Global Quick Release Coupling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435320 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Global Quick Release Coupling Market Size

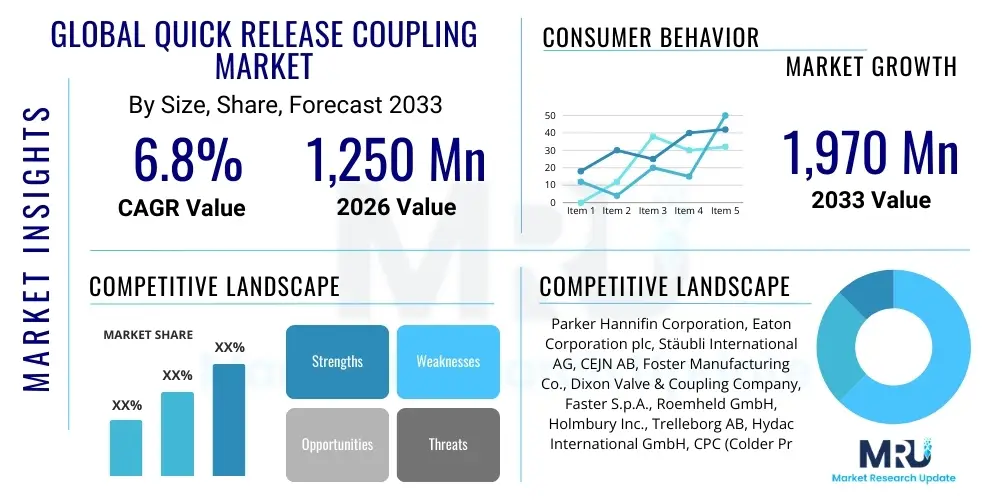

The Global Quick Release Coupling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1,250 Million in 2026 and is projected to reach $1,970 Million by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating demand for operational efficiency and stringent safety regulations across diverse industrial applications, particularly within the construction, automotive, and manufacturing sectors. The need to minimize downtime during equipment maintenance and fluid transfer operations critically supports this market trajectory.

The valuation reflects robust adoption rates in developed economies where high levels of automation necessitate swift and reliable connection solutions. Quick release couplings (QRCs) are essential components in fluid power systems, allowing for quick, tool-free connection and disconnection of lines carrying hydraulic fluids, gases, or other media. Furthermore, the push towards high-pressure applications and the migration to specialized flat-face couplings to prevent spillage and enhance environmental protection are key factors influencing market size expansion throughout the forecast period. Investment in research and development focusing on novel materials and enhanced sealing technologies is expected to further solidify market growth.

Global Quick Release Coupling Market introduction

The Global Quick Release Coupling Market encompasses the production, distribution, and utilization of mechanical devices designed to provide a rapid, repeatable, and secure connection and disconnection for fluid lines without the need for manual threading or specialized tools. These couplings are vital for maintaining system integrity and operational continuity in environments where efficiency and safety are paramount. Quick Release Couplings, often referred to as quick connect fittings or couplers, facilitate the swift replacement of tools, attachments, or modules in hydraulic, pneumatic, and specialized chemical transfer systems, thereby significantly reducing machine downtime and improving overall productivity.

The primary applications for these devices span across industries such as heavy machinery (excavators, loaders), factory automation (robotic systems, assembly lines), automotive manufacturing (painting and assembly robots), and the oil and gas sector (subsea and onshore drilling equipment). Key benefits driving their adoption include enhanced safety through spill-free designs (particularly flat-face couplings), improved operational flexibility, and guaranteed leak prevention under high-pressure conditions. The demand for modular machinery and the increasing complexity of industrial processes mandate the integration of reliable quick connect systems, positioning QRCs as indispensable components in modern industrial infrastructure. This foundational reliance on efficient fluid management systems ensures sustained market relevance and expansion.

The market is predominantly driven by increasing industrial automation, particularly in emerging economies where manufacturing capabilities are rapidly scaling. Furthermore, strict regulatory mandates concerning occupational safety and environmental protection—such as those requiring non-drip connections to prevent hazardous spills—are accelerating the adoption of high-quality quick release solutions. The continuous evolution of materials science, leading to the development of couplings capable of handling extreme temperatures and corrosive media, further expands the addressable market across specialized applications like aerospace and healthcare. The inherent requirement across industrial landscapes to minimize maintenance intervals and maximize uptime provides persistent tailwinds for market expansion, cementing the quick release coupling’s role as a critical enabler of operational excellence.

Global Quick Release Coupling Market Executive Summary

The Global Quick Release Coupling Market is exhibiting robust growth, propelled by the worldwide trend towards industrial automation and the essential requirement for minimizing operational downtime across critical sectors. Business trends indicate a strong shift toward specialized, high-performance couplings, particularly flat-face and non-drip variants, which address stringent safety and environmental regulations concerning fluid spillage. Manufacturers are focusing heavily on integrating advanced materials like specialized stainless steel and composites to enhance durability and compatibility with aggressive media, thereby expanding their market footprint in high-pressure and high-temperature environments. Strategic mergers, acquisitions, and technological partnerships among leading global players are shaping the competitive landscape, aiming to consolidate expertise and optimize global supply chain efficiencies to meet diversified regional demands effectively.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely fueled by rapid industrialization, extensive infrastructural development projects (especially in construction and transportation), and the massive expansion of the automotive and machinery manufacturing bases in countries like China, India, and South Korea. North America and Europe, while representing mature markets, maintain dominance in terms of value, primarily due to the high adoption rate of premium, technologically advanced couplings compliant with strict regional safety standards, such as those prevalent in the aerospace and advanced healthcare sectors. Latin America, the Middle East, and Africa (LAMEA) are anticipated to witness steady growth, driven by investments in the oil and gas sector and expanding local manufacturing capabilities.

Segment trends reveal that the Hydraulic segment remains the largest revenue contributor due to the indispensable role of quick release couplings in heavy machinery requiring high power density. However, the Pneumatic segment is projected to show accelerated growth, primarily driven by the expansion of factory automation and robotic systems that rely heavily on pneumatic controls for speed and precision. In terms of material, Stainless Steel couplings are experiencing increased demand across the board due to their superior corrosion resistance and strength, crucial for demanding applications in chemical processing and food and beverage industries. The end-use segmentation highlights Construction and Automotive as perennial heavyweights, though the Healthcare and Aerospace sectors are emerging as high-value niches demanding custom-engineered, ultra-reliable coupling solutions that conform to specialized certification requirements.

AI Impact Analysis on Global Quick Release Coupling Market

User queries regarding AI's impact on the Quick Release Coupling market frequently center on how AI can enhance predictive maintenance, optimize manufacturing processes, and improve product design integrity. Users are keen to understand if AI-driven sensors embedded within coupling systems can preemptively identify wear and tear, fluid leaks, or connection failure risks, thereby dramatically reducing unexpected equipment downtime. There is also significant interest in leveraging generative AI for designing couplings with complex internal geometries optimized for flow dynamics and material strength, moving beyond traditional simulation methods. Furthermore, users explore how AI in supply chain logistics can ensure timely delivery of specific, often highly customized, coupling units necessary for specialized industrial repairs, minimizing inventory costs while maintaining operational readiness. The overarching theme is the transition from purely mechanical components to smart, connected fluid management systems integrated with Industry 4.0 infrastructure.

- AI facilitates predictive maintenance by analyzing sensor data (pressure, temperature, vibration) from connected coupling systems to forecast failure points.

- Generative AI tools are utilized in R&D to optimize coupling designs for better flow efficiency and material utilization, accelerating the product development cycle.

- Machine learning algorithms enhance quality control during manufacturing by rapidly identifying microscopic defects in coupling components, ensuring higher reliability.

- AI-driven inventory management and supply chain optimization ensure that highly specific Quick Release Coupling replacements are available precisely when needed, reducing lead times.

- Integration of smart couplings with Industrial IoT platforms allows for real-time performance monitoring and anomaly detection, crucial for high-stakes environments like aerospace and oil exploration.

- AI systems can analyze operational data to suggest optimal coupling type and material selection based on specific environmental and media transfer requirements.

- Automation in coupling assembly lines is increasingly guided by computer vision and AI, improving precision and consistency in high-volume production.

DRO & Impact Forces Of Global Quick Release Coupling Market

The Global Quick Release Coupling Market is primarily propelled by significant drivers, including the rapid acceleration of industrial automation across manufacturing sectors globally, which necessitates efficient and rapid fluid connection solutions for robotic systems and modular machinery. The inherent market requirement to minimize costly operational downtime through quick changeover capabilities serves as a perpetual driver. Furthermore, increasingly stringent global safety and environmental regulations, particularly regarding the prevention of hazardous fluid spills, compel industries to adopt advanced non-drip and flat-face coupling technologies. These drivers are fundamentally linked to the push for higher productivity and safer working conditions worldwide.

However, the market faces notable restraints, chiefly the substantial initial investment required for high-quality, specialized quick release couplings, particularly those made from aerospace-grade materials or featuring complex valve mechanisms. The lack of universal standardization across different manufacturers and regions often leads to compatibility issues, increasing complexity for end-users operating diverse fleets of machinery. Furthermore, intense price competition from low-cost coupling manufacturers, particularly in emerging markets, pressures established players to maintain high quality while optimizing production costs, presenting a constant challenge to profit margins and technological differentiation. The educational curve for ensuring correct installation and maintenance of specialized couplings also represents a latent constraint.

Significant opportunities exist in the expansion of the fluid power sector, particularly in the booming construction and infrastructure development markets of Asia Pacific and LAMEA, driving demand for high-pressure hydraulic couplings. The trend towards modular machine design in factory automation offers new pathways for specialized, multi-coupler systems that connect several lines simultaneously. Technological innovation focusing on smart couplings integrated with IoT sensors represents a major opportunity, allowing for predictive maintenance and remote monitoring, adding substantial value beyond simple connection capabilities. Impact forces, such as rapid technological advancement (e.g., development of hybrid quick release systems) and strict regulatory enforcement regarding safety and environmental compliance, continuously reshape market demand, prioritizing innovation and certified reliability over cost.

Segmentation Analysis

The Global Quick Release Coupling Market is rigorously segmented based on product Type, Material composition, specific Application, and the End-Use Industry served, offering a structured view of diverse market dynamics and specialized demand centers. This segmentation is crucial for understanding the varied requirements across sectors, ranging from the high-pressure needs of hydraulic systems in construction to the precise, often sterile, requirements of pneumatic systems in medical devices. The largest segment by revenue is typically driven by high-volume applications in hydraulic circuits, while the fastest-growing segments often reflect niche demands for specialized materials and spill-prevention features, underscoring the market's evolution towards performance and safety optimization. Analyzing these segments provides strategic insights into investment priorities and technological development trajectories for market stakeholders.

- By Type:

- Non-Drip Couplings

- Flat Face Couplings

- Ball Lock Couplings

- Screw Type Couplings

- Bayonet Couplings

- Push-Pull Couplings

- Standard Couplings

- By Material:

- Stainless Steel

- Brass

- Carbon Steel

- Aluminum

- Plastic/Composite

- By Application:

- Hydraulics

- Pneumatics

- Chemical Transfer

- Thermal Management/Cooling

- Gas and Liquid Transfer

- By End-Use Industry:

- Automotive

- Construction and Heavy Equipment

- Aerospace & Defense

- Oil & Gas

- Healthcare and Medical Devices

- Manufacturing/Industrial Machinery

- Food & Beverage Processing

- Agriculture

Value Chain Analysis For Global Quick Release Coupling Market

The value chain for the Global Quick Release Coupling Market begins with the upstream procurement of raw materials, primarily high-grade metals such as stainless steel, brass, carbon steel, and specialized polymers. Success at this stage relies heavily on securing stable supply contracts and ensuring material quality meets stringent industrial specifications, especially for high-pressure and corrosive environments. Leading manufacturers often engage in proprietary metal treating and finishing processes to enhance the durability and surface integrity of the coupling components, contributing significantly to the final product's reliability and cost. Innovation in upstream processes, such as additive manufacturing for complex component geometries, is a growing trend aimed at optimizing material use and reducing production waste, impacting overall cost efficiency.

The central phase involves design, manufacturing, and assembly. This is where intellectual property and technological expertise are most critical, focusing on precision machining, advanced sealing technology, and robust locking mechanisms (e.g., ball locking or screw thread). Direct distribution channels involve manufacturers selling high-volume or highly customized couplings directly to large OEMs (Original Equipment Manufacturers) in the automotive, aerospace, and heavy equipment sectors, fostering strong technical relationships and co-development efforts. Indirect distribution relies on a vast network of authorized distributors, industrial suppliers, and specialized hydraulic and pneumatic equipment dealers, who provide regional inventory, immediate availability, and local technical support to smaller end-users and MRO (Maintenance, Repair, and Operations) buyers. This multi-tiered distribution strategy ensures market penetration across diverse geographical and industrial segments.

Downstream analysis focuses on installation, maintenance, and the aftermarket services, which are critical revenue drivers, particularly for replacement parts and specialized maintenance kits. End-users’ demand for prompt, localized support emphasizes the importance of the indirect channel partners. The product lifecycle often involves rigorous testing and certification (e.g., ISO, CE) to ensure compliance with specific industry standards, particularly in the oil & gas and aerospace segments. The shift towards smart manufacturing encourages the integration of couplings with sensors, pushing service providers to offer data analysis and predictive maintenance consultation alongside physical products. Efficient supply chain management, particularly regarding rapid fulfillment of MRO orders for standardized and proprietary couplings, significantly enhances customer satisfaction and market loyalty, closing the value chain loop effectively.

Global Quick Release Coupling Market Potential Customers

Potential customers for the Global Quick Release Coupling Market are highly diversified, encompassing any industry that utilizes fluid power systems (hydraulic or pneumatic) or requires rapid, contamination-free transfer of fluids, gases, or chemicals. The primary buyer segment includes Original Equipment Manufacturers (OEMs) of heavy machinery, industrial robots, and automated production lines, which integrate these couplings directly into their foundational equipment design to ensure ease of maintenance and modularity. Key OEMs are found in the construction sector, requiring high-pressure hydraulic couplings for excavators and cranes, and the automotive sector, needing quick-change tools and paint-line connections for manufacturing processes.

Another major customer group consists of Maintenance, Repair, and Operations (MRO) buyers and end-users who purchase couplings for replacement, upgrades, or retrofit projects to improve existing equipment efficiency and safety standards. This group includes large-scale industrial plants, military logistics organizations, and resource extraction companies (e.g., mining and oil & gas). For instance, the oil and gas sector demands highly durable, corrosion-resistant couplings for offshore and subsea applications, where reliability under extreme conditions is non-negotiable and failure is catastrophic. Specialized end-users, such as medical device manufacturers, represent high-value customers seeking sterile, non-magnetic, and chemically inert couplings for critical applications like patient cooling systems or laboratory fluid handling.

The agricultural sector is also a rapidly expanding consumer, driven by the increasing automation of farm machinery, requiring durable couplings to withstand outdoor environmental stresses and frequent changes of hydraulic implements. Furthermore, the burgeoning field of thermal management, particularly in data centers and high-performance computing (HPC), relies on quick release couplings for swift and spill-free connection of cooling loops. Ultimately, the purchasing decision is typically driven by reliability, compliance with international safety standards, pressure ratings, and the total cost of ownership (TCO), making certified quality a crucial factor for all potential customers across various buying tiers and technical requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,250 Million |

| Market Forecast in 2033 | $1,970 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parker Hannifin Corporation, Eaton Corporation plc, Stäubli International AG, CEJN AB, Foster Manufacturing Co., Dixon Valve & Coupling Company, Faster S.p.A., Roemheld GmbH, Holmbury Inc., Trelleborg AB, Hydac International GmbH, CPC (Colder Products Company), Kurt Manufacturing Co., Nitto Kohki Co., Ltd., Tema Quick Release Couplings, Snap-tite Inc., Alfagomma SpA, IMI Norgren, Hansen Coupling Division (Eaton), and EATON |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Global Quick Release Coupling Market Key Technology Landscape

The technological landscape of the Global Quick Release Coupling Market is rapidly evolving, driven by the persistent need for increased pressure resistance, reduced fluid loss, and enhanced operational longevity. A central technological focus remains the refinement of valve mechanisms, particularly the shift towards flat-face technology. Flat-face couplings are crucial for eliminating spillage and air inclusion during connection and disconnection, aligning with modern environmental mandates and safety protocols, especially in hydraulic circuits. Advanced sealing materials, such as specialized elastomers and PTFE compounds, are continuously being developed to withstand extreme temperatures, aggressive media, and high-pulsation cycles prevalent in heavy industrial applications like offshore drilling and aerospace hydraulics, ensuring reliable performance where traditional seals might fail.

Another significant area of innovation involves the implementation of multi-coupling systems and robotic tool changers. These integrated solutions allow for the simultaneous connection of multiple hydraulic, pneumatic, and electrical lines in a single, automated motion, dramatically improving the efficiency of machine changeovers, especially in automated assembly lines and modular manufacturing environments. The adoption of robust locking mechanisms, including proprietary ball-lock designs and secure screw-locking systems, ensures vibration resistance and minimizes the risk of accidental disconnection under dynamic load conditions, a critical requirement for safety-critical applications such as overhead lifting and mobile hydraulics. Furthermore, material science advances are enabling the use of lightweight, high-strength composites and specialized aluminum alloys for weight reduction without compromising burst pressure limits, particularly beneficial for aerospace and portable equipment.

The increasing integration of couplings into the Industrial IoT (IIoT) ecosystem marks a significant technological shift toward "smart couplings." This involves embedding miniature sensors (pressure, temperature, flow rate, and connection status) directly within the coupling or adjacent assembly. These smart couplings transmit real-time diagnostic data to centralized monitoring systems, enabling predictive maintenance algorithms to flag potential seal degradation or connection integrity issues before catastrophic failure occurs. This capability dramatically reduces unscheduled downtime and improves operational visibility. Furthermore, unique identification technologies, such as RFID or specific QR codes etched onto the coupling body, are becoming standard practice, ensuring proper component matching and traceability throughout the supply chain and maintenance history, thereby preventing costly compatibility errors in complex systems.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally, driven by massive investments in infrastructure development, rapid urbanization, and the region's status as a global manufacturing hub, particularly for automotive, machinery, and construction equipment. Countries like China and India are seeing exponential growth in industrial automation adoption, significantly increasing demand for high-volume, cost-competitive quick release couplings. The expanding consumer electronics and semiconductor industries also require specialized QRCs for cooling and chemical transfer applications.

- North America: North America holds a substantial market share characterized by the high adoption of premium, specialized coupling solutions, particularly within the aerospace and defense, oil and gas exploration, and advanced manufacturing sectors. Demand here is driven by stringent safety regulations and the consistent need for highly reliable, certified flat-face and non-drip hydraulic couplings capable of handling extreme pressures and media complexity. Technological leadership in IIoT integration also fuels the adoption of smart, sensor-enabled coupling systems.

- Europe: Europe represents a mature market focusing heavily on standardization, environmental protection, and quality. Strong regulatory pressure, notably the emphasis on leak-free and non-spill technologies (Flat Face Standard ISO 16028), accelerates the replacement cycle of older coupling designs with superior QRCs. Germany, as a manufacturing powerhouse, dictates much of the demand for high-precision pneumatic and hydraulic couplings used in machine tools and sophisticated automation systems. The region shows strong growth potential in specialized areas like thermal management for electric vehicles and data centers.

- Latin America, Middle East, and Africa (LAMEA): This region is characterized by steady growth primarily anchored by the oil and gas sector (MEA) and large-scale mining and agricultural operations (LATAM). Investments in energy infrastructure, particularly pipeline maintenance and hydrocarbon extraction, create consistent demand for robust, heavy-duty couplings that can resist harsh chemical environments and high operational pressures. Infrastructure projects in countries like Brazil and Saudi Arabia further contribute to the demand for hydraulic QRCs for heavy construction equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Global Quick Release Coupling Market.- Parker Hannifin Corporation

- Eaton Corporation plc

- Stäubli International AG

- CEJN AB

- Foster Manufacturing Co.

- Dixon Valve & Coupling Company

- Faster S.p.A.

- Roemheld GmbH

- Holmbury Inc.

- Trelleborg AB

- Hydac International GmbH

- CPC (Colder Products Company)

- Kurt Manufacturing Co.

- Nitto Kohki Co., Ltd.

- Tema Quick Release Couplings

- Snap-tite Inc.

- Alfagomma SpA

- IMI Norgren

- Hansen Coupling Division (Eaton)

- Connect-Flow

Frequently Asked Questions

Analyze common user questions about the Global Quick Release Coupling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for flat-face quick release couplings?

The primary factor driving demand for flat-face couplings is the stringent regulatory requirement for environmental protection and operator safety, as these designs virtually eliminate fluid spillage and air inclusion during connection and disconnection, particularly vital in hydraulic applications.

How are quick release couplings integrated with Industry 4.0 or smart manufacturing?

QRCs are integrated into smart manufacturing through the embedding of sensors (pressure, temperature) to create "smart couplings." These sensors enable real-time condition monitoring, predictive maintenance scheduling, and remote diagnostics via Industrial IoT (IIoT) platforms, enhancing overall operational efficiency.

Which material segment is projected to show the strongest growth in the forecast period?

The Stainless Steel material segment is projected to exhibit robust growth, driven by its superior corrosion resistance and strength, making it essential for high-demand environments such as chemical processing, food and beverage, and specialized high-pressure oil and gas applications.

What major restraint challenges the global market expansion?

A major challenge restraining market expansion is the high initial cost associated with specialized, high-performance couplings and the prevalent lack of universal standardization across different regional manufacturers, which complicates cross-compatibility and system integration for end-users.

Which end-use industry represents the largest consumer of quick release couplings?

The Construction and Heavy Equipment industry currently represents the largest end-use consumer segment, driven by the extensive use of high-pressure hydraulic systems in machinery like excavators, loaders, and cranes, necessitating durable and efficient hydraulic quick release couplings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager