Glass Forming Mold Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435657 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Glass Forming Mold Market Size

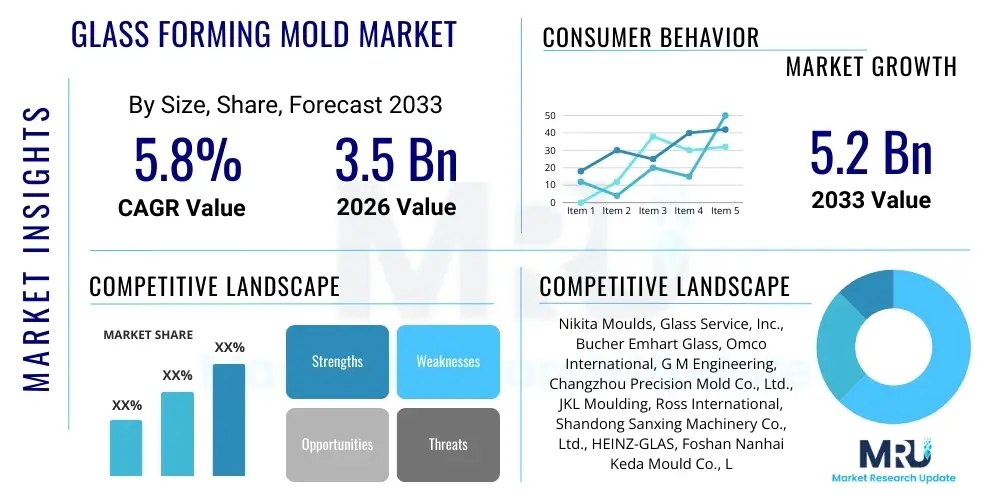

The Glass Forming Mold Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Glass Forming Mold Market introduction

The Glass Forming Mold Market encompasses the design, manufacturing, and maintenance of precision tools utilized to shape molten glass into final products such as containers, flat glass, and specialized industrial glassware. These molds are critical components in the glass manufacturing process, dictating the dimensional accuracy, surface finish, and overall quality of the end product. The functionality of these molds relies heavily on material science, demanding high thermal stability, resistance to wear, and excellent machinability, often utilizing materials like specialized cast iron, nickel alloys, and high-performance steels. The industry is highly reliant on advancements in machining technologies and metallurgy to enhance mold lifespan and production efficiency.

Major applications for glass forming molds span multiple high-growth sectors, primarily including the food and beverage industry for packaging, pharmaceuticals for sterile storage solutions, and the construction and automotive sectors for flat and architectural glass. The increasing global demand for sustainable packaging solutions, particularly glass over plastics, is a primary catalyst driving the need for more efficient and durable molds capable of handling high-speed production lines. Furthermore, the rising consumer preference for premium and uniquely shaped glass containers necessitates complex mold designs and advanced manufacturing techniques.

Key benefits associated with high-quality glass forming molds include reduced production downtime, improved glass product consistency, and the ability to achieve complex aesthetic designs that cater to branding requirements. Driving factors fueling market expansion include rapid industrialization in Asia Pacific, stringent regulatory standards favoring glass packaging in pharmaceutical applications, and continuous technological innovation focusing on mold cooling systems and surface coatings to extend operational life and minimize maintenance costs.

Glass Forming Mold Market Executive Summary

The Glass Forming Mold Market is experiencing substantial growth propelled by robust expansion in the global container glass industry, particularly driven by emerging economies and the escalating demand for sustainable packaging solutions in food, beverage, and pharmaceutical sectors. Current business trends indicate a critical shift toward advanced manufacturing techniques, including 3D printing for rapid prototyping and specialized coatings (such as plasma vapor deposition) to enhance mold durability and thermal properties, thereby minimizing thermal shock and erosion during high-volume production cycles. Manufacturers are increasingly investing in smart mold technologies integrated with sensors for real-time temperature and wear monitoring, leading to predictive maintenance capabilities and significant operational efficiency gains across glass production facilities globally.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, largely due to massive investments in infrastructure development, increasing disposable incomes boosting demand for packaged goods, and the establishment of new large-scale glass manufacturing hubs, particularly in China and India. North America and Europe, characterized by highly mature glass industries, focus primarily on mold replacement and technological upgrades to meet stringent quality standards for high-end pharmaceutical and specialty packaging, driving demand for premium nickel-alloy and specialized steel molds. Market segments are showing pronounced growth in the Blow Mold category, essential for high-speed bottle production, while applications in the pharmaceutical sector are exhibiting the highest annual growth rate, demanding ultra-precise molds for vial and ampoule manufacturing.

Segment trends underscore the rising utilization of specialized materials; while cast iron remains the cost-effective standard, nickel alloys and advanced tool steels are gaining traction due to their superior heat resistance and longevity, crucial for ultra-lightweight glass production. The trend toward lightweighting glass containers, aimed at reducing material usage and shipping costs, necessitates molds with extremely precise tolerances and superior cooling efficiency. Overall, the executive landscape is defined by competition centered on material innovation, integration of Industry 4.0 principles into mold manufacturing, and strategic partnerships aimed at securing long-term supply agreements with major glass producers globally.

AI Impact Analysis on Glass Forming Mold Market

Common user inquiries regarding AI's influence in the Glass Forming Mold Market often center on how Artificial Intelligence can enhance mold design precision, optimize manufacturing parameters, and predict component failure. Users are keen to understand the practical applications of machine learning in streamlining the complex mold prototyping process and improving material yield. Key concerns revolve around the cost of integrating AI-driven systems into traditional foundry and machining operations, the necessity for specialized data scientists, and the potential displacement of highly skilled mold designers. Users expect AI to reduce the iteration cycles in design, leading to faster time-to-market for new glass products, and to significantly extend the lifespan of costly molds through superior predictive maintenance algorithms, ultimately enhancing profitability for both mold manufacturers and glass producers.

- AI-driven topology optimization facilitates generative design, minimizing material usage while maximizing cooling efficiency within the mold structure.

- Machine learning algorithms analyze historical production data (temperature, pressure, material composition) to predict optimal operating parameters, reducing defects like checks and blisters.

- Predictive maintenance schedules for molds are created using AI analysis of real-time sensor data regarding wear, thermal stress accumulation, and micro-cracks, extending mold life significantly.

- Automated Quality Control (AQC) systems using computer vision and AI rapidly inspect finished molds and glass products for minute imperfections beyond human detection capabilities.

- AI optimizes supply chain logistics for mold materials (e.g., nickel and specialized steel alloys) by forecasting demand and identifying potential bottlenecks.

- Natural Language Processing (NLP) aids in rapidly summarizing complex material science journals and patents, accelerating R&D into new mold coating technologies.

DRO & Impact Forces Of Glass Forming Mold Market

The dynamics of the Glass Forming Mold Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the impact forces determining market trajectory. A primary driver is the accelerating global shift towards sustainable and recyclable packaging, positioning glass as a preferred material, thereby continuously stimulating demand for high-volume, high-quality molds. Simultaneously, technological advancements in mold material science, such as the increasing use of Nickel-based alloys and Ceramic Matrix Composites (CMCs), significantly enhance mold durability and thermal resistance, allowing glass manufacturers to increase production speeds and achieve greater energy efficiency. These drivers collectively push the market forward, demanding higher precision and longevity in tooling solutions.

However, the market faces notable restraints, chiefly including the extremely high initial capital investment required for state-of-the-art mold manufacturing equipment, such as high-precision 5-axis CNC machines and Electron Beam Melting (EBM) systems for additive manufacturing. Furthermore, the requirement for highly skilled metallurgists and specialized machinists capable of working with exotic mold materials poses a significant constraint, leading to elevated labor costs and production lead times. The cyclical nature of the construction and automotive industries, which consume large volumes of flat glass, also introduces market volatility, impacting overall mold demand during economic downturns.

Opportunities for growth are abundant, particularly in the domain of customization and specialization. The growing trend of product differentiation, especially in the premium beverage and cosmetics industries, necessitates unique glass shapes, which mandates the use of highly specialized, complex molds manufactured using advanced techniques like additive manufacturing (AM). Moreover, the increasing focus on lightweight glass manufacturing to reduce energy consumption and logistics costs presents a long-term opportunity for suppliers proficient in producing molds with highly optimized cooling channels and thin-wall capabilities. The adoption of Industry 4.0 technologies, including IoT sensors for real-time mold performance monitoring, offers significant pathways for new service revenue models focusing on predictive mold maintenance and optimization.

- Drivers (D): Increased global demand for container glass driven by sustainable packaging trends; technological innovations in mold material science extending mold lifespan; rapid industrialization in emerging markets bolstering construction and beverage sectors.

- Restraints (R): High capital expenditure required for precision mold manufacturing; scarcity of specialized expertise in advanced metallurgy and machining; volatility in raw material prices (e.g., Nickel, Chromium).

- Opportunities (O): Expanding application of Additive Manufacturing (3D Printing) for complex mold geometries; growing market for lightweight and ultra-lightweight glass containers; integration of IoT and AI for mold performance monitoring and predictive maintenance services.

- Impact Forces: The powerful influence of sustainability mandates and technological progress (D) strongly outweighs the constraints related to capital investment and material costs (R), creating a net positive impact, propelling moderate to high growth, particularly in specialized and high-performance segments (O).

Segmentation Analysis

The Glass Forming Mold Market is comprehensively segmented based on product type, material, application, and end-use industry, reflecting the diverse requirements of the global glass manufacturing ecosystem. Product type segmentation distinguishes between the fundamental mold designs used, such as Blow Molds, critical for standard bottle production, and Press Molds, used extensively for tableware and flat glass, each requiring different material specifications and precision tolerances. The material segment highlights the shift from traditional cast iron toward high-performance alloys like specialized steels and nickel alloys, driven by the need for superior heat resistance and longevity in high-speed production environments. Understanding these segments is crucial for manufacturers to align their R&D and production capabilities with specific market demands, optimizing resource allocation for the most profitable sectors.

Application-based segmentation provides insight into the primary use cases of the final glass product, with Container Glass representing the largest volume segment due to the vast global requirements of the food, beverage, and pharmaceutical industries. Conversely, segments like Technical Glass (e.g., laboratory equipment) and Flat Glass (used in construction and automotive) demand molds designed for extreme precision or large dimensions, respectively. End-use industry segmentation directly correlates market demand with global economic indicators, showing strong resilience in the pharmaceutical sector and sensitivity to housing and automotive production cycles in the construction and automotive segments. This granular segmentation allows stakeholders to accurately gauge market penetration potential and tailor their product offerings to meet the specific quality, volume, and geometric requirements unique to each application area.

The pharmaceutical industry's heightened requirements for defect-free vials and ampoules necessitate molds capable of micron-level precision and exceptional surface finish, often utilizing complex cooling systems to maintain tight dimensional control. In contrast, the food and beverage industry demands molds optimized for high-volume, rapid production cycles where mold robustness and quick changeover capabilities are paramount. The interdependence of these segmentation variables means that a mold manufacturer specializing in high-alloy press-and-blow molds for pharmaceutical vials operates under a vastly different set of market dynamics and regulatory pressures than one focusing on cast iron blow molds for standard consumer beverage bottles.

- By Product Type:

- Blow Molds (Used primarily for narrow-neck containers like bottles)

- Press Molds (Used for wide-mouth containers, tableware, and some flat glass)

- Press-and-Blow Molds (Hybrid method for medium to wide-mouth containers)

- Vacuum Molds (Specialty molds for complex shapes or technical glass)

- By Material:

- Cast Iron (Standard, cost-effective option)

- Nickel Alloys (High-performance, excellent thermal resistance)

- Steel Alloys (Tool steel, used for high-precision components)

- Ceramic Composites (Emerging, offering ultra-high temperature resistance)

- By Application:

- Container Glass (Food & Beverage bottles, jars, pharmaceutical vials)

- Flat Glass (Architectural glass, automotive windshields)

- Tableware and Decorative Glass

- Technical and Specialty Glass (Fiberglass, laboratory apparatus)

- By End-Use Industry:

- Food & Beverage

- Pharmaceuticals & Healthcare

- Cosmetics & Personal Care

- Construction & Architecture

- Automotive & Transportation

Value Chain Analysis For Glass Forming Mold Market

The value chain for the Glass Forming Mold Market is characterized by a series of specialized steps, beginning with upstream raw material suppliers and culminating in the final deployment and maintenance of the molds at glass manufacturing facilities. Upstream analysis focuses on the procurement of specialized ferrous and non-ferrous metals, primarily high-grade cast iron, nickel, chromium, and specialized tool steels. The quality and purity of these raw materials are absolutely crucial, as they directly determine the thermal stability, erosion resistance, and overall longevity of the mold. Key activities at this stage include sourcing, alloying, and preliminary heat treatment processes managed by specialized foundries and metal suppliers. Fluctuations in global commodity markets, particularly nickel prices, exert a substantial impact on the production costs and subsequent pricing strategies of mold manufacturers.

Midstream activities involve the highly technical process of mold manufacturing itself, encompassing design via Computer-Aided Design (CAD), precision machining (CNC milling, grinding), sophisticated surface treatments (e.g., nitriding, coating), and rigorous quality control. Mold manufacturers often utilize direct distribution channels, negotiating directly with large glass producers to fulfill specific tooling orders tailored to unique product lines, especially in the high-end pharmaceutical and specialty glass sectors. Indirect distribution may involve smaller local distributors or agents, particularly when supplying standardized or replacement components to smaller glassworks globally. The complexity of the product means that the distribution phase often integrates technical support and installation expertise.

Downstream analysis centers on the glass manufacturing operations where the molds are utilized in high-speed Individual Section (IS) machines or pressing lines. The primary users are large, multinational glass conglomerates and smaller, specialized glasshouses. The post-sale phase, including mold maintenance, repair, and refurbishment services, represents a significant and recurring revenue stream for mold suppliers. The direct channel is preferred for complex, high-value orders as it allows for customized technical service and intellectual property protection regarding proprietary mold designs. The efficiency and reliability of the distribution and subsequent support channels are critical competitive differentiators in this market, impacting glass producer uptime and operational costs.

Glass Forming Mold Market Potential Customers

The Glass Forming Mold Market targets a specific group of sophisticated end-users who operate high-volume, continuous manufacturing processes. The primary buyers of glass forming molds are major global glass manufacturers specializing in container glass production. These entities, such as multinational corporations like Owens-Illinois (O-I), Verallia, Ardagh Group, and Gallo Glass, possess vast networks of glass plants globally and require continuous replacement and upgrade of molds to maintain production quality and introduce new product designs. Their demand is driven by consumer trends in packaged goods and commitments to sustainable glass packaging over alternatives like plastic.

Secondary, yet highly profitable, potential customers include manufacturers focused on specialty glass products. This category encompasses pharmaceutical glass producers (vials, ampoules, syringes) demanding extremely high precision and consistency, as well as companies manufacturing architectural flat glass for large-scale commercial and residential construction projects. Furthermore, technical glass manufacturers producing fiberglass, laboratory glassware, or specialized components for electronics also represent a valuable customer base, albeit requiring lower volume but higher complexity molds. These end-users prioritize mold material stability and thermal management capabilities to ensure the integrity of highly sensitive glass compositions.

The buying decision among these end-users is predominantly influenced by mold lifespan, the supplier’s ability to meet precise geometric specifications, and the provision of rapid maintenance and repair services. Long-term supply contracts are common, emphasizing the customer-supplier relationship as a partnership aimed at maximizing production uptime. Glass manufacturers often invest in molds constructed from high-performance materials (nickel alloys) specifically to reduce the frequency of costly production interruptions and maintenance, making cost-per-unit-produced over the mold's lifetime a more significant metric than the initial purchase price.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nikita Moulds, Glass Service, Inc., Bucher Emhart Glass, Omco International, G M Engineering, Changzhou Precision Mold Co., Ltd., JKL Moulding, Ross International, Shandong Sanxing Machinery Co., Ltd., HEINZ-GLAS, Foshan Nanhai Keda Mould Co., Ltd., TORAY INDUSTRIES, INC., Fives Group, P-MEC Glass, Shandong Huateng Machinery Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glass Forming Mold Market Key Technology Landscape

The technological landscape of the Glass Forming Mold Market is rapidly evolving, driven by the need for increased production efficiency, superior surface quality, and extended mold lifespan. A central technological focus is on precision machining and high-speed CNC (Computer Numerical Control) machining, including 5-axis milling capabilities, which are essential for producing complex, asymmetrical mold geometries required for modern bottle designs and lightweighting initiatives. Furthermore, the integration of advanced cooling technologies is paramount; this includes designing molds with optimized, often conformal, cooling channels to ensure uniform heat extraction, drastically reducing thermal shock and enabling faster cycle times in the glass forming process. These technological advancements are moving the industry away from conventional heat exchange methods toward highly sophisticated, digitally controlled thermal management systems.

Additive Manufacturing (AM), or 3D printing, has emerged as a disruptive technology, particularly utilizing metal powders such as nickel alloys, enabling the creation of intricate internal structures that are impossible to produce via traditional casting or subtractive machining. AM allows for the production of molds with internal conformal cooling channels that precisely follow the contour of the glass product, significantly improving thermal homogeneity and product quality. Beyond fabrication, material science innovations are critical. This includes the development and application of advanced mold coatings, such as Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) coatings based on materials like TiN (Titanium Nitride) or diamond-like carbon (DLC), which provide enhanced hardness, abrasion resistance, and reduced adherence of molten glass, thereby minimizing downtime for mold cleaning.

The pervasive trend of Industry 4.0 integration is transforming how molds are utilized and maintained. Smart molds equipped with embedded Internet of Things (IoT) sensors are becoming common. These sensors monitor critical parameters such as temperature distribution, internal pressure, and vibration in real-time. This data feeds into cloud-based analytics platforms and AI algorithms, facilitating predictive maintenance, optimizing machine settings automatically, and diagnosing potential failure points before they lead to production stoppages. This fusion of material engineering, precision manufacturing, and digital sensing represents the future of mold technology, shifting the focus from simply manufacturing a tool to delivering a high-performance, intelligent tooling solution.

- Precision Machining: High-speed 5-axis CNC machining for complex geometries and micron-level tolerances, especially for lightweight glass containers.

- Additive Manufacturing (AM): Metal 3D printing (e.g., DMLS/SLM using nickel alloys) for molds featuring complex conformal cooling channels to optimize heat extraction.

- Advanced Coatings: Application of PVD/CVD coatings (e.g., Titanium Nitride, Chromium Carbide) to enhance mold surface hardness, corrosion resistance, and release properties.

- Thermal Management Systems: Implementation of highly optimized cooling channel designs, sometimes utilizing liquid cooling circuits, to control temperature uniformity and increase forming speeds.

- IoT and Sensor Integration: Embedding smart sensors (thermocouples, pressure sensors) into molds to enable real-time monitoring and data collection for predictive maintenance and process optimization.

- Metallurgy and Alloys: Continued research into new high-nickel and specialized tool steel alloys offering superior thermal conductivity, wear resistance, and resistance to oxidation at high temperatures.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for glass forming molds globally. This dominance is driven by high population density, rapid industrialization, and massive infrastructural investments, particularly in China, India, and Southeast Asian countries. The escalating demand for consumer packaged goods, coupled with regulatory pushes in certain nations favoring glass for pharmaceutical packaging, fuels substantial demand for new glass manufacturing capacity and associated molds. The region serves as a global manufacturing hub, necessitating high-volume, cost-effective molds, alongside a growing demand for premium, specialized molds catering to the burgeoning middle-class consumption of premium beverages.

- Europe: Characterized by a mature and highly automated glass industry, Europe is a key consumer of high-precision, long-life molds, focusing heavily on sustainability and quality standards. Demand is primarily driven by replacement cycles, technological upgrades (e.g., lightweighting molds), and the pharmaceutical sector. Western European countries are leaders in adopting specialized nickel alloys and advanced cooling technologies to meet stringent quality requirements and achieve high levels of energy efficiency in production. Regulatory pressure regarding environmental impact also mandates the use of molds that reduce glass rejects and optimize material usage.

- North America: The North American market is stable and mature, characterized by a high adoption rate of advanced manufacturing techniques, including the early integration of smart molds and predictive maintenance systems. Demand is sustained by the expansive food and beverage sector, alongside significant requirements from the automotive industry (flat glass). Key focus areas for mold suppliers include rapid prototyping, reducing lead times, and providing end-to-end technical support services, driving competition based on technological superiority rather than cost alone.

- Latin America (LATAM): This region exhibits moderate growth, tied closely to economic stability and investment in the domestic beverage industry, particularly in Brazil and Mexico. The market often seeks cost-effective mold solutions but shows increasing interest in modern, durable molds as manufacturers upgrade aging machinery to improve efficiency and competitiveness against global imports.

- Middle East and Africa (MEA): Growth in MEA is highly localized, concentrated primarily in the GCC countries and South Africa, driven by construction booms and expanding soft drink and water bottling operations. While smaller in scale, the market shows potential due to diversification efforts and reliance on imported glass manufacturing expertise, translating into demand for molds tailored to extreme operating conditions (high ambient temperatures).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glass Forming Mold Market.- Nikita Moulds

- Glass Service, Inc.

- Bucher Emhart Glass

- Omco International

- G M Engineering

- Changzhou Precision Mold Co., Ltd.

- JKL Moulding

- Ross International

- Shandong Sanxing Machinery Co., Ltd.

- HEINZ-GLAS

- Foshan Nanhai Keda Mould Co., Ltd.

- TORAY INDUSTRIES, INC. (In material supply and R&D)

- Fives Group

- P-MEC Glass

- Shandong Huateng Machinery Co., Ltd.

- Cimprogetti S.p.A.

- Toyo Glass Machinery Co., Ltd.

- Vidrala S.A. (As a major end-user and technology integrator)

- Accurate Moulds

- MSK Kolding A/S

Frequently Asked Questions

Analyze common user questions about the Glass Forming Mold market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for glass forming molds?

The primary demand drivers are the global consumer shift toward sustainable and recyclable glass packaging, rapid growth in the pharmaceutical packaging sector requiring high-precision molds, and continuous technological advancements improving mold durability and production efficiency.

How does Additive Manufacturing (3D Printing) impact mold production?

Additive Manufacturing (AM) allows mold manufacturers to create complex, intricate mold geometries, particularly those incorporating optimized internal conformal cooling channels, significantly enhancing heat exchange efficiency and extending the mold's operational lifespan compared to traditionally manufactured molds.

Which material segment holds the highest growth potential in the mold market?

The Nickel Alloys and specialized tool steel segments demonstrate the highest growth potential, driven by the requirement for superior thermal shock resistance, abrasion resistance, and longevity needed for high-speed, lightweight glass manufacturing processes, offering a superior cost-per-use value.

Which region is leading the market adoption of glass forming molds?

The Asia Pacific (APAC) region currently leads the market in volume and growth rate due to massive investments in new glass manufacturing plants, driven by rising consumer demand for packaged goods and large-scale construction projects in countries like China and India.

What role do smart molds play in modern glass manufacturing?

Smart molds integrate IoT sensors to monitor critical parameters like temperature and wear in real-time. This data feeds into AI systems, enabling predictive maintenance, minimizing unplanned downtime, optimizing production cycle times, and significantly improving the overall consistency and quality of the finished glass products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager