Global Back Contact Solar Cells Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432027 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Global Back Contact Solar Cells Market Size

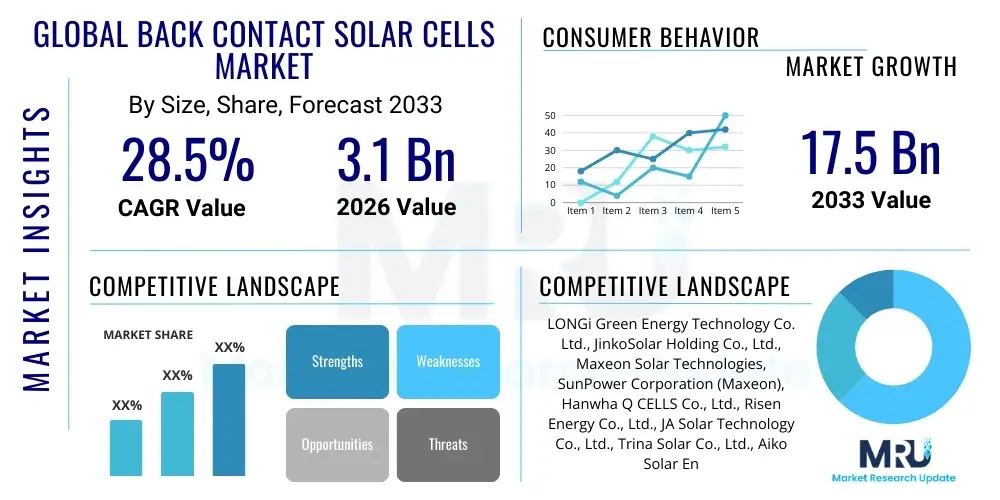

The Global Back Contact Solar Cells Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 17.5 Billion by the end of the forecast period in 2033.

Global Back Contact Solar Cells Market introduction

The Global Back Contact Solar Cells Market encompasses the manufacturing, distribution, and utilization of photovoltaic cells where all electrical contacts (both positive and negative) are located on the rear side of the wafer, optimizing the front surface for maximum light absorption. This architecture, commonly implemented in technologies like Interdigitated Back Contact (IBC) and Hybrid Passivated Back Contact (HPBC) cells, eliminates the shading losses caused by front-side metallization grids present in conventional solar cells, leading to significantly higher energy conversion efficiencies, typically exceeding 22% for mass-produced modules.

Major applications for back contact solar cells include high-efficiency photovoltaic modules used in utility-scale solar farms, residential and commercial rooftop installations where space constraints necessitate high power density, and niche markets such as Building-Integrated Photovoltaics (BIPV) and portable power devices. The inherent aesthetic advantages of a uniform black or dark module surface, achieved by eliminating visible busbars, further boost their adoption in premium residential and architectural applications. The primary benefit these cells offer is superior power output per unit area, directly translating into lower balance-of-system (BOS) costs for solar projects.

Driving factors for the accelerated market expansion include increasing global emphasis on decarbonization and renewable energy deployment targets, aggressive technological advancements reducing manufacturing complexities (such as copper plating and simpler doping processes), and declining production costs making them competitive against high-end conventional cells like PERC. Furthermore, government incentives and supportive regulatory frameworks promoting high-efficiency solar deployment across key economies in Asia Pacific and Europe are instrumental in stimulating demand, particularly in environments with limited installable area.

Global Back Contact Solar Cells Market Executive Summary

The Global Back Contact Solar Cells Market is characterized by intense innovation and a rapid shift towards high-efficiency architectures, positioning it as one of the fastest-growing segments within the photovoltaic industry. Current business trends indicate a strong move by Tier 1 manufacturers to integrate IBC or HPBC technology into their core product offerings, driven by the need to differentiate products based on power density and longevity. Strategic partnerships focusing on equipment standardization and material sourcing are emerging to streamline the complex manufacturing processes associated with back-contact structures, lowering the CapEx required for new production lines and accelerating technology adoption across emerging markets.

Regionally, Asia Pacific, specifically China and Southeast Asian nations, remains the undisputed manufacturing powerhouse, dominating both production capacity and technology development. However, significant demand growth is observed in Europe and North America, fueled by ambitious net-zero energy goals and high electricity prices, which make the superior performance of back contact modules economically attractive for long-term investments. Regulatory standardization and supply chain diversification efforts, particularly in the US and EU, are crucial regional trends shaping future market dynamics and localization strategies.

Segmentation trends highlight the dominance of Interdigitated Back Contact (IBC) technology due to its maturity and established high performance. However, newer, simplified versions like Hybrid Passivated Back Contact (HPBC) and Tunnel Oxide Passivated Contact (TOPCon) architectures are rapidly gaining ground, offering a compelling balance between efficiency gains and manageable production costs. The utility-scale application segment, which benefits most from improved land utilization efficiency, commands the largest market share, while the residential segment is exhibiting the fastest growth due to aesthetic appeal and roof space maximization.

AI Impact Analysis on Global Back Contact Solar Cells Market

User queries regarding AI's influence in the Global Back Contact Solar Cells Market predominantly center on optimizing manufacturing processes, enhancing predictive maintenance for deployed modules, and accelerating R&D for next-generation cell designs. Users are concerned about how AI-driven process control can manage the inherent complexity of back-contact metallization and patterning steps, aiming to reduce defects and improve yield rates. Key expectations revolve around using machine learning for real-time quality control during complex laser doping and plating stages, and utilizing generative design models to simulate optimal busbar-free configurations that maximize current collection efficiency without compromising durability. Furthermore, significant interest lies in AI's role in grid integration optimization, forecasting the enhanced power output of high-efficiency back-contact arrays under various climatic conditions, and maximizing the lifetime performance of these premium solar assets.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning algorithms to forecast potential module failures or degradation rates specific to back-contact module stress points, maximizing uptime and reducing operational expenditures (OPEX) in large solar farms.

- Manufacturing Yield Optimization: Deploying computer vision and deep learning models for precise, real-time defect detection during critical micro-fabrication steps, such as laser scribing and plating, ensuring consistent high-quality cell production and minimizing waste.

- Accelerated Material and Design Research: Using generative AI and neural networks to simulate and optimize novel back-contact architectures, including pattern geometries and material combinations (e.g., copper vs. silver metallization), drastically shortening the R&D cycle for next-generation IBC variants.

- Supply Chain and Production Forecasting: Applying AI tools to better manage the intricate global supply chain for specialized materials, offering accurate forecasting of raw material prices (silicon, silver paste replacements) and optimizing production schedules based on regional demand signals.

- Grid Integration Enhancement: Leveraging AI to model the enhanced power profile stability and response time of high-efficiency back-contact modules, assisting grid operators in better managing the integration of large-scale solar assets into the electrical infrastructure.

- Automated Inspection and Quality Control: Implementing robotic systems guided by AI for automated inspection of the complex rear-side electrical connections, ensuring zero defects escape the factory floor and validating the integrity of the crucial passivation layers.

DRO & Impact Forces Of Global Back Contact Solar Cells Market

The market dynamics are defined by robust driving factors, tempered by significant manufacturing restraints, while technological evolution presents substantial opportunities. Drivers include the global push for renewable energy sources, the increasing demand for high power density solar installations due to land constraints, and the continuous efficiency gains achieved by IBC technology over standard front-contact cells. These factors exert a strong upward force on market growth, pushing manufacturers towards premium, higher-ASP products. Conversely, the market faces strong restraints primarily centered around the high capital investment required for establishing back-contact manufacturing lines, the complex process steps (like high-precision laser work and intricate doping profiles), and the historical reliance on expensive silver paste for rear-side metallization, which poses a cost challenge compared to simpler cell types.

Opportunities for growth are concentrated in the development of cost-effective alternatives for metallization, such as electroplated copper or advanced aluminum alloys, which promise to significantly narrow the cost gap with conventional cells. Furthermore, the integration of back-contact architectures with other advanced technologies, such as heterojunction (HJT-IBC) or perovskite tandem structures, offers an avenue for achieving unprecedented conversion efficiencies, opening up new premium market segments. The continuous scale-up of production capacity globally, supported by strategic government initiatives aimed at domestic solar manufacturing independence, represents a critical opportunity for market penetration.

The key impact forces currently shaping the market include technological advancements, where rapid innovation in cell structure (e.g., transitioning from IBC to HPBC for simplified processing) quickly renders older production lines obsolete; economic competitiveness, where the Levelized Cost of Electricity (LCOE) achieved by these high-efficiency modules must consistently beat lower-cost alternatives; and regulatory support, particularly feed-in tariffs and tax credits that specifically favor high-efficiency installations. These forces collectively dictate the speed of adoption and the competitive landscape among major manufacturers, forcing continuous investment in R&D to maintain market relevance and profitability in this fast-evolving sector.

Segmentation Analysis

The Global Back Contact Solar Cells Market is comprehensively segmented based on technology type, material composition, application, and end-user, providing a granular view of market dynamics and adoption patterns. The segmentation based on technology type, primarily IBC, focuses on the core design structure that places all contacts on the rear. Material composition segmentation is crucial as it reflects the cost structure and efficiency potential, covering both monocrystalline silicon wafers and emerging thin-film integration efforts. Application segmentation differentiates between the primary deployment scenarios, acknowledging that efficiency maximization is paramount in certain use cases, while end-user segmentation targets the specific purchasing behaviors of large utility companies versus decentralized residential buyers.

- By Technology Type:

- Interdigitated Back Contact (IBC) Solar Cells

- Hybrid Passivated Back Contact (HPBC) Solar Cells

- Back Contact Passivated Emitter and Rear Cell (BC-PERC)

- Back Contact Heterojunction (BCHJT) Cells

- Tunnel Oxide Passivated Contact (TOPCon) Back Contact Variants

- By Material:

- Monocrystalline Silicon

- Polycrystalline Silicon (Minimal Adoption)

- Thin-Film Back Contact Cells

- By Application:

- Utility-Scale Solar Farms

- Commercial Rooftop Installations

- Residential Rooftop Installations

- Building-Integrated Photovoltaics (BIPV)

- Specialty Applications (e.g., Portable Solar Devices, Automotive)

- By End-User:

- Independent Power Producers (IPPs)

- Residential Consumers

- Commercial and Industrial (C&I) Sector

- Government and Public Utilities

Value Chain Analysis For Global Back Contact Solar Cells Market

The value chain for the Back Contact Solar Cells Market is intricate and highly integrated, starting with the upstream sourcing of high-purity silicon wafers and specialized materials. Upstream analysis highlights the critical need for advanced processing equipment, including sophisticated laser systems for cell patterning and high-vacuum deposition tools for passivation layers. Suppliers of high-quality N-type silicon wafers, which are essential for achieving the highest IBC efficiencies, hold significant leverage. The midstream involves complex manufacturing steps: diffusion, passivation, laser contact opening, and the crucial back-side metallization, where intellectual property and process control are key competitive differentiators. Due to the precision required, vertical integration or tight control over specialized equipment suppliers is often pursued by leading cell manufacturers.

Downstream analysis focuses on module assembly, system integration, and deployment. Module assembly for back-contact cells involves careful handling to ensure the integrity of the rear electrical contacts and often incorporates higher-end encapsulation materials to match the 30-year expected lifespan of these high-efficiency cells. The primary distribution channels are complex, involving both direct sales to large utility developers (for utility-scale projects) and indirect distribution through solar distributors, EPC (Engineering, Procurement, and Construction) firms, and specialized installers who target the residential and commercial markets. The EPC companies play a crucial role in validating the performance and installation complexity of these premium modules.

Direct channels are preferred for massive utility tenders where manufacturers can offer technical support and long-term warranties directly to the project owners, maximizing profit margins and maintaining brand control. Indirect channels are vital for penetrating fragmented residential and small commercial markets, relying on the installer network's ability to market the superior aesthetics and performance benefits to end-users. Aftermarket services, including O&M (Operations and Maintenance), are becoming increasingly important, especially considering the long-term, high-power nature of back-contact solar arrays, creating a service layer that extends the value chain beyond the initial sale and installation phase.

Global Back Contact Solar Cells Market Potential Customers

The primary potential customers and end-users of Global Back Contact Solar Cells are those who prioritize energy yield per square meter, long-term reliability, and aesthetic integration, effectively commanding a price premium for high-efficiency solutions. Independent Power Producers (IPPs) and large utility companies constitute a major customer base, especially for projects in land-constrained regions or those requiring maximum power output to meet stringent grid connection standards. These large-scale buyers focus heavily on the verifiable efficiency ratings, bankability, and the long-term Levelized Cost of Electricity (LCOE) benefits derived from the superior performance of back-contact modules over decades.

The second substantial customer segment includes the Commercial and Industrial (C&I) sector, particularly businesses with limited rooftop space but high energy demands, such as data centers, logistics hubs, and manufacturing facilities. For C&I customers, maximizing the return on investment from finite rooftop area is critical, making the high power density of IBC modules an essential differentiator. Furthermore, the aesthetic appeal of busbar-free modules is highly attractive for commercial buildings and corporate campuses where visual impact and architectural integration are key considerations for sustainability branding initiatives and property value.

Residential consumers, particularly in premium housing markets of North America, Europe, and Australia, represent the fastest-growing customer segment. Homeowners are increasingly willing to invest in aesthetically superior solar solutions that maximize generation from limited roof surface area while offering a clean, uniform look. Specialty markets, including manufacturers of high-end automotive solar roofs, aerospace power solutions, and luxury marine applications, also form a lucrative niche customer base demanding the extreme efficiency and robustness inherent in back-contact cell designs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 17.5 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LONGi Green Energy Technology Co. Ltd., JinkoSolar Holding Co., Ltd., Maxeon Solar Technologies, SunPower Corporation (Maxeon), Hanwha Q CELLS Co., Ltd., Risen Energy Co., Ltd., JA Solar Technology Co., Ltd., Trina Solar Co., Ltd., Aiko Solar Energy Co., Ltd., Canadian Solar Inc., Meyer Burger Technology AG, Waaree Energies Ltd., GCL System Integration Technology Co., Ltd., China Sunergy Co., Ltd., Solaria Corporation, Mission Solar Energy, Qidong Good-Ark Solar Energy Co., Ltd., Boviet Solar, Talesun Solar, Jolywood (Suzhou) Sunwatt Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Global Back Contact Solar Cells Market Key Technology Landscape

The technology landscape of the Global Back Contact Solar Cells Market is dominated by the pursuit of higher efficiency through complex rear-side engineering, shifting the industry focus from merely passivating the back surface to actively leveraging it for current collection. The foundational technology remains the Interdigitated Back Contact (IBC) cell, which requires precise laser doping and patterning to create alternating N- and P-type contact fingers on the rear. Recent advancements in this domain focus on simplifying the process by replacing traditional diffusion steps with advanced laser processing and adopting screen-printed copper metallization to reduce the dependence on costly silver. This innovation stream aims to maintain high efficiency while significantly cutting production costs and increasing throughput necessary for mass market adoption.

A crucial technological evolution is the rise of the Hybrid Passivated Back Contact (HPBC) architecture, notably popularized by market leaders. HPBC cells offer a middle ground, retaining high efficiency comparable to IBC but using simplified manufacturing steps that are more compatible with existing production lines, thus lowering the barrier to entry for many manufacturers. This simplification typically involves fewer doping steps and a modified rear-side structure that is less sensitive to alignment tolerances. Furthermore, the integration of back-contact principles with Tunnel Oxide Passivated Contact (TOPCon) structures—often referred to as BC-TOPCon—is emerging, combining the benefits of excellent passivation with busbar-free design to achieve efficiencies potentially exceeding 25% at the cell level, representing the cutting edge of current research.

Beyond crystalline silicon, research is progressing on integrating back-contact technology into thin-film and tandem cell architectures. For instance, creating back-contact electrodes for perovskite solar cells eliminates transparent conductive oxide (TCO) layers, potentially simplifying the front electrode and improving light utilization. The core technological objective across all variants remains leveraging N-type wafers for superior carrier lifetime, optimizing the rear-side field (BSF) for maximum minority carrier reflection, and designing contact patterns that minimize resistive losses while maximizing light absorption in the active layer. Automation, high-precision laser ablation, and advanced material deposition techniques are the fundamental tools driving technological progress in this competitive market segment.

Regional Highlights

The geographic distribution of the Back Contact Solar Cells Market is unevenly balanced between high-volume manufacturing hubs and high-demand installation markets, dictated primarily by renewable energy policy and local manufacturing capacity.

- Asia Pacific (APAC): Dominates the market both in terms of production and installation. China is the global epicenter for manufacturing capacity, housing the majority of Tier 1 IBC and HPBC production lines. Strong domestic solar deployment targets in China, India, and Southeast Asia drive substantial demand, making it the largest regional market for both supply and consumption.

- North America: A high-value market driven by the stringent efficiency requirements in the residential and commercial sectors, coupled with incentives like the Inflation Reduction Act (IRA) in the US, which supports high-efficiency domestic manufacturing and deployment. Demand here is characterized by a strong preference for premium, aesthetically pleasing modules (busbar-free), translating into higher Average Selling Prices (ASPs).

- Europe: Exhibits significant growth, propelled by the European Green Deal and the necessity to maximize energy generation on limited land resources. Countries like Germany, the Netherlands, and France show high adoption rates, particularly for residential and BIPV applications where maximizing energy density and aesthetic integration are prioritized.

- Middle East and Africa (MEA): Emerging market with growing potential, driven by large-scale utility projects aiming to leverage solar resources efficiently in high-irradiance environments. Deployment here focuses on rugged, highly reliable back-contact modules that maintain high efficiency under elevated operating temperatures.

- Latin America: Focused growth in countries such as Brazil and Mexico, driven by increasing energy demands and favorable solar irradiation levels. While cost-sensitivity remains a factor, large-scale IPPs are beginning to procure high-efficiency back-contact modules to maximize power output from utility installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Global Back Contact Solar Cells Market.- LONGi Green Energy Technology Co. Ltd.

- JinkoSolar Holding Co., Ltd.

- Maxeon Solar Technologies

- SunPower Corporation (Maxeon)

- Hanwha Q CELLS Co., Ltd.

- Risen Energy Co., Ltd.

- JA Solar Technology Co., Ltd.

- Trina Solar Co., Ltd.

- Aiko Solar Energy Co., Ltd.

- Canadian Solar Inc.

- Meyer Burger Technology AG

- Waaree Energies Ltd.

- GCL System Integration Technology Co., Ltd.

- China Sunergy Co., Ltd.

- Solaria Corporation

- Mission Solar Energy

- Qidong Good-Ark Solar Energy Co., Ltd.

- Boviet Solar

- Talesun Solar

- Jolywood (Suzhou) Sunwatt Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Global Back Contact Solar Cells market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of back contact solar cells?

The primary advantage is the elimination of metal contacts (busbars and fingers) from the front surface, which maximizes the active area exposed to sunlight, significantly reducing shading losses and resulting in superior energy conversion efficiency compared to conventional cells.

How do Back Contact Solar Cells compare in cost to standard PERC cells?

Back Contact Solar Cells currently command a price premium due to the complexity and precision required in manufacturing, including specialized laser processing and metallization steps. However, their superior efficiency leads to lower Balance-of-System (BOS) costs and a better Levelized Cost of Electricity (LCOE) over the project lifespan.

Which technology type is currently dominating the back contact market?

Interdigitated Back Contact (IBC) technology remains dominant due to its proven track record for high efficiency. However, Hybrid Passivated Back Contact (HPBC) cells are rapidly gaining market share due to simplified manufacturing processes and competitive performance metrics.

What role does the adoption of copper plating play in this market?

Copper plating is a crucial technological opportunity designed to replace expensive silver paste used for rear-side metallization. Widespread adoption of copper plating is expected to significantly reduce manufacturing costs and resource consumption, enhancing the economic competitiveness of back-contact solar cells.

Which geographical region exhibits the fastest growth rate for Back Contact Solar Cell deployment?

North America and Europe are experiencing the fastest deployment growth rates, driven by favorable government incentives, strong consumer demand for high-performance and aesthetic modules, and a regulatory environment that prioritizes energy yield per unit area, particularly in residential and commercial segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager