GIS Data Collector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432147 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

GIS Data Collector Market Size

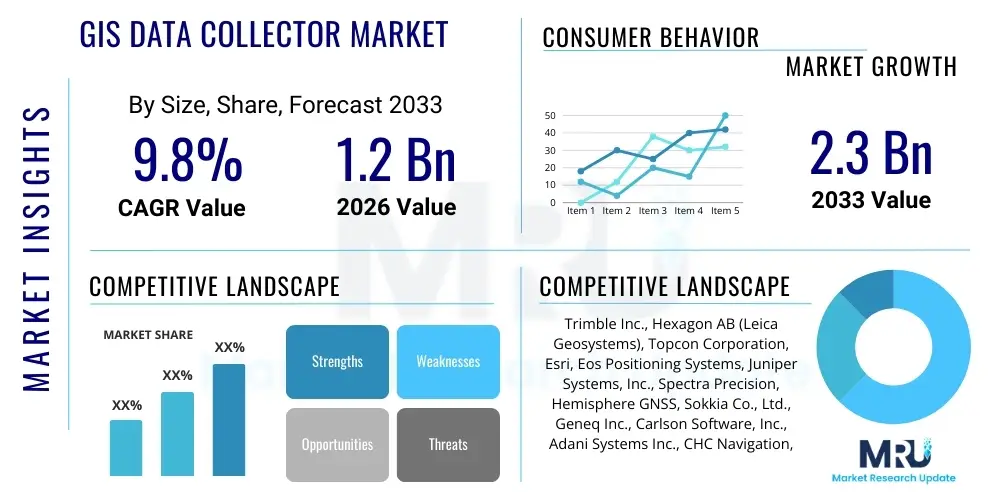

The GIS Data Collector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033.

GIS Data Collector Market introduction

The GIS Data Collector Market encompasses hardware and software solutions designed for the efficient acquisition, processing, and management of spatial data in field environments. These devices, ranging from rugged handheld units to advanced tablet systems integrated with high-precision Global Navigation Satellite System (GNSS) receivers, are essential tools for ensuring data accuracy and timeliness across various professional sectors. The primary function of a GIS data collector is to link real-world physical attributes with precise geographical coordinates, enabling detailed mapping, asset inventory, and spatial analysis. The evolution of these collectors is marked by a shift towards increased integration of complex sensor technologies, improved positional accuracy down to the centimeter level, and seamless connectivity for real-time data synchronization with central enterprise Geographic Information Systems (GIS).

Product descriptions for modern GIS data collectors emphasize ruggedness, operability in harsh environmental conditions, and sophisticated operating systems capable of running complex field data collection software. Key applications span resource management, utilities and infrastructure mapping, urban planning, environmental monitoring, agriculture (precision farming), and surveying. The inherent benefits derived from utilizing these systems include drastically reduced data collection time, minimization of human error, enhanced data reliability, and the ability to update critical organizational databases dynamically. This efficiency gain translates directly into improved decision-making capabilities and optimized operational workflows across governmental and commercial entities reliant on accurate spatial intelligence.

The market growth is fundamentally driven by the escalating global demand for geospatial intelligence to support digital transformation initiatives, particularly in infrastructure development and smart city projects. Furthermore, the proliferation of utility mapping projects, the need for stringent regulatory compliance regarding environmental data, and the widespread adoption of high-accuracy surveying techniques in construction are major propellants. The integration of Internet of Things (IoT) sensors and the demand for real-time spatial analytics are continuously pushing manufacturers to innovate, focusing on lightweight, high-performance devices with expanded processing power and battery life, solidifying the data collector's role as a mission-critical tool for field operations.

GIS Data Collector Market Executive Summary

The GIS Data Collector Market is currently characterized by robust business trends centered on technological convergence and high-accuracy requirements. A significant trend involves the integration of high-definition imagery capture (UAV/drone connectivity) and augmented reality (AR) capabilities directly into field devices, allowing users to visualize and interact with spatial data layers in real-time context. The market is witnessing strong competition driven by hardware miniaturization and improved software usability, shifting the preference toward unified platforms that support both traditional surveying tasks and mobile GIS applications. Furthermore, the subscription-based model for software licenses and cloud services associated with data collectors is gaining traction, ensuring users always have access to the latest processing power and security patches, moving capital expenditure towards operational expenditure.

Regional trends indicate North America and Europe maintaining leadership due to early adoption of high-precision GNSS technology and substantial investment in infrastructure monitoring and utility management (e.g., gas and electricity networks). However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by massive urbanization projects, expansive agricultural modernization (precision agriculture), and large-scale government initiatives in land parcel mapping and disaster management. Emerging markets in Latin America and the Middle East & Africa (MEA) are increasingly adopting lower-cost, robust GIS data collection solutions to manage rapidly expanding energy and water infrastructure, though growth is often dependent on stabilizing commodity prices and governmental IT expenditure.

In terms of segment trends, the market is primarily segmented by Product Type (Integrated Collectors, Handheld Devices, and Accessories) and Application (Surveying, Engineering & Construction, Utilities, Government, and Agriculture). The Handheld Devices segment, particularly those offering sub-meter to centimeter accuracy through external or integrated GNSS antennas, dominates in volume due to their versatility and ease of deployment. Simultaneously, the Utilities and Infrastructure segment continues to be the largest consumer, driven by continuous maintenance, asset lifecycle management, and regulatory mandates requiring precise locational data for buried assets. The future trajectory leans heavily towards devices optimized for multi-frequency GNSS constellations (GPS, GLONASS, Galileo, BeiDou) to maximize global reliability and achieve unparalleled positional accuracy.

AI Impact Analysis on GIS Data Collector Market

User queries regarding AI's influence on the GIS Data Collector Market frequently revolve around automation capabilities, real-time data processing efficiency, and the potential displacement of traditional manual fieldwork. Users are keenly interested in how AI algorithms can enhance data quality assurance, specifically querying the ability of machine learning (ML) models to automatically classify features captured in the field (e.g., identifying utility poles, hydrants, or specific vegetation types from integrated camera input) and flag anomalies or errors in real-time coordinate logging. A significant theme is the expectation that AI will transform data cleaning and preparation processes, dramatically reducing post-fieldwork office time. Furthermore, questions address predictive maintenance applications, where AI analyzes historical GIS data collected by these devices to forecast infrastructure failure or map change requirements, moving the market toward proactive rather than reactive data strategies. Concerns often center on the computational overhead required to run sophisticated AI models on remote field devices and the subsequent security implications of transmitting sensitive spatial data to cloud-based AI processing centers.

The practical application of AI in GIS data collection hardware involves edge computing capabilities where localized ML models perform initial processing and quality checks, minimizing bandwidth dependency. This on-device intelligence allows for automated feature extraction from photogrammetry or laser scanning data collected by the device, enhancing the richness and speed of mapping projects. AI-driven algorithms also optimize GNSS signal processing, improving accuracy and reducing multipath errors in challenging urban or forested environments, thereby making the collected raw data inherently more reliable before it leaves the field. This integration moves the data collector from a mere input tool to an intelligent decision support system.

Ultimately, the impact of AI is fostering a paradigm shift from simple positional logging to intelligent spatial feature capture and validation. By automating repetitive tasks like feature recognition and utilizing predictive analytics for route optimization or site selection, AI elevates the role of the field technician, enabling them to focus on complex decision-making rather than rudimentary data entry. This optimization directly addresses market demands for higher throughput and superior data integrity, ensuring the longevity and relevance of high-end GIS data collectors that can harness these advanced processing capabilities.

- Enhanced Data Validation: AI algorithms automatically detect and correct input errors, ensuring positional and attribute accuracy in real-time.

- Automated Feature Recognition: Machine learning models classify and identify assets (e.g., road signs, pipelines) from imagery collected by the device camera, speeding up attribute logging.

- Predictive Maintenance Integration: Utilizing collected spatial data to forecast infrastructure issues, informing field teams on priority data collection areas.

- Optimized GNSS Performance: AI-driven processing reduces signal noise and multipath effects, improving positional accuracy in dense urban canyons.

- Route and Mission Planning Optimization: ML analyzes terrain and historical data to suggest the most efficient routes for field workers, maximizing data collection coverage.

- Edge Computing Deployment: Running core AI validation models directly on the collector device to ensure responsiveness without continuous cloud connectivity.

DRO & Impact Forces Of GIS Data Collector Market

The GIS Data Collector Market is powerfully influenced by a confluence of driving factors, persistent restraints, and significant opportunities, which collectively determine its growth trajectory and competitive landscape. The primary drivers include the global mandate for precise infrastructure asset management, driven by aging utility networks and the expansion of smart cities, which necessitates highly accurate spatial data for planning, maintenance, and regulation compliance. Furthermore, the technological advancements in GNSS receivers, particularly the shift towards multi-constellation and multi-frequency support, enable sub-centimeter accuracy at increasingly accessible price points, broadening the application base beyond traditional surveying into mainstream GIS applications. The ubiquitous availability of high-speed wireless connectivity (5G) facilitates real-time data synchronization, enhancing operational efficiency and making immediate field updates possible, which is crucial for dynamic environments.

Restraints, however, limit market potential, primarily stemming from the high initial acquisition cost of professional-grade, high-accuracy collectors and associated proprietary software licenses, making sophisticated solutions inaccessible to smaller enterprises or governmental bodies in developing nations. Another restraint is the complexity associated with integrating collected data across disparate legacy enterprise systems, often requiring significant IT investment and specialized training, leading to slower adoption rates in organizations hesitant to overhaul existing workflows. The market also faces competition from consumer-grade devices (smartphones/tablets) that, while offering lower accuracy, leverage advanced GNSS chips and increasingly powerful processing capabilities, pressuring dedicated collector manufacturers to continually justify the premium cost of their specialized hardware based on superior durability and verifiable accuracy.

Opportunities for exponential growth are concentrated in the rapid commercialization of precision agriculture and the integration of GIS collectors with Unmanned Aerial Vehicles (UAVs) for hybrid data acquisition workflows. The proliferation of digital twin projects across manufacturing and urban development requires continuous, high-fidelity spatial updates, positioning GIS data collectors as crucial tools for maintaining the physical-digital link. The impact forces acting on this market include intense regulatory pressures (e.g., environmental mapping standards and mandated utility location accuracy) and rapid technological obsolescence, forcing manufacturers to shorten innovation cycles to keep up with faster processors, better battery technology, and evolving communication standards. The synergistic relationship between GIS collectors and remote sensing data sources (satellite, aerial) further dictates market dynamics, requiring seamless interoperability and data harmonization tools.

Segmentation Analysis

The GIS Data Collector Market is segmented across several critical dimensions, allowing for a detailed analysis of market dynamics, end-user preferences, and technological adoption patterns. The primary segmentation categories include the classification of devices by Product Type, the delineation of accuracy levels achievable (e.g., sub-meter, centimeter), and the identification of major End-User Industries. Analyzing these segments provides strategic insights into areas of highest revenue generation and future investment priorities. The market structure reflects the varied needs of professional users, ranging from basic field mapping requirements met by robust handhelds to highly specialized surveying tasks requiring integrated, high-precision GNSS receivers and sophisticated external antennas.

The segmentation by Accuracy Level is particularly crucial, as accuracy dictates the suitability of the device for specific applications; for instance, construction staking demands centimeter-level accuracy, whereas asset inventory and general resource management often suffice with sub-meter or decimeter accuracy. This differentiation directly affects the price point and technological complexity of the collector. Furthermore, the segmentation by Offering (Hardware, Software, and Services) highlights the increasing importance of recurring revenue streams derived from cloud integration, data processing platforms, and specialized maintenance contracts, shifting the market emphasis toward holistic solutions rather than just hardware sales.

Understanding these segments confirms that while hardware sales remain foundational, the future competitive advantage lies in developing highly optimized, industry-specific software applications (e.g., specialized utility mapping software, forestry inventory tools) that run seamlessly on the collector, coupled with robust customer support and training services. This strategic focus ensures that manufacturers cater directly to the precise operational demands of major end-user verticals, such as government entities requiring mass land data collection or utility companies needing rigorous positional precision for compliance and safety standards. The sustained growth in the Agriculture segment is driven specifically by the demand for affordable, yet reliable, positioning tools critical for variable rate application and yield mapping in precision farming.

- By Product Type:

- Handheld GIS Collectors

- Integrated GNSS/GIS Systems (Tablet-based)

- Data Collector Accessories (Antennas, Batteries, Mounts)

- By Accuracy Level:

- Sub-Meter Accuracy

- Decimeter Accuracy

- Centimeter/Millimeter Accuracy (Survey Grade)

- By Offering:

- Hardware

- Software (Field Collection Apps, Post-Processing)

- Services (Consulting, Maintenance, Training)

- By End-User Industry:

- Utilities and Telecommunication

- Surveying and Civil Engineering

- Government and Defense (Public Works, Land Management)

- Agriculture and Forestry

- Oil, Gas, and Mining

- Environmental Management and Conservation

Value Chain Analysis For GIS Data Collector Market

The value chain for the GIS Data Collector Market begins with upstream activities focused on the procurement and manufacturing of highly specialized components. This stage involves sourcing high-performance multi-frequency GNSS chipsets, durable and ruggedized enclosures, high-resolution display technologies, and embedded operating systems. Key upstream suppliers include semiconductor manufacturers (for GNSS receivers and processors) and specialized firms providing ruggedized display and battery technologies tailored for extreme field use. Research and development (R&D) at this stage is crucial, focusing on miniaturization, enhanced processing power for edge computing, and extending battery life, all of which determine the final product's performance specifications and cost structure.

The midstream process involves the core manufacturing, assembly, and integration of hardware components with proprietary or licensed operating system platforms, followed by rigorous quality assurance and calibration, particularly concerning GNSS accuracy testing. This stage is dominated by major GIS hardware manufacturers who develop and integrate specialized GIS field software applications (the "brain" of the collector). Downstream activities focus heavily on effective distribution and highly specialized sales strategies. Products are often sold through a tiered distribution channel, utilizing regional value-added resellers (VARs) and authorized dealers who provide crucial local technical support, specialized training, and integration services tailored to specific regional industry demands (e.g., specific correction services required for local surveying). Direct sales channels are typically used for large governmental contracts or major corporate accounts requiring customized fleet management solutions.

The final layer involves the post-sale service components, which are increasingly important for recurring revenue and customer retention. These services include providing cloud-based data hosting and synchronization platforms, technical support for field data errors, regular firmware/software updates, and offering subscription services for real-time kinematic (RTK) or precise point positioning (PPP) correction services necessary to achieve high accuracy. The efficiency of this downstream segment—especially the quality of the technical support provided by the dealer network—is a key competitive differentiator, as operational downtime due to hardware or software issues can be extremely costly for end-users relying on continuous field work. The entire chain emphasizes intellectual property protection related to precision algorithms and software usability.

GIS Data Collector Market Potential Customers

The potential customer base for GIS Data Collectors is exceptionally diverse, spanning nearly every sector that relies on accurate spatial data for operational efficiency, asset management, and regulatory compliance. The largest and most consistent buyers are governmental agencies at local, state, and federal levels, particularly public works departments, land management agencies, environmental protection bodies, and defense organizations. These customers utilize collectors extensively for infrastructure inventory (roads, bridges), utility mapping, tax parcel delineation, environmental monitoring, and disaster response planning, often requiring large fleet deployments and standardization across multiple internal departments. Their purchasing decisions are heavily influenced by robustness, established vendor reliability, and seamless integration with existing enterprise GIS platforms like Esri.

The Engineering and Construction sector represents a rapidly growing customer segment, driven by large-scale commercial and residential development, as well as complex civil engineering projects (pipelines, railway networks). These customers demand high-precision (centimeter-level) integrated GNSS systems for stakeout, as-built mapping, volume calculations, and verification of positional tolerances. Utility providers (electric, gas, water, telecom) constitute a crucial segment, utilizing collectors for mapping buried assets, documenting maintenance activities, ensuring regulatory safety compliance (e.g., pipeline safety), and managing vast telecommunication fiber optic networks. The need to accurately locate and document underground infrastructure minimizes excavation damage and improves service continuity.

Emerging and high-growth potential customers are concentrated in the Precision Agriculture and Forestry sectors. Farmers and agricultural consultants use GIS data collectors for boundary mapping, soil sampling, yield monitoring, and implementing variable rate technology applications (fertilizer, pesticides) to optimize resource use and maximize crop output, driving demand for rugged, easy-to-use sub-meter devices. Furthermore, ecological consultants, archaeological surveyors, and research institutions form a specialized niche, requiring versatile tools capable of collecting complex geo-referenced data across challenging, remote field locations. These customers prioritize mobility, battery life, and the ability to interface with specialized scientific sensors, pushing the boundaries of collector adaptability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trimble Inc., Hexagon AB (Leica Geosystems), Topcon Corporation, Esri, Eos Positioning Systems, Juniper Systems, Inc., Spectra Precision, Hemisphere GNSS, Sokkia Co., Ltd., Geneq Inc., Carlson Software, Inc., Adani Systems Inc., CHC Navigation, U-blox, and Satlab Geosolutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

GIS Data Collector Market Key Technology Landscape

The key technology landscape of the GIS Data Collector Market is fundamentally defined by advancements in Global Navigation Satellite Systems (GNSS) and the convergence of high-performance computing with mobile devices. Modern data collectors leverage multi-constellation and multi-frequency GNSS receivers, capable of tracking signals from GPS, GLONASS, Galileo, and BeiDou simultaneously. This technological shift is paramount as it drastically improves positional accuracy, reduces reliance on any single system, and enhances performance in challenging environments (e.g., near tall buildings or under dense canopy). Crucially, the reliance on high-accuracy correction services, such as Real-Time Kinematic (RTK) and Network RTK (NRTK), or Precise Point Positioning (PPP) services delivered via satellite or the internet, is standard practice, enabling centimeter-level precision necessary for demanding surveying and engineering applications. The hardware must incorporate robust, high-gain antennas designed to maintain signal lock under adverse conditions.

Beyond positioning technology, the market is characterized by sophisticated software integration and ruggedized hardware design. Collectors utilize operating systems optimized for field work (typically Android or Windows Mobile derivatives) that support specialized GIS software featuring advanced capabilities like georeferenced photo documentation, attribute data capture forms, and integrated laser rangefinders for offset measurements. The physical design emphasizes MIL-STD-810G military standards for shock, vibration, temperature, and IP ratings (e.g., IP67) for dust and water resistance, ensuring operational reliability in all field conditions. Furthermore, enhanced battery technology, often featuring hot-swappable or long-life packs, is critical for minimizing downtime during extended field sessions.

The contemporary technological trajectory involves heavy integration of ancillary sensors and connectivity solutions. This includes embedded high-resolution cameras for photogrammetry, integration with LiDAR sensors for 3D point cloud collection, and seamless Bluetooth/Wi-Fi connectivity to peripheral sensors (e.g., ground-penetrating radar, methane detectors). The trend towards cloud synchronization and the deployment of edge computing capabilities is accelerating, allowing field data to be uploaded and validated in near real-time, thereby maximizing operational throughput and minimizing post-processing requirements. The adoption of 5G connectivity is set to further revolutionize the speed and reliability of correction service delivery and data transfer, cementing the data collector’s role as a real-time spatial intelligence tool.

Regional Highlights

- North America (USA and Canada)

North America holds a dominant share in the GIS Data Collector Market, primarily driven by high expenditure on advanced GNSS technology, robust infrastructure development, and strong government support for digital mapping initiatives. The region is characterized by early and widespread adoption of high-accuracy RTK and network correction services, particularly across oil and gas, utility management, and large-scale agricultural operations. The competitive landscape is mature, featuring sophisticated end-users in government and private surveying firms demanding the latest technology, including integration with drone photogrammetry and advanced 3D modeling software. Regulatory compliance regarding precise asset location, particularly for underground utilities, continually fuels demand for professional-grade collectors.

The United States, in particular, showcases high utilization rates across state Departments of Transportation (DOTs) and major utility companies (e.g., electric and telecom). Innovation often originates here, driven by major technology vendors headquartered in the region who invest heavily in R&D focusing on software usability, cloud integration, and enhanced security features for sensitive government data. The rapid expansion of 5G infrastructure also creates specific demand for data collectors capable of accurately mapping new tower locations and fiber optic routes, ensuring continued regional market leadership in terms of technological depth and market size.

- Europe (Germany, UK, France)

The European market is distinguished by strict environmental regulations and high investment in sustainable infrastructure and smart city development, particularly in countries like Germany and the Netherlands. Demand is strong for collectors that support multi-constellation GNSS (especially Galileo) to achieve high levels of precision for land administration (cadastral mapping), agricultural subsidy programs, and complex rail and highway projects. The market places a strong emphasis on interoperability and adherence to open data standards, facilitating seamless data sharing among various public and private sector stakeholders.

The United Kingdom and Nordic countries show significant demand in asset management for water and gas utilities, driven by aging infrastructure that requires continuous, accurate mapping and maintenance documentation. The shift towards BIM (Building Information Modeling) and digital twin initiatives in construction further accelerates the adoption of integrated GIS data collection hardware capable of generating accurate 3D spatial data. Although growth rates are steady, the market is highly competitive, with established European manufacturers maintaining a strong presence through localized support and integration expertise tailored to national surveying standards.

- Asia Pacific (APAC) (China, India, Japan, Australia)

APAC is projected to be the fastest-growing market globally, primarily fueled by rapid urbanization, massive infrastructure spending (e.g., Belt and Road Initiative), and large-scale demographic shifts requiring accurate land management. China and India represent enormous potential due to large government mapping projects, significant agricultural sectors transitioning to precision farming techniques, and extensive expansion of utility grids. The market is characterized by a mix of high-end specialized equipment for major engineering firms and a growing segment of lower-cost, highly functional collectors often manufactured locally.

Australia and Japan represent mature sub-markets within APAC, exhibiting high technology adoption similar to North America, focusing on advanced surveying techniques, mining operations, and detailed environmental monitoring. However, the sheer volume of governmental land survey and urbanization projects in Southeast Asia and India ensures vigorous market expansion. Challenges in this region include highly fragmented distribution channels and varying degrees of readiness for high-accuracy correction services, requiring vendors to offer flexible solutions encompassing both differential GPS (DGPS) and full RTK capabilities.

- Latin America (Brazil, Mexico)

Latin America's GIS Data Collector Market is experiencing consistent growth, driven mainly by resource extraction industries (mining and oil & gas), large-scale agriculture (soy, sugar cane), and government initiatives aimed at modernizing land records and managing complex terrain. Brazil and Mexico are key markets, where demand is spurred by the need for efficient infrastructure planning and addressing illegal land usage through accurate mapping. Affordability and ruggedness are primary purchasing factors, as devices must withstand varied climatic conditions and operate reliably in remote areas with limited connectivity.

Market penetration is expanding as regional governments invest in capacity building and training programs to leverage geospatial technology for environmental conservation (e.g., Amazon rainforest monitoring) and municipal planning. While adoption rates for the highest-end RTK systems are localized, there is significant interest in cost-effective GNSS solutions offering sub-meter accuracy combined with intuitive Spanish or Portuguese language field software. The reliance on indirect distribution channels through local partners who can provide financing and technical support is critical for success in this region.

- Middle East and Africa (MEA) (Saudi Arabia, UAE, South Africa)

The MEA market is largely influenced by massive energy projects, ambitious construction and infrastructure development (e.g., NEOM in Saudi Arabia, rapid expansion in the UAE), and significant investments in water management and utility mapping. Countries in the Gulf Cooperation Council (GCC) drive demand for high-accuracy surveying equipment for complex, modern construction sites and managing expansive pipeline networks in challenging desert environments. High temperatures and sand necessitate specialized ruggedization in the hardware requirements.

In Africa, growth is more heterogeneous, concentrating in segments like natural resource management, precision agriculture in commercial farming areas, and mobile mapping for humanitarian and developmental aid projects. Government bodies are increasingly adopting GIS technology to improve governance and asset visibility, particularly in land tenure security and managing new transportation corridors. Challenges include securing reliable correction services across vast geographic areas and managing import duties and logistical complexities, requiring vendors to offer robust, self-contained solutions that minimize reliance on external infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the GIS Data Collector Market.- Trimble Inc.

- Hexagon AB (Leica Geosystems)

- Topcon Corporation

- Esri

- Eos Positioning Systems

- Juniper Systems, Inc.

- Spectra Precision

- CHC Navigation

- Geneq Inc.

- Carlson Software, Inc.

- Handheld Group AB

- Samsung (Enterprise Solutions Division)

- TSI Incorporated

- U-blox

- Satlab Geosolutions

- Javad GNSS

- Kolida Instrument Co., Ltd.

- Stonex S.p.A.

- Adani Systems Inc.

- Sokkia Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the GIS Data Collector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-accuracy GIS data collectors?

The primary driver is the accelerating global need for precise, verifiable spatial data to support critical infrastructure lifecycle management and regulatory compliance. Modern utility networks, smart city frameworks, and complex construction projects require centimeter-level accuracy for asset location, inventory, and as-built documentation. This stringent requirement is mandated by safety standards and efficiency targets, particularly in underground utility locating, where positional precision is essential to prevent costly and dangerous damages during excavation. Furthermore, the integration of these high-accuracy coordinates into digital twin environments demands consistently reliable data input from field collectors, distinguishing professional-grade devices from consumer alternatives based on guaranteed positional integrity.

How are AI and machine learning transforming the workflow of GIS data collection?

AI and machine learning (ML) are transforming GIS data collection by shifting focus from manual data entry to intelligent data validation and automated feature extraction. AI algorithms embedded in field devices (edge computing) enable real-time quality assurance, automatically checking for errors or anomalies in collected attributes and location data. ML models are increasingly used to instantly classify features from integrated high-resolution camera inputs—for example, automatically identifying a specific type of utility pole or tree species. This automation drastically reduces the time field workers spend on documentation, minimizes costly post-processing time back in the office, and significantly improves the overall reliability and richness of the spatial database, accelerating project completion rates and optimizing resource allocation.

What are the key technological differences between consumer-grade and professional-grade GIS data collectors?

The key differences center on positional accuracy, ruggedness, and interoperability. Professional-grade collectors integrate multi-frequency, multi-constellation GNSS chipsets (supporting RTK/PPP corrections) capable of achieving centimeter-level accuracy, which is non-negotiable for surveying and engineering tasks. Consumer devices typically offer only basic single-frequency GPS/GLONASS, yielding accuracies measured in several meters. Furthermore, professional devices adhere to stringent durability standards (e.g., IP67, MIL-STD-810G) to withstand harsh field environments, while running specialized, proprietary software designed for direct data transfer into enterprise GIS ecosystems (like Esri or AutoCAD). The superior internal antenna, processing power, battery life, and compatibility with external high-end sensors cement the professional device's specialized niche.

Which end-user industries represent the fastest-growing application segment in the market?

The fastest-growing application segment is Precision Agriculture, followed closely by the Utilities and Telecommunication sector. Precision agriculture requires affordable, reliable GIS collectors (often sub-meter or decimeter accuracy) to enable tasks such as soil mapping, yield monitoring, and the use of variable rate technology for input optimization. This is driven by global pressures to increase food productivity while minimizing environmental impact. Simultaneously, the Utilities and Telecommunication segment is growing rapidly due to the massive global rollout of 5G networks and the mandatory replacement or mapping of aging infrastructure. This segment demands the highest accuracy devices to ensure compliance, safety, and efficient maintenance of highly dense, complex underground and above-ground assets.

How is cloud computing impacting the functionality and market strategy for GIS data collectors?

Cloud computing profoundly impacts functionality by enabling real-time data synchronization, collaborative field workflows, and enhanced data security management. Field workers can instantly upload collected data to a central cloud server, allowing office personnel to validate and utilize the information immediately, eliminating traditional delays associated with manual file transfer. This facilitates true collaboration between field teams and the back office, supporting iterative data collection cycles. For manufacturers, cloud integration forms the basis of their Service segment, allowing them to offer subscription-based access to high-accuracy correction services (NRTK), software updates, fleet management tools, and secure data storage, shifting revenue models toward continuous service provision rather than singular hardware sales.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager