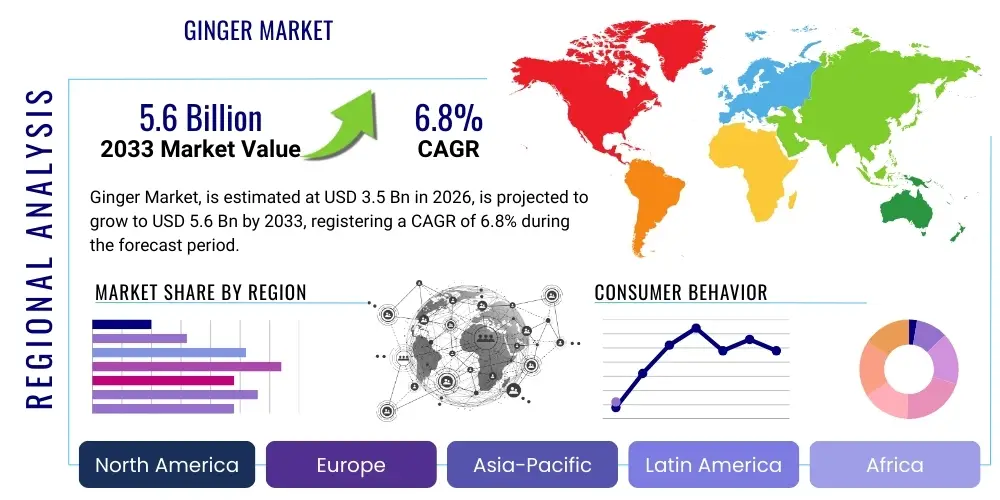

Ginger Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431480 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Ginger Market Size

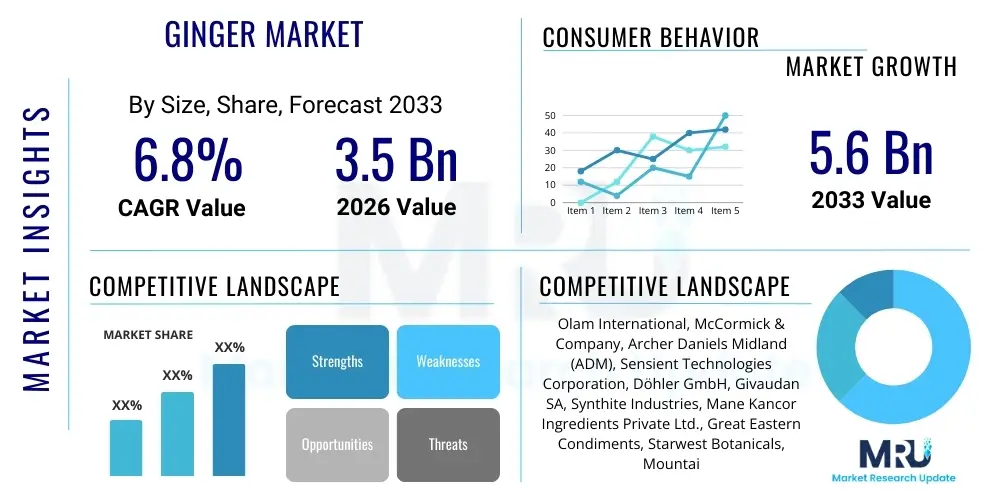

The Ginger Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Ginger Market introduction

The global Ginger Market encompasses the cultivation, processing, distribution, and consumption of Zingiber officinale, a widely utilized spice and medicinal herb. This market is characterized by robust demand across multiple sectors, primarily driven by increasing consumer awareness regarding natural health benefits and the global rise in ethnic and functional food consumption. Ginger's versatility allows it to be marketed in various forms, including fresh rhizomes, dried powder, essential oils, and specialized extracts like oleoresins, catering to diverse industrial requirements from flavoring agents to active pharmaceutical ingredients.

Major applications of ginger span the food and beverage industry, where it is critical for flavoring baked goods, confectionery, non-alcoholic beverages (especially ginger ale and herbal teas), and savory dishes. Beyond culinary uses, its application in the pharmaceutical and nutraceutical sectors is expanding rapidly due to its scientifically recognized anti-inflammatory, antioxidant, and antiemetic properties. Manufacturers are increasingly incorporating ginger extracts into dietary supplements targeting digestive health, immune support, and joint care, positioning ginger as a vital component in the natural wellness movement.

Key driving factors propelling the ginger market expansion include shifting consumer preferences towards natural and organic ingredients, the escalating demand for traditional and herbal remedies globally, and significant investment in R&D to explore new applications of ginger isolates in therapeutic formulations. Furthermore, expanding international trade agreements and improvements in cold chain logistics facilitate the efficient movement of fresh and processed ginger products across continents, supporting market growth in both developed and emerging economies. The inherent health benefits of ginger, coupled with its distinctive pungent flavor profile, solidify its position as a high-value commodity in the global spice trade.

Ginger Market Executive Summary

The Ginger Market is experiencing dynamic growth, characterized by strong business trends centered on sustainability, organic farming practices, and vertical integration across the supply chain. Companies are investing heavily in advanced extraction techniques to produce high-purity oleoresins and essential oils demanded by the premium nutraceutical and cosmetic segments. A significant business trend involves the rapid expansion of ready-to-use ginger products, such as ginger pastes and frozen ginger cubes, addressing consumer demand for convenience without compromising nutritional integrity. Strategic alliances between growers in key production regions (like India and China) and major international food processors are defining the competitive landscape, focused on ensuring stable, high-quality raw material sourcing.

Regionally, the market displays pronounced trends, with Asia Pacific maintaining dominance both in production and consumption, driven by deep-rooted cultural usage and large populations relying on traditional medicine. However, North America and Europe exhibit the highest growth potential, largely attributable to the swift adoption of Westernized dietary supplements and functional beverages containing standardized ginger extracts. Regulatory harmonization efforts, particularly concerning food safety and labeling standards for imported spices in the EU and US, are influencing sourcing strategies, pushing regional players towards certified and traceable supply chains. This regional differentiation highlights contrasting demand profiles: high-volume, commodity-grade in APAC versus high-value, specialized extracts in the West.

Segment-wise, the market sees robust performance in the Powder segment, favored for its long shelf life and ease of incorporation into industrial formulations, while the Fresh segment remains dominant in developing countries for daily consumption. The Application segment is spearheaded by Pharmaceuticals and Nutraceuticals, demonstrating superior growth rates compared to the established Food and Beverage sector. This surge is intrinsically linked to rising health consciousness globally, post-pandemic focus on immunity-boosting ingredients, and the verifiable efficacy of ginger compounds like gingerols and shogaols. Distribution channel trends indicate a steady migration of sales from traditional B2B bulk purchases towards organized retail and e-commerce platforms, particularly for branded, consumer-packaged ginger products.

AI Impact Analysis on Ginger Market

Common user questions regarding AI's impact on the Ginger Market revolve around optimizing agricultural yields, ensuring supply chain integrity, and predicting price volatility. Key concerns include how machine learning can enhance disease detection in ginger crops, minimize post-harvest losses, and accurately forecast demand shifts based on localized health trends. The central theme emerging from user inquiries is the desire for enhanced transparency and efficiency—specifically, leveraging predictive analytics for smarter inventory management and using computer vision systems for automated quality grading of fresh rhizomes. Users expect AI to stabilize commodity prices and provide early warnings on climate-related supply disruptions, ensuring reliability for industrial buyers while maximizing profit margins for small-scale farmers through precise resource management.

- AI-driven Precision Agriculture: Utilization of drones and sensors coupled with machine learning algorithms to optimize irrigation, nutrient delivery, and early detection of diseases (e.g., bacterial wilt or soft rot) in ginger fields, leading to improved yield per hectare.

- Supply Chain Optimization: Deployment of predictive logistics models to forecast optimal shipping routes and storage conditions, significantly reducing spoilage of fresh ginger during long-distance transportation and warehousing.

- Automated Quality Control: Implementation of computer vision systems during processing to automatically grade, sort, and classify ginger based on size, color, texture, and defect presence, ensuring uniformity for premium industrial buyers.

- Demand Forecasting and Price Prediction: Use of advanced time-series analysis and econometric models to predict future demand for different ginger forms (powder vs. oil) based on global commodity indices, seasonal consumer behavior, and public health data, stabilizing market pricing.

- Traceability Enhancement: Blockchain integration, managed by AI, to create an immutable ledger tracking ginger from farm to fork, ensuring authenticity, combating counterfeiting, and verifying organic or geographic origin claims.

DRO & Impact Forces Of Ginger Market

The Ginger Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces influencing future trajectory. The primary driver is the exponentially growing global demand for natural remedies and functional ingredients, particularly in Western markets where consumers are actively seeking alternatives to synthetic drugs. This is powerfully complemented by extensive clinical research validating the traditional uses of ginger, especially its efficacy against nausea, motion sickness, and chronic inflammation. This positive feedback loop between consumer health consciousness and scientific validation acts as a significant propellant for market expansion across all segments, from fresh produce to high-concentration extracts.

However, the market faces significant restraints, chiefly concerning supply side volatility. Ginger cultivation is highly susceptible to weather conditions, pests, and diseases, leading to unpredictable harvests and subsequent price fluctuations. Furthermore, stringent regulatory requirements regarding pesticide residues and heavy metal contamination in exported spices pose a major hurdle, requiring substantial investment in advanced farming and testing infrastructure, which often limits participation by small-scale farmers. Economic factors, such as high tariffs and non-tariff barriers in international trade, also restrict market accessibility and profitability, particularly for producers in emerging economies.

Opportunities for growth are abundant and strategically focused. These include the massive potential in product innovation, particularly the development of novel delivery formats like microencapsulated ginger oil for enhanced bioavailability in nutraceuticals, and the creation of specialized flavor systems for the functional beverage industry. Geographically, expanding cultivation into non-traditional regions with controlled environment agriculture (CEA) offers a way to mitigate climate risks and ensure stable supply year-round. Moreover, focusing on value-added products, such as certified organic and Fair Trade ginger, allows companies to capture premium price points and build strong brand loyalty, capitalizing on global ethical consumption trends. The convergence of these factors defines the market's impact forces, pointing towards sustained growth mediated by supply chain optimization and innovation.

Segmentation Analysis

The Ginger Market is comprehensively segmented based on its physical Form, the primary Application sectors it serves, and the channels through which it is distributed to both industrial and consumer buyers. Understanding these segments is crucial for strategic market entry and differentiation, as demand profiles and pricing structures vary significantly between fresh rhizomes sold in retail produce sections and specialized oleoresins purchased in bulk by pharmaceutical manufacturers. The segmentation analysis reveals the increasing industrialization of ginger, shifting market share towards highly processed and standardized forms suitable for large-scale manufacturing and global trade, while traditional fresh ginger consumption maintains strong growth in regional food markets.

- By Form

- Fresh Ginger

- Dried Ginger

- Ginger Powder

- Ginger Oil

- Ginger Paste

- Ginger Oleoresin and Extracts

- By Application

- Food and Beverages

- Savory Dishes and Seasonings

- Confectionery and Bakery

- Non-Alcoholic Beverages (Teas, Ales)

- Pharmaceuticals and Nutraceuticals

- Dietary Supplements

- Traditional Medicine Formulations

- Cosmetics and Personal Care

- Fragrances

- Skin and Hair Care Products

- Food and Beverages

- By Distribution Channel

- Business-to-Business (B2B)

- Direct Sales to Manufacturers

- Industrial Distributors

- Business-to-Consumer (B2C)

- Supermarkets and Hypermarkets

- Specialty Stores

- E-commerce

- Business-to-Business (B2B)

Value Chain Analysis For Ginger Market

The value chain for the Ginger Market begins with complex upstream activities involving cultivation and harvesting. Upstream analysis focuses on ensuring genetic quality of the planting material, optimizing farming techniques (conventional vs. organic), and managing post-harvest handling processes like washing, grading, and initial drying. Key stakeholders in this phase include farmers, agricultural cooperatives, and seed suppliers. Efficiency at the upstream level is critical as the quality of the raw rhizome directly impacts the yield and quality of downstream processed products like essential oils and standardized extracts. Ensuring sustainable farming practices and reliable contractual agreements between growers and processors minimizes supply shocks and maintains ethical sourcing standards.

The midstream stage is dominated by processing activities, ranging from simple drying and grinding into powder to advanced solvent extraction for oleoresins and steam distillation for essential oils. This processing stage adds substantial value, transforming a perishable raw material into stable, industrially usable ingredients. Major processors and intermediate traders focus on achieving specific quality metrics, such as defined levels of active compounds (gingerols and shogaols), and adhering to strict international food safety standards (ISO, HACCP). The efficiency of distribution channels is paramount in this stage, linking processors to international markets, often involving specialized logistics for bulk ingredient transport.

Downstream analysis centers on the final use and distribution channels, categorized broadly into direct (B2B) and indirect (B2C). Direct distribution involves bulk sales of processed ingredients (e.g., ginger powder, extracts) directly to large industrial buyers—such as major pharmaceutical companies, functional beverage manufacturers, and large food processors. Indirect distribution caters to the final consumer via organized retail (supermarkets, specialty stores) and the rapidly expanding e-commerce sector, typically involving finished, packaged products like fresh ginger, spice jars, or bottled ginger juice. The growth of e-commerce has significantly compressed the downstream value chain, allowing smaller producers to reach global consumers directly and enhancing market transparency.

Ginger Market Potential Customers

Potential customers for ginger and its derivatives are highly diversified, encompassing industrial entities requiring high-volume ingredients and consumers purchasing finished goods. The largest segment of industrial buyers consists of manufacturers in the Pharmaceuticals and Nutraceuticals sector. These customers demand standardized ginger extracts, often specified by the concentration of bio-active markers, for use in anti-inflammatory supplements, digestive aids, and antiemetic medications. Their purchase criteria prioritize purity, compliance with Good Manufacturing Practices (GMP), and certified traceability, making them high-value, quality-sensitive clients requiring B2B direct relationships.

Another major customer group resides in the Food and Beverage industry, including large commercial bakeries, confectionery producers, beverage companies (alcoholic and non-alcoholic), and seasoning manufacturers. These customers primarily utilize ginger powder, paste, and essential oils for flavoring. Their purchasing decisions are driven by cost-effectiveness, consistency in flavor profile, and ease of integration into existing production lines. The rising popularity of ready-to-drink functional beverages, such as kombucha and health shots, creates significant opportunities for suppliers specializing in water-soluble ginger extracts. Furthermore, the Cosmetics and Personal Care industry represents a growing, niche customer base, using ginger oil and extracts for their antioxidant properties in anti-aging creams, shampoos, and natural fragrances, focusing on unique branding and natural origin claims.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olam International, McCormick & Company, Archer Daniels Midland (ADM), Sensient Technologies Corporation, Döhler GmbH, Givaudan SA, Synthite Industries, Mane Kancor Ingredients Private Ltd., Great Eastern Condiments, Starwest Botanicals, Mountain Rose Herbs, Yummy Group, Guizhou Changsheng, Nedspice, Ambo International, Organic India, S&B Foods Inc., Kikkoman Corporation, Naturex (Givaudan), Robertet Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ginger Market Key Technology Landscape

The technology landscape in the Ginger Market is rapidly evolving, moving beyond traditional sun drying and manual processing towards sophisticated industrial methods aimed at maximizing yield, purity, and safety. A core area of technological advancement is in post-harvest handling and storage, where controlled atmosphere storage (CAS) and modified atmosphere packaging (MAP) technologies are utilized to extend the shelf life of fresh ginger, reducing microbial spoilage and maintaining flavor intensity during transit. Furthermore, advanced mechanical drying techniques, such as vacuum microwave drying, are being adopted to quickly reduce moisture content while preserving volatile essential oils and bioactive compounds like gingerols, which are crucial for pharmaceutical applications.

In the processing sector, Supercritical Fluid Extraction (SFE) using carbon dioxide (CO2) represents a transformative technology. SFE offers a solvent-free method to produce high-purity, standardized ginger oleoresins and extracts, avoiding the residual toxicity associated with conventional solvent extraction methods like hexane or ethanol. This technology is particularly valuable for the nutraceutical and cosmetic industries, which demand exceptionally clean label ingredients. Coupled with spectrophotometric and High-Performance Liquid Chromatography (HPLC) techniques for quality control, SFE enables manufacturers to precisely quantify the concentration of active components, ensuring batch-to-batch consistency required for therapeutic formulations and meeting stringent regulatory guidelines globally.

Beyond processing, digitalization and traceability technologies are gaining prominence. The implementation of IoT (Internet of Things) sensors in agricultural settings helps monitor soil conditions and environmental factors in real-time, facilitating precision farming. Furthermore, the integration of blockchain technology is becoming crucial for enhancing supply chain transparency. This system allows end-users, especially in Western markets, to verify the origin, processing history, and quality certifications of the ginger ingredients, mitigating fraud and ensuring consumer trust in premium, traceable products like organic ginger powder or certified high-potency extracts.

Regional Highlights

The global Ginger Market exhibits significant regional variations concerning production capacity, consumption patterns, and processing capabilities. Asia Pacific (APAC) stands as the undisputed leader, characterized by the highest volume of both production (led by India, China, and Nigeria) and consumption. This dominance is intrinsically linked to the cultural embedding of ginger in Asian cuisine and Traditional Chinese Medicine (TCM) and Ayurvedic practices. The regional dynamic is shifting, however, with a strong focus on enhancing export-oriented processing capabilities in countries like India, which are transitioning from simply exporting raw material to producing high-value standardized extracts for global pharmaceutical markets.

North America and Europe, while possessing minimal domestic ginger cultivation, represent the fastest-growing consumption regions for value-added products. Demand here is driven primarily by the functional food, beverage, and dietary supplement sectors, spurred by elevated consumer interest in immune health and natural ingredients. Regulatory standards in these regions, such as those set by the FDA and EFSA, dictate high standards for imported goods, favoring suppliers who can provide extensive documentation on quality, purity, and contaminant levels. The demand is skewed towards premium, organic certified, and ethically sourced ginger derivatives, making these regions highly lucrative but requiring sophisticated market access strategies.

- Asia Pacific (APAC): Dominates production and consumption; key markets include India, China, and Indonesia. Growth driven by traditional usage and increasing local processing capacity for extracts.

- North America: High growth region focusing on nutraceuticals and functional beverages; sensitive to organic and clean label certifications.

- Europe: Strong demand for high-purity extracts and essential oils; stringent import regulations drive preference for certified suppliers, particularly Germany and the UK leading consumption.

- Latin America (LATAM): Emerging production hub (Brazil, Peru) leveraging favorable climates; market characterized by domestic consumption and increasing exports of fresh organic ginger to North America.

- Middle East and Africa (MEA): Nigeria is a massive global producer of dried ginger; consumption centers around traditional remedies and culinary uses, with rising industrial demand in regional food manufacturing centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ginger Market.- Olam International

- McCormick & Company

- Archer Daniels Midland (ADM)

- Sensient Technologies Corporation

- Döhler GmbH

- Givaudan SA

- Synthite Industries Private Ltd.

- Mane Kancor Ingredients Private Ltd.

- Great Eastern Condiments

- Starwest Botanicals

- Mountain Rose Herbs

- Yummy Group

- Guizhou Changsheng

- Nedspice

- Ambo International

- Organic India

- S&B Foods Inc.

- Kikkoman Corporation

- Naturex (Givaudan)

- Robertet Group

Frequently Asked Questions

Analyze common user questions about the Ginger market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Ginger Market?

The primary factor is the increasing global consumer preference for natural, plant-based functional ingredients and herbal remedies, particularly the utilization of ginger in immunity-boosting supplements and digestive health products post-2020. This trend is amplified by scientific validation of ginger's therapeutic properties, leading to higher adoption rates in pharmaceuticals and nutraceuticals.

Which form of ginger holds the largest market share globally?

Fresh ginger traditionally holds a substantial market share due to widespread culinary use and high demand in major production regions like Asia Pacific. However, the Powder and standardized Extract segments are exhibiting the fastest value growth, driven by industrial scale adoption in the food processing and supplements manufacturing sectors due to their stability and ease of formulation.

What are the main risks associated with the ginger supply chain?

The main risks include high susceptibility to climate variability and specific diseases (like bacterial wilt), leading to volatile supply and price fluctuations. Additionally, meeting stringent international regulatory standards for heavy metal and pesticide residues, particularly for exports to Europe and North America, poses ongoing operational challenges for global sourcing managers.

How is technology impacting the cultivation and processing of ginger?

Technology is significantly impacting the sector through the adoption of Supercritical Fluid Extraction (SFE) for high-purity extracts, advanced cold chain logistics for preserving fresh rhizomes, and the increasing use of digital traceability systems (like blockchain) to ensure supply chain transparency and combat product adulteration, particularly for high-value organic certified ingredients.

Which geographic region presents the highest growth potential for ginger exports?

North America and Europe offer the highest growth potential in terms of value, driven by high consumer purchasing power and robust demand for premium, value-added products like standardized nutraceutical extracts and organic ginger oils. Suppliers capable of meeting strict quality and traceability certifications are positioned best to capitalize on these export markets.

The comprehensive analysis provided herein underscores the essential market dynamics shaping the future trajectory of the global Ginger Market. Emphasis on natural health trends, technological integration in processing, and strategic regional expansion will define competitive success over the forecast period. Continuous investment in sustainable farming and high-purity extraction methods remains critical for stakeholders aiming to capture increasing demand across the high-growth nutraceutical and functional ingredient segments globally. The convergence of consumer health consciousness and supply chain advancements is cementing ginger's position as a premium, non-volatile commodity in the global spice and ingredient trade. Market players must prioritize quality control measures and leverage digital tools for supply assurance, mitigating the inherent risks associated with agricultural commodity sourcing.

Further strategic insights suggest that vertical integration, particularly extending control from cultivation through primary processing, provides a substantial competitive advantage by guaranteeing quality consistency and minimizing vulnerability to supply chain shocks. Emerging markets in Latin America, such as Peru and Brazil, are rapidly gaining traction as reliable sources of organic ginger, offering diversified geographical sourcing options for large multinational corporations seeking supply resilience. The development of innovative delivery systems for ginger compounds, enhancing bioavailability and taste masking for supplements, represents a key avenue for intellectual property creation and market differentiation in the immediate future. These technological advancements will enable manufacturers to target specific health conditions with greater efficacy and consumer appeal.

In conclusion, the ginger market is poised for robust expansion, reflecting broader shifts in global dietary and wellness trends. Successful market navigation requires a dual strategy: first, ensuring stable, high-quality raw material sourcing through climate-resilient farming techniques; and second, maximizing value creation through sophisticated processing and product innovation tailored to the stringent requirements of the pharmaceutical and specialized food industries. The long-term outlook remains highly positive, driven by persistent demand for natural ingredients that offer both flavor and functional health benefits. Stakeholders should focus on adhering to global safety and sustainability standards to secure long-term market access and profitability.

Detailed regulatory compliance across various jurisdictions, especially concerning heavy metal contamination and pesticide residue limits, requires significant operational oversight. As trade routes diversify and consumer scrutiny of ingredient sourcing intensifies, transparent documentation becomes non-negotiable. Leading companies are investing in internal laboratories and third-party certifications (e.g., GFSI standards) to build demonstrable quality assurance programs. This shift towards verified quality assurance acts as a significant barrier to entry for smaller, non-compliant producers but solidifies the competitive standing of integrated industry leaders who can guarantee traceability back to the farm level for every batch of ginger ingredient.

Furthermore, the competitive landscape is increasingly influenced by intellectual property rights, particularly surrounding patented extraction methods and novel formulations utilizing high-purity ginger compounds. Companies specializing in branded ingredients with clinical trial support often command premium pricing and secure long-term supply agreements with leading nutraceutical firms. This move towards proprietary, standardized extracts signals a maturation of the market, where raw commodity pricing volatility is partially decoupled from the price of finished, specialized ingredients. The focus on efficacy and scientific backing differentiates high-value players from general commodity traders, driving strategic mergers and acquisitions targeting niche expertise in botanical extraction technologies.

The role of sustainability and ethical sourcing continues to grow in importance, influencing procurement decisions across North America and Europe. Consumer demand for Fair Trade certified ginger and products sourced through verifiable programs that support farmer livelihoods are impacting corporate social responsibility agendas. Companies are responding by initiating grower partnership programs, providing training in sustainable agriculture, and ensuring premium pricing for certified production. This not only meets consumer ethical expectations but also helps secure long-term supply by fostering loyal relationships with farming communities, thereby mitigating the risk of future supply shortages caused by abandonment of the crop due to poor profitability.

The digitalization of sales channels merits specific attention. While B2B bulk sales remain crucial for industrial users, the B2C market is rapidly leveraging e-commerce and direct-to-consumer models. This allows specialized brands focusing on unique ginger products—such as gourmet ginger vinegars, concentrated shots, or rare ginger varieties—to bypass traditional retail middlemen, improving margins and enabling personalized marketing based on granular consumer data. E-commerce platforms are also becoming essential for niche health brands selling powdered organic ginger or standardized capsules, emphasizing transparency and ingredient information accessibility, thereby transforming how small and medium enterprises interact with the global customer base.

Future market development hinges significantly on innovation in product formulation. For instance, the creation of highly dispersible and stable ginger emulsions for use in beverage processing is a key technical challenge being addressed by flavor houses. Similarly, in the cosmetics sector, stabilizing the potent antioxidant components of ginger extract for use in anti-pollution and anti-aging skincare products is driving research and development efforts. These targeted innovations ensure that ginger remains a relevant and highly utilized ingredient across a spectrum of sophisticated, high-margin end-user applications, far surpassing its traditional role as a simple spice or household remedy.

Finally, governmental policies concerning agricultural subsidies, export incentives, and food safety standards in major producing nations (like India and China) exert a foundational influence on global supply dynamics. Favorable policies promoting modernization of farming and processing infrastructure can lead to stable, high-quality global output, while restrictive policies or trade disputes can rapidly create market instability. Monitoring regulatory shifts and engaging proactively with government bodies is a necessary strategic function for multinational players seeking stable sourcing and efficient market access globally. The interplay between local agricultural policy and international trade law defines the economic feasibility of large-scale ginger commerce.

The utilization of high-efficiency processing equipment, such as continuous flow extractors and membrane filtration systems, is essential for major processors to handle large volumes while maintaining the integrity and activity of ginger's delicate compounds. These systems minimize thermal degradation and oxidation, which are common issues in traditional processing methods. Capital expenditure in such advanced machinery is justified by the increasing demand for extracts with documented pharmacological activity, necessitating strict control over every phase of ingredient preparation to meet the rigorous standards of the pharmaceutical sector, where ingredient quality directly impacts final product claims and regulatory approval.

Market penetration strategies often revolve around cultural adaptation and regional flavor preferences. While North American markets may prefer the sharper, more concentrated flavor profiles found in certain ginger varieties for beverage applications, Asian markets maintain strong demand for the less pungent, high-moisture fresh rhizome used daily in cooking. Successful market entry in diverse geographical zones requires not only logistical efficiency but also a deep understanding of local culinary and medicinal traditions, allowing suppliers to tailor their product offerings—be it specific cultivars of fresh ginger or custom-blended spice mixes—to optimize acceptance and consumption across different regional demographics.

Considering the long-term forecast, the market's stability will increasingly depend on climate change mitigation strategies implemented by major producers. Investing in drought-resistant ginger cultivars and utilizing covered cultivation or greenhouses in vulnerable regions are becoming mandatory measures to ensure crop resilience. Furthermore, insurance schemes and hedging mechanisms for agricultural commodities are being developed to protect farmers and industrial buyers alike from severe financial losses resulting from extreme weather events, which pose an existential threat to the stability of the global supply of this climate-sensitive spice. This focus on long-term agricultural sustainability is a crucial component of future strategic planning.

The emphasis on the health and wellness sector is driving a distinct split in market focus: commodity trading targets bulk food flavoring, while specialty trading targets functional food and nutraceuticals. Companies that successfully bridge these two segments, offering both high-volume commodity grades and low-volume, high-purity extracts, gain a significant competitive edge through economies of scope. Such integration allows for better utilization of the raw material, directing specific parts of the harvest to their highest value-added application, minimizing waste, and maximizing overall profitability throughout the value chain of ginger processing and distribution.

Final considerations for stakeholders involve navigating the complexity of global labeling regulations. Claims related to health benefits (e.g., "anti-inflammatory," "digestive aid") must be substantiated by scientific evidence that is acceptable to governing bodies like the FDA or EFSA, which requires specific extract standardization. Non-compliance can lead to product recalls and significant market penalties. Therefore, regulatory affairs and legal compliance teams play a critical, front-line role in ensuring that product marketing and formulation meet the highest international standards, reinforcing the need for continuous monitoring of evolving global food and supplement laws.

The ongoing trade dynamics between major geopolitical blocs also influence sourcing decisions. Tariffs and non-tariff barriers can suddenly shift the comparative advantage between different producing nations. Companies must maintain flexible sourcing portfolios, potentially utilizing multiple origins (e.g., Peru for organic, China for conventional bulk, India for specialty extracts) to mitigate political or economic risks associated with relying too heavily on any single geographic source. This diversification is a key pillar of modern supply chain risk management within the Ginger Market.

The increasing consumer preference for transparent ingredient lists and simplified formulations, often termed "clean label" trends, strongly favors the use of natural ingredients like ginger extracts over synthetic alternatives. This trend compels food and beverage manufacturers to reformulate existing products, substituting artificial flavors with high-quality natural extracts derived from ginger. This shift provides a long-term, structural tailwind for the market, ensuring sustained demand growth for naturally sourced ginger products across various consumer packaged goods categories globally.

In summary, successful participation in the modern Ginger Market necessitates a blend of agricultural expertise, advanced processing technology, and sophisticated regulatory compliance. The market rewards precision, sustainability, and quality, moving away from purely volume-driven commodity dynamics toward a specialized ingredient landscape defined by verifiable health claims and supply chain integrity. Continuous innovation in product form and application remains the strongest predictor of market leadership and sustained financial performance within this evolving spice market.

The integration of advanced genomic research is beginning to impact the upstream segment by identifying and breeding ginger cultivars with enhanced resistance to common diseases, higher yield potentials, and elevated levels of specific bioactive compounds, such as shogaols, which are valued for specific therapeutic applications. This biotechnology approach promises to reduce reliance on agrochemicals and ensure a more stable supply of raw materials with targeted chemical profiles, meeting the precise specifications increasingly demanded by the pharmaceutical industry for their standardized ingredient supply chains.

Finally, the competitive landscape is shifting towards intellectual property protection concerning novel processing methods, such as patented microencapsulation techniques that protect ginger oil's volatility and improve its dissolution properties in liquid formulations. These proprietary technologies allow smaller, specialized firms to compete effectively against large commodity traders by offering unique ingredient solutions that solve specific manufacturing challenges faced by downstream food and nutraceutical producers, thus maximizing the overall value captured per unit of raw ginger processed.

The market also faces challenges related to labor practices and fair wages in primary production regions. Ethical sourcing demands often require compliance audits and investment in social programs to ensure that the global market growth does not come at the expense of local farming communities. Certification schemes focused on social responsibility are becoming critical procurement criteria for multinational food corporations, reinforcing the holistic nature of sustainability in the contemporary ginger supply chain.

The ongoing expansion of the functional beverage category, including wellness shots, energy drinks, and fortified waters, is driving innovation in liquid-soluble ginger extracts. Developing stable, concentrated extracts that do not precipitate or alter the appearance of clear beverages requires specific technological solutions (like nano-emulsification). This specialization caters directly to high-margin, trendy consumer segments, representing a significant area for short-term revenue growth and technological differentiation for ingredient suppliers globally.

The ginger market's robust trajectory confirms its status as a cornerstone functional ingredient. Strategic alignment with health trends, coupled with continuous investment in quality control and sustainable production, will determine market leadership. The shift towards transparency and certified quality validates the premiumization trend, ensuring that the market for high-value ginger derivatives continues to outperform the general commodity trade in the foreseeable future.

Advanced predictive maintenance systems using IoT sensors are increasingly being deployed in large-scale processing facilities to monitor equipment health and prevent unexpected downtime. This is particularly crucial in solvent extraction and distillation plants where continuous operation is vital for economic efficiency. By minimizing unplanned stoppages and optimizing machine performance, these technological interventions contribute significantly to reducing operational costs and maintaining high levels of supply reliability for industrial customers relying on Just-In-Time inventory management for specialized ginger products.

The regulatory evolution in areas like novel food definitions in the European Union (EU) necessitates that extract producers thoroughly document the history and safety profile of new or highly concentrated ginger derivatives. This regulatory scrutiny ensures consumer safety but adds complexity and cost to new product introduction. Successful players must maintain strong internal regulatory teams capable of preparing comprehensive documentation and toxicology reports to facilitate quick and compliant market entry for innovative ginger ingredients, minimizing time-to-market risks.

In conclusion, the ginger market is a dynamic field where traditional usage converges with modern science and technology. The continuous validation of its health benefits, combined with advancements in extraction and traceability, ensures its sustained relevance. Future growth will be highly concentrated in segments that offer standardization, transparency, and certified quality, cementing ginger's position as a premium ingredient essential for global wellness and functional product formulation strategies.

The shift towards plant-based diets and veganism further supports the ginger market, as the spice is a key flavoring and functional component in many meat substitutes, dairy alternatives, and plant-forward meals. This demographic change ensures a structural increase in demand from the manufactured food sector looking for natural, intense flavor boosters that align with clean label requirements. Ingredient suppliers are actively working with food scientists to develop highly concentrated, yet natural, ginger flavor solutions that can replace less desirable artificial flavorings in these rapidly expanding consumer categories.

Focusing on the sustainability aspect, water usage efficiency in ginger cultivation is becoming a critical research area, especially in water-stressed regions like parts of India and China. Implementing micro-irrigation systems, coupled with AI-driven weather forecasting to optimize watering schedules, not only conserves resources but also leads to healthier crops and higher yields, directly impacting the profitability and environmental footprint of the upstream supply chain in the global ginger industry.

This report confirms that the future competitive advantage in the Ginger Market will accrue to entities that demonstrate excellence across three pillars: superior raw material quality achieved through precision agriculture, efficiency in processing via advanced extraction technologies, and integrity in distribution ensured by robust traceability and compliance frameworks. These elements collectively maximize the value proposition of ginger derivatives in the demanding global marketplace for functional and natural ingredients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Flavors & Fragrances Market Size Report By Type (Natural, Essential Oils, Orange Essential Oils, Corn mint Essential Oils, Eucalyptus Essential Oils, Pepper Mint Essential Oils, Lemon Essential Oils, Citronella Essential Oils, Patchouli Essential Oils, Clove Essential Oils, Ylang Ylang/Canaga Essential Oils, Lavender Essential Oils, Oleoresins, Paprika Oleoresins, Black Pepper Oleoresins, Turmeric Oleoresins, Ginger Oleoresins, Others, Aroma Chemical, Esters, Alcohol, Aldehydes, Phenol, Terpenes, Others), By Application (Flavors, Confectionery, Convenience Food, Bakery Food, Dairy Food, Beverages, Animal Feed, Others, Fragrances, Fine Fragrances, Cosmetics & Toiletries, Soaps & Detergents, Aromatherapy, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Instant Tea Market Size Report By Type (Cardamom Tea Premix, Ginger Tea Premix, Masala Tea Premix, Lemon Tea Premix, Lemon grass Tea Premix, Other Tea Premix), By Application (Supermarkets/Hypermarkets, Specialty Stores, Discount Stores, Convenience Stores, E-commerce, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Essential Oils Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ginger Oil, Turmeric Oil, Other Essential Oils), By Application (Cosmetic, Food & Beverages, Pharmaceutical, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Ginger Beer Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Alcoholic Ginger Beer, Non-Alcoholic Ginger Beer), By Application (Retail, Catering), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Ginger Extract Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Gingerol, Curcumin, Others), By Application (Medical use, Food additives, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager