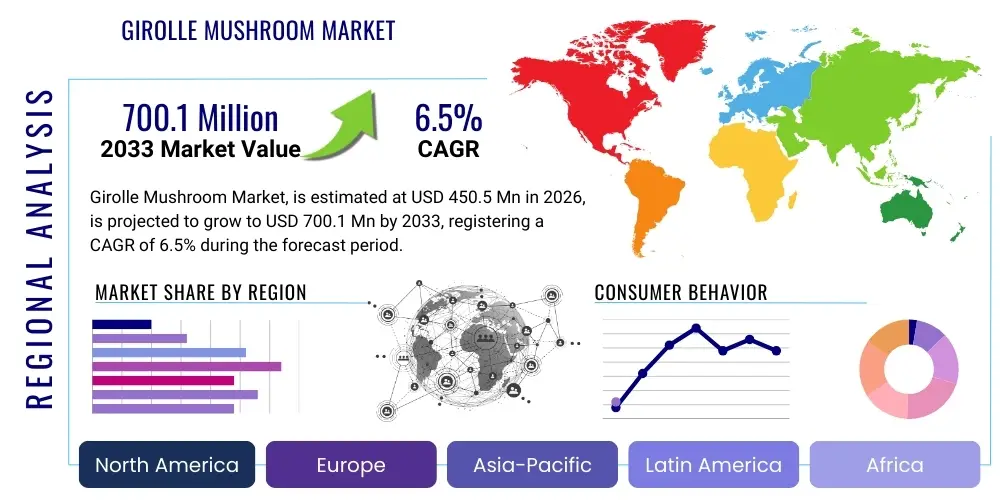

Girolle Mushroom Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432026 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Girolle Mushroom Market Size

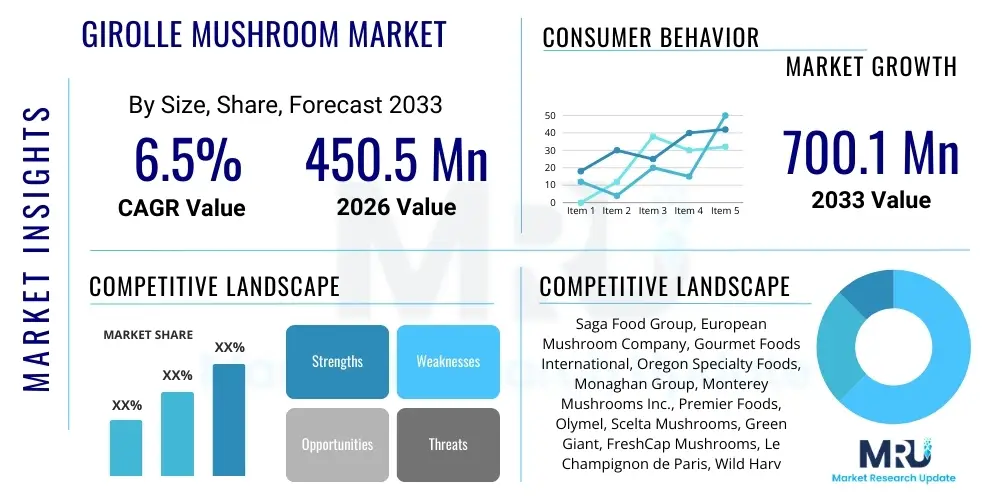

The Girolle Mushroom Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 700.1 Million by the end of the forecast period in 2033.

Girolle Mushroom Market introduction

The Girolle Mushroom, scientifically known as Cantharellus cibarius (also referred to as Chanterelle), represents a premium segment within the global edible fungi market, highly valued for its distinctive peppery flavor, fruity aroma, and unique texture. These wild-foraged mushrooms are predominantly sourced from temperate forests across Europe and North America, and their availability is highly seasonal and dependent on specific ecological conditions, making consistent supply a significant market constraint and a key factor driving price volatility. The product is categorized primarily into fresh, dried, and frozen formats, catering to diverse culinary needs ranging from high-end gastronomic applications to processed food ingredients.

Major applications of Girolle mushrooms span the gourmet food service industry, where they are utilized in fine dining preparations such as sauces, risottos, and main courses, and the retail sector, where they are increasingly purchased by home cooks seeking premium ingredients. Beyond culinary uses, there is a growing, albeit niche, application in the nutraceutical space due to preliminary research suggesting antioxidant and potential immune-modulating properties, though the market remains overwhelmingly driven by flavor and culinary demand. The high value associated with wild harvesting and the perceived purity of the product contribute to its premium positioning.

The market is currently being driven by several macro-environmental factors, including the increasing global appreciation for authentic, natural, and wild-foraged foods, the expansion of high-end restaurant chains globally, and rising consumer disposable income in developed economies, which supports the purchase of luxury food items. Furthermore, advancements in preservation technologies, particularly freezing and freeze-drying techniques, have helped extend the geographical reach and shelf life of this highly perishable commodity, smoothing out the supply fluctuations characteristic of a wild-harvested product. Sustainability concerns regarding foraging practices are also beginning to influence market trends, pushing stakeholders towards responsible sourcing initiatives.

Girolle Mushroom Market Executive Summary

The Girolle Mushroom Market exhibits robust growth, underpinned by sustained demand from the gourmet food sector and a general shift in consumer preference toward natural, specialty ingredients. Key business trends indicate increasing vertical integration among specialty food distributors who are establishing stronger relationships with foraging cooperatives and implementing sophisticated cold chain logistics to manage the high perishability of fresh girolles. Furthermore, market participants are strategically investing in high-quality processing facilities, particularly for freezing and deep-drying, to maintain flavor integrity and secure year-round supply for industrial clients and international export, mitigating the risks associated with highly fluctuating harvest yields.

Regional trends highlight Europe, particularly France, Germany, and the Nordic countries, as the primary consumers and a significant sourcing hub, benefitting from deeply ingrained culinary traditions involving wild mushrooms. North America is also witnessing strong growth, driven by an expanding consumer base interested in exotic and seasonal produce, alongside established foraging communities in the Pacific Northwest. Asia Pacific (APAC) represents an emerging market, primarily focused on importing dried and processed girolles for use in premium catering and high-end ingredient retail, though consumption remains relatively lower compared to traditional markets like Europe.

Segmentation trends reveal that the Food Service application segment retains dominance due to the high volume requirement and premium pricing associated with restaurant usage. However, the Retail segment, specifically premium grocery stores and specialty food shops, is showing the fastest growth trajectory, indicating increasing adoption among affluent households. Product-wise, frozen girolles are gaining traction as they offer quality retention close to fresh products while providing logistical flexibility and extended shelf life, addressing a fundamental challenge in the wild mushroom supply chain. The overall market dynamic is characterized by intense price competition tempered by strong brand loyalty based on perceived sourcing quality and freshness.

AI Impact Analysis on Girolle Mushroom Market

Common user questions regarding AI's impact on the Girolle Mushroom Market frequently revolve around optimizing the supply chain, forecasting harvest yields, and ensuring product authenticity, given the product's wild nature. Users are keen to know if AI can stabilize the volatile pricing caused by unpredictable harvests and if machine learning can enhance traceability to combat issues related to mislabeling or illegal foraging. Furthermore, there is significant interest in how predictive modeling can inform optimal foraging times and locations, and whether automated quality control systems can rapidly assess large batches of wild-harvested fungi for contaminants or species accuracy before distribution, thereby enhancing consumer trust and market efficiency.

The application of Artificial Intelligence and advanced analytics is poised to introduce significant efficiencies, particularly in areas traditionally plagued by uncertainty. AI algorithms can analyze vast datasets, including localized weather patterns, soil moisture levels, historical yield data, and satellite imagery, to develop sophisticated predictive models for girolle mushroom availability. These forecasts are invaluable for processors and distributors, allowing them to optimize purchasing, logistics, and labor deployment ahead of the seasonal harvest. By providing more accurate supply estimations, AI can help stabilize inventory management and mitigate severe price spikes or crashes often seen in this wild-foraged commodity market.

Moreover, AI contributes substantially to quality assurance and traceability. Implementing computer vision systems powered by AI allows for rapid, automated identification of mushroom species, reducing the risk of accidental misidentification inherent in manual sorting. In the logistics phase, machine learning optimizes cold chain management by analyzing real-time sensor data regarding temperature and humidity, flagging potential spoilage risks and minimizing post-harvest losses, which are crucial for perishable items like fresh girolles. The integration of blockchain technology, often combined with AI-driven authentication, further strengthens the transparency of the supply chain, providing consumers with verifiable information about the origin and ethical sourcing of the product.

- Predictive yield modeling using climatic and environmental data.

- Optimization of cold chain logistics and inventory management via machine learning.

- Automated species identification and quality control using computer vision technology.

- Enhanced traceability and anti-counterfeiting measures through AI-supported blockchain integration.

- Data-driven pricing strategy optimization to mitigate market volatility.

- Identification of optimal foraging locations based on historical success data and ecological inputs.

DRO & Impact Forces Of Girolle Mushroom Market

The Girolle Mushroom Market is fundamentally shaped by the delicate interplay of strong demand (Driver) driven by global gastronomy and inherent supply limitations (Restraint) tied to wild harvesting, which together create significant volatility. The primary drivers include the expanding global gourmet food industry's reliance on premium ingredients and the increasing awareness of the distinct nutritional and flavor profile of girolles among general consumers. Restraints center on the unpredictable nature of wild yields, the short shelf life of the fresh product necessitating complex logistics, and regulatory hurdles concerning harvesting permissions and sustainable forest management. Opportunities lie in developing advanced processing methods (e.g., highly effective freeze-drying) and expanding sourcing into underutilized geographic regions. These internal and external factors exert significant Impact Forces on pricing, availability, and market entry barriers.

Drivers: The sustained high demand for authentic, seasonal, and wild-foraged ingredients is a primary market accelerator. Chefs and consumers increasingly seek out girolles for their specific taste and high culinary prestige, positioning them as a high-margin product. Furthermore, growing tourism and cross-cultural culinary exchange expose new consumer bases, particularly in emerging markets, to the unique qualities of this mushroom. The natural, organic positioning of girolles, coupled with the trend toward clean label ingredients, further boosts consumer acceptance and willingness to pay premium prices, reinforcing market expansion despite supply constraints. Investment in sophisticated marketing and branding around the heritage of foraging also plays a crucial role in maintaining premium status.

Restraints: The most significant constraint remains the lack of scalability inherent in wild harvesting; girolles cannot currently be commercially cultivated efficiently, linking supply directly to environmental factors such as rainfall, temperature, and forest health. This unpredictability leads to massive year-to-year yield variations, resulting in sharp price fluctuations that complicate stable business planning for large food processors. Additionally, strict import regulations in certain jurisdictions concerning contaminants (like heavy metals or radioactive isotopes, though rare) found in wild fungi, coupled with the high cost of rigorous testing and certification, add complexity and expense to the international supply chain. The labor-intensive nature of manual foraging also keeps production costs high.

Opportunities: Opportunities for market growth primarily involve technological advancements in preservation and processing, allowing distributors to extend the product's availability far beyond the traditional foraging season. Developing strategic, ethical sourcing agreements and certifications (e.g., sustainable wild harvesting certification) can enhance brand reputation and open doors to retailers and consumers demanding environmentally responsible products. Moreover, exploring new geographic regions with suitable forest ecosystems for sustainable foraging, under strict regulatory oversight, could diversify the global supply base and reduce reliance on historically dominant European and North American sources, thereby potentially stabilizing annual supply.

- Drivers:

- Rising global demand for gourmet and specialty wild-foraged ingredients.

- Increasing disposable income supporting purchases of premium food items.

- Advancements in cold chain and preservation technologies extending product reach.

- Growing trend towards clean label and naturally sourced food products.

- Restraints:

- Inherent supply volatility due to dependence on unpredictable wild harvesting.

- High perishability and short shelf life demanding complex and costly logistics.

- Difficulty and expense associated with high-quality identification and contamination testing.

- Lack of established, efficient commercial cultivation techniques.

- Opportunity:

- Expansion into untapped Asian and South American premium food markets.

- Development of innovative dried and processed girolle products (e.g., extracts, flours).

- Implementation of sustainable and certified foraging practices to ensure long-term supply.

- Leveraging digital platforms for direct sourcing from foragers to reduce intermediary costs.

- Impact Forces:

- Environmental and climatic variability directly impacts annual supply levels.

- Consumer perception of quality and authenticity dictates premium pricing power.

- Regulatory policies regarding wild food safety and export standards influence market access.

- Technological investment in preservation affects market duration and stability.

Segmentation Analysis

The Girolle Mushroom Market segmentation provides a clear structure for understanding consumption patterns, pricing strategies, and regional variances based on product type, application, and form. The market is primarily segmented by the state in which the mushroom is sold, recognizing that handling and processing significantly affect both cost and end-use functionality. Application segmentation delineates the two main channels—the high-volume, quality-sensitive food service sector and the growing, affluent consumer retail sector. Analyzing these segments helps stakeholders tailor their supply strategies, from optimizing high-speed deep-freezing lines for industrial clients to focusing on pristine presentation for the retail fresh market, thereby maximizing profitability across diverse consumer profiles.

Understanding the interplay between form (Fresh vs. Dried/Processed) and application is crucial. While fresh girolles command the highest price and are the preferred choice for high-end restaurants during peak season, dried and frozen forms enable year-round availability, which is essential for larger food manufacturing entities or international exports requiring stable supply volumes. This diversity in product form allows the market to cater to different operational needs and budgets, ensuring market resilience against seasonal supply shocks. Pricing premiums are typically highest in the fresh segment, emphasizing the logistical value and inherent quality associated with recent harvesting.

Further segment analysis reveals distinct regional preferences. European markets show a strong bias towards fresh and locally foraged girolles, valuing seasonality and regional provenance highly. Conversely, markets in regions like the Middle East or parts of Asia Pacific rely almost exclusively on high-quality dried or deep-frozen products due to logistical distance and cost efficiency. These geographical disparities necessitate customized distribution networks and processing capacities, driving investment into regional hubs for preparation and packaging that comply with specific import standards and consumer expectations regarding texture and flavor reconstitution.

- By Product Form:

- Fresh Girolles (Highest perceived quality; peak seasonal demand)

- Frozen Girolles (Offers stability; used extensively in food service)

- Dried Girolles (Long shelf life; ideal for seasoning and international transport)

- Powder and Extract (Niche market for nutraceuticals and flavor agents)

- By Application:

- Food Service (Restaurants, Hotels, Catering - dominant volume share)

- Retail (Supermarkets, Specialty Grocery Stores, Online Sales - fastest growing)

- Food Processing (Sauces, Soups, Ready Meals)

- By Distribution Channel:

- Direct Sales (Foragers to Local Markets/Restaurants)

- Wholesalers & Distributors (High volume global trade)

- Online Retail (Specialty E-commerce platforms)

- By Region:

- North America (USA, Canada, Mexico)

- Europe (Germany, France, Nordic Countries, UK)

- Asia Pacific (China, Japan, South Korea, Australia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA)

Value Chain Analysis For Girolle Mushroom Market

The Girolle Mushroom value chain is distinctively characterized by its reliance on the natural environment and a complex, often fragmented, upstream process centered around specialized foraging networks. Upstream activities begin with the highly skilled and localized process of wild foraging, where collectors (foragers) manually harvest the mushrooms during the brief seasonal window. Given the wild nature of the product, quality control and initial sorting are critical first steps carried out by local cooperatives or small collection centers. The immediate need for preservation defines this stage, often involving rapid chilling before handing off to the next stage. This upstream sector is crucial as it determines the total annual supply volume, making it highly susceptible to weather fluctuations and environmental policy.

The middle segment of the value chain involves primary processing, preservation, and aggregation. This phase includes sorting, cleaning, quality grading, and preservation techniques such as flash freezing, drying, and packaging. Aggregators and specialized food distributors, often operating internationally, play a key role here, consolidating small batches from numerous foraging sources into commercially viable lots while managing complex logistics, specifically the maintenance of the cold chain for fresh and frozen products. Direct sales channels, bypassing major distributors, exist for local markets but contribute only a small fraction to the overall global trade volume. Regulatory compliance, including phytosanitary certificates and origin tracking, is heavily focused within this processing phase.

Downstream analysis focuses on distribution channels, which are typically bifurcated into direct channels (primarily serving local specialty restaurants or farmers' markets) and indirect channels dominated by food service distributors and high-end retail networks. Indirect channels rely heavily on major global food logistics companies to transport bulk, processed girolles across borders, ultimately reaching fine dining establishments, hotels, and specialty grocery stores. The end-user demand dictates the final form of the product, with bulk frozen girolles moving towards large institutional buyers, while meticulously packaged fresh or dried products are directed towards high-margin retail segments. Efficiency in this downstream phase relies heavily on speed and reliability to minimize spoilage and maintain premium pricing.

Girolle Mushroom Market Potential Customers

The primary customer base for Girolle mushrooms is highly specialized, dominated by the commercial food service sector, particularly high-end restaurants, luxury hotel chains, and premium catering companies that prioritize ingredient quality and seasonal authenticity. These professional buyers require consistent supply, albeit seasonal for fresh products, and excellent flavor profiles to justify the premium prices they charge for their prepared dishes. Their procurement is often handled through specialized wholesale distributors who guarantee quality assurance and cold chain integrity, recognizing the girolle's status as a 'star ingredient' often featured prominently during its peak season menus, driving high annual demand.

The second major segment comprises the retail consumer market, segmented primarily into affluent individuals and enthusiastic home cooks who seek specialty, gourmet, and often exotic ingredients. This segment is characterized by purchasing smaller quantities, frequently through specialty grocery stores, farmer's markets, or online gourmet food platforms. These consumers are typically less price-sensitive than other food buyers and are motivated by the desire for high-quality culinary experiences, sustainability credentials, and the perceived health benefits of wild mushrooms. The growth in this retail segment is significantly influenced by food media and cooking shows highlighting the use of premium ingredients.

A third, emerging customer segment includes large-scale food processors involved in manufacturing premium ready-meals, specialty soups, and gourmet sauces, which require girolle powder, extract, or frozen cuts for year-round flavor inclusion. While this segment is highly price-sensitive and demands stability in supply (hence relying heavily on frozen or dried inventory), their bulk purchasing power makes them crucial for absorbing large annual harvests. Furthermore, the niche nutraceutical industry represents a potential, albeit small, customer base interested in mushroom extracts for functional food applications, driven by research into the bio-active compounds present in Cantharellus cibarius.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 700.1 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saga Food Group, European Mushroom Company, Gourmet Foods International, Oregon Specialty Foods, Monaghan Group, Monterey Mushrooms Inc., Premier Foods, Olymel, Scelta Mushrooms, Green Giant, FreshCap Mushrooms, Le Champignon de Paris, Wild Harvest, Marx Foods, Urbani Truffles, Specialty Produce, Mushroom Kingdom, Valley Foods Group, Kinoko Company, Fungi Perfecti |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Girolle Mushroom Market Key Technology Landscape

The technology landscape in the Girolle Mushroom market is primarily focused on overcoming the inherent challenges of preservation and quality assurance in a highly perishable, wild-foraged product. The most critical technologies revolve around cold chain logistics, particularly rapid freezing methods such as Individual Quick Freezing (IQF) and cryogenic freezing. IQF technology is essential for freezing girolles quickly and individually, preventing clumping and preserving the cellular structure, which minimizes texture degradation upon thawing, making frozen girolles highly acceptable to professional chefs. Sophisticated temperature monitoring and tracking systems using IoT sensors are deployed throughout the transportation phase to ensure consistent quality and compliance with international food safety standards, crucial for maintaining the premium status of the product.

Another significant technological area is dehydration and advanced processing. While traditional air-drying methods are common, modern players utilize vacuum drying and freeze-drying (lyophilization) to produce high-quality dried girolles and powders. Freeze-drying is particularly impactful as it preserves nearly all the original volatile flavor compounds and nutritional value while offering an extremely long shelf life and lightweight product for global shipping. These advanced techniques transform the seasonal crop into a year-round ingredient, addressing the core supply restraint faced by the market. Furthermore, the development of high-barrier packaging materials minimizes oxidation and moisture absorption, ensuring the stability and freshness of dried products over extended periods.

In the near future, the integration of digital technologies, as highlighted in the AI analysis, will become increasingly prevalent. This includes the use of spectroscopic analysis and non-destructive testing for rapid quality and safety screening, replacing slower, laboratory-based methods. Geographical Information Systems (GIS) are being used to map successful foraging sites and manage sustainable rotation practices, optimizing the labor-intensive harvesting process. Traceability platforms, often leveraging blockchain technology, are becoming the technical standard for verifying the origin and ethical sourcing of girolles, responding directly to growing consumer demand for transparency and mitigating concerns related to illegal or environmentally damaging foraging practices across various regions.

Regional Highlights

- Europe: Europe represents both the historical heartland and the largest consumer market for Girolle mushrooms globally. Countries such as Germany, France, Poland, and the Nordic nations boast deep-seated culinary traditions utilizing fresh girolles, driving immense seasonal demand. The region is also a major sourcing hub, though strict forest management regulations and fluctuating environmental conditions heavily influence annual yields. Sophisticated logistics networks and a high concentration of gourmet food distributors ensure efficient movement of fresh and processed girolles across the continent, maintaining its dominant market position. The strong emphasis on local sourcing and provenance drives premium pricing in the fresh segment.

- North America (USA & Canada): This region is characterized by substantial domestic foraging, particularly in the Pacific Northwest (Oregon, Washington, British Columbia), providing a reliable, though environmentally sensitive, source. The market is driven by rapidly growing consumer awareness of specialty foods and an expanding high-end restaurant scene in metropolitan areas. While fresh girolles are highly sought after seasonally, the majority of the market relies on high-quality imported frozen and dried products, reflecting the challenge of supplying a large, geographically diverse consumer base efficiently. Investment in high-tech freezing facilities is a key regional trend.

- Asia Pacific (APAC): APAC is emerging as a critical growth market, predominantly reliant on imports of dried and frozen girolles from European and North American suppliers. Key consuming nations like Japan, South Korea, and increasingly China, are developing a taste for Western gourmet ingredients in high-end hotels and specialty retail. The market size in APAC is currently smaller than Europe but shows a high growth rate, driven by urbanization, rising disposable incomes, and the luxury food segment expansion. Logistical excellence and guaranteed authenticity are crucial factors for success in this import-heavy region.

- Latin America (LATAM): The Girolle market in LATAM is relatively nascent and highly concentrated within affluent urban centers (e.g., Sao Paulo, Buenos Aires). Demand is almost exclusively met through imports of premium dried products and specialty frozen offerings, catering to international hotel chains and highly specialized restaurants. Local sourcing is minimal, making the market highly sensitive to global commodity prices and import duties. The focus here is on high-margin, low-volume trade aimed at the elite culinary segment.

- Middle East & Africa (MEA): Similar to LATAM, the MEA market for girolles is restricted to luxury consumption within major economic hubs like Dubai and Riyadh. Demand is tied to high-end expatriate communities and international five-star hospitality sectors. Due to climatic conditions, all products are imported, typically in dried or frozen form. The logistical challenge involves maintaining product integrity across long transport routes and high ambient temperatures, making reliable cold chain management a decisive competitive factor for distributors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Girolle Mushroom Market.- Saga Food Group

- European Mushroom Company

- Gourmet Foods International

- Oregon Specialty Foods

- Monaghan Group

- Monterey Mushrooms Inc.

- Premier Foods

- Olymel

- Scelta Mushrooms

- Green Giant

- FreshCap Mushrooms

- Le Champignon de Paris

- Wild Harvest

- Marx Foods

- Urbani Truffles

- Specialty Produce

- Mushroom Kingdom

- Valley Foods Group

- Kinoko Company

- Fungi Perfecti

Frequently Asked Questions

Analyze common user questions about the Girolle Mushroom market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor limiting the commercial scalability of the Girolle Mushroom Market?

The primary constraint is the Girolle mushroom's dependence on being wild-foraged. Unlike common button mushrooms, Cantharellus cibarius forms complex mycorrhizal relationships with specific trees (like pine or oak) and cannot be efficiently cultivated in controlled, commercial settings. This reliance on unpredictable natural ecosystems leads to inherent supply volatility and high labor costs, making large-scale, consistent production impossible and thereby limiting overall market scalability and stabilizing capacity.

How does the seasonality of girolles affect pricing and supply chain management?

Girolles are highly seasonal, typically peaking in late summer and autumn, leading to sharp supply bottlenecks and significant price fluctuations outside these months. Supply chain management must prioritize advanced preservation technologies, such as flash freezing and professional drying, during the peak season to bank inventory. This allows distributors to offer year-round supply, albeit at higher prices for non-fresh forms, mitigating the seasonal impact on the food service and processing sectors by ensuring stable ingredient availability.

Which geographical region dominates the consumption and sourcing of Girolle mushrooms?

Europe is the dominant region for both consumption and sourcing of Girolle mushrooms. Countries in Central and Western Europe, including France, Germany, and the Nordic countries, have strong cultural culinary ties to these wild fungi and represent the largest consumer base for fresh and high-quality processed forms. Sourcing is also concentrated across European temperate forests, though North America (particularly the Pacific Northwest) is a crucial secondary source market providing significant export volumes, especially of frozen product.

What role do frozen Girolles play in the modern market, and why are they increasingly popular?

Frozen girolles are essential for bridging the gap between seasonal supply and year-round demand, especially within the global food service industry. Advanced freezing techniques, such as Individual Quick Freezing (IQF), help retain much of the mushroom's texture and distinctive flavor profiles close to the fresh state. They offer crucial logistical advantages—extended shelf life and easier international transportation—making them a highly practical and cost-effective solution for restaurants and food processors that require stable, high-quality inventory regardless of the harvest calendar.

What technological advancements are critical for ensuring the authenticity and safety of wild-foraged girolles?

Key technological advancements focus on traceability and quality control. Traceability is enhanced through the adoption of blockchain systems combined with GIS mapping to verify the precise origin of the foraged mushrooms, combating counterfeiting and illegal harvesting. For safety, AI-powered computer vision and spectroscopic analysis are increasingly used for rapid, non-destructive screening to confirm species identity and detect potential contaminants (like heavy metals or pesticides) before the product enters the distribution network, thereby safeguarding consumer health and market integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager