Global Notchback Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432312 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Global Notchback Market Size

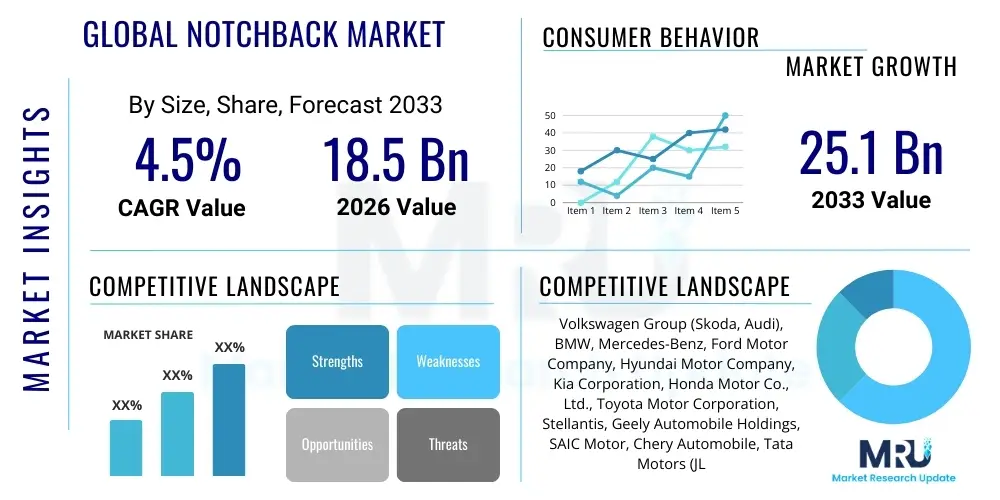

The Global Notchback Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 25.1 Billion by the end of the forecast period in 2033.

Global Notchback Market introduction

The Global Notchback Market encompasses vehicles characterized by a distinct three-box design where the trunk lid forms a separate horizontal plane, creating a noticeable step between the roofline and the rear deck. This body style often provides aerodynamic advantages over traditional sedans while maintaining a clearly separated luggage compartment, highly valued in many key automotive markets, particularly across Asia Pacific and specific regions of Europe. The product category includes models ranging from compact economy cars to executive luxury vehicles, positioning it as a highly versatile segment appealing to middle-income demographics seeking practicality combined with a formal aesthetic. Market adoption is driven by consumer preference for safety, efficiency, and the perceived status associated with a distinct sedan form factor.

Major applications for notchback vehicles are predominantly found in personal mobility and fleet operations, including ride-sharing services and corporate transportation. The structural rigidity inherent in the three-box design, coupled with continuous advancements in chassis technology and occupant protection systems, makes notchbacks a preferred choice for family use. Furthermore, modern notchbacks are increasingly integrating sophisticated connectivity features, advanced driver-assistance systems (ADAS), and efficient powertrain options, including mild-hybrid and fully electric variants. The shift towards electrification within the compact and mid-size vehicle segment is revitalizing the notchback design, offering optimized battery packaging and superior aerodynamic profiles compared to bulkier SUV alternatives, thereby enhancing overall efficiency and range performance.

Key driving factors supporting the market expansion include the burgeoning middle class in emerging economies, notably in India, China, and Southeast Asia, where sedans (including notchbacks) remain symbolic of upward mobility and affluence. Regulatory pressures promoting lower emissions standards worldwide also favor the inherently more aerodynamic notchback design over SUVs or hatchbacks for internal combustion engine (ICE) and electric vehicle (EV) platforms. The strategic push by Original Equipment Manufacturers (OEMs) to consolidate platform architecture (such as Volkswagen Group's MQB or specific Hyundai/Kia platforms) allows for cost-effective production of diverse body styles, ensuring that the notchback remains a core component of global product portfolios, offering substantial economies of scale.

Global Notchback Market Executive Summary

The global notchback market is experiencing nuanced growth, defined by a geographical divergence in consumer preference and rapid technological convergence driven by electrification and digitalization. Current business trends indicate a strategic focus by major OEMs on platform flexibility to simultaneously cater to high-volume markets in Asia Pacific and premium niche demands in Europe. While traditional ICE models still dominate sales volume, the capital expenditure allocation is heavily skewed towards developing electric and hybrid notchback variants, reflecting anticipated future regulatory landscapes and shifting consumer sentiment towards sustainable mobility. Supply chain resilience, particularly concerning semiconductor shortages and raw material price volatility (such as lithium and cobalt for EV batteries), remains a critical operational challenge impacting production schedules and profitability across the value chain, forcing vertical integration and long-term procurement contracts.

Regionally, Asia Pacific (APAC), particularly China, holds paramount importance due to its sheer scale of manufacturing capacity and consumer demand, effectively setting the pace for compact and mid-size notchback development. European markets show a preference for premium or performance-oriented notchbacks, often emphasizing sophisticated design and advanced driver technologies, although this segment faces intense competition from high-end SUVs and crossover coupes. North America, traditionally dominated by larger sedans or trucks, sees niche growth for entry-level luxury notchbacks. Meanwhile, emerging markets in Latin America and MEA are focused on durable, fuel-efficient models, driven by infrastructure constraints and sensitivity to ownership costs, cementing the notchback’s position as a reliable, mainstream vehicle choice.

Segment trends confirm the rapid adoption of electric powertrain technology as the primary future growth trajectory. Although the Compact Notchback segment currently commands the largest market share by volume due to affordability and urban suitability, the Mid-size and Luxury segments are witnessing faster revenue growth, driven by higher average selling prices and greater technology integration. Furthermore, personalization and connectivity features are increasingly standard, transforming the vehicle from a mere mode of transport into an integrated digital device. The segmentation by application reveals robust growth in fleet sales, catalyzed by corporate sustainability mandates requiring the integration of low-emission or electric vehicles into their operational fleets, further boosting demand for efficient, high-utility notchback models.

AI Impact Analysis on Global Notchback Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the notchback market frequently revolve around how AI enhances safety features, optimizes manufacturing efficiency, and revolutionizes the in-car user experience. Users are keen to understand how AI-driven predictive maintenance can lower long-term ownership costs and improve vehicle reliability. A significant concern is the balance between autonomous driving capabilities (leveraging complex AI algorithms for sensor fusion and decision-making) and cybersecurity vulnerabilities associated with highly connected vehicles. Furthermore, there is substantial interest in how generative AI tools are used during the vehicle design phase to optimize aerodynamics, internal space utilization, and material strength for the specific three-box architecture of notchbacks.

AI is fundamentally transforming the manufacturing lifecycle of notchback vehicles, moving from traditional automation to intelligent production systems. AI-powered vision systems are employed in assembly lines for extremely precise quality control, identifying micro-defects in paint finish or panel alignment that are crucial for maintaining the aesthetic integrity of the three-box design. In logistics and supply chain management, AI optimizes inventory levels and predicts bottlenecks, ensuring timely delivery of complex components required for ADAS and infotainment systems. This intelligent approach minimizes waste, reduces production cycles, and ensures high consistency, which is vital for maintaining competitive pricing in the high-volume notchback segment.

On the consumer front, AI is central to developing personalized and secure in-vehicle ecosystems. Advanced driver assistance systems (ADAS) utilize deep learning algorithms to enhance features like adaptive cruise control, lane-keeping assist, and parking assistance, making the driving experience safer and less stressful, especially in dense urban environments where many notchbacks operate. AI also powers highly sophisticated infotainment interfaces, offering predictive navigation, natural language processing for voice commands, and personalized climate and seating adjustments based on learned user behaviors. These AI-enhanced features are rapidly becoming non-negotiable prerequisites for consumer purchasing decisions, especially in the premium notchback category.

- AI optimizes vehicle design parameters, enhancing aerodynamic performance specific to the notchback shape, maximizing range in EV models.

- Predictive maintenance algorithms analyze sensor data in real-time to forecast component failures, drastically reducing unexpected downtime and service costs.

- AI-driven manufacturing robots improve precision and consistency in welding and paint application, ensuring structural integrity and premium visual finish.

- Implementation of advanced sensor fusion for Level 2 and Level 3 autonomous driving features, utilizing machine learning for enhanced environmental perception.

- Personalized in-cabin experience delivered through AI learning systems that adapt infotainment, climate control, and driver profiles automatically.

- Enhanced cybersecurity measures leveraging AI to detect and neutralize threats in the vehicle's vast network of connected systems (V2X communication).

DRO & Impact Forces Of Global Notchback Market

The Global Notchback Market operates under a complex set of dynamic forces: Drivers (D) center around global urbanization, the rising economic power of emerging market middle classes, and the inherent cost-effectiveness and durability of the body style. Restraints (R) primarily include the aggressive market cannibalization by SUVs and Crossovers globally, alongside stringent global emission regulations requiring substantial capital investment in new powertrains. Opportunities (O) are plentiful, mainly driven by the rapid expansion of electric vehicle platforms perfectly suited for the aerodynamic sedan form, alongside the potential for premiumization and technological integration. The interplay of these forces dictates market trajectory, with urbanization and electrification acting as primary accelerators, while the consumer shift towards utility vehicles acts as a significant decelerator, requiring continuous innovation in design and technology to retain market share.

Impact forces such as competitive intensity and technological disruption profoundly influence the market structure. The competitive landscape is fierce, particularly in high-volume segments, leading to intense price competition and compressed margins, forcing OEMs to seek efficiency through platform sharing and global sourcing strategies. Simultaneously, technological advancements, especially in battery energy density and autonomous driving systems, necessitate rapid cycles of research and development. Regulatory forces, particularly those relating to safety (e.g., NCAP ratings) and environmental protection (e.g., Euro 7, CAFE standards), act as mandatory drivers for innovation but also increase the cost structure, potentially limiting accessibility in price-sensitive markets. Socio-cultural forces, which dictate body style preference (e.g., preference for a defined trunk in APAC versus global SUV trends), also exert significant regional influence.

The transition toward sustainable mobility represents the single largest impact force. While ICE notchbacks have traditionally focused on fuel economy through efficient engines and lightweight construction, the future of the segment is inextricably linked to successful EV adoption. The opportunity lies in leveraging the intrinsic aerodynamic advantages of the notchback form to achieve superior EV range compared to boxier competitors. However, this transition requires overcoming restraining factors such as inadequate charging infrastructure in developing markets and the high initial cost of battery technology, which remains a barrier to mass-market acceptance. Successful navigation of these D-R-O dynamics hinges on OEMs’ ability to deliver highly efficient, technologically advanced, and aesthetically appealing notchback models at globally competitive prices.

Segmentation Analysis

The Global Notchback Market is primarily segmented based on vehicle type, powertrain, size, and end-user application, reflecting the diverse global demand landscape and the varying functional requirements across different consumer groups and geographical regions. Understanding these segments is crucial for strategic market positioning and product development, allowing OEMs to tailor vehicle features and marketing efforts effectively. The segmentation highlights the market's duality: established, high-volume segments dominated by conventional internal combustion engines, and rapidly emerging, high-growth segments focusing on electric powertrains and premium compact models suitable for dense urban environments.

Segmentation by Powertrain is the most dynamic area, tracking the industry's energy transition. While gasoline and diesel-powered notchbacks still hold the dominant market share, the hybrid electric vehicle (HEV) and battery electric vehicle (BEV) segments are demonstrating exponential growth, fueled by regulatory mandates and consumer environmental awareness. The size segmentation is critical, with Compact Notchbacks appealing to first-time buyers and urban commuters due to their maneuverability and lower cost, whereas Mid-size and Luxury Notchbacks target established professionals and executive fleets, offering greater cabin space, sophisticated technology, and superior performance characteristics.

Furthermore, segmentation by end-user application distinguishes between Personal Use and Commercial Use (Fleet). Personal buyers prioritize design aesthetics, safety ratings, and in-car technology, whereas commercial operators focus on Total Cost of Ownership (TCO), fuel efficiency (or charge efficiency for EVs), durability, and minimal maintenance requirements. This clear distinction necessitates different product configurations, from robust, stripped-down fleet models to highly personalized, feature-rich consumer variants. The future profitability of the market will largely depend on the success of integrating high-demand features (like ADAS and seamless connectivity) across all segments while managing cost pressures.

- By Vehicle Type:

- Sedan

- Coupe (Specific performance-oriented three-box models)

- By Powertrain:

- Internal Combustion Engine (ICE)

- Hybrid Electric Vehicle (HEV)

- Battery Electric Vehicle (BEV)

- By Size:

- Compact Notchback (Sub-4 meter and equivalent)

- Mid-size Notchback (Executive models)

- Luxury/Premium Notchback

- By End-User:

- Personal Use

- Commercial Use (Fleet & Taxi Services)

Value Chain Analysis For Global Notchback Market

The value chain for the Global Notchback Market is highly complex, beginning with extensive upstream activities encompassing raw material extraction (metals, polymers, battery components) and the supply of Tier 2 and Tier 3 components, such as semiconductors, electronic control units (ECUs), and specialized powertrain parts. This stage is characterized by high global interdependence, particularly concerning specialized materials and microelectronics, making it vulnerable to geopolitical and logistical disruptions. Effective upstream management relies on long-term supplier contracts, strategic inventory buffering, and strict quality control to meet the rigorous specifications required by automotive standards. Optimization at this stage is crucial for managing manufacturing costs and ensuring component quality, directly impacting the vehicle's final reliability and price point.

The midstream section involves the core operations of Original Equipment Manufacturers (OEMs), covering research and development, design, platform engineering, and final assembly. For notchbacks, R&D efforts are heavily focused on lightweighting techniques (using high-strength steel and aluminum), aerodynamic optimization specific to the body style, and the integration of sophisticated vehicle architectures that support both traditional and electric powertrains. Manufacturing processes are highly automated, leveraging global production networks (e.g., facilities in Mexico, Slovakia, China, India) to serve regional markets and achieve maximum economies of scale. Direct quality assurance systems are critical here to maintain high fit and finish standards, crucial for market perception of the sedan category.

Downstream activities involve global distribution, sales, and aftermarket services. The distribution channel utilizes a mix of direct sales models (increasingly common for EV startups) and established indirect networks of authorized dealerships. Dealerships provide essential services including financing, inventory management, test drives, and, most crucially, post-sales maintenance and warranty services. The aftermarket segment, including spare parts, repairs, and customization, represents a significant source of recurring revenue and contributes substantially to the overall value retention of notchback vehicles, especially in markets where vehicle lifecycles are long. Efficient logistics management, encompassing both finished vehicle transport and spare parts distribution, is vital for ensuring consumer satisfaction and market presence.

Global Notchback Market Potential Customers

The primary customers for the Global Notchback Market are diverse, ranging from urban professionals and young families in developed economies to the rapidly expanding middle-income segments in emerging markets. Urban professionals often seek compact or mid-size notchbacks that offer a blend of style, technological connectivity, and efficiency for daily commuting, valuing the vehicle's maneuverability and the status associated with a distinct sedan form. Families prioritize safety features, trunk capacity for luggage and gear, and overall reliability, making mid-size notchbacks with high NCAP ratings particularly appealing.

In high-growth regions like APAC, the potential customer base consists heavily of first-time car buyers transitioning from two-wheelers, who perceive the ownership of a notchback (especially compact models) as a significant lifestyle upgrade and a symbol of economic stability. For this demographic, affordability, fuel efficiency, and low maintenance costs are critical purchasing determinants. OEMs often target this group with region-specific, cost-optimized models that still incorporate essential modern safety and infotainment features, capitalizing on the strong cultural preference for the three-box design.

A secondary, yet highly lucrative customer segment includes large corporate fleets, government agencies, and ride-hailing service providers. These commercial buyers prioritize long-term durability, minimal operational expenditure (OpEx), high residual values, and increasingly, low-emission powertrains to meet corporate sustainability goals. The inherent robustness and spaciousness of mid-size notchbacks make them ideal for high-mileage commercial applications, where reliability and passenger comfort are paramount for maintaining service quality. The shift to electric vehicle platforms offers these fleets attractive incentives through tax breaks and lower running costs, further accelerating commercial adoption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 25.1 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Volkswagen Group (Skoda, Audi), BMW, Mercedes-Benz, Ford Motor Company, Hyundai Motor Company, Kia Corporation, Honda Motor Co., Ltd., Toyota Motor Corporation, Stellantis, Geely Automobile Holdings, SAIC Motor, Chery Automobile, Tata Motors (JLR), Renault Group, Nissan Motor Corporation, Volvo Cars, Mazda Motor Corporation, General Motors, Lucid Motors, Tesla Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Global Notchback Market Key Technology Landscape

The technological landscape of the Global Notchback Market is defined by convergence across several critical areas: platform standardization, advanced material utilization, passive and active safety systems, and seamless vehicle connectivity. Platform architectures, such as modular transverse matrix systems (like VW’s MQB or specific CMF platforms), are foundational, enabling OEMs to rapidly scale production and introduce diverse notchback models while sharing up to 60-70% of components. This technological approach drastically reduces R&D costs and accelerates the time-to-market for new iterations, especially crucial for accommodating both legacy ICE systems and future-focused BEV architectures within a unified design framework, maintaining cost competitiveness in the segment.

Material science and powertrain efficiency are central pillars of current innovation. The adoption of high-strength, low-alloy (HSLA) steel, aluminum alloys, and carbon fiber composites focuses on reducing vehicle mass, which directly translates to improved fuel efficiency for ICE models and extended range for electric notchbacks. Furthermore, aerodynamic engineering is paramount for the notchback form, utilizing computational fluid dynamics (CFD) to optimize body shape, underbody paneling, and active grille shutters to minimize drag, thereby maximizing energy efficiency. Powertrain technology advances include highly efficient turbocharging, cylinder deactivation, and sophisticated energy management systems for hybrid models, ensuring compliance with increasingly strict global environmental standards.

Digital technology integration encompasses sophisticated ADAS and comprehensive connectivity features. Modern notchbacks are equipped with complex sensor suites (Lidar, Radar, Cameras) enabling functionalities like automatic emergency braking (AEB), cross-traffic alerts, and semi-autonomous highway driving (Level 2+). Connectivity is facilitated through 5G telematics control units (TCUs), providing over-the-air (OTA) software updates, remote diagnostics, and V2X (Vehicle-to-Everything) communication capabilities, enhancing both safety and user convenience. The rapid maturation of these digital technologies is transforming the notchback into a sophisticated mobile data hub, appealing strongly to tech-savvy consumers globally.

Regional Highlights

Regional dynamics are paramount in the Global Notchback Market, as consumer preferences and regulatory environments vary significantly. Asia Pacific (APAC) stands as the undisputed market leader, accounting for the largest share in both production and consumption. Countries like China and India exhibit robust demand for compact and mid-size notchbacks, driven by economic expansion and high cultural acceptance of the three-box structure as a sign of prestige and formality. Government subsidies for new energy vehicles (NEVs) in China have further spurred the development and localized manufacturing of electric notchbacks, making APAC the primary innovation hub for high-volume electrification in this segment. Southeast Asia also contributes significantly, where notchbacks are valued for their durability and suitability for diverse road conditions.

Europe represents a highly mature and technologically advanced market, focusing predominantly on premium and performance-oriented notchbacks (often referred to as 'saloons' or 'limousines'). Demand here is characterized by stringent emission standards, pushing manufacturers toward advanced diesel, plug-in hybrid (PHEV), and high-performance BEV models. Germany, the UK, and France are key consumers, where brand prestige, superior driving dynamics, and sophisticated interior technology are the main purchase motivators. However, the segment faces strong internal competition from premium compact SUVs and stylish estate cars, forcing OEMs to continually differentiate notchback offerings through cutting-edge design and sustainability features.

North America, while historically favoring large SUVs and trucks, maintains a significant, albeit concentrated, market for notchbacks, primarily within the luxury and entry-level segments. Premium European and Japanese brands dominate this niche, where consumers value comfort, powerful engine options, and extensive safety technologies. In emerging markets like Latin America (LATAM) and the Middle East & Africa (MEA), the market focuses on affordable, robust, and fuel-efficient models. High import tariffs in many LATAM countries necessitate local assembly, while the MEA region demands durable vehicles capable of withstanding extreme climate conditions and providing reliable transport, making the notchback's time-tested architecture highly popular.

- China: Dominant market for compact and electric notchbacks; high localization of production and rapid EV adoption.

- India: Significant volume market driven by affordability and the sub-4 meter compact sedan category; strong cultural preference for three-box design.

- Germany: Key market for high-performance and luxury notchbacks; strong emphasis on engineering excellence and driving dynamics.

- North America (USA/Canada): Concentrated demand in the premium and executive segments; focus on technology and comfort.

- Brazil/Mexico: Growing demand for reliable, cost-effective notchbacks; importance of local manufacturing and assembly operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Global Notchback Market.- Volkswagen Group (Skoda, Audi, VW)

- BMW AG

- Mercedes-Benz Group AG

- Toyota Motor Corporation

- Hyundai Motor Company

- Kia Corporation

- Honda Motor Co., Ltd.

- Ford Motor Company

- Stellantis N.V. (Peugeot, Citroen)

- Geely Automobile Holdings Ltd.

- SAIC Motor Corporation Limited

- Chery Automobile Co., Ltd.

- Tata Motors Limited (JLR)

- Renault Group

- Nissan Motor Corporation

- Mazda Motor Corporation

- General Motors Company

- Volvo Cars

- Lucid Motors

- Tesla Inc.

Frequently Asked Questions

Analyze common user questions about the Global Notchback market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a notchback and a standard sedan?

A notchback specifically refers to a sedan design where the roofline drops sharply to meet the trunk lid, creating a distinct, near 90-degree angle or "notch," whereas a standard sedan can include designs with a smoother, slightly sloping rear window transitioning into the trunk (though often less exaggerated than a fastback).

How is the rise of electric vehicles (EVs) impacting the design of notchbacks?

The transition to EVs favors the notchback design due to its superior aerodynamics compared to SUVs. Lower drag coefficients achieved by the notchback body style are crucial for maximizing battery range, making it a preferred format for many new BEV models focused on efficiency and sleek profile.

Which geographical region dominates the global notchback market in terms of sales volume?

The Asia Pacific (APAC) region, particularly China and India, dominates the global notchback market. This is driven by the significant volume demand for affordable compact and mid-size models, strong economic growth, and a persistent cultural preference for the three-box sedan structure.

What are the key technological advancements driving safety in modern notchback vehicles?

Key safety advancements include the extensive integration of Advanced Driver Assistance Systems (ADAS) such as Automatic Emergency Braking (AEB), sophisticated sensor fusion techniques, and structural enhancements utilizing high-strength steel and advanced airbag deployment strategies, ensuring superior occupant protection.

What is the main restraint challenging the growth of the notchback segment?

The most significant restraint is the sustained global consumer shift toward Sport Utility Vehicles (SUVs) and Crossovers, which offer higher ride height, perceived utility, and greater cabin versatility, often cannibalizing sales from traditional sedan and notchback segments across multiple price points.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager