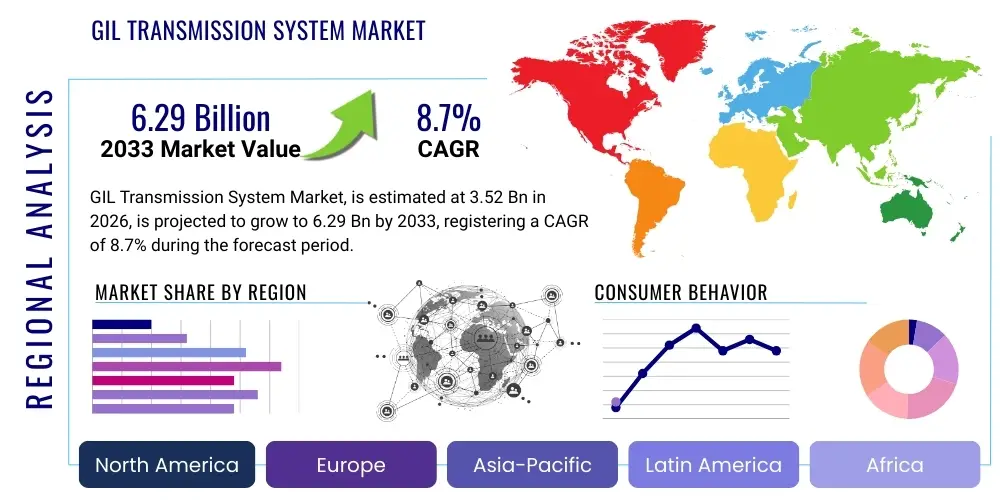

GIL Transmission System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439615 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

GIL Transmission System Market Size

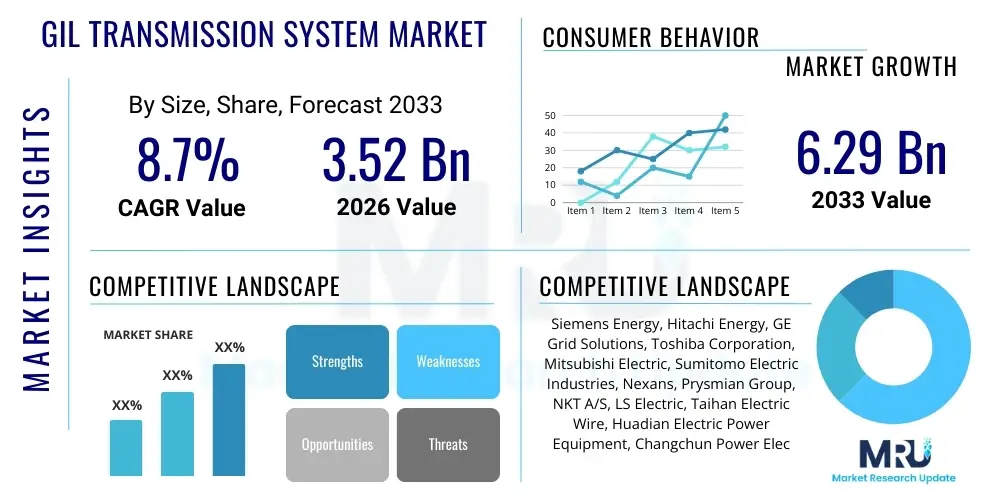

The GIL Transmission System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 3.52 Billion in 2026 and is projected to reach USD 6.29 Billion by the end of the forecast period in 2033.

GIL Transmission System Market introduction

The Gas-Insulated Line (GIL) Transmission System market encompasses the design, manufacturing, installation, and maintenance of high-voltage power transmission systems where conductors are insulated by an inert gas, typically sulfur hexafluoride (SF6) or its eco-friendly alternatives, within a metallic enclosure. This technology is crucial for modern power infrastructure, offering a compact, reliable, and environmentally robust solution for transmitting large amounts of electrical power over long distances, particularly in space-constrained environments such as urban areas, mountainous regions, or beneath water bodies. Major applications include grid interconnections, integration of renewable energy sources, urban underground power feeds, and industrial plant power distribution where land availability is limited or environmental impact needs to be minimized. The primary benefits of GIL systems stem from their high power transmission capacity, reduced electromagnetic fields, enhanced operational safety, minimal visual impact, and superior reliability against external environmental factors like extreme weather or pollution. The driving factors behind the increasing adoption of GIL systems include the accelerating global demand for electricity, the imperative for grid modernization and expansion, the growing integration of geographically dispersed renewable energy projects, and the increasing urbanization leading to a premium on space for infrastructure development.

GIL Transmission System Market Executive Summary

The GIL Transmission System market is poised for significant expansion, driven by critical business trends such as the global energy transition towards renewables, the urgent need for robust and resilient grid infrastructure, and technological advancements focusing on higher voltage capacities and eco-friendly insulation solutions. Enterprises within this sector are increasingly investing in research and development to address environmental concerns associated with traditional SF6 gas, exploring novel gas mixtures and solid-state insulation alternatives to maintain growth momentum. Regional trends indicate strong growth in Asia Pacific, propelled by rapid industrialization, urbanization, and ambitious renewable energy targets in countries like China and India, while Europe and North America continue to lead in grid modernization and the deployment of advanced high-voltage direct current (HVDC) GIL technologies. Latin America and the Middle East & Africa regions are emerging as high-potential markets, driven by new infrastructure projects and expanding power demands. Segment-wise, the market is seeing a shift towards higher voltage GIL systems and specialized applications like subsea and underground installations, reflecting the complex demands of modern power grids. Furthermore, a growing emphasis on lifecycle cost optimization, smart grid integration, and predictive maintenance solutions is shaping market dynamics across all segments, pushing manufacturers to offer more integrated and intelligent transmission solutions.

AI Impact Analysis on GIL Transmission System Market

Users are keen to understand how artificial intelligence (AI) will revolutionize the GIL Transmission System market, specifically regarding efficiency, reliability, and cost-effectiveness. Common questions revolve around AI's capability to enhance predictive maintenance, optimize grid performance, and automate design processes, thereby mitigating operational risks and reducing downtime. There is significant interest in AI's role in improving the monitoring and fault detection capabilities of complex GIL networks, ensuring more stable and secure power transmission. Users also expect AI to contribute to the development of smarter, self-healing grids that can dynamically adapt to changing load conditions and integrate variable renewable energy sources more seamlessly, ultimately leading to a more resilient and sustainable power infrastructure. Concerns often touch upon data security, the ethical implications of autonomous systems, and the need for skilled personnel to manage AI-driven technologies.

- AI-powered predictive maintenance reduces unscheduled outages and extends asset lifespan through real-time data analysis.

- Optimized grid operation and energy flow management using AI algorithms for enhanced efficiency and reduced transmission losses.

- Automated design and simulation tools driven by AI accelerate development cycles and improve the accuracy of GIL system layouts.

- Enhanced fault detection and diagnosis capabilities leading to quicker response times and minimized power disruptions.

- Improved security and anomaly detection against cyber threats targeting critical infrastructure.

- Intelligent monitoring of GIL system health parameters, providing proactive insights for maintenance and operational adjustments.

- Facilitation of seamless integration of distributed renewable energy sources into existing GIL networks through smart controls.

DRO & Impact Forces Of GIL Transmission System Market

The GIL Transmission System market is significantly shaped by a confluence of driving forces, inherent restraints, and burgeoning opportunities. Key drivers include the global push for decarbonization and the subsequent integration of large-scale renewable energy projects, which often require robust and high-capacity transmission lines over long distances or through challenging terrains. Urbanization, leading to increased electricity demand and limited space for traditional overhead lines, further boosts the adoption of compact GIL systems. Grid modernization initiatives aimed at enhancing reliability, reducing transmission losses, and building resilient infrastructure also fuel market growth. However, several restraints temper this expansion, notably the high initial capital expenditure associated with GIL systems compared to conventional overhead lines, the complexity and specialized expertise required for installation and maintenance, and environmental concerns related to SF6 gas, despite ongoing efforts to find eco-friendly alternatives. The market also faces opportunities arising from advancements in high-voltage direct current (HVDC) GIL technology, the development of next-generation insulating gases, the increasing adoption of smart grid technologies that integrate GIL systems, and the expansion into emerging economies with developing power infrastructure. These impact forces collectively define the market landscape, influencing investment decisions, technological trajectories, and strategic partnerships within the GIL transmission sector.

Segmentation Analysis

The GIL Transmission System market is segmented across various critical dimensions, allowing for a comprehensive analysis of market dynamics, growth drivers, and competitive landscapes. These segmentations provide granular insights into specific applications, technological preferences, and regional demand patterns, enabling stakeholders to identify lucrative opportunities and tailor their strategies effectively. Understanding these segments is crucial for manufacturers, service providers, and investors to navigate the complexities of the evolving energy transmission sector. Each segment reflects unique requirements and growth potentials, driven by specific end-user needs and technological advancements.

- By Voltage Level

- <200 kV

- 200 kV - 400 kV

- >400 kV

- By Installation Type

- Underground

- Subsea

- Tunnel/Shaft

- By Component

- Conductors

- Insulators/Spacers

- Enclosures

- Terminations

- Joints & Connectors

- Monitoring & Control Systems

- By Application

- Grid Interconnections

- Renewable Energy Integration

- Urban Power Grids

- Industrial & Commercial Applications

- Power Plant Connections

- By Insulation Medium

- SF6 Gas

- SF6-Free Gas Mixtures

Value Chain Analysis For GIL Transmission System Market

The value chain for the GIL Transmission System market is intricate, involving multiple stages from raw material sourcing to final installation and aftermarket services. Upstream activities begin with the procurement of specialized raw materials such as high-grade aluminum or copper for conductors, stainless steel or aluminum alloys for enclosures, and advanced ceramic or epoxy resins for insulators. These materials are sourced from a global network of suppliers, often requiring strict quality control and certifications to meet the demanding specifications of high-voltage applications. Midstream operations involve the manufacturing processes where these raw materials are transformed into various GIL components, including the fabrication of the conductor system, gas-tight enclosures, insulators, and complex termination units. This stage heavily relies on precision engineering, specialized welding techniques, and rigorous testing protocols to ensure system integrity and performance. Downstream activities encompass the transportation, installation, and commissioning of the GIL systems. Installation is often complex, requiring highly skilled technicians and specialized equipment due to the modular nature and critical gas handling procedures. The distribution channel primarily operates through direct sales and project-based engagements, where manufacturers work closely with utilities, independent power producers (IPPs), and engineering, procurement, and construction (EPC) firms. Indirect channels may involve partnerships with regional distributors for specific components or smaller projects, but the predominant model remains direct client interaction given the bespoke nature and high value of GIL projects. Aftermarket services, including maintenance, monitoring, and repair, also form a crucial part of the value chain, ensuring the long-term reliability and operational efficiency of these critical assets.

GIL Transmission System Market Potential Customers

The primary potential customers for GIL Transmission Systems are diverse, predominantly comprising entities involved in large-scale power generation, transmission, and distribution. National and regional electric utilities form the largest customer base, investing in GIL technology to modernize aging grids, expand capacity to meet growing demand, and ensure reliable power supply in densely populated areas or environmentally sensitive zones. Independent Power Producers (IPPs), particularly those operating large renewable energy farms such as offshore wind farms or remote solar power plants, are significant buyers, utilizing GIL for efficient and high-capacity evacuation of generated power to the main grid. Furthermore, industrial enterprises with high power requirements, such as smelters, chemical plants, or large data centers, represent a niche but important customer segment, seeking robust and secure power connections. Infrastructure development agencies and urban planning authorities also indirectly drive demand by specifying underground power transmission solutions for new city developments or major transportation projects. Lastly, engineering, procurement, and construction (EPC) companies, acting on behalf of these end-users, play a crucial role in the procurement and implementation of GIL systems, making them key influencers and direct purchasers within the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.52 Billion |

| Market Forecast in 2033 | USD 6.29 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, Hitachi Energy, GE Grid Solutions, Toshiba Corporation, Mitsubishi Electric, Sumitomo Electric Industries, Nexans, Prysmian Group, NKT A/S, LS Electric, Taihan Electric Wire, Huadian Electric Power Equipment, Changchun Power Electric, Shanghai Electric, China XD Electric, ABB Ltd., Qingdao Hanhe Cable, ZTT Group, Southwire Company, TBEA Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

GIL Transmission System Market Key Technology Landscape

The technology landscape for GIL Transmission Systems is characterized by continuous innovation aimed at enhancing performance, reliability, and environmental sustainability. A primary technological focus revolves around the evolution of insulation mediums, moving beyond traditional sulfur hexafluoride (SF6) gas to more eco-friendly alternatives. This includes the development and commercialization of SF6-free gas mixtures, such as those based on fluoronitriles or air-gas mixtures, which offer significantly reduced global warming potential while maintaining comparable dielectric strength and operational safety. Another crucial area is the advancement in high-voltage direct current (HVDC) GIL technology. HVDC GIL systems are gaining traction for long-distance, high-power transmission, especially for connecting offshore wind farms or inter-regional grids, due to their lower transmission losses and reduced footprint compared to HVAC GIL. Material science advancements are also pivotal, leading to improved conductor materials for enhanced current carrying capacity and lighter, more robust enclosure materials. Furthermore, the integration of smart monitoring and diagnostic systems utilizing fiber optics, sensors, and AI-driven analytics is becoming standard. These technologies enable real-time condition monitoring, predictive maintenance, and early fault detection, thereby increasing the overall reliability and operational efficiency of GIL infrastructure. Automation in manufacturing and installation processes, along with modular design principles, is also contributing to cost reduction and accelerated project timelines, making GIL systems more competitive against conventional transmission solutions.

Regional Highlights

- North America: Characterized by significant investment in grid modernization and resilience, particularly in urban centers and for connecting large-scale renewable energy projects. The US and Canada are driving demand for compact, reliable transmission solutions.

- Europe: A mature market with strong environmental regulations pushing for SF6-free GIL solutions and extensive deployment for offshore wind farm connections and cross-border grid interconnections. Germany, the UK, and Nordic countries are key players.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid industrialization, urbanization, and massive renewable energy integration projects, especially in China, India, Japan, and South Korea, where space constraints and energy demand are high.

- Latin America: An emerging market with increasing investments in infrastructure development, hydroelectric power, and grid expansion projects, leading to growing adoption of GIL systems for challenging terrains and urban areas.

- Middle East and Africa (MEA): Witnessing significant infrastructure spending, particularly in the Gulf Cooperation Council (GCC) countries for large-scale power generation and transmission projects, alongside efforts to diversify energy sources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the GIL Transmission System Market.- Siemens Energy

- Hitachi Energy

- GE Grid Solutions

- Toshiba Corporation

- Mitsubishi Electric

- Sumitomo Electric Industries

- Nexans

- Prysmian Group

- NKT A/S

- LS Electric

- Taihan Electric Wire

- Huadian Electric Power Equipment

- Changchun Power Electric

- Shanghai Electric

- China XD Electric

- ABB Ltd.

- Qingdao Hanhe Cable

- ZTT Group

- Southwire Company

- TBEA Co. Ltd.

Frequently Asked Questions

What is a GIL Transmission System?

A GIL (Gas-Insulated Line) Transmission System is an advanced power transmission technology where high-voltage conductors are housed within a metal enclosure and insulated by an inert gas, typically SF6 or eco-friendly alternatives. It offers a compact, reliable, and environmentally robust solution for transmitting large amounts of electrical power, often used in underground or subsea applications where space is limited or environmental impact needs to be minimized.

What are the primary advantages of GIL over traditional overhead lines?

GIL systems offer several advantages, including significantly reduced footprint due to their compact design, high power transmission capacity, immunity to external weather conditions and pollution, minimal visual impact (as they are often underground), reduced electromagnetic fields, and enhanced safety and reliability compared to traditional overhead lines.

What are the key drivers for the GIL Transmission System market growth?

Key drivers include the global push for renewable energy integration, rapid urbanization and industrialization leading to increased electricity demand in space-constrained areas, the need for grid modernization and increased resilience, and the growing demand for reliable and high-capacity power transmission solutions.

What are the main challenges facing the GIL Transmission System market?

Major challenges include the high initial capital investment required for GIL systems compared to conventional alternatives, the complexity and specialized expertise needed for their installation and maintenance, and environmental concerns associated with the use of SF6 gas, although research into eco-friendly alternatives is ongoing.

How is AI impacting the GIL Transmission System market?

AI is significantly impacting the GIL Transmission System market by enhancing predictive maintenance, optimizing grid operations for efficiency and stability, automating design and simulation processes, and improving fault detection and diagnostic capabilities. It contributes to making GIL systems smarter, more reliable, and cost-effective through data-driven insights.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager