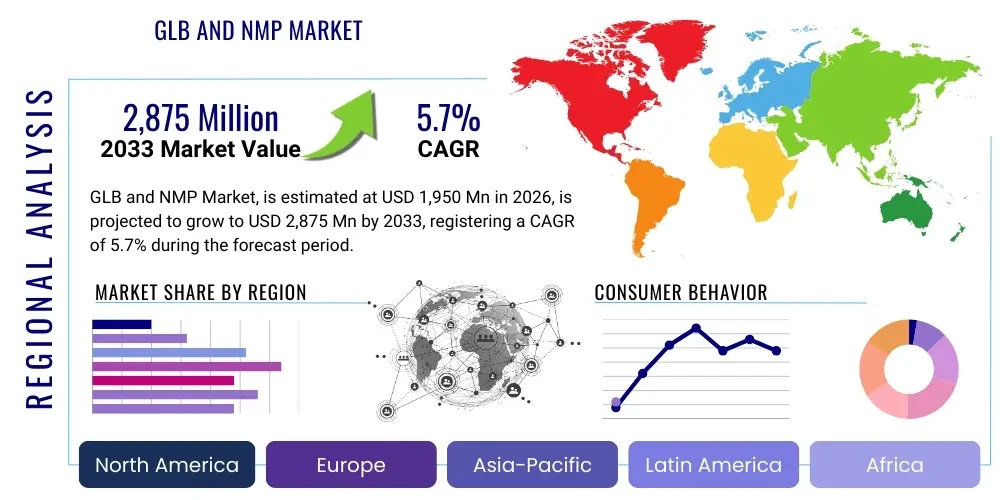

GLB and NMP Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435850 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

GLB and NMP Market Size

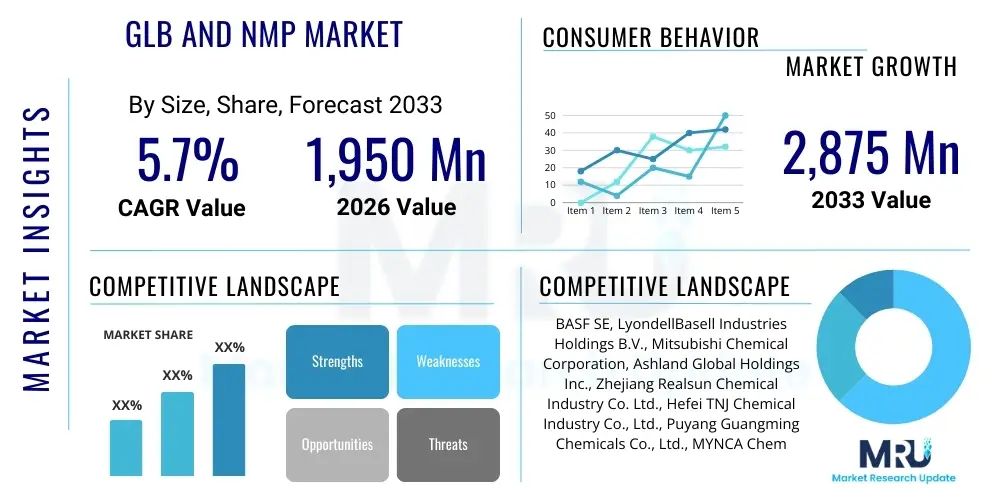

The GLB and NMP Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% between 2026 and 2033. The market is estimated at USD 1,950 Million in 2026 and is projected to reach USD 2,875 Million by the end of the forecast period in 2033.

The market expansion for Gamma-Butyrolactone (GLB) and N-Methyl-2-pyrrolidone (NMP) is fundamentally driven by the accelerating demand across high-growth technological sectors, particularly the energy storage industry. NMP, known for its excellent solvency and high boiling point, is indispensable in the production of cathode slurries for lithium-ion batteries (Li-ion), a critical component powering electric vehicles (EVs) and grid storage systems. As global regulatory bodies continue to mandate decarbonization efforts and promote sustainable transportation, the deployment of Li-ion battery manufacturing facilities globally necessitates a sustained and growing supply of high-purity NMP. Concurrently, GLB serves as a crucial intermediate, precursor, or solvent in various applications, including pharmaceutical synthesis, agrochemical manufacturing, and the production of specialized polymers, solidifying its steady market position.

Furthermore, the shift towards advanced manufacturing techniques and the growing focus on solvent recovery and recycling significantly influence market dynamics. While NMP faces regulatory scrutiny in certain regions, particularly in Europe, due to its classification as a substance of very high concern (SVHC), this pressure simultaneously drives innovation toward high-efficiency recovery systems and alternative solvents. However, the superior performance profile of NMP in specific high-precision applications, such as membrane filtration and specialty electronics cleaning, maintains its competitive edge. The market growth is also spatially heterogeneous, with robust expansion centered in the Asia Pacific region, driven by massive investments in domestic semiconductor fabrication plants and large-scale battery gigafactories established primarily in China, South Korea, and Japan.

GLB and NMP Market introduction

The GLB and NMP market encompasses the production, distribution, and consumption of two interconnected cyclic organic compounds. Gamma-Butyrolactone (GLB) is a colorless, weakly volatile liquid commonly utilized as an intermediate in producing pyrrolidone chemicals and as a high-performance solvent or extraction agent. N-Methyl-2-pyrrolidone (NMP), derived largely from GLB, is widely recognized as a versatile, polar aprotic solvent known for its low volatility, high stability, and strong solvency, making it essential in complex chemical reactions, polymer dissolution, and surface coating applications. Major applications span the electronics industry, particularly for lithography and cleaning processes, the energy sector for Li-ion battery production, petrochemical processes for extraction, and the pharmaceutical industry for drug synthesis. Key benefits include improved process efficiency, high performance in demanding applications, and recyclability. Driving factors include the exponential growth in EV adoption and the continuous expansion of the semiconductor and specialty chemicals industries globally.

Gamma-Butyrolactone (GLB) is inherently linked to the NMP market as it serves as a primary raw material feedstock for the synthesis of NMP and its derivatives. Beyond this, GLB is employed in the formulation of paint removers, as a precursor to herbicides, and within specialized adhesive and sealant products, reflecting its wide industrial utility. Its relatively low toxicity and effectiveness as a solvent in highly specific industrial cleaning applications ensure its consistent demand, especially where rigorous safety standards and material compatibility are paramount. The interdependence between GLB supply and NMP manufacturing means that fluctuations in the production capacity or pricing of one chemical often ripple across the supply chain of the other, requiring careful inventory management by downstream users.

N-Methyl-2-pyrrolidone (NMP) stands out due to its superior ability to dissolve a wide range of organic and inorganic compounds, making it irreplaceable in several high-tech manufacturing processes. Its role in battery manufacturing involves dissolving polyvinylidene fluoride (PVDF) binders used in electrode coating, a critical step that requires a highly specific and efficient solvent for consistent battery performance. The push for higher energy density batteries and faster charging capabilities increases the stringency of manufacturing conditions, cementing NMP’s role despite ongoing regulatory concerns. Furthermore, NMP is essential in petrochemical refining, specifically for gas sweetening and the extraction of aromatic hydrocarbons, showcasing its indispensable role across diverse industrial domains far beyond consumer electronics.

GLB and NMP Market Executive Summary

The GLB and NMP market is characterized by robust demand, primarily anchored by transformative technological trends in the energy and electronics sectors. Business trends show a strategic focus on expanding production capacity in Asia to meet burgeoning Li-ion battery and semiconductor demands, alongside intensive R&D efforts in Europe and North America aimed at developing sustainable, bio-based alternatives to mitigate regulatory risks associated with NMP. Regional trends highlight the Asia Pacific region as the dominant consumer and producer, benefiting from extensive government support for high-tech manufacturing, while stricter environmental regulations in the European Union are pushing market players toward adopting closed-loop recycling systems. Segmentation trends indicate that the Li-ion battery application segment is experiencing the fastest growth, commanding a premium for high-purity NMP grades, while the GLB segment remains stable, driven by intermediate chemical synthesis and agrochemical requirements.

From a business perspective, major chemical manufacturers are prioritizing vertical integration to secure the supply of critical precursors, notably GLB, thereby enhancing control over the NMP production cost structure and mitigating supply chain volatilities. Mergers, acquisitions, and strategic partnerships are increasingly common, particularly those focused on acquiring patented recycling technologies or securing long-term supply agreements with major battery and chip makers. Furthermore, the market is witnessing significant capital expenditure directed towards optimizing solvent recovery processes, allowing manufacturers to achieve high purity levels post-recycling, which is crucial for maintaining performance consistency in sensitive electronic applications and addressing environmental concerns raised by end-users and regulatory bodies.

Analyzing segmentation and regional dynamics reveals a bifurcated market strategy. The high-volume, cost-sensitive industrial segment (e.g., petrochemical extraction, basic cleaning) often sources standard technical grades, whereas the high-value, high-purity segment (e.g., semiconductors, Li-ion batteries) demands ultra-high purity NMP, often certified to specific electronic-grade standards. This segmentation dictates pricing strategies and technological investment. Geographically, while APAC dominates volume, North America and Europe, despite slower volume growth, drive innovation in sustainability and regulatory compliance. European market participants are actively exploring substitute solvents and bio-based pyrrolidones to navigate REACH restrictions, a critical factor influencing medium-term investment cycles and regional competitive landscapes.

AI Impact Analysis on GLB and NMP Market

Common user questions regarding AI's influence on the GLB and NMP market center on optimization of chemical synthesis, prediction of feedstock price volatility, and enhanced process control in sensitive manufacturing environments like battery production. Users are keenly interested in how machine learning algorithms can minimize solvent wastage during recycling operations, optimize reactor conditions (temperature, pressure, catalyst concentration) to maximize GLB yield and purity, and predict maintenance requirements for NMP recovery units. Key themes also revolve around leveraging AI for sustainable chemistry by designing novel, less toxic pyrrolidone alternatives and accelerating R&D timelines. The consensus expectation is that AI will primarily serve as an efficiency multiplier, reducing operational costs and improving material quality consistency, crucial for the highly regulated and capital-intensive end-use sectors.

The immediate and tangible impact of Artificial Intelligence (AI) and advanced analytics is visible in streamlining complex chemical production processes. AI models are being deployed to monitor real-time sensor data from large-scale reactors, enabling predictive quality control and dynamic adjustments to maintain optimal GLB synthesis rates while minimizing energy consumption. By analyzing correlations between input variables and final product purity, AI systems significantly reduce batch variability, which is especially important for the electronic-grade NMP required by semiconductor and battery manufacturers, where trace impurities can lead to device failure or shortened battery life. This optimization minimizes waste streams and improves resource efficiency, directly addressing cost pressures and sustainability goals.

Furthermore, AI plays a crucial role in managing the complex logistics and supply chain dynamics inherent to the GLB and NMP market. Given that NMP's price and availability are often linked to global upstream crude oil derivatives (though indirectly via feedstock costs) and downstream demand fluctuations from the cyclical EV sector, AI-driven forecasting tools provide superior demand prediction accuracy compared to traditional econometric models. This enhanced predictive capability allows manufacturers to optimize raw material procurement (e.g., securing GLB feedstock), manage inventory levels effectively, and respond rapidly to sudden shifts in regional regulatory policies or end-user demands, thereby enhancing resilience and mitigating market risk.

- AI optimizes GLB synthesis pathways, enhancing yield and reducing byproduct formation.

- Machine learning models predict and mitigate equipment failure in NMP recycling plants, ensuring high operational uptime.

- AI-driven demand forecasting improves inventory management and procurement strategies for raw materials, reducing cost volatility exposure.

- Advanced analytics support R&D efforts in identifying and characterizing potentially superior, bio-based solvent alternatives.

- Predictive maintenance schedules for critical production assets are established, minimizing unscheduled downtime in manufacturing facilities.

- Real-time process control ensures the consistent, ultra-high purity required for electronic-grade NMP applications.

DRO & Impact Forces Of GLB and NMP Market

The market for GLB and NMP is principally driven by the explosive demand from the Li-ion battery sector, which uses NMP as a critical processing solvent in electrode production, coupled with steady growth in pharmaceutical intermediates. Restraints largely stem from the classification of NMP as an SVHC under European REACH regulations, leading to substitution pressure and significant capital investment requirements for closed-loop systems to meet emission standards. Opportunities are vast in developing bio-based GLB and NMP alternatives, expanding recycling infrastructure globally, and catering to the escalating demand for high-purity solvents in advanced semiconductor manufacturing. The primary impact forces include stringent environmental regulations concerning solvent emissions, technological advancements in battery chemistry that may require different solvent systems, and the dynamic geopolitical landscape affecting raw material costs and global trade flows.

Key drivers include global government incentives promoting electric vehicles and renewable energy storage, which directly translates into soaring demand for Li-ion batteries. This demand secures NMP’s short-to-medium-term market growth, particularly in APAC. Additionally, the steady expansion of the global population and subsequent demand for generic and specialty pharmaceuticals ensures a stable requirement for GLB as a synthesis intermediate. However, the market faces significant headwinds from regulatory bodies, particularly in the European Union, where the hazardous classification of NMP necessitates high-cost infrastructure upgrades for industrial users to minimize exposure and maximize solvent recovery. This regulatory burden often shifts production focus and market growth towards regions with less stringent, or different, regulatory frameworks, creating regional divergences in market maturity and investment attractiveness.

The opportunities within this market predominantly lie in sustainability and technological specialization. The necessity for closed-loop solvent recovery systems represents a capital-intensive opportunity for specialized engineering firms and NMP suppliers who can offer integrated solutions. Furthermore, the search for "green" or bio-based precursors and alternatives to NMP—compounds that offer comparable performance without the reproductive toxicity concerns—is a major R&D focus and a lucrative long-term growth avenue. Impact forces, specifically technological changes in the battery sector (such as the shift towards solid-state batteries, which may reduce or eliminate the need for liquid solvents like NMP), pose a long-term threat. Meanwhile, fluctuating prices of precursor chemicals, largely driven by petrochemical market movements, exert continuous pressure on the operational margins of GLB and NMP manufacturers globally.

Segmentation Analysis

The GLB and NMP market is intricately segmented based on product type, application, purity grade, and geographical region, reflecting the diverse industrial requirements for these critical chemicals. Product segmentation distinguishes between Gamma-Butyrolactone (GLB) and N-Methyl-2-pyrrolidone (NMP), with NMP typically capturing the larger market share due to its pivotal role as a high-performance solvent. Application segmentation is critical, highlighting Li-ion batteries, electronics and semiconductors, petrochemical processing, pharmaceuticals, and agrochemicals as key consumption sectors. The requirement for high-purity electronic-grade NMP is the fastest-growing and highest-value segment, driven by advanced manufacturing demands. Analyzing these segments provides crucial insight into where capital investments are concentrated and how regulatory pressures differentially impact end-use industries.

The differentiation by purity grade is increasingly important, driven by the stringent quality demands of modern high-tech industries. Technical grade NMP is sufficient for certain industrial cleaning and petrochemical extraction processes, whereas the rapidly growing demand for electronic-grade NMP and battery-grade NMP requires extremely low levels of moisture and metallic impurities (parts per billion level). This requirement dictates specialized purification processes and dedicated manufacturing lines, justifying the higher premium commanded by these high-purity products. The electronics and semiconductor segment, relying on NMP for photoresist stripping and cleaning, is highly sensitive to product consistency, maintaining rigorous quality control standards that suppliers must meet consistently.

The primary growth engine remains the application segmentation, particularly the Li-ion battery market. As battery technologies evolve, the requirement for high throughput and consistent quality solvent remains paramount, ensuring NMP's continued dominance in this field, despite continuous R&D into alternative processing methods. Simultaneously, the pharmaceutical segment provides stable, recession-resistant demand for both GLB (as an intermediate) and NMP (as a reaction solvent), particularly in complex organic synthesis requiring a polar aprotic environment. Understanding these segmented growth profiles allows stakeholders to strategically allocate resources toward capacity expansion in high-growth, high-margin areas, mitigating risks associated with slower, mature segments.

- Product Type:

- Gamma-Butyrolactone (GLB)

- N-Methyl-2-pyrrolidone (NMP)

- Application:

- Lithium-ion Batteries (Li-ion)

- Electronics and Semiconductors

- Petrochemical Processing (Aromatic Extraction, Gas Purification)

- Pharmaceuticals

- Agrochemicals

- Coatings and Solvents

- Purity Grade:

- Technical Grade

- Electronic Grade / Battery Grade

- Pharmaceutical Grade

Value Chain Analysis For GLB and NMP Market

The value chain for the GLB and NMP market begins with upstream chemical feedstock procurement, primarily relying on butane or maleic anhydride derivatives, which are converted into 1,4-Butanediol (BDO), the key precursor for GLB synthesis. The midstream involves the transformation of BDO into GLB, followed by the subsequent methylation reaction to produce NMP. Downstream analysis focuses on specialized purification and grading (e.g., electronic vs. technical grade) and the distribution channel, which utilizes both direct sales to major end-users (like battery gigafactories) and indirect channels through regional chemical distributors. Critical control points in the chain are centered on BDO pricing volatility, efficiency in solvent recovery technologies, and meeting rigorous purity specifications demanded by advanced electronics and Li-ion manufacturing.

Upstream stability is heavily influenced by the global supply and pricing of 1,4-Butanediol (BDO). Manufacturers often seek long-term contracts or invest in captive BDO production facilities to stabilize input costs and ensure consistent supply. The conversion processes (BDO to GLB, and GLB to NMP) are capital-intensive and require precise temperature and pressure control, with efficient catalyst management being a key competitive differentiator in the midstream. Furthermore, a highly crucial stage in the midstream value chain, particularly for NMP, is the solvent recovery and purification segment. Given the high cost of fresh NMP and regulatory pressures, the capability to efficiently recover NMP from electrode coating lines at high purity levels directly impacts the downstream user’s operating expenses and the overall market sustainability profile.

The distribution channel is structured to accommodate varying customer needs. Direct sales channels are preferred for high-volume, strategic customers in the battery and large petrochemical segments, allowing for customized delivery schedules, bulk logistics, and specific technical support related to solvent handling and recovery. Indirect distribution channels, utilizing specialized chemical distributors and agents, cater to smaller volume users in the pharmaceutical, agrochemical, and specialty cleaning sectors, providing wider regional reach and logistical flexibility. Effective inventory management and hazardous material handling compliance across the distribution network are essential, given the classification and safety requirements associated with both GLB and NMP, particularly when transporting highly purified grades across international borders.

GLB and NMP Market Potential Customers

The primary end-users and buyers of GLB and NMP are multinational corporations operating in high-growth technological sectors that require premium solvents for critical manufacturing steps. The largest segment of potential customers includes Li-ion battery manufacturers (or gigafactories) producing cells for electric vehicles and grid storage, who demand battery-grade NMP for cathode coating processes. Other significant customers are semiconductor fabrication plants (fabs) and integrated device manufacturers (IDMs) requiring electronic-grade NMP for photoresist stripping and cleaning. Additionally, major pharmaceutical companies and agrochemical producers constitute a stable customer base, utilizing both GLB and NMP as essential intermediates or reaction solvents in the synthesis of complex organic molecules and active pharmaceutical ingredients (APIs). These customers prioritize product purity, reliable supply, and compliance with strict environmental health and safety standards.

In the energy sector, potential customers are highly concentrated and strategically important. They include major global players in EV manufacturing and specialized battery cell producers who are setting up regional supply chains to reduce reliance on single-source regions. These clients often engage in long-term supply contracts, emphasizing supplier track records regarding consistency, purity specifications, and the ability to manage closed-loop solvent recovery partnerships. The solvent cost, while significant, is often secondary to the assurance of consistent quality, as defects caused by impure NMP can lead to billions in wasted materials and recall costs within the battery supply chain.

The semiconductor industry represents a high-margin, albeit volatile, customer base. As chip geometries shrink and fabrication processes become more complex, the tolerance for impurities in NMP utilized for cleaning and stripping processes decreases significantly, driving demand for the most rigorously purified grades. Potential customers here include foundries and memory chip makers across Taiwan, South Korea, and the US. Finally, diversified chemical conglomerates purchasing GLB as a building block for subsequent derivative products (like specialty polymers or plastics) represent a reliable and recurring customer pool, driven by global construction, consumer goods, and industrial manufacturing output forecasts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,950 Million |

| Market Forecast in 2033 | USD 2,875 Million |

| Growth Rate | 5.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, Ashland Global Holdings Inc., Zhejiang Realsun Chemical Industry Co. Ltd., Hefei TNJ Chemical Industry Co., Ltd., Puyang Guangming Chemicals Co., Ltd., MYNCA Chemical Co., Ltd., Chang Xin Chemical Co., Ltd., Jiangyin City Huada Chemical Co., Ltd., Dalian Richon Chemical Co., Ltd., Shanxi Sanwei Group Co., Ltd., Eastman Chemical Company, Taminco Corporation, Hexion Inc., Sigma-Aldrich (Merck KGaA), Wanhua Chemical Group Co., Ltd., Sinopharm Chemical Reagent Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

GLB and NMP Market Key Technology Landscape

The technology landscape for the GLB and NMP market is dominated by advancements in catalytic processes for synthesis and, more importantly, sophisticated closed-loop solvent recovery and purification systems. For synthesis, catalytic hydrogenation of maleic anhydride or its derivatives remains the established technology for producing 1,4-Butanediol (BDO), which is then cyclized to GLB and further converted to NMP. Continuous process optimization focuses on enhancing catalyst lifespan, minimizing energy consumption, and improving reaction selectivity to boost GLB yield. However, the most critical technological advancements are centered on optimizing the purification of NMP to meet stringent electronic and battery-grade specifications, requiring advanced fractional distillation, membrane filtration, and proprietary ion-exchange resin systems to remove trace metallic ions and moisture content effectively.

A significant technological imperative driving R&D spending is the development and implementation of highly efficient NMP recovery systems within end-user manufacturing environments, particularly within large battery gigafactories. These closed-loop systems are vital not only for reducing environmental impact and complying with regulations like REACH but also for significantly lowering operational costs, as recovered NMP can often be reused immediately after purification. Technologies in this area include specialized vapor condensation units, multi-stage distillation columns customized for NMP/water separation, and adsorption techniques designed to capture solvent vapors before atmospheric release. The efficiency of these recovery systems, often exceeding 99%, directly contributes to the sustainability profile and competitiveness of the battery manufacturer.

Furthermore, the future technological landscape is being shaped by the exploration of bio-based routes for GLB and NMP production. Utilizing renewable feedstocks, such as sugar or bio-derived succinic acid, instead of petroleum-based butane, offers a pathway to a more sustainable and regulation-compliant product portfolio. While these bio-based technologies are currently less cost-competitive than established petrochemical routes, ongoing research aims to achieve economies of scale through improved fermentation and biocatalysis techniques. Successful commercialization of bio-NMP would provide a critical competitive advantage, particularly in regions like Europe, where environmental footprint and regulatory compliance are major procurement criteria for industrial buyers.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed epicenter of the GLB and NMP market, dominating both production capacity and consumption. This dominance is intrinsically linked to the region’s massive, government-backed investments in the electronics, semiconductor, and electric vehicle battery manufacturing sectors, particularly in China, South Korea, and Japan. China not only hosts the largest number of battery gigafactories globally, driving immense NMP consumption but also possesses extensive domestic GLB and NMP production capacities, making it a key price setter. The high concentration of petrochemical refining and agrochemical production further cements APAC's leading market position, characterized by robust demand for all purity grades.

Europe presents a complex market dynamic, constrained primarily by the stringent regulatory environment imposed by REACH, specifically targeting NMP due to its SVHC classification. This regulation compels European manufacturers and users to invest heavily in advanced, costly closed-loop recycling and emission control technologies or actively seek alternative, less hazardous solvents. Consequently, while end-user demand in key sectors like specialty chemicals and high-end pharmaceuticals remains stable, production capacity growth is restrained, leading to significant reliance on imports, often from Asian suppliers. The focus in Europe is less on volume expansion and more on technological leadership in sustainability and bio-based alternatives.

North America, particularly the United States, is experiencing a resurgence in demand, primarily fueled by the Inflation Reduction Act (IRA) and associated policies incentivizing domestic semiconductor and EV battery manufacturing. This shift is driving substantial capital expenditure for new Giga-factories, directly increasing the regional requirement for electronic and battery-grade NMP. While historically reliant on imports, the region is seeing increasing investment in local production capacity to secure resilient supply chains. The market here is characterized by a high willingness to pay for ultra-pure grades and an increasing focus on supply chain transparency and regulatory certainty, mirroring the strict demands of the high-tech industry.

- Asia Pacific (APAC): Dominates production and consumption; driven by EV battery and semiconductor boom in China, South Korea, and Japan.

- Europe: Market growth constrained by REACH regulations on NMP (SVHC); high investment in recycling and alternative solvent R&D; stable demand in specialty chemicals.

- North America: Experiencing rapid growth due to government initiatives (IRA) fostering domestic battery and chip manufacturing; increasing focus on local supply resilience.

- Latin America: Moderate growth, primarily driven by agrochemical and basic industrial solvent applications; less developed high-purity solvent infrastructure.

- Middle East & Africa (MEA): Stable demand from petrochemical processing (aromatic extraction) and basic industrial solvent markets; growth linked to regional petrochemical investment cycles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the GLB and NMP Market.- BASF SE

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- Ashland Global Holdings Inc.

- Zhejiang Realsun Chemical Industry Co. Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Puyang Guangming Chemicals Co., Ltd.

- MYNCA Chemical Co., Ltd.

- Chang Xin Chemical Co., Ltd.

- Jiangyin City Huada Chemical Co., Ltd.

- Dalian Richon Chemical Co., Ltd.

- Shanxi Sanwei Group Co., Ltd.

- Eastman Chemical Company

- Taminco Corporation

- Hexion Inc.

- Sigma-Aldrich (Merck KGaA)

- Wanhua Chemical Group Co., Ltd.

- Sinopharm Chemical Reagent Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the GLB and NMP market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the current demand for NMP?

The primary application driving NMP demand is the manufacturing of lithium-ion batteries, where it functions as a critical solvent for dissolving PVDF binders used in coating cathode materials for electric vehicles and grid storage systems. Secondary drivers include advanced semiconductor cleaning and photoresist stripping processes.

How is the GLB and NMP market addressing environmental and regulatory concerns?

The market is addressing concerns, particularly regarding NMP’s SVHC status in the EU, by aggressively investing in high-efficiency, closed-loop solvent recovery and recycling systems within manufacturing plants. Additionally, substantial R&D is focused on developing bio-based or less hazardous alternative solvents with comparable performance characteristics.

Which geographical region dominates the consumption and production of these chemicals?

The Asia Pacific (APAC) region, led by China, South Korea, and Japan, dominates both the production and consumption of GLB and NMP. This regional supremacy is directly attributable to the massive concentration of Li-ion battery gigafactories and advanced electronics manufacturing facilities.

What is the significance of the purity grade in NMP pricing and demand?

Purity grade is critical, as high-purity electronic and battery grades (with extremely low moisture and metallic impurity content) are essential for high-tech applications like semiconductors and Li-ion batteries. These stringent requirements command a significant price premium compared to standard technical grade NMP used in industrial cleaning or petrochemical extraction.

How does the price of BDO impact the GLB and NMP market?

1,4-Butanediol (BDO) is the primary precursor for GLB synthesis. Therefore, fluctuations in the global price and supply of BDO directly affect the production cost structure and profitability of GLB and NMP manufacturers. Supply stability of BDO is a key strategic factor for market players.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager