Geotechnical Instrumentation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440384 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Geotechnical Instrumentation Market Size

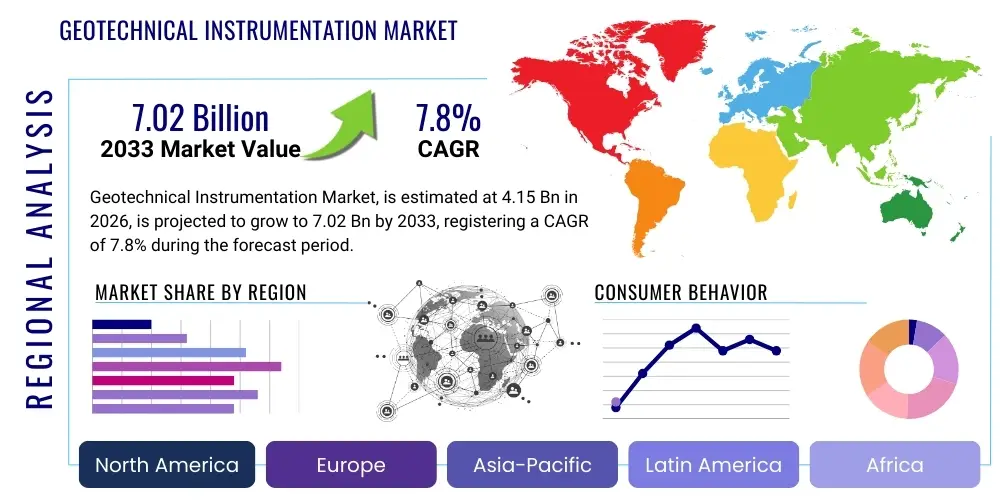

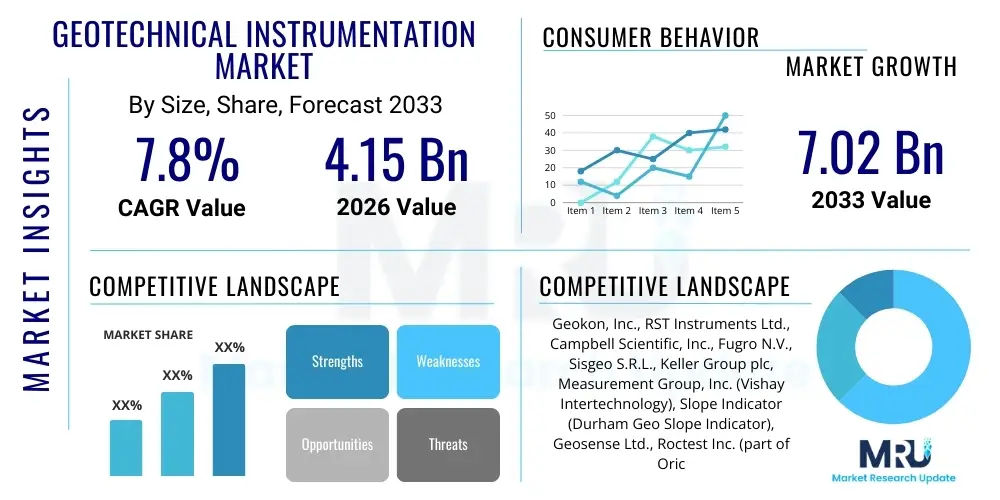

The Geotechnical Instrumentation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.15 billion in 2026 and is projected to reach USD 7.02 billion by the end of the forecast period in 2033. This robust growth is primarily fueled by increasing global infrastructure development, growing concerns over the safety and stability of civil structures, and the accelerating adoption of advanced monitoring technologies across various industries.

Geotechnical Instrumentation Market introduction

Geotechnical instrumentation encompasses a wide array of devices and systems specifically designed to measure and monitor the physical properties and behavior of soil, rock, and other ground materials. These instruments provide critical data on parameters such as pore water pressure, ground movement, strain, stress, temperature, and seismic activity, which are essential for ensuring the safety, stability, and longevity of civil engineering projects. Products range from simple manual gauges to sophisticated automated sensor networks, including inclinometers, extensometers, piezometers, load cells, strain gauges, and crack meters.

The major applications of geotechnical instrumentation span across diverse sectors including large-scale construction (buildings, bridges, dams, tunnels), mining operations, oil and gas exploration, environmental monitoring, and landslide prevention. These tools are indispensable for critical phases of project development, from site investigation and design validation to construction monitoring and long-term performance assessment. The benefits derived from their use are profound, encompassing enhanced structural safety, optimized design, improved operational efficiency, reduced project risks, and significant cost savings through early detection of potential failures.

Key driving factors for the market's expansion include the escalating pace of urbanization and infrastructure development worldwide, particularly in emerging economies, which necessitates robust monitoring of new constructions. Furthermore, a heightened focus on maintaining and rehabilitating aging infrastructure in developed regions, coupled with increasingly stringent safety regulations and environmental concerns, further propels the demand for reliable geotechnical monitoring solutions. Technological advancements, such as the integration of wireless communication, IoT, and data analytics, are also playing a pivotal role in transforming the market landscape by offering more efficient, precise, and real-time monitoring capabilities.

Geotechnical Instrumentation Market Executive Summary

The Geotechnical Instrumentation Market is currently experiencing dynamic growth, largely driven by significant business trends that emphasize automation, digitalization, and data integration. Companies are increasingly investing in smart monitoring systems that offer real-time data acquisition and analysis, moving away from traditional manual methods. This shift is critical for complex infrastructure projects and hazardous environments, enhancing both efficiency and safety. Furthermore, there's a growing trend towards rental and service-based models, allowing project managers to access cutting-edge technology without significant upfront capital investment, which supports smaller firms and short-term projects.

Regionally, the market exhibits varied growth trajectories. Asia Pacific is poised for substantial growth due to rapid urbanization, massive infrastructure projects in countries like China and India, and increasing investments in smart city initiatives. North America and Europe, while more mature, continue to show steady demand, primarily driven by maintenance, rehabilitation of aging infrastructure, and a strong regulatory environment emphasizing structural integrity. Latin America, the Middle East, and Africa are emerging markets, with investments in mining, oil and gas, and transport infrastructure projects gradually boosting the adoption of geotechnical instrumentation, albeit at a slower pace due to economic and political variabilities.

Segmentation trends highlight a strong demand for advanced monitoring systems, including wireless sensor networks and integrated data acquisition systems, which offer comprehensive insights into ground conditions. The inclinometer and piezometer segments continue to hold significant market share due to their fundamental role in measuring ground movement and pore water pressure, respectively. Moreover, the mining and civil construction end-use segments remain dominant, driven by continuous operational monitoring requirements and safety regulations. The market is also seeing a rise in specialized sensors tailored for specific applications, such as tunnel monitoring or slope stability assessment, reflecting a growing need for precision and application-specific solutions.

AI Impact Analysis on Geotechnical Instrumentation Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Geotechnical Instrumentation Market frequently center on its potential to revolutionize data interpretation, predictive analysis, and automation. Common questions include how AI can enhance the accuracy of geotechnical models, streamline data processing from numerous sensors, and provide early warnings of potential structural failures. Users are particularly interested in AI's capability to move beyond raw data presentation to generate actionable insights, identify complex patterns that human analysts might miss, and optimize decision-making processes in civil engineering and construction. There's also curiosity about the integration challenges, data requirements for effective AI implementation, and the ethical implications of relying on AI for critical safety assessments. The overarching expectation is that AI will make geotechnical monitoring more proactive, efficient, and intelligent, fundamentally altering project management and risk mitigation strategies.

- Enhanced Data Interpretation: AI algorithms can process vast amounts of sensor data from various geotechnical instruments simultaneously, identifying subtle trends and anomalies that may indicate impending issues. This leads to more accurate and timely interpretations of ground behavior and structural integrity.

- Predictive Analytics: Machine learning models can leverage historical and real-time data to forecast future ground movements, slope stability, and potential failure points. This enables proactive maintenance and intervention, significantly reducing the risk of catastrophic events and unexpected delays.

- Automated Anomaly Detection: AI systems can continuously monitor data streams for deviations from normal patterns, flagging unusual readings or rapid changes without constant human oversight. This allows for immediate alerts and responses to critical situations, improving overall safety protocols.

- Optimized Decision Making: By providing data-driven insights and predictive warnings, AI empowers engineers and project managers to make more informed decisions regarding design modifications, construction methodologies, and emergency responses, leading to more resilient and cost-effective projects.

- Resource Efficiency: AI can optimize the deployment and operation of geotechnical instruments, recommending optimal sensor placement, calibration schedules, and data collection frequencies, thereby reducing operational costs and maximizing the utility of monitoring equipment.

- Integration with BIM and Digital Twins: AI facilitates the seamless integration of geotechnical data with Building Information Modeling (BIM) and digital twin platforms, creating comprehensive virtual models that simulate real-world conditions and predict structural responses to various stresses, enhancing project lifecycle management.

- Reduced Human Error: Automation of data processing and analysis tasks through AI minimizes the potential for human error in interpreting complex geotechnical information, leading to more reliable safety assessments and project outcomes.

DRO & Impact Forces Of Geotechnical Instrumentation Market

The Geotechnical Instrumentation Market is propelled by several key drivers, primarily the global surge in infrastructure development projects, including smart cities, high-speed rail networks, and large-scale urban expansions, which inherently require extensive ground monitoring. Increased awareness and stringent regulatory frameworks concerning structural safety, especially for aging infrastructure in developed nations, further fuel demand. Additionally, advancements in sensor technology, data acquisition systems, and software integration are making these instruments more precise, reliable, and accessible, driving their adoption across new applications. However, significant restraints challenge market growth, including the high initial capital investment required for sophisticated instrumentation and monitoring systems, which can deter smaller projects or budget-constrained organizations. The complexity of installing, operating, and maintaining these systems, often requiring specialized expertise, also acts as a barrier to wider adoption, particularly in regions with a shortage of skilled personnel. Furthermore, the variability of ground conditions and the need for customized solutions can increase project costs and lead to slower implementation.

Opportunities within this market are abundant, particularly with the advent of remote monitoring capabilities and the integration of IoT (Internet of Things) and cloud-based platforms, enabling real-time data access and analysis from anywhere. The growing demand for sustainable construction practices and disaster risk reduction strategies presents new avenues for geotechnical instrumentation in environmental monitoring and early warning systems for natural hazards like landslides and earthquakes. Emerging economies, with their rapid industrialization and urbanization, represent vast untapped markets for both new installations and retrofitting projects. The development of more cost-effective, wireless, and energy-efficient sensors also broadens the potential customer base. Strategic partnerships between instrumentation providers, software developers, and civil engineering firms can create integrated solutions that address complex project requirements more comprehensively.

The market is also shaped by various impact forces. The threat of new entrants is moderate, as establishing credibility and developing advanced, reliable instrumentation requires significant R&D investment and technical expertise, creating barriers. However, smaller innovative firms focusing on niche sensor technologies or software solutions can still carve out a space. The bargaining power of buyers is significant, driven by the specialized and often project-specific nature of purchases, allowing them to demand competitive pricing and customized solutions, particularly for large-scale infrastructure projects. The bargaining power of suppliers is relatively low to moderate; while specialized components may come from limited sources, the overall market for standard sensors and data loggers is diverse enough to offer alternatives. The threat of substitute products or services is low for core geotechnical measurements, as direct physical monitoring remains indispensable, though advancements in remote sensing (e.g., satellite imagery) can complement or reduce the need for some on-site instrumentation. Finally, the intensity of rivalry among existing competitors is high, with numerous established players and continuous innovation pushing companies to differentiate through technology, service quality, and integrated solutions to capture market share.

Segmentation Analysis

The Geotechnical Instrumentation Market is meticulously segmented across various dimensions to provide a detailed understanding of its complex dynamics and diverse applications. These segmentations typically include instrument type, technology employed, end-use industry, and application area, each revealing unique market characteristics and growth drivers. Understanding these segments is crucial for stakeholders to identify specific market niches, tailor product development strategies, and optimize marketing efforts to reach the most relevant customer bases. The interplay between these segments often dictates competitive strategies and investment priorities within the industry.

- Instrument Type

- Inclinometers: Used to measure subsurface lateral ground movement and deformation.

- Piezometers: Employed to monitor pore water pressure in soil and rock.

- Extensometers: Measures displacement or deformation in rock or soil masses.

- Load Cells: Utilized to measure axial loads, pressure, and stress in structural components and anchors.

- Strain Gauges: Detects minute deformations and strains in structures or materials.

- Settlement Systems: Monitors vertical ground movement and settlement.

- Crack Meters: Measures displacement and width changes across cracks in concrete or rock.

- Geophones/Seismographs: Records ground vibrations and seismic activity.

- Tiltmeters: Measures changes in inclination or tilt of structures and ground surfaces.

- Thermometers/Temperature Sensors: Monitors temperature profiles in ground and structures.

- Technology

- Conventional/Manual Instruments: Traditional mechanical or hydraulic instruments requiring manual readings.

- Automated/Digital Instruments: Electronic sensors with data loggers for automatic data acquisition.

- Wireless Sensor Networks (WSN): Networks of spatially distributed autonomous sensors to monitor conditions collaboratively.

- Fiber Optic Sensors: Utilizes optical fibers for highly sensitive and robust measurements in harsh environments.

- IoT-Enabled Devices: Instruments integrated with internet connectivity for real-time remote monitoring and data access.

- Application

- Slope Stability Monitoring: Assessing the stability of natural slopes, embankments, and excavations.

- Tunnel and Underground Works Monitoring: Tracking deformations, pressures, and stability in tunnels, caverns, and shafts.

- Dam and Embankment Monitoring: Ensuring the structural integrity and safety of water retention structures.

- Bridge and Structural Monitoring: Assessing the health and performance of bridges, buildings, and other civil structures.

- Mining Monitoring: Monitoring ground movement, stress, and stability in open-pit and underground mines.

- Environmental Monitoring: Tracking ground deformation, groundwater levels, and seismic activity related to environmental hazards.

- Foundation and Excavation Monitoring: Ensuring stability during the construction of foundations and deep excavations.

- End-Use Industry

- Civil Construction: Buildings, roads, bridges, railways, and urban infrastructure.

- Mining: Open-pit mining, underground mining, tailings dams, and heap leach pads.

- Oil and Gas: Pipeline monitoring, platform stability, and drilling operations.

- Power Generation: Hydroelectric dams, nuclear power plants, wind turbine foundations.

- Environmental Agencies: Landfill monitoring, groundwater management, natural hazard assessment.

- Research and Academic Institutions: Experimental studies and geotechnical research.

Value Chain Analysis For Geotechnical Instrumentation Market

The value chain for the Geotechnical Instrumentation Market begins with upstream activities, primarily involving the research and development of new sensor technologies, material science, and data processing algorithms. This phase is critical for innovation, driving the performance and reliability of instrumentation. Key suppliers in the upstream segment include manufacturers of specialized electronic components, precision mechanical parts, optical fibers, and software developers who create the fundamental intellectual property and raw materials essential for producing advanced geotechnical instruments. The quality and cost-effectiveness of these inputs directly influence the final product's performance and market competitiveness, making strong supplier relationships vital.

Midstream activities involve the actual manufacturing, assembly, and calibration of geotechnical instruments. This stage includes sophisticated production processes that ensure accuracy, durability, and compliance with industry standards. Instrument manufacturers often specialize in particular types of sensors or monitoring systems, leveraging proprietary technologies and manufacturing expertise. Following production, a significant part of the value chain focuses on the distribution channels. These include direct sales by manufacturers, a network of authorized distributors, and value-added resellers who often provide localized support, installation services, and maintenance. The choice of distribution channel heavily depends on the target market's geographical spread and the complexity of the solutions offered, with direct sales often preferred for large, complex projects requiring bespoke solutions, while distributors cater to broader markets and smaller projects.

Downstream activities encompass the installation, commissioning, data collection, analysis, and ongoing maintenance services provided to end-users. This segment is highly service-intensive, often involving geotechnical consultants, civil engineering firms, and specialized instrumentation service providers. These entities add significant value by ensuring proper deployment, accurate data interpretation, and integration of monitoring results into broader project management systems. The demand for direct and indirect channels also plays a crucial role. Direct channels involve manufacturers engaging directly with large clients or specific projects, offering integrated solutions, and long-term support. Indirect channels, through distributors and integrators, allow for wider market penetration, catering to diverse customer needs and providing local support. The effectiveness of this downstream support is paramount for customer satisfaction and the long-term success of geotechnical instrumentation projects.

Geotechnical Instrumentation Market Potential Customers

The Geotechnical Instrumentation Market caters to a diverse range of potential customers, all sharing a common need for accurate and reliable information about ground conditions and structural behavior. These end-users typically include large construction companies engaged in building complex infrastructure projects such as bridges, tunnels, highways, and high-rise buildings, where ensuring foundational stability and monitoring structural integrity during and after construction is paramount. These firms rely on geotechnical instruments to validate designs, monitor excavation stability, and comply with stringent safety regulations. Their requirements often involve integrated monitoring systems capable of handling multiple data streams and providing real-time insights for large-scale operations.

Another significant customer segment comprises mining companies, both in open-pit and underground operations. These companies utilize geotechnical instrumentation for crucial applications such as slope stability monitoring in open-pit mines, assessing ground movement and support system effectiveness in underground mines, and monitoring tailings dams to prevent environmental disasters. The harsh and dynamic environments of mining operations demand robust and reliable instruments that can withstand extreme conditions and provide continuous data for operational safety and efficiency. Government agencies and public works departments also represent substantial potential customers, as they are responsible for overseeing and maintaining extensive public infrastructure, including roads, dams, and utilities. They use geotechnical instrumentation for long-term structural health monitoring, risk assessment of aging assets, and planning rehabilitation projects.

Furthermore, civil engineering consultants, specialized geotechnical engineering firms, and environmental consulting groups form a vital customer base. These entities act as intermediaries, providing expert services to various clients across different sectors, often specifying and implementing geotechnical monitoring solutions as part of their project scope. Research and academic institutions also constitute potential customers, utilizing these instruments for experimental studies, model validation, and advancing the scientific understanding of soil and rock mechanics. The oil and gas sector, particularly for pipeline stability monitoring and offshore platform foundations, also contributes to the customer landscape, requiring specialized instruments capable of operating in challenging subsea or remote terrestrial environments. This broad customer spectrum underscores the foundational importance of geotechnical instrumentation across critical global industries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.15 billion |

| Market Forecast in 2033 | USD 7.02 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Geokon, Inc., RST Instruments Ltd., Campbell Scientific, Inc., Fugro N.V., Sisgeo S.R.L., Keller Group plc, Measurement Group, Inc. (Vishay Intertechnology), Slope Indicator (Durham Geo Slope Indicator), Geosense Ltd., Roctest Inc. (part of Orica), Nova Metrix LLC, Soil Instruments Ltd., Acuity Brands, Inc. (formerly Senorics), Omni Instruments Ltd., Eijkelkamp Geomonitoring, ITM Instruments Inc., SolData, Load Systems Inc., GeoSpectrum Technologies Inc., Canary Systems Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Geotechnical Instrumentation Market Key Technology Landscape

The technological landscape of the Geotechnical Instrumentation Market is rapidly evolving, driven by the demand for more precise, reliable, and real-time data acquisition and analysis. One of the most significant advancements is the proliferation of wireless sensor networks (WSN) and Internet of Things (IoT) enabled devices. These technologies allow for remote monitoring of geotechnical parameters, eliminating the need for manual data collection in often hazardous or inaccessible locations. WSNs provide flexible deployment, scalable solutions, and reduced installation costs, while IoT integration enables seamless data transmission to cloud-based platforms for centralized monitoring, alerting, and analysis. This shift towards connected instrumentation facilitates proactive decision-making and enhances the efficiency of project management.

Another pivotal technological development involves the integration of advanced data analytics, artificial intelligence (AI), and machine learning (ML) algorithms. These computational tools are transforming raw sensor data into actionable insights by identifying complex patterns, predicting potential failures, and generating early warnings. AI-powered platforms can process immense volumes of data from numerous sensors, offering capabilities such as automated anomaly detection, predictive maintenance scheduling, and optimized resource allocation. Furthermore, the adoption of fiber optic sensors is gaining traction due to their immunity to electromagnetic interference, high sensitivity, long-distance monitoring capabilities, and durability in harsh environments, making them ideal for critical applications like tunnel monitoring and dam surveillance.

The market is also witnessing innovations in sensor design, leading to the development of more robust, miniaturized, and multi-functional sensors that can measure several parameters simultaneously. Geotechnical software platforms are becoming increasingly sophisticated, offering advanced visualization tools, integration with Building Information Modeling (BIM) for comprehensive project oversight, and digital twin capabilities that create virtual replicas of physical assets. These digital twins allow for real-time simulation and performance prediction, enhancing design optimization and operational management throughout the asset's lifecycle. Moreover, satellite-based remote sensing technologies, such as InSAR (Interferometric Synthetic Aperture Radar), are emerging as complementary tools for wide-area ground deformation monitoring, providing macro-level insights that can guide the strategic placement of ground-based instrumentation.

Regional Highlights

- North America: This region represents a mature yet robust market for geotechnical instrumentation, driven by significant investments in maintaining and upgrading aging infrastructure across the United States and Canada. Stringent safety regulations and a proactive approach to structural health monitoring for bridges, dams, and highways fuel consistent demand. The adoption of advanced technologies like IoT and AI in monitoring solutions is high, reflecting a strong emphasis on efficiency and predictive maintenance.

- Europe: Similar to North America, Europe is characterized by a strong focus on infrastructure renewal and rehabilitation, particularly in Western European countries. Strict environmental and safety standards, combined with an increasing number of complex urban development projects and tunneling initiatives, sustain market growth. Countries like Germany, the UK, and France are leaders in adopting sophisticated geotechnical monitoring systems, including fiber optic sensors and automated solutions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the geotechnical instrumentation market, primarily due to rapid urbanization, massive infrastructure development projects (e.g., smart cities, high-speed railways, large-scale residential and commercial complexes) in China, India, and Southeast Asian countries. The region's increasing investment in mining activities and oil and gas exploration also contributes significantly to market expansion, with a growing emphasis on adopting modern monitoring technologies for safety and efficiency.

- Latin America: This region is experiencing steady growth, largely driven by ongoing investments in mining projects, particularly in countries like Chile, Peru, and Brazil, where geotechnical instrumentation is crucial for slope stability and mine safety. Infrastructure development, while sometimes hampered by economic fluctuations, also contributes to demand, especially in urban centers and for large-scale energy projects.

- Middle East and Africa (MEA): The MEA market is an emerging region with considerable potential, propelled by ambitious infrastructure development plans in the GCC countries (e.g., UAE, Saudi Arabia) related to smart cities, tourism, and transportation networks. The oil and gas sector remains a major end-user, requiring instrumentation for pipeline integrity and facility stability. Africa's burgeoning mining sector and increasing infrastructure investments also present long-term growth opportunities, despite challenges related to economic stability and technological adoption rates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Geotechnical Instrumentation Market.- Geokon, Inc.

- RST Instruments Ltd.

- Campbell Scientific, Inc.

- Fugro N.V.

- Sisgeo S.R.L.

- Keller Group plc

- Measurement Group, Inc. (Vishay Intertechnology)

- Slope Indicator (Durham Geo Slope Indicator)

- Geosense Ltd.

- Roctest Inc. (part of Orica)

- Nova Metrix LLC

- Soil Instruments Ltd.

- Acuity Brands, Inc. (formerly Senorics)

- Omni Instruments Ltd.

- Eijkelkamp Geomonitoring

- ITM Instruments Inc.

- SolData

- Load Systems Inc.

- GeoSpectrum Technologies Inc.

- Canary Systems Inc.

Frequently Asked Questions

What is geotechnical instrumentation and why is it important?

Geotechnical instrumentation refers to specialized devices and systems designed to measure and monitor the physical properties and behavior of soil, rock, and ground materials. It is critical for ensuring the safety, stability, and longevity of civil engineering projects by providing data on ground movement, pore pressure, stress, and strain, enabling proactive risk mitigation and informed decision-making.

What are the primary applications of geotechnical instrumentation?

The primary applications include monitoring for construction projects like buildings, bridges, dams, and tunnels; ensuring slope stability in mining operations; assessing the structural health of aging infrastructure; and preventing natural hazards such as landslides. It is also extensively used in environmental monitoring and foundation stability assessments.

How is technology impacting the geotechnical instrumentation market?

Technology is profoundly impacting the market through the integration of wireless sensor networks (WSN), IoT-enabled devices, and cloud computing for real-time remote monitoring. Furthermore, artificial intelligence (AI) and machine learning (ML) are enhancing data analysis, predictive modeling, and automated anomaly detection, leading to more efficient, accurate, and proactive geotechnical assessments.

Which regions are driving the growth of the geotechnical instrumentation market?

Asia Pacific (APAC) is currently the fastest-growing region due to rapid urbanization and large-scale infrastructure development projects. North America and Europe also contribute significantly, driven by the need for maintenance and rehabilitation of aging infrastructure and stringent safety regulations.

What are the key challenges faced by the geotechnical instrumentation market?

Key challenges include the high initial capital investment required for advanced systems, the complexity associated with installation, operation, and maintenance, and a shortage of skilled personnel. Additionally, the variability of ground conditions often necessitates customized solutions, which can increase project costs and implementation timelines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager