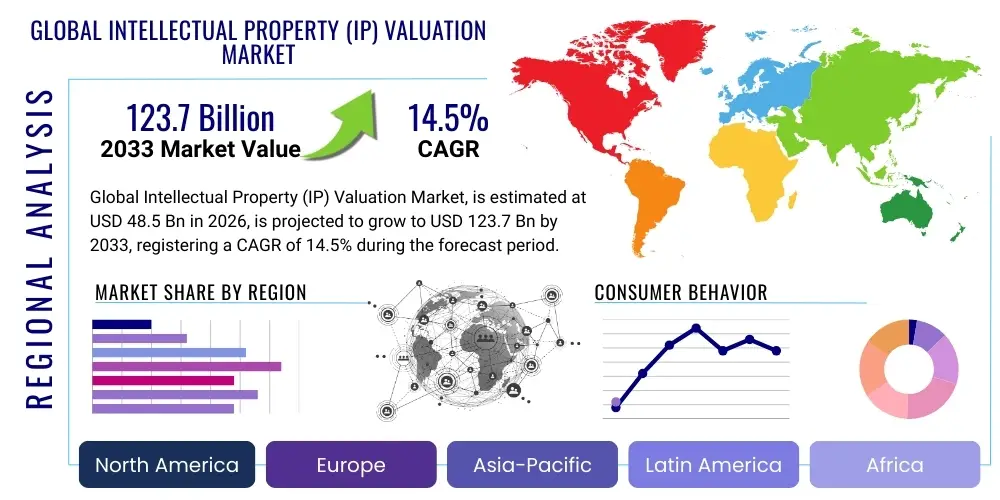

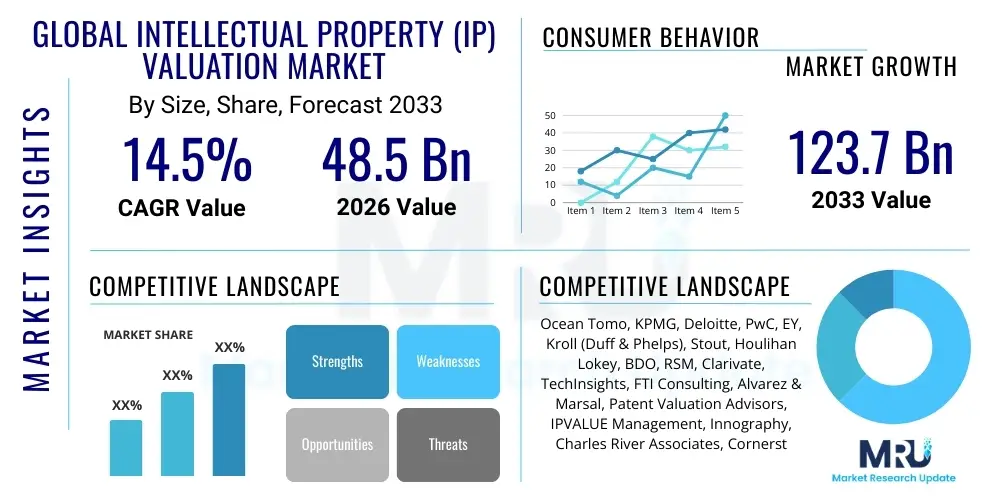

Global Intellectual Property (IP) Valuation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436294 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Global Intellectual Property (IP) Valuation Market Size

The Global Intellectual Property (IP) Valuation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 48.5 Billion in 2026 and is projected to reach USD 123.7 Billion by the end of the forecast period in 2033.

Global Intellectual Property (IP) Valuation Market introduction

The Global Intellectual Property (IP) Valuation Market encompasses the professional services and technology solutions dedicated to determining the economic worth of intangible assets such as patents, trademarks, copyrights, and trade secrets. This market is fundamentally driven by the increasing realization among corporations and financial institutions that IP assets constitute a significant, often undervalued, portion of enterprise value. Effective IP valuation is crucial for numerous corporate activities, including financial reporting (e.g., adherence to IFRS and GAAP standards for purchase price allocation), litigation support, mergers and acquisitions (M&A) due diligence, licensing agreements, and collateralization for financing. The complexity and unique nature of each IP asset—varying by legal jurisdiction, technological maturity, commercial applicability, and remaining economic life—necessitate sophisticated methodologies and specialized expertise, thereby sustaining high demand for valuation services globally.

The core product delivered in this market is a formal valuation report utilizing established methodologies, primarily categorized into the Cost, Market, and Income approaches. The Income approach, particularly the Discounted Cash Flow (DCF) and Relief from Royalty methods, dominates usage due to its ability to capture the future economic benefits derived from the exclusive rights conferred by IP ownership. Major applications span across transactional analysis, where IP value dictates negotiation terms in M&A deals; strategic portfolio management, helping companies prioritize investment in promising R&D areas; and tax planning, addressing transfer pricing regulations related to cross-border IP transfers. The shift toward a knowledge-based global economy, characterized by rapid technological innovation and globalization of supply chains, amplifies the need for precise and legally defensible IP valuations.

The principal benefits derived from robust IP valuation include enhanced transparency in corporate balance sheets, improved ability to secure financing by using IP as collateral, optimized litigation outcomes through quantified damages assessment, and maximized returns from licensing and commercialization strategies. Key driving factors fueling market expansion are the escalating volume of patent applications worldwide, the stringent regulatory environment requiring fair value accounting, the proliferation of IP disputes necessitating expert witness testimony on valuation, and the digital transformation forcing businesses to rely heavily on proprietary software and data, which are protectable intangible assets. These factors collectively establish IP valuation as an indispensable service integral to modern corporate finance and legal strategy.

- Market Intro: Professional services quantifying the economic value of intangible assets like patents, trademarks, and trade secrets for corporate finance and legal compliance.

- Product Description: Formal valuation reports utilizing structured financial methodologies (Income, Market, Cost approaches) to determine the fair market value of intellectual property.

- Major Applications: Mergers and Acquisitions (M&A) due diligence, financial reporting (PPA), licensing negotiation, litigation support, tax planning, and internal strategic management.

- Benefits: Improved balance sheet transparency, enhanced collateral capacity for financing, optimized licensing revenue, and defensible evidence in IP litigation cases.

- Driving Factors: Global rise in patent and trademark filings, strict financial accounting standards (IFRS/GAAP), increase in cross-border M&A activity, and growing prevalence of IP litigation.

Global Intellectual Property (IP) Valuation Market Executive Summary

The Global IP Valuation Market is characterized by significant momentum driven by evolving global regulatory landscapes and accelerated corporate digital asset accumulation. Current business trends indicate a strong shift towards the use of specialized valuation software integrated with big data analytics and machine learning to improve the speed and accuracy of initial assessments, particularly for large patent portfolios. Major consulting firms are aggressively acquiring smaller, specialized IP valuation boutiques to bolster their full-service offerings, reflecting the high strategic value placed on IP expertise in M&A advisory services. Furthermore, there is a pronounced focus on standardizing valuation methodologies for nascent technologies, such as blockchain and generative AI models, where traditional financial metrics are often challenging to apply due to high uncertainty and rapid obsolescence cycles. This demand for specialized expertise ensures sustained high revenue generation for top-tier valuation professionals.

Regionally, North America remains the dominant market, largely attributed to the robust legal enforcement framework, mature venture capital environment, and the high concentration of technology and pharmaceutical industries that rely heavily on intangible assets. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by intensified patent filing activity in China, South Korea, and India, coupled with increasing regulatory requirements for intellectual property monetization and mandatory financial disclosure of intangibles. European markets are driven primarily by complex cross-border licensing agreements and adherence to EU-wide competition laws, necessitating consistent, transparent valuation practices across member states. These regional disparities highlight differential regulatory pressures and varying levels of corporate maturity regarding IP asset management.

Segment trends reveal that valuation for Patents and Technology assets holds the largest market share, driven by massive R&D spending in the life sciences and technology sectors. However, the Trade Secrets segment is experiencing rapid growth, reflecting increasing corporate reliance on proprietary know-how, data algorithms, and customer lists that are not publicly registered, making their valuation highly intricate but strategically vital. Regarding the approach segmentation, the Income Approach, particularly the Relief from Royalty method, maintains preeminence, favored by financial auditors and tax authorities for its clear linkage between IP asset use and future cash flows. Technology adoption is increasingly segmenting the market between firms utilizing automated tools for preliminary screening and those relying purely on bespoke human expertise for contentious or highly complex valuation scenarios, such as determining damages in infringement cases.

- Business Trends: Consolidation among valuation firms, integration of Big Data and AI into valuation processes, and increasing focus on valuing data sets and proprietary algorithms as critical IP assets.

- Regional Trends: North America dominance due to legal maturity; Asia Pacific exhibiting fastest growth due to rising indigenous innovation and stringent local IP protection laws.

- Segments Trends: Patents and Technology remain largest; Trade Secrets segment shows highest growth rate due to increased corporate data protection efforts; Income Approach methodologies are preferred globally.

AI Impact Analysis on Global Intellectual Property (IP) Valuation Market

User queries regarding the impact of AI on IP valuation frequently center on whether automated tools will replace human analysts, how AI can standardize highly subjective inputs, and the methodology for valuing AI-generated inventions or complex algorithmic IP portfolios. Users are deeply concerned about the transparency and auditability of AI-driven valuation models, especially in high-stakes litigation or regulatory compliance scenarios. Furthermore, there is significant interest in using AI not just for valuation calculation, but for predictive analytics related to IP obsolescence, competitive landscape analysis, and market acceptance forecasting, key factors that heavily influence asset value. The consensus expectation is that AI will function primarily as an augmentation tool, enhancing efficiency in data collection and preliminary analysis rather than fully automating the expert judgment required for final valuation.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the operational efficiency of the IP valuation market by automating the data aggregation and analysis phases. AI algorithms can rapidly process vast datasets related to comparable transactions, industry-specific royalty rates, market growth forecasts, and technical specifications of patents. This capability significantly reduces the time and cost associated with the initial stages of valuation, allowing human experts to focus their efforts on sophisticated sensitivity analysis, risk assessment, and legal interpretation. Specifically, ML models are highly effective at identifying relevant comparable licenses or sales transactions from global databases, a task that historically consumed considerable analyst time, thereby enhancing the objectivity and defensibility of the Market Approach valuations.

However, AI's impact extends beyond mere efficiency gains; it introduces new complexities related to the valuation object itself. The IP generated by AI systems—such as autonomous code or novel chemical compounds—presents unique ownership and inventorship challenges, which directly impact economic life and enforceability, two critical valuation drivers. Valuation experts are now required to assess the economic contribution of the underlying data (the 'training data') and the unique algorithms used, necessitating hybrid valuation models. Furthermore, advanced natural language processing (NLP) capabilities in AI tools are being used to assess the strength and breadth of patent claims by comparing them against prior art with unprecedented speed, yielding data-driven insights into potential litigation risk, which is a major factor in discounting future IP cash flows. This strategic augmentation necessitates upskilling among valuation professionals to leverage these powerful analytical tools effectively.

- AI automates comparable data search, improving efficiency in the Market Approach.

- Machine Learning models predict patent litigation risk and potential economic life, refining discount rates.

- Natural Language Processing (NLP) rapidly analyzes patent claims and legal documents for claim strength assessment.

- AI tools streamline due diligence in M&A by quickly screening large IP portfolios for core value drivers.

- Valuation methodologies must evolve to incorporate the intrinsic value of training datasets and proprietary algorithms.

- AI assists in identifying and quantifying potential infringement damages based on historical litigation trends.

DRO & Impact Forces Of Global Intellectual Property (IP) Valuation Market

The dynamics of the Global Intellectual Property Valuation Market are dictated by a compelling intersection of escalating corporate innovation, complex international taxation rules, and inherent subjectivity in intangible asset assessment. The primary drivers (D) include the exponential increase in intangible asset concentration on corporate balance sheets, mandatory financial reporting requirements (like IFRS 3 and ASC 805) demanding Purchase Price Allocation (PPA) which necessitates valuation, and the global proliferation of licensing and franchising activities requiring fair royalty rate determination. Opportunities (O) arise from the expanding use of IP as collateral for asset-backed financing (IP securitization), the emerging need to value digital assets like NFTs and data rights, and the rapid growth in patent monetization firms seeking optimized portfolio structuring. Conversely, restraints (R) often stem from the high level of subjectivity and the reliance on future projections, leading to potential disputes among stakeholders, the significant cost associated with engaging highly specialized valuation professionals, and the lack of universally standardized valuation metrics across diverse international jurisdictions.

The impact forces within the market are predominantly high-pressure financial and legal obligations. The force exerted by regulatory bodies (e.g., SEC, IRS, local tax authorities) demanding auditable and transparent valuations, particularly concerning transfer pricing, is exceptionally strong. Technological advancements act as a substantial influencing force, providing both disruptive potential (through AI automation) and new valuation objects (complex software, bio-data). Economic cycles also play a significant role, as M&A activity and subsequent demand for PPA services surge during periods of economic expansion, while litigation and bankruptcy-related valuations increase during economic contractions. Understanding these forces is crucial for service providers navigating the market and tailoring their offerings to meet dynamic regulatory and transactional demands.

Ultimately, the successful growth trajectory of the IP Valuation Market depends on mitigating the core restraints through technological standardization and greater clarity in accounting standards. While the inherent uncertainty of valuing future cash flows derived from innovation remains, the industry is moving towards utilizing advanced modeling techniques and empirical data to narrow the range of acceptable valuation estimates. The increasing adoption of intangible asset management (IAM) platforms further standardizes data inputs, making valuation processes more repeatable and less dependent solely on proprietary expert models. The collective impact of strong drivers and compelling opportunities significantly outweighs the persistent restraints, ensuring robust long-term market expansion.

- Drivers: Increased M&A activity requiring Purchase Price Allocation (PPA), stricter financial reporting standards (IFRS/GAAP), global rise in patent litigation, and the shift towards knowledge-based economies.

- Restraints: High subjectivity and reliance on future economic projections, lack of global harmonization in valuation standards, and the high cost of specialized expert services.

- Opportunities: Expansion of IP securitization and collateralization, demand for valuing new digital assets (data, algorithms), and geographical expansion into high-growth developing markets.

- Impact Forces: Regulatory compliance requirements (Tax, Financial Reporting), technological change (AI integration), and fluctuations in global M&A transaction volumes.

Segmentation Analysis

The Global Intellectual Property (IP) Valuation Market is systematically segmented based on the type of intellectual property being valued, the primary methodology employed for calculating value, and the end-use industry utilizing the valuation service. This segmentation framework allows market players to specialize their expertise and service offerings to meet the unique legal and financial requirements associated with different intangible asset classes and industry-specific market dynamics. The primary segment determining revenue contribution remains IP Type, with Patents consistently generating the highest demand due to their formalized legal protection, quantifiable economic life, and established role in technology transfer and licensing agreements. Understanding these segments is vital for accurate market forecasting and strategic resource allocation.

- By IP Type:

- Patents (Utility Patents, Design Patents)

- Trademarks and Brands (Word Marks, Logos, Slogans)

- Copyrights

- Trade Secrets and Know-How

- Goodwill and Licensing Agreements

- By Valuation Method:

- Income Approach (Discounted Cash Flow, Relief from Royalty, Multi-Period Excess Earnings)

- Market Approach (Comparable Transactions, Guideline Public Company)

- Cost Approach (Reproduction Cost, Replacement Cost)

- By End-User Industry:

- Technology and Telecommunications (T&T)

- Pharmaceuticals and Life Sciences (P&LS)

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing (Automotive, Aerospace, Industrials)

- Media and Entertainment (M&E)

- Consumer Goods and Retail

- By Application:

- Financial Reporting and Regulatory Compliance (PPA, Impairment Testing)

- Transaction Advisory (M&A, Divestitures)

- Taxation and Transfer Pricing

- Litigation and Dispute Resolution

- Internal Strategic Decision Making and Licensing

Value Chain Analysis For Global Intellectual Property (IP) Valuation Market

The Intellectual Property Valuation market operates through a specialized and knowledge-intensive value chain that begins upstream with data gathering and analysis and culminates downstream in the delivery of a legally and financially defensible valuation report to the end-user. The upstream segment is dominated by IP data providers, patent search platforms, and specialized financial data aggregators who supply critical inputs—such as historical licensing rates, comparable transaction data, legal infringement databases, and technological roadmaps. Sophisticated software providers, increasingly utilizing AI and predictive modeling, also play a key upstream role by standardizing the initial screening and analysis of large IP portfolios, providing preliminary value estimates and identifying key risks before expert intervention. The quality and comprehensiveness of this foundational data significantly dictate the reliability of the final valuation output.

The core midstream activities involve the professional execution of the valuation itself, primarily carried out by specialized valuation consulting firms, the "Big Four" accounting firms (KPMG, PwC, Deloitte, EY), and boutique IP economic consultancies. This stage requires deep expertise in financial modeling, legal IP frameworks, and specific industry economics to select the appropriate valuation methodology, customize the financial assumptions (e.g., royalty rates, discount rates, growth projections), and perform rigorous sensitivity analyses. Distribution channels for the final product—the valuation report—are predominantly direct, involving consultants delivering the services and reports directly to corporate legal departments, CFOs, transactional advisors, or specialized IP monetization entities. However, indirect channels also exist where law firms or investment banks subcontract the valuation component to specialized third parties as part of a larger service package, such as M&A due diligence or litigation preparation.

Downstream activities center on the utilization and defense of the valuation output. End-users apply these valuations for financial reporting (e.g., auditors reviewing PPA compliance), strategic decision-making (determining R&D investment focus or divestiture candidates), and resolving disputes (expert testimony in patent infringement trials). The credibility of the valuation firm and the defensibility of the report's underlying assumptions are paramount in this final stage, particularly when facing scrutiny from tax authorities during transfer pricing audits or cross-examining opposing expert witnesses in court. The cyclical nature of the market means successful downstream application often drives repeat business and referrals, strengthening the position of highly reputable valuation providers.

Global Intellectual Property (IP) Valuation Market Potential Customers

The potential customers for Global Intellectual Property Valuation services span the entire spectrum of high-value, knowledge-intensive industries, ranging from multinational corporations to governmental bodies and specialized legal entities. Large corporations in sectors like Technology, Pharmaceuticals, and Manufacturing are primary buyers, driven by mandatory compliance requirements such as purchase price allocation following M&A transactions and quarterly impairment testing of acquired intangible assets. These corporate buyers also require valuation services for strategic purposes, including determining the minimum acceptable price for licensing out technology, calculating internal transfer pricing for inter-company IP usage, and prioritizing investment in their vast patent estates. Their demands are characterized by high volume and complexity, necessitating continuous valuation support.

Another critical customer segment includes financial institutions and investors, notably private equity firms, venture capital funds, and commercial banks. These entities utilize IP valuation primarily for due diligence before investment, assessing the true proprietary technological advantage of a target company, or when determining the collateral value of IP assets for lending purposes (IP asset-backed lending). Furthermore, law firms, both corporate counsel and external litigators, represent a significant demand pool. They require valuation services to quantify damages in intellectual property infringement cases, a process that can involve determining lost profits, reasonable royalties, or unjust enrichment. This segment demands legally robust, defensible valuation reports suitable for submission as expert evidence in court.

Finally, governmental organizations and regulatory bodies, particularly tax authorities, indirectly or directly drive demand. While they may not be direct buyers of valuation services, their stringent enforcement of transfer pricing regulations requires companies to commission valuation reports demonstrating that cross-border IP transfers occurred at arm's length value. Specialized entities such as IP monetization firms, sovereign patent funds, and universities (managing technology transfer offices) are also essential customers, relying on accurate valuations to maximize the commercial returns from their owned intellectual property portfolios through structured licensing and enforcement campaigns. The diversity of customer needs ensures broad and resilient market demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 48.5 Billion |

| Market Forecast in 2033 | USD 123.7 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ocean Tomo, KPMG, Deloitte, PwC, EY, Kroll (Duff & Phelps), Stout, Houlihan Lokey, BDO, RSM, Clarivate, TechInsights, FTI Consulting, Alvarez & Marsal, Patent Valuation Advisors, IPVALUE Management, Innography, Charles River Associates, Cornerstone Research, LECG Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Global Intellectual Property (IP) Valuation Market Key Technology Landscape

The IP Valuation market is undergoing a significant technological transformation, moving beyond reliance on basic spreadsheet models to incorporate sophisticated analytical platforms, big data architectures, and artificial intelligence. The primary technological advancements focus on streamlining the data ingestion and analysis phase, which traditionally accounts for the majority of the valuation time budget. Key tools include specialized database management systems (DBMS) designed to efficiently catalog and cross-reference millions of patent documents, trademark registrations, and litigation filings from diverse global sources. Furthermore, proprietary analytical software that can model complex financial scenarios, such as Monte Carlo simulations, is crucial for assessing the risk and uncertainty associated with long-term technology projections and market adoption rates, thereby improving the rigor of the Income Approach valuations.

The most impactful recent technology integration is the use of Artificial Intelligence (AI) and Machine Learning (ML). These technologies enable automated portfolio screening, allowing large corporations to quickly triage thousands of IP assets to identify the top 5% or 10% requiring detailed human valuation, based on metrics such as citation count, claim breadth, remaining economic life, and proximity to emerging technological trends. AI algorithms are particularly valuable for the Market Approach, utilizing natural language processing (NLP) to parse complex licensing agreements and extract standardized royalty rate benchmarks, significantly overcoming the historical challenge of finding truly comparable transactions. These advancements reduce operational bias and increase the consistency of preliminary valuation outputs across geographically dispersed teams.

Furthermore, blockchain technology is beginning to emerge as a potential foundational layer for IP management and valuation, particularly in the verification of ownership provenance and transaction history, which are crucial inputs for establishing value, especially for digital assets and NFTs. While not yet mainstream, the secure, immutable ledger provided by blockchain could drastically reduce the due diligence risks associated with verifying the legal status and history of IP. Finally, cloud-based Integrated Intellectual Asset Management (IAM) platforms are becoming standard, providing a centralized system where legal, R&D, and finance departments can collaboratively monitor, manage, and calculate the value of their intangible assets in real time, shifting valuation from an episodic event to a continuous strategic process.

Regional Highlights

The demand for IP valuation services demonstrates substantial regional variation, reflecting differing legal maturities, economic structures, and rates of technological innovation. North America, specifically the United States, represents the epicenter of the global market, primarily due to its robust and aggressive IP litigation environment, mature financial markets that facilitate IP-backed financing, and the dominance of technology and pharmaceutical giants requiring mandatory financial reporting valuations (PPA/Impairment). The sheer volume and high stakes of patent infringement cases in the U.S. drive constant demand for expert witness valuation services, ensuring this region maintains its leading market share, characterized by high fees and complex engagement scopes.

Europe, driven largely by regulatory requirements and cross-border commercialization, constitutes the second-largest market. European demand is often centered on transfer pricing compliance under OECD guidelines, necessitating precise valuations for IP migrating between subsidiaries in different tax jurisdictions. Furthermore, the European Union's cohesive patent system and common legal frameworks support large-scale licensing programs, where valuation is essential for setting fair and reasonable royalty (FRAND) terms. Countries like Germany and the UK are key hubs, balancing strong manufacturing IP with burgeoning financial service IP needs, resulting in a steady, compliance-driven demand curve.

Asia Pacific (APAC) is projected to be the fastest-growing market globally. This exponential growth is underpinned by massive government investment in R&D, rapid increases in patent and trademark filings, particularly in China and South Korea, and the maturation of local innovation ecosystems shifting from imitation to proprietary creation. As Asian companies expand globally and engage in more complex M&A, they face increasing pressure to adhere to international financial standards and transfer pricing rules, dramatically accelerating the adoption of formal IP valuation practices. This shift, combined with growing awareness of IP monetization strategies, promises sustained double-digit growth rates throughout the forecast period.

- North America (US & Canada): Market leader driven by high volume of IP litigation, strong venture capital activity, and stringent financial accounting standards (GAAP). Focus on high-tech patents and life sciences IP.

- Europe (Germany, UK, France): Strong demand fueled by OECD transfer pricing regulations, cross-border licensing of industrial and consumer brands, and M&A transactions requiring PPA compliance.

- Asia Pacific (China, Japan, South Korea, India): Fastest-growing region due to explosive growth in domestic patent applications, increasing regulatory enforcement of IP rights, and corporate adoption of IP monetization strategies.

- Latin America (LATAM): Emerging market characterized by gradual improvements in IP legal frameworks and initial requirements for IP valuation stemming from major infrastructure and resource sector investments.

- Middle East and Africa (MEA): Nascent market, primarily concentrated in financial centers (UAE, Saudi Arabia) requiring IP valuation for foreign direct investment (FDI) and large-scale government technology initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Global Intellectual Property (IP) Valuation Market.- Ocean Tomo

- KPMG

- Deloitte

- PwC

- EY

- Kroll (Duff & Phelps)

- Stout

- Houlihan Lokey

- BDO

- RSM

- Clarivate

- TechInsights

- FTI Consulting

- Alvarez & Marsal

- Patent Valuation Advisors

- IPVALUE Management

- Charles River Associates

- Cornerstone Research

- LECG Corporation

- Intangible Asset Finance Group

Frequently Asked Questions

Analyze common user questions about the Global Intellectual Property (IP) Valuation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between the three standard IP valuation methods?

The three standard methods are Income, Market, and Cost. The Income Approach (e.g., DCF, Relief from Royalty) calculates value based on projected future economic benefits derived from the IP. The Market Approach determines value by reference to recent, comparable transactions involving similar IP assets. The Cost Approach assesses value based on the historical cost of creating or replacing the IP. The Income Approach is typically preferred for unique, income-generating assets, while the Market Approach is favored when robust comparable data exists.

How does IP valuation affect M&A transactions and purchase price allocation (PPA)?

In M&A, IP valuation is crucial for due diligence, ensuring the acquiring entity understands the true value of intangible assets being purchased. For PPA required under financial standards (IFRS 3, ASC 805), valuation determines how the purchase price is allocated across identifiable acquired tangible and intangible assets, including patents, customer relationships, and goodwill. Accurate PPA valuation ensures compliance and impacts future depreciation and impairment testing.

Is Intellectual Property valuation mandatory for financial reporting purposes?

Yes, IP valuation is mandatory in several key financial reporting contexts. Specifically, when a company is acquired (M&A), the acquiring company must value all identifiable intangible assets for Purchase Price Allocation (PPA). Furthermore, all companies must conduct regular impairment testing on capitalized intangible assets, a process that requires periodic valuation to determine if the asset's carrying value exceeds its recoverable amount.

What role does IP valuation play in transfer pricing and global taxation?

IP valuation is fundamental to transfer pricing compliance. When multinational corporations transfer or license IP (like technology or trademarks) between related entities across different tax jurisdictions, the valuation establishes an "arm's length" price or royalty rate. This prevents profit shifting and satisfies OECD guidelines and national tax authority requirements, minimizing the risk of costly tax audits and penalties.

How is the value of newly developed or emerging technology IP assessed when comparable market data is unavailable?

For nascent or emerging technologies lacking comparable market transactions or established royalty rates, analysts primarily rely on the Income Approach using Discounted Cash Flow (DCF) models, often combined with probability-weighted expected outcomes (PWECO) analysis. This involves highly sensitive projections of future market adoption, technological success rates, and the required R&D investment remaining, utilizing expert technical assessments to derive a defensible present value.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager