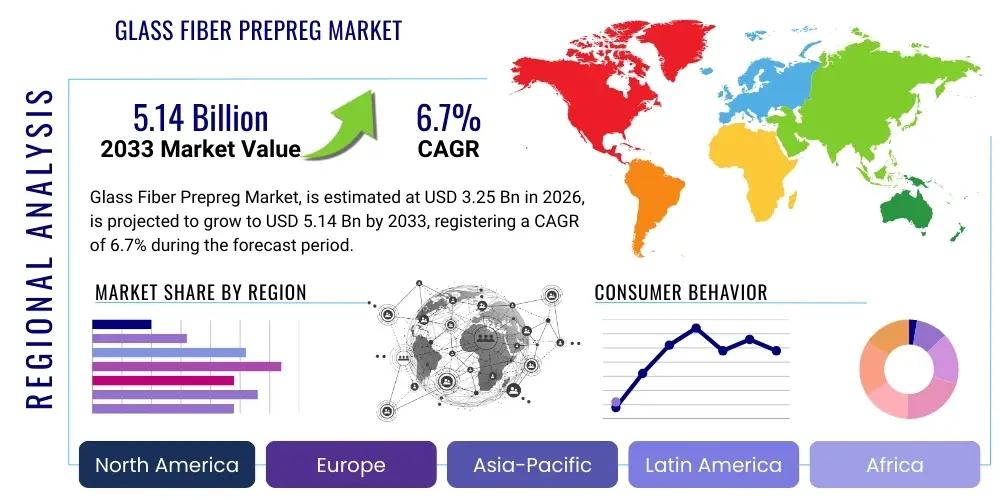

Glass Fiber Prepreg Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435324 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Glass Fiber Prepreg Market Size

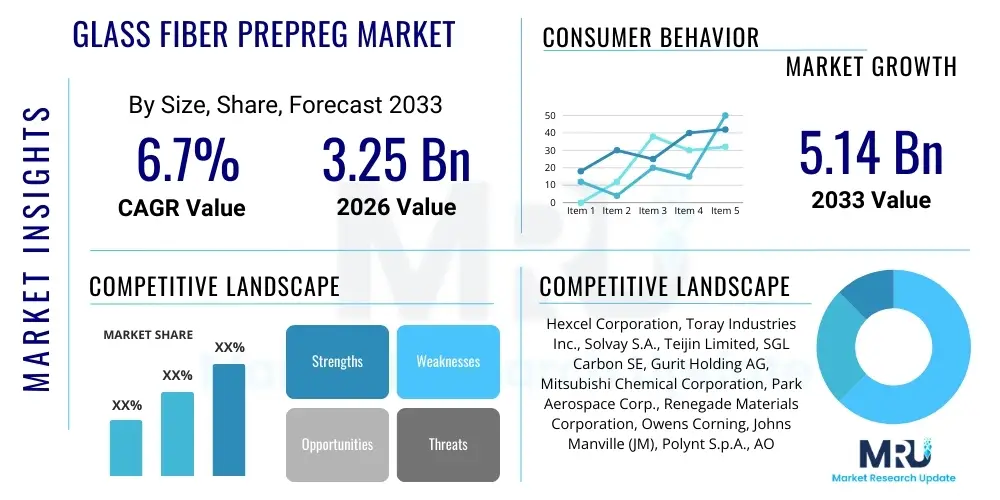

The Glass Fiber Prepreg Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 3.25 Billion in 2026 and is projected to reach USD 5.14 Billion by the end of the forecast period in 2033.

Glass Fiber Prepreg Market introduction

The Glass Fiber Prepreg Market encompasses the manufacturing, distribution, and utilization of semi-finished composite materials consisting of glass fibers (typically E-glass or S-glass) uniformly impregnated with a thermoset or thermoplastic resin matrix, such as epoxy, phenolic, or polyester. These pre-impregnated materials, known as prepregs, offer superior structural properties, including high strength-to-weight ratio, stiffness, corrosion resistance, and excellent fatigue life, which are crucial for demanding applications across various industries. The primary characteristic of prepregs is their optimized resin-to-fiber ratio achieved under controlled conditions, ensuring consistent quality and reduced processing complexity for end-users compared to traditional wet lay-up methods. This allows for cleaner operations, minimized waste, and precise control over component performance, especially critical in high-performance structural parts.

Major applications driving the demand for glass fiber prepregs include the wind energy sector, primarily for the manufacturing of large, high-performance wind turbine blades; the automotive industry, utilized in structural components, body panels, and chassis parts to facilitate lightweighting and enhance fuel efficiency; and the aerospace and defense sector, although carbon fiber dominates, glass fiber prepregs are used for secondary structures, radomes, and interior components where dielectric properties are essential. Furthermore, the marine sector employs these materials for boat hulls and components requiring excellent moisture resistance, while the sporting goods industry leverages them for high-strength, lightweight equipment.

The core benefits propelling market expansion include the ease of automated processing, the guaranteed performance due to consistent fiber volume fraction, and the ability to manufacture complex geometries with high repeatability. Key driving factors involve stringent global regulations mandating reduced emissions and improved fuel economy in transportation, coupled with massive global investment in renewable energy infrastructure, particularly offshore and onshore wind farms. Technological advancements in resin chemistry, enabling faster cure cycles and enhanced toughness, further solidify the position of glass fiber prepregs as foundational materials in modern composite engineering.

Glass Fiber Prepreg Market Executive Summary

The Glass Fiber Prepreg Market is characterized by robust growth, primarily fueled by the accelerating global transition towards sustainable energy production, making wind blade manufacturing the largest consumer segment. Business trends indicate a strong push towards developing faster-curing epoxy systems and exploring thermoplastic glass fiber prepregs, which offer advantages in recyclability and high-volume automotive production due cycles. Key market players are focusing on backward integration to secure raw material supply (glass fiber fabric and specialty resins) and forward integration to offer tailored solutions, including specific cutting and kitting services, directly to major OEMs in aerospace and wind energy. Strategic partnerships and licensing agreements aimed at co-developing specialized prepreg formulations for extreme operating conditions are becoming central to maintaining competitive advantage.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid industrialization, massive investments in infrastructure, and the dominant presence of global wind energy manufacturing hubs, particularly in China and India. Europe maintains a significant market share due to its established automotive lightweighting initiatives and pioneering offshore wind development projects. North America demonstrates stable demand, driven by sophisticated aerospace programs and increasing utilization of prepregs in oil and gas infrastructure and specialized industrial applications. The trend across all major regions is a shift from traditional, heavy materials towards composites to achieve mandated performance targets related to efficiency and sustainability.

Segment trends highlight the dominance of epoxy resin-based prepregs due to their versatility and superior mechanical properties, although the thermoplastic segment is gaining traction, particularly with Polyamide (PA) and Polypropylene (PP) matrices, targeting high-volume automotive applications where short cycle times are paramount. Application-wise, wind energy remains the anchor segment, but the automotive sector is poised for accelerated growth as manufacturers scale up electric vehicle (EV) production, necessitating lightweight battery enclosures and structural elements. The increasing refinement of automated fiber placement (AFP) and automated tape laying (ATL) technologies compatible with glass fiber prepregs further enhances their appeal across various high-tech manufacturing sectors.

AI Impact Analysis on Glass Fiber Prepreg Market

Common user inquiries regarding AI's influence on the Glass Fiber Prepreg Market primarily revolve around optimizing manufacturing efficiency, ensuring quality control, and accelerating material development cycles. Users are keen to understand how AI-driven predictive maintenance can reduce downtime in prepreg production lines and how machine learning algorithms can analyze complex material parameters (such as resin viscosity, impregnation quality, and curing kinetics) to minimize defects. A major concern is the potential of AI to automate design optimization for composite structures, particularly wind turbine blades, leading to material reduction while maintaining or improving structural integrity. Expectations focus heavily on AI facilitating the rapid development and qualification of novel, high-performance glass fiber prepreg formulations through data-intensive simulations and process parameter prediction.

- AI-Driven Quality Control: Utilizing computer vision and machine learning (ML) for real-time defect detection during the prepreg manufacturing process, improving material consistency.

- Predictive Process Optimization: Employing algorithms to forecast optimal temperature, pressure, and speed settings for large-scale impregnation, minimizing waste and energy consumption.

- Automated Design and Simulation: AI assisting engineers in rapidly iterating composite layups and structural designs, particularly in complex geometries like aircraft components and wind turbine roots.

- Supply Chain Forecasting: ML models enhancing the prediction of raw material demand (glass fiber and specialty resins) and optimizing inventory management.

- Accelerated Material Discovery: AI analyzing vast datasets of experimental results to identify promising new resin formulations or fiber surface treatments that enhance prepreg performance.

DRO & Impact Forces Of Glass Fiber Prepreg Market

The Glass Fiber Prepreg Market dynamics are shaped by a powerful synergy of increasing demand from critical lightweighting industries and ongoing material innovation, counterbalanced by cost pressures and technical hurdles associated with long-term performance validation. The primary driver is the unparalleled global growth in renewable energy infrastructure, demanding stronger and larger wind turbine blades made predominantly from glass fiber prepregs. Opportunities exist primarily in developing recyclable thermoplastic glass fiber prepregs to address sustainability mandates and in expanding usage within the mass-market electric vehicle sector, moving beyond niche applications to core structural components. Restraints include the inherent sensitivity of thermoset prepregs to storage conditions (requiring freezer transportation), leading to logistical complexities and costs, coupled with intense competition from lower-cost composite manufacturing methods like infusion, although prepregs offer superior performance consistency.

Impact forces are predominantly high due to the high capital investment required for state-of-the-art prepreg manufacturing lines and the significant regulatory pressures influencing end-use sectors. For instance, global aviation safety standards and increasing requirements for fire resistance in public transportation and building materials mandate the use of specific, qualified prepreg systems. The substitution threat is moderate, primarily stemming from advanced carbon fiber prepregs in high-end applications and resin infusion techniques for lower performance, thicker parts. However, glass fiber prepregs maintain a superior cost-performance ratio for mid-range structural demands.

Segmentation Analysis

The Glass Fiber Prepreg Market is systematically segmented based on the type of resin matrix utilized, the specific form of the prepreg material, and the diverse applications in which these materials are structurally employed. Segmentation is crucial as the end-user requirements dictate the matrix chemistry—epoxy for high strength, phenolic for fire resistance, and thermoplastics for rapid processing. The primary resin systems, Epoxy and Phenolic, account for the largest market share, but the Thermoplastic segment is rapidly accelerating due to improved production efficiency and environmental considerations such as the potential for recycling. Understanding these segments provides clarity on market focus, technology investment priorities, and strategic alignment with key growth industries such as wind power and automotive lightweighting, which demand tailored material specifications and handling characteristics.

- By Resin Type:

- Epoxy

- Phenolic

- BMI (Bismaleimide)

- Thermoplastic (e.g., PA, PP, PEEK)

- Others (e.g., Polyimide, Cyanate Ester)

- By Fiber Type:

- E-Glass

- S-Glass (High-Strength)

- Others (e.g., R-Glass)

- By Product Form:

- Unidirectional (UD) Tapes

- Woven Fabrics

- Non-Crimp Fabrics (NCF)

- By Application:

- Wind Energy

- Aerospace and Defense

- Automotive and Transportation

- Marine

- Sporting Goods

- Industrial

Value Chain Analysis For Glass Fiber Prepreg Market

The value chain for glass fiber prepregs begins with the upstream suppliers, focusing on the highly specialized manufacturing of glass fibers (E-glass being most common, requiring high energy input and specific mineral compositions) and the synthesis of performance resins (primarily epoxy, requiring specific curing agents and modifiers). These raw material producers have significant leverage over pricing and quality, necessitating strong procurement relationships for prepreg manufacturers. Key activities in the midstream involve the precise impregnation process, where glass fibers are saturated with the resin matrix, followed by controlled cooling and rolling into the final prepreg sheets or tapes, requiring highly calibrated machinery and stringent quality checks to ensure consistent fiber-to-resin ratio and void content.

The downstream sector involves the distribution and direct sale of the prepreg materials, which often requires a cold chain logistical network, particularly for thermoset systems that need temperature-controlled storage and transportation to prevent premature curing. Distribution channels are typically specialized, involving direct sales teams working closely with large OEMs (Original Equipment Manufacturers) in the aerospace, wind, and automotive sectors, often requiring pre-cut kits tailored to specific component dimensions. Indirect sales through distributors are common for smaller volume industrial and sporting goods applications, but the trend in high-volume, high-performance sectors is towards direct engagement to ensure technical support and supply consistency.

The high criticality of prepreg performance means that material qualification and technical support are integrated into the distribution strategy. Direct engagement allows manufacturers to collaborate on component design, optimizing the lay-up and curing profiles, thereby reducing waste and accelerating the time-to-market for the end product. The efficiency and quality achieved in the prepreg manufacturing step directly impact the downstream processing costs and the ultimate performance of the final composite structure, establishing the prepreg manufacturer as a critical partner rather than just a material supplier. This necessitates robust technical field support and application engineering expertise within the sales channel.

Glass Fiber Prepreg Market Potential Customers

Potential customers for glass fiber prepregs are concentrated in industries that prioritize lightweight construction, superior mechanical performance, and durability in high-stress environments. The largest customer segment remains large-scale wind turbine blade manufacturers (e.g., Vestas, Siemens Gamesa, GE Renewable Energy), who require massive volumes of high-quality glass fiber prepregs, particularly UD tapes and woven fabrics, to produce blades ranging from 60 to over 100 meters in length. These customers demand materials with guaranteed fatigue life and minimal variation in material properties, driving the need for extremely consistent prepreg manufacturing.

The second major consumer base includes automotive OEMs and Tier 1 suppliers engaged in lightweighting programs, particularly focusing on electric vehicles where battery boxes, crash structures, and body panels utilize glass fiber prepregs for enhanced safety and reduced weight, maximizing battery range. Specific requirements here include fast-curing resins compatible with rapid production cycles (often favoring thermoplastic prepregs). Aerospace and defense contractors represent a highly lucrative, albeit niche, market segment, purchasing prepregs for secondary structural components, radomes (where glass fiber's radio frequency transparency is crucial), and interior elements, prioritizing high-performance specifications like fire, smoke, and toxicity (FST) ratings.

Furthermore, marine shipbuilders, especially those constructing high-performance yachts and specialized naval vessels, rely on glass fiber prepregs for hulls and decks that require excellent resistance to harsh environmental conditions, moisture ingress, and impact. Finally, manufacturers of high-end sporting goods (e.g., skis, snowboards, hockey sticks) and specialized industrial equipment (e.g., pressure vessels, chemical tanks) constitute the remaining customer base, valuing the tailored stiffness and strength that precise prepreg layups provide, ensuring that glass fiber prepreg utilization spans across highly demanding sectors prioritizing reliability and advanced structural performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.25 Billion |

| Market Forecast in 2033 | USD 5.14 Billion |

| Growth Rate | CAGR 6.7% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hexcel Corporation, Toray Industries Inc., Solvay S.A., Teijin Limited, SGL Carbon SE, Gurit Holding AG, Mitsubishi Chemical Corporation, Park Aerospace Corp., Renegade Materials Corporation, Owens Corning, Johns Manville (JM), Polynt S.p.A., AOC Resins, Barrday Inc., Euro-Composites S.A., Cytec Industries (Solvay), Kineco Kaman Composites – India Pvt. Ltd., TCR Composites Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glass Fiber Prepreg Market Key Technology Landscape

The technology landscape in the Glass Fiber Prepreg Market is defined by continuous innovation focused on enhancing material throughput, minimizing defect rates, and expanding the applicability of prepregs beyond traditional thermosets. The foundational technology remains the hot-melt process, where heated resin film is pressed onto the fiber reinforcement, ensuring precise and solvent-free impregnation. However, advancements are centered on improving resin delivery systems, particularly exploring solvent-based prepregging for certain niche applications and adapting machinery to handle ultra-low viscosity resins that penetrate high-density fiber bundles more effectively, crucial for high-performance applications like aerospace components where homogeneity is paramount.

A significant technological shift involves the rise of thermoplastic prepregs, which necessitates specialized manufacturing equipment capable of handling higher processing temperatures and pressures compared to thermosets. Technologies such as melt impregnation, solvent coating, and powder impregnation are being refined to produce thermoplastic UD tapes (TUDT) and woven fabrics. These thermoplastic materials require specialized automated processing techniques downstream, such as thermoforming and welding, enabling their utilization in high-volume production cycles characteristic of the automotive industry. This technological push is directly linked to AEO mandates demanding materials that facilitate efficient, quick-cure composite manufacturing.

Furthermore, process control and automation are key technological focus areas. Manufacturers are increasingly integrating inline monitoring systems, including sophisticated sensor arrays and non-destructive testing (NDT) techniques, to instantaneously measure parameters such as areal weight, fiber volume fraction, and resin content variability across the width of the prepreg roll. This reliance on data-driven manufacturing processes ensures the consistent quality required by large wind and aerospace OEMs, minimizing material wastage and qualifying the product for demanding structural use. Research is also heavily focused on developing bio-based resins and specialty functionalized fibers to meet increasing sustainability criteria without compromising mechanical performance.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for glass fiber prepregs globally, driven primarily by China's dominant position in global wind turbine blade production and rapidly increasing automotive manufacturing base, particularly for electric vehicles. Government incentives promoting renewable energy and infrastructural development in India, South Korea, and Southeast Asian nations further accelerate demand, making APAC the hub for volume manufacturing and material consumption.

- Europe: Europe holds a mature and technologically advanced market share, characterized by high adoption rates in offshore wind development (UK, Germany, Denmark) and stringent automotive lightweighting regulations driven by the European Union's emissions targets. The region is a pioneer in developing highly engineered, specialty prepregs, including those meeting strict Fire, Smoke, and Toxicity (FST) standards for rail and civil aviation applications.

- North America: North America exhibits stable growth, driven by robust demand from the aerospace and defense sectors, where glass fiber prepregs are critical for specific radome and secondary structure applications. The resurgence of onshore wind projects and growing use in industrial infrastructure (oil and gas, pipelines) contribute significantly to consumption, with a strong focus on high-performance S-glass prepregs.

- Latin America (LATAM): The LATAM market, while smaller, is projected for moderate growth, primarily stemming from investments in wind energy capacity, particularly in Brazil and Mexico, and expanding local manufacturing capabilities for transportation components, creating a niche market for imported and domestically manufactured prepreg materials.

- Middle East & Africa (MEA): MEA presents emerging opportunities, linked to large-scale infrastructure projects, including investments in specialized marine vessels and localized wind energy initiatives in countries like South Africa and Saudi Arabia. Demand is generally focused on materials offering extreme resistance to high temperatures and corrosive environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glass Fiber Prepreg Market.- Hexcel Corporation

- Toray Industries Inc.

- Solvay S.A.

- Teijin Limited

- SGL Carbon SE

- Gurit Holding AG

- Mitsubishi Chemical Corporation

- Park Aerospace Corp.

- Renegade Materials Corporation

- Owens Corning

- Johns Manville (JM)

- Polynt S.p.A.

- AOC Resins

- Barrday Inc.

- Euro-Composites S.A.

- Cytec Industries (Solvay)

- Kineco Kaman Composites – India Pvt. Ltd.

- TCR Composites Inc.

- Vectorply Corporation

- Porcher Industries

Frequently Asked Questions

Analyze common user questions about the Glass Fiber Prepreg market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between glass fiber and carbon fiber prepregs in application?

Glass fiber prepregs offer a superior cost-performance ratio, excellent dielectric properties (radio frequency transparency), and higher strain-to-failure, making them ideal for wind turbine blades, radomes, and cost-sensitive structural components. Carbon fiber prepregs, conversely, provide significantly higher stiffness and strength, dominating high-performance aerospace structures and demanding applications where weight savings are critical regardless of cost.

Why are thermoplastic glass fiber prepregs gaining traction over traditional thermoset prepregs?

Thermoplastic glass fiber prepregs (TGP) are favored due to their inherent ability to be rapidly processed (short cycle times through thermoforming), offering potential for high-volume manufacturing, especially in the automotive industry. Additionally, TGP offers higher impact resistance, indefinite shelf life (no cold storage required), and theoretical recyclability, aligning with modern sustainability goals.

Which industry segment is the largest consumer of glass fiber prepregs globally?

The Wind Energy sector is the largest global consumer. Glass fiber prepregs, particularly large format woven fabrics and unidirectional (UD) tapes, are foundational materials for the construction of increasingly long and complex wind turbine blades, requiring materials with proven fatigue resistance and high strength-to-weight ratios.

What major logistical challenge affects the supply chain of thermoset glass fiber prepregs?

The requirement for a temperature-controlled cold chain logistics network is a major challenge. Thermoset prepregs, especially epoxy-based systems, have limited shelf life at ambient temperatures and must be stored and transported below freezing to prevent premature curing (B-staging), increasing handling complexity and associated costs significantly throughout the distribution process.

How does the quality of the prepreg material impact the final composite component?

The quality of the prepreg, specifically the consistency of the resin-to-fiber ratio and the absence of voids, directly determines the structural integrity and performance of the cured composite part. Consistent material quality minimizes variability in mechanical properties, ensures predictable fatigue life, and reduces potential defects during the final manufacturing stages (autoclave or oven curing).

What role does the 'hot-melt' process play in prepreg manufacturing technology?

The hot-melt process is the dominant method for manufacturing high-quality prepregs. It involves melting the resin and impregnating the fiber reinforcement under heat and pressure. This solvent-free technique ensures precise resin content, minimizes void formation, and results in a highly consistent, dimensionally stable prepreg material essential for demanding aerospace and high-performance industrial applications.

Are regulatory standards impacting the use of glass fiber prepregs in transportation?

Yes, stringent regulatory standards, particularly concerning fire, smoke, and toxicity (FST) in aerospace and rail, heavily influence the choice of prepreg systems. Manufacturers must use specialty resins (e.g., phenolic or specific epoxy formulations) with glass fibers to meet strict safety compliance requirements, driving innovation in fire-resistant matrix chemistries.

In the automotive industry, where are glass fiber prepregs primarily used?

In the automotive sector, glass fiber prepregs are increasingly used in structural battery enclosures for electric vehicles (EVs), chassis components, and semi-structural body panels. Their use is critical for lightweighting, which extends EV range and improves fuel efficiency in traditional vehicles, often utilizing fast-curing thermoplastic systems.

What is Bismaleimide (BMI) resin and where is it applied in prepregs?

BMI is a type of high-performance thermoset resin used in glass fiber prepregs for applications requiring excellent thermal stability and high glass transition temperatures (Tg), often exceeding 250°C. BMI prepregs are typically utilized in engine components, high-temperature aircraft structures, and specialized industrial equipment where exposure to extreme heat is expected.

How do automated manufacturing technologies like AFP affect glass fiber prepreg demand?

Automated Fiber Placement (AFP) and Automated Tape Laying (ATL) technologies are accelerating demand for highly controlled, uniform unidirectional (UD) glass fiber tapes. These automated methods increase manufacturing efficiency, reduce manual labor costs, and enable the production of highly complex, high-precision composite parts with superior repeatability, particularly in large-scale structures like wind turbine blade roots.

What are the typical end-user benefits of using prepregs over traditional wet lay-up methods?

Prepregs offer predictable mechanical performance due to controlled fiber content and resin ratio, reduced cure times (when using oven-cure or rapid-cure systems), significantly lower volatile organic compound (VOC) emissions, and cleaner, safer manufacturing environments. They streamline production by eliminating the need for manual resin mixing and impregnation on the shop floor.

What is the significance of E-Glass versus S-Glass in prepreg formulation?

E-Glass (Electrical Grade) is the most common and cost-effective fiber, providing standard strength and excellent electrical insulation, used widely in wind and marine applications. S-Glass (Structural or High-Strength Glass) is significantly more expensive but offers 30-40% higher tensile strength and stiffness, reserved for performance-critical applications like high-stress aerospace components or demanding automotive parts.

How is sustainability driving innovation in glass fiber prepreg materials?

Sustainability concerns are primarily driving research into thermoplastic matrices (which can be melted and reformed, facilitating end-of-life recycling) and the development of bio-based or partially bio-derived thermoset resins. Additionally, optimization through AI and process control aims to reduce manufacturing waste and energy consumption during the prepregging phase.

Explain the term 'Non-Crimp Fabrics' (NCF) in the context of glass fiber prepregs.

NCF refers to fiber reinforcement where the layers of fibers are stitched together rather than woven, ensuring the fibers remain straight (non-crimped) and maximize the load-bearing capacity in their respective directions. Glass fiber NCF prepregs are highly valued in large structural applications like wind blades where maximizing stiffness and minimizing weight are crucial, offering improved mechanical performance over standard woven fabrics.

What are the financial implications of high capital investment in the prepreg market?

The necessity for high capital investment in specialized manufacturing lines (impregnation machines, controlled environment facilities, cold storage) creates significant barriers to entry for new players. This high fixed cost structure necessitates large production volumes and strong vertical integration or long-term contracts with major OEMs to ensure profitability and sustained market share.

How does the aerospace industry utilize glass fiber prepregs alongside carbon fiber?

In aerospace, glass fiber prepregs are utilized where carbon fiber's electrical conductivity is undesirable, such as in radomes (antenna covers) where radio frequency transparency is essential. They are also used for interior panels, ducting, and secondary structures requiring specific FST compliance and lower cost alternatives for non-critical parts, complementing the high-performance carbon fiber primary structures.

What is the competitive landscape like for glass fiber prepreg manufacturers?

The market is moderately consolidated, dominated by a few major integrated players (e.g., Hexcel, Toray, Solvay, Teijin) that offer both glass and carbon fiber prepregs and resins. Competition centers on material performance (e.g., faster cure cycles, improved toughness), global supply chain reliability, and ability to meet precise quality standards required by major aerospace and wind energy OEMs.

How do prepreg manufacturers ensure consistent quality control?

Quality control is maintained through rigorous upstream testing of raw materials (fiber and resin batches), continuous inline monitoring of process parameters (temperature, pressure, speed) during impregnation, and advanced non-destructive testing (NDT) methods like ultrasonic inspection and automated visual inspection systems (AI/ML powered) to measure areal weight and resin content across the material roll.

Which factors contribute most significantly to the cost of glass fiber prepregs?

The primary cost factors include the high cost of specialty resins (especially aerospace-grade epoxies or high-temperature thermoplastics), the energy-intensive nature of glass fiber manufacturing, and the associated costs of maintaining the sophisticated machinery and stringent quality control required for the impregnation process. Cold chain logistics also adds substantial operational expenditure.

What opportunities exist in the industrial application segment for glass fiber prepregs?

Opportunities in the industrial segment include the manufacturing of robust, corrosion-resistant components such as pressure vessels, piping, and specialized equipment used in the chemical, oil and gas, and construction industries. Prepregs offer durability, chemical resistance, and the ability to fabricate complex shapes necessary for demanding operational environments.

What is the forecast growth outlook for the Thermoplastic Glass Fiber Prepreg segment?

The Thermoplastic Glass Fiber Prepreg segment is forecast to exhibit above-average growth compared to thermosets, driven by mandates for increased production efficiency and material recyclability, particularly gaining momentum in high-volume industries like automotive and consumer electronics where rapid forming and processing techniques are essential for cost competitiveness.

How does the development of ultra-large wind turbine blades impact prepreg requirements?

The trend towards ultra-large wind blades necessitates the development of prepregs with optimized low-density formulations, superior interlaminar toughness, and exceptional fatigue properties. This demands wider UD tapes and NCFs, often utilizing high-modulus E-glass or S-glass variants, requiring prepreg manufacturers to scale up production and improve thickness consistency.

What are the key technical specifications required by aerospace buyers for glass fiber prepregs?

Aerospace buyers typically require prepregs to meet extremely high standards for mechanical properties (strength, stiffness, compression after impact), stringent Fire, Smoke, and Toxicity (FST) ratings, verifiable batch-to-batch traceability, and low volatile content, often necessitating qualified supplier certifications such as Nadcap.

How does prepreg technology support the construction of high-performance marine vessels?

In the marine sector, glass fiber prepregs are used to build lighter, stronger, and stiffer hulls and decks. The use of prepregs minimizes resin inconsistencies compared to traditional methods, enhancing fatigue life and providing superior resistance to osmotic blistering and water ingress, crucial for long-term reliability in saltwater environments.

What emerging resin types are being explored for glass fiber prepregs?

Emerging resin types include specialized cyanate esters for extreme temperature stability (niche aerospace), novel hybrid vinyl esters tailored for fast curing in marine applications, and various bio-based epoxy systems that seek to replace petroleum-derived components, driven by increasing industry focus on environmental impact reduction.

What impact does carbon fiber pricing volatility have on the glass fiber prepreg market?

While glass fiber and carbon fiber target different performance brackets, significant volatility in carbon fiber pricing can occasionally drive down-specification, pushing some non-critical applications back towards glass fiber prepregs, especially when cost-efficiency becomes a higher priority than ultimate lightweighting performance.

Describe the role of Unidirectional (UD) tapes in glass fiber prepreg applications.

UD tapes contain fibers aligned strictly in one direction, maximizing strength and stiffness along the load path. They are essential for applications like wind turbine spars and aerospace stringers where precise, directional load transfer is required, allowing engineers to tailor the composite layup efficiently to specific stress profiles.

How does AI contribute to reducing defects during the prepreg manufacturing stage?

AI, utilizing computer vision and machine learning models, can analyze high-resolution images of the impregnated material in real-time, identifying minute flaws such as fiber misalignment, resin-rich areas, or foreign debris far more accurately and consistently than human operators, allowing for immediate process adjustments and superior final product quality.

What geopolitical factors influence the regional growth of the glass fiber prepreg market?

Geopolitical factors, particularly trade policies related to the renewable energy sector and defense spending, significantly influence regional growth. For instance, wind farm subsidy policies in Europe and tax incentives for EV production in North America directly stimulate demand for glass fiber prepregs used in these critical industrial outputs, driving manufacturing regionalization.

What are the future opportunities related to prepregs in the construction and infrastructure sector?

The construction sector offers nascent opportunities, particularly for rehabilitation and strengthening of existing concrete and steel structures using high-strength glass fiber prepreg wraps and rods (GFRP). This application leverages the material's superior corrosion resistance and high strength-to-weight ratio to extend the lifespan of infrastructure components.

How do prepregs address the challenge of material waste in composite manufacturing?

Prepregs significantly reduce material waste compared to wet lay-up by offering precise, pre-measured resin content, eliminating mixing errors and spillage. Furthermore, advanced kitting services provide pre-cut shapes tailored exactly to component dimensions, minimizing off-cuts and trim waste during the component fabrication phase.

What types of curing methods are typically used for glass fiber prepreg components?

Typical curing methods include autoclave curing (providing high pressure and temperature for maximum consolidation, common in aerospace), oven curing (using heat but ambient pressure, common in wind), and vacuum bagging with heated molds (out-of-autoclave, increasingly popular for industrial parts), depending on the resin system and required performance level.

Why is the quality of the resin crucial for glass fiber prepreg performance?

The resin matrix dictates the temperature resistance, chemical resistance, impact toughness, and environmental durability of the final composite. Poor resin quality or inconsistent formulation can lead to premature failure, especially under cyclic loading (fatigue), highlighting the need for specialty resin suppliers with strict process control.

What is the market size projection for the European Glass Fiber Prepreg segment?

The European segment is projected to maintain strong growth, slightly above the global average, driven by the expanding offshore wind market and advanced material specifications required for the region's highly regulated rail and specialized automotive segments, securing its position as a major consumer of high-performance formulations.

How do competitive infusion technologies limit the growth of the glass fiber prepreg market?

Vacuum Assisted Resin Transfer Molding (VARTM) and Resin Infusion techniques offer a lower material cost and eliminate the need for cold storage, making them competitive alternatives for very large, less structurally critical parts (e.g., larger yacht hulls, some industrial tanks). This limits prepreg expansion where the cost benefits of infusion outweigh the slight performance superiority of prepregs.

What are the primary differences between UD Tapes and Woven Fabric prepregs?

UD Tapes optimize strength in one specific direction and are used when loads are precisely known. Woven Fabrics offer balanced strength across two primary axes (0°/90°) and are easier to handle and drape over complex shapes, often used for outer cosmetic or simpler structural layers requiring multi-directional reinforcement.

What technical requirements must prepregs meet for high-temperature automotive exhaust systems?

For high-temperature automotive applications, prepregs must utilize high-Tg thermoset resins, such as polyimide or specific phenolics, often paired with S-glass or ceramic fibers, to withstand continuous operating temperatures that far exceed standard epoxy limits, ensuring structural integrity under prolonged thermal stress and vibration.

How is the sporting goods industry leveraging glass fiber prepregs?

The sporting goods industry uses glass fiber prepregs for items like high-performance surfboards, skis, snowboards, fishing rods, and bicycle components, where a combination of high strength, durability, and a lower cost point compared to full carbon fiber construction is desired, allowing for highly engineered stiffness and impact resistance.

What security concerns exist regarding the supply chain for glass fiber prepregs in defense applications?

Defense applications require highly secure and controlled supply chains to ensure material specifications are maintained and to mitigate risks of counterfeit materials. Glass fiber prepreg manufacturers supplying this sector must adhere to strict ITAR or similar government regulations regarding material provenance, manufacturing location, and security clearance of personnel handling sensitive formulations.

How do curing cycles affect the performance and cost of prepreg utilization?

Shorter curing cycles translate to faster part production, reducing oven or autoclave time and lowering manufacturing costs. However, very rapid cure formulations sometimes compromise final material properties (toughness, fatigue life). The optimal curing cycle balances efficiency, energy consumption, and the critical mechanical performance requirements of the end product.

What is the long-term outlook for raw material pricing stability in the prepreg market?

Raw material pricing stability, particularly for specialized epoxy resins derived from petroleum products, remains a persistent challenge due to global energy market volatility. Fiber prices are relatively stable but are subject to high energy costs required for glass melting. Manufacturers employ long-term contracts and hedging strategies to mitigate these inherent supply chain volatilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager