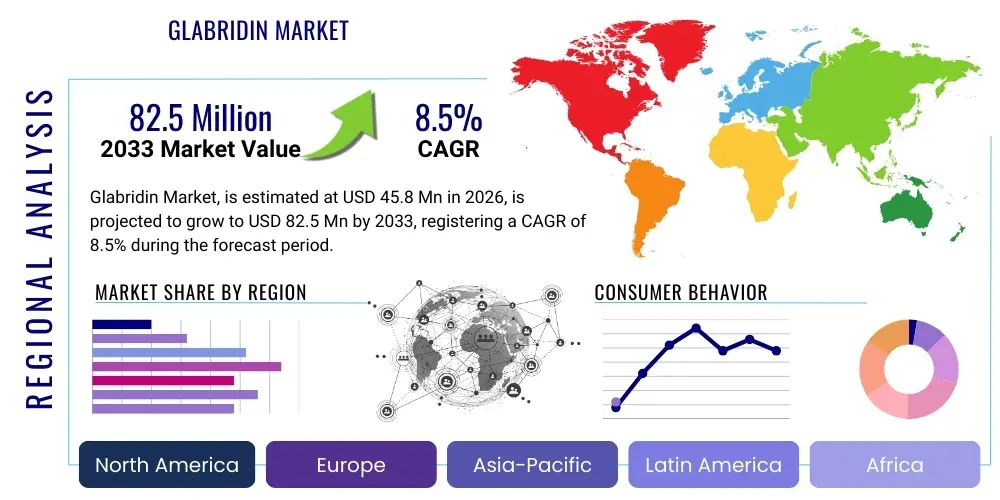

Glabridin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438497 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Glabridin Market Size

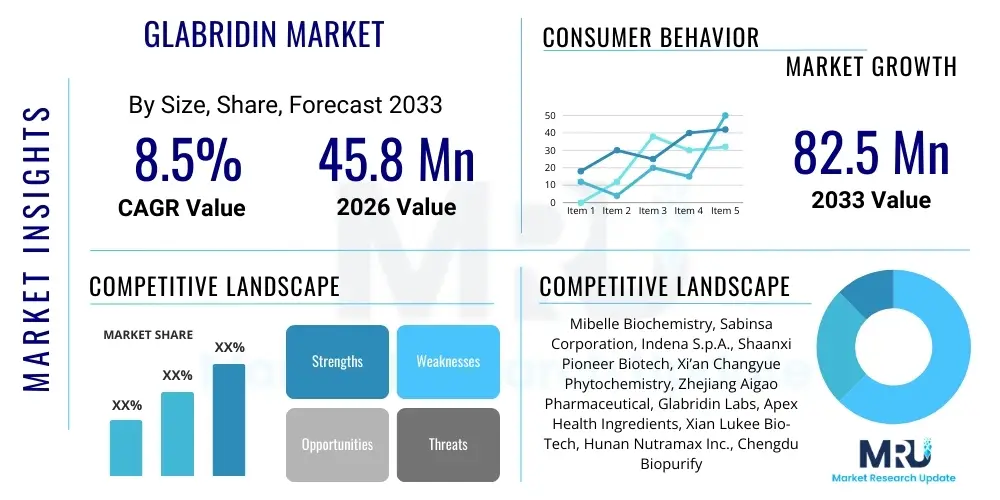

The Glabridin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 45.8 Million in 2026 and is projected to reach USD 82.5 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating consumer preference for natural, high-efficacy cosmetic ingredients, particularly those offering superior skin brightening and anti-aging properties. Glabridin, a key component extracted from licorice root (Glycyrrhiza glabra), stands out due to its potent tyrosinase inhibiting activity, making it a highly valued ingredient in premium skincare formulations across Asia Pacific and Europe, regions characterized by high per capita spending on cosmeceuticals.

The valuation reflects robust demand not only from the traditional cosmetics sector but also from the burgeoning functional foods and nutraceuticals industries where its antioxidant and anti-inflammatory characteristics are increasingly utilized. Investments in sustainable and efficient extraction technologies, such as supercritical fluid extraction (SFE) and enzyme-assisted extraction, are lowering production costs and improving ingredient purity, further encouraging its adoption across various application segments. Furthermore, stringent regulatory scrutiny favoring natural, plant-derived active pharmaceutical ingredients (APIs) in dermatology is expected to bolster Glabridin’s market position over synthetic alternatives, securing its continuous growth trajectory through the forecast period.

Glabridin Market introduction

The Glabridin Market encompasses the global trade, production, and utilization of Glabridin, a polyphenolic flavonoid derived primarily from the roots of the Chinese licorice species, Glycyrrhiza glabra. Known for its potent biological activities, Glabridin is highly sought after across numerous industries, primarily cosmetics, dermatology, pharmaceuticals, and increasingly, functional food supplements. Its efficacy in inhibiting tyrosinase, the rate-limiting enzyme in melanin production, makes it one of the most effective natural skin lightening agents available, driving its incorporation into premium skin whitening and anti-hyperpigmentation products. This demand is particularly pronounced in regions where flawless complexion and anti-aging treatments are highly prioritized consumer goals.

Major applications of Glabridin extend beyond simple cosmetic brightening; they include topical treatments for inflammatory skin conditions such as eczema and psoriasis, leveraging its significant anti-inflammatory and antioxidant properties. In the pharmaceutical sector, research is intensifying into Glabridin's potential as a therapeutic agent for conditions related to metabolic syndrome, cardiovascular health, and even certain oncological applications, although commercialization in these areas remains nascent compared to its established role in cosmeceuticals. The market is characterized by a high degree of technological sophistication in extraction and purification, as purity levels significantly impact both efficacy and cost, leading manufacturers to invest heavily in advanced chromatographic and solvent-free techniques to meet stringent industry standards.

The driving factors behind market expansion include heightened global awareness regarding the adverse effects of UV radiation and pollution, which stimulate demand for protective and restorative skincare solutions. Glabridin’s natural origin aligns perfectly with the clean beauty movement, providing a safe and effective alternative to controversial synthetic brighteners like hydroquinone. Additionally, continuous product innovation, such as the encapsulation of Glabridin for enhanced stability and bioavailability, is expanding its application scope and improving consumer satisfaction, thereby sustaining the market’s positive growth momentum. Furthermore, growing disposable incomes in emerging economies, coupled with expanding consumer base seeking high-end skincare products, ensure robust demand for this specialized ingredient.

Glabridin Market Executive Summary

The Glabridin market is experiencing vigorous growth, predominantly fueled by transformative business trends centered on sustainability, clinical validation, and digital consumer engagement. Key business trends include strategic mergers and acquisitions among ingredient suppliers aimed at consolidating intellectual property related to proprietary extraction methods, ensuring higher yield and purity. Furthermore, the shift towards certified organic and sustainably sourced licorice roots is becoming a competitive differentiator, satisfying the ethical sourcing demands of major global cosmetic brands. Companies are increasingly investing in clinical trials to substantiate Glabridin's efficacy in addressing complex dermatological concerns, translating scientific validation into premium product positioning and higher market share, particularly in the highly competitive North American and European markets.

Regionally, Asia Pacific maintains its dominance in volume consumption due to deeply ingrained cultural preferences for skin whitening and large manufacturing hubs in China and South Korea specializing in cosmeceuticals. However, North America and Europe demonstrate the highest value growth rates, driven by premium product pricing and the rapid integration of Glabridin into sophisticated anti-aging and natural ingredient portfolios. These Western markets are also leading in the regulatory frameworks governing novel natural ingredients, thereby influencing global quality standards. Emerging markets in Latin America and the Middle East show significant potential, characterized by increasing urbanization, rising disposable incomes, and the introduction of global beauty standards, prompting local manufacturers to seek high-quality imported active ingredients like Glabridin.

In terms of segment trends, the high-purity (>90%) Glabridin segment commands the highest price point and fastest growth rate, reflecting the industry's focus on maximizing biological activity per application. The application segmentation shows cosmetic and personal care products retaining the largest share, specifically the skin lightening and sun care sub-segments. Concurrently, the nutraceuticals segment, capitalizing on Glabridin's internal antioxidant benefits, is projected to exhibit robust double-digit growth. The distribution channel landscape is evolving, with direct sales to large cosmetic manufacturers remaining crucial, while B2C channels are expanding rapidly through specialized online ingredient platforms and personalized beauty formulation services, utilizing e-commerce penetration to reach smaller, innovative brands globally.

AI Impact Analysis on Glabridin Market

User queries regarding the impact of Artificial Intelligence (AI) on the Glabridin market primarily focus on how AI can optimize extraction efficiency, streamline supply chain traceability, and accelerate novel application discovery. Common concerns center on whether AI-driven formulation tools might lead to ingredient commoditization or if the technology could help smaller players compete with large established suppliers by providing sophisticated analytical capabilities. Expectations are high regarding AI's role in predictive modeling for consumer trends related to specific efficacy claims (e.g., hyperpigmentation reduction percentages) and optimizing the cultivation and harvesting of licorice roots to maximize Glabridin yield under varying environmental conditions. This collective analysis reveals a strong user interest in leveraging AI for efficiency, quality control, and strategic R&D alignment within the complex natural ingredient supply chain.

The integration of AI and machine learning (ML) is beginning to revolutionize the R&D phase, allowing researchers to quickly analyze vast genomic data related to licorice biosynthesis pathways, potentially leading to bioengineered production methods that bypass traditional agriculture constraints. AI algorithms can model complex chemical interactions between Glabridin and other cosmetic formulation ingredients, predicting stability, efficacy, and potential side effects with high accuracy, thereby significantly reducing the time and cost associated with traditional laboratory testing. Furthermore, in quality assurance, sophisticated machine vision systems powered by AI are being deployed during the purification process to detect even minor impurities in high-purity Glabridin batches, ensuring compliance with the stringent quality standards required for pharmaceutical and premium cosmeceutical applications globally.

From a commercial perspective, AI significantly enhances market strategy by analyzing consumer feedback across digital platforms, identifying unmet needs related to specific skin types or regional preferences, and guiding manufacturers toward developing tailored Glabridin-based products. Supply chain management benefits immensely from predictive analytics, optimizing inventory levels of raw licorice root based on forecasted demand fluctuations, geopolitical risks, and seasonal variability, minimizing waste and ensuring a continuous, reliable supply. This application of AI provides a critical competitive edge by improving cost efficiency and ensuring the sustained availability of this high-value botanical extract, ultimately stabilizing pricing and improving market accessibility for end-product manufacturers.

- AI optimizes extraction protocols to maximize Glabridin yield and purity.

- Machine learning models predict Glabridin stability and interaction in complex formulations.

- Predictive analytics enhance supply chain efficiency and minimize raw material procurement risks.

- AI-driven image analysis accelerates quality control and impurity detection in final products.

- Consumer sentiment analysis guides R&D toward high-demand Glabridin applications (e.g., specific age spots treatment).

DRO & Impact Forces Of Glabridin Market

The Glabridin market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming crucial Impact Forces that shape its trajectory. The primary Driver is the overwhelming consumer demand for naturally derived, clinically proven skin brightening and anti-aging ingredients, particularly as Glabridin offers a safe alternative to synthetic depigmenting agents, capitalizing on the clean beauty mega-trend. However, a significant Restraint is the high cost of raw material procurement and the complex, labor-intensive extraction and purification processes required to achieve cosmetic-grade purity, which limits market entry for smaller firms and drives up end-product prices. The core Opportunity lies in expanding Glabridin's application into the clinical dermatology and pharmaceutical sectors, leveraging its proven anti-inflammatory and antioxidant capabilities for treating chronic skin diseases, moving beyond traditional cosmetic uses.

One major impact force stemming from these factors is the intense pressure on the supply chain to ensure sustainable and ethical sourcing of licorice root, which faces geopolitical instability and overharvesting concerns in key sourcing regions like China and Central Asia. This pressure forces manufacturers to invest heavily in advanced cultivation technologies, such as controlled environment agriculture (CEA) or cellular agriculture, to secure a reliable, high-quality supply independent of wild harvesting limitations. Simultaneously, the lack of global standardization for Glabridin content in licorice extracts creates variability in product quality, acting as a frictional force that necessitates expensive in-house quality assurance testing by end-product manufacturers before formulation, adding complexity to the regulatory compliance process, particularly in export-heavy regions like Europe.

Despite these challenges, the market is consistently propelled forward by technological advancements in microencapsulation and nanotechnology, which enhance the ingredient's bioavailability and stability within diverse formulation matrices. These technological opportunities mitigate the inherent instability of Glabridin when exposed to light and air, making it more effective and broadening its integration into sensitive product formats like transparent serums or sunscreens. The strategic shift towards personalized beauty, driven by genetic testing and consumer data, further amplifies the need for highly effective, targeted ingredients like Glabridin, allowing premium brands to justify higher pricing and capture niche high-value segments, thereby sustaining the overall upward momentum of the market despite underlying cost pressures.

Segmentation Analysis

The Glabridin market segmentation provides a granular view of market dynamics based on Purity Level, Application, and Distribution Channel. Analyzing these segments is essential for understanding where value creation is maximized and how consumer preferences are driving innovation across different sectors. The purity level segmentation is critical because Glabridin efficacy is directly proportional to its concentration; therefore, high-purity grades (>90%) command a significant premium and are preferred for specialized pharmaceutical and premium anti-aging products where formulation integrity is paramount. Conversely, lower purity grades are typically integrated into mass-market functional foods or entry-level cosmetic formulations, highlighting the market's stratification based on price-to-performance requirements across various consumer segments globally.

The application landscape clearly delineates the market's primary revenue streams, with the Cosmetic and Personal Care sector dominating due to the sustained global enthusiasm for skin brightening, hyperpigmentation correction, and UV protection products. Within this sector, specialized dermatological formulations tailored for sensitive skin or chronic conditions are growing rapidly, utilizing Glabridin's robust anti-inflammatory profile. Furthermore, the Food and Beverages segment, particularly within functional drinks and dietary supplements, represents the fastest-growing application area. This growth is attributable to increasing consumer awareness regarding internal beauty (nutricosmetics) and the systemic benefits of antioxidants, driving demand for Glabridin-based oral supplements aimed at holistic skin health and general wellness improvement.

The distribution channel segmentation reflects a mature business-to-business (B2B) ecosystem where direct sales and ingredient distributors remain the cornerstone of supply, facilitating large volume transactions between Glabridin manufacturers and major cosmetic houses. However, the influence of online ingredient marketplaces and specialized chemical e-commerce platforms is expanding, simplifying procurement for small and medium-sized enterprises (SMEs) and specialized contract manufacturers worldwide. This trend is fostering greater market accessibility and competition, prompting suppliers to enhance their digital presence and provide extensive technical documentation online, thereby transforming the traditional, relationship-driven ingredient supply chain into a more transparent and technology-enabled procurement process that caters efficiently to global formulation needs.

- By Purity Level:

- < 40% Purity

- 40% – 90% Purity

- > 90% Purity (High Purity)

- By Application:

- Cosmetics and Personal Care

- Skin Whitening/Brightening

- Anti-Aging Products

- Sunscreens and UV Protection

- Anti-Inflammatory Dermatologicals

- Pharmaceuticals and Dermatology

- Nutraceuticals and Functional Foods

- Cosmetics and Personal Care

- By Distribution Channel:

- Direct Sales (B2B)

- Distributors/Suppliers

- Online Retail/E-commerce Platforms

Value Chain Analysis For Glabridin Market

The Glabridin market value chain begins with the highly specialized Upstream Analysis stage, involving the cultivation or wild harvesting of licorice roots, predominantly in regions like China, Afghanistan, and parts of Central Asia. This stage is characterized by significant vulnerability due to climate dependency, political instability in sourcing regions, and high initial costs related to sustainable farming practices. Subsequent to harvesting, the raw material undergoes primary processing, where drying and initial milling prepare the roots for sophisticated extraction procedures. Manufacturers often utilize proprietary methods, such as solvent extraction, supercritical CO2 extraction, or enzyme-assisted hydrolysis, all aimed at isolating the Glabridin compound from the crude licorice extract. The efficiency and purity achieved at this extraction stage dictate the final product's market grade and cost, making technological investment here a critical determinant of competitive advantage and profit margins across the industry.

The midstream phase focuses intensely on Purification and Quality Control. Crude extracts containing varying levels of Glabridin are subjected to advanced chromatographic techniques, crystallization, and rigorous testing to achieve the high-purity levels required for premium cosmetic and pharmaceutical applications, often exceeding 90%. Adherence to international standards, such as cGMP (current Good Manufacturing Practices), is mandatory during this refinement phase. Following purification, the Glabridin is stabilized, often through encapsulation or complexation with excipients, to protect its efficacy against environmental degradation, ensuring a shelf-stable ingredient ready for formulation. This stabilization step is crucial for maintaining bioavailability and integrating the ingredient seamlessly into diverse end-product bases, which often contain conflicting chemistries that could degrade the active compound.

The Downstream Analysis involves the distribution and final product manufacturing. Glabridin reaches End-User/Buyers, which include large multinational cosmetic corporations, specialized dermatological laboratories, and nutraceutical companies, primarily through Direct sales or specialized Chemical Distributors. Direct sales are preferred for high-volume, long-term contracts, fostering deep technical collaborations between suppliers and formulators. Indirect channels, primarily distributors and online marketplaces, serve smaller, niche brands requiring lower volumes and quick access to technical data sheets. The final application involves incorporating Glabridin into finished goods—creams, serums, supplements—which are then marketed to consumers via retail, pharmacies, or e-commerce, completing the value cycle where brand reputation, packaging, and efficacy claims drive final consumer acceptance and determine market success.

Glabridin Market Potential Customers

The primary potential customers and End-User/Buyers in the Glabridin market are highly diversified but converge mainly around sectors focused on health, beauty, and wellness due to the ingredient's multi-functional properties. The largest volume consumers are multinational Cosmetic and Personal Care companies, especially those specializing in high-end anti-aging, skin brightening, and targeted hyperpigmentation treatment ranges, particularly in Asian and Western luxury markets where Glabridin is actively marketed as a 'natural hydroquinone alternative.' These companies seek consistent supply of high-purity Glabridin, often requiring long-term supply agreements and demanding stringent quality certifications to meet internal regulatory and branding standards, reflecting consumer desire for transparency and proven efficacy in their daily routines.

A rapidly expanding customer base includes Nutraceutical and Functional Food manufacturers who incorporate Glabridin into dietary supplements and functional beverages targeting 'beauty from within' concepts. These buyers value Glabridin for its systemic anti-inflammatory and potent antioxidant characteristics, positioning their products to address oxidative stress and promote overall skin and cardiovascular health internally. This segment demands ingredients that are easily dispersible, highly stable, and comply with food safety regulations, often requiring different formulation considerations compared to topical applications. Furthermore, the growth of personalized medicine and wellness trends means that customized formulation services and direct-to-consumer supplement brands are increasingly becoming viable, albeit smaller, purchasers of Glabridin powder or encapsulated forms.

The third major segment comprises specialized Pharmaceutical and Dermatology research institutions and compounding pharmacies. These entities require ultra-high-purity Glabridin for clinical trials, research into chronic inflammatory skin diseases (like dermatitis), and the compounding of prescription-strength dermatological preparations where efficacy and purity are non-negotiable. These customers are highly sensitive to batch-to-batch consistency and require extensive documentation regarding synthesis routes and toxicology profiles. Their procurement processes are often longer and more rigorous than those in the cosmetic industry, emphasizing the ingredient's potential as an Active Pharmaceutical Ingredient (API) rather than just a cosmetic additive, reflecting a high-value, albeit volume-constrained, customer segment demanding the utmost level of product validation and supply chain reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Million |

| Market Forecast in 2033 | USD 82.5 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mibelle Biochemistry, Sabinsa Corporation, Indena S.p.A., Shaanxi Pioneer Biotech, Xi’an Changyue Phytochemistry, Zhejiang Aigao Pharmaceutical, Glabridin Labs, Apex Health Ingredients, Xian Lukee Bio-Tech, Hunan Nutramax Inc., Chengdu Biopurify Phytochemicals, Fufeng Group, Bioriginal Food & Science Corp., LGC Standards, Cayman Chemical, Merck KGaA, Santa Cruz Biotechnology, Sino-Nature International, Tauto Biotech Co. Ltd., Nanjing Spring Autumn Bio-technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glabridin Market Key Technology Landscape

The technological landscape of the Glabridin market is fundamentally defined by advanced extraction and purification techniques necessary to achieve high-grade purity from the complex matrix of the licorice root. Traditional solvent extraction methods, while economical, often yield lower purity levels and may leave residual toxic solvents, which are increasingly unacceptable in regulated markets. Consequently, modern producers are heavily adopting sophisticated technologies like Supercritical Fluid Extraction (SFE), particularly using CO2, which is non-toxic, non-flammable, and allows for precise control over extraction parameters. SFE technology not only ensures a cleaner, purer extract but also improves yield and significantly minimizes the environmental footprint associated with manufacturing, aligning with global green chemistry initiatives and consumer demand for sustainably produced ingredients.

Beyond initial extraction, the technological focus shifts to enhancing the stability and bioavailability of the Glabridin compound, which is inherently sensitive to light, heat, and oxidation. Key innovations here involve encapsulation technologies, such as liposomal delivery systems and microencapsulation using biodegradable polymers. These advanced delivery systems protect the active molecule until it reaches its target in the epidermis or the gastrointestinal tract, ensuring maximal efficacy and prolonged release. For instance, liposomal encapsulation allows Glabridin to penetrate the skin barrier more effectively, increasing its depigmenting and anti-inflammatory action at lower concentrations, which helps offset the high cost of the raw ingredient and enhances product performance metrics crucial for premium cosmetic brands.

Furthermore, analytical technologies play a critical role in quality assurance, ensuring batch-to-batch consistency which is vital for both regulatory compliance and maintaining brand trust. High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry (MS) are standard technologies used to accurately quantify Glabridin content and detect minute impurities, providing the scientific validation necessary for its use in pharmaceutical applications. Emerging technologies include the integration of biotechnology and synthetic biology, where research explores genetically engineered yeasts or bacteria to biosynthesize Glabridin in controlled environments, potentially offering a sustainable, scalable, and cost-effective alternative to traditional agriculture-dependent sourcing, although this segment remains in the nascent research and pilot production stages.

Regional Highlights

The Glabridin market exhibits distinct dynamics across key geographical regions, driven by localized consumer preferences, regulatory environments, and manufacturing capabilities. Asia Pacific (APAC) stands as the largest consumer market by volume, profoundly influenced by deeply ingrained cultural desires for fair, luminous skin, making skin whitening and anti-hyperpigmentation products core categories. Countries like South Korea, Japan, and China are both major consumers and significant manufacturers of finished cosmeceuticals, often prioritizing high-purity Glabridin (>90%) for their innovative formulations, reflecting a sophisticated market demanding clinical-level efficacy and utilizing advanced ingredient delivery technologies. Furthermore, APAC serves as the primary sourcing hub for the raw licorice root, solidifying its role across the entire value chain.

North America and Europe represent highly mature markets characterized by high per capita spending on premium, science-backed anti-aging and natural beauty products, driving value growth. In these regions, the demand for Glabridin is strongly associated with the clean beauty movement and the rejection of ingredients like hydroquinone and parabens. European regulatory frameworks, governed by the European Union (EU), are particularly strict regarding ingredient traceability and toxicology, compelling suppliers to provide comprehensive documentation. North America, while having robust demand for topical applications, is also a rapidly growing market for Glabridin-containing nutraceuticals, leveraging the ingredient’s antioxidant benefits for systemic health and wellness, demonstrating a diversified application portfolio compared to the heavily cosmetics-focused APAC region.

The remaining regions, including Latin America (LATAM) and the Middle East & Africa (MEA), are emerging as high-potential growth areas. LATAM markets, driven by improving economic conditions and increased exposure to global beauty trends, are showing strong demand for imported high-efficacy ingredients for localized cosmetic manufacturing, particularly in Brazil and Mexico. The MEA region, specifically the Gulf Cooperation Council (GCC) countries, exhibits robust growth fueled by affluent consumer bases seeking luxury skincare and high-SPF products suitable for intense climates. While local manufacturing is less developed in these regions, the reliance on high-quality imports, combined with burgeoning local retail sectors, positions them for accelerated growth in Glabridin consumption over the forecast period, especially as consumers seek sun damage repair and preventative care.

- Asia Pacific (APAC): Dominates volume consumption due to high demand for skin whitening products in China, South Korea, and Japan. Key manufacturing hub for cosmeceuticals and primary source of licorice root.

- North America: High-value market focused on anti-aging, clean beauty, and growing nutraceutical applications. Driven by strong R&D investment and consumer preference for clinically validated, natural ingredients.

- Europe: Characterized by stringent regulatory standards (EU mandates) favoring high traceability and purity. Strong uptake in premium dermatological and anti-inflammatory cosmetic formulations.

- Latin America (LATAM): Emerging market showing accelerated growth driven by urbanization and rising disposable income, increasing demand for imported efficacy-driven cosmetic ingredients.

- Middle East & Africa (MEA): High growth potential in GCC countries due to demand for luxury skincare and specialized UV-damage repair products suitable for extreme environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glabridin Market.- Mibelle Biochemistry

- Sabinsa Corporation

- Indena S.p.A.

- Shaanxi Pioneer Biotech

- Xi’an Changyue Phytochemistry

- Zhejiang Aigao Pharmaceutical

- Glabridin Labs

- Apex Health Ingredients

- Xian Lukee Bio-Tech

- Hunan Nutramax Inc.

- Chengdu Biopurify Phytochemicals

- Fufeng Group

- Bioriginal Food & Science Corp.

- LGC Standards

- Cayman Chemical

- Merck KGaA

- Santa Cruz Biotechnology

- Sino-Nature International

- Tauto Biotech Co. Ltd.

- Nanjing Spring Autumn Bio-technology

Frequently Asked Questions

Analyze common user questions about the Glabridin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Glabridin and how does it function as a skin brightener?

Glabridin is a polyphenolic flavonoid extracted from licorice root (Glycyrrhiza glabra). It functions as a powerful natural skin brightener primarily by inhibiting the enzyme tyrosinase, which is essential for melanin production, thereby reducing hyperpigmentation, dark spots, and promoting an even skin tone.

What are the primary applications of high-purity Glabridin?

High-purity Glabridin (>90%) is primarily used in premium anti-aging cosmetic formulations, specialized dermatological treatments for inflammatory conditions like eczema, and in pharmaceutical research where maximized biological activity and stringent purity standards are required for efficacy and safety.

Which geographical region dominates the consumption of Glabridin?

The Asia Pacific (APAC) region dominates the consumption of Glabridin by volume. This dominance is driven by high consumer demand for skin whitening and brightening products across major markets such as China, Japan, and South Korea, where Glabridin is highly valued as an effective natural ingredient.

What technological advancements are driving market efficiency for Glabridin production?

Key technological advancements include Supercritical Fluid Extraction (SFE) for purer yields and advanced encapsulation technologies (e.g., liposomes) to enhance Glabridin's stability, bioavailability, and targeted delivery within cosmetic and pharmaceutical formulations, offsetting the compound's natural instability.

Is the Glabridin market sustainable given its reliance on licorice root sourcing?

Sustainability is a major concern due to geopolitical risks and overharvesting of wild licorice root. The industry is addressing this by investing in controlled environment agriculture (CEA) and exploring biosynthetic production methods (using engineered microorganisms) to ensure a reliable and environmentally friendly supply chain for long-term market stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager