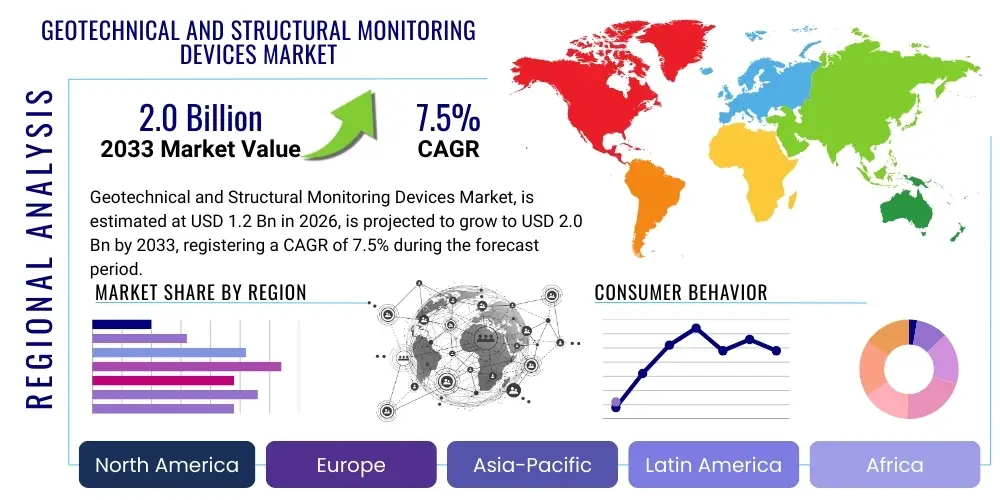

Geotechnical and Structural Monitoring Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436264 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Geotechnical and Structural Monitoring Devices Market Size

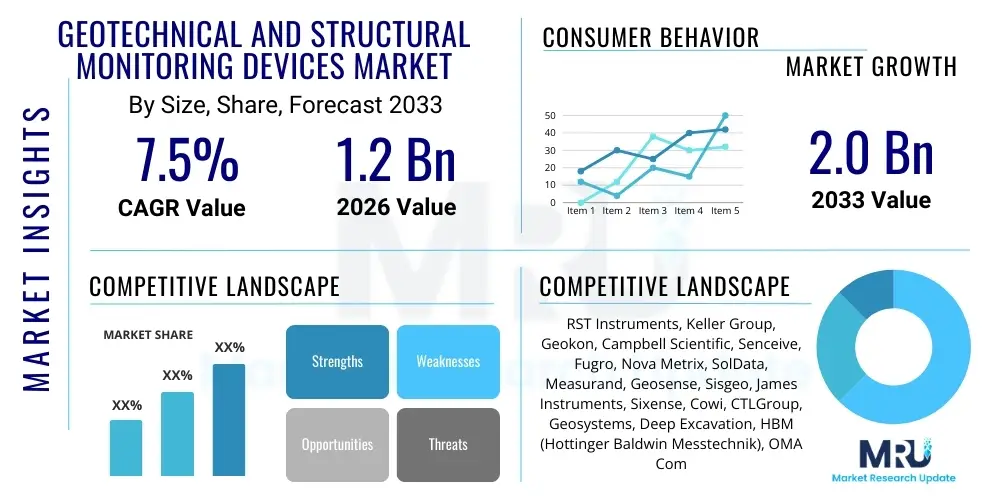

The Geotechnical and Structural Monitoring Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.0 Billion by the end of the forecast period in 2033.

Geotechnical and Structural Monitoring Devices Market introduction

The Geotechnical and Structural Monitoring Devices Market encompasses advanced instrumentation utilized to measure and track physical parameters such as strain, deformation, pressure, temperature, and inclination in civil engineering infrastructure and geological formations. These devices, which include piezometers, inclinometers, strain gauges, and tiltmeters, are critical for assessing the stability, safety, and long-term performance of assets like dams, bridges, tunnels, mining operations, and high-rise buildings. The primary objective is to provide timely data that informs decision-making regarding maintenance, risk mitigation, and early warning systems, thereby preventing catastrophic failures and ensuring compliance with stringent safety regulations globally. The sophistication of these tools ranges from manual readouts to fully automated, high-frequency wireless sensor networks.

The core product offerings are engineered to withstand harsh environmental conditions while delivering high-precision measurements. Major applications span across diverse sectors, including infrastructure development, energy production (hydropower, nuclear), and natural hazard mitigation, particularly in areas prone to seismic activity or landslides. Key benefits derived from the deployment of these monitoring solutions include enhanced asset life extension, reduction in operational costs associated with manual inspections, and the critical ability to predict potential structural distress before it becomes irreparable. These devices are foundational for implementing predictive maintenance strategies and ensuring the resilience of modern infrastructure systems against aging and environmental stresses.

Market expansion is fundamentally driven by the escalating global expenditure on infrastructure projects, particularly in developing economies, coupled with a pervasive trend towards infrastructure renewal and maintenance in developed nations. Furthermore, the increasing complexity and scale of construction—such as deeper tunnels and taller high-rises—necessitate sophisticated monitoring during both construction and operational phases. Regulatory mandates promoting public safety and stringent environmental standards related to earthworks and mining waste management further propel the adoption of reliable geotechnical instrumentation, solidifying the market's trajectory towards digitalization and automation.

Geotechnical and Structural Monitoring Devices Market Executive Summary

The Geotechnical and Structural Monitoring Devices Market is currently experiencing robust growth, primarily fueled by the accelerating integration of IoT, AI, and wireless sensor networks, which are transforming traditional monitoring from labor-intensive manual processes to highly automated, continuous surveillance systems. Business trends indicate a strong shift towards service-based models, where providers offer comprehensive data analysis and interpretation alongside hardware sales, moving up the value chain. Key mergers, acquisitions, and strategic partnerships are focused on integrating specialized software platforms for real-time data visualization and predictive analytics, enhancing system interoperability and overall efficiency in large-scale infrastructure projects. The competitive landscape is characterized by established players expanding their digital offerings to cater to the growing demand for remote monitoring capabilities, ensuring data availability 24/7 across geographically dispersed assets.

Regionally, Asia Pacific (APAC) stands out as the highest growth potential region, largely due to massive government investments in new public infrastructure, including high-speed rail networks, extensive subway systems, and large hydroelectric dams, particularly in China and India. North America and Europe, while representing mature markets, are characterized by high demand for maintenance, retrofitting, and digitalization of aging infrastructure, driving the adoption of advanced wireless and autonomous monitoring solutions. Segment trends show a clear dominance of optical and vibrating wire technologies due to their reliability and long-term stability, although micro-electromechanical systems (MEMS) sensors are rapidly gaining traction, offering cost-effective and miniaturized solutions for densely packed urban monitoring environments. The shift towards automated monitoring systems, incorporating advanced data analytics tools, is defining the future direction of the market, focusing on preventative rather than reactive safety measures across all segments.

AI Impact Analysis on Geotechnical and Structural Monitoring Devices Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Geotechnical and Structural Monitoring Devices Market often center on its ability to enhance predictive maintenance, automate data interpretation, and improve risk modeling accuracy. Users frequently question how AI algorithms can effectively manage and derive actionable insights from the massive volumes of heterogeneous data generated by dense sensor networks, specifically focusing on anomaly detection and correlation of environmental factors (like temperature or rainfall) with structural responses (like displacement or strain). There is significant user interest in the expected reduction in false alarms and the capacity for AI to forecast degradation timelines, thus enabling asset owners to optimize maintenance schedules and minimize operational disruption. The overarching theme is the transition from descriptive reporting to prescriptive and predictive decision support systems driven by machine learning.

The integration of AI, particularly machine learning models, is profoundly transforming the operational paradigm of structural health monitoring (SHM). AI provides the capability to move beyond simple threshold alarms, allowing algorithms to learn the normal behavior patterns of complex structures under varying loads and environmental conditions. This sophisticated baseline modeling enables the detection of subtle, emergent anomalies that traditional statistical methods often miss, significantly improving the reliability and precision of structural assessments. Furthermore, AI facilitates the fusion of data from multiple sources—including satellite imagery, weather reports, and seismic data—with sensor readings, creating comprehensive digital twins that enhance predictive accuracy and provide a holistic view of asset integrity.

The deployment of AI tools within this sector also addresses the major challenge of data overload, enabling infrastructure owners to effectively manage distributed sensor networks spanning thousands of kilometers, such as those used for pipeline or railway monitoring. Automated data processing powered by AI reduces the reliance on highly specialized human analysts for initial data filtering and quality assurance, thereby lowering operational costs and increasing the speed of critical decision-making. This technological shift is driving the development of smarter, self-calibrating devices and cloud-based analytical platforms, positioning AI as the central nervous system for future geotechnical and structural risk management.

- AI enables highly accurate anomaly detection and predictive failure forecasting.

- Machine learning algorithms automate the interpretation of massive, complex sensor data streams.

- AI optimizes sensor network design and resource allocation through data-driven insights.

- Integration with Digital Twins allows for sophisticated simulations of structural behavior under stress.

- Automated correlation of external factors (weather, seismicity) with structural response data.

- Enhancement of prescriptive maintenance planning, minimizing downtime and costs.

- Reduced reliance on human intervention for initial data validation and alarm filtering.

DRO & Impact Forces Of Geotechnical and Structural Monitoring Devices Market

The market for Geotechnical and Structural Monitoring Devices is strongly influenced by a robust set of drivers centered on mandatory safety regulations, the massive global investment in infrastructure, and the inherent necessity for long-term asset integrity management. The primary driver is the pervasive aging infrastructure across mature economies like North America and Western Europe, where continuous monitoring is essential for rehabilitation and safety compliance of decades-old bridges, dams, and tunnels. Simultaneously, the restraints largely revolve around the high initial capital investment required for deploying extensive, state-of-the-art monitoring systems, particularly wireless and fiber optic solutions, which can be prohibitive for smaller projects or developing economies with limited municipal budgets. Furthermore, the specialized expertise required for accurate system installation, calibration, and subsequent data interpretation poses a significant operational barrier, leading to a shortage of qualified professionals capable of maximizing the utility of complex monitoring outputs.

Opportunities within this market are principally driven by the rapid adoption of Wireless Sensor Networks (WSN) utilizing low-power wide-area network (LPWAN) technologies such as LoRaWAN, which dramatically reduce installation complexity and cabling costs, making automated monitoring accessible to remote or difficult-to-access locations. This shift democratizes sophisticated monitoring, extending its reach beyond mega-projects. Moreover, the integration of advanced data analytics, Big Data processing capabilities, and AI offers substantial growth opportunities by transforming raw data into predictive intelligence, generating new revenue streams through software and service subscriptions rather than just hardware sales. The rising global concern over climate change-induced natural hazards, such as increased frequency of landslides, soil erosion, and coastal flooding, also generates continuous demand for preventative geotechnical monitoring systems.

The impact forces exerted on this market include intense regulatory pressure, especially following high-profile infrastructure failures globally, compelling stricter governmental oversight and mandatory real-time monitoring standards across high-risk civil works. This external pressure accelerates technology adoption and investment. Porter’s Five Forces analysis suggests moderate to high bargaining power of buyers due to the specialized nature of monitoring projects, often requiring customized solutions; however, the high switching costs associated with infrastructure-specific installed systems mitigate this threat over the long term. The threat of substitutes is relatively low, as manual inspection methods are demonstrably inferior and insufficient for modern risk management, solidifying the market position of electronic and optical monitoring devices as essential tools for responsible asset management.

Segmentation Analysis

The Geotechnical and Structural Monitoring Devices Market is extensively segmented based on device type, technology utilized, application area, and end-user vertical, reflecting the highly specialized nature of the measurements required in civil and geotechnical engineering. Segmentation by device type—including inclinometers, piezometers, extensometers, and strain gauges—is essential as each device is designed to measure a unique physical parameter critical for structural analysis, such as subsurface deformation or hydrostatic pressure. The dominant device segments often correlate directly with the largest infrastructure categories, such as the high demand for piezometers in dam safety monitoring and inclinometers in landslide and retaining wall surveillance.

Technology segmentation is becoming increasingly vital, distinguishing between traditional wired systems and advanced wireless solutions (IoT-enabled and fiber optic). The significant market shift is towards wireless systems and automated monitoring due to the lower deployment costs and ability to provide continuous, high-frequency data logging, which is crucial for dynamic structure monitoring like rail bridges or high-rise buildings subject to wind loads. Application segmentation highlights core end-use sectors, with Tunnels and Underground Excavations, Dams and Bridges, and Mining operations being the largest consumption areas, each requiring distinct combinations of monitoring equipment to ensure safety and operational efficiency specific to their environmental risks.

The detailed segmentation enables vendors to tailor complex solutions—often combining several device types and communication technologies—to address the unique stability challenges faced by specific end-users, such as transportation authorities, mining companies, or infrastructure concessionaires. The growth trajectory of each segment is intrinsically linked to global trends in urbanization and industrial expansion, dictating specific regional demands, for instance, high demand for building monitoring devices in rapidly urbanizing APAC cities versus specialized tunnel monitoring equipment in European infrastructure renewal projects.

- By Device Type:

- Piezometers (Vibrating Wire, Electric, Hydraulic)

- Inclinometers (Digital, MEMS, Wireless)

- Strain Gauges (Vibrating Wire, Electrical Resistance)

- Extensometers (Rod, Borehole, Multipoint)

- Tiltmeters and Load Cells

- Settlement Monitoring Systems

- Crack Meters and Joint Meters

- By Technology:

- Wired Monitoring Systems (Traditional Data Loggers)

- Wireless Sensor Networks (WSN)

- Fiber Optic Sensing (FOS) Technology (Bragg Grating, Distributed Sensing)

- Automated and Autonomous Monitoring Systems

- By Application:

- Dams and Reservoirs Monitoring

- Bridges and Viaducts Monitoring

- Tunnels and Underground Excavations

- Mining and Slope Stability Monitoring

- Buildings and High-Rise Structures

- Pipelines and Utilities

- Rail and Road Transportation Infrastructure

- By End User:

- Government and Public Agencies

- Construction Companies

- Mining Companies

- Energy and Utilities Sector

- Consulting and Engineering Firms

Value Chain Analysis For Geotechnical and Structural Monitoring Devices Market

The value chain for the Geotechnical and Structural Monitoring Devices Market begins with upstream activities focused on the research and development (R&D) of highly specialized sensors, materials, and communication hardware. This phase involves precision manufacturing of robust components, often involving micro-electromechanical systems (MEMS), vibrating wire, and advanced optical fibers, requiring substantial intellectual property investment. Key upstream suppliers include component manufacturers providing sophisticated data acquisition systems, high-durability wiring, and specialized housing materials capable of surviving prolonged exposure to harsh environments such as high humidity, extreme temperatures, and corrosive soils. Procurement logistics emphasize quality assurance and certification (e.g., ISO standards) given the critical safety function of the final installed devices.

Midstream activities involve the integration and assembly of individual components into complete, calibrated monitoring systems, followed by sales and direct/indirect distribution channels. Direct distribution is common for large, complex projects where manufacturers engage directly with major engineering firms or government bodies to provide tailored solutions and specialized installation expertise. Indirect channels often utilize a network of regional distributors or system integrators who add value through localized service, installation, and initial data processing capabilities, particularly beneficial for smaller-scale projects or geographically diverse markets. Effective midstream management relies heavily on minimizing lead times and ensuring the availability of highly technical support teams capable of commissioning complex sensor arrays.

The downstream segment is defined by installation, commissioning, maintenance, and the crucial element of data interpretation and delivery. End-users require not just the hardware but increasingly sophisticated software platforms for data visualization, trending, and alarm management. This has driven providers to offer comprehensive service contracts (XaaS models), where the core value shifts from the device itself to the actionable insights derived from the data. Direct interactions occur between the system integrator/manufacturer and the asset owner (e.g., dam operators, mining managers), focusing on customized risk assessment reports and predictive maintenance recommendations, thereby closing the loop in the value delivery process and maximizing the lifespan and safety performance of the monitored assets.

Geotechnical and Structural Monitoring Devices Market Potential Customers

The primary customers for Geotechnical and Structural Monitoring Devices are organizations responsible for the design, construction, ownership, and maintenance of critical civil and industrial infrastructure where structural integrity and public safety are paramount. These potential buyers predominantly fall into four major categories: government infrastructure authorities, large engineering and construction firms, resource extraction companies, and utility providers. Government and municipal bodies, such as departments of transportation (DOTs) and water management agencies (e.g., dam safety organizations), are substantial purchasers, driven by regulatory compliance and the need to manage extensive portfolios of public assets like highways, bridges, and water retaining structures. Their purchasing decisions are heavily influenced by regulatory mandates and long-term cost of ownership, favoring highly reliable, durable systems.

Major engineering, procurement, and construction (EPC) firms represent another critical customer base, particularly during the design and construction phases of massive projects like high-speed rail lines, deep tunnels, and metropolitan subway expansions. They utilize these devices to ensure compliance with design specifications, monitor ground movement during excavation, and manage construction-related risks. For these customers, real-time data acquisition and system robustness are key purchasing criteria. Furthermore, mining companies, both surface and underground operations, are high-volume users, requiring monitoring for pit slope stability, tailings dam safety, and monitoring of underground excavation convergence to prevent catastrophic failures and ensure worker safety, often preferring automated and ruggedized systems.

Finally, utility providers, including those in the energy sector (hydropower generation, oil and gas pipelines) and telecommunications, require specialized monitoring to safeguard their infrastructure assets. Hydropower operators utilize extensive geotechnical instrumentation for dam safety, while pipeline operators employ monitoring devices to detect ground movement, seismic effects, and potential pipe strains in geologically unstable regions. These customers prioritize systems that offer remote, continuous data transmission and seamlessly integrate into existing supervisory control and data acquisition (SCADA) systems for centralized risk management and rapid response capability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | RST Instruments, Keller Group, Geokon, Campbell Scientific, Senceive, Fugro, Nova Metrix, SolData, Measurand, Geosense, Sisgeo, James Instruments, Sixense, Cowi, CTLGroup, Geosystems, Deep Excavation, HBM (Hottinger Baldwin Messtechnik), OMA Compagnia Generale Strumentazione. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Geotechnical and Structural Monitoring Devices Market Key Technology Landscape

The technological landscape of the Geotechnical and Structural Monitoring Devices Market is rapidly evolving, driven by the need for higher precision, lower power consumption, and increased automation. Traditional monitoring methods, heavily reliant on vibrating wire and electrical resistance technologies, remain fundamental due to their proven long-term stability and durability, particularly in highly saturated or high-pressure environments common in deep boreholes and dam foundations. However, the most significant shift is the proliferation of micro-electromechanical systems (MEMS) sensors, which offer highly miniaturized, low-cost solutions for measuring tilt, acceleration, and inclination. MEMS technology facilitates the creation of densely arrayed sensor networks, providing granular data collection essential for sophisticated structural health modeling in urban environments and complex infrastructure.

The digital transformation is centered around advanced communication technologies. Wireless Sensor Networks (WSN), utilizing LPWAN standards such as LoRaWAN, NB-IoT, and 4G/5G cellular connectivity, are displacing bulky, expensive wired systems by enabling remote data transmission over long distances with minimal power draw. This technological shift addresses the high cost and logistical complexity traditionally associated with deploying monitoring systems in remote locations, such as mountainous regions for landslide monitoring or extensive railway networks. Furthermore, Fiber Optic Sensing (FOS), specifically Distributed Acoustic Sensing (DAS) and Fiber Bragg Grating (FBG), represents a high-precision, interference-immune technology capable of measuring parameters like strain and temperature continuously along the entire length of the fiber. FOS is particularly critical in high-risk environments, including deep tunnels and structurally sensitive environments where electrical interference must be avoided.

Beyond the sensors themselves, the overarching technological advancement involves the platforms used for data acquisition, processing, and visualization. Cloud computing and edge computing capabilities are foundational to modern monitoring solutions, allowing for immediate data quality checks and preliminary analysis at the device level before transmission. This infrastructure supports the application of sophisticated Big Data analytics and machine learning algorithms, which automate the detection of critical trends and anomalies. The combination of highly stable hardware, low-power wireless communication, and intelligent data processing tools defines the state-of-the-art in structural monitoring, facilitating the migration towards autonomous, self-diagnostic monitoring systems that require minimal human intervention for daily operation and maintenance checks.

Regional Highlights

The market dynamics for Geotechnical and Structural Monitoring Devices show distinct characteristics across major global regions, influenced by infrastructure age, regulatory environments, and investment cycles. Asia Pacific (APAC) currently dominates the market growth trajectory. This is attributed to unprecedented infrastructure development, specifically in China, India, and Southeast Asian nations, driven by rapid urbanization and large-scale government investment in energy, transportation (high-speed rail, metro systems), and municipal water projects. These projects necessitate extensive monitoring for ground stability during construction and structural integrity post-completion. The APAC market shows high adoption rates for advanced technologies like wireless IoT solutions due to the often vast and remote project sites.

North America (NA) and Europe represent mature markets characterized primarily by asset rehabilitation and maintenance of aging critical infrastructure. In these regions, demand is spurred by stringent regulatory updates and the need for continuous surveillance of assets constructed decades ago, such as bridges, dams, and historic buildings, to ensure public safety and mitigate failure risks. The adoption focus here is on digitalization, automation, and advanced data analytics (AI/ML) integration, rather than solely new construction monitoring. High labor costs also accelerate the shift towards fully automated, remote monitoring systems, ensuring operational efficiency and long-term cost reduction for asset owners.

Latin America and the Middle East & Africa (MEA) are emerging markets with significant potential. Latin America’s demand is driven by mining operations (e.g., Chile, Peru) requiring rigorous slope and tailings dam stability monitoring, alongside investments in new urban transportation infrastructure. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in mega-projects (e.g., smart cities, extensive deep-water ports), demanding state-of-the-art structural monitoring systems. Political stability and commodity price fluctuations, however, often influence the pace of project execution in these emerging markets, but the underlying need for sophisticated geotechnical assessment remains high due to challenging environmental and seismic conditions.

- Asia Pacific (APAC): Highest growth driver due to vast new infrastructure construction (rail, dams, high-rise buildings) and rapid urbanization in China and India.

- North America (NA): Focus on retrofitting, maintenance, and digitalization of aging civil assets, driven by strict infrastructure safety regulations and high adoption of AI-enabled predictive platforms.

- Europe: Strong demand fueled by rehabilitation of old tunnels, bridges, and historic structures; emphasis on precision monitoring (Fiber Optic Sensing) and sustainable construction practices.

- Middle East and Africa (MEA): Growth driven by regional mega-projects (e.g., NEOM in Saudi Arabia) and critical monitoring needs for complex oil and gas infrastructure in challenging desert environments.

- Latin America: Sustained demand from large-scale mining operations for slope and tailings dam monitoring, alongside public works investments in seismic zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Geotechnical and Structural Monitoring Devices Market.- RST Instruments

- Keller Group

- Geokon

- Campbell Scientific

- Senceive

- Fugro

- Nova Metrix

- SolData

- Measurand

- Geosense

- Sisgeo

- James Instruments

- Sixense

- Cowi

- CTLGroup

- Geosystems

- Deep Excavation

- HBM (Hottinger Baldwin Messtechnik)

- OMA Compagnia Generale Strumentazione

- Giatec Scientific Inc.

Frequently Asked Questions

Analyze common user questions about the Geotechnical and Structural Monitoring Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Geotechnical Monitoring Devices globally?

The primary driver is the accelerating deterioration of aging global infrastructure, particularly in developed economies, coupled with stringent government regulations mandating continuous safety monitoring and risk mitigation to prevent catastrophic structural failures and ensure public safety compliance.

How are Wireless Sensor Networks (WSN) influencing market growth and technology adoption?

WSNs, utilizing technologies like LoRaWAN and cellular connectivity, are substantially lowering the cost and complexity of deployment by eliminating extensive cabling. This facilitates continuous, real-time monitoring in remote or hazardous locations, significantly enhancing data frequency and reducing operational expenses compared to traditional wired systems.

Which application segment holds the largest share in the Geotechnical and Structural Monitoring Devices Market?

The Tunnels and Underground Excavations segment, along with Dams and Bridges, typically accounts for the largest market share. These large infrastructure projects inherently require extensive, long-term monitoring systems to manage immense geotechnical risks associated with ground movement, hydrostatic pressure, and construction-induced stress.

What role does Artificial Intelligence (AI) play in modern structural health monitoring (SHM)?

AI, specifically machine learning, is vital for transforming raw sensor data into actionable predictive insights. It automates anomaly detection, forecasts structural degradation timelines, and correlates complex datasets (e.g., weather and strain readings), moving monitoring from reactive alerting to proactive, prescriptive maintenance planning.

What is the key technological restraint facing the widespread adoption of advanced monitoring solutions?

The principal restraint remains the high initial capital investment required for installing complex, integrated sensor networks, coupled with the ongoing challenge of securing highly specialized personnel needed for system calibration, maintenance, and the sophisticated interpretation of complex geotechnical data outputs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager