Glass Cockpit Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440029 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Glass Cockpit Market Size

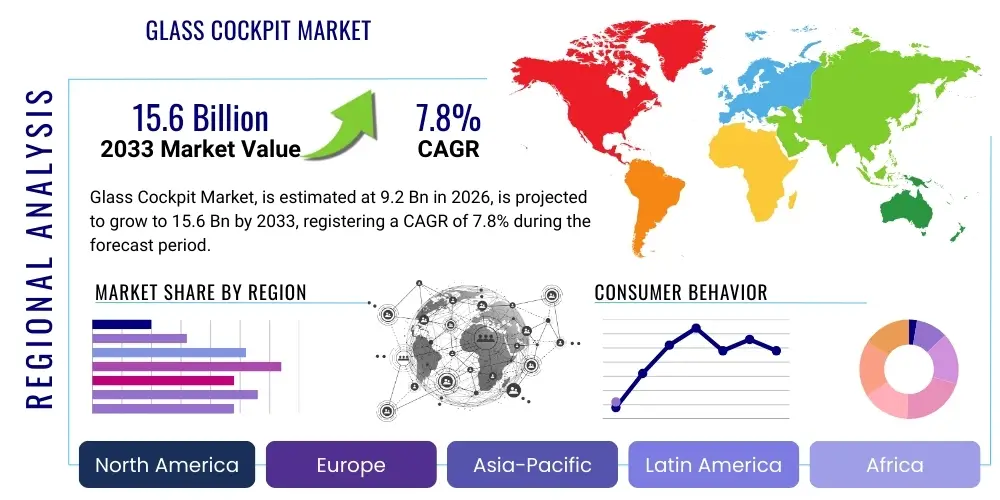

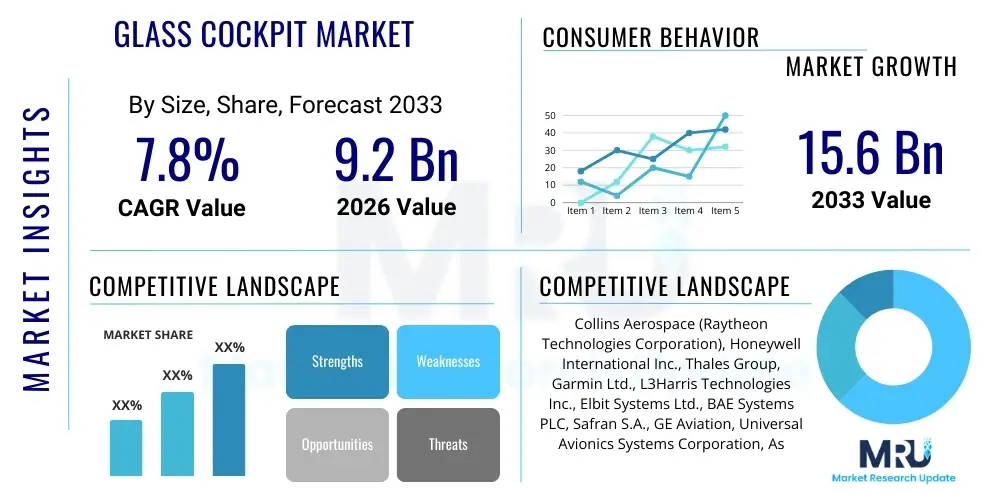

The Glass Cockpit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 9.2 Billion in 2026 and is projected to reach USD 15.6 Billion by the end of the forecast period in 2033.

Glass Cockpit Market introduction

The Glass Cockpit Market signifies a profound transformation in aviation technology, characterized by the replacement of traditional analog flight instruments with advanced digital display systems. This innovation integrates critical flight information, navigation data, engine parameters, and sensor inputs onto multi-function displays, providing pilots with a consolidated and intuitive view of their operational environment. The core benefit lies in significantly enhancing situational awareness, reducing cognitive workload, and improving overall flight safety and efficiency. Modern glass cockpits incorporate sophisticated avionics suites, including advanced flight management systems, communication and surveillance tools, and real-time weather radar, all accessible through a highly graphical and interactive interface. The market spans across various aviation platforms, including commercial airliners, military combat and transport aircraft, business jets, helicopters, and increasingly, emerging segments like Urban Air Mobility (UAM) vehicles and advanced Unmanned Aerial Vehicles (UAVs). This widespread adoption is fueled by the continuous pursuit of greater operational precision, reduced maintenance requirements, and improved fuel economy.

The evolution of glass cockpit technology extends beyond mere display upgrades; it represents a comprehensive shift towards integrated modular avionics (IMA) architectures that enable seamless data flow and centralized processing. This integration allows for advanced functionalities such as synthetic vision, enhanced vision systems, and sophisticated terrain awareness and warning systems, which dramatically improve pilot perception in challenging conditions. The driving factors behind the market's robust growth are manifold, including the accelerating global demand for air travel necessitating more efficient and safer aircraft, ongoing modernization programs for aging aircraft fleets worldwide, and increasingly stringent aviation safety regulations imposed by bodies like the FAA and EASA. Furthermore, continuous technological advancements in display resolution, processor capabilities, and sensor fusion techniques are consistently pushing the boundaries of what these systems can achieve, making them an indispensable component of contemporary and future aircraft designs. The market's trajectory is also influenced by the growing emphasis on environmental sustainability, as glass cockpits contribute to optimized flight paths and reduced fuel consumption through precise navigation and performance management.

Glass Cockpit Market Executive Summary

The Glass Cockpit Market is poised for substantial expansion, driven primarily by an intensifying global focus on aviation safety, significant investments in aircraft fleet modernization, and the persistent growth in both commercial and military aviation sectors. Key business trends highlight a concerted industry effort towards developing and integrating highly advanced avionics, incorporating elements of artificial intelligence for enhanced decision support, and leveraging superior connectivity for real-time data exchange. Both Original Equipment Manufacturers (OEMs) and aftermarket service providers are crucial to market dynamics, with OEMs integrating cutting-edge glass cockpits as standard features in new aircraft, while the retrofit market continues to flourish by upgrading older generation aircraft to meet modern operational and regulatory standards. Strategic alliances and collaborations between avionics system developers and airframe manufacturers are instrumental in fostering innovation, accelerating product development cycles, and expanding market reach. The competitive landscape is characterized by leading players engaging in intensive research and development to deliver next-generation display solutions, open-architecture integrated modular avionics, and robust cybersecurity features, all while striving for cost-effectiveness and ease of maintenance. Furthermore, the industry's commitment to reducing carbon footprints through lighter and more efficient cockpit designs is gaining prominence, influencing product development and market acceptance.

From a regional perspective, North America and Europe currently represent the largest market shares, attributed to their established aerospace industries, substantial defense budgets, and early adoption of advanced aviation technologies. However, the Asia Pacific region is rapidly emerging as the primary growth engine, propelled by burgeoning air travel demand, extensive investments in new aircraft procurement, and the expansion of regional airline networks in countries like China and India. Latin America, the Middle East, and Africa are also demonstrating promising growth trajectories, albeit at a more measured pace, driven by increasing air traffic, ongoing fleet modernization efforts, and the strategic development of aviation infrastructure. In terms of market segmentation, the commercial aircraft segment dominates due to the sheer volume of new aircraft deliveries and a strong demand for technological upgrades. The military aircraft segment follows closely, stimulated by global defense modernization initiatives and the need for superior tactical advantage. The business jet and helicopter segments are also experiencing steady growth, benefiting from continuous technological advancements that enhance safety, operational flexibility, and pilot comfort. The overarching trend across all segments is a move towards more intelligent, interconnected, and highly resilient cockpit systems capable of supporting increasingly complex flight missions and air traffic environments.

AI Impact Analysis on Glass Cockpit Market

Common user questions surrounding the impact of Artificial Intelligence (AI) on the Glass Cockpit Market predominantly focus on how AI will enhance automation, improve pilot decision-making, facilitate predictive maintenance, and redefine the roles and training requirements for flight crews. Users are keen to understand AI's potential to further reduce pilot workload through intelligent assistance, bolster situational awareness by processing vast amounts of real-time data, and significantly contribute to flight safety by identifying anomalies and predicting potential system failures. Key concerns frequently raised include the complexities of certifying AI-driven systems, the ethical considerations associated with autonomous decision-making in critical flight phases, and the necessity for robust cybersecurity measures to safeguard AI algorithms from manipulation or attack. Additionally, there are strong expectations for AI to enable more seamless integration with future air traffic management systems, support highly complex and dynamic mission planning in military operations, and foster advanced human-machine interfaces that intuitively adapt to pilot physiological and cognitive states.

- Enhanced Situational Awareness: AI algorithms process a multitude of inputs from sensors, weather systems, and air traffic control data, synthesizing this information to provide pilots with predictive and highly refined operational insights, thereby anticipating potential hazards or optimizing flight trajectories.

- Predictive Maintenance and Diagnostics: AI continuously monitors the operational health and performance of glass cockpit components and integrated avionics, proactively identifying potential failures and enabling scheduled maintenance before critical issues arise, thus significantly improving aircraft dispatch reliability and reducing unscheduled downtime.

- Automated Decision Support Systems: AI assists pilots in navigating complex operational scenarios, offering real-time, optimized recommendations for flight path adjustments, fuel management, emergency procedures, and tactical maneuvers, thereby reducing cognitive load and enhancing response efficacy.

- Adaptive Human-Machine Interfaces (HMI): AI-driven interfaces dynamically adjust information presentation and interaction modalities based on pilot preferences, workload, and physiological cues (e.g., eye-tracking, voice commands), creating a more intuitive, personalized, and efficient cockpit environment.

- Optimized Flight Operations: AI-powered systems can dynamically re-optimize flight plans in real-time to account for changing weather, air traffic congestion, and operational constraints, leading to improved fuel efficiency, reduced emissions, and enhanced on-time performance.

- Advanced Cybersecurity Protocols: AI is utilized to develop sophisticated algorithms for real-time threat detection, anomaly identification, and proactive response to cyberattacks, thereby fortifying the security of critical flight systems and sensitive data within the highly networked glass cockpit.

- Intelligent Training and Simulation: AI creates highly realistic and adaptive training environments that personalize scenarios, provide immediate feedback, and simulate complex operational challenges, significantly accelerating pilot proficiency development and readiness for novel situations.

- Seamless Integration with Unmanned Systems: AI facilitates the command and control of Unmanned Aerial Vehicles (UAVs) from manned glass cockpits, enabling cooperative missions, enhanced operational coordination, and the integration of autonomous flight capabilities.

- Ethical AI and Trust Building: Addressing regulatory and pilot trust concerns through the development of explainable AI (XAI) models, robust validation processes, and clear operational boundaries ensures transparency and accountability in AI-assisted decision-making.

DRO & Impact Forces Of Glass Cockpit Market

The Glass Cockpit Market's growth trajectory and competitive landscape are profoundly influenced by a complex interplay of driving forces, significant restraints, and emerging opportunities. Key drivers include the relentless global emphasis on enhancing aviation safety, which mandates clearer and more comprehensive data presentation to pilots, directly leading to reduced human error and improved operational integrity. Concurrently, the escalating demand for air travel globally necessitates increasingly efficient, reliable, and technologically advanced aircraft operations. Extensive modernization programs for existing aircraft fleets, especially in the commercial and military sectors, serve as a powerful impetus for adopting advanced glass cockpit systems. Furthermore, stringent regulatory mandates from leading aviation authorities such as the FAA and EASA for updated avionics systems compel operators to upgrade, acting as a consistent market stimulant. Conversely, several significant restraints challenge market acceleration, predominantly the substantial upfront capital investment required for the development, installation, and rigorous certification of advanced glass cockpit systems. These high costs can be prohibitive for smaller operators or for large-scale retrofit programs. The inherent complexity of integrating diverse systems into a cohesive cockpit, coupled with the extensive and specialized training required for pilots to transition to these sophisticated digital interfaces, also poses considerable hurdles. Moreover, the increasing interconnectedness of digital cockpits introduces growing cybersecurity vulnerabilities, presenting a continuous restraint that necessitates substantial and ongoing investment in robust protective measures and secure architectures. Despite these challenges, the market's opportunity landscape remains expansive and dynamic.

The impact forces influencing the market are multifaceted, encompassing technological advancements, economic fluctuations, evolving regulatory frameworks, and shifting operational requirements. From a technological standpoint, continuous breakthroughs in display resolution, processing power, sensor miniaturization, and data fusion capabilities consistently expand the functionality and integration potential of glass cockpits, acting as a primary driver. Economic forces, such as global GDP growth, airline profitability, and defense budgets, directly correlate with investment cycles in new aircraft procurement and fleet upgrades, thereby influencing market demand. Intense competition among avionics manufacturers fuels innovation while simultaneously exerting pressure on pricing and market share, driving efficiency and technological differentiation. Regulatory bodies play a dual role: not only do they mandate safety enhancements, but their certification processes for new technologies can significantly impact market adoption rates, either by accelerating or delaying deployment based on the complexity and duration of approvals. Geopolitical stability and global defense spending patterns significantly impact the military aircraft segment, influencing procurement decisions for advanced cockpit technologies. Furthermore, the growing global emphasis on environmental sustainability acts as a significant impact force, encouraging the development of more fuel-efficient flight management systems and lightweight cockpit components to help reduce the aviation industry's carbon footprint. These intertwined forces collectively dictate the market's dynamism, influencing product development roadmaps, market entry strategies, and overall industry expansion within the glass cockpit domain.

Segmentation Analysis

The Glass Cockpit Market is meticulously segmented across various critical dimensions to offer a comprehensive understanding of its underlying structure, growth dynamics, and evolving demand patterns. These segmentations are instrumental for market stakeholders, including manufacturers, airlines, and defense organizations, to accurately identify specific growth opportunities, customize product development, and formulate targeted market penetration strategies. By dissecting the market along different axes, a granular view of distinct trends, customer needs, and technological requirements emerges, allowing for more precise strategic planning. The primary segmentation categories encompass Platform, Component, and Fit, each providing unique insights into the market's current state and future potential, highlighting areas of high growth and technological innovation.

- By Platform: This segment categorizes the market based on the specific type of aircraft that integrates glass cockpit systems, reflecting diverse operational contexts, mission profiles, and market volumes across different aviation sectors.

- Commercial Aircraft: Includes all categories of passenger and cargo aircraft such as wide-body, narrow-body, and regional jets, driven by global air travel demand.

- Military Aircraft: Encompasses various defense platforms including fighter jets, bomber aircraft, military transport planes, surveillance aircraft, and advanced trainers, focusing on mission effectiveness.

- Business Jets: Covers a range of private aircraft from light jets to ultra-long-range models, prioritizing safety, efficiency, and advanced features for corporate and private travel.

- Helicopters: Includes both civil (e.g., EMS, SAR, oil & gas, corporate) and military rotorcraft, emphasizing versatility, multi-mission capabilities, and enhanced situational awareness in complex environments.

- Unmanned Aerial Vehicles (UAVs)/Drones: An emerging segment for sophisticated ground control station interfaces and onboard autonomous flight management systems, particularly for larger commercial and military drones.

- By Component: This segmentation focuses on the individual hardware and software elements that collectively form a complete glass cockpit system, highlighting technological specialization and the ecosystem of suppliers.

- Displays: Critical visual interfaces including Primary Flight Displays (PFD) for essential flight data, Multi-Function Displays (MFD) for navigation and system information, and Engine Indicating and Crew Alerting System (EICAS)/Electronic Centralized Aircraft Monitor (ECAM) for engine and system status.

- Flight Management Systems (FMS): Integrated computer systems responsible for navigation, flight planning, performance calculations, and optimal flight path execution, significantly enhancing efficiency.

- Communication Systems: Essential for air-to-ground and air-to-air communication, comprising VHF/UHF radios, satellite communication systems, and advanced data link solutions.

- Navigation Systems: Includes a suite of technologies such as Global Positioning System (GPS), Inertial Navigation System (INS), VOR/DME, Instrument Landing System (ILS), and weather radar, ensuring precise positioning and guidance.

- Surveillance Systems: Critical for safety, encompassing Traffic Collision Avoidance System (TCAS), Transponders, Terrain Awareness and Warning System (TAWS), and Automatic Dependent Surveillance-Broadcast (ADS-B).

- Integrated Modular Avionics (IMA): A core architectural concept enabling a common computing platform and network infrastructure to host various aircraft functions, providing modularity, scalability, and reduced complexity.

- By Fit: This segment distinguishes between installations in newly manufactured aircraft and upgrades to existing fleets, indicating distinct market opportunities within manufacturing and aftermarket services.

- Linefit (OEM): Pertains to glass cockpit systems installed as original equipment during the manufacturing process of new aircraft, representing initial market penetration.

- Retrofit (Aftermarket): Involves upgrading older aircraft with modern glass cockpit systems to enhance capabilities, extend operational life, and meet contemporary regulatory requirements, a significant segment for MRO providers.

Value Chain Analysis For Glass Cockpit Market

The value chain within the Glass Cockpit Market is a complex and highly specialized network, encompassing a series of sequential activities that add value from the conceptualization phase to the deployment and ongoing support of these advanced systems. At the upstream segment, the chain begins with the sourcing of specialized raw materials and critical electronic components. This includes advanced display panels (e.g., AMLCD, OLED), high-performance microprocessors, specialized sensors (e.g., MEMS accelerometers, gyroscopes), sophisticated software algorithms, and robust interconnection technologies. Suppliers at this stage are often highly specialized technology firms, including semiconductor manufacturers, display technology innovators, and specialized software developers who contribute foundational elements crucial for the performance, reliability, and innovation of the final glass cockpit products. The strength and resilience of relationships with these upstream suppliers are paramount for avionics manufacturers to ensure a consistent supply of high-quality, cutting-edge components and to integrate the latest technological advancements effectively into their designs. Furthermore, research and development in areas like human-machine interface design and data fusion techniques are also integral parts of the upstream value creation, shaping the capabilities of the final product.

Moving downstream, the value chain progresses through the critical stages of design, manufacturing, system integration, rigorous testing, and certification of the complete glass cockpit solution. Leading avionics manufacturers procure the necessary components from their upstream partners, conduct extensive in-house research and development to create proprietary hardware and software, and then meticulously assemble and test the integrated systems. This stage demands exceptional engineering expertise, adherence to stringent quality control processes, and strict compliance with global aviation regulatory standards, such as RTCA DO-178C for software and DO-254 for complex electronic hardware. Once manufactured and certified, these sophisticated systems are channeled to their end-users through various distribution methods. The primary channel is direct sales to aircraft Original Equipment Manufacturers (OEMs) for linefit installations in newly produced aircraft, often involving long-term strategic contracts. An equally vital channel is the indirect distribution network, which includes authorized Maintenance, Repair, and Overhaul (MRO) providers, specialized avionics shops, and distributors who cater to the retrofit market for upgrading existing aircraft. These indirect channels are critical for providing localized sales, installation services, technical support, and comprehensive pilot training globally. The final stage of the value chain involves ongoing post-sales support, including software updates, hardware maintenance, and performance monitoring, ensuring the long-term operational integrity and compliance of the glass cockpit systems throughout the aircraft's lifecycle. Efficient collaboration and communication across all these stages are vital for maximizing value and driving innovation within the market.

Glass Cockpit Market Potential Customers

The Glass Cockpit Market serves a diverse and expansive array of potential customers across the global aviation ecosystem, each driven by distinct operational needs, financial considerations, and regulatory compliance requirements. At the forefront are commercial airlines, ranging from major international carriers to regional and low-cost operators, which continuously invest in new aircraft equipped with the latest glass cockpit technologies and undertake extensive retrofit programs for their existing fleets. Their purchasing decisions are primarily motivated by the imperative to enhance flight safety, optimize operational efficiency through reduced pilot workload and improved fuel economy, and meet increasingly stringent air traffic management regulations. The accelerating growth in global passenger and cargo air travel directly fuels demand from this customer base. Airlines often prioritize integrated systems that offer high reliability, ease of maintenance, and seamless compatibility with their broader operational infrastructure and existing avionics systems, considering the total cost of ownership and long-term support as critical factors.

Another significant customer segment comprises military and defense organizations globally. These entities procure advanced glass cockpits for a wide spectrum of platforms, including high-performance fighter jets, strategic transport aircraft, maritime patrol aircraft, and next-generation training aircraft. Their requirements are highly specialized, focusing on superior situational awareness for combat and surveillance missions, enhanced tactical decision-making capabilities, and robust, often customized, systems capable of operating in extreme environmental conditions and integrating with specific weapon systems. Government agencies involved in specialized operations such as border patrol, search and rescue, law enforcement, and environmental monitoring also represent a niche yet crucial customer base, particularly for helicopter and special mission fixed-wing aircraft applications where mission-specific display configurations and advanced sensor integration are paramount. Furthermore, the growing business and general aviation sectors, encompassing corporate flight departments, charter operators, and private aircraft owners, constitute a robust segment. These customers typically seek a blend of advanced safety features, enhanced pilot comfort, and the latest technological innovations that improve the overall flight experience. Finally, the rapidly evolving Urban Air Mobility (UAM) sector and operators of large commercial Unmanned Aerial Vehicles (UAVs) are emerging as critical potential customers, necessitating sophisticated ground control station interfaces and onboard autonomous flight management systems that mirror the complexity and reliability of manned aircraft cockpits.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.2 Billion |

| Market Forecast in 2033 | USD 15.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Collins Aerospace (Raytheon Technologies Corporation), Honeywell International Inc., Thales Group, Garmin Ltd., L3Harris Technologies Inc., Elbit Systems Ltd., BAE Systems PLC, Safran S.A., GE Aviation, Universal Avionics Systems Corporation, Astronautics Corporation of America, Curtiss-Wright Corporation, Moog Inc., Northrop Grumman Corporation, Raytheon Technologies Corporation, Pilatus Aircraft Ltd., Innovative Solutions & Support, Inc., TransDigm Group Inc. (Esterline Technologies), Meggitt PLC (part of Parker Hannifin), Dynon Avionics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glass Cockpit Market Key Technology Landscape

The Glass Cockpit Market is continuously evolving, driven by a dynamic and innovative technological landscape that pushes the boundaries of aviation safety, efficiency, and pilot interaction. Central to this evolution are advanced display technologies, which have progressed significantly beyond traditional Active Matrix Liquid Crystal Displays (AMLCD). The adoption of Organic Light Emitting Diode (OLED) and Quantum Dot Light Emitting Diode (QLED) displays is gaining traction, offering superior contrast ratios, wider viewing angles, reduced power consumption, and enhanced color vibrancy. These improvements are critical for presenting high-fidelity graphical information and ensuring readability in diverse lighting conditions, thereby dramatically improving pilot situational awareness. Furthermore, the integration of intuitive Human-Machine Interfaces (HMI) such as multi-touch screens, gesture control, and voice command systems is transforming pilot interaction, making it more natural and efficient. Head-Up Displays (HUDs) and Helmet-Mounted Displays (HMDs) are also vital technologies, projecting crucial flight data directly into the pilot's forward field of view, allowing them to maintain external visual references while simultaneously accessing essential flight information, which is particularly beneficial during critical phases of flight and in military applications.

Beyond visual interfaces, the underlying processing architecture is equally transformative. Integrated Modular Avionics (IMA) represents a cornerstone technology, utilizing a common computing platform and a highly integrated network infrastructure to host various aircraft functions. This modular approach significantly reduces hardware complexity, wiring, weight, and power consumption, while simultaneously enhancing system flexibility, scalability, and ease of maintenance for future upgrades. High-speed, secure data bus technologies, such as ARINC 664 (AFDX) and MIL-STD-1553, form the backbone for reliable communication between diverse avionics systems within the glass cockpit. Sensor fusion, leveraging advanced algorithms to combine and process data from multiple disparate sensors (e.g., GPS, INS, weather radar, synthetic vision systems), provides a more comprehensive, accurate, and resilient picture of the aircraft's position and environment. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is an emerging and highly impactful trend, enabling capabilities such as predictive maintenance, intelligent decision support systems that offer optimized solutions for complex scenarios, and highly adaptive interfaces that respond to pilot cognitive states. Moreover, as cockpits become increasingly interconnected, advanced cybersecurity measures, including robust encryption, intrusion detection systems, and secure boot processes, are absolutely critical to protect these digital environments from potential threats. These technological pillars collectively contribute to the enhanced safety, operational efficiency, and intelligence that define the modern glass cockpit, continually adapting to the evolving demands of the aviation sector.

Regional Highlights

- North America: This region consistently maintains a dominant position in the Glass Cockpit Market, primarily driven by substantial defense expenditures, a highly developed commercial aviation infrastructure, and the presence of leading aircraft manufacturers and avionics suppliers, particularly in the United States. Ongoing military aircraft modernization programs and a consistent demand for upgrading commercial aircraft fleets significantly contribute to market expansion here.

- Europe: Europe represents another key market with a robust aerospace industry, stringent aviation safety regulations, and continuous investment in both new commercial aircraft development and military upgrades. Countries like France, Germany, the UK, and Italy host major aerospace OEMs and a strong ecosystem of component suppliers, fostering significant innovation in glass cockpit technologies and their widespread adoption.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market segment, fueled by the rapid expansion of commercial aviation, escalating passenger traffic, and massive investments in new aircraft procurement by airlines, particularly in China, India, and Southeast Asian nations. Growing defense budgets across the region also contribute to a strong demand for modern military aircraft cockpits and associated upgrades.

- Latin America: This region exhibits steady growth in the Glass Cockpit Market, largely driven by the modernization efforts of commercial airline fleets, increasing demand for business jets, and the growing utility of helicopters in various sectors. Brazil and Mexico are prominent contributors, with continuous investments aimed at improving aviation infrastructure and integrating advanced avionics to enhance safety and efficiency.

- Middle East and Africa (MEA): The MEA region is demonstrating promising growth, primarily propelled by significant investments in new aircraft by rapidly expanding airlines in the Middle East, along with ongoing efforts to enhance defense capabilities across the region. Fleet modernization in both civil and military aviation is a key driver, alongside the strategic development of new aviation hubs and increased air connectivity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glass Cockpit Market.- Collins Aerospace (Raytheon Technologies Corporation)

- Honeywell International Inc.

- Thales Group

- Garmin Ltd.

- L3Harris Technologies Inc.

- Elbit Systems Ltd.

- BAE Systems PLC

- Safran S.A.

- GE Aviation

- Universal Avionics Systems Corporation

- Astronautics Corporation of America

- Curtiss-Wright Corporation

- Moog Inc.

- Northrop Grumman Corporation

- Pilatus Aircraft Ltd.

- Innovative Solutions & Support, Inc.

- TransDigm Group Inc. (Esterline Technologies)

- Meggitt PLC (part of Parker Hannifin)

- Dynon Avionics

- Avidyne Corporation

Frequently Asked Questions

What is a glass cockpit and how does it differ from traditional cockpits?

A glass cockpit is an aircraft cockpit that replaces traditional analog flight instruments with multi-function digital displays. It differs by consolidating flight, navigation, and engine data onto integrated screens, offering superior situational awareness, reduced pilot workload, and advanced system integration compared to older mechanical gauges.

What are the primary benefits of using a glass cockpit in modern aircraft?

The primary benefits include significantly enhanced flight safety through clearer data presentation, reduced human error, improved operational efficiency via advanced flight management systems, lower maintenance costs due to fewer mechanical components, and a substantial reduction in pilot workload, leading to increased focus and comfort.

Which types of aircraft commonly feature glass cockpit technology?

Glass cockpit technology is standard across virtually all modern aircraft types, including commercial airliners (e.g., Boeing 787, Airbus A350), military aircraft (e.g., F-35, C-17), business jets, and both civil and military helicopters. It is also increasingly integrated into Urban Air Mobility (UAM) vehicles and large Unmanned Aerial Vehicles (UAVs).

How is Artificial Intelligence (AI) expected to impact glass cockpit functionality?

AI is projected to significantly enhance glass cockpits by providing advanced decision support, predictive maintenance, intelligent human-machine interfaces that adapt to pilot needs, and increased automation for complex tasks. This will lead to further improvements in safety, efficiency, and pilot effectiveness through real-time data analysis and optimized operations.

What are the main challenges associated with the adoption and implementation of glass cockpits?

Key challenges include the high upfront costs for research, development, installation, and certification of advanced systems, the inherent complexity of integrating diverse avionics, stringent regulatory approval processes, the ongoing need for robust cybersecurity measures, and the requirement for comprehensive and specialized pilot training for digital interfaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager