Gf and Gfrp Composites Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431396 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Gf and Gfrp Composites Market Size

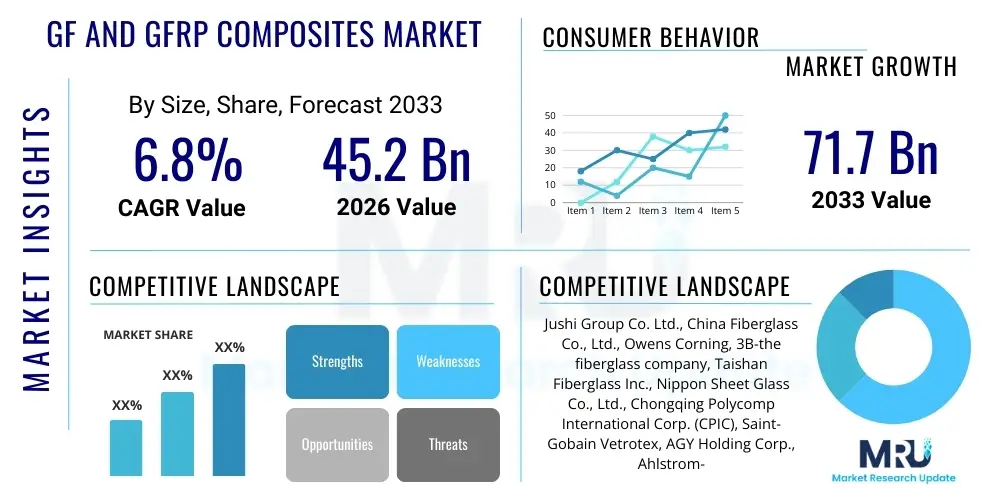

The Gf and Gfrp Composites Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 71.7 Billion by the end of the forecast period in 2033.

Gf and Gfrp Composites Market introduction

The Glass Fiber (GF) and Glass Fiber Reinforced Polymer (GFRP) Composites Market encompasses a wide range of materials where glass fibers are embedded in a polymer matrix, typically thermoset resins like polyester, vinyl ester, or epoxy, or sometimes thermoplastics. This synergistic combination results in materials that possess superior properties compared to traditional engineering materials, specifically characterized by high specific strength, excellent corrosion resistance, low weight, and enhanced durability. GFRP composites are foundational to modern lightweighting strategies across multiple industrial sectors, enabling manufacturers to meet stringent performance and efficiency requirements without compromising structural integrity. The inherent flexibility in manufacturing processes, including pultrusion, filament winding, and hand lay-up, allows these composites to be tailored precisely for specific end-use applications, ensuring optimal material utilization and cost-effectiveness.

Major applications of GF and GFRP composites span infrastructure, transportation, aerospace, wind energy, and consumer goods. In the construction sector, GFRP rebars are increasingly replacing traditional steel rebar due to their non-corrosive nature, significantly extending the lifespan of concrete structures exposed to harsh environments, such as bridges and marine infrastructure. The wind energy sector stands as a substantial driver, demanding vast quantities of glass fiber for manufacturing lightweight, high-performance rotor blades that maximize energy capture efficiency. Furthermore, the automotive industry utilizes GFRP extensively for internal and external components to reduce vehicle weight, thereby improving fuel efficiency and reducing emissions, aligning with global regulatory mandates for sustainability.

The primary benefits driving the robust growth of the GF and GFRP composites market include their outstanding mechanical properties, chemical inertness, and thermal insulation capabilities. Glass fibers provide high tensile strength, while the polymer matrix protects the fibers, transfers loads, and determines the composite’s environmental resilience. Key driving factors involve the global shift toward renewable energy infrastructure, rapid urbanization requiring advanced, durable construction materials, and the continuous need for lightweighting in the transportation sector. Technological advancements in fiber sizing, resin chemistry, and high-speed manufacturing techniques, such as automated fiber placement and resin transfer molding (RTM), further enhance the cost-competitiveness and performance profile of GFRP solutions, cementing their indispensable role in future material engineering.

Gf and Gfrp Composites Market Executive Summary

The Gf and Gfrp Composites Market is characterized by vigorous growth driven predominantly by sustainability imperatives and the persistent demand for materials offering a superior strength-to-weight ratio. Current business trends indicate a strong move towards operational efficiency through vertical integration among key players, securing raw material supply chains (glass roving, resins, and catalysts) and controlling processing costs. Innovations are centered on developing next-generation glass fiber types, such as high-modulus (H-glass) and corrosion-resistant (E-CR glass) fibers, coupled with bio-based or recyclable polymer matrices to address environmental concerns. Furthermore, the adoption of Industry 4.0 technologies, including predictive maintenance and AI-driven quality control in composite manufacturing, is optimizing production cycles and reducing material wastage, bolstering overall profitability and market competitiveness globally.

Regional trends highlight Asia Pacific (APAC) as the undisputed leader in consumption and manufacturing capacity, fueled primarily by expansive infrastructure development in China and India, coupled with massive investments in wind energy generation across the region. North America and Europe, while representing mature markets, exhibit high growth potential in specialized, high-performance applications, such as aerospace interiors, advanced automotive structures, and offshore wind power components, driven by stringent safety standards and high technological readiness. Manufacturers in these regions focus heavily on automation and achieving high throughput rates for complex structural parts, moving away from labor-intensive traditional methods. Regulatory environments, particularly those related to automotive emissions and building codes, significantly influence regional material choices and accelerate the adoption of GFRP solutions.

Segment trends reveal that the Wind Energy sector remains the largest consumer by application, although the Construction and Infrastructure segment is demonstrating the fastest growth rate, fueled by the adoption of non-corrosive GFRP rebar and structural profiles. By product type, the demand for continuous roving glass fiber, essential for pultrusion and filament winding, continues to dominate due to its requirement in large-scale structural applications. The shift towards higher-performance epoxy and vinyl ester resins, replacing basic polyesters, is also noticeable, reflecting the market’s pivot towards applications demanding greater chemical resistance and thermal stability. This segmented growth underscores the versatility of GFRP, confirming its status as a critical enabler of innovation across diverse industrial value chains.

AI Impact Analysis on Gf and Gfrp Composites Market

User inquiries concerning the integration of Artificial Intelligence (AI) and machine learning (ML) within the GF and GFRP composites market primarily revolve around optimizing manufacturing efficiency, enhancing product quality control, and accelerating material discovery. Common themes include how AI can predict fiber orientation during complex molding processes, thereby minimizing defects like voids or warping, and its role in optimizing curing cycles for thermoset resins to reduce energy consumption and cycle time. There is significant interest in using AI for analyzing real-time sensor data from pultrusion or filament winding lines to implement immediate adjustments, ensuring consistent structural integrity. Furthermore, users are keen to understand how generative design principles, powered by AI, can lead to novel, lightweight composite structures with tailored performance characteristics that surpass traditional human-designed limitations, particularly in aerospace and high-speed rail applications.

The primary concerns users articulate relate to the cost of implementing sophisticated AI/ML infrastructure, the requirement for extensive, clean, and well-labeled historical manufacturing data to train reliable models, and the need for specialized personnel capable of interpreting and managing these advanced analytical systems. Expectations are high regarding AI’s potential to revolutionize the often complex and empirical process of composite material development. Specifically, the ability of AI to simulate various fiber/matrix combinations under different loading conditions—significantly faster and cheaper than physical testing—is anticipated to drastically shorten the time-to-market for new composite formulations. This transition promises to move the industry toward highly automated, zero-defect manufacturing environments, enhancing competitiveness and enabling greater customization for demanding end-use clients.

Ultimately, the impact of AI is viewed as transformative, shifting GFRP production from an empirical process reliant on operator experience to a data-driven science. AI algorithms are being deployed to manage supply chain risks by predicting raw material price fluctuations and optimizing inventory levels. In non-destructive testing (NDT), ML models are surpassing traditional inspection methods by accurately identifying subtle internal defects (e.g., delamination or micro-cracks) using ultrasound or X-ray data, thereby ensuring the long-term reliability of critical components like wind turbine blades and aircraft parts. This proactive approach to quality management, facilitated by AI, will be a fundamental differentiator for leading composite manufacturers in the coming decade.

- AI-driven optimization of fiber placement and orientation in automated manufacturing (AFP/ATL).

- Predictive maintenance for composite manufacturing equipment, reducing unplanned downtime.

- Machine learning models for accelerated material development and formulation testing (virtual screening).

- Enhanced quality control and defect detection using computer vision and NDT data analysis.

- Optimization of resin curing cycles and process parameters to maximize material performance and reduce energy usage.

- Generative design application for lightweight structural components in transportation and aerospace.

DRO & Impact Forces Of Gf and Gfrp Composites Market

The Gf and Gfrp Composites Market operates under a complex interplay of internal and external forces that dictate its growth trajectory and stability. The primary driving forces stem from global sustainability goals and the necessity for lightweight materials in energy-intensive sectors. Rapid industrialization in emerging economies, combined with substantial government investments in infrastructure rehabilitation and modernization (especially using non-corrosive materials), significantly boosts demand. Furthermore, the relentless expansion of the renewable energy sector, particularly onshore and offshore wind farms, creates an almost insatiable demand for large, robust, and lightweight composite blades. These drivers collectively push for higher volume production and continuous innovation in material properties and manufacturing technologies.

Restraints, however, pose significant challenges to widespread adoption. The high initial processing cost of GFRP components compared to traditional materials like steel or aluminum remains a major deterrent, particularly for high-volume, cost-sensitive applications like mass-market automobiles. Furthermore, end-of-life management and the recyclability of thermoset GFRP composites present substantial environmental hurdles. While mechanical and chemical recycling methods exist, they are often energy-intensive or result in lower-quality secondary materials, leading to concerns regarding the circular economy compliance. Regulatory scrutiny regarding disposal and volatile organic compound (VOC) emissions during certain manufacturing processes also pressures manufacturers to invest in cleaner, more expensive technologies.

Opportunities for market expansion are abundant, particularly in novel application areas such as 5G infrastructure (radomes and antennae housing), hydrogen fuel storage tanks, and advanced deep-sea infrastructure where corrosion resistance is paramount. The developing trend toward hybrid composites (combining glass fiber with carbon or aramid fibers) offers pathways to achieve tailored high-performance characteristics for demanding industrial applications. Impact forces, driven by geopolitical stability affecting oil prices (which influence resin costs) and global trade dynamics, constantly necessitate supply chain agility. The impact of material substitution, where composites displace metals, represents a fundamental structural force shaping the market, while simultaneous competition from basalt and natural fiber composites acts as a moderating force, forcing GFRP manufacturers to maintain competitive pricing and performance differentiation.

The market trajectory is primarily propelled by technological advancements in high-speed manufacturing (like continuous compression molding and rapid RTM) that drive down unit costs, mitigating the restraint of high processing expenses. The push for sustainability, driven by corporate mandates and consumer preference, generates opportunities for innovative, recyclable resin systems, effectively addressing the recycling challenge. Overall, the positive momentum from renewable energy and infrastructure spending significantly outweighs the constraints, leading to a strong, resilient market outlook characterized by incremental technological refinement and broadening industrial applications.

Segmentation Analysis

The Gf and Gfrp Composites market is systematically segmented based on various technical and commercial factors, including the type of glass fiber used, the class of polymer matrix, the specific manufacturing process employed, and the end-use industry utilizing the final composite product. Understanding these segmentations is critical for market participants to identify niche opportunities and allocate resources effectively toward high-growth areas. The differentiation between continuous fibers (rovings) and short fibers (mats/chopped strands) directly influences the mechanical properties and manufacturing feasibility, segmenting the market based on required structural performance. Continuous fibers are preferred for high-strength applications like pressure vessels and pultruded profiles, while short fibers dominate bulk molding compounds (BMC) used in automotive interiors and appliance housings.

The segmentation by polymer matrix is equally vital, distinguishing between thermoset (polyester, epoxy, vinyl ester) and thermoplastic matrices (polypropylene, polyamide). Thermoset composites dominate large structural applications due to their superior chemical resistance and creep performance, while thermoplastic GFRPs are gaining traction in the automotive sector because of their faster cycle times, ease of reprocessing, and potential for welding, aligning with mass production requirements. Furthermore, regional segmentation reflects disparities in infrastructure maturity, regulatory focus (e.g., green building codes vs. automotive lightweighting), and access to raw materials, leading to distinct supply chain configurations and product demand characteristics across geographic areas.

Application segmentation highlights the breadth of the market, spanning from highly specialized, low-volume aerospace components to high-volume, standardized industrial pipes and tanks. This wide application range necessitates diverse supply chains and varying degrees of customization. Manufacturers must align their core competencies—whether in high-precision pultrusion for construction or complex lay-up techniques for wind blades—with the specific demands of these end-use sectors. Overall, this multi-dimensional segmentation provides a robust framework for assessing market dynamics, competitive intensity, and future investment strategies within the complex GF and GFRP composites ecosystem.

- By Fiber Type:

- E-glass

- S-glass/R-glass (High Strength)

- C-glass/E-CR glass (Corrosion Resistant)

- Others (A-glass, D-glass)

- By Resin Type (Polymer Matrix):

- Thermoset Composites (Polyester, Epoxy, Vinyl Ester, Phenolic)

- Thermoplastic Composites (Polypropylene (PP), Polyamide (PA), Polybutylene Terephthalate (PBT))

- By Manufacturing Process:

- Hand Lay-up/Spray Lay-up

- Pultrusion

- Filament Winding

- Resin Transfer Molding (RTM)

- Injection Molding

- Compression Molding

- By Application/End-Use Industry:

- Wind Energy

- Transportation (Automotive, Aerospace, Marine, Rail)

- Construction and Infrastructure (Rebar, Profiles, Panels)

- Pipes and Tanks

- Electrical and Electronics

- Consumer Goods and Others

Value Chain Analysis For Gf and Gfrp Composites Market

The value chain for GF and GFRP composites begins with the upstream procurement and processing of fundamental raw materials. This stage is dominated by the production of high-quality glass fibers, primarily involving the melting of silica sand, limestone, and other mineral components in high-temperature furnaces and subsequent drawing into fine filaments. Key upstream suppliers include glass fiber manufacturers (who convert raw minerals into rovings, mats, or chopped strands) and chemical producers who supply the essential polymer resins (epoxy, polyester, etc.), catalysts, additives, and curing agents. The cost and quality of these primary inputs are highly sensitive to energy prices and global commodity markets. Vertical integration is a prevalent strategy in this segment, as major composite producers often seek to control or acquire glass fiber manufacturing capabilities to ensure supply consistency and manage material cost volatility effectively.

The intermediate stage involves the conversion of raw materials into semi-finished products or complex finished parts by specialized composite manufacturers. This highly technical segment encompasses diverse manufacturing processes such as pultrusion (for constant cross-section parts like rods and beams), filament winding (for cylindrical structures like pipes and tanks), and various molding techniques (RTM, SMC/BMC) for complex shapes. These converters add significant value through engineering design, tooling development, process optimization, and quality assurance. Their efficiency directly impacts the final unit cost and performance characteristics of the composite part. The choice of manufacturing process is dictated by volume requirements, geometric complexity, and the mechanical specifications demanded by the downstream application.

Downstream analysis focuses on the distribution channels and end-user consumption. Products are distributed through a mix of direct sales to large Original Equipment Manufacturers (OEMs)—such as wind turbine manufacturers or major automotive companies—and indirect channels involving specialized distributors and fabricators who serve smaller construction or industrial clients. Direct channels are typical for highly customized, high-value components, whereas indirect channels handle standardized profiles and commodity materials. The effectiveness of the distribution network, including logistics for handling large components like wind blades, is critical. The end-users, including construction firms, energy companies, and automotive assemblers, drive demand specifications, requiring highly detailed technical support and compliance with industry standards, thereby closing the feedback loop for continuous material improvement and process refinement.

Gf and Gfrp Composites Market Potential Customers

Potential customers for GF and GFRP composites are diverse, primarily falling into sectors that prioritize lightweighting, high durability, and resistance to corrosion, particularly in harsh or demanding operational environments. The largest and most influential customer segment is the renewable energy sector, specifically wind turbine manufacturers. These customers require massive volumes of high-performance glass fiber composite materials for producing rotor blades, nacelle covers, and structural supports, demanding materials that offer high stiffness and fatigue resistance to withstand prolonged, cyclic loading over a 20-25 year service life. Their procurement decisions are heavily influenced by cost efficiency, supply chain reliability, and material certifications that meet international wind industry standards.

Another rapidly expanding customer base is the civil infrastructure and construction industry. These buyers, including state transportation agencies, marine infrastructure developers, and specialized construction contractors, utilize GFRP composites primarily as non-corrosive reinforcement (rebar), bridge decks, and structural profiles in concrete structures exposed to chloride ions (road salt, sea water). For these customers, the superior longevity and reduced maintenance costs associated with GFRP—compared to traditional steel which requires extensive repair due to rust—represent the key value proposition. Adoption is often driven by evolving building codes and government mandates promoting durable, sustainable public works projects, making them high-volume, long-term procurement partners.

Furthermore, the global transportation industry, encompassing automotive, aerospace, and rail manufacturers, represents critical potential customers focused intensely on vehicle weight reduction to improve energy efficiency (fuel economy or battery range). Automotive OEMs, in particular, are volume buyers of GFRPs for semi-structural components, internal panels, and underbody protection, valuing the material’s crash performance characteristics and moldability for complex designs. Aerospace customers, while demanding lower volumes than automotive, require extremely high standards of performance and traceability for cabin interiors, radomes, and secondary structural components, often favoring sophisticated resins and requiring stringent qualification processes, positioning them as high-value, niche buyers within the market structure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 71.7 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jushi Group Co. Ltd., China Fiberglass Co., Ltd., Owens Corning, 3B-the fiberglass company, Taishan Fiberglass Inc., Nippon Sheet Glass Co., Ltd., Chongqing Polycomp International Corp. (CPIC), Saint-Gobain Vetrotex, AGY Holding Corp., Ahlstrom-Munksjö, Gurit Holding AG, Hexcel Corporation, Toray Industries, Inc., Teijin Limited, SGL Carbon, Mitsubishi Chemical Corporation, Hanwha Advanced Materials, BASF SE, Cytec Solvay Group, Polynt-Reichhold Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gf and Gfrp Composites Market Key Technology Landscape

The Gf and Gfrp Composites market is continually being shaped by technological advancements focused on increasing production speed, reducing material waste, and improving the consistency and complexity of manufactured parts. One pivotal area of innovation is in the automated processing technologies, particularly Automated Fiber Placement (AFP) and Automated Tape Laying (ATL), which are migrating from aerospace applications into high-volume industrial sectors like wind energy. These technologies allow for precise, rapid placement of glass fiber tapes or towpreg, significantly optimizing fiber orientation for maximum structural performance while reducing manual labor requirements. Complementing these are advancements in Resin Transfer Molding (RTM) and High-Pressure RTM (HP-RTM), which enable extremely fast cycle times for complex, net-shape parts, crucial for competing effectively with metal stamping processes in the automotive industry.

Another crucial technological frontier involves material science, specifically the development of advanced fiber coatings, or sizings, and novel resin systems. Sizing technology is vital as it dictates the chemical compatibility and adhesion between the glass fiber and the polymer matrix, fundamentally impacting the final composite strength and durability. Manufacturers are investing heavily in sizings optimized for non-conventional resins, such as polyurethane and high-performance thermoplastics, allowing GFRP to enter previously inaccessible application niches. Simultaneously, the market is seeing a rise in bio-based and recyclable resin matrices, addressing the sustainability challenge associated with traditional thermosets. These bio-resins often require modifications in curing technologies, sometimes incorporating UV or electron-beam curing systems to maintain high throughput rates.

Digitalization and integration of smart manufacturing are rapidly becoming standard technologies. The deployment of advanced sensors throughout the production line, coupled with robust data analytics and AI/ML, allows for real-time monitoring of critical process parameters such as temperature, pressure, and resin viscosity. This data-driven approach facilitates closed-loop control systems, minimizing variations and ensuring quality consistency, which is particularly challenging in large-scale composite manufacturing like wind blade production. Non-Destructive Testing (NDT) techniques, including advanced ultrasound arrays and thermography, integrated with automated inspection robots, further guarantee structural integrity, reducing reliance on destructive quality checks and enhancing the material's perception of reliability across critical end-use applications.

Regional Highlights

The global Gf and Gfrp Composites market exhibits strong regional disparities in terms of production capacity, application focus, and growth dynamics, largely influenced by local economic policies, industrial maturity, and infrastructure spending. Asia Pacific (APAC) stands as the largest and fastest-growing market, primarily due to the overwhelming presence of manufacturing hubs, particularly in China. The region benefits from substantial government-backed infrastructure projects, rapid expansion of domestic automotive manufacturing, and unparalleled investment in renewable energy generation, making it the epicenter for both high-volume production and consumption of glass fiber materials. The availability of low-cost manufacturing labor, although increasingly automated, and strong domestic demand ensures continuous capacity additions in countries like China and India, fueling global supply.

Europe represents a mature yet highly innovative market, characterized by stringent environmental regulations and a strong focus on high-performance, specialized composites. The region is a pioneer in offshore wind technology, driving demand for complex, durable, and highly engineered GFRP parts. The European market prioritizes advancements in recycling technologies, leading to greater adoption of thermoplastic GFRPs and the implementation of chemical recycling pilots for thermoset composites. Germany, France, and Spain are key markets, focusing intensely on high-end transportation applications, including aerospace and premium automotive sectors, where weight reduction and material traceability are paramount competitive advantages.

North America maintains a strong position, driven by significant investment in oil and gas infrastructure (requiring corrosion-resistant GFRP pipes and tanks) and ongoing modernization of its aging civil infrastructure (using GFRP rebar). The U.S. remains a key consumer in the aerospace and defense sectors, demanding high-specification materials. Furthermore, the push for electrification in the automotive industry necessitates lightweight battery enclosures and structural components, providing robust growth avenues for advanced GFRP solutions. While manufacturing costs are higher than in APAC, North American producers focus on highly automated processes and integration of digital twin technology to maintain high quality and competitiveness in specialized, complex composite parts.

- Asia Pacific (APAC): Dominates manufacturing capacity and consumption; fueled by Chinese wind energy and infrastructure spending; strong growth in construction and transportation sectors.

- Europe: Focuses on high-performance applications (offshore wind, aerospace); leads in sustainability efforts and development of composite recycling technologies; strict regulatory environment drives material innovation.

- North America: Significant end-user in construction, oil & gas, and aerospace/defense; driven by infrastructure renewal and automotive electrification mandates; emphasis on process automation and quality control.

- Latin America (LATAM): Emerging market with growing demand in local infrastructure development and basic industrial applications; potential limited by slower pace of large-scale renewable energy deployment.

- Middle East and Africa (MEA): Strong demand for corrosion-resistant GFRP pipes and tanks due to harsh environmental conditions (high salinity, heat) and ongoing oil & gas projects; rapid urbanization fueling construction composite use.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gf and Gfrp Composites Market.- Jushi Group Co. Ltd.

- Owens Corning

- China Fiberglass Co., Ltd.

- Taishan Fiberglass Inc.

- 3B-the fiberglass company (Owned by The Komeri Group)

- Nippon Sheet Glass Co., Ltd. (NSG)

- Chongqing Polycomp International Corp. (CPIC)

- Saint-Gobain Vetrotex

- AGY Holding Corp.

- Ahlstrom-Munksjö

- Gurit Holding AG

- Hexcel Corporation

- Toray Industries, Inc.

- Teijin Limited

- SGL Carbon

- Mitsubishi Chemical Corporation

- Hanwha Advanced Materials

- BASF SE

- Cytec Solvay Group

- Polynt-Reichhold Group

Frequently Asked Questions

Analyze common user questions about the Gf and Gfrp Composites market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between GFRP and CFRP, and why choose GFRP?

GFRP (Glass Fiber Reinforced Polymer) uses glass fibers, offering lower cost, higher elongation capability, and superior radar transparency. CFRP (Carbon Fiber Reinforced Polymer) uses carbon fibers, providing significantly higher stiffness, tensile strength, and reduced weight. GFRP is typically chosen when cost-effectiveness and high volume production are critical, especially in non-primary structural applications like wind blades and corrosion-resistant infrastructure, whereas CFRP is reserved for extremely high-performance, weight-critical applications like aerospace and high-end sports equipment.

How is the challenge of recycling thermoset GFRP composites being addressed?

The industry is addressing thermoset GFRP recycling through two main avenues: mechanical grinding to produce fillers for cement or new composites, and chemical recycling (pyrolysis or solvolysis). Pyrolysis, involving high heat in an oxygen-deprived environment, recovers the glass fibers and energy from the resin. Manufacturers are also increasingly developing and adopting thermoplastic GFRPs, which can be melted and reshaped, simplifying their end-of-life processing and improving compliance with circular economy mandates.

Which end-use industry drives the highest demand volume for GFRP composites?

The Wind Energy sector currently represents the largest volume consumer of GFRP composites globally. The manufacturing of large-scale, high-efficiency rotor blades requires continuous glass fiber rovings and mats in massive quantities. This demand is intrinsically linked to global energy transition efforts and government commitments to expand renewable power generation capacity, maintaining this segment as the primary market driver.

What role does pultrusion technology play in market growth?

Pultrusion is a critical technology driving growth, particularly in the construction and infrastructure segments. It is a continuous manufacturing process used to produce profiles of constant cross-section (rods, beams, tubes). Pultruded GFRP parts offer high fiber loading and superior structural performance, enabling the mass production of non-corrosive GFRP rebar and utility poles, which are rapidly replacing traditional materials in civil engineering due to their longevity and low maintenance requirements.

How do fluctuations in oil prices impact the cost of GFRP products?

Fluctuations in crude oil prices significantly impact the manufacturing costs of GFRP, as most polymer matrices, including polyester, vinyl ester, and epoxy resins, are petrochemical derivatives. Higher oil prices translate directly into increased raw material costs for the polymer matrix component, pressuring composite manufacturers' margins and necessitating efficiency improvements in fiber manufacturing and processing to mitigate overall cost inflation and maintain competitive pricing against conventional materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager