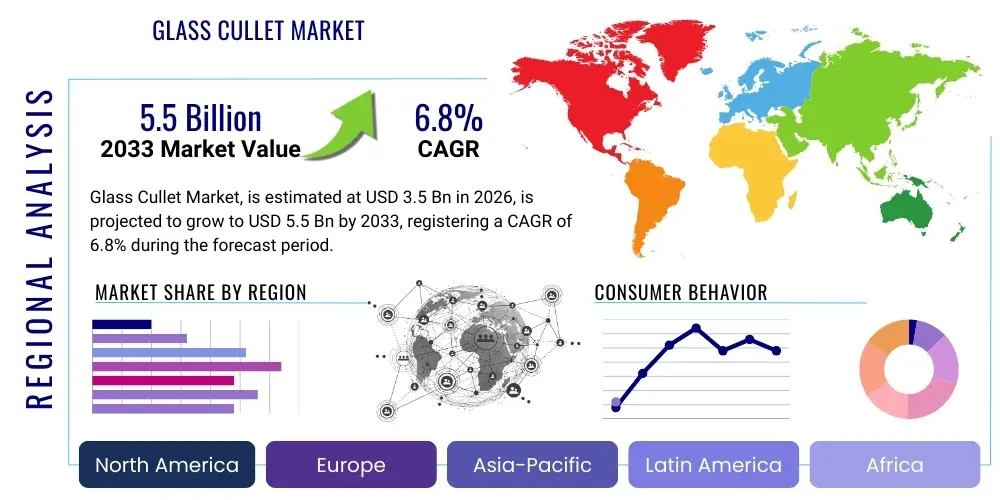

Glass Cullet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435206 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Glass Cullet Market Size

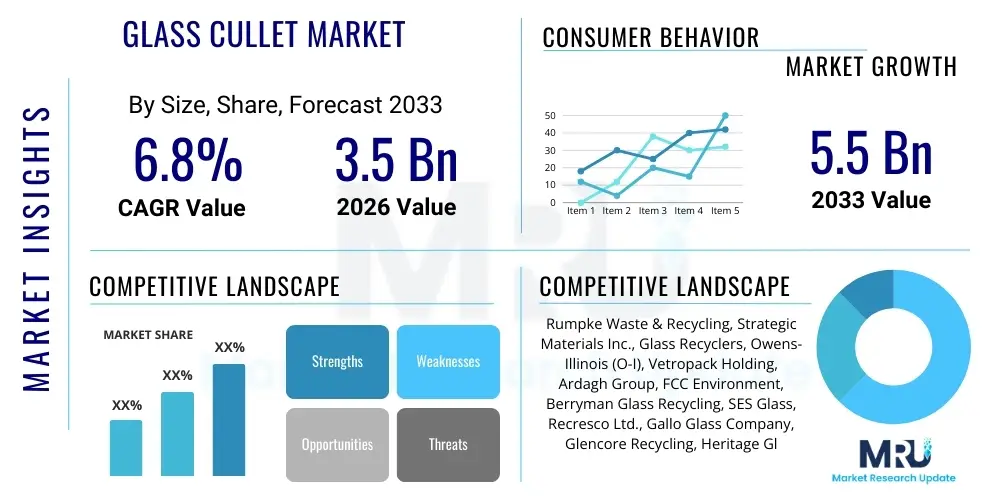

The Glass Cullet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by stringent governmental regulations promoting waste reduction and the increasing industrial focus on circular economy principles, especially within high-volume glass manufacturing sectors such as container production and flat glass fabrication.

Glass Cullet Market introduction

Glass cullet, which refers to waste glass that is crushed and processed for recycling, serves as a crucial raw material substitute for virgin materials (sand, soda ash, limestone) in glass production. The market is defined by the collection, processing, and distribution of high-quality, contaminant-free recycled glass across various industrial applications. Utilizing cullet significantly lowers the energy required for melting in the furnace, resulting in substantial cost savings for manufacturers and a reduced carbon footprint, positioning it as an environmentally indispensable component of the modern industrial economy. The quality and color purity of the cullet are critical factors influencing its market value and usability across specialized applications.

The primary applications of glass cullet span several critical industries. Container glass manufacturing (bottles and jars) represents the largest segment, where cullet incorporation rates often exceed 70% in developed regions. Additionally, cullet is vital for producing fiberglass insulation, where it contributes to material strength and lowers production temperatures. Lesser, but growing, applications include use in road construction aggregates, filtration media, and abrasive blasting materials. The versatility and inherent chemical stability of glass cullet ensure its continued relevance across diverse high-volume markets, driven by mandates requiring increased recycled content in consumer goods packaging.

The market expansion is propelled by several key factors, including the global shift towards mandatory recycling targets and Extended Producer Responsibility (EPR) schemes that place the onus on manufacturers to manage end-of-life products. Furthermore, volatile energy prices make energy-intensive virgin glass production less competitive compared to recycling, reinforcing the economic viability of cullet use. Technological advancements in sorting and cleaning processes, particularly optical and sensor-based technologies, have dramatically improved the quality of processed cullet, opening doors for its use in demanding applications previously restricted to virgin materials.

Glass Cullet Market Executive Summary

The Glass Cullet Market is characterized by robust growth underpinned by sustainability mandates and escalating raw material costs. Business trends indicate a movement towards vertical integration among glass manufacturers who are securing dedicated cullet supply chains to stabilize production costs and ensure compliance with regulatory recycled content targets. Technological investments are primarily focused on enhancing sorting efficiency and reducing contamination levels, moving the industry away from mixed-color cullet towards high-value, single-color sorted products. This strategic shift is crucial for maintaining the stringent quality requirements of the primary end-use sectors, particularly high-end container glass and technical flat glass production.

Regionally, Europe continues to dominate the market due to established high collection rates and pioneering regulatory frameworks, such as the EU Waste Framework Directive, setting ambitious recycling targets. However, the Asia Pacific (APAC) region is forecasted to exhibit the fastest growth, propelled by rapid urbanization, increasing consumer awareness, and significant infrastructure investments that require glass aggregates and recycled materials. North America demonstrates mature, stable growth, focusing on optimizing Material Recovery Facility (MRF) operations and tackling contamination issues inherent in single-stream recycling systems. Regulatory convergence globally is a major theme, standardizing requirements and facilitating cross-border trade of processed cullet.

Segment-wise, the Post-Consumer segment remains the largest volume source, but the Post-Industrial segment provides the highest quality, low-contamination cullet, commanding a price premium. Among end-use applications, container glass recycling leads the market share, driven by massive demand from the beverage and food packaging industries. The fiberglass segment is showing promising growth, leveraging cullet’s ability to reduce furnace temperatures, thereby providing substantial energy savings. Overall, the market outlook is overwhelmingly positive, driven by the inescapable economic and environmental pressures to adopt circular economy models, making glass cullet a foundational component of sustainable manufacturing.

AI Impact Analysis on Glass Cullet Market

Common user questions regarding AI's influence in the Glass Cullet market often center on how automation can solve the persistent challenges of contamination, purity, and inconsistent supply quality. Users frequently ask about the cost-effectiveness of implementing AI-driven sorting systems, the potential reduction in manual labor dependence, and the capacity of machine learning algorithms to distinguish complex materials like ceramics, stones, and porcelain (CSP) from glass. The primary concerns revolve around capital investment versus operational savings, and the integration of sophisticated imaging and spectroscopic data processing within existing recycling infrastructure. Users expect AI to deliver radical improvements in material purity, which is critical for meeting the high technical specifications demanded by premium glass manufacturers.

AI's primary transformative impact is observed in the processing stage, specifically within high-speed sorting lines. Machine learning algorithms, coupled with advanced sensor technology (such as near-infrared and hyperspectral imaging), enable sorting machines to analyze materials instantaneously, identifying and ejecting contaminants with unmatched precision. This capability is vital for increasing the yield of high-purity, color-separated cullet, which fetches significantly higher market prices than mixed cullet. Predictive modeling, another AI application, is being utilized to forecast cullet availability and quality based on seasonal trends and municipal collection data, allowing processors and manufacturers to optimize inventory management and furnace scheduling, minimizing unexpected downtime related to material inconsistencies.

Furthermore, AI facilitates predictive maintenance in complex sorting and crushing machinery. By analyzing real-time operational data from sensors placed on conveyors, motors, and crushers, AI systems can identify potential equipment failures before they occur, drastically reducing maintenance costs and avoiding costly operational interruptions in a continuous flow process. The optimization of logistics and transportation routes for collection and delivery of processed cullet using AI-powered route planning software also leads to reduced fuel consumption and lower carbon emissions associated with the supply chain. These efficiency gains make the entire recycling process more economically robust and environmentally compliant, reinforcing the market’s positive growth outlook.

- AI-enhanced sensor-based sorting increases cullet purity, enabling higher incorporation rates in premium glass products.

- Machine learning algorithms significantly improve the detection and rejection of critical contaminants like CSP (Ceramics, Stones, Porcelain).

- Predictive maintenance implemented via AI minimizes operational downtime and reduces capital expenditure on emergency repairs in recycling plants.

- AI optimizes logistics and fleet management for collection and distribution, lowering transportation costs and carbon footprint.

- Data analytics driven by AI provide granular insights into feedstock quality fluctuations, aiding pricing strategies and inventory control.

DRO & Impact Forces Of Glass Cullet Market

The dynamics of the Glass Cullet Market are strongly influenced by the interplay of supportive regulatory drivers, persistent logistical and quality restraints, and significant opportunities arising from technological advancements and emerging market demand. The dominant driving force remains the global push for sustainability and decarbonization, codified through national and international laws requiring minimum recycled content. Conversely, the market faces structural challenges, primarily the high cost associated with reducing contamination, especially in regions relying on commingled or single-stream recycling systems. Strategic opportunities are concentrated in developing sophisticated, fully automated sorting infrastructure and exploring innovative, non-traditional uses for lower-grade cullet, such as in engineered materials or infrastructure projects, mitigating disposal costs and broadening the market scope. These forces collectively define the competitive intensity and long-term viability of the recycling industry.

Drivers: Stricter environmental regulations, particularly in Europe and North America, mandating higher recycling rates and imposing carbon taxes on virgin material consumption, act as powerful economic incentives for utilizing cullet. The substantial energy savings achieved by using cullet—approximately 2-3% less energy for every 10% of cullet incorporated—translate directly into significant operational cost reductions for glass manufacturers, making recycling an economic necessity, not just an environmental choice. Furthermore, the finite nature and geopolitical sensitivity of key virgin raw materials, such as soda ash, stabilize the demand for domestically sourced and processed cullet, enhancing supply chain resilience against global commodity price fluctuations.

Restraints: The primary restraint is the contamination of collected glass, particularly with CSP, metals, and organic residues, which severely compromises the quality required for furnace-ready cullet. Processing and cleaning contaminated glass is capital-intensive, increasing the final cost of high-grade cullet. Logistical challenges, including inefficient municipal collection systems and the high cost of transporting bulky, low-density glass waste, particularly in sparsely populated areas, impede the economic viability of recycling infrastructure development. Additionally, a lack of standardized cullet quality metrics across different geographies can create trade barriers and inconsistencies in manufacturer inputs, leading to cautious adoption in high-specification glass sectors.

Opportunities: Opportunities lie in the commercialization of advanced sensor-based sorting technologies, including advanced laser, X-ray transmission (XRT), and NIR sorting, which can process commingled streams into high-purity, furnace-ready cullet efficiently. The expansion into high-growth applications, such as the use of fine glass powder in cement production to enhance concrete strength (pozzolanic material) and its application in geothermal insulation materials, offers diversified revenue streams for lower-grade or fine cullet that is unsuitable for furnace use. Developing strong public-private partnerships to standardize collection infrastructure and increase consumer participation in source separation recycling programs offers long-term stability and quality improvements in feedstock supply.

Impact Forces: The market is influenced by the cyclical nature of the construction and packaging industries, which are the primary consumers of glass products. Legislative shifts, such as new tariffs on imported materials or changes in domestic recycling mandates, have an immediate and measurable impact on cullet pricing and demand. The rising cost of energy, especially natural gas used in melting furnaces, disproportionately favors the use of cullet, intensifying its competitive advantage over virgin materials. Technological innovation in recycling processes is a continuous force, improving the efficiency of the supply chain and constantly lowering the minimum economic threshold for viable recycling operations, thereby expanding the overall market volume.

Segmentation Analysis

The Glass Cullet Market is rigorously segmented based on source, product type, and diverse end-use applications, reflecting the varied quality requirements and consumption patterns across the industry. This detailed segmentation is crucial for understanding market dynamics, as the value proposition of cullet is highly dependent on its purity and color. High-purity, color-sorted cullet derived primarily from post-industrial sources commands premium pricing, catering to high-specification flat glass and specialty container manufacturers. Conversely, mixed-color, lower-grade cullet finds utility in bulk applications such as fiberglass and construction aggregates, where color and minor impurities are less detrimental to the final product performance. Market participants strategically focus on optimizing their sorting capabilities to maximize the yield of the most profitable segments.

Analysis by Source highlights the distinction between the abundant, yet often contaminated, Post-Consumer segment and the cleaner, more consistent Post-Industrial segment. Post-Consumer cullet necessitates extensive, multi-stage processing involving crushing, screening, aspiration, and advanced optical sorting to remove non-glass materials. Post-Industrial cullet, typically waste from manufacturing processes like cutting scraps or quality rejects, often bypasses several initial cleaning steps, making it immediately viable for high-value applications. The market's profitability hinges on efficient processing technologies capable of upgrading large volumes of post-consumer material to match the quality standards of post-industrial inputs.

The End-Use segmentation clearly illustrates the market's reliance on the packaging industry, with container glass being the dominant application. However, strategic growth is anticipated in the fiberglass and road aggregate segments. Fiberglass production, driven by increasing global demand for energy-efficient insulation materials in residential and commercial construction, represents a high-volume, albeit slightly lower-specification, consumer. The construction sector’s growing acceptance of recycled glass as a sustainable substitute for sand or aggregate in asphalt and cement provides a scalable outlet for materials that cannot meet furnace-ready standards, offering an essential pathway for achieving zero-waste recycling goals across the entire value chain.

- By Source:

- Post-Consumer Cullet

- Post-Industrial Cullet

- By Product Type:

- Color-Sorted Cullet (Flint/Clear, Amber, Green, Blue)

- Mixed Cullet

- By End-Use Application:

- Container Glass (Bottles, Jars)

- Flat Glass (Windows, Automotive)

- Fiberglass Insulation

- Road Aggregate and Construction Materials

- Abrasives and Filtration

Value Chain Analysis For Glass Cullet Market

The value chain of the Glass Cullet market is complex, beginning with the collection of waste glass and culminating in its consumption by glass manufacturers, involving several critical intermediary processing steps. The upstream segment is dominated by municipal solid waste (MSW) collectors, private waste management firms, and Material Recovery Facilities (MRFs). Collection efficiency and the degree of source separation at this stage significantly determine the quality and subsequent processing cost of the feedstock. Inefficient collection systems yielding high contamination require extensive processing downstream, increasing the overall cost structure and diminishing the final market value of the cullet.

Midstream activities involve sophisticated processing, which is the core value addition stage. This includes crushing, screening (to control size specifications), magnetic separation (to remove ferrous and non-ferrous metals), aspiration (to remove light debris like paper labels), and, most critically, advanced optical sorting using sensor technology to separate glass by color and remove non-glass contaminants (CSP). Processors specializing in achieving furnace-ready purity levels hold significant leverage due to the high capital investment required for these technologies and the scarcity of high-purity cullet. The distribution channel primarily utilizes bulk transportation methods, including rail and truck, requiring close geographical proximity between processing facilities and large-scale manufacturing plants to minimize logistics expenses, which constitute a major component of the final cost.

Downstream utilization involves the consumption of processed cullet by various manufacturing industries. Direct distribution involves long-term contracts between large processors and major glass producers (e.g., O-I, Saint-Gobain) who incorporate the cullet directly into their melt furnaces. Indirect channels involve specialty brokers or distributors who supply smaller manufacturers or clients in secondary markets, such as those producing abrasives, decorative aggregates, or road construction materials. The efficiency of the entire chain is contingent upon effective communication and standardized quality metrics between the processor and the end-user, ensuring that the delivered cullet meets the precise specifications necessary for consistent production runs, thereby maximizing both volume throughput and energy efficiency for the buyer.

Glass Cullet Market Potential Customers

Potential customers for high-quality, processed glass cullet are concentrated within large-scale industrial consumers who prioritize sustainable sourcing, energy efficiency, and cost reduction in their manufacturing processes. The largest end-user segment comprises container glass manufacturers, including global beverage and food packaging companies, who leverage cullet extensively to achieve high recycled content targets mandated by legislation and consumer preferences. These buyers require stringent quality control, especially regarding color separation and the absence of CSP contamination, as impurities can cause major defects in packaging products and lead to furnace damage. Contractual agreements with these major players often involve long-term, high-volume supply arrangements.

Another significant group of buyers is the flat glass industry, supplying construction and automotive sectors. While flat glass historically used lower percentages of cullet due to strict clarity and uniformity requirements, technological improvements in processing now allow for higher incorporation rates, especially for lower-grade flat glass products. Fiberglass insulation manufacturers represent a rapidly growing customer base, as cullet readily substitutes virgin raw materials and significantly reduces the energy intensity of the melting process, aligning perfectly with the industry's focus on sustainable building materials and energy efficiency standards.

Beyond traditional glass manufacturing, emerging potential customers include civil engineering and construction firms that utilize cullet as a sustainable aggregate in road base, asphalt, and concrete mixes. Water filtration companies and abrasive blasting media producers also form niche customer bases, seeking specific grain sizes and purity levels for their specialized applications. The market expansion relies heavily on educating these non-traditional users on the technical and environmental benefits of substituting conventional raw materials with processed glass cullet, unlocking new, scalable outlets for materials that cannot be re-melted into high-grade products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $5.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rumpke Waste & Recycling, Strategic Materials Inc., Glass Recyclers, Owens-Illinois (O-I), Vetropack Holding, Ardagh Group, FCC Environment, Berryman Glass Recycling, SES Glass, Recresco Ltd., Gallo Glass Company, Glencore Recycling, Heritage Glass Inc., Recycle Glass, Coloured Sands. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glass Cullet Market Key Technology Landscape

The technological landscape of the Glass Cullet market is defined by continuous innovation aimed at improving sorting accuracy, throughput, and reducing contamination, thereby transforming low-value commingled glass into high-purity, furnace-ready materials. Central to this evolution is the deployment of advanced sensor-based sorting (SBS) systems. These systems utilize a combination of technologies, including Near-Infrared (NIR) spectroscopy for material identification, high-resolution cameras for color sorting, and X-ray transmission (XRT) or X-ray fluorescence (XRF) for detecting high-density contaminants like leaded glass, ceramics, and metals that are optically difficult to distinguish. The integration of these sensors allows for multi-faceted material characterization in milliseconds, dramatically enhancing the quality of the final cullet product and reducing manual intervention.

Beyond sensing, sophisticated crushing and cleaning techniques are crucial. The initial crushing process must be optimized to liberate contaminants without creating excessive fines, as fine glass powder (which often carries a high concentration of impurities) is typically less valuable for furnace use. Wet processing systems, which use water baths and hydrocyclones, are increasingly employed downstream of the initial sorting stages to meticulously remove organic residues, paper labels, and fine dust particles that can negatively affect glass melting processes. These washing and drying steps are essential for processors targeting the highly demanding specifications of the flat glass industry, where clarity and absence of residue are paramount to prevent cosmetic defects in the finished product.

Furthermore, technology is being applied to address the logistical inefficiencies of the upstream market. Modern processing facilities leverage highly automated conveying systems and centralized monitoring software, often incorporating AI and machine vision, to optimize material flow and ensure consistent input to the high-speed sorters. The future direction of technology involves developing affordable, modular sorting solutions that can be scaled for smaller collection points, decentralizing processing, and reducing the transportation burden associated with moving large volumes of unprocessed glass over long distances. Innovations in utilizing hard-to-recycle glass, such as incorporating pulverized cullet into geopolymers or advanced construction insulation, are also expanding the technological application spectrum beyond traditional remelting.

Regional Highlights

The geographical analysis of the Glass Cullet Market reveals distinct maturity levels and growth drivers across major regions, heavily influenced by regulatory environments and economic structures.

- Europe: Europe is the global leader in glass recycling, characterized by the highest collection and cullet utilization rates (often exceeding 80% in countries like Belgium and Germany). This maturity is driven by early adoption of stringent EU directives, particularly the Waste Framework Directive and the Packaging and Packaging Waste Directive, which mandate ambitious recycling targets. The regional market benefits from well-established, integrated supply chains and advanced processing infrastructure that allows for large volumes of high-purity, color-separated cullet production. The continued focus on energy efficiency and decarbonization solidifies Europe's dominance in high-quality cullet supply.

- Asia Pacific (APAC): APAC represents the fastest-growing market, primarily fueled by rapid industrialization, massive construction booms, and escalating demand for packaged goods in populous countries like China, India, and Southeast Asia. While collection rates are historically lower than in Europe, significant governmental investment in urban recycling infrastructure and increasing consumer awareness are accelerating market development. The region presents substantial opportunities for foreign investors to deploy advanced sorting technologies, particularly to handle the large volumes of mixed waste generated by emerging mega-cities.

- North America (NA): North America exhibits stable, high-value growth, driven by large manufacturers in the U.S. and Canada who rely on cullet for cost management. The market faces challenges related to the prevalence of single-stream recycling, which leads to high contamination and requires substantial investment in optical sorting technology to purify the feedstock. Regulatory pressures, especially at the state level (e.g., California’s recycled content mandates), push manufacturers toward higher cullet incorporation, stimulating demand for regionally sourced, high-grade material.

- Latin America (LATAM): The LATAM market is nascent but shows strong potential, particularly in Brazil and Mexico, due to increasing industrial production and developing regulatory frameworks focused on sustainable waste management. The region requires significant investment in collection logistics and primary processing facilities, often focusing initially on local, lower-grade applications like road aggregates due to the high capital cost associated with full-scale optical sorting required for furnace-ready cullet.

- Middle East and Africa (MEA): Growth in MEA is highly localized, concentrated around industrial hubs in the UAE and Saudi Arabia, driven by major infrastructure projects and the establishment of local packaging manufacturing bases. While overall recycling rates are low, the necessity for sustainable water management and reducing landfill dependency is slowly prompting governmental action to support initial investment in recycling infrastructure and cullet processing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glass Cullet Market.- Strategic Materials Inc.

- Rumpke Waste & Recycling

- Glass Recyclers

- Owens-Illinois (O-I)

- Ardagh Group

- Vetropack Holding

- FCC Environment

- Berryman Glass Recycling

- SES Glass

- Recresco Ltd.

- Gallo Glass Company

- Glencore Recycling

- Heritage Glass Inc.

- Coloured Sands

- Recycle Glass

- CRH plc

- Saint-Gobain

- Gerresheimer AG

- Trex Company, Inc. (Indirectly via recycled content)

- Knauf Insulation (Major Fiberglass Consumer)

Frequently Asked Questions

Analyze common user questions about the Glass Cullet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for glass cullet globally?

The primary driver is the necessity for energy conservation and the stringent enforcement of environmental regulations, particularly governmental mandates requiring glass manufacturers to meet minimum recycled content targets to reduce carbon emissions and dependency on energy-intensive virgin raw materials.

How does the quality of glass cullet impact its market price and application?

Cullet quality is paramount; color-sorted, contaminant-free cullet (furnace-ready) commands a significantly higher price and is required for high-end container and flat glass production. Mixed-color or contaminated cullet is cheaper and relegated to lower-value applications like fiberglass insulation or road aggregate.

Which region dominates the Glass Cullet Market in terms of recycling volume and infrastructure?

Europe currently dominates the market, possessing the most mature and efficient recycling infrastructure, resulting in the highest collection rates and utilization percentages, driven by pioneering environmental legislation and widespread adoption of circular economy principles.

What role does Artificial Intelligence (AI) play in the future of the glass cullet industry?

AI is essential for the industry’s future, primarily by enhancing sensor-based sorting (SBS) technology. AI algorithms improve the speed and accuracy of contaminant removal (especially ceramics, stones, porcelain), leading to higher yields of premium-grade cullet necessary for furnace applications.

What are the main constraints limiting the greater adoption of recycled glass in manufacturing?

The main constraints include high operational costs associated with removing contaminants, particularly from single-stream recycling systems, and logistical inefficiencies related to the bulky nature of waste glass, which makes transportation expensive and restricts the economic viability of recycling in rural areas.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager