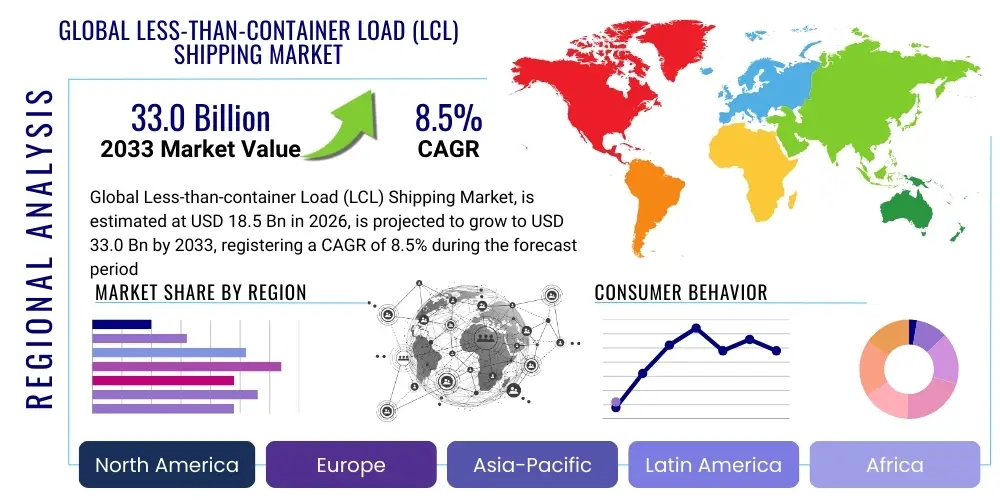

Global Less-than-container Load (LCL) Shipping Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436518 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Global Less-than-container Load (LCL) Shipping Market Size

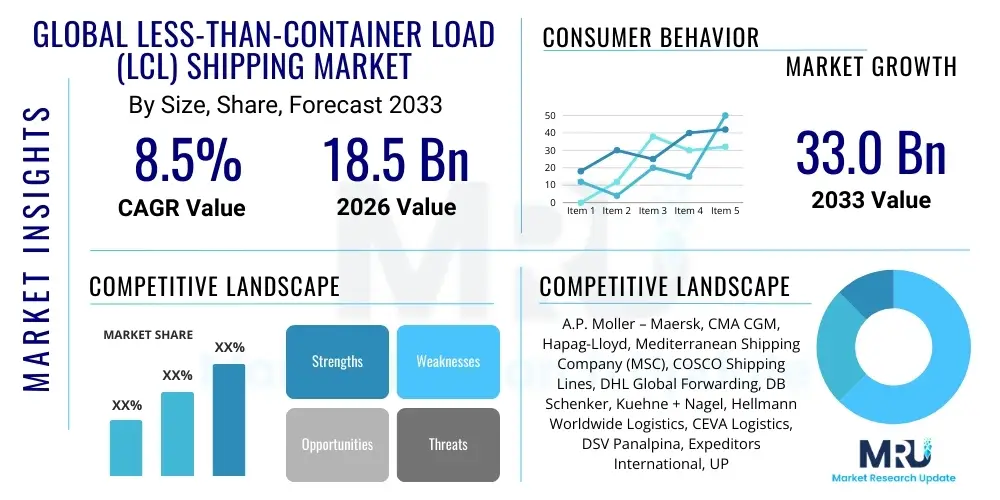

The Global Less-than-container Load (LCL) Shipping Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $33.0 Billion by the end of the forecast period in 2033.

Global Less-than-container Load (LCL) Shipping Market introduction

The Global Less-than-container Load (LCL) Shipping Market encompasses the transportation of cargo volumes that are insufficient to fill a standard 20-foot or 40-foot container. This shipping method consolidates multiple small shipments from various shippers into a single Full Container Load (FCL), optimizing space utilization and reducing costs for individual clients. LCL services are crucial for Small and Medium-sized Enterprises (SMEs), e-commerce fulfillment, and businesses managing lean inventories, providing flexibility and scalability in global supply chains. The demand for LCL has surged as businesses increasingly favor smaller, more frequent shipments to mitigate inventory risk and respond quickly to consumer demand fluctuations.

The core product of the LCL market is the provision of consolidated ocean freight services, characterized by specialized handling, warehousing, and customs brokerage integrated into the end-to-end logistics solution. Major applications span diverse industries, including retail, automotive components, pharmaceuticals, and technology hardware, where inventory levels are tightly managed. The primary benefit of LCL shipping is cost efficiency, as shippers only pay for the volume or weight of space utilized within the container, making global trade accessible to a wider array of businesses.

Key driving factors fueling market expansion include the rapid proliferation of cross-border e-commerce, which generates massive volumes of fragmented, smaller shipments requiring consolidation. Furthermore, the rising need for resilient and flexible supply chain structures post-pandemic has encouraged companies to move away from sole reliance on large FCL shipments, favoring the agility provided by LCL services. Technological advancements, particularly in digitalization and tracking capabilities, have also improved the visibility and reliability of LCL shipments, further enhancing user adoption across global trade lanes.

Global Less-than-container Load (LCL) Shipping Market Executive Summary

The LCL Shipping Market is experiencing robust expansion driven by structural shifts in global manufacturing and retail dynamics, predominantly the acceleration of e-commerce and the trend toward just-in-time inventory management. Current business trends indicate a strong focus on digital transformation, with freight forwarders integrating AI-powered booking platforms, real-time tracking, and automated documentation processes to streamline complex consolidation procedures and enhance service reliability. Geopolitical volatility and fluctuating fuel prices remain critical external factors influencing operational costs and pricing strategies, prompting carriers and logistics providers to emphasize optimized route planning and collaborative networking.

Regionally, Asia Pacific maintains its dominance, primarily fueled by extensive manufacturing output in China, Vietnam, and India, serving as the largest source of LCL exports globally. North America and Europe represent major consumption hubs, focusing on improving intra-regional LCL services and developing sophisticated inland transportation networks to support final-mile delivery. Emerging regional trends highlight the growth of LCL traffic within Latin America and the Middle East, catalyzed by rising regional trade agreements and substantial investments in port infrastructure and logistics hubs, diversifying global trade lanes beyond traditional East-West routes.

Segment trends emphasize the rapid growth of the digital freight forwarding segment, where platform-based solutions offer transparent pricing and instant booking for LCL shipments, attracting tech-savvy shippers. Furthermore, specialized LCL services catering to refrigerated or hazardous materials are witnessing increased demand, reflecting the complexity and diversification of goods being shipped in smaller volumes. The consolidation segment remains crucial, with major logistics players continually acquiring or partnering with smaller consolidation experts to gain control over warehousing and sorting facilities essential for efficient LCL operations.

AI Impact Analysis on Global Less-than-container Load (LCL) Shipping Market

Users frequently inquire about AI's role in mitigating the complexities inherent in LCL operations, specifically addressing concerns related to pricing opacity, optimal container stuffing, and predictive scheduling delays. Common questions revolve around how AI can facilitate instant, accurate quoting for varied shipment sizes, improve terminal efficiency by predicting congestion, and automate the intricate documentation required for consolidated freight across multiple jurisdictions. The prevailing user expectation is that AI will introduce unprecedented levels of precision and transparency into a segment traditionally characterized by manual processes and high variability, ultimately leading to lower costs and faster transit times through superior operational planning and dynamic space management.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is fundamentally reshaping the LCL market by optimizing capacity utilization, which is a critical profitability factor for consolidators. AI algorithms can analyze historical shipment data, booking patterns, and container dimensions instantaneously to determine the most effective cargo placement (stuffing), maximizing container fill rates and minimizing dead space. Furthermore, AI-driven demand forecasting allows forwarders to preemptively secure space on vessels and dynamically adjust pricing based on real-time market fluctuations, ensuring competitive rates while maintaining profitability.

Beyond operational optimization, AI is revolutionizing customer service and risk management within LCL shipping. Natural Language Processing (NLP) and chatbots are improving the speed and quality of customer interactions, handling routine inquiries regarding tracking, documentation, and pricing instantly. Predictive maintenance and risk assessment models utilize ML to identify potential supply chain disruptions, such as port strikes or weather delays, providing forwarders and shippers with timely alerts and automated rerouting suggestions, significantly enhancing the resilience and reliability of LCL logistics services.

- AI-driven optimization of container stuffing (load planning) to maximize space and minimize consolidation costs.

- Predictive analytics for demand forecasting, enabling preemptive procurement of vessel space on key trade lanes.

- Automated dynamic pricing models, offering real-time, personalized quotes based on current market conditions and capacity availability.

- Implementation of robotic process automation (RPA) for rapid documentation processing, customs clearance, and error reduction.

- Enhanced tracking and visibility through ML analysis of sensor data and logistics network status for accurate Estimated Time of Arrival (ETA) predictions.

- Improved security and fraud detection in documentation verification and cargo handling processes using pattern recognition algorithms.

DRO & Impact Forces Of Global Less-than-container Load (LCL) Shipping Market

The LCL market is primarily driven by the exponential growth in cross-border e-commerce, which inherently generates smaller shipments, and the global trend toward risk-averse inventory strategies demanding smaller, more frequent deliveries. Restraints include the inherent operational complexities and higher risk of damage associated with handling consolidated cargo, alongside significant volatility in ocean freight rates and persistent port congestion that affects transit times. Opportunities arise from the increasing adoption of digital freight platforms offering transparent LCL services and the expansion into niche logistics services, such as cold chain LCL. The market is subject to intense impact forces from digital transformation, trade policy shifts (tariffs and regional agreements), and the pressure for environmental sustainability, demanding green logistics solutions and optimized route planning.

Segmentation Analysis

The Global Less-than-container Load (LCL) Shipping Market is comprehensively segmented based on various operational and functional parameters, primarily differentiating services by type, application, and geographic scope. Service type segmentation distinguishes between the physical execution (transportation and warehousing) and the digital/value-added components (customs brokerage and insurance), recognizing the increasing reliance on integrated door-to-door solutions. Application segmentation highlights the different demands placed on LCL providers by key end-user industries, such as retail and manufacturing, each requiring specialized handling and timing. Furthermore, the market structure is analyzed based on the size of the shipper (SMEs versus large enterprises) and the mode of transport used for consolidation.

The transportation mode split is critical, focusing heavily on ocean freight as the backbone of LCL, but also incorporating air freight LCL (though significantly smaller in volume) and multimodal transportation solutions that combine sea and land links for enhanced efficiency. The growth in specialized services, such as refrigerated LCL (reefer LCL) for perishable goods, is expanding the scope of the market beyond general dry cargo. Understanding these segments is crucial for logistics providers aiming to tailor their operational capabilities and technological investments to address specific industry needs and capture higher-margin, specialized shipping demands.

Segmentation allows for targeted strategic planning. For instance, the market segment dominated by SMEs requires easy-to-use digital booking interfaces and highly competitive pricing, while the manufacturing segment often requires complex, tightly scheduled supply chain integration and specific compliance documentation. The ongoing trend towards global nearshoring and regional trade further influences segmentation, creating higher demand for intra-regional LCL services, particularly in mature markets like Europe and North America, necessitating regional consolidation hubs and efficient road networks complementing ocean transport.

- By Service Type:

- Standard LCL Shipping

- Value-Added Services (Customs Clearance, Insurance, Documentation)

- Specialized LCL (Dangerous Goods, Temperature Controlled)

- Door-to-Door LCL

- By Application/End-User Industry:

- Retail and E-commerce

- Manufacturing (Automotive, Machinery)

- Pharmaceuticals and Healthcare

- Chemicals and Materials

- Food and Beverages

- By Transport Mode:

- Ocean Freight LCL

- Air Freight LCL

- Multimodal LCL

- By Shipper Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Value Chain Analysis For Global Less-than-container Load (LCL) Shipping Market

The LCL value chain is inherently complex due to the multi-party coordination required for cargo consolidation and deconsolidation. Upstream analysis involves the initial booking and pickup from the shipper, often relying heavily on digital freight platforms and local trucking services. This stage also includes the procurement of space from primary ocean carriers (Vessel Operating Common Carriers - VOCCs). Midstream operations are dominated by Non-Vessel Operating Common Carriers (NVOCCs) and freight forwarders, who manage critical processes such as warehousing, sorting, container stuffing (consolidation), and ensuring regulatory compliance and documentation for all individual shipments within the container. The efficiency of this midstream process dictates the overall cost and transit time of LCL services.

Downstream analysis focuses on the destination side, encompassing the deconsolidation process at the destination Container Freight Station (CFS), customs clearance specific to each shipment, and the final delivery to the consignee via last-mile logistics providers. The complexity here lies in the accurate sorting and timely release of individual shipments. Distribution channels are predominantly indirect, utilizing a network of third-party logistics (3PL) providers and specialized consolidation agents who manage physical assets and operational processes. Direct channels, though less common, involve large global forwarders or integrated logistics companies that manage the entire process end-to-end using their own infrastructure and digital platforms, offering higher control over service quality and lead times.

The increasing digitalization is shifting power dynamics within the value chain. Technology platforms act as meta-brokers, connecting upstream shippers directly to downstream services, potentially bypassing traditional intermediaries for simple shipments. However, specialized, complex LCL movements (e.g., hazardous materials or temperature-sensitive goods) continue to rely heavily on experienced agents and centralized CFS operations. Strategic partnerships between NVOCCs and technology firms are essential for maintaining competitive advantage, ensuring seamless data exchange from booking to final delivery, thereby optimizing asset utilization and minimizing delays inherent in cross-border transactions.

Global Less-than-container Load (LCL) Shipping Market Potential Customers

The primary customer base for LCL services consists overwhelmingly of Small and Medium-sized Enterprises (SMEs) that lack sufficient volume for dedicated Full Container Load (FCL) shipments but require global market access. These customers prioritize cost-effectiveness and flexibility, often relying on digital interfaces for transparent pricing and simplified booking procedures. Another major segment includes large corporations, particularly in retail and automotive sectors, utilizing LCL for just-in-time inventory replenishment, carrying safety stock, or transporting samples and replacement parts, thereby minimizing large buffer inventory holdings and increasing supply chain responsiveness to unexpected demand spikes.

E-commerce businesses, ranging from independent online retailers to major marketplace sellers, represent the fastest-growing customer segment. Their business model dictates high frequency, low volume shipments, often directly from Asian manufacturing centers to fulfillment centers globally, making LCL an indispensable tool for managing seasonal fluctuations and rapid product launches. Furthermore, suppliers to large global manufacturers (OEMs) frequently use LCL to deliver components or sub-assemblies based on rigid production schedules that require precise timing, underscoring the necessity for reliable scheduling and clear communication from LCL service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $33.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | A.P. Moller – Maersk, CMA CGM, Hapag-Lloyd, Mediterranean Shipping Company (MSC), COSCO Shipping Lines, DHL Global Forwarding, DB Schenker, Kuehne + Nagel, Hellmann Worldwide Logistics, CEVA Logistics, DSV Panalpina, Expeditors International, UPS Supply Chain Solutions, XPO Logistics, FedEx Logistics, NVOCC Specialists, ShipBob, Flexport, ZIM Integrated Shipping Services, OOCL. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Global Less-than-container Load (LCL) Shipping Market Key Technology Landscape

The technological landscape of the LCL shipping market is rapidly evolving, moving away from legacy systems toward highly integrated, cloud-based digital solutions. Central to this transformation is the deployment of advanced Transportation Management Systems (TMS) that offer modular functionalities specifically tailored for the complexities of consolidation, including multi-vendor coordination, automated documentation generation (especially crucial for LCL’s diverse shipments), and integrated tariff management. These systems utilize APIs to connect seamlessly with carrier scheduling platforms and customs portals, ensuring timely data exchange and minimizing manual data entry errors, which are frequent pain points in traditional LCL management.

Furthermore, the increased focus on transparency and visibility is driving the adoption of Internet of Things (IoT) devices and sophisticated tracking technologies. Real-time cargo tracking at the individual shipment level, rather than just the container level, is becoming a standard expectation. IoT sensors embedded within the packaging or consolidation warehouses provide crucial data on temperature, humidity, and shock events, particularly vital for specialized LCL cargo like pharmaceuticals or high-value electronics. This granular level of data enables proactive communication with shippers and facilitates faster claims processing if damage occurs, directly impacting customer satisfaction and operational risk management.

Blockchain technology is also gaining traction, primarily in securing and simplifying the vast array of documentation required for LCL shipments (Bills of Lading, packing lists, commercial invoices, certificates of origin, etc.) originating from various sources. By creating an immutable, distributed ledger, blockchain enhances trust and speeds up cross-border transactions by providing a single source of verified truth for all regulatory and commercial paperwork. This technological integration is essential for supporting the predicted high growth volumes in LCL, ensuring scalability and compliance while driving down the administrative overhead previously associated with manually managing diverse consolidated shipments.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of global LCL supply, driven by colossal manufacturing capacity, especially in China, Vietnam, and India. The region's market growth is supported by large-scale government investments in port modernization and logistics infrastructure, coupled with the dominance of cross-border e-commerce exports. Key trade lanes originating from APAC (e.g., Trans-Pacific and Asia-Europe) see the highest density of LCL movements, making efficient consolidation operations in hubs like Shenzhen, Singapore, and Shanghai crucial for global supply chain flow.

- North America: As a major consumption market, North America focuses on inbound LCL services, with a strong demand for speed and visibility to support sophisticated retail inventory models. The region is characterized by high operational complexity in last-mile delivery and a rapid adoption of digital freight forwarders that streamline the documentation and customs processes upon arrival. Intra-regional LCL, supported by robust trucking and rail networks, is also growing, facilitating trade between the US, Canada, and Mexico.

- Europe: Europe exhibits strong demand for highly reliable and integrated multimodal LCL solutions, linking major ports (Rotterdam, Hamburg) with extensive inland road and rail networks across the European Union. The market is driven by just-in-time manufacturing needs, especially in the automotive and machinery sectors, and benefits from harmonized customs procedures within the EU, although Brexit has added regulatory complexity to UK-EU LCL movements. Sustainability mandates are also heavily influencing route selection and carrier partnerships in this region.

- Latin America: This region presents significant growth potential, fueled by increasing industrialization and greater participation in global value chains. Challenges include underdeveloped port infrastructure in certain countries and complex, often fragmented customs regulations. However, investments in modernized logistics corridors and the proliferation of regional trade agreements are accelerating the adoption of professional LCL services, primarily serving agricultural, mining, and consumer goods imports.

- Middle East and Africa (MEA): MEA is strategically important due to its positioning as a major transshipment hub (e.g., Jebel Ali, Jeddah). LCL market growth here is strongly correlated with infrastructure development, particularly in the UAE and Saudi Arabia. The African continent shows demand for inbound LCL to support developing consumer markets, though reliance on external logistics expertise and overcoming diverse regulatory environments remain key operational considerations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Global Less-than-container Load (LCL) Shipping Market.- A.P. Moller – Maersk

- Mediterranean Shipping Company (MSC)

- CMA CGM

- Hapag-Lloyd

- COSCO Shipping Lines

- DHL Global Forwarding

- DB Schenker

- Kuehne + Nagel

- Hellmann Worldwide Logistics

- CEVA Logistics

- DSV Panalpina

- Expeditors International

- UPS Supply Chain Solutions

- XPO Logistics

- FedEx Logistics

- NVOCC Specialists

- Flexport

- ZIM Integrated Shipping Services

- OOCL

- SNCF Logistics

Frequently Asked Questions

Analyze common user questions about the Global Less-than-container Load (LCL) Shipping market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between LCL and FCL shipping, and when should I choose LCL?

LCL (Less-than-container Load) involves consolidating multiple small shipments into one container, where the shipper pays only for the space used. FCL (Full Container Load) means the shipper rents the entire container exclusively. LCL should be chosen when shipment volumes are small (typically less than 15 cubic meters) and cost optimization is prioritized over transit speed, making it ideal for SMEs and small e-commerce shipments.

How does digitalization impact the cost and reliability of LCL services?

Digitalization significantly improves LCL efficiency by enabling automated instant quoting, optimizing container stuffing via AI algorithms, and providing real-time, individual shipment tracking. This technological integration reduces manual handling errors, enhances transparency in pricing, and ultimately contributes to lower operational costs and increased service reliability compared to traditional booking methods.

What are the main risks associated with using Less-than-container Load shipping?

The main risks in LCL include longer transit times due to necessary consolidation and deconsolidation procedures at both ends, a higher potential for damage or loss during multiple handling stages, and increased exposure to delays if one shipment within the container faces customs issues, potentially holding up the entire load.

Which geographical region dominates the global LCL shipping market, and why?

The Asia Pacific (APAC) region dominates the global LCL market. This is primarily driven by its overwhelming capacity in global manufacturing and exports, particularly from China and Southeast Asian nations. This dominance is sustained by rapid cross-border e-commerce growth and significant regional investments in advanced logistics and port infrastructure supporting vast export volumes.

What role do NVOCCs play in the Less-than-container Load value chain?

Non-Vessel Operating Common Carriers (NVOCCs) are the central orchestrators of the LCL value chain. They specialize in consolidating cargo from multiple shippers, issuing their own Bill of Lading, managing the critical container stuffing/deconsolidation processes at Container Freight Stations (CFS), and handling all necessary documentation and customs brokerage, acting as the primary link between small shippers and the ocean carriers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager