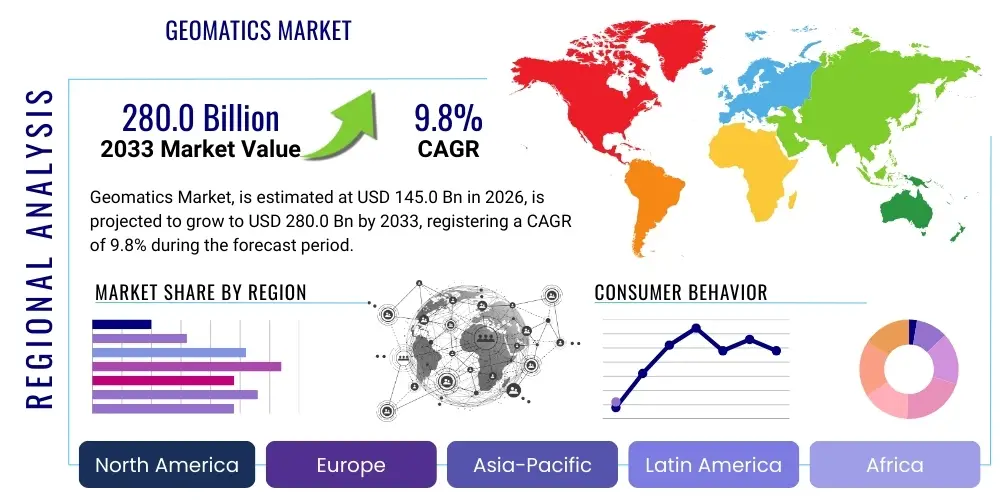

Geomatics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437996 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Geomatics Market Size

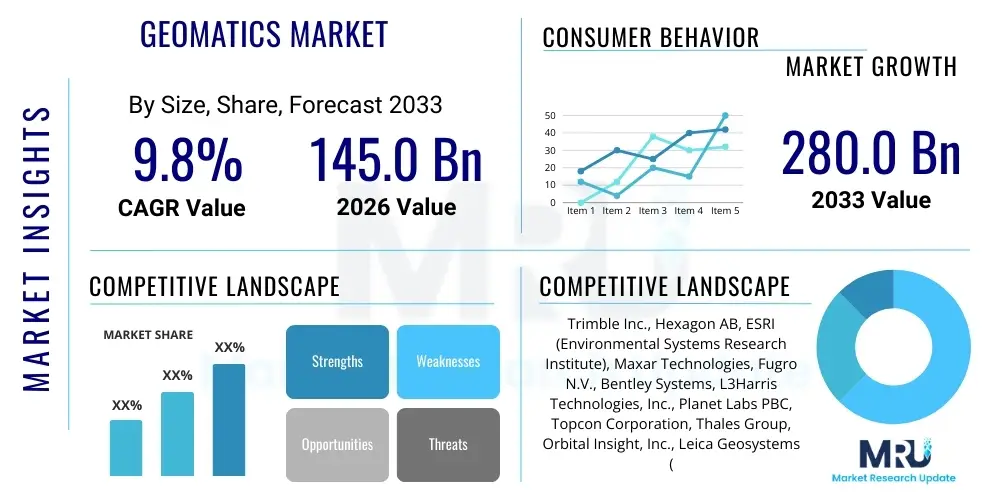

The Geomatics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 145.0 billion in 2026 and is projected to reach USD 280.0 billion by the end of the forecast period in 2033.

Geomatics Market introduction

The Geomatics market, a comprehensive field encompassing the collection, management, analysis, and visualization of spatially referenced data, is central to modern infrastructure development and environmental monitoring. This discipline integrates diverse technologies, primarily including Geographic Information Systems (GIS), Remote Sensing (RS), Global Navigation Satellite Systems (GNSS), photogrammetry, and advanced surveying techniques like LiDAR (Light Detection and Ranging). Geomatics products range from sophisticated sensor hardware and satellite imagery to specialized desktop and cloud-based software platforms used for processing and modeling geospatial information. The primary objective is to transform raw spatial data into actionable intelligence necessary for informed decision-making across numerous governmental, commercial, and scientific sectors. Key applications span urban planning, natural resource management, precision agriculture, infrastructure inspection, defense, and emergency response, establishing geomatics as a foundational pillar of the global digital economy.

Major applications of geomatics technology are witnessing profound expansion, particularly within smart city initiatives and the development of Digital Twins. Urban areas leverage high-resolution geospatial data for efficient traffic management, utilities mapping, and zoning compliance, driving demand for precise and frequently updated three-dimensional models of the built environment. Simultaneously, the proliferation of low-cost, high-accuracy sensors, particularly those integrated into Unmanned Aerial Vehicles (UAVs) and mobile mapping systems, has democratized data acquisition, shifting the market paradigm from large, expensive governmental projects to accessible, on-demand commercial services. This democratization is significantly accelerating adoption rates across emerging economies and non-traditional user groups such as insurance and real estate firms that require detailed property and hazard assessments.

Driving factors underpinning the market growth include the escalating global focus on infrastructure resilience and sustainability, necessitating detailed mapping for climate change adaptation and disaster mitigation planning. Government mandates for digital transformation, especially in land administration and defense intelligence, further amplify the need for accurate spatial databases. Additionally, the convergence of geomatics with big data analytics and cloud computing platforms enables complex spatial modeling and real-time data streaming, enhancing the utility and accessibility of geospatial information. The inherent benefits—improved operational efficiency, reduced field costs, enhanced decision support accuracy, and superior resource allocation—make geomatics essential for achieving both commercial competitiveness and public sector goals.

Geomatics Market Executive Summary

The Geomatics Market is currently characterized by significant consolidation among major satellite imagery providers and rapid innovation among software and analytics firms specializing in data interpretation and visualization. Key business trends include the shift towards Geospatial as a Service (GaaS) models, offering cloud-based data access and processing capabilities, which lowers the barrier to entry for small and medium enterprises. Furthermore, strategic partnerships between GNSS hardware manufacturers and software developers are crucial for creating integrated, end-to-end solutions, particularly in high-precision markets like autonomous vehicle navigation and construction layout. The market momentum is strongly linked to capital expenditure in infrastructure (roads, rail, utilities), defense modernization programs requiring advanced intelligence gathering, and environmental regulatory compliance which mandates accurate mapping and monitoring of sensitive ecosystems.

Regionally, North America and Europe maintain dominance, driven by mature regulatory frameworks, early adoption of high-tech surveying equipment (e.g., aerial LiDAR), and robust investment in military and governmental geospatial programs. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth trajectory, fueled by large-scale infrastructure projects (such as China’s Belt and Road Initiative and urban expansion across India and Southeast Asia) and the rapid deployment of 5G networks, which rely heavily on accurate geomatics data for site planning and coverage optimization. Latin America and the Middle East and Africa (MEA) are also emerging as significant markets, specifically driven by energy exploration (oil and gas) and the modernization of land registries, creating substantial demand for basic mapping and cadastral services.

Segmentation trends highlight the increasing importance of the software segment, which is outpacing hardware growth due to the immense value derived from advanced processing algorithms, machine learning-driven analytics, and platform integration capabilities (such as BIM/GIS integration). Within applications, infrastructure and urban planning remain the largest segments, but precision agriculture and natural resource management are demonstrating accelerated uptake, driven by efficiency needs and environmental pressures. The sensor technology segmentation reflects a preference for fusion platforms, where optical, thermal, and LiDAR data are combined to create rich, multi-dimensional geospatial datasets, moving beyond reliance on single-source data streams.

AI Impact Analysis on Geomatics Market

User questions regarding the impact of Artificial Intelligence (AI) on the Geomatics Market frequently revolve around three core themes: the automation of data processing tasks, the accuracy and reliability of AI-driven feature extraction, and the potential disruption to traditional geospatial analysis roles. Users are primarily concerned with how AI—specifically deep learning and convolutional neural networks (CNNs)—can handle the immense volumes of satellite and drone imagery being generated daily, seeking confirmation that AI can transition from proof-of-concept to industrial-scale, reliable automation. They also question the ethical implications, data privacy, and the level of human oversight required when AI models perform critical tasks such as flood damage assessment or land classification, demanding transparency and explainability in AI outputs. Furthermore, there is strong interest in predictive modeling capabilities, such as using AI to forecast urban sprawl or resource depletion based on historical geospatial patterns.

AI is fundamentally reshaping the geomatics workflow by addressing the critical bottleneck of data interpretation and feature extraction. Traditionally, tasks like classifying land cover, identifying objects (vehicles, buildings), or monitoring changes required intensive, manual labor by skilled analysts. AI algorithms now perform these tasks with high speed and precision, reducing latency and cost. Deep learning models excel at semantic segmentation of high-resolution imagery, automatically creating comprehensive digital maps from raw sensor input, which dramatically accelerates time-to-insight for large-scale projects like national mapping updates or real-time situational awareness platforms. This shift enables geomatics professionals to pivot from basic data preparation to advanced spatial modeling and strategic analysis.

The integration of AI also facilitates the creation of smarter, more responsive geospatial systems. AI optimizes sensor tasking, improving the efficiency of data collection by determining optimal flight paths for UAVs or scheduling satellite acquisitions based on atmospheric conditions and temporal requirements. Moreover, it is central to fusing disparate data sources—combining point clouds, raster images, vector data, and IoT sensor feeds—into coherent, synchronized datasets, forming the backbone of dynamic Digital Twin environments. This advancement not only enhances data quality and consistency but also unlocks sophisticated analytical capabilities, such as predicting equipment failure in remote utility infrastructure or optimizing crop yield management based on hyper-local environmental variables.

- Automation of Feature Extraction: AI accelerates the identification and mapping of objects (buildings, roads, trees) from aerial and satellite imagery, reducing reliance on manual digitization.

- Real-Time Change Detection: Machine learning models continuously monitor geospatial feeds for anomalies, crucial for defense, disaster response, and urban planning enforcement.

- Data Fusion and Quality Control: AI algorithms automatically harmonize diverse datasets (LiDAR, optical, radar) and identify sensor errors or data gaps, enhancing overall geospatial product reliability.

- Predictive Geospatial Modeling: Deep learning analyzes historical spatial patterns to forecast future environmental shifts, infrastructure needs, or disease spread risk.

- Optimized Sensor Management: AI schedules and targets satellite and drone collection missions based on analytic priorities, maximizing data acquisition efficiency and resource utilization.

DRO & Impact Forces Of Geomatics Market

The Geomatics Market is propelled by powerful drivers centered on global urbanization, digital transformation mandates, and technological convergence, yet it faces significant constraints related to data management complexity and regulatory hurdles. The primary driver is the pervasive need for precise location intelligence across virtually all economic sectors, amplified by the rise of 5G, IoT, and autonomous systems that require centimeter-level positioning accuracy and real-time mapping updates. This is complemented by geopolitical forces and environmental necessity, compelling governments and corporations to invest in sophisticated monitoring tools. Opportunities abound in integrating geospatial data with enterprise systems (ERP, CRM) and expanding into niche high-growth sectors such as high-definition mapping (HD Maps) for self-driving vehicles and advanced subsurface utility engineering (SUE).

Restraints primarily stem from the technological complexity and the resultant high initial investment required for sophisticated geomatics systems, including high-end LiDAR scanners, professional surveying equipment, and robust data storage infrastructure necessary for managing petabytes of imagery and point clouds. Furthermore, regulatory fragmentation across different regions regarding drone operations, data privacy (especially concerning sensitive location data), and spectrum allocation poses significant compliance challenges for multinational service providers. The critical shortage of highly skilled geospatial analysts proficient in advanced AI/ML algorithms and cloud computing further restricts the speed of market adoption and innovation, particularly in developing markets.

The impact forces influencing the market are profound and multi-faceted. Technological impact forces, driven by Moore's law for sensors and exponential growth in processing power, continuously drive down the cost of data acquisition while increasing resolution and coverage. Economically, the proven Return on Investment (ROI) derived from efficiency gains (e.g., reduced construction rework, optimized agricultural input) validates continued investment. Socially, the demand for transparency and resilience in infrastructure planning and disaster management ensures sustained governmental spending on geomatics services. These interlocking forces create a market environment where fundamental geospatial data rapidly becomes a non-negotiable component of modern business operations and governance, ensuring strong long-term growth despite cyclical economic downturns.

Segmentation Analysis

The Geomatics Market is comprehensively segmented based on technology, component, application, and end-user, reflecting the diverse mechanisms through which spatial data is collected and consumed. Segmentation by technology highlights the split between the established categories of GNSS, Remote Sensing (Satellite and Aerial), and LiDAR/Surveying techniques, each serving distinct accuracy and scale requirements. Component segmentation is vital, distinguishing between high-value physical assets (Hardware like sensors and receivers) and the intellectual property embedded in Software (GIS platforms, analytics tools) and Services (data collection, processing, consulting). Application segmentation provides insight into where demand is strongest, ranging from traditional infrastructure planning and land surveying to emerging domains like location-based services (LBS) and 3D modeling for gaming and simulation. Analyzing these segments is essential for vendors seeking to align product development with areas of accelerated technological investment and end-user utility.

- By Component:

- Hardware (Sensors, Receivers, UAV Platforms, Mobile Mapping Systems)

- Software (GIS Software, Photogrammetry Software, Cloud-Based Platforms)

- Services (Data Acquisition, Data Processing & Analysis, Consulting)

- By Technology:

- Remote Sensing (Satellite Imagery, Aerial Imagery)

- Global Navigation Satellite System (GNSS)

- LiDAR (Aerial, Terrestrial, Mobile)

- Photogrammetry & Surveying

- By Application:

- Engineering & Construction (Infrastructure Development, BIM Integration)

- Natural Resource Management (Environmental Monitoring, Forestry, Mining)

- Urban Planning & Land Development (Smart Cities, Cadastral Mapping)

- Defense & Intelligence (Surveillance, Mapping, Situational Awareness)

- Precision Agriculture & Farming

- Disaster Management & Emergency Response

- By End-User:

- Government & Public Safety

- Energy & Utility

- Transportation & Logistics

- Construction & Real Estate

- Academia & Research

Value Chain Analysis For Geomatics Market

The Geomatics value chain is structured sequentially, beginning with upstream data acquisition and moving through processing and analysis to final distribution and end-user application. The upstream segment is dominated by specialized manufacturers of high-precision sensors, including satellite operators (for imagery), GNSS chipset providers, and manufacturers of high-resolution LiDAR and multispectral cameras often integrated onto UAV platforms. This stage requires significant capital investment in research and development to achieve high accuracy and miniaturization. Key activities include calibration, quality control of raw data, and the establishment of robust data acquisition methodologies that meet stringent quality standards for diverse regulatory environments. Competition in this stage focuses heavily on technological superiority and data refresh rates.

The midstream stage centers on data processing and transformation, where the raw data is cleaned, orthorectified, georeferenced, and subjected to analytical routines, often leveraging proprietary algorithms and cloud computing resources. This stage is crucial for adding intellectual value, turning petabytes of raw sensor data into meaningful information products such as digital elevation models (DEMs), 3D point clouds, or thematic maps. Midstream players include specialized processing firms and major GIS software vendors that offer platforms for spatial analysis and visualization. The shift towards cloud-based processing services and GaaS models is rapidly reducing the cost and time required for this stage, democratizing access to complex analytical tools and fostering a robust ecosystem of specialized third-party data integrators.

Downstream analysis involves the direct interaction with end-users and the deployment of final geomatics products through robust distribution channels. Direct channels are typical for large governmental contracts or specialized engineering firms that require highly customized data collection and consulting services. Indirect channels, such as online marketplaces, cloud data portals, and reseller networks, are increasingly prevalent for standardized products like commercial satellite imagery or readily available thematic data layers. The value delivered at this stage is primarily through actionable insights—integrating geospatial data seamlessly into client workflows (e.g., utility management systems or BIM software) and providing ongoing maintenance and support. Successful downstream players focus on user experience, application programming interfaces (APIs), and seamless data integration capabilities, ensuring the final output directly addresses specific industry pain points.

Geomatics Market Potential Customers

Potential customers for geomatics products and services span a vast spectrum of public and private sector organizations, unified by their need for accurate, timely, and spatially referenced intelligence to manage physical assets and operational processes. The largest and most consistent buyers are governmental bodies, including national mapping agencies, defense organizations, public works departments, and regulatory agencies responsible for environmental monitoring and land administration. These entities require comprehensive, national-scale datasets for cadastral mapping, infrastructure planning, and critical national security applications. Their procurement often involves long-term contracts for data collection and custom software deployment, demanding high reliability and security standards from vendors.

In the private sector, the construction, engineering, and infrastructure development industries are massive consumers of geomatics technology. They utilize LiDAR, photogrammetry, and high-precision GNSS for site surveying, construction monitoring, volume calculation, and asset management throughout the project lifecycle. Energy and utility companies represent another critical customer group, requiring detailed mapping for pipeline routing, transmission line inspection, facility siting, and monitoring environmental risks to their assets. Furthermore, the burgeoning sectors of autonomous vehicles and high-definition mapping are creating new, high-value demand for extremely dense and accurate geospatial data, often requiring continuous refresh rates.

Emerging buyers include those traditionally peripheral to the core geomatics market, such as the finance and insurance sectors, which utilize spatial analytics for risk modeling, catastrophe assessment, and asset valuation. Technology companies providing Location-Based Services (LBS) and geospatial search engines also represent significant buyers of processed vector and raster data. Finally, the agricultural sector, driven by precision farming imperatives, uses geomatics to optimize fertilizer application, monitor crop health via drone and satellite imagery, and manage water resources efficiently, making farmers and large agricultural enterprises key recurring end-users of specialized geomatics applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 145.0 billion |

| Market Forecast in 2033 | USD 280.0 billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trimble Inc., Hexagon AB, ESRI (Environmental Systems Research Institute), Maxar Technologies, Fugro N.V., Bentley Systems, L3Harris Technologies, Inc., Planet Labs PBC, Topcon Corporation, Thales Group, Orbital Insight, Inc., Leica Geosystems (part of Hexagon), SNC-Lavalin Group Inc., PASCO CORPORATION, Intergraph Corporation, NV5 Geospatial, Airbus Defence and Space, DigitalGlobe (now Maxar), Babcock International Group, and NVidia Corporation (GPU Processing). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Geomatics Market Key Technology Landscape

The Geomatics technology landscape is currently undergoing rapid transformation, characterized by the convergence of high-resolution data acquisition methods and sophisticated, scalable cloud processing architectures. The increasing deployment of UAV-based photogrammetry and LiDAR systems has revolutionized data collection, enabling higher spatial resolution, greater flexibility, and lower operational costs compared to traditional aerial mapping. These platforms are increasingly integrated with multi-sensor payloads (combining optical, thermal, and hyperspectral imaging) to capture richer information, expanding applications in detailed corridor mapping, environmental monitoring, and asset integrity checks. Furthermore, advancements in GNSS technology, specifically the implementation of Real-Time Kinematic (RTK) and Precise Point Positioning (PPP) corrections delivered via IP networks, are providing centimeter-level accuracy essential for high-precision tasks like autonomous machinery operation and detailed construction layout.

Cloud computing and Big Data analytics form the backbone of modern geomatics processing. Hyperscale cloud environments (AWS, Azure, Google Cloud Platform) offer the requisite elasticity and computational power to handle petabytes of geospatial data, facilitating large-scale data ingestion, storage, and parallel processing. Key technological shifts include the move towards serverless GIS, allowing users to run complex spatial analyses without managing underlying infrastructure, and the adoption of open-source geospatial libraries that foster innovation and interoperability. The democratization of GIS tools via web and mobile platforms is crucial, making spatial data accessible and usable by non-specialists directly in the field, moving away from desktop-centric analysis models and enhancing collaborative workflows.

Perhaps the most impactful emerging technology is the Digital Twin, which requires continuous integration of geospatial data with BIM (Building Information Modeling) and IoT sensor feeds to create dynamic, living models of physical environments. Geomatics provides the essential foundation (the geo-reference framework and the surface/subsurface geometry) for these twins. Technology providers are heavily investing in integrating machine learning and computer vision into 3D reconstruction pipelines to automate the creation and maintenance of these highly complex models. This allows for simulation, predictive maintenance, and real-time interaction within a validated spatial context, driving demand for perpetual mapping updates and advanced data governance frameworks to manage the temporal dimension of geospatial intelligence.

Regional Highlights

Regional dynamics in the Geomatics Market reflect varied levels of technological maturity, infrastructural investment, and regulatory support, leading to distinct growth profiles across the globe.

- North America: This region maintains market leadership due to high defense spending on geospatial intelligence, extensive adoption of precision agriculture, and a mature ecosystem for commercial remote sensing providers. The US and Canada are pioneers in LiDAR and aerial surveying, driven by robust governmental mapping programs (e.g., USGS 3D Elevation Program) and significant private sector investment in autonomous vehicle technology and smart city infrastructure.

- Europe: Characterized by strong regulatory mandates (like the INSPIRE Directive) promoting data sharing and interoperability, Europe shows significant market strength in environmental monitoring, urban resilience, and utility management. The UK, Germany, and France are leading the integration of BIM and GIS for infrastructure projects, leveraging advanced satellite data from the European Space Agency's Copernicus program.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC’s expansion is fueled by massive infrastructure investment in emerging economies (China, India, Indonesia) and accelerated urbanization. Demand is high for both basic mapping services (cadastral renewal) and advanced technologies (LiDAR for high-speed rail and smart ports). Governmental digital initiatives are providing substantial funding for geospatial data infrastructure establishment.

- Latin America (LATAM): Growth in LATAM is primarily driven by natural resource industries (mining, oil & gas, forestry) and the modernization of land administration systems to combat illegal deforestation and improve land tenure security. Market adoption is increasing, though often constrained by infrastructure limitations and fragmented regulatory environments, favoring satellite-based solutions for wide-area coverage.

- Middle East and Africa (MEA): This region is heavily influenced by large-scale energy projects and ambitious mega-city developments (e.g., NEOM in Saudi Arabia). High disposable income for large-scale governmental projects drives demand for advanced surveying and 3D modeling services, while the African market focuses on fundamental mapping for resource planning and disaster risk reduction, often relying on international aid projects for foundational geospatial datasets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Geomatics Market.- Trimble Inc.

- Hexagon AB

- ESRI (Environmental Systems Research Institute)

- Maxar Technologies

- Fugro N.V.

- Bentley Systems

- L3Harris Technologies, Inc.

- Planet Labs PBC

- Topcon Corporation

- Thales Group

- Orbital Insight, Inc.

- Leica Geosystems (part of Hexagon)

- SNC-Lavalin Group Inc.

- PASCO CORPORATION

- Intergraph Corporation

- NV5 Geospatial

- Airbus Defence and Space

- DigitalGlobe (now Maxar)

- Babcock International Group

- NVidia Corporation (GPU Processing)

Frequently Asked Questions

Analyze common user questions about the Geomatics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between GIS and Geomatics?

Geomatics is the comprehensive scientific discipline encompassing the acquisition, processing, storage, and delivery of geospatial data. GIS (Geographic Information System) is a foundational software tool and technological framework used within Geomatics for managing, analyzing, and visualizing that spatial data. Geomatics covers the entire lifecycle, while GIS is focused on the analytical and managerial components.

How are cloud computing and GaaS models affecting geomatics accessibility?

Cloud computing and Geospatial as a Service (GaaS) models are democratizing the Geomatics Market by eliminating the need for extensive local infrastructure and high initial software licensing fees. This allows smaller organizations and non-specialist users to access powerful analytical tools, massive data archives, and processing capabilities on a subscription basis, significantly lowering the barrier to entry and accelerating project timelines.

Which technologies are driving growth in the data acquisition segment?

The primary technologies driving growth in data acquisition are high-resolution LiDAR (Light Detection and Ranging) systems, particularly those integrated into UAVs (drones) and mobile mapping vehicles, and enhanced multi-spectral and hyperspectral satellite sensors. These technologies offer improved accuracy, higher data density, and faster refresh rates, crucial for dynamic monitoring applications.

What role does the Digital Twin concept play in the future of the Geomatics Market?

The Digital Twin concept is vital, positioning geomatics as the foundational layer for creating spatially accurate virtual replicas of real-world assets and cities. Geomatics provides the precise geometry (using 3D modeling and laser scanning) and the geo-reference framework necessary to integrate real-time data from IoT sensors, enabling dynamic simulation and predictive analysis within the twin environment.

Which regional market is anticipated to show the highest Compound Annual Growth Rate (CAGR)?

The Asia Pacific (APAC) region is anticipated to exhibit the highest CAGR due to rapid urbanization, massive government investment in infrastructure projects (e.g., smart city development and high-speed rail networks), and increasing commercial adoption of geospatial intelligence across diverse industries, particularly in China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager