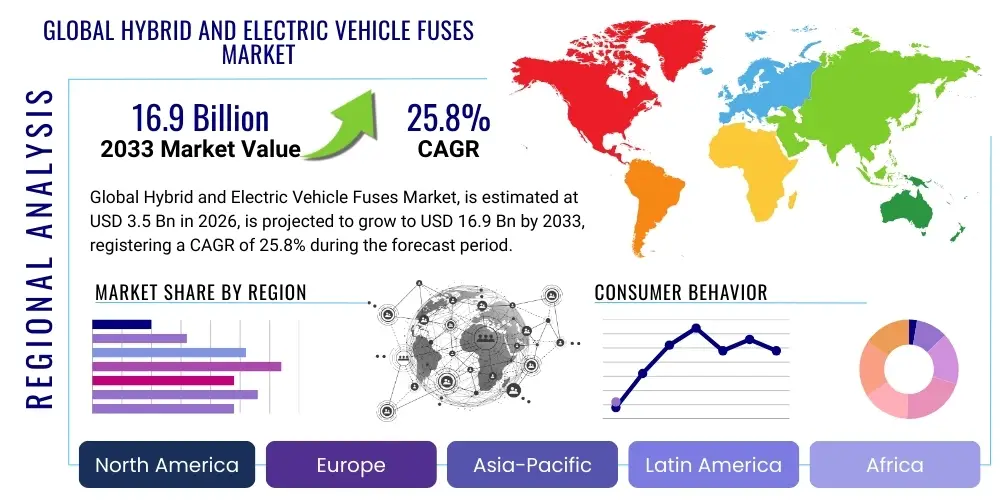

Global Hybrid and Electric Vehicle Fuses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437549 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Global Hybrid and Electric Vehicle Fuses Market Size

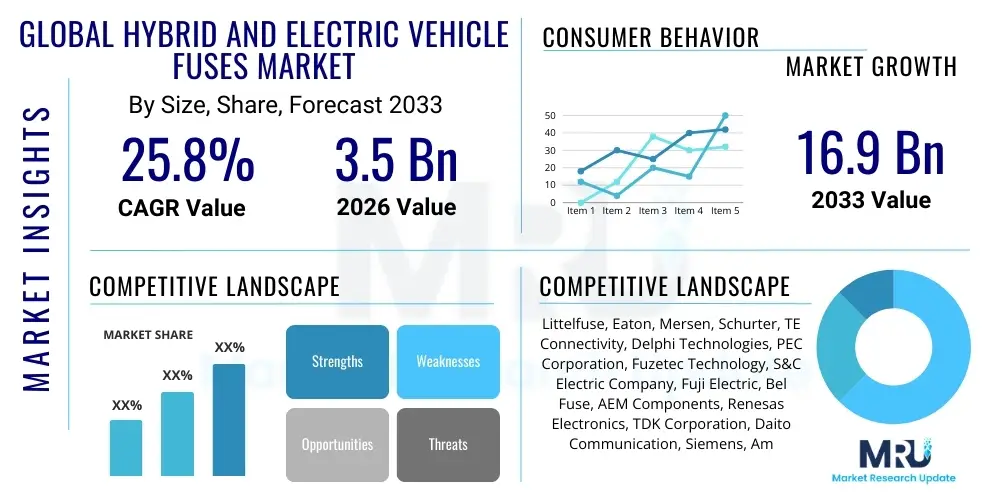

The Global Hybrid and Electric Vehicle Fuses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $16.9 Billion by the end of the forecast period in 2033.

Global Hybrid and Electric Vehicle Fuses Market introduction

The Global Hybrid and Electric Vehicle (H/EV) Fuses Market is a critical component sector within the rapidly expanding electrification of the automotive industry. These specialized fuses are designed to provide robust overcurrent and short-circuit protection for high-voltage (HV) systems, including battery packs, inverters, DC/DC converters, on-board chargers, and auxiliary circuits in hybrid, plug-in hybrid, and fully electric vehicles. Unlike traditional automotive fuses, H/EV fuses must reliably interrupt fault currents often exceeding 1,000 Amperes and handle the unique thermal and vibration stresses associated with electric propulsion systems, ensuring the safety of occupants and the longevity of expensive high-voltage battery systems. The performance characteristics, such as high breaking capacity, low heat dissipation, and compact size, are essential features driving the development of new fuse technologies in this demanding environment, necessitating ongoing material science and design innovation to meet stricter regulatory safety standards and power density requirements across the global automotive landscape.

Major applications of H/EV fuses span the entire high-voltage architecture of electric vehicles. They are instrumental in isolating the primary traction battery from the power electronics during fault conditions, protecting complex components like the inverter (which manages the flow of power to the electric motor) and the charging infrastructure interface. The principal benefit derived from these fuses is enhanced system reliability and safety, preventing catastrophic thermal runaway events or fires that could result from uncontrolled current flow, thereby bolstering consumer confidence in electric mobility solutions. Furthermore, these safety devices comply with stringent international standards, such as ISO 26262 for functional safety, contributing significantly to the overall integrity and operational readiness of modern electric vehicles, which are increasingly relying on 800V architectures requiring even higher performance fusing solutions capable of handling elevated voltage levels and increased power transmission demands within optimized thermal envelopes.

The market is predominantly driven by the accelerating global transition towards sustainable transportation, supported by favorable government mandates, subsidies, and ambitious emission reduction targets set forth by major economies in North America, Europe, and Asia Pacific. As the production volumes of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) continue to surge, the corresponding demand for high-reliability, fast-acting protective devices grows proportionally. Technological advancements, particularly in increasing battery energy density and moving towards higher voltage platforms (e.g., 800V systems replacing 400V systems), compel fuse manufacturers to continuously innovate, offering fuses with superior interrupting capabilities and reduced size profiles to fit densely packed vehicle layouts, thereby serving as a crucial catalyst for market expansion and sophisticated product development across the supply chain.

Global Hybrid and Electric Vehicle Fuses Market Executive Summary

The Global Hybrid and Electric Vehicle Fuses Market is experiencing robust expansion, fundamentally propelled by rapid electrification mandates and continuous innovation in battery technology and vehicle power management systems. Business trends indicate a strong shift towards specialized, high-performance fuses, particularly those designed for 800V architectures, as Original Equipment Manufacturers (OEMs) prioritize fast charging capabilities and increased vehicle range. Key market players are heavily investing in ceramic and semiconductor fuse technologies to meet strict demands for functional safety (ASIL-D requirements) and size optimization, leading to consolidation and strategic partnerships aimed at securing long-term supply agreements and optimizing manufacturing efficiencies for high-volume production necessary for scaling electric vehicle manufacturing capacity globally and reliably.

Regionally, the Asia Pacific (APAC) stands as the dominant market, primarily driven by the colossal EV manufacturing and sales volumes in China, coupled with significant governmental support and rapidly maturing supply chains in South Korea and Japan. Europe and North America follow closely, characterized by stringent safety regulations and strong consumer adoption of premium and high-performance electric vehicles, which often feature advanced fusing technologies across multiple subsystems. The European market, benefiting from the European Green Deal, is seeing accelerated adoption, while North America’s growth is spurred by initiatives like the Infrastructure Investment and Jobs Act, stimulating both domestic manufacturing and the deployment of advanced EV infrastructure, thereby guaranteeing sustained demand for protective components like specialized fuses.

Segment trends reveal that the Battery Electric Vehicle (BEV) application segment holds the largest market share and is projected to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the overall trend of increasing fully electric vehicle penetration compared to hybrids. Furthermore, within the product segment, High-Voltage Fuses (HV Fuses) are gaining prominence as vehicle platforms transition from 400V to 800V, demanding enhanced interrupting ratings and thermal management capabilities, ensuring that future electric vehicle platforms are robustly protected against unprecedented electrical demands and unforeseen fault conditions throughout their operational life cycle.

AI Impact Analysis on Global Hybrid and Electric Vehicle Fuses Market

Common user questions regarding AI's impact on the H/EV Fuses Market often center on how Artificial Intelligence and Machine Learning (ML) can improve fault detection, enhance predictive maintenance, and optimize fuse design and lifespan. Users are primarily concerned with whether AI integration will lead to the replacement of physical fuses with intelligent, self-healing circuits or simply optimize the performance and placement of existing physical components. The analysis reveals a consensus that while AI is unlikely to fully replace physical overcurrent protection in the near term due to essential safety standards, it will dramatically influence the entire value chain. Key themes include using AI for real-time diagnostics of battery management systems (BMS) to anticipate potential faults before they trigger a hard fuse break, thereby extending component life and improving overall system reliability. Furthermore, AI is crucial for optimizing manufacturing processes, particularly quality control, ensuring zero-defect production of safety-critical components like high-voltage fuses used in mission-critical automotive applications.

AI's initial impact is most pronounced in the design and testing phase. Generative design tools powered by AI are enabling manufacturers to simulate complex thermal and electrical stress scenarios faster and more accurately than traditional methods. This capability allows for the creation of optimized fuse geometries and material compositions that offer lower impedance, faster reaction times, and better heat dissipation, specifically tailored for the dynamic load profiles characteristic of high-power EV applications. This accelerated design cycle reduces time-to-market for next-generation fuses required for advanced EV platforms, providing a significant competitive advantage to firms that successfully integrate these AI tools into their product development pipelines and simulation frameworks, ensuring optimal performance under extreme operational conditions.

In the operational sphere, integrated Vehicle Health Monitoring (VHM) systems, utilizing AI algorithms, analyze vast datasets from the EV’s various electrical subsystems—including temperature, current fluctuations, and voltage levels. By detecting subtle anomalies indicative of component degradation or impending fault conditions, AI can generate predictive alerts. This capability allows the vehicle’s central control unit or the fleet manager to schedule preventative actions, potentially reducing the frequency of severe electrical faults that require a fuse blow-out, thereby improving vehicle uptime and reducing warranty costs associated with component failure. This shift from reactive protection to predictive safety is a transformative application of AI in the H/EV safety market, extending the life of the protection mechanism and the expensive components it safeguards.

- AI-driven Predictive Maintenance: Enhancing Battery Management Systems (BMS) to predict electrical faults, minimizing reliance on reactive fuse activation.

- Generative Design Optimization: Utilizing ML algorithms to optimize fuse geometry and material science for superior thermal performance and faster interrupting capabilities.

- Automated Quality Control: Employing computer vision and AI for high-speed, zero-defect inspection during the fuse manufacturing process.

- Real-Time Diagnostics: Integrating AI into vehicle telematics for continuous monitoring of current flow anomalies indicative of precursor fuse degradation.

- Supply Chain Forecasting: Improving component inventory management and mitigating risks associated with raw material shortages through advanced predictive modeling.

DRO & Impact Forces Of Global Hybrid and Electric Vehicle Fuses Market

The Global Hybrid and Electric Vehicle Fuses Market is characterized by a strong interplay of powerful drivers, significant regulatory restraints, and immense long-term opportunities, all shaped by profound impact forces emanating from technological innovation and geopolitical shifts. The primary driver is the pervasive governmental push for vehicle electrification globally, evidenced by increasingly ambitious mandates to phase out internal combustion engines (ICEs) and substantial financial incentives for EV adoption, creating an irreversible trajectory for market growth. This is structurally supported by the continuous advancements in battery technology, which increases energy density and subsequently necessitates higher-performance, more reliable fusing solutions to manage elevated power output and mitigate inherent fire risks associated with lithium-ion chemistry, thereby continuously elevating the demand floor for specialized high-voltage protection devices.

Conversely, the market faces notable restraints, most critically the fluctuating prices and availability of key raw materials, such as copper, silver, and ceramics, essential for manufacturing high-performance fuses, leading to potential supply chain bottlenecks and cost inflation. Furthermore, the complexity associated with integrating new 800V fusing solutions into rapidly evolving vehicle architectures poses technical challenges, requiring intensive research and development, stringent validation cycles, and standardized testing protocols, which can slow down product time-to-market. The rapid obsolescence risk, where current fuse technologies may become inadequate for next-generation solid-state batteries or even higher voltage platforms (1000V or above), mandates high capital expenditure in continuous innovation, potentially straining the margins of smaller market participants lacking scale.

The foremost opportunity lies in the burgeoning adoption of commercial electric vehicles, including buses and heavy-duty trucks, which require large, highly customized, and extremely durable fuse systems to manage multi-megawatt power flows. Moreover, the aftermarket segment presents a significant opportunity as the global H/EV fleet ages, necessitating replacement of safety-critical components. Impact forces, particularly the stringent regulatory environment (e.g., UNECE R100, FMVSS standards, and ISO 26262), exert massive pressure on manufacturers to guarantee functional safety, thereby driving innovation towards robust, traceable, and certifiable products. Economic impact forces, such as global inflation and interest rate hikes, might temporarily dampen new vehicle sales, but the long-term structural commitment to decarbonization ensures sustained market resilience, forcing players to focus on cost-effective, high-reliability production methods to maintain competitiveness.

Segmentation Analysis

The Global Hybrid and Electric Vehicle Fuses Market is highly segmented based on the fundamental characteristics of the product, the vehicle type it protects, the specific electrical system application, and the required voltage range. This segmentation is crucial for understanding the diverse technological requirements across the electric mobility spectrum, allowing manufacturers to tailor their R&D and product offerings precisely. The primary segmentation by fuse type differentiates between high-voltage (HV) fuses, typically rated above 60V DC, which protect the main propulsion components and battery pack, and low-voltage (LV) fuses, which safeguard auxiliary systems such as infotainment, lighting, and conventional 12V circuitry, reflecting the complexity of modern vehicle electrical architectures that integrate multiple voltage domains.

Segmentation by Application is critical, distinguishing fuses used in the Battery/Charging System (the most critical segment requiring the highest rupture capacity and fastest response), the Power Distribution Unit (PDU), the On-Board Charger (OBC), and the Inverter/Converter system. Each application poses unique electrical and thermal stress profiles, requiring fuses designed for specific fault clearing times and environmental tolerances, such as vibration resistance. The fastest growth is observed in the high-voltage application segments directly linked to the traction power chain, reflecting the increasing capacity and complexity of modern EV battery packs and their associated power electronics, which are becoming exponentially more sophisticated and demanding in terms of protective mechanisms.

Further granularity is achieved through segmentation by Vehicle Type (BEV, PHEV, HEV), where BEVs typically demand the most complex and highest-rated fuse configurations due to their entirely electric powertrain and large battery capacities, driving significant revenue share. Geographically, market dynamics are segmented based on regional EV adoption rates and regulatory compliance needs, with APAC leading in volume while North America and Europe lead in the rapid adoption of high-performance 800V components. Understanding these segments enables stakeholders to forecast demand shifts, optimize production capacity, and strategically position their offerings to capitalize on regional and technological trends, such as the increasing demand for semiconductor fuses in certain high-frequency switching applications.

- Fuse Type:

- High-Voltage Fuses

- Low-Voltage Fuses

- Application:

- Battery/Charging System (BMS, On-Board Charger)

- Power Distribution Unit (PDU)

- Inverter/Converter Systems (DC/DC, AC/DC)

- Auxiliary Systems

- Vehicle Type:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

- Voltage Range:

- <400V

- 400V–600V

- >600V (Including 800V Architectures)

Value Chain Analysis For Global Hybrid and Electric Vehicle Fuses Market

The value chain for the Global Hybrid and Electric Vehicle Fuses Market begins with the upstream sourcing of specialized raw materials, primarily high-purity ceramic casing materials, conductive elements (silver, copper, and specialized alloys), and high-quality filler materials (often quartz sand) crucial for arc quenching and breaking high currents reliably. Upstream activities are dominated by specialized material suppliers who must meet rigorous quality and purity standards, as the performance and functional safety of the fuse critically depend on the consistency and properties of these inputs. This stage is characterized by significant vulnerability to global commodity price volatility and requires robust supplier relationship management to ensure continuous supply and maintain cost competitiveness in high-volume production cycles necessary for automotive standardization.

The midstream involves the core manufacturing, assembly, and testing of the fuses, a process requiring sophisticated machinery, specialized intellectual property related to element design (K-factor, M-effect), and advanced quality control systems, often leveraging automation for precision assembly. Leading fuse manufacturers integrate vertical capabilities or establish strong partnerships with specialized component producers to maintain high production throughput and ensure compliance with demanding automotive functional safety standards (ISO 26262). This stage adds the most significant value by transforming raw materials into a safety-critical, high-performance product capable of handling the severe electrical stress imposed by modern EV powertrains, necessitating comprehensive in-house validation and rigorous third-party certification before deployment.

Downstream analysis focuses on distribution and integration. The distribution channel is predominantly Direct-to-OEM, where major fuse manufacturers supply components directly to Tier 1 suppliers or the automotive OEMs themselves, often under long-term supply contracts established during the vehicle design phase, reflecting the custom nature and critical safety role of these components. Indirect distribution channels primarily serve the replacement market (aftermarket) and smaller niche vehicle manufacturers or customizers through specialized industrial distributors. The end-user integration involves embedding these fuses within complex Power Distribution Units (PDUs) and Battery Junction Boxes (BJBs). Efficiency in the downstream logistics and technical support is paramount, as failure of these safety components can have severe consequences, emphasizing the need for robust traceability and swift replacement services across the global vehicle fleet.

Global Hybrid and Electric Vehicle Fuses Market Potential Customers

The primary potential customers and buyers in the Global Hybrid and Electric Vehicle Fuses Market are the automotive Original Equipment Manufacturers (OEMs) who design, assemble, and sell hybrid and electric vehicles. These include global players like Tesla, Volkswagen Group (including Audi, Porsche), General Motors, Ford, Hyundai-Kia, Toyota, BYD, and numerous emerging electric vehicle startups globally, particularly those centered in China. As safety components, fuses are sourced early in the vehicle development lifecycle, making the Tier 1 electrical system suppliers (who design and supply PDUs, inverters, and battery packs) also critical intermediate customers. The procurement decisions are driven by stringent functional safety requirements, reliability performance data, cost-effectiveness, and the supplier's capacity to deliver high-volume, standardized products globally.

A second major customer segment includes manufacturers of EV charging infrastructure (e.g., fast charging stations and residential wall boxes). While these entities require fuses for power electronics protection, their requirements often differ slightly from on-board vehicle applications, focusing on robust industrial-grade protection for high-power stationary deployment. Furthermore, the commercial vehicle sector, encompassing electric bus manufacturers, electric delivery van producers, and emerging electric heavy-duty truck companies, represents a high-growth customer segment. These vehicles demand extremely high-rated fuses due to their massive battery packs and sustained heavy-duty operation profiles, often requiring custom protective solutions designed for exceptional durability and thermal cycling resistance.

Finally, the independent aftermarket sector, including specialized repair shops, authorized service centers, and global component distributors, constitutes the third key customer group. As the existing fleet of H/EVs ages, the demand for replacement fuses—either due to maintenance, repair following a fault, or standard wear-and-tear replacement—will grow substantially. This segment is highly sensitive to product availability, price, and standardization. Ensuring wide availability and easy identification of approved, high-quality replacement fuses is essential for sustaining the long-term operational safety and reliability of the global electric vehicle population, thus making aftermarket distribution channels increasingly important for long-term revenue streams for fuse manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $16.9 Billion |

| Growth Rate | 25.8% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Littelfuse, Eaton, Mersen, Schurter, TE Connectivity, Delphi Technologies, PEC Corporation, Fuzetec Technology, S&C Electric Company, Fuji Electric, Bel Fuse, AEM Components, Renesas Electronics, TDK Corporation, Daito Communication, Siemens, Amphenol, Vishay Intertechnology, Sensata Technologies, Honeywell. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Global Hybrid and Electric Vehicle Fuses Market Key Technology Landscape

The technology landscape in the H/EV fuses market is rapidly evolving, driven primarily by the need for higher voltage endurance, faster interruption speeds, and improved thermal management in compact spaces. One of the central technological developments is the transition from conventional silver-link fuses to advanced ceramic-body fuses utilizing specialized quartz sand filler materials to enhance arc quenching capabilities, essential for reliably breaking massive fault currents (up to 50kA or more) characteristic of high-capacity lithium-ion battery packs. Manufacturers are also focusing heavily on proprietary melting elements and complex internal structures, engineered using advanced simulation tools, to achieve specific I²t characteristics—a metric defining the energy needed to melt the fuse—thereby ensuring the fuse coordinates perfectly with associated power semiconductor devices like IGBTs and SiC MOSFETs, protecting them rapidly and selectively under overload conditions.

A significant ongoing innovation involves semiconductor fuses and hybrid protection modules, although physical fuses remain the primary safety mechanism. Hybrid solutions integrate a fast-acting electronic trip mechanism with a conventional physical fuse link. This combination provides both the ultra-fast response needed to protect sensitive electronics against transient overcurrents and the guaranteed, high-capacity interruption capability of a physical fuse for catastrophic short circuits. Furthermore, the rise of 800V vehicle architectures necessitates the development of fuses capable of handling higher DC working voltages (up to 1,000V DC and beyond) while maintaining compact form factors and minimizing heat generation (low power dissipation). This pushes material science towards optimized silver alloys and advanced insulating techniques to prevent parasitic arcs and ensure long-term stability under severe electrical stress.

The integration of smart features into fuse monitoring systems is another key technological trend. While the fuse itself remains a passive safety device, surrounding circuitry and sensors monitor the fuse’s status (blown or intact) and sometimes measure temperature or resistance changes that might indicate impending failure or degradation. This smart monitoring capability feeds vital diagnostic data back to the Battery Management System (BMS) and vehicle control unit, enabling predictive maintenance and enhancing overall system diagnostics. Furthermore, new packaging technologies, such as bolt-down and surface-mount power fuse designs, are being adopted to improve thermal interfaces, reduce connection resistance, and enhance vibration resilience, critical factors for components operating in the harsh under-hood environment of electric vehicles.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global H/EV Fuses Market, largely due to China’s massive domestic EV production volumes and consumer adoption, supported by aggressive government industrial policies favoring New Energy Vehicles (NEVs). Countries like South Korea (home to major battery and automotive OEMs) and Japan (known for advanced hybrid technology) are also significant contributors. The region is characterized by high-volume manufacturing and rapid technological adoption, often serving as the primary proving ground for new, high-performance fusing solutions designed to meet competitive cost structures and high safety requirements of local markets.

- Europe: Europe represents a high-growth market, driven by stringent emission standards (e.g., Euro 7) and the EU’s commitment to phasing out ICE vehicles under the European Green Deal. The demand here is concentrated on high-quality, fully certified fuses that comply strictly with UNECE regulations and functional safety standards (ISO 26262). Germany, France, and Norway are leading adopters, focusing heavily on premium BEV segments and increasingly adopting 800V architectures, driving demand for technologically sophisticated protection components.

- North America: The market in North America, primarily the United States, is expanding rapidly, fueled by significant investments in domestic EV manufacturing capacity and supportive federal policies (like the Inflation Reduction Act). Key focus areas include robust solutions for large, high-capacity battery packs used in electric trucks and SUVs. The regional market demands high-reliability products capable of withstanding extreme environmental conditions (hot and cold weather) while meeting stringent US automotive safety standards and often requiring high power interrupt capabilities.

- Latin America (LATAM) and Middle East & Africa (MEA): While currently smaller in volume, these regions present nascent growth opportunities as infrastructure projects and initial EV adoption programs gain momentum, particularly in metropolitan areas. Demand in these regions is heavily focused on basic, reliable high-voltage protection for imported vehicles, with increasing local manufacturing efforts starting to create localized demand for regional sourcing of standard fuse types.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Global Hybrid and Electric Vehicle Fuses Market.- Littelfuse

- Eaton

- Mersen

- Schurter

- TE Connectivity

- Delphi Technologies

- PEC Corporation

- Fuzetec Technology

- S&C Electric Company

- Fuji Electric

- Bel Fuse

- AEM Components

- Renesas Electronics

- TDK Corporation

- Daito Communication

- Siemens

- Amphenol

- Vishay Intertechnology

- Sensata Technologies

- Honeywell

Frequently Asked Questions

Analyze common user questions about the Global Hybrid and Electric Vehicle Fuses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between EV fuses and traditional automotive fuses?

EV fuses are engineered for high-voltage DC systems (up. to 1000V) and possess significantly higher interrupting ratings (breaking capacity), typically designed to manage and safely interrupt massive fault currents (tens of kA) emanating from large lithium-ion battery packs, unlike traditional low-voltage 12V automotive fuses.

How is the shift to 800V architectures affecting the EV fuses market?

The shift to 800V platforms necessitates fuses capable of maintaining optimal performance and functional safety at higher DC working voltages. This drives technological innovation towards new material composites and design geometries to minimize power loss, enhance thermal stability, and ensure reliable arc quenching at elevated voltages, accelerating market demand for highly specialized HV fuses.

Which segmentation segment is driving the highest growth in the EV fuses market?

The Battery Electric Vehicle (BEV) application segment, specifically fuses integrated into the Battery/Charging System and Power Distribution Units (PDUs), is expected to exhibit the highest growth rate due to the global increase in fully electric vehicle adoption and the corresponding increase in battery pack sizes and complexity.

What role does functional safety (ISO 26262) play in the manufacturing of EV fuses?

Functional Safety, particularly achieving Automotive Safety Integrity Level (ASIL) standards, is paramount. Manufacturers must design, test, and trace EV fuses with extreme rigor to ensure predictable failure behavior, robust performance, and compliance with high safety integrity levels, as these components are critical for preventing thermal runaway and vehicle fire hazards.

What are the major challenges related to raw material procurement for EV fuses?

The key challenges include price volatility and supply chain stability for critical conductive materials like high-purity silver and copper, as well as specialized ceramic materials. Ensuring a consistent supply of these materials is essential for meeting the rapidly scaling production demands of global electric vehicle manufacturing and maintaining cost-effective production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager