Global Steel Rule Die Cutting System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433606 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Global Steel Rule Die Cutting System Market Size

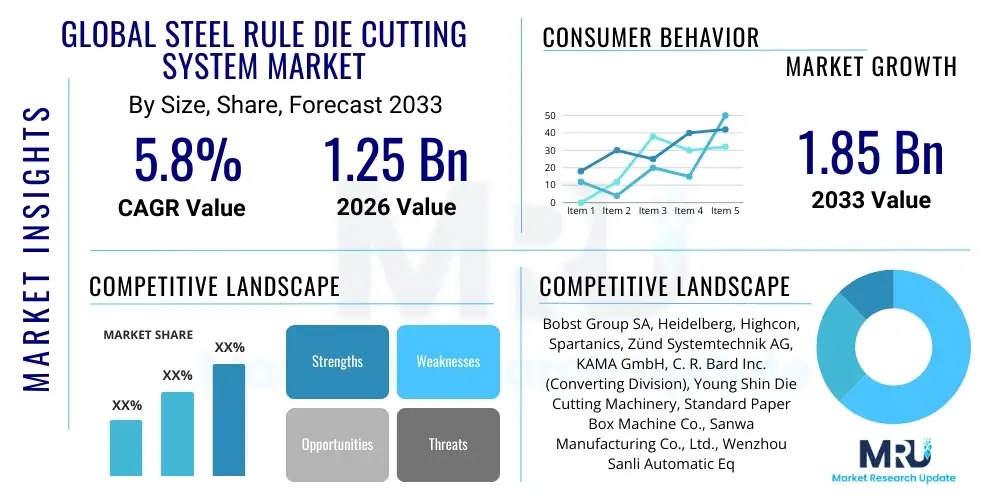

The Global Steel Rule Die Cutting System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Global Steel Rule Die Cutting System Market introduction

The Global Steel Rule Die Cutting System Market encompasses machinery designed to accurately and efficiently cut, score, and crease materials using specialized steel rules embedded in a die board. These systems are foundational components across various manufacturing sectors, including packaging, automotive gaskets, textiles, leather goods, and medical disposables. Steel rule die cutting, valued for its versatility and cost-effectiveness compared to expensive tooling methods, facilitates high-volume production of complex shapes from non-metallic or thin metallic substrates. The core product utilizes sharp steel blades formed into specific patterns (the die), mounted within a press or cutting machine, providing high precision necessary for critical applications like consumer electronics packaging and medical device components.

Major applications of these systems span the vast packaging industry, where they are crucial for producing folding cartons, corrugated boxes, and blister packs with consistent quality and intricate designs. Beyond packaging, the automotive industry utilizes steel rule dies for cutting interior trim, insulation, and various seals and gaskets. Benefits associated with adopting modern steel rule die cutting systems include rapid setup times, lower initial tooling costs, the ability to process a wide array of materials—from paperboard and plastics to foams and composites—and high throughput efficiency. These machines offer superior flexibility for short-run production or prototyping before transitioning to more permanent, high-cost tooling.

The market growth is primarily driven by the escalating global demand for specialized packaging solutions, particularly in e-commerce and fast-moving consumer goods (FMCG) sectors. Furthermore, advancements in automation technology, integrating automatic material feeding and waste stripping capabilities into die-cutting systems, enhance operational efficiency and precision, driving replacement cycles and new system installations. The ongoing expansion of the flexible electronics and display industries, requiring precise material handling and cutting, further solidifies the essential role of steel rule die cutting systems in modern manufacturing supply chains.

Global Steel Rule Die Cutting System Market Executive Summary

The Global Steel Rule Die Cutting System Market is experiencing robust expansion, fundamentally supported by the dynamic growth of the global packaging sector and the continuous requirement for high-precision component fabrication in various industrial verticals. Key business trends include the shift towards fully automated die-cutting processes to mitigate labor costs and enhance safety standards, coupled with an increasing focus on developing larger format die-cutting systems capable of handling industrial-sized sheets of corrugated and specialized protective materials. Manufacturers are strategically investing in systems that offer quick die changeover capabilities and integrate advanced vision inspection systems to ensure quality control, positioning these features as primary competitive differentiators in a maturing market landscape.

Regionally, Asia Pacific maintains its dominance in market share, fueled by the rapid industrialization and expansion of manufacturing hubs, particularly in China, India, and Southeast Asian nations, which are major producers of packaging and automotive components. North America and Europe demonstrate steady, quality-driven growth, emphasizing the adoption of high-speed, high-tolerance die cutters for specialized and technical applications, such as medical packaging and advanced composites. These mature regions prioritize efficiency upgrades and integration with Industry 4.0 standards, while emerging economies focus on volume production capacity additions to meet local and export demands.

Segment trends reveal a sustained dominance of rotary die-cutting systems due to their superior speed in high-volume applications, although flatbed die-cutting systems remain essential for thick materials and intricate, fine-detail work. The primary end-use segment, packaging, continues to drive demand, specifically the corrugated and folding carton sub-segments. Furthermore, the material processing segment, encompassing textiles and non-metallic gaskets, is showing accelerated demand, driven by the proliferation of electric vehicles (EVs) requiring specialized thermal and acoustic insulation components cut with high precision using steel rule dies.

AI Impact Analysis on Global Steel Rule Die Cutting System Market

User inquiries regarding AI's influence on the Steel Rule Die Cutting System Market predominantly center on three main themes: the potential for AI to optimize production scheduling and throughput, the integration of machine learning for predictive maintenance to minimize downtime, and the role of AI-powered vision systems in enhancing cutting accuracy and reducing material waste. Users are keen to understand if AI can effectively manage the complexities of mixed-run production, where multiple dies and materials are processed sequentially, and how these technologies compare against traditional automation approaches. Concerns often arise regarding the complexity of retrofitting existing machinery with AI capabilities and the required data infrastructure investment, balancing the potential efficiency gains against implementation costs in a market where capital expenditure must be carefully justified.

The implementation of Artificial Intelligence and Machine Learning (ML) in the steel rule die cutting sector is transforming operational efficiencies from reactive to predictive modes. AI algorithms are increasingly being used to analyze vast datasets related to material properties, die wear rates, environmental factors (like temperature and humidity affecting material stability), and cutting force requirements. This analysis allows for the real-time adjustment of cutting parameters, ensuring consistent quality across long production runs and minimizing the risk of material tearing or incomplete cuts. Furthermore, advanced ML models are crucial for optimizing job sequencing on shared machinery, reducing the time spent on tooling changes and press adjustments, thereby maximizing the overall equipment effectiveness (OEE).

In the near future, AI integration will fundamentally shift the landscape of quality control and tooling management. AI-driven vision inspection systems, capable of identifying microscopic flaws or deviations in the cut profiles far faster and more reliably than human operators, will become standard. Moreover, AI predictive maintenance tools will use sensor data (vibration, temperature, power draw) to forecast potential component failures, particularly regarding the press mechanisms or bearing systems, allowing for proactive maintenance scheduling rather than reacting to catastrophic failures. This intelligent maintenance approach significantly reduces expensive, unscheduled downtime, thereby increasing the profitability of high-volume die-cutting operations.

- AI-powered predictive maintenance reduces machine downtime by anticipating tooling and component failures.

- Machine learning algorithms optimize cutting parameters (pressure, speed) in real-time based on material variance.

- Advanced vision systems, guided by AI, perform high-speed quality control checks for dimensional accuracy and flaw detection.

- AI optimizes production scheduling, managing complex job sequencing and material allocation for maximum throughput.

- Enhanced simulation tools utilizing AI improve die design processes, predicting material stress points and preventing costly errors before manufacturing the physical die.

- Automated waste stripping effectiveness is boosted by AI determining optimal stripping patterns based on cut complexity.

DRO & Impact Forces Of Global Steel Rule Die Cutting System Market

The dynamics of the Global Steel Rule Die Cutting System Market are governed by a complex interplay of driving forces stemming primarily from global economic trends, material science evolution, and technological advancements, counterbalanced by restraints such as high initial capital investment and increasing regulatory pressures related to industrial safety and noise pollution. Opportunities largely emerge from the transition to sustainable and flexible packaging materials that still require precision cutting, and the untapped potential in specialized medical device fabrication. These forces collectively shape the competitive environment, influencing procurement decisions and strategic investments made by equipment manufacturers and end-user industries alike, determining the pace and direction of market growth over the forecast period.

Key drivers include the relentless expansion of the e-commerce sector globally, necessitating high volumes of customized, durable, yet lightweight protective packaging, which relies heavily on efficient corrugated and foam die cutting. Rapid technological advancements, particularly in integrating servo-motor technology for superior speed and precision control, also propel market growth by making newer machines significantly more efficient than legacy systems. However, the market faces significant restraints, including the substantial capital outlay required for acquiring high-end, large-format automatic die cutters, posing a barrier to entry for small and medium enterprises (SMEs). Furthermore, skilled labor shortages required to operate and maintain sophisticated CNC-based die cutting systems constrain rapid adoption in certain developing regions.

Opportunities for market expansion are abundant, particularly in developing innovative die-cutting solutions for new, complex composite materials used in aerospace and high-tech electronics, where conventional cutting methods are insufficient. The drive towards circular economy initiatives generates opportunities for systems optimized to handle recycled and biodegradable materials, often characterized by inconsistent density and thickness, requiring adaptive cutting technology. The primary impact forces driving immediate market shifts include intense competitive pricing pressure, especially from Asian manufacturers, and the volatile cost of raw materials (steel for rules and specialized die board materials), which directly affects the profitability of both the die makers and the machinery providers, compelling a continuous focus on optimizing manufacturing costs and system efficiency.

Segmentation Analysis

The Global Steel Rule Die Cutting System Market is primarily segmented based on the type of machine mechanism (Flatbed and Rotary), the degree of automation (Manual/Semi-Automatic and Automatic), and the major end-use industries (Packaging, Gaskets & Seals, Automotive, Printing & Converting, and Others). This comprehensive segmentation allows for a detailed analysis of specific technological adoption rates and regional demand characteristics. Flatbed systems, known for precision and ability to handle thicker materials, cater to short-to-medium runs and complex profiles, while Rotary systems dominate high-volume applications like folding carton and label production due to their continuous operation capability. The trend towards automatic systems across all segments highlights the industry’s push for reduced labor dependence and increased throughput efficiency, especially in high-labor-cost economies.

The dominance of the packaging segment is indisputable, encompassing all forms of corrugated, folding carton, and specialized consumer goods packaging, driven by global consumption patterns. Within industrial applications, the Gaskets & Seals segment provides a stable and high-value market, relying on steel rule dies for precise cutting of materials like rubber, foam, and specialized synthetic polymers required for HVAC, fluid sealing, and construction applications. The automotive segment, particularly with the transition to Electric Vehicles (EVs), is increasingly utilizing specialized die cutters for thermal management and battery component insulation layers, requiring extreme accuracy and consistency across different material types. Understanding these segments is crucial for manufacturers to tailor machinery features—such as enhanced registration systems for printed materials or heavier press capacities for dense composites—to meet specific industry needs effectively.

Furthermore, the material type processed heavily influences the system choice. Paperboard and corrugated cardboard remain the largest volume materials, suitable for high-speed automatic systems. However, the growing use of technical textiles, abrasive films, and multi-layered composites in electronics and medical fields demands robust flatbed systems with advanced pressure control mechanisms. The market trajectory indicates a future where modular systems capable of switching rapidly between different material types and cutting methods (e.g., hybrid laser/steel rule) will gain significant traction, addressing the diverse and fragmented material requirements of modern manufacturing supply chains and allowing end-users maximum flexibility in production planning.

- By Type:

- Flatbed Die Cutting Systems

- Rotary Die Cutting Systems

- Clamshell Die Cutting Systems

- By Operation Mode:

- Manual/Semi-Automatic

- Automatic

- By End-Use Industry:

- Packaging (Corrugated, Folding Carton)

- Automotive (Gaskets, Insulation, Interior Trim)

- Printing & Converting

- Gaskets, Seals, and Insulations (Non-Automotive)

- Footwear and Leather Goods

- Medical and Electronics

- By Material Processed:

- Paper and Paperboard

- Corrugated Materials

- Plastics and Foams

- Composites and Technical Textiles

- Rubber and Gasket Materials

Value Chain Analysis For Global Steel Rule Die Cutting System Market

The value chain for the Steel Rule Die Cutting System Market begins with the upstream suppliers of critical raw materials and components, including high-grade steel for rule manufacturing (tool steel), specialized plywood or plastic composite materials for the die boards, and complex electromechanical components such as servo motors, hydraulic systems, and CNC controls used in machine assembly. These suppliers, often specialized manufacturers themselves, dictate the input quality and cost structure of the final die cutting system. The competition among these upstream providers focuses on material purity, consistency, and the ability to deliver customized, high-tolerance components crucial for the precision performance of the die cutters. Price volatility in steel and electronic components represents a consistent risk in this phase.

Mid-stream activities involve the core manufacturing of the die cutting machinery and the fabrication of the steel rule dies themselves. Machinery manufacturers, such as Bobst or Heidelberg, focus on integrating advanced automation, safety features, and high-speed mechanics. Parallel to this, specialized die shops focus on precision bending, cutting, and inserting the steel rules into the die boards, a highly skilled craft supported by automated rule bending machines. The distribution channel is bifurcated: high-value, automatic systems are often sold directly to large multinational converters and packaging companies, involving installation, training, and long-term maintenance contracts. Smaller, manual, or semi-automatic presses and replacement dies are frequently handled through indirect channels, utilizing regional distributors or specialized tooling suppliers who provide localized support and quicker turnaround times.

Downstream analysis focuses on the end-users—the packaging converters, automotive suppliers, and industrial fabricators—who utilize the systems to produce final components. The efficiency and reliability of the cutting system directly impact the profitability of these end-users, driving demand for robust after-sales service and readily available spare parts. Direct channels are preferred for complex machinery sales to ensure adequate technical support and integration into the customer's existing production lines. Indirect channels play a vital role in maintaining the installed base by supplying consumables (steel rules, cutting pads) and standard replacement parts. The increasing complexity of end-user products necessitates closer collaboration between machine manufacturers and end-users, potentially leading to customized machine designs optimized for unique material handling challenges, thereby shortening the effective value chain through tighter integration.

Global Steel Rule Die Cutting System Market Potential Customers

The primary customer base for Global Steel Rule Die Cutting Systems consists of businesses within the vast and critical Converting and Fabrication Industries that require high-precision, repeatable shaping of non-metallic or thin gauge metallic materials. The largest segment remains commercial packaging converters, including those specializing in folding cartons, rigid boxes, corrugated cardboard containers for shipping, and specialty label manufacturers. These buyers, driven by massive consumer demand and logistical necessity, require highly efficient automatic flatbed and rotary systems capable of processing millions of units annually with minimal waste and high graphic registration accuracy. Their purchasing decisions are heavily influenced by OEE metrics, service contracts, and the speed of machine setup.

A secondary, yet highly specialized and growing customer group is the industrial fabricators sector, encompassing manufacturers of gaskets, seals, insulation, and sound damping materials utilized across the aerospace, HVAC, heavy machinery, and defense industries. These customers prioritize high-tolerance cutting capabilities, machine robustness, and the ability to handle abrasive or thick composite materials using specialized flatbed hydraulic presses. The automotive industry represents a high-volume buyer for interior components (carpets, headliners, trim) and increasingly, thermal and electrical insulation components necessary for the burgeoning electric vehicle battery manufacturing sector, where material consistency and thermal stability are paramount, driving demand for precision rotary systems.

Furthermore, niche markets such as the footwear, leather goods, and medical disposables manufacturing sectors form essential customer clusters. Medical device manufacturers, in particular, demand systems that meet strict validation standards (e.g., ISO cleanroom compatibility) for cutting complex components like surgical drapes, diagnostic test strips, and specialized packaging inserts. These end-users typically require smaller, highly precise, and often semi-automatic systems where material traceability and quality consistency trump sheer speed, indicating a diverse array of customer requirements spanning manual to fully automated configurations across the market spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bobst Group SA, Heidelberg, Highcon, Spartanics, Zünd Systemtechnik AG, KAMA GmbH, C. R. Bard Inc. (Converting Division), Young Shin Die Cutting Machinery, Standard Paper Box Machine Co., Sanwa Manufacturing Co., Ltd., Wenzhou Sanli Automatic Equipment, Landa Corporation, Gietz AG, Quality Engineering, B & R Machine and Gear Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Global Steel Rule Die Cutting System Market Key Technology Landscape

The core technology landscape of the Steel Rule Die Cutting System market is characterized by a blend of established mechanical principles refined by advanced mechatronics and digital control systems. The primary technological focus has shifted from mere mechanical force application to precision control over cutting parameters. Key technological advancements include the integration of high-performance servo motor drives, replacing older hydraulic or mechanical clutches, which allows for dynamic speed adjustments, superior cutting force consistency, and vastly improved energy efficiency. Furthermore, sophisticated registration systems utilizing high-resolution cameras and optical sensors are crucial for accurately aligning the material (especially pre-printed sheets) with the die, minimizing registration errors and reducing material waste to levels below industry standards, a critical factor for high-value packaging applications.

Modern steel rule die cutting systems increasingly incorporate Computer Numerical Control (CNC) capabilities for managing machine setup, job parameters, and fault diagnostics. This move facilitates faster job changeovers, which is essential for the trend toward shorter production runs and personalized packaging. A significant innovation is the rise of automated stripping and blanking units integrated directly into the cutting line. These technologies remove the waste matrix and separate finished components automatically, dramatically reducing post-cutting labor and bottlenecking. These systems often utilize programmable fingers or pin systems managed by dedicated software to handle complex geometries efficiently, further enhancing the overall throughput and automation level of the converting process.

Looking forward, the technology landscape is being influenced by hybrid cutting solutions. Although strictly a steel rule market, competition and technological synergy are leading to systems that combine traditional steel rule methods with digital cutting technologies, such as laser or high-powered plotters. This allows converters to handle highly complex prototypes or ultra-short runs without the expense of a physical die, preserving the steel rule die cutters for high-volume jobs. Advances in specialized die materials, including self-leveling bases and micro-adjusting rule systems, are also enhancing the life and precision of the tooling itself, ensuring the market remains competitive against fully digital cutting alternatives for volume production.

Regional Highlights

The Global Steel Rule Die Cutting System Market demonstrates significant regional variation in adoption rates, technological sophistication, and growth drivers, heavily influenced by local manufacturing and consumer trends. Asia Pacific (APAC) holds the commanding market share, driven by its status as the world's largest manufacturing hub, especially for consumer electronics, textiles, and packaging materials. Countries such as China, India, and Vietnam are seeing accelerated investment in automatic, high-speed die-cutting equipment to meet soaring domestic e-commerce demand and maintain competitiveness in global export markets. The region focuses heavily on volume and maximizing production capacity.

North America and Europe represent mature markets characterized by replacement demand and a strong emphasis on precision, automation, and technological integration (Industry 4.0). Demand in these regions is heavily focused on sophisticated systems capable of handling specialized, high-value applications, including medical packaging, advanced composites for automotive safety, and high-security printing materials. High labor costs necessitate the rapid adoption of fully automatic systems with minimal human intervention, driving innovation in waste stripping and robotic handling solutions. Strict environmental regulations also push demand towards energy-efficient systems.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets exhibiting potential for future growth. LATAM's growth is tied to the expansion of its domestic consumer goods and food packaging industries, leading to moderate investment in semi-automatic and entry-level automatic systems. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is focusing on diversifying its manufacturing base away from oil dependence, resulting in localized investment in packaging and light industrial fabrication capacity. Growth in these regions is contingent on stable economic policies and sustained foreign direct investment in manufacturing infrastructure.

- Asia Pacific (APAC): Dominates the market share due to rapid industrialization, large-scale consumer goods manufacturing, and booming e-commerce activity in China and India.

- North America: Focuses on adopting high-speed, fully automated flatbed systems for high-tolerance applications in medical and automotive industries; strong demand for digital integration.

- Europe: Characterized by demand for precision machinery, sustainability compliance, and technology upgrades (Industry 4.0); key markets include Germany, Italy, and the UK.

- Latin America (LATAM): Moderate growth driven by regional packaging demand and industrial expansion in Brazil and Mexico; preference for cost-effective, durable systems.

- Middle East and Africa (MEA): Emerging market growth driven by infrastructure investment and diversification efforts, increasing demand for localized corrugated box production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Global Steel Rule Die Cutting System Market.- Bobst Group SA

- Heidelberg

- Highcon

- Spartanics

- Zünd Systemtechnik AG

- KAMA GmbH

- Young Shin Die Cutting Machinery Co., Ltd.

- Standard Paper Box Machine Co. (SPBM)

- Sanwa Manufacturing Co., Ltd.

- Wenzhou Sanli Automatic Equipment Co., Ltd.

- Landa Corporation

- Gietz AG

- Quality Engineering (QEC)

- SBL Group

- C. R. Bard Inc. (Converting Division)

- B & R Machine and Gear Corp.

- Sino-Euro Machinery

- Comet Die and Engraving Co.

- Marbach Group

- Delta Industrial Services, Inc.

Frequently Asked Questions

Analyze common user questions about the Global Steel Rule Die Cutting System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for automatic steel rule die cutting systems?

The primary driver is the accelerating global growth of the e-commerce sector, which necessitates massive volumes of complex and accurately cut protective and retail packaging, compelling converters to adopt high-speed automatic systems to achieve cost-efficiency and high throughput rates while minimizing labor costs.

How do flatbed and rotary die cutting systems differ in their application?

Flatbed die cutting systems offer greater flexibility, superior cutting pressure, and precision for thicker, denser materials like heavy corrugated board or gaskets, making them ideal for short to medium runs. Rotary die cutting systems are preferred for extremely high-volume, continuous applications involving lighter materials such as labels, folding cartons, and thin foams, prioritizing speed over extreme material thickness capability.

What role does digitalization play in modern steel rule die cutting machinery?

Digitalization enables advanced features like rapid job setup via CNC controls, precise registration using vision systems, real-time diagnostics, and integration with manufacturing execution systems (MES). This integration enhances overall equipment effectiveness (OEE), facilitates predictive maintenance, and supports the trend toward shorter, diversified production runs.

Which industry segment holds the largest market share for steel rule die cutting systems?

The Packaging industry segment, encompassing folding carton, corrugated, and general consumer product packaging, consistently holds the largest market share due to the non-negotiable requirement for precision cutting in volume manufacturing and its direct link to global consumer spending and supply chain logistics.

What are the main constraints impacting market growth in developed economies?

The main constraints in developed economies include the high initial capital investment required for top-tier automatic machinery and the shortage of skilled labor proficient in operating and maintaining advanced, automated die cutting systems and complex tooling, necessitating extensive training programs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager