularly Western Europe, leads the adoption of sustainable retail practices, driven by stringent government regulations, strong consumer advocacy for environmental protection, and corporate commitments to circular economy initiatives across apparel and durable goods.

What impact do personalized loyalty programs have on market share?

Personalized loyalty programs significantly increase customer retention and wallet share. By rewarding frequent purchasing and offering customized benefits (discounts, early access), retailers solidify their customer base against competitors, making loyalty schemes a key strategic asset.

How does the convenience store format compete in the general merchandise sector?

Convenience stores compete by offering highly accessible, localized points of sale focused on immediate consumption and necessity-based general merchandise (e.g., basic stationery, personal hygiene travel kits), leveraging their proximity and extended operating hours over large format stores.

What is the key difference between indirect and direct distribution channels for general merchandise?

Indirect distribution involves selling through intermediaries like wholesalers or major retailers (e.g., manufacturers selling via Walmart). Direct distribution (D2C) involves the brand selling straight to the consumer, usually via its own e-commerce site or dedicated branded stores, offering greater margin control.

How is robotic process automation (RPA) being utilized beyond the warehouse?

RPA is increasingly utilized in administrative and back-office functions such as automated invoice processing, managing returns documentation, and compliance reporting, improving efficiency in finance and regulatory aspects of the general merchandise business.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Intimate Underwear Market Size Report By Type (Bras, Underpants, Sleepwear and Homewear, Shapewear, Thermal Clothes, Others), By Application (Department/General Merchandise Stores, Specialty Stores, Supermarket, Online Sales), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- General Merchandise Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Home & Furniture, Garden, Electrical, Food & Drink, Others), By Application (Supermarket, Retail market, Specialty store, E-tailer, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Stationery and Cards Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Adhesive Part, Stationery Products, Cards, Printing Supplies, Writing & Marking Instruments, Others), By Application (Stationery Specialists, Gift Shops, General Merchandise Retailers, Bookstores, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager