Glaucoma Treatment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435915 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Glaucoma Treatment Market Size

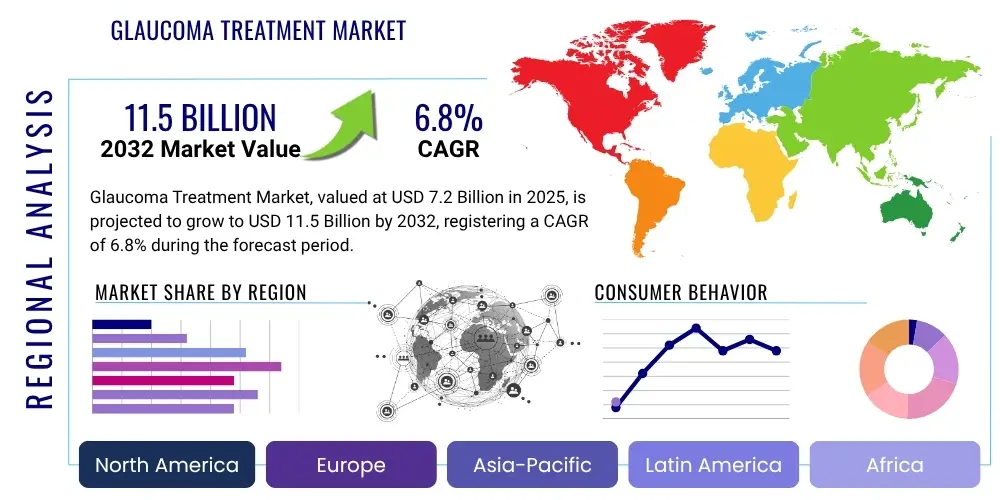

The Glaucoma Treatment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

Glaucoma Treatment Market introduction

The Glaucoma Treatment Market encompasses pharmaceuticals, surgical devices, and laser therapies designed to manage or cure glaucoma, a group of eye conditions that damage the optic nerve, often due to abnormally high pressure in the eye (intraocular pressure or IOP). The primary objective of treatment is to reduce IOP and prevent irreversible vision loss. As glaucoma is the second leading cause of blindness globally, the demand for effective, safe, and long-term treatment modalities remains critically high, particularly in aging populations worldwide. The market includes pharmacological agents such as prostaglandin analogs, beta-blockers, alpha agonists, and combination drugs, alongside advanced surgical procedures like Minimally Invasive Glaucoma Surgery (MIGS) and traditional filtration surgeries.

Product descriptions within this market vary significantly, ranging from simple, once-daily eye drops (which constitute the first line of defense) to complex implantable devices used in surgical settings. Pharmaceutical treatment dominates the initial phase of disease management due to its non-invasiveness and efficacy in lowering IOP in early-stage glaucoma. However, poor patient adherence, systemic side effects, and insufficient IOP lowering in advanced cases drive the adoption of surgical alternatives. Major applications of these treatments include primary open-angle glaucoma (POAG) treatment, which accounts for the vast majority of cases, and secondary glaucoma management stemming from underlying conditions such as inflammation or trauma.

The benefits associated with timely glaucoma treatment are profound, fundamentally preserving patients' quality of life by halting or slowing the progression of vision field loss. Driving factors for market expansion include the increasing prevalence of geriatric populations, who are highly susceptible to the disease, improved diagnostic capabilities leading to earlier intervention, and continuous innovation in drug delivery systems and surgical devices, specifically the burgeoning field of MIGS. Furthermore, increased healthcare expenditure and greater awareness programs, particularly in developing economies, are contributing significantly to higher diagnosis rates and subsequent treatment initiation, pushing market valuation upwards across all key geographical regions.

The introduction of novel drug candidates with enhanced efficacy profiles, reduced side effects, and less frequent dosing regimens is a significant catalyst. Pharmaceutical companies are heavily investing in sustained-release drug delivery systems, such as implants or punctal plugs, aiming to improve patient compliance, which is historically a major challenge in chronic glaucoma management. Simultaneously, the surgical landscape is undergoing a revolutionary shift toward micro-invasive techniques. MIGS procedures offer faster recovery times, fewer complications, and lower costs compared to traditional trabeculectomy, making them increasingly popular among surgeons and patients alike. This dual-pronged innovation approach—both pharmacological and surgical—ensures a robust pipeline and sustained market growth throughout the forecast period.

Demographic shifts remain paramount. The global increase in life expectancy means a larger cohort of individuals living long enough to develop age-related ocular conditions, including glaucoma. This inherent demographic driver ensures a steady, expanding patient pool. Additionally, the growing incidence of co-morbidities such as diabetes and hypertension, which are often linked to secondary glaucoma or accelerated disease progression, further bolsters the need for advanced treatment options. The continuous refinement of diagnostic technologies, such as advanced Optical Coherence Tomography (OCT) and visual field testing, allows clinicians to detect subtle changes earlier, facilitating intervention before significant optic nerve damage occurs, thereby expanding the population eligible for treatment.

Glaucoma Treatment Market Executive Summary

The Glaucoma Treatment Market is characterized by robust growth, driven primarily by demographic aging, technological shifts towards minimally invasive surgeries, and high R&D investment in sustained-release pharmaceuticals. Business trends highlight a consolidation among major players acquiring specialized technology firms, particularly in the MIGS segment, to diversify their product portfolios and capture a greater share of the procedural market. Regional trends show North America maintaining dominance due to high healthcare spending and quick adoption of advanced technology, while the Asia Pacific region is emerging as the fastest-growing market, propelled by rapidly increasing prevalence rates, improving healthcare infrastructure, and rising disposable incomes. Segment trends indicate that the pharmacological segment, specifically Prostaglandin Analogs (PGAs), holds the largest revenue share, though the surgical segment, spearheaded by MIGS devices, is projected to register the highest CAGR, reflecting a growing preference for combined therapy approaches that include surgical intervention earlier in the disease progression.

The pharmaceutical sector is strategically moving away from traditional daily drops towards innovative drug delivery systems. This strategic pivot addresses the long-standing challenge of patient non-adherence, which severely impacts treatment outcomes. Companies are focusing on producing biodegradable implants, subconjunctival injections, and ocular inserts that release medication steadily over several months, thus significantly enhancing therapeutic compliance and maximizing treatment efficacy. This focus on long-term drug retention represents a major business trend, ensuring recurring revenue streams for manufacturers and better clinical results for patients. Moreover, the increasing regulatory approvals for generic versions of established drugs are also shaping the competitive landscape, putting pressure on branded drug manufacturers to innovate continuously to maintain premium pricing power.

From a regional perspective, the mature markets of North America and Western Europe are driven by the high penetration of sophisticated diagnostic and treatment modalities, including premium MIGS devices and complex drug formulations. These regions benefit from comprehensive reimbursement policies and established clinical guidelines that favor evidence-based, cutting-edge treatments. Conversely, emerging markets like China and India represent massive untapped potential. Although current per-capita spending is lower, the sheer volume of undiagnosed and untreated glaucoma patients, coupled with governmental efforts to improve eye care access (such as large-scale screening programs), ensures that the APAC region will be the primary engine of future volume growth. Local manufacturing and distribution partnerships are key strategic initiatives for global companies aiming to penetrate these high-growth regions.

Analysis of market segments further reveals a dynamic transition in treatment paradigms. While the drug segment remains fundamental, the surgical segment's exponential growth is undeniable. MIGS devices, including micro-stents, shunts, and trabecular bypass devices, are fundamentally changing the management protocol. These surgeries are increasingly performed concurrently with cataract surgery, expanding their applicability and market reach. The movement towards intervention earlier in the disease course, rather than reserving surgery as a last resort, signifies a shift in clinical philosophy. Furthermore, the segmentation by end-user highlights hospitals and specialty ophthalmic clinics as key revenue generators, with Ambulatory Surgical Centers (ASCs) gaining traction due to their cost-effectiveness and efficiency in performing outpatient surgical procedures like MIGS, thereby optimizing healthcare delivery systems.

AI Impact Analysis on Glaucoma Treatment Market

User inquiries regarding Artificial Intelligence (AI) in glaucoma treatment frequently center on its ability to enhance early diagnosis, predict disease progression, and personalize therapeutic interventions. Common questions revolve around the accuracy of AI algorithms in interpreting complex imaging data (such as OCT and fundus photographs), the integration of these AI tools into existing clinical workflows, and the potential for AI-driven systems to reduce diagnostic errors and workload for ophthalmologists. Users are keenly interested in predictive analytics—specifically, how AI can forecast which patients will respond best to medical vs. surgical treatment, and the expected reduction in healthcare costs due to optimized screening and resource allocation. The overriding theme is the expectation that AI will transition glaucoma management from a reactive approach based on established damage to a proactive, predictive, and preventative model, optimizing the timing and type of intervention.

- AI integration significantly accelerates the diagnostic process by automatically analyzing optic nerve images and visual field data, detecting subtle signs of damage before human experts might.

- Predictive modeling powered by machine learning algorithms assesses personalized risk profiles, allowing clinicians to forecast the rate of progression and determine optimal intervention points.

- AI-driven personalized medicine selects the most effective drug class or surgical technique for individual patients, improving treatment success rates and minimizing adverse effects.

- Improved clinical trial efficiency through AI-assisted patient selection, monitoring, and data analysis, accelerating the development of new pharmacological agents and devices.

- Automated remote monitoring solutions leverage AI to track IOP and other biomarkers outside the clinic, enhancing patient compliance and providing real-time data for timely clinical adjustments.

- Enhanced surgical planning and robotic assistance utilizing AI for precision in complex procedures, particularly in optimizing placement and orientation of MIGS devices.

The application of deep learning algorithms to large-scale datasets of ophthalmic images and patient records promises a revolution in screening efficiency, especially in underserved populations where specialist access is limited. AI models can be deployed on portable devices to perform preliminary screening, flagging high-risk individuals for immediate referral. This capability addresses a major public health challenge: the significant percentage of glaucoma patients who remain undiagnosed until the disease is advanced. Furthermore, AI systems are crucial in standardizing the interpretation of diagnostic tests, reducing inter-observer variability and leading to more consistent clinical decision-making across different healthcare settings.

In the therapeutic domain, AI’s impact is becoming increasingly procedural. Beyond simply diagnosing, AI algorithms can predict the likelihood of success for various surgical interventions, such as Trabeculectomy versus various MIGS procedures, based on patient-specific anatomical and demographic data. This high degree of predictability reduces unnecessary surgical risks and optimizes resource utilization. For pharmaceutical treatments, AI is being used to analyze genetic markers and patient response data to tailor drug prescriptions, moving beyond the current trial-and-error approach. This shift towards data-driven, precision ophthalmology is expected to drive demand for integrated diagnostic and therapeutic platforms, pushing software developers and medical device manufacturers into collaborative ventures.

However, the integration of AI also presents implementation challenges, notably the need for robust validation studies, regulatory approval for clinical use, and ensuring data privacy and security (particularly concerning sensitive medical imagery). Clinician acceptance also requires high levels of trust in the algorithms’ reliability. Despite these hurdles, the consensus is that AI represents a transformative force, enabling earlier, more accurate detection and customized management strategies, ultimately improving long-term patient outcomes and significantly expanding the market for technology-enabled glaucoma solutions and associated data infrastructure services.

DRO & Impact Forces Of Glaucoma Treatment Market

The Glaucoma Treatment Market is driven by the rising global prevalence of the disease, directly correlated with the aging population, and continuous technological advancements, particularly in Minimally Invasive Glaucoma Surgery (MIGS) and sustained-release drug delivery systems. Restraints include the high cost of advanced treatments, limited patient adherence to long-term pharmacological regimens, and the significant proportion of undiagnosed cases, especially in low- and middle-income countries. Opportunities are centered on expanding outreach through enhanced public awareness campaigns, penetrating emerging markets with growing healthcare access, and developing integrated AI-driven screening and management platforms. These forces collectively exert substantial influence, with the demographic imperative acting as the strongest long-term driver, countered by cost-containment pressures and the need for innovation that improves adherence and accessibility.

Drivers: The dominant driver remains the demographic shift, specifically the global increase in individuals over the age of 60, who are at significantly higher risk for glaucoma. This population growth ensures a constantly expanding patient pool requiring chronic care. Secondly, substantial R&D investments by pharmaceutical and medical device companies are yielding superior products; the development of highly effective, low-risk MIGS devices has fundamentally expanded the surgical treatment landscape, making intervention more palatable for both patients and surgeons. Furthermore, improved reimbursement policies across major markets, particularly for newer surgical procedures, incentivize the adoption of advanced treatments, accelerating market penetration.

Restraints: A primary restraint is the critical challenge of patient non-adherence to daily topical medications, which leads to uncontrolled IOP and vision loss, ultimately hindering the effectiveness of pharmacological therapy and driving up overall healthcare costs. Another significant barrier is the diagnostic lag; globally, many patients remain unaware they have the condition until irreversible vision damage has occurred, limiting the addressable market for early-stage intervention. The high cumulative cost of lifetime treatment, encompassing repeated consultations, medications, and potential surgeries, particularly in systems with high out-of-pocket expenses, also acts as a constraint, leading to under-treatment among economically vulnerable populations.

Opportunities: The market has vast opportunities in developing sustained-release drug reservoirs (e.g., implants) that circumvent daily dosing issues, thereby maximizing adherence and efficacy. Geographical expansion into populous emerging economies, coupled with public-private partnerships to establish subsidized screening programs, presents a massive opportunity to capture the currently undiagnosed population. Furthermore, the integration of telehealth and remote monitoring technologies offers a scalable solution for managing chronic glaucoma patients efficiently, improving clinical outcomes while lowering the burden on specialized clinics. Innovation in neuroprotection—developing therapies that protect the optic nerve independent of IOP reduction—represents a long-term, high-value opportunity.

Impact Forces: The interplay of these factors creates significant impact forces. The high prevalence acts as a persistent demand pull. The rapid innovation cycle, particularly in MIGS, creates competitive pressure, forcing companies to continuously refine devices for better efficacy and safety profiles. Regulatory harmonization (or lack thereof) across major markets significantly impacts market entry and product timelines. Lastly, the increasing focus on value-based care models encourages the adoption of cost-effective, long-term solutions (like sustained-release drugs and one-time surgical interventions) over lifelong reliance on high-cost, low-adherence topical medications, fundamentally altering purchasing decisions in large healthcare systems.

Segmentation Analysis

The Glaucoma Treatment Market is comprehensively segmented based on therapeutic approach, drug class, surgical method, and end-user, providing a granular view of market dynamics and adoption patterns. The segmentation by treatment type is crucial, dividing the market between pharmacological (medications) and surgical therapies. Within the drug segment, the dominance of Prostaglandin Analogs (PGAs) is well-established due to their high efficacy and favorable dosing schedule. The surgical segment is undergoing the most dynamic growth, largely driven by the adoption of Minimally Invasive Glaucoma Surgery (MIGS) devices over traditional incisional surgeries like trabeculectomy, reflecting a global trend toward safer, less invasive procedures with quicker recovery profiles. End-user segmentation confirms that hospitals and specialized ophthalmic clinics remain the primary consumption hubs due to their infrastructure capacity for complex diagnostics and advanced surgical interventions.

- By Treatment Type:

- Pharmacological Treatment (Eye Drops, Oral Medications)

- Surgical Treatment (Laser Therapy, Incisional Surgery, MIGS)

- By Drug Class:

- Prostaglandin Analogs (PGAs)

- Beta-Blockers

- Alpha Adrenergic Agonists

- Carbonic Anhydrase Inhibitors (CAIs)

- Combination Drugs

- By Disease Type:

- Primary Open-Angle Glaucoma (POAG)

- Angle-Closure Glaucoma (ACG)

- Secondary Glaucoma

- Congenital Glaucoma

- By Surgery Type:

- Minimally Invasive Glaucoma Surgery (MIGS) Devices

- Trabeculectomy and Tube Shunt Surgeries

- Laser Therapy (Selective Laser Trabeculoplasty SLT and Argon Laser Trabeculoplasty ALT)

- By End User:

- Hospitals

- Ophthalmic Clinics and Specialty Centers

- Ambulatory Surgical Centers (ASCs)

The segmentation by drug class is foundational, reflecting clinical guidelines that favor PGAs as the first-line treatment due to their powerful IOP-lowering capabilities and once-daily dosing. The subsequent growth in combination drugs highlights the need for synergistic effects in patients requiring further IOP reduction, optimizing convenience and adherence. The market share of older drug classes, like beta-blockers and CAIs, is diminishing relative to PGAs, but they remain vital second-line or additive therapies, particularly where PGAs are contraindicated or ineffective. The continuous expiry of patents in this segment also paves the way for intense competition from generics, which affects pricing dynamics globally.

Surgical segmentation illustrates the most radical shifts. MIGS has rapidly gained acceptance as a bridge between medication and traditional, high-risk filtration surgery. These devices include micro-stents (e.g., iStent), micro-shunts (e.g., Xen), and specialized devices designed for suprachoroidal or subconjunctival drainage. The appeal of MIGS lies in its minimal trauma, rapid post-operative recovery, and suitability for combination with cataract surgery, making it a highly attractive option for the large demographic of older patients requiring both procedures. The adoption rate of MIGS is highly correlated with reimbursement status in mature markets, indicating that favorable payer policies are a critical factor in driving this segment's growth far beyond that of traditional, more invasive surgeries.

Value Chain Analysis For Glaucoma Treatment Market

The value chain for the Glaucoma Treatment Market begins with rigorous Upstream Activities, involving raw material sourcing, active pharmaceutical ingredient (API) synthesis, and the design and manufacturing of complex surgical devices (especially micro-implants for MIGS). This phase is characterized by high R&D intensity and strict regulatory compliance. The Midstream focuses on manufacturing, quality control, formulation (for drugs), and assembly (for devices). Downstream Analysis involves complex distribution channels, marketing strategies, and final delivery to End-Users, primarily hospitals, clinics, and pharmacies. Distribution is a crucial link, relying heavily on specialized third-party logistics (3PL) providers for cold-chain management (for certain biological treatments) and precision inventory management for high-value surgical devices. The channel structure involves both Direct Sales (high-value devices to hospitals) and Indirect Channels (wholesalers/distributors for pharmaceuticals to pharmacies and clinics), optimized to ensure wide geographic reach and timely supply.

Upstream operations are dominated by specialized chemical and biotechnological companies that provide the essential components. For pharmaceutical treatments, securing reliable and cost-effective API synthesis, which must meet stringent Good Manufacturing Practice (GMP) standards, is paramount. For surgical devices, high precision engineering firms are critical in producing biocompatible materials and miniature components required for MIGS. The high entry barrier in the upstream segment relates to intellectual property (patents protecting novel drug compounds or device designs) and the massive capital investment required for establishing compliant R&D and manufacturing facilities. Optimization in this stage focuses on process chemistry improvements and efficient supply chain management to reduce the cost of goods sold (COGS).

The Downstream phase is characterized by complex interactions with various stakeholders. The distribution channel is segmented: direct sales teams are deployed to manage high-touch relationships with key opinion leaders (KOLs) and large hospital networks for surgical device sales, which require intensive clinical training and technical support. Conversely, the high-volume pharmaceutical segment relies more on indirect channels, utilizing regional wholesalers who manage inventory and reach thousands of independent pharmacies and smaller clinics. Effective marketing in the downstream segment involves both professional medical education (CME programs) to influence prescribing and procedural preferences and direct-to-consumer (DTC) advertising, particularly in regions like the U.S., to drive patient awareness and demand for specific branded treatments or procedures. Payers (insurance companies and government health systems) wield significant power in this stage, influencing market access and pricing through formulary inclusions and reimbursement policies.

The efficiency of the entire value chain hinges on seamless coordination between R&D, manufacturing, and commercialization activities. For instance, the successful launch of a new MIGS device requires not only a high-quality product but also robust training programs for surgeons and effective market access strategies to secure favorable reimbursement coding. Furthermore, the role of healthcare providers, specifically ophthalmologists and optometrists, cannot be overstated, as they are the key decision-makers who influence product demand based on clinical evidence, safety profiles, and ease of use. Value chain profitability is maximized by companies that successfully integrate vertical aspects, controlling specialized manufacturing, optimizing distribution logistics, and leveraging strong relationships with key clinical and payer groups globally.

Glaucoma Treatment Market Potential Customers

Potential customers for the Glaucoma Treatment Market primarily include end-users such as institutional healthcare providers, individual patients suffering from the condition, and intermediate distribution channels like specialized pharmacies. Hospitals, particularly those with dedicated ophthalmology departments, represent high-volume customers for both surgical devices and high-cost injectable/implantable drugs, benefiting from centralized purchasing power and performing the majority of complex surgeries like trabeculectomy and the initial wave of MIGS procedures. Ophthalmic clinics and Ambulatory Surgical Centers (ASCs) are rapidly growing customer segments, increasingly adopting less invasive treatments such as SLT laser therapy and advanced MIGS procedures due to their efficiency and outpatient setting suitability. Ultimately, the individual patient, often elderly and requiring chronic, lifelong management, is the consumer driving demand, purchasing daily drops through retail and specialty pharmacies, or opting for surgical solutions recommended by their physician.

Hospitals remain critical potential customers because they serve as referral centers for severe and complex glaucoma cases, where traditional or complex filtration surgeries are still required. Their purchasing decisions are heavily influenced by clinical efficacy data, cost-effectiveness analyses for high-volume procedures, and the comprehensive service agreements offered by manufacturers. As teaching institutions, hospitals also drive adoption of the latest technologies through training programs. Meanwhile, the accelerating adoption of ASCs as end-users is a crucial market development. ASCs favor procedures like MIGS that can be performed quickly under local anesthesia, offering lower overhead costs compared to inpatient hospital settings. Manufacturers tailor their device sales and support structure to meet the fast-paced, efficiency-driven environment of ASCs, making them highly desirable customers for device companies.

Furthermore, specialized retail and mail-order pharmacies constitute a major customer segment for the vast array of prescription glaucoma medications. Their demand is driven by the volume of prescriptions written by ophthalmologists and optometrists. Pharmacists also play an indirect role in customer engagement by influencing adherence through counseling and dispensing convenience. The final, yet increasingly important, customer segment comprises payers (government bodies, private insurers, and Managed Care Organizations). While they don't consume the product, their policies dictate market access and pricing. Manufacturers must strategically target these payers with pharmacoeconomic data demonstrating the long-term value and cost-savings of their treatments (e.g., sustained-release implants reducing the need for emergency care or subsequent surgeries) to ensure favorable reimbursement for end-users and patients, solidifying the commercial viability of the products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AbbVie (Allergan), Novartis (Alcon), Bausch Health Companies, Pfizer Inc., Santen Pharmaceutical Co. Ltd., Aerie Pharmaceuticals Inc., Amgen (Horizon Therapeutics), iSTAR Medical, Glaukos Corporation, Ivantis (acquired by Alcon), Johnson & Johnson Vision, Boston Scientific, Ellex Medical Lasers Ltd. (part of Quantel Medical), New World Medical, InnFocus (acquired by Santen), Katalyst Surgical, Sight Sciences, Topcon Corporation, Carl Zeiss Meditec, Lumenis. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glaucoma Treatment Market Key Technology Landscape

The technology landscape of the Glaucoma Treatment Market is rapidly evolving, driven by the imperative to improve therapeutic efficacy, safety, and patient adherence. The most significant technological advancements are clustered in two areas: sustained-release drug delivery systems and Minimally Invasive Glaucoma Surgery (MIGS). Sustained-release technologies, such as biodegradable implants placed in the anterior chamber or punctal plugs, aim to provide consistent drug levels over months, eliminating the compliance issues associated with daily eye drops. These innovations reduce peak-to-trough variation in IOP, leading to better long-term control. Simultaneously, the proliferation of specialized MIGS devices, which target different anatomical outflow pathways (trabecular meshwork, Schlemm’s canal, or suprachoroidal space) through micro-incisions, represents a technological paradigm shift away from traditional, high-complication filtration surgeries, making surgical intervention accessible earlier in the disease progression and expanding the pool of patients eligible for safe surgical management.

In the pharmaceutical realm, technological focus is shifting toward innovative formulations and novel molecular targets. Beyond merely enhancing existing drug classes (like the highly effective prostaglandin analogs), research is heavily invested in neuroprotection—developing compounds that directly shield the vulnerable retinal ganglion cells and the optic nerve from damage, independent of intraocular pressure reduction. This represents a frontier technology aimed at addressing the fundamental cause of vision loss in glaucoma, rather than just managing IOP, which is a risk factor. Advances in genetic sequencing and targeted therapy delivery are also key, enabling the development of treatments specific to certain genetic forms of glaucoma, ensuring greater precision in treatment protocols. Furthermore, advancements in diagnostic imaging, particularly high-resolution Optical Coherence Tomography (OCT) systems integrated with AI, are essential components of the technology ecosystem, providing the crucial data required for monitoring treatment efficacy and progression detection.

The adoption of advanced surgical tools is transforming procedural safety and outcomes. Modern laser technologies, such as Selective Laser Trabeculoplasty (SLT), offer a low-risk, repeatable treatment option that is non-thermal, preserving the tissue structure. In the device segment, MIGS technologies are continually being refined. Second and third-generation devices are focusing on better long-term IOP lowering and simplified implantation techniques. Examples include the continuous development of Schlemm's canal scaffolding devices, micro-shunts that divert aqueous humor, and sustained-release micro-implants that combine surgical placement with pharmaceutical delivery. The integration of 3D imaging and micro-robotics into the surgical suite is also an emerging technology that promises to further enhance the precision and standardization of these micro-invasive procedures, cementing the role of technology in driving superior clinical outcomes and optimizing healthcare resource utilization across the global glaucoma treatment landscape.

Regional Highlights

- North America: North America, comprising the United States and Canada, dominates the global Glaucoma Treatment Market in terms of revenue share. This dominance is attributable to several factors: highly advanced healthcare infrastructure, high per capita healthcare spending, favorable reimbursement policies for innovative treatments (especially MIGS devices and high-cost branded pharmaceuticals), and high patient awareness. The region is a primary early adopter of novel technologies, including sustained-release drug implants and AI-driven diagnostic tools. The high prevalence of glaucoma coupled with a well-established regulatory pathway facilitates quick market entry for new products, solidifying the region's position as the leading revenue generator. The market here is mature but characterized by high technological velocity and intense competition among key players.

- Europe: Europe represents a robust and diverse market, driven by universal healthcare coverage and comprehensive clinical guidelines across major economies like Germany, the UK, and France. While regulatory pathways (via the CE Mark) are generally efficient, pricing pressures and cost-containment measures by national health services (NHS) often restrict the adoption of the most expensive treatments compared to the US. The market sees strong adoption of both generics (due to price sensitivity) and advanced MIGS procedures. Western European countries exhibit high diagnostic rates and treatment standards, while Eastern Europe presents growth opportunities as healthcare infrastructure and disposable incomes improve, driving demand for both pharmaceutical and surgical treatments.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market globally due to its vast patient population, rapidly aging demographics (particularly in Japan and China), and significant improvements in healthcare access and infrastructure across developing nations like India and Southeast Asian countries. While treatment awareness and diagnosis rates remain lower than in Western regions, the sheer scale of the undiagnosed population presents a massive opportunity. Market growth is powered by increasing government investment in public health, rising medical tourism, and localized manufacturing of cost-effective generic drugs and surgical devices, making treatment more affordable and accessible to a larger segment of the population.

- Latin America (LATAM): The LATAM market growth is driven by increasing penetration of multinational pharmaceutical and device companies, urbanization, and the expansion of private healthcare facilities. Key countries like Brazil and Mexico contribute significantly to regional revenue. However, challenges persist related to fragmented healthcare systems, economic volatility impacting healthcare expenditure, and limited reimbursement for premium-priced surgical innovations. The market is moderately mature for pharmacological treatments but is rapidly accelerating in the adoption of basic and mid-tier surgical options.

- Middle East and Africa (MEA): MEA presents mixed dynamics. The Gulf Cooperation Council (GCC) countries demonstrate high spending power and adopt advanced technologies rapidly, often mirroring North American trends due to robust private healthcare systems and medical tourism initiatives. Conversely, the African market faces significant challenges, including low patient awareness, lack of specialized ophthalmologists, and limited access to affordable medication. Growth in this region will be largely dependent on philanthropic initiatives and subsidized public health programs aimed at tackling blindness prevention and improving primary eye care infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glaucoma Treatment Market.- AbbVie (Allergan)

- Novartis (Alcon)

- Bausch Health Companies Inc.

- Pfizer Inc.

- Santen Pharmaceutical Co. Ltd.

- Aerie Pharmaceuticals Inc.

- Glaukos Corporation

- Ivantis (acquired by Alcon)

- Sight Sciences

- New World Medical

- Johnson & Johnson Vision

- Topcon Corporation

- Carl Zeiss Meditec AG

- Katalyst Surgical

- Ellex Medical Lasers Ltd. (part of Quantel Medical)

- Boston Scientific Corporation

- Amgen (Horizon Therapeutics)

- Iridex Corporation

- Lumenis Ltd.

- InFocus Inc. (acquired by Santen)

Frequently Asked Questions

Analyze common user questions about the Glaucoma Treatment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Glaucoma Treatment Market?

The primary driver is the accelerating aging of the global population, as glaucoma prevalence significantly increases with age. This demographic shift ensures a continually expanding patient base requiring lifelong chronic management and specialized care, coupled with rising adoption of advanced minimally invasive surgical techniques (MIGS).

How are Minimally Invasive Glaucoma Surgery (MIGS) devices impacting traditional surgical methods?

MIGS devices are rapidly displacing traditional incisional surgeries (like trabeculectomy) for early-to-moderate stage glaucoma. MIGS offers superior safety profiles, faster recovery times, and are often performed concurrently with cataract surgery, fundamentally changing clinical protocols and leading to earlier surgical intervention.

Which geographical region holds the largest market share for glaucoma treatment?

North America currently holds the largest revenue share in the Glaucoma Treatment Market, driven by high adoption rates of premium technologies, sophisticated healthcare infrastructure, and favorable reimbursement structures for specialized medications and surgical procedures.

What technological innovations are addressing the challenge of patient adherence to eye drops?

Technological innovations focus heavily on sustained-release drug delivery systems, including biodegradable ocular implants, punctal plugs, and subconjunctival injections, which release medication consistently over several months, minimizing patient reliance on daily topical applications and improving overall therapeutic compliance.

What is the anticipated role of Artificial Intelligence (AI) in future glaucoma management?

AI is expected to revolutionize glaucoma management by significantly enhancing early detection through automated analysis of complex ophthalmic imagery, predicting individual disease progression, and personalizing treatment plans, thereby optimizing the timing and efficacy of both pharmacological and surgical interventions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Glaucoma Treatment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Glaucoma Treatment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Open Angle Glaucoma, Closed Angle Glaucoma, Secondary Glaucoma, Congenital Glaucoma, Others), By Application (Hospitals, Ophthalmic Clinics, Ambulatory Surgical Centers), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Glaucoma Treatment Drugs Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Prostaglandin Analogs (PGAs), Alpha Agonist, Beta Blockers, Cholinergic Drugs, Carbonic Anhydrase Inhibitors, Others), By Application (Hospital, Clinic, Home Care), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager