Global Aerospace Data Acquisition System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431811 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Global Aerospace Data Acquisition System Market Size

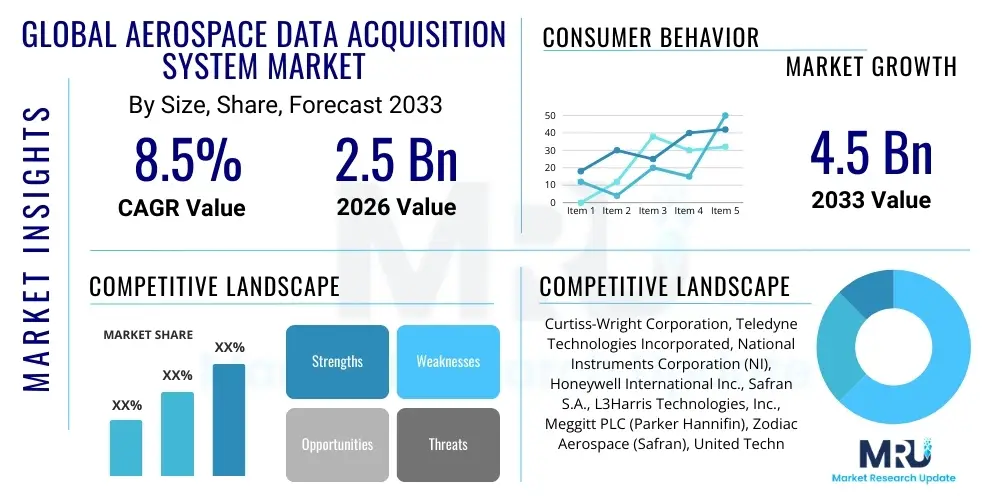

The Global Aerospace Data Acquisition System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.5 Billion by the end of the forecast period in 2033.

Global Aerospace Data Acquisition System Market introduction

The Global Aerospace Data Acquisition System (DAS) Market encompasses technologies and instruments designed to measure, record, analyze, and manage physical or electrical parameters within aerospace environments, including flight testing, structural health monitoring, and in-service diagnostics. These systems are critical for ensuring the safety, performance, and certification of aircraft, spacecraft, and related subsystems. DAS units are sophisticated instruments that collect real-time data from various sensors (e.g., strain gauges, accelerometers, thermocouples) during flight maneuvers or ground testing, converting analog signals into digital data for subsequent analysis. The primary function is to provide engineers and researchers with high-fidelity, time-synchronized data necessary for verifying design specifications, troubleshooting anomalies, and predicting maintenance needs.

Product descriptions within this market range from ruggedized, high-channel-count flight test instrumentation (FTI) designed for extreme environmental conditions to modular, lightweight embedded systems used for continuous monitoring in commercial transport aircraft. Major applications span across military and defense aerospace programs, commercial aviation (including both fixed-wing and rotary-wing platforms), space exploration missions, and unmanned aerial vehicles (UAVs). The increasing complexity of modern aerospace vehicles, coupled with stringent regulatory requirements concerning airworthiness and reliability, drives the demand for more advanced, higher-speed, and more accurate DAS solutions capable of handling massive streams of disparate sensor data.

The benefits derived from advanced DAS implementations are substantial, including reduced time-to-market for new aircraft models through efficient flight test campaigns, enhanced operational safety due to comprehensive structural health monitoring (SHM), and significant cost savings achieved through predictive maintenance based on collected operational data. Key driving factors include the rapid expansion of global air travel demanding new aircraft deliveries, modernization programs within defense sectors requiring updated avionics and surveillance capabilities, and the growing focus on developing reusable launch vehicles and deep-space exploration technologies, all of which necessitate robust and reliable data logging capabilities.

Global Aerospace Data Acquisition System Market Executive Summary

The Global Aerospace Data Acquisition System Market is characterized by robust technological development centered around miniaturization, higher sampling rates, and enhanced data processing capabilities at the edge. Current business trends indicate a strong shift towards modular and distributed architecture solutions that offer flexibility and scalability, allowing operators to easily integrate new sensors or adapt systems for varied test programs, thereby reducing system footprint and weight, which is critical in aerospace applications. Furthermore, the convergence of DAS technology with IoT and big data analytics is transforming raw measurements into actionable insights, fueling demand for software platforms that facilitate advanced data visualization and correlation analysis, moving beyond simple data logging towards integrated diagnostic platforms for lifecycle management.

Regionally, North America maintains market leadership, driven by significant defense spending, the presence of major aerospace OEMs (Original Equipment Manufacturers), and substantial investment in advanced flight test and space programs (e.g., NASA and private space companies). However, the Asia Pacific region is demonstrating the highest growth trajectory, primarily fueled by the burgeoning commercial aviation sector, particularly in China and India, alongside increasing indigenous defense manufacturing capabilities. European markets remain steady, supported by established aerospace conglomerates and collaborative defense initiatives like the Future Combat Air System (FCAS), demanding specialized high-performance DAS for next-generation platforms.

Segmentation trends reveal strong growth in the Airborne segment, particularly driven by high-channel-count systems for full-scale structural fatigue testing and developmental flight testing of new aircraft prototypes. By end-user, the Flight Test Organizations segment remains dominant due to the continuous cycle of certification and verification required for aerospace components. Technologically, the shift from traditional wired systems to wireless sensor networks (WSNs) is a pivotal trend, offering installation efficiency and accessibility in confined or difficult-to-reach areas of aircraft, although robustness and bandwidth limitations remain areas of ongoing R&D focus, shaping the competitive landscape among key players.

AI Impact Analysis on Global Aerospace Data Acquisition System Market

User queries regarding AI in the Aerospace DAS market frequently center on three key areas: how AI can handle the massive volume of data generated by high-speed DAS, whether AI can improve predictive maintenance accuracy beyond traditional statistical models, and the reliability and safety implications of integrating machine learning models into critical flight test analysis workflows. Users are keen to understand if AI can automate the complex process of data correlation, anomaly detection, and fault diagnosis, tasks which traditionally require extensive human expertise and time. Expectations are high regarding AI's ability to reduce the time spent on post-processing data and to provide real-time, in-flight recommendations or diagnostics, thus accelerating decision-making during crucial testing phases.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing the application layer of the Aerospace Data Acquisition System market, moving the focus from mere data collection to intelligent data interpretation. AI allows for the development of advanced diagnostic and prognostic algorithms capable of analyzing multivariate sensor streams to detect subtle deviations indicative of potential equipment failure or structural fatigue. This shift enables true predictive maintenance (PdM), optimizing aircraft availability and reducing unexpected operational downtime, a major cost driver for airlines and defense operators. Furthermore, during flight testing, AI models can rapidly sift through petabytes of data collected across thousands of sensor channels, identifying correlations and performance boundaries far quicker than human analysts, significantly accelerating the iterative design and certification cycle.

The influence of AI extends deeply into optimizing the DAS hardware itself. Edge computing powered by AI is increasingly being integrated directly into DAS units to perform real-time data compression, filtering, and feature extraction before transmission. This alleviates bandwidth constraints and minimizes the need to store redundant data, leading to lighter, more efficient systems. As aerospace platforms generate increasingly complex high-frequency data, AI acts as a necessary filter and interpretation layer, enhancing the strategic value of the collected information by providing rapid, context-aware insights crucial for mission success and long-term asset management. Concerns regarding AI transparency (explainability) and validation in safety-critical systems, however, are major research hurdles currently being addressed by regulatory bodies and developers.

- Enhanced Predictive Maintenance (PdM) through ML-driven anomaly detection in operational data.

- Real-time, on-board data processing and compression using AI at the edge, reducing telemetry bandwidth needs.

- Automated classification and clustering of flight test data to accelerate certification timelines.

- Optimized resource allocation and data filtering based on sensor health and relevance.

- Development of digital twins enhanced by continuous DAS inputs interpreted via deep learning models.

DRO & Impact Forces Of Global Aerospace Data Acquisition System Market

The Aerospace Data Acquisition System market is propelled by key Drivers such as the increasing global demand for new commercial aircraft, requiring extensive certification flight testing, and rising defense expenditures focused on modernizing surveillance platforms and developing next-generation fighter jets. Restraints include the high initial cost and complexity associated with implementing high-fidelity, ruggedized DAS solutions, especially for smaller aerospace firms, alongside the stringent regulatory compliance and long certification cycles unique to the aerospace industry. Opportunities are primarily centered on the adoption of wireless and distributed sensing technologies, the integration of AI/ML for advanced data analysis, and the expanding market for unmanned aerial vehicles (UAVs) and advanced urban air mobility (UAM) platforms, all demanding specialized, lightweight data capture systems. These forces collectively shape the market dynamics, dictating investment in R&D towards more efficient, modular, and secure data handling capabilities.

The primary impact forces shaping the market are technological evolution and regulatory pressure. Technological advancements, particularly in sensor technology (e.g., fiber optic sensors, microelectromechanical systems (MEMS)), microprocessors, and data storage capabilities, continuously push the boundaries of system performance, leading to higher channel density and faster sampling rates. Simultaneously, global regulatory bodies (like FAA and EASA) impose rigorous requirements for flight testing and airworthiness data, which mandates the use of certified, highly accurate, and reliable DAS platforms. These external pressures necessitate continuous innovation, particularly concerning data integrity, synchronization accuracy, and cyber resilience of networked aerospace data systems. The need for standardized data formats across different test environments also influences procurement decisions.

Furthermore, economic volatility impacts defense and commercial procurement cycles, acting as a periodic restraint, while the geopolitical landscape drives regional demand spikes, especially in regions focusing on establishing aerospace self-sufficiency. The scarcity of specialized technical expertise required for operating and maintaining complex DAS infrastructures also presents a systemic challenge. However, the foundational trend towards "More Electric Aircraft" (MEA) and increased onboard data generation ensures that the fundamental requirement for advanced DAS solutions remains robust, positioning these systems as indispensable components in the lifecycle management of all modern aerospace vehicles, from conceptual design validation through end-of-life monitoring.

Segmentation Analysis

The Global Aerospace Data Acquisition System Market is comprehensively segmented across several dimensions, including the type of platform, the deployment environment, the type of technology utilized, and the specific application or end-user involved. Analyzing these segments provides a nuanced view of market growth pockets and investment priorities. The key segmentation criteria revolve around differentiating between systems used in extremely controlled environments (like ground testing or lab simulation) versus those requiring high ruggedization for operational or flight testing, where environmental factors (temperature, vibration, pressure) are highly variable and extreme. This differentiation drives distinct design requirements for hardware robustness, packaging, and power consumption characteristics.

Critical segmentation analysis highlights the distinction between centralized and distributed architectures. Centralized systems, traditionally used in older aircraft or ground test benches, are being gradually superseded by distributed systems. Distributed DAS architecture involves placing smaller, ruggedized data collection units closer to the sensor source, significantly reducing the wiring harness weight and complexity, a paramount concern in aerospace design. This structural evolution significantly impacts the supplier landscape and procurement strategies of OEMs. Furthermore, segmenting the market by application, such as Structural Health Monitoring (SHM) versus Engine Testing, reveals divergent needs regarding measurement precision and required sampling frequencies, compelling manufacturers to offer highly specialized product lines catering to specific test mandates.

The market's segmentation by component—hardware versus software—demonstrates the rising importance of the software segment. While hardware provides the foundational robustness and measurement accuracy, sophisticated software platforms are increasingly required for efficient data management, visualization, and post-analysis, often incorporating machine learning capabilities. This focus on software solutions, including data correlation tools and test management suites, is a key indicator of market maturity, reflecting the industry's shift from simply recording data to utilizing it strategically across the product lifecycle. The growing emphasis on secure data handling and integration with enterprise systems further elevates the value proposition of specialized aerospace DAS software solutions.

- By Component: Hardware (Data Recorders, Signal Conditioners, Sensors, Data Loggers, Telemetry Units), Software (Data Analysis Software, Test Management Software, Visualization Tools).

- By Platform: Commercial Aircraft (Narrow-body, Wide-body, Regional Jets), Military Aircraft (Fighter Jets, Transport Aircraft, Helicopters), Spacecraft & Launch Vehicles, Unmanned Aerial Vehicles (UAVs).

- By Application: Flight Testing & Certification (Developmental, Acceptance), Structural Health Monitoring (SHM), Engine & Component Testing (Turbine, Avionics), Ground Vibration Testing, Telemetry & Tracking.

- By Architecture: Centralized Data Acquisition Systems, Distributed Data Acquisition Systems.

- By End-User: Aircraft Manufacturers (OEMs), Maintenance, Repair, and Overhaul (MRO) Providers, Test Organizations & Laboratories, Defense Agencies, Space Research Organizations.

Value Chain Analysis For Global Aerospace Data Acquisition System Market

The value chain for the Global Aerospace Data Acquisition System market begins with the Upstream analysis, which focuses on the suppliers of fundamental components, including specialized high-performance sensors (pressure, temperature, acceleration), high-speed analog-to-digital converters (ADCs), specialized microprocessors, and ruggedized housing materials. Key activities at this stage involve raw material sourcing, precision manufacturing, and quality control of electronic components, demanding highly specialized fabrication facilities to meet aerospace-grade reliability and temperature tolerance standards. Collaboration between DAS manufacturers and specialized semiconductor providers is crucial here to ensure access to cutting-edge conversion and processing technologies required for high-channel-count, high-bandwidth applications.

Mid-stream activities encompass the core functions of DAS manufacturers: research and development, system integration, software development, and assembly. Manufacturers combine procured components with proprietary intellectual property to create modular signal conditioners, data loggers, and flight-ready recorders, focusing heavily on synchronization accuracy, robust packaging, and adherence to rigorous aerospace standards (e.g., DO-160, MIL-STD-810). The integration of robust, certified software for data management and analysis adds significant value at this stage. Direct and indirect distribution channels then facilitate market reach; direct channels involve sales teams and application engineers engaging directly with major OEMs (Boeing, Airbus, Lockheed Martin) and government defense agencies, often requiring long-term contractual agreements and tailored solutions.

Downstream analysis involves the deployment, maintenance, and ultimate application of the DAS by end-users like flight test organizations, MROs, and space agencies. These users rely heavily on after-sales support, calibration services, and training provided by the manufacturers or specialized third-party service providers. Indirect channels often involve system integrators or specialized engineering consultants who procure DAS components and integrate them into larger, bespoke test environments for smaller manufacturers or research institutions. The value chain concludes with the generation of valuable test data, which feeds back into the R&D and design modification processes of aerospace platforms, demonstrating the critical, cyclical role of DAS technology in the aerospace ecosystem.

Global Aerospace Data Acquisition System Market Potential Customers

The primary customers for Global Aerospace Data Acquisition Systems are institutions and entities involved in the design, testing, certification, and operational monitoring of aerospace vehicles. Aircraft Manufacturers (OEMs) represent a crucial segment, requiring advanced DAS during the entire product development lifecycle, from laboratory testing of components and subsystems (e.g., landing gear, actuators) to full-scale developmental and certification flight testing of new airframes. These large manufacturers demand high-channel-count, highly modular, and extremely reliable systems capable of simultaneously measuring hundreds or even thousands of parameters under extreme conditions to meet strict regulatory deadlines and performance criteria.

Defense and Government Agencies, including air forces, defense laboratories, and space organizations (like NASA, ESA, Roscosmos), constitute another major end-user category. These entities require DAS for mission-critical applications such as monitoring weapon systems performance, conducting ballistic testing, surveillance platform development, and crucial data capture during expensive and non-repeatable space launch events. Their requirements often emphasize security, extreme environmental ruggedization (MIL-SPEC compliance), and long-term supportability for systems deployed across decades of platform service life, often leading to proprietary or highly customized solution procurement.

Furthermore, specialized Test Organizations and Independent Laboratories, which often contract out their services to smaller aerospace suppliers or provide third-party validation, are significant consumers of flexible, high-accuracy DAS equipment. Maintenance, Repair, and Overhaul (MRO) providers are increasingly adopting DAS technology for structural health monitoring (SHM) and operational trend monitoring during routine checks or major overhauls, utilizing the data to inform preventative maintenance actions and asset lifespan extensions, thereby moving beyond traditional time-based maintenance models toward condition-based models, making them a rapidly growing customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Curtiss-Wright Corporation, Teledyne Technologies Incorporated, National Instruments Corporation (NI), Honeywell International Inc., Safran S.A., L3Harris Technologies, Inc., Meggitt PLC (Parker Hannifin), Zodiac Aerospace (Safran), United Technologies Corporation (Raytheon Technologies), Acra Controls (HBM), Data Device Corporation (DDC), General Electric (GE) Aviation, Ametek Inc., HGL Dynamics Ltd., United Electronic Industries (UEI). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Global Aerospace Data Acquisition System Market Key Technology Landscape

The current technology landscape in the Global Aerospace Data Acquisition System market is heavily defined by the pursuit of higher measurement fidelity combined with physical efficiency. Key technological innovations center around modular and distributed data acquisition systems, which utilize remote, synchronized input/output modules connected via high-speed, standardized buses like Ethernet or specific aerospace protocols (e.g., ARINC 429, MIL-STD-1553). This distributed architecture allows for the placement of high-speed ADCs and signal conditioners near the sensor, minimizing analog signal degradation and drastically reducing the complex, heavy wiring typically required in centralized systems, directly addressing the critical aerospace design constraint of weight reduction.

Furthermore, there is a strong shift towards integration of robust and reliable Wireless Sensor Networks (WSNs) for non-critical or difficult-to-wire locations, such as rotating engine parts or areas inaccessible during flight. While historically challenged by reliability and power consumption issues, modern WSN technology, utilizing low-power wide-area network (LPWAN) protocols or specialized RF communication, is proving viable for supplementary monitoring applications. Simultaneously, manufacturers are incorporating advanced time synchronization technologies, such as IEEE 1588 (PTP), across all distributed units to ensure microsecond-level synchronization of data streams collected from disparate physical locations, crucial for accurate structural dynamics analysis and flutter testing.

Finally, the market is leveraging advancements in High-Performance Computing (HPC) and Field-Programmable Gate Arrays (FPGAs). FPGAs are increasingly embedded within DAS hardware to enable real-time, in-situ data processing, filtering, and initial analysis, ensuring that only relevant, conditioned data is transmitted via telemetry links or stored. This integration of computing power at the acquisition stage (edge computing) significantly reduces latency and allows for complex algorithms, including basic structural health checks or safety limit monitoring, to be run autonomously, thereby enhancing operational safety and reducing the massive post-processing burden traditionally associated with flight test campaigns.

Regional Highlights

- North America: North America, led by the United States, represents the largest and most mature market for Aerospace Data Acquisition Systems globally. The dominance is attributed to the presence of major aerospace and defense contractors (Boeing, Lockheed Martin, Northrop Grumman) and significant ongoing defense modernization and space exploration programs (driven by DoD and NASA). High R&D expenditure on cutting-edge military aircraft development and commercial space technologies mandates continuous investment in sophisticated, high-performance DAS solutions. The region is also a key innovation hub for highly integrated, secure DAS software platforms and edge computing hardware designed for complex verification and validation tasks.

- Europe: Europe holds a substantial market share, driven primarily by established commercial aerospace manufacturing (Airbus) and pan-European defense projects (e.g., Eurofighter Typhoon upgrades, development of FCAS). European market growth is steady, focused on adopting standardized, highly certified DAS components that comply with stringent EASA regulations. Key trends involve the uptake of modular COTS (Commercial Off-The-Shelf) solutions integrated with advanced structural health monitoring (SHM) capabilities, supporting the region’s strong focus on lifecycle maintenance and fleet optimization across its commercial airline base.

- Asia Pacific (APAC): The APAC region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fundamentally linked to the tremendous growth in passenger traffic, driving large-scale procurement of new commercial aircraft, particularly in China and India. Furthermore, increasing geopolitical tensions are accelerating indigenous defense development programs across countries like China, South Korea, and Japan, necessitating localized production and testing of fighter jets and military transport platforms, which, in turn, fuels demand for specialized flight test instrumentation and DAS infrastructure development.

- Latin America: The Latin American market for Aerospace DAS is relatively smaller, characterized by defense modernization efforts and localized commercial fleet expansion. Demand is often focused on MRO activities and integrating simpler, cost-effective DAS solutions for structural monitoring of aging military and commercial fleets. Procurement is highly reliant on international defense partnerships and imported technology from North American and European suppliers.

- Middle East and Africa (MEA): The MEA region is witnessing growth driven primarily by substantial defense spending by Gulf Cooperation Council (GCC) nations acquiring advanced military aircraft that require complex maintenance and occasional upgrades involving specialized DAS for performance verification. Commercial aviation growth in key regional hubs also contributes to the MRO and testing segment demand, although the overall market volume remains limited compared to North America or APAC.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Global Aerospace Data Acquisition System Market.- Curtiss-Wright Corporation

- Teledyne Technologies Incorporated

- National Instruments Corporation (NI)

- Honeywell International Inc.

- Safran S.A.

- L3Harris Technologies, Inc.

- Meggitt PLC (Parker Hannifin)

- Zodiac Aerospace (Safran)

- United Technologies Corporation (Raytheon Technologies)

- Acra Controls (HBM)

- Data Device Corporation (DDC)

- General Electric (GE) Aviation

- Ametek Inc.

- HGL Dynamics Ltd.

- United Electronic Industries (UEI)

- Microchip Technology Inc.

- Aerosystems (Kaman)

- Sciemetric Instruments Inc.

- Aeronix, Inc.

- DEWETRON GmbH

Frequently Asked Questions

Analyze common user questions about the Global Aerospace Data Acquisition System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Data Acquisition System (DAS) in aerospace flight testing?

The primary function of an aerospace DAS is to measure, condition, convert, and record critical physical parameters (e.g., pressure, temperature, strain, acceleration) from various sensors during flight operations. This process provides high-fidelity, time-synchronized data essential for validating aircraft performance, ensuring airworthiness compliance, and certifying new designs according to regulatory standards (FAA, EASA). Modern DAS units must be ruggedized to operate reliably under extreme aerospace environmental conditions.

How is the adoption of Distributed DAS Architecture impacting aircraft design and system weight?

Distributed DAS architecture significantly impacts aircraft design by allowing smaller, remote acquisition modules to be placed close to the sensors. This minimizes long analog signal runs, improves signal integrity, and most importantly, drastically reduces the overall weight and complexity of the aircraft's internal wiring harness. Weight savings are critical in aerospace, directly improving fuel efficiency and payload capacity, making distributed systems highly desirable for new aircraft development programs and upgrades.

Which technology trends are driving innovation in aerospace DAS hardware?

Key technology trends include the shift towards integrating high-speed Field-Programmable Gate Arrays (FPGAs) for real-time, edge data processing and filtering, enabling autonomous data analysis directly on the acquisition unit. Additionally, advancements in miniaturization, high-channel-density packaging, and robust, reliable Wireless Sensor Networks (WSNs) are driving innovation, alongside the necessity for ultra-precise time synchronization (e.g., using protocols like IEEE 1588) across all networked DAS components.

What is the role of AI and Machine Learning in the future of Aerospace DAS applications?

AI and ML are transforming DAS applications by enabling advanced predictive maintenance (PdM) through intelligent anomaly detection in collected operational data, moving beyond traditional statistical monitoring. They also automate the complex analysis of massive flight test datasets, accelerating the identification of critical correlations, optimizing data storage through smart compression, and providing real-time diagnostics that enhance operational safety and reduce ground analysis time.

What are the main market restraints affecting the growth of the Aerospace Data Acquisition System market?

The primary market restraints include the exceptionally high capital expenditure required for acquiring advanced, high-fidelity, and certified aerospace-grade DAS equipment. Furthermore, the stringent regulatory environment mandates long and costly certification cycles for new DAS hardware and software, adding to development time and expense. Finally, the specialized technical expertise required to operate, maintain, and interpret data from complex DAS infrastructure acts as a barrier to entry for smaller organizations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager