GGBS Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433172 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

GGBS Market Size

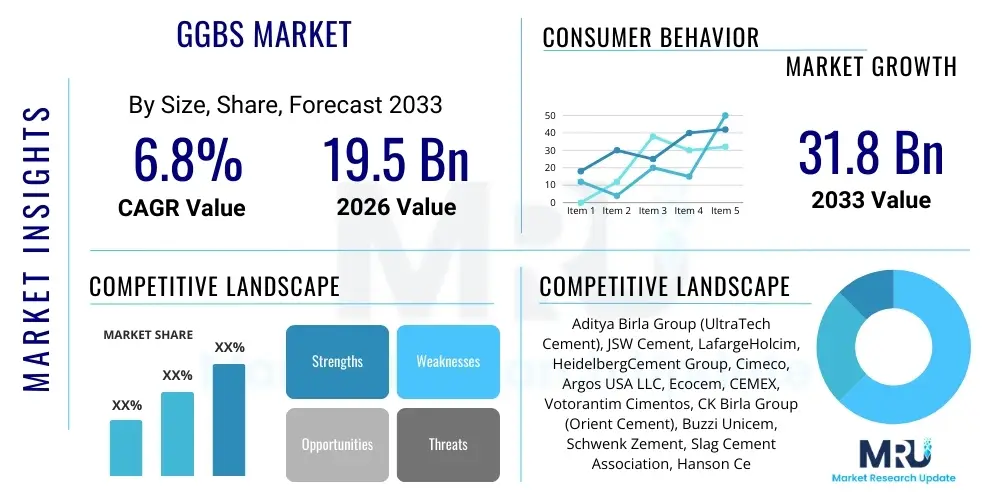

The GGBS Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $19.5 Billion in 2026 and is projected to reach $31.8 Billion by the end of the forecast period in 2033.

GGBS Market introduction

The Ground Granulated Blast-furnace Slag (GGBS) market encompasses the production and utilization of a supplementary cementitious material (SCM) derived from the quenched molten slag produced during the reduction of iron ore in a blast furnace. GGBS is primarily used as a partial substitute for Portland cement in concrete applications, offering superior long-term strength, enhanced durability, and significant environmental advantages. The product description highlights its amorphous, glassy, and hydraulic properties, which allow it to react with calcium hydroxide released during cement hydration to form secondary cementitious compounds. This pozzolanic activity is central to its utility in high-performance and sustainable construction projects.

Major applications for GGBS include high-rise buildings, marine structures, bridge decks, pavements, and dams, where resistance to chloride ingress, sulfate attack, and alkali-silica reaction (ASR) is critical. The growing awareness regarding the carbon footprint of traditional cement production—which accounts for approximately 8% of global anthropogenic CO2 emissions—has positioned GGBS as a pivotal solution within the decarbonization efforts of the construction industry. Its benefits extend beyond reduced CO2 emissions, including lower heat of hydration, which minimizes thermal cracking in massive concrete pours, thereby improving structural integrity and longevity.

Driving factors propelling the GGBS market include stringent regulatory mandates promoting green building standards and sustainable construction practices across developed and emerging economies. Furthermore, the inherent cost-effectiveness of GGBS, often available as a byproduct, coupled with its superior technical performance in specialized concrete mixes, encourages its adoption. The increasing pace of global urbanization and the corresponding demand for robust civil infrastructure, particularly in the Asia Pacific region, ensure sustained market growth, further catalyzed by the expanding availability of high-quality slag processing facilities.

GGBS Market Executive Summary

The GGBS market is characterized by robust growth, driven primarily by favorable environmental regulations and the escalating global demand for durable, high-performance concrete (HPC). Current business trends indicate a significant shift in the construction sector's procurement strategy, moving away from purely cost-centric purchasing towards value-based decisions that prioritize sustainability and structural resilience. Key industry stakeholders, including major cement producers and ready-mix concrete providers, are increasingly integrating GGBS into their standard product lines to meet green certification requirements, signaling a fundamental change in material formulation practices across the industry. Technological advancements in grinding efficiency and blending techniques are further enabling higher substitution rates, optimizing both material performance and economic viability.

Regionally, Asia Pacific (APAC) stands as the dominant market, fueled by massive government investments in infrastructure development, particularly in China and India, where rapid urbanization necessitates the construction of durable roads, ports, and high-density residential complexes. However, established markets in North America and Europe are exhibiting strong growth momentum, supported by ambitious net-zero emission targets and mature regulatory frameworks that actively incentivize the use of Supplementary Cementitious Materials (SCMs). European markets, especially in Western Europe, are leading in the standardization and specification of high-quality GGBS grades, ensuring consistent performance and boosting contractor confidence in complex engineering projects. The regional trends underscore a global commitment to reducing embodied carbon in construction.

Segmentation trends highlight the infrastructure and residential construction applications as the largest consumers of GGBS, with the ready-mix concrete segment maintaining the highest compound annual growth rate due to its efficiency and widespread application versatility. In terms of grade, high-fines GGBS grades, offering superior reactivity and strength development, are experiencing accelerated demand, particularly for specialized structural applications requiring quick turnaround times and enhanced early strength. The segment analysis reveals that market expansion will be heavily dependent on reliable supply chain logistics, connecting steel production hubs efficiently with major construction material suppliers, ensuring regional supply stability remains a critical factor influencing localized pricing and adoption rates.

AI Impact Analysis on GGBS Market

Common user questions regarding AI's impact on the GGBS market typically revolve around optimizing material performance, predicting supply chain stability, and standardizing quality across varied source materials. Users are keenly interested in how Artificial Intelligence can minimize the inherent variability in GGBS quality stemming from different steel manufacturing processes and blast furnace chemistries. They also question AI's role in developing novel, multi-component blended cements where GGBS is combined with other SCMs like fly ash or calcined clay, seeking computational models that predict long-term durability and reaction kinetics under specific environmental conditions. Furthermore, concerns often surface regarding the economic viability of implementing complex AI models, particularly for small-to-medium enterprises (SMEs) involved in GGBS processing and distribution.

Based on this analysis, the key thematic concerns center on precision material formulation and predictive logistics. AI is anticipated to revolutionize the quality control phase by utilizing machine learning algorithms to analyze real-time chemical compositions of molten slag, providing immediate feedback loops to adjust quenching parameters, thereby ensuring highly consistent granulometry and glass content. This level of quality assurance is paramount for boosting contractor trust and facilitating higher GGBS substitution rates in performance-critical applications. By minimizing material variability, AI addresses one of the primary historical restraints facing widespread GGBS adoption.

The practical application of AI extends significantly into market logistics and blending optimization. Algorithms can process vast datasets related to cement demand, steel production schedules, transportation costs, and geological factors to create highly efficient, demand-driven supply chains. Moreover, computational tools are being deployed to optimize GGBS blending ratios dynamically based on specific project requirements, required cure times, and ambient temperature conditions, moving beyond standardized mix designs to custom-engineered concrete solutions. This shift towards intelligent material engineering is expected to reduce waste, lower production costs, and accelerate the development of next-generation sustainable concrete products.

- AI optimizes GGBS quality control by analyzing real-time slag chemistry and adjusting processing parameters.

- Predictive modeling enhances concrete mix design, determining optimal GGBS substitution rates for specific performance criteria (e.g., strength gain, heat of hydration).

- Machine learning algorithms forecast supply chain bottlenecks and demand fluctuations, improving logistical efficiency between steel mills and construction sites.

- AI-driven image analysis ensures consistent particle size distribution (PSD) during the grinding process, minimizing material variability.

- Generative AI supports the development of new blended SCM formulations, maximizing resource utilization and durability predictions.

DRO & Impact Forces Of GGBS Market

The GGBS market is propelled by significant drivers, fundamentally rooted in global sustainability mandates and the economic advantages offered by utilizing an industrial byproduct. The most potent driver is the intense pressure on the construction industry to decarbonize, making GGBS, which offers up to 90% CO2 reduction compared to ordinary Portland cement (OPC) production, an indispensable material. Simultaneously, the material’s superior technical performance in enhancing concrete durability against harsh chemical environments, such as marine and acidic conditions, positions it favorably for critical infrastructure projects, reinforcing its value proposition beyond mere cost savings. These drivers are intrinsically linked, creating a self-reinforcing cycle of regulatory push and performance pull.

However, the market faces considerable restraints, primarily related to supply dependency and perceived variability. Since GGBS is a byproduct of the steel industry, its availability is directly tied to the highly cyclical and often volatile primary iron production rates, leading to potential supply instability and price fluctuations in regional markets. Furthermore, historical concerns regarding the consistency of quality across different processing facilities, particularly concerning glass content and reactivity, have mandated stringent quality control standards, which can act as a barrier to entry for smaller suppliers. Standardization challenges, especially in emerging markets lacking robust testing infrastructure, also slow down large-scale adoption.

Opportunities for market growth are abundant, particularly in geographical expansion and niche application development. Regions with nascent construction booms and high projected steel production, such as Southeast Asia and Latin America, represent untapped markets for GGBS processing and distribution infrastructure. Technological opportunities involve the development of ultra-fine GGBS grades for specialized high-strength applications and the integration of GGBS into pre-cast concrete and 3D printing applications, further diversifying its end-user base. The dominant impact force shaping the market is stringent governmental regulation concerning carbon emissions and waste utilization, which effectively pushes construction specifications towards mandatory SCM inclusion, ensuring long-term structural demand for GGBS.

Segmentation Analysis

The GGBS market segmentation provides a detailed view of consumption patterns, driven primarily by application type, end-user industry, and product grade. The application segment, including ready-mix concrete, cement manufacturing, infrastructure, and mining backfill, reveals that ready-mix concrete production accounts for the largest volume share, reflecting its versatility across residential, commercial, and non-residential construction sectors. The performance benefits of GGBS, such as improved workability and reduced thermal stress in mass concrete, are highly valued in the RMC sector, cementing its dominance in this segment. Understanding these consumption dynamics is crucial for strategic capacity planning and logistical optimization across the supply chain.

The end-user segmentation is critical, with the construction and infrastructure sectors acting as the primary revenue generators. Within construction, large-scale public works projects, including tunnels, highways, dams, and marine facilities, are significant consumers due to the demanding durability requirements inherent in these environments. The long-term performance guarantees associated with GGBS make it the material of choice for governmental and public-private partnership ventures. Furthermore, the segmentation by grade, often categorized by fineness (e.g., standard, fine, and ultra-fine), dictates the specific performance profile, with finer grades commanding a premium for applications requiring accelerated strength development.

Market forecasts suggest that the infrastructure application segment will exhibit the highest CAGR over the forecast period, supported by renewed global emphasis on resilient infrastructure renewal and expansion. The strategic importance of high-fines GGBS grades is expected to rise as concrete manufacturers seek to maximize the early-age strength gain without compromising the environmental benefits. Effective analysis of these segments enables manufacturers to tailor product offerings—for instance, developing specialized GGBS formulations for specific climatic conditions or unique construction methods like segmental bridge construction—thereby maximizing market penetration and profitability in targeted geographic areas.

- By Application:

- Ready-Mix Concrete (RMC)

- Cement Manufacturing

- Infrastructure Projects (Roads, Bridges, Tunnels)

- Residential and Commercial Construction

- Mining Backfill

- By End-User:

- Residential Sector

- Commercial Sector

- Industrial Sector

- Public Infrastructure (Government)

- By Grade (Fineness):

- Standard Grade GGBS

- High Fines Grade GGBS

Value Chain Analysis For GGBS Market

The value chain of the GGBS market begins with the upstream segment, dominated entirely by the integrated steel industry. The crucial raw material, molten blast furnace slag, is a high-temperature byproduct generated during primary iron making. The immediate processing step involves quenching this molten slag rapidly using high-pressure water jets, a process known as granulation, which transforms the glassy slag into sand-like particles. The efficiency and quality of this granulation process, often performed captive within the steel mill or adjacent facilities, directly influence the physical and chemical properties of the raw GGBS material, setting the foundation for the subsequent value-addition stages.

The midstream segment involves the processing and refinement of the granulated slag. This typically includes drying and, most importantly, fine grinding using sophisticated equipment such as vertical roller mills (VRMs) or high-efficiency ball mills to achieve the required fineness (Blaine surface area) necessary for optimal pozzolanic activity. This processing stage adds significant value and converts the inert granulated material into a high-performance SCM. Distribution channels then move the finished GGBS product, which relies heavily on bulk transportation—via rail, barges, or specialized road tankers—due to the high volume and relatively low value-per-ton characteristics of the commodity. Direct distribution often occurs from processing plants to major ready-mix concrete sites or cement manufacturers' blending terminals.

Downstream analysis highlights the end-users: concrete batching plants, pre-cast concrete manufacturers, and large infrastructure project contractors. Indirect distribution involves trading companies and construction material distributors who manage inventory and handle smaller-volume orders for regional contractors. A critical dynamic in the value chain is the trend towards vertical integration, where major cement and concrete companies acquire or establish their own GGBS processing capabilities to ensure reliable supply, cost control, and consistent quality, reducing dependency on independent slag processors and stabilizing procurement logistics. The overall efficiency of the value chain is highly dependent on geographical proximity between slag sources (steel mills) and consumption centers (major construction hubs).

GGBS Market Potential Customers

The primary cohort of potential customers for GGBS consists of bulk consumers within the construction material manufacturing sector, notably Ready-Mix Concrete (RMC) producers and integrated cement manufacturers. RMC companies are pivotal buyers, utilizing GGBS extensively as a partial replacement for cement in their diverse product offerings to meet sustainability requirements, enhance long-term concrete durability, and control thermal cracking in high-volume pours. These customers value the material’s performance specifications and reliable supply, often requiring GGBS in specialized bulk handling logistics. Cement manufacturers, conversely, blend GGBS directly into their final cement products, offering composite cements that inherently possess lower embodied carbon and superior resistance to environmental degradation, catering to market segments demanding green building materials.

A secondary, yet highly influential, customer group includes governmental bodies and specialized civil engineering contractors focused on large-scale public infrastructure projects. Buyers in this segment, such as departments of transportation, port authorities, and water management agencies, mandate GGBS use through project specifications due to its proven resistance to chemical attacks, especially sulfates and chlorides prevalent in marine and wastewater environments. For projects like major bridges, high-speed rail lines, and deep foundations, GGBS offers a critical technical advantage in achieving a design lifespan of 100 years or more. These clients prioritize performance and regulatory compliance over marginal cost differences, driving demand for high-quality, certified GGBS products.

Furthermore, specialized end-users include pre-cast concrete producers and manufacturers of dry-mix mortars and grouts. Pre-cast firms leverage GGBS to achieve smoother surface finishes, reduce efflorescence, and manage the heat generated during rapid curing cycles required in factory settings. The decision-makers among potential customers include procurement managers, R&D concrete technologists, and project engineers whose buying decisions are jointly informed by price competitiveness, environmental mandates, performance data, and the consistency of the supplier’s quality assurance protocols. Establishing strong technical support and verifiable sustainability credentials are key requirements for securing long-term contracts with these sophisticated buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $19.5 Billion |

| Market Forecast in 2033 | $31.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aditya Birla Group (UltraTech Cement), JSW Cement, LafargeHolcim, HeidelbergCement Group, Cimeco, Argos USA LLC, Ecocem, CEMEX, Votorantim Cimentos, CK Birla Group (Orient Cement), Buzzi Unicem, Schwenk Zement, Slag Cement Association, Hanson Cement, Puzzolan Slag Cement, Ohori Co., Ltd., Taiwan Cement Corporation, Steel & Cement Co., Sino Slag (Shanghai) Materials Co., Ltd., China Slag Cement Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

GGBS Market Key Technology Landscape

The core technology in the GGBS market centers on achieving optimal particle fineness and homogeneity, which is primarily accomplished through advanced grinding techniques. The Vertical Roller Mill (VRM) technology has become the dominant method for processing GGBS, favored for its superior energy efficiency compared to traditional ball mills, lower maintenance requirements, and ability to handle high moisture content material. VRMs allow processors to achieve the ultra-fine particle sizes (high Blaine values, often exceeding 500 m2/kg) required for high-reactivity GGBS grades, which are essential for meeting the demands of modern, performance-driven concrete specifications. Continuous technological refinement focuses on improving the mill lining materials and optimizing grinding pressure to minimize wear and tear while maximizing throughput.

Beyond mechanical grinding, crucial technological advancements are observed in the area of quality control and process monitoring. Modern GGBS processing facilities integrate sophisticated online analyzer systems utilizing X-ray fluorescence (XRF) and laser diffraction technologies. These systems provide real-time chemical composition and particle size distribution (PSD) data, enabling immediate adjustments to the grinding circuit or blending ratios. This predictive quality assurance capability is essential for overcoming the variability challenge associated with blast furnace slag derived from different steel batches and ensures the final product consistently meets strict standards like ASTM C989 and EN 15167, thereby fostering greater market acceptance and trust among structural engineers.

Further technological integration includes specialized storage and blending solutions aimed at maintaining product quality and enabling complex composite cement formulations. Silo technology incorporates sophisticated aeration and humidity control systems to prevent premature hydration or caking of the fine powder. Additionally, dynamic blending systems, often controlled by AI and IoT infrastructure, precisely meter GGBS with OPC and other SCMs, ensuring volumetric and mass consistency in the final blended cement product. The future technology landscape is moving towards maximizing the utilization of low-grade or non-standard slags through chemical activation or micro-milling techniques, expanding the available raw material base and further reducing dependency on high-quality primary feedstocks.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market for GGBS, predominantly due to unprecedented infrastructure spending and rapid urbanization in countries like China, India, and Southeast Asian nations. The region benefits from high domestic steel production, ensuring a readily available supply of blast furnace slag. Government initiatives focusing on sustainable cities and affordable housing heavily rely on high-volume, cost-effective SCMs, positioning APAC as the epicenter of GGBS consumption and processing capacity expansion.

- Europe: Europe is characterized by stringent environmental regulations and a mature market framework that actively promotes the circular economy. The market penetration of GGBS is high, particularly in Germany, France, and the UK. European demand is driven by high-specification requirements for civil engineering and marine structures, valuing GGBS for its superior resistance to sulfate and chloride attacks. Innovation in blending technology and the proliferation of low-carbon concrete standards sustain steady, high-value growth.

- North America: The market in North America, particularly the United States and Canada, is experiencing accelerated growth stimulated by updated infrastructure bills and state-level green procurement policies. Adoption is concentrated in coastal regions and areas with high freeze-thaw cycles, where GGBS’s durability advantages are most pronounced. Increased investment in dedicated processing facilities is necessary to mitigate logistical challenges associated with transporting bulk material across vast distances.

- Middle East & Africa (MEA): GGBS consumption is rising rapidly in the MEA, especially in the Gulf Cooperation Council (GCC) countries, due to massive construction projects and the need for concrete resistant to extreme heat and high salinity environments. Supply stability is a key challenge, relying heavily on imports or establishing local processing facilities near burgeoning steel production centers to support the large-scale residential and commercial development pipeline.

- Latin America: This region presents significant long-term growth opportunities, driven by industrialization and modernization of public infrastructure. Brazil and Mexico are leading the adoption, utilizing GGBS to optimize large dam projects and urban development. Market growth here is contingent on regulatory harmonization and overcoming initial investment hurdles in local grinding capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the GGBS Market.- Aditya Birla Group (UltraTech Cement)

- JSW Cement

- LafargeHolcim (Holcim Group)

- HeidelbergCement Group

- Cimeco

- Argos USA LLC

- Ecocem

- CEMEX

- Votorantim Cimentos

- CK Birla Group (Orient Cement)

- Buzzi Unicem

- Schwenk Zement

- Slag Cement Association

- Hanson Cement (Lehigh Hanson)

- Puzzolan Slag Cement

- Ohori Co., Ltd.

- Taiwan Cement Corporation

- Steel & Cement Co.

- Sino Slag (Shanghai) Materials Co., Ltd.

- China Slag Cement Co.

Frequently Asked Questions

Analyze common user questions about the GGBS market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary environmental benefit of using GGBS in construction?

The primary environmental benefit of GGBS is the significant reduction in embodied carbon dioxide (CO2) emissions. Replacing a portion of ordinary Portland cement (OPC) with GGBS can reduce the CO2 footprint of concrete by up to 90% per ton of substitute material, as GGBS production utilizes industrial waste and requires far less energy than manufacturing new cement clinker.

How does GGBS impact the long-term strength and durability of concrete?

GGBS enhances long-term concrete durability by significantly reducing permeability, thereby limiting the ingress of damaging substances like chlorides and sulfates. Its pozzolanic reaction refines the pore structure and consumes harmful calcium hydroxide, greatly increasing resistance to alkali-silica reaction (ASR) and extending the structural lifespan, especially in aggressive chemical environments.

What are the main logistical challenges associated with the GGBS supply chain?

The main logistical challenges include the dependency of GGBS supply on the cyclical production rates of the steel industry, which introduces supply volatility. Additionally, the material requires specialized bulk handling and storage (to prevent moisture damage) and must be transported efficiently from steel production hubs to often geographically distant construction centers, increasing transport costs and complexity.

In which applications are high substitution rates of GGBS most commonly specified?

High substitution rates (up to 70-80% replacement of OPC) are most commonly specified in mass concrete pours (like dam foundations or large rafts) to control the heat of hydration and prevent thermal cracking, and in marine or wastewater structures where superior resistance to chloride and sulfate attack is absolutely essential for structural integrity.

Which technological trend is most crucial for improving the quality of GGBS?

The most crucial technological trend is the adoption of advanced online quality control systems, specifically X-ray fluorescence (XRF) and laser diffraction for real-time analysis. These technologies ensure consistent chemical composition and optimal particle size distribution (PSD), minimizing product variability which is vital for increasing engineer confidence and standardizing high-performance GGBS grades globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager