Glass Fiber Nonwoven Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433684 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Glass Fiber Nonwoven Market Size

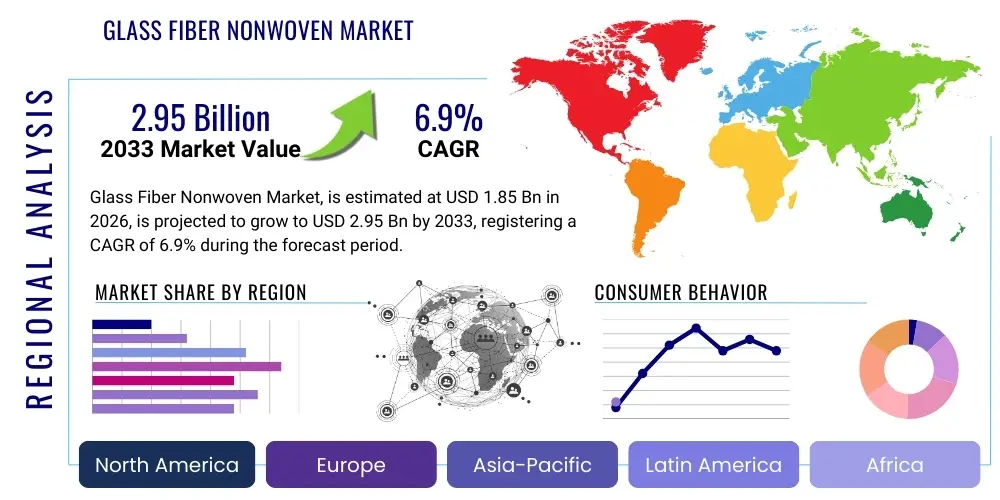

The Glass Fiber Nonwoven Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2033.

Glass Fiber Nonwoven Market introduction

Glass fiber nonwoven materials represent advanced fibrous sheets manufactured from continuous or chopped glass strands, bonded through mechanical, chemical, or thermal means. These materials are highly valued for their exceptional characteristics, including high dimensional stability, excellent fire resistance, superior thermal insulation, and strong corrosion resistance. The primary products, manufactured typically via wet-laid or dry-laid processes, are essential components in demanding industrial applications where reliability and performance under stress are paramount. Their inherent resistance to moisture and chemicals makes them indispensable across various critical infrastructure sectors.

The major applications span critical industries such as construction, where they are used for roofing membranes and insulation; filtration systems, due to their high capture efficiency and chemical inertness; and the electrical and electronics sector, where they provide essential dielectric strength and thermal management in printed circuit boards (PCBs) and battery separators. Furthermore, the automotive and aerospace industries leverage glass fiber nonwovens for lightweighting, noise suppression, and enhanced durability of composite components. The versatility of these materials allows for tailored solutions specific to end-user requirements, ranging from thin veils for surface finishing to thick mats for structural reinforcement.

Market growth is primarily driven by escalating global construction activities, particularly in emerging economies focused on modern, energy-efficient building standards. Regulatory mandates promoting fire safety and stricter environmental standards requiring highly efficient filtration media further propel demand. The unique combination of high strength-to-weight ratio and cost-effectiveness compared to alternative reinforcing fibers solidifies the position of glass fiber nonwovens as a preferred material choice. Continuous advancements in manufacturing technology, such as optimized wet-laid processes for improved fiber dispersion and reduced binder content, are enhancing product performance and expanding application possibilities.

Glass Fiber Nonwoven Market Executive Summary

The Glass Fiber Nonwoven Market is experiencing robust expansion driven by sustained demand from infrastructure development and the increasing adoption of composite materials in the renewable energy sector, particularly wind turbine manufacturing. Key business trends indicate a strong focus on sustainability, leading manufacturers to invest in bio-based binders and environmentally friendly production processes to meet stringent global certification standards. Strategic mergers, acquisitions, and partnerships aimed at vertical integration and geographical expansion are shaping the competitive landscape. Furthermore, technological innovation centered on ultra-thin glass veils for enhanced surface protection in high-performance composites is becoming a critical differentiator among market leaders, allowing for penetration into demanding niche applications like aerospace radomes and specialized automotive components.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, primarily fueled by massive infrastructure spending in China and India, coupled with the rapid expansion of the region's electronics manufacturing base. North America and Europe maintain significant market shares, characterized by mature industries focusing on high-value, specialized applications such as advanced filtration, high-temperature insulation, and fire-resistant construction materials, often driven by strict regulatory frameworks regarding energy efficiency and safety. The market in Latin America and the Middle East and Africa (MEA) is poised for accelerated growth, albeit from a smaller base, contingent on regional industrialization and government investment in large-scale energy and construction projects.

Segmentation trends reveal that the Construction application segment holds the largest share due to the widespread use of glass fiber mats in roofing shingles, waterproofing membranes, and insulation materials, driven by global urbanization patterns. In terms of product type, the wet-laid process segment is dominant, offering superior uniformity and fiber dispersion essential for high-quality filtration media and specialized laminates. The E-glass type continues to be the workhorse of the industry due to its balance of cost and performance. However, there is growing traction for C-glass in corrosion-prone environments and specialized S-glass materials in high-stress, defense, and aerospace applications demanding exceptional mechanical properties and higher temperature resistance.

AI Impact Analysis on Glass Fiber Nonwoven Market

User inquiries concerning the impact of Artificial Intelligence on the Glass Fiber Nonwoven Market frequently revolve around optimizing production efficiency, enhancing quality control, and developing predictive maintenance strategies within complex manufacturing facilities. Users are keen to understand how AI-driven image recognition systems can detect microscopic defects in nonwoven webs in real-time, significantly reducing waste and ensuring product uniformity, especially for high-specification end-uses like PCBs or high-efficiency air filters. Another major theme is the use of machine learning algorithms to fine-tune the highly variable wet-laid process parameters—such as slurry consistency, fiber length distribution, and binder application rates—to achieve consistent product performance despite fluctuating raw material inputs. Concerns often center on the initial investment costs associated with implementing AI infrastructure and the need for specialized data scientists to maintain and train these sophisticated monitoring systems within traditional manufacturing environments.

- AI-powered predictive maintenance reduces equipment downtime in high-speed nonwoven production lines.

- Machine learning optimizes process parameters (temperature, speed, binder concentration) for improved fiber dispersion and web uniformity.

- Real-time quality control systems using AI vision detect defects such as pinholes, voids, or non-uniform fiber distribution instantaneously.

- Enhanced supply chain forecasting utilizing AI minimizes inventory risks and optimizes raw material procurement (glass fiber roving and binder chemicals).

- Development of novel nonwoven compositions through AI simulation, accelerating R&D cycles for specialized products (e.g., high-dielectric materials).

- AI-driven energy management systems decrease overall operational costs in energy-intensive glass melting and fiberizing stages.

DRO & Impact Forces Of Glass Fiber Nonwoven Market

The market dynamics are defined by a confluence of strong driving forces rooted in infrastructure expansion and sustainability mandates, counterbalanced by inherent manufacturing complexities and reliance on volatile raw material markets. The primary driver is the global transition toward energy-efficient building materials and fire-resistant solutions, mandated by increasingly stringent building codes worldwide, creating persistent demand for glass fiber nonwovens in insulation and roofing. Simultaneously, the accelerating deployment of renewable energy technologies, particularly offshore and onshore wind turbines, relies heavily on high-performance glass composites that often utilize nonwoven reinforcements to enhance structural integrity and reduce weight.

Restraints primarily stem from the price volatility of key raw materials, including glass components and petroleum-derived binders, which introduce significant cost uncertainty for manufacturers. Additionally, the manufacturing process, especially the wet-laid technique, requires substantial capital investment and complex waste water management, posing challenges for smaller entrants. The availability and fluctuating cost of energy, critical for the high-temperature melting of glass, also impacts operational profitability. Another significant constraint is the competition from alternative synthetic nonwoven materials (such as polyester or polypropylene) in less demanding applications, although these alternatives often fail to match the high thermal and dimensional stability offered by glass fibers.

Opportunities for growth are concentrated in emerging fields such as battery technology, where glass nonwovens are explored as separators for enhanced safety and performance in electric vehicle (EV) batteries. Significant potential also lies in developing tailored, highly specialized products for advanced filtration in semiconductor manufacturing and pharmaceutical clean rooms, which demand absolute material purity and precise pore size distribution. The impact forces indicate a shift towards innovation in binder chemistry—moving away from formaldehyde-based resins towards healthier, more sustainable alternatives—as a key factor influencing market leadership. Furthermore, geopolitical stability and trade policies significantly affect the global supply chain efficiency for large-volume products.

Segmentation Analysis

The Glass Fiber Nonwoven Market is meticulously segmented based on production process (Type), glass composition (Glass Type), and end-use requirements (Application), allowing for a granular understanding of diverse market needs and competitive niches. The segmentation reveals a mature market structure where product specification directly dictates applicability, ranging from large-scale commoditized products used in construction to highly specialized, thin veils required in high-tech electronics. Understanding the interplay between these segments is crucial for strategic planning, as technological advancements often create new sub-segments, such as ultra-lightweight veils optimized for resin flow in specialized composite manufacturing techniques.

- By Type: Wet-laid, Dry-laid (Needle-punch, Spunbond), Meltblown.

- By Glass Type: E-glass, C-glass, S-glass, High Silica Glass, Others (e.g., A-glass, ECR-glass).

- By Application: Construction (Roofing, Insulation, Waterproofing), Filtration (Air Filtration, Liquid Filtration), Electrical & Electronics (PCBs, Battery Separators, Thermal Insulation), Automotive & Transportation (Headliners, Heat Shields, Composites), Wind Energy, Consumer Goods, Others (e.g., Aerospace, Marine).

Value Chain Analysis For Glass Fiber Nonwoven Market

The value chain for the Glass Fiber Nonwoven Market begins with the upstream sourcing of high-purity raw materials, primarily silica sand, alumina, limestone, and specialized chemical components, which are vital for the glass melting and fiberization processes. This stage is highly capital-intensive and concentrated among specialized global glass fiber manufacturers. Midstream activities involve the complex nonwoven manufacturing processes (wet-laid, dry-laid), where the glass fibers are combined with proprietary chemical binders and processed into mats, veils, or tissues of varying densities and thicknesses. Process efficiency and the intellectual property related to binder formulations are major competitive advantages at this stage, dictating the final product's performance characteristics, such as fire resistance and tensile strength.

The downstream segment involves converting, finishing, and distributing the nonwoven materials. Converters often slit, laminate, or chemically treat the rolls of nonwoven material to meet precise end-user specifications, particularly for specialized applications like pre-pregs for composite molding or ready-to-use roofing membranes. Distribution channels are typically dual: direct sales are common for high-volume, custom orders to large industrial consumers (e.g., major roofing manufacturers or filtration system builders), ensuring quality control and technical support. Indirect distribution, leveraging specialized industrial distributors and regional agents, serves smaller or geographically dispersed consumers and handles standardized product offerings, providing necessary warehousing and logistical support for timely delivery.

The efficiency of the logistics network is paramount due to the large volume and sometimes delicate nature of the nonwoven rolls, requiring careful handling to prevent deformation. Technological integration along the value chain, especially real-time data sharing between manufacturers and converters, is increasingly essential for optimizing inventory and customizing production runs. The final step involves the integration of the glass fiber nonwoven product into the end application, where its performance directly affects the quality and safety standards of the final product, such as the durability of a solar panel backing or the fire rating of a building material. Effective management of the supply chain mitigates risks related to material scarcity and ensures compliance with regional environmental regulations throughout the entire product lifecycle.

Glass Fiber Nonwoven Market Potential Customers

Potential customers for glass fiber nonwoven products are broadly classified into key industrial segments that rely on high-performance, stable, and durable materials for their core products. The largest segment comprises manufacturers in the construction industry, including producers of asphalt roofing shingles, synthetic waterproofing membranes, specialized insulation boards, and exterior wall systems. These buyers prioritize materials that offer excellent dimensional stability, superior weather resistance, and compliance with stringent fire safety codes, making glass fiber nonwovens an essential purchase for product longevity and certification.

A second crucial customer base lies within the automotive and transportation sectors, specifically manufacturers of vehicle acoustic components (headliners, floor mats), heat shields, and composite body panels. These buyers seek lightweight materials that can withstand high operating temperatures and contribute to noise, vibration, and harshness (NVH) reduction, supporting modern automotive demands for fuel efficiency and passenger comfort. Furthermore, the electrical and electronics sector, particularly manufacturers of high-density printed circuit boards (PCBs) and advanced battery systems (lithium-ion and solid-state), are critical buyers, requiring ultra-thin, highly uniform glass veils for dielectric separation and thermal management within complex electronic assemblies.

Other significant end-users include specialized industrial filtration companies that integrate glass fiber mats into high-efficiency particulate air (HEPA) filters, liquid process filters, and high-temperature gas cleanup systems, valuing the material's chemical inertness and consistent pore size. Lastly, energy companies and their suppliers, particularly those involved in wind turbine blade manufacturing and solar panel construction, represent high-growth potential customers, utilizing these nonwovens for structural reinforcement, surface finishing, and enhanced material durability against environmental factors like moisture and UV radiation, ensuring the long operational life of renewable energy assets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | 6.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Owens Corning, Johns Manville, Ahlstrom-Munksjö, Lydall (now part of Solenis), Chongqing Polycomp International Corporation (CPIC), Binani Industries, Saint-Gobain Adfors, Nippon Electric Glass Co. Ltd. (NEG), Jushi Group, Vliegenthart, Taiwan Glass Industry Corporation, Hollingsworth & Vose, Sinoma Science & Technology Co. Ltd., BGF Industries, Taishan Fiberglass Inc. (CTGF), Xingtai Jinniu, PPG Industries, Hexcel Corporation, Schweiter Technologies (Isola Group), Guangdong Donghai Glass Fiber Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glass Fiber Nonwoven Market Key Technology Landscape

The manufacturing technology landscape for the Glass Fiber Nonwoven Market is dominated by two primary methodologies: the wet-laid process and the dry-laid process. The wet-laid technique, analogous to papermaking, is critical for producing high-quality, lightweight, and thin veils with exceptional uniformity and fiber distribution. Recent technological advancements in the wet-laid sector focus heavily on optimizing hydrodynamics and slurry preparation, incorporating specialized dispersants and foaming agents to minimize fiber entanglement and aggregation, which is crucial for filtration and electronics applications requiring micro-uniformity. Furthermore, continuous process monitoring using advanced sensors and control systems is improving the consistency of fiber deposition and subsequent binder application.

Conversely, the dry-laid process encompasses technologies like carding, needle-punching, and air-laying, typically utilized for producing thicker, heavier mats required in structural and insulation applications. Innovation in the dry-laid sector centers on improving mechanical bonding efficiency (e.g., optimized needle geometry in needle-punching) and enhancing thermal bonding processes using thermoplastic fibers alongside glass fibers. Another significant area of technological focus is the development of advanced binder systems. Manufacturers are increasingly utilizing formaldehyde-free, acrylic, and styrene-butadiene rubber (SBR) based binders that offer enhanced performance characteristics—such as greater elasticity, improved dimensional stability under heat, and resistance to hydrolysis—while complying with stringent environmental and health regulations regarding volatile organic compounds (VOCs).

Looking ahead, the integration of automation and data analytics is transforming the production floor. The implementation of IoT sensors throughout the manufacturing lines allows for real-time monitoring of machine vibration, temperature, and moisture levels, enabling predictive maintenance and significantly reducing unscheduled downtime. Furthermore, research into novel glass compositions, such as ECR (Electrical/Chemical Resistance) glass and specialized S-glass formulations, is aimed at providing materials with higher strength, lower dielectric constants, and superior resistance to harsh chemical environments, expanding the use of nonwovens into high-performance composite tooling and next-generation battery technologies. These technological enhancements are pivotal for manufacturers seeking to capture market share in high-specification, high-margin segments.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in both consumption and manufacturing capacity, driven by colossal infrastructure projects, rapid urbanization, and massive growth in the electronics and automotive industries, particularly in China, Japan, South Korea, and India. The region benefits from lower operating costs and governmental support for manufacturing, leading to a strong supply base for commoditized and specialty products.

- North America: Characterized by a high demand for high-value, specialized nonwovens, especially in the filtration (HEPA and HVAC systems) and advanced composite sectors (aerospace and premium automotive). Market growth is driven by rigorous building codes requiring high fire resistance and thermal insulation standards, propelling the demand for glass fiber roofing mats and insulation materials.

- Europe: The European market is highly regulated, focusing heavily on sustainability, recycling, and stringent environmental standards (REACH). This drives the demand for nonwovens made with bio-based or formaldehyde-free binders. Key application areas include advanced filtration, noise reduction in premium vehicles, and the extensive wind energy sector, especially in Germany and Spain.

- Latin America (LAMEA): LAMEA is an emerging market experiencing steady growth fueled by regional economic development and increasing foreign direct investment in manufacturing and construction, particularly in Brazil and Mexico. The market currently relies heavily on imports but is seeing increased localization of manufacturing for basic construction-grade materials.

- Middle East and Africa (MEA): Growth in the MEA region is intrinsically linked to massive government-funded construction and diversification projects, particularly in the Gulf Cooperation Council (GCC) countries. There is a specific high demand for nonwovens used in high-temperature and harsh environmental insulation and specialized pipeline protection coatings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glass Fiber Nonwoven Market.- Owens Corning

- Johns Manville

- Ahlstrom-Munksjö

- Lydall (now part of Solenis)

- Chongqing Polycomp International Corporation (CPIC)

- Binani Industries

- Saint-Gobain Adfors

- Nippon Electric Glass Co. Ltd. (NEG)

- Jushi Group

- Vliegenthart

- Taiwan Glass Industry Corporation

- Hollingsworth & Vose

- Sinoma Science & Technology Co. Ltd.

- BGF Industries

- Taishan Fiberglass Inc. (CTGF)

- Xingtai Jinniu

- PPG Industries

- Hexcel Corporation

- Schweiter Technologies (Isola Group)

- Guangdong Donghai Glass Fiber Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Glass Fiber Nonwoven market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for glass fiber nonwovens in the construction industry?

The primary driver is the increasing global requirement for highly durable and fire-resistant building materials, particularly in roofing membranes and advanced insulation systems, mandated by stricter international building codes focused on energy efficiency and safety standards.

How does the wet-laid process differ from the dry-laid process in manufacturing glass fiber nonwovens?

The wet-laid process produces thinner, more uniform veils ideal for filtration and electrical components by suspending fibers in water, similar to papermaking. The dry-laid process utilizes air or mechanical means (like needling) to create thicker, denser mats generally used for structural reinforcement and heavy-duty insulation.

Which geographical region exhibits the fastest growth rate in the Glass Fiber Nonwoven Market?

The Asia Pacific (APAC) region is projected to register the fastest CAGR, fueled by massive government investments in infrastructure, rapid industrialization, and high demand from flourishing electronics and automotive manufacturing bases across countries like China and India.

What role do glass fiber nonwovens play in the Electric Vehicle (EV) sector?

Glass fiber nonwovens are increasingly used as high-performance battery separators, offering superior thermal stability and chemical resistance crucial for safety and lifespan extension in lithium-ion and next-generation solid-state batteries required for Electric Vehicles (EVs).

What is the main challenge related to the sustainability of glass fiber nonwoven production?

A primary challenge is the high energy consumption required for the glass melting and fiberization stage, coupled with the environmental impact of traditional binders. Manufacturers are mitigating this through investment in energy-efficient furnaces and the adoption of formaldehyde-free and bio-based binder systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager