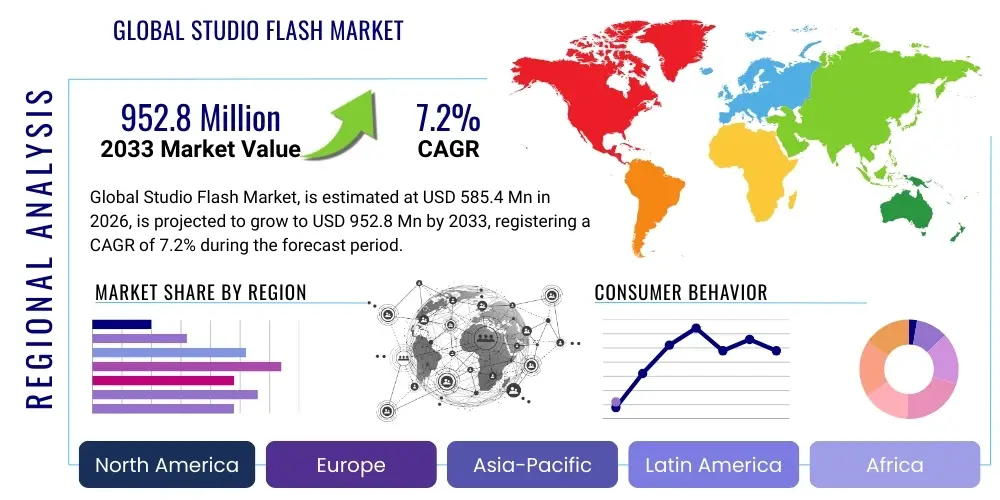

Global Studio Flash Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435719 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Global Studio Flash Market Size

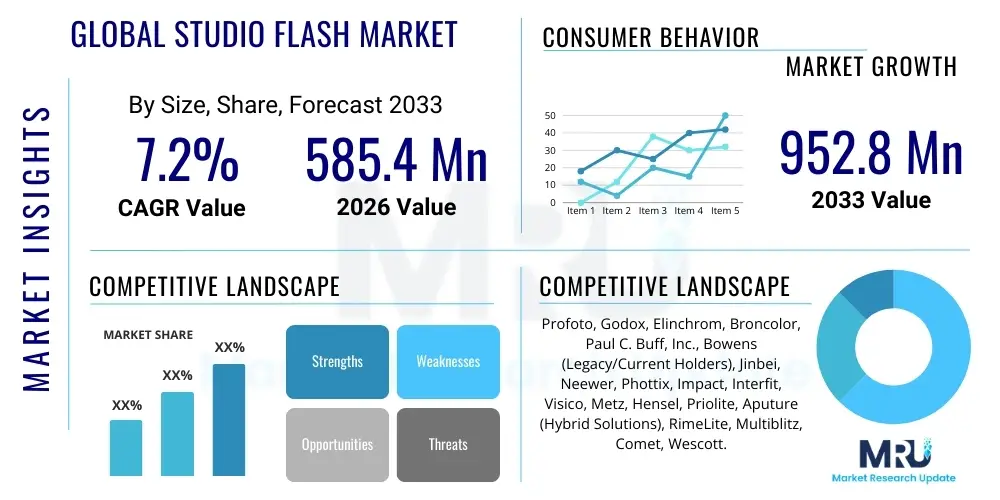

The Global Studio Flash Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 585.4 million in 2026 and is projected to reach USD 952.8 million by the end of the forecast period in 2033.

Global Studio Flash Market introduction

The Global Studio Flash Market encompasses lighting equipment specifically designed for professional photography studios, characterized by high power output, precise color temperature control, and rapid recycling times necessary for high-volume commercial and artistic work. Studio flashes, including monolights and generator packs with heads, are essential tools for shaping and controlling light, providing significantly greater intensity and reliability compared to continuous lighting or on-camera speedlights. These products are critical for achieving high-quality visual assets in portraiture, fashion, product photography, and architectural documentation. The foundational product, the studio strobe, operates by storing electrical energy in a capacitor and releasing it instantaneously through a xenon flash tube, often synchronized wirelessly or via cable to the camera shutter. Modern iterations increasingly integrate advanced battery technology, enabling high-speed sync (HSS) capabilities and TTL (Through-The-Lens) automatic metering, drastically improving workflow efficiency both in the studio and on location.

Major applications for studio flash technology span across the entire professional visual content ecosystem. In the fashion and editorial sectors, powerful studio flashes are indispensable for freezing movement and creating dramatic, controllable lighting setups that define high-end visual aesthetics. E-commerce and product photography constitute a massive application area, where consistent, accurate color rendition and crisp detail—often requiring multiple, precisely positioned strobes—are mandatory for driving online sales conversion rates. Beyond commercial use, educational institutions and artistic studios rely on durable, flexible studio lighting systems to teach and execute complex lighting theory. The shift towards higher-resolution digital cameras and the demand for visually superior content across platforms, from high-definition print to 4K video stills, continuously pushes the technological requirements and subsequent market growth for sophisticated studio flash systems.

The market is primarily driven by the exponential growth of digital content consumption and the corresponding need for high-quality, professional-grade imagery. Key benefits of utilizing studio flash systems include unparalleled light intensity, which allows for smaller apertures and lower ISO settings for maximum image quality; extreme consistency in color temperature and output across thousands of shots; and the versatility offered by a vast array of light modifiers (softboxes, beauty dishes, reflectors) essential for creative control. Furthermore, the driving factors include the proliferation of independent content creators and small photography businesses requiring semi-professional lighting solutions, advancements in lithium-ion battery technology making portable, high-power flashes feasible for location shoots, and fierce competition among manufacturers leading to better feature sets, such as advanced wireless connectivity and robust build quality, at competitive price points. These drivers collectively ensure sustained demand across established and emerging geographic markets.

Global Studio Flash Market Executive Summary

The Global Studio Flash Market is undergoing a significant transformation, characterized by distinct business trends focused on miniaturization, enhanced portability, and integration of smart features. Business trends indicate a strong move away from traditional, heavy power pack systems towards high-powered, battery-integrated monolights that offer superior flexibility without compromising output quality. Manufacturers are increasingly adopting direct-to-consumer models alongside traditional distributor networks, optimizing supply chains and accelerating product launch cycles, particularly in regions with high digital photography adoption rates like North America and Europe. The competitive landscape is intensely focused on feature parity in areas like High-Speed Sync (HSS) and TTL automation, forcing established premium brands to innovate rapidly against agile, cost-effective manufacturers primarily based in the Asia Pacific region. Furthermore, sustainability and longevity are becoming critical purchasing factors, pushing brands to develop more energy-efficient components and modular repair systems, addressing the growing environmental consciousness among professional users.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive expansion in e-commerce, booming social media visual content creation, and the rapid professionalization of photography services in developing economies like China and India. This region shows high demand for cost-effective, high-output flash solutions, often favoring brands that offer excellent performance-to-price ratios. North America and Europe remain mature markets, driving innovation in high-end, technologically sophisticated studio systems, where professionals prioritize precise control, workflow integration, and established brand reliability. The demand in these Western markets is often replacement-driven, focusing on upgrades to systems featuring advanced color consistency features and robust wireless control mechanisms. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by initial investment in entry-level and mid-range professional lighting kits, reflecting increasing local media production capabilities and a growing creative sector seeking accessible studio equipment.

Segment trends underscore the dominance of the Monolight segment due to its versatility, ease of use, and competitive pricing structure. Battery-powered monolights, specifically, are experiencing explosive growth, catering to the hybrid studio and location workflow demanded by modern photographers. In terms of power output, the mid-range (400Ws to 800Ws) remains the most popular segment, providing sufficient power for most studio applications without the excessive cost or complexity of high-end generator packs. Accessories and light modifiers represent a stable but highly profitable segment, driven by the need for continuous creative variation; this includes sophisticated parabolic reflectors, large softboxes, and grid systems designed to shape the intense light output of modern strobes. Furthermore, the integration of advanced connectivity protocols, such as Wi-Fi and robust proprietary radio systems, is becoming standard, shifting segment focus toward interoperability and seamless remote control via smartphone applications or dedicated transmitters, thus improving on-set efficiency significantly across all application areas.

AI Impact Analysis on Global Studio Flash Market

User queries regarding the impact of Artificial Intelligence on the Global Studio Flash Market predominantly center on how AI will influence lighting setup automation, post-production workflow, and equipment design optimization. Common questions include whether AI algorithms can automatically suggest optimal flash power, position, and modifier choice based on the subject and desired aesthetic, effectively replacing some traditional lighting skills. Concerns also revolve around AI’s role in color correction consistency, where AI-powered software could instantly compensate for minor color shifts resulting from flash tube aging or power fluctuations, a vital feature for high-volume commercial shooting. Users are eager to understand if AI integration will lead to smarter, predictive flash units that learn specific studio environments and shooter preferences, streamlining the repetitive aspects of complex lighting setups, thereby reducing setup time and minimizing operational errors on commercial sets.

The consensus emerging from user expectations is that AI will act as an augmenting tool rather than a replacement for professional expertise. Expectations are high for AI to enhance the reliability and efficiency of studio flash systems, particularly through diagnostics and predictive maintenance. For instance, AI could analyze usage patterns to predict flash tube failure or optimal capacitor replacement schedules, minimizing downtime for high-end studio operations. In product design, AI is expected to revolutionize internal component layout and thermal management, optimizing the power-to-weight ratio in portable units. Furthermore, the potential for AI in the capture stage, specifically in controlling complex multi-strobe setups via computer vision, is a major theme, where automated subject recognition dictates real-time adjustments to individual light units, ensuring perfect exposure and shadow control even during dynamic action, pushing the boundaries of what is possible in high-speed and complex scene photography.

- AI-powered auto-metering for multi-flash setups, predicting optimal power ratios based on subject distance and modifier type.

- Enhanced color consistency algorithms using machine learning to compensate for spectrum drifts in aged flash tubes.

- Integration of predictive maintenance features, analyzing usage data to forecast component failure in high-demand environments.

- AI optimization of battery consumption and thermal performance in portable monolights.

- Automated lighting diagram generation and recall via connected flash systems, improving set repeatability.

DRO & Impact Forces Of Global Studio Flash Market

The market trajectory for the Global Studio Flash Market is predominantly shaped by a powerful interplay of Driving forces, Restraints, and Opportunities, collectively forming the critical Impact Forces that dictate investment and innovation decisions. The primary driving force is the escalating global demand for visually rich digital content, spurred by the expansion of e-commerce, the creator economy, and sophisticated digital advertising campaigns that mandate professional-grade imagery. Technological opportunities, specifically the ongoing advancement in compact, high-density lithium-ion batteries and sophisticated wireless trigger technologies (TTL and HSS), are simultaneously accelerating market expansion by making high-power studio quality lighting viable for versatile, remote location shoots. These factors collectively push manufacturers towards continuous feature enhancement and improved system portability, ensuring the studio flash remains an indispensable tool even in an increasingly mobile content creation landscape, significantly impacting purchasing decisions across all professional photography segments.

Conversely, the market faces significant restraints, most notably the high initial cost barrier associated with premium, high-power studio flash systems, which can limit adoption among entry-level professionals and smaller content creation startups, particularly in developing economies. Another restraint is the intensifying competition from advanced, energy-efficient continuous LED lighting systems. While LEDs cannot yet match the sheer instantaneous power output of strobes, they offer constant light, which simplifies video production and allows for easier visual pre-visualization of lighting effects, posing a subtle competitive threat. Furthermore, the complexity inherent in setting up and mastering multi-strobe flash photography requires specialized technical skills, presenting a skill gap that restricts broader market penetration compared to simpler lighting solutions, forcing manufacturers to invest heavily in user-friendly interfaces and automated functions to mitigate this complexity barrier.

The key opportunities lie in the emerging segments of high-speed photography (HSS) and specialized industrial imaging applications (e.g., scientific documentation, specialized macro photography), which require the precision and power that only dedicated studio flash units can reliably deliver. The expansion of professional video production, which increasingly utilizes still photography principles, presents a hybrid opportunity, pushing manufacturers to develop units that seamlessly integrate flash and continuous modeling light capabilities. The major impact forces thus center on price accessibility versus feature density: brands that successfully deliver high-quality HSS and TTL features in highly portable, competitively priced packages are gaining significant market share. The need for absolute color consistency in commercial output serves as a crucial non-negotiable impact force, continuously driving research into better flash tube chemistry and power stability management to meet the demanding specifications of global advertising agencies and major e-commerce platforms requiring photographic perfection.

Segmentation Analysis

The Global Studio Flash Market is fundamentally segmented based on product type, power output, and end-user application, allowing for a detailed understanding of varying professional needs and purchasing patterns. The classification by product type—Monolight vs. Pack & Head systems—reflects the user's primary requirement for either portability and modularity (monolights) or extreme power output and rapid recycling speed for high-volume shoots (pack and head systems). Furthermore, the segmentation by power output (measured in Watt-seconds or Ws) directly correlates with the scale of the shoot, ranging from lower-power units suitable for small portrait studios to ultra-high-power units necessary for large architectural or fashion sets. Analyzing these segments is critical for manufacturers to tailor product development and marketing efforts towards specific professional sub-markets, ensuring optimal resource allocation and competitive positioning in a highly specialized equipment market.

Segmentation by connectivity technology, focusing on wired, proprietary radio, and Wi-Fi/Bluetooth capabilities, reveals trends in workflow modernization and remote operational requirements. Wireless control and HSS capability are now standard expectations, shifting the market focus toward the reliability and range of these wireless proprietary protocols, which is a major differentiator between competing high-end brands. The end-user segmentation—covering professional commercial photographers, amateur/prosumer studios, and specialized applications like scientific photography—allows for pricing strategies to align with the financial capacity and technical demands of each group. For instance, commercial studios prioritize durability and service support, while prosumers often seek maximum features at accessible price points, influencing the core product features prioritized by brands targeting these different demographic clusters within the photographic industry.

- By Product Type:

- Monolights (Self-Contained Units)

- Generator/Power Pack Systems (Pack and Head)

- Dedicated Accessories (Triggers, Modifiers, Stands)

- By Power Output (Watt-seconds - Ws):

- Less than 300 Ws (Entry-level and Small Studio)

- 300 Ws – 800 Ws (Mid-range Professional)

- More than 800 Ws (High-power Commercial and Rental)

- By Connectivity:

- Wired Synchronization

- Proprietary Radio Systems (TTL, HSS)

- Integrated Wi-Fi/Bluetooth

- By End-User:

- Commercial Photography Studios (Fashion, Product, Advertising)

- Individual Professional Photographers (Portrait, Wedding)

- Rental Houses and Equipment Leasing

- Educational Institutions and Academic Research

Value Chain Analysis For Global Studio Flash Market

The value chain for the Global Studio Flash Market initiates with upstream activities centered on the procurement and manufacturing of highly specialized components, which is a critical phase due to the technical demands of the equipment. Key upstream suppliers include manufacturers of high-voltage capacitors, essential for power storage; specialized xenon flash tubes, which determine light quality and consistency; and advanced battery management systems, particularly for portable monolights. The reliance on sophisticated electronics, including microprocessors for TTL/HSS control and proprietary radio chipsets, means that supplier relationships must be deeply collaborative and focused on maintaining stringent quality control standards for electrical and color consistency. Geographic concentration is noticeable, with much of the core electronic and battery component manufacturing centered in East Asia, creating inherent supply chain vulnerabilities related to geopolitical stability and material sourcing, necessitating robust inventory management by major studio flash producers.

The midstream section involves the core manufacturing, assembly, and quality assurance processes, which are characterized by high precision engineering. Brands invest heavily in R&D to optimize light efficiency, heat dissipation, and ruggedness, ensuring the equipment withstands the rigorous demands of professional studio use. The distribution channel segment is complex, utilizing both direct and indirect routes. Direct sales are often utilized by premium brands for high-end systems, allowing for direct customer relationships, enhanced technical support, and higher profit margins. Indirect channels, involving global distributors, specialized photography retailers, and large-scale e-commerce platforms (like Amazon and B&H Photo), are essential for mass-market penetration, particularly for mid-range and entry-level products. Retailers often provide crucial hands-on demonstration and local technical support, playing a vital role in consumer decision-making, particularly for complex equipment requiring significant initial investment and expert advice regarding compatibility with existing camera systems.

Downstream activities focus heavily on installation, training, and extensive after-sales support, crucial components in professional equipment sales where downtime is costly. Due to the high investment nature of studio flash systems, customers place a premium on warranty, repair services, and the availability of replacement parts (e.g., flash tubes, modeling lamps). The end-users, primarily professional photography studios and content creators, are often linked to the distribution channel through specialized rental houses, which allow professionals to trial equipment or access specialized, extremely high-power units on a project basis. This downstream ecosystem also involves modifier and accessory manufacturers (often third-party providers) whose products must maintain seamless compatibility with major flash brands. The continuous feedback loop from these professional end-users through service centers and direct interaction informs future product iterations, creating a highly technical and customer-driven value chain where efficiency and reliability are paramount determinants of success and market longevity.

Global Studio Flash Market Potential Customers

The primary and largest segment of potential customers for the Global Studio Flash Market consists of commercial photography studios and advertising agencies. These entities require lighting systems that offer maximum reliability, extreme power output consistency, and high-speed synchronization capabilities to meet the demanding schedules and exacting standards of high-profile advertising campaigns, corporate branding, and large-scale product launches. For these commercial entities, the investment in top-tier studio flash systems is directly linked to their operational efficiency and the quality of their deliverables. They are less sensitive to price but highly sensitive to technical specifications, durability, and the comprehensiveness of warranty and service packages. Their purchasing decisions are often guided by brand reputation for robustness and technological leadership, focusing on generator pack systems and high-wattage monolights capable of dominating large scenes and overpowering ambient light, essential for flawless e-commerce visualization and high-end editorial work.

A rapidly expanding segment of potential customers includes professional independent photographers specializing in portraiture, wedding photography, and social media content creation, often operating as small businesses or freelancers. This group represents a major driver for the mid-range and portable monolight segments. These customers require flexibility and portability, as their work frequently moves between dedicated studio spaces, client locations, and outdoor venues. Their purchasing decisions are strongly influenced by the value proposition—seeking HSS, TTL, and robust battery life at a manageable price point. They prioritize ease of use, often favoring all-in-one monolights over complex pack systems. This segment is particularly sensitive to digital marketing and relies heavily on reviews and recommendations within professional communities to validate equipment performance before making a purchase, thus requiring manufacturers to maintain strong digital presence and community engagement strategies.

Finally, specialized end-users, including educational institutions, equipment rental houses, and forensic/scientific documentation laboratories, constitute a significant niche customer base. Educational customers prioritize durability and standardized systems for teaching purposes, often buying in bulk and favoring systems with extensive support documentation. Rental houses act as crucial intermediaries, purchasing the most expensive, specialized, and high-output gear to service professionals who only need such equipment intermittently, driving demand for the most technologically advanced and powerful systems available. Scientific and industrial users demand absolute color accuracy and extremely fast, short flash durations for freezing motion (e.g., fluid dynamics), requiring highly specialized flash heads and power controls that fall outside the typical consumer scope, influencing a small but high-value segment focusing on extreme precision engineering and validated photometric specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 585.4 Million |

| Market Forecast in 2033 | USD 952.8 Million |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Profoto, Godox, Elinchrom, Broncolor, Paul C. Buff, Inc., Bowens (Legacy/Current Holders), Jinbei, Neewer, Phottix, Impact, Interfit, Visico, Metz, Hensel, Priolite, Aputure (Hybrid Solutions), RimeLite, Multiblitz, Comet, Wescott. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Global Studio Flash Market Key Technology Landscape

The core technology landscape of the Global Studio Flash Market is undergoing rapid evolution, shifting from reliance on heavy AC-powered systems to sophisticated, battery-driven portable solutions, primarily driven by advancements in lithium-ion energy density and power management systems. The integration of robust High-Speed Sync (HSS) and Through-The-Lens (TTL) metering capabilities is no longer a niche feature but a technological prerequisite for premium market positioning. HSS allows photographers to utilize flash at shutter speeds far exceeding the traditional camera sync speed (e.g., 1/8000th of a second), essential for balancing bright ambient light on location. TTL technology enables the flash unit to automatically calculate the required power output based on real-time measurements from the camera’s metering system, drastically simplifying complex lighting setups and improving workflow speed, especially in dynamic shooting environments like weddings and events. The technological race among key players is focused on improving the reliability and range of proprietary wireless radio systems used to transmit these complex HSS and TTL signals, ensuring seamless communication across large studios or remote locations.

Another significant technological focus involves the refinement of flash consistency and color stability, which is crucial for commercial work. Manufacturers are investing heavily in advanced power regulation circuitry to ensure minimal variation in light output (measured in F-stops) and color temperature (measured in Kelvin) across continuous, high-volume firing sequences. Furthermore, the role of LED modeling lamps is expanding rapidly, replacing older, heat-generating halogen or tungsten bulbs. Modern, high-CRI (Color Rendering Index) LED modeling lamps offer several advantages: they are energy-efficient, generate minimal heat, and often mirror the actual flash color temperature, providing an accurate preview of the final shadow and light placement. The technology trajectory indicates a strong trend toward hybrid units that seamlessly transition between powerful flash output and high-quality continuous LED video light output, catering to the growing market of videographers and content creators who require dual-purpose lighting solutions without compromising quality.

The proliferation of smart connectivity, leveraging Wi-Fi and advanced Bluetooth protocols, is fundamentally altering the user interface and control experience. Flash units are increasingly being designed to connect directly to proprietary smartphone or tablet applications, allowing for precise, real-time control over power, groups, channel settings, and modeling light intensity, removing the need for physical interaction with the units placed in hard-to-reach positions. This enhanced digital integration also facilitates easier firmware updates and centralized system diagnostics, substantially improving the user experience and extending the operational lifespan of the equipment. Finally, the development of specialized flash tube technology focusing on ultra-short flash durations (T.1 time) remains critical for applications requiring the freezing of extremely fast motion, such as scientific and liquids photography. These technological advancements collectively prioritize power density, portability, automation, and consistent output, reinforcing the market's professional orientation.

Regional Highlights

The Global Studio Flash Market exhibits distinct characteristics across major geographical regions, driven by local economic conditions, the maturity of the professional photography industry, and the pace of e-commerce adoption. North America, anchored by the US and Canada, represents a highly mature and premium market. Demand here is characterized by high investment in advanced, high-end studio systems offering unparalleled reliability, service, and cutting-edge features like sophisticated wireless control and battery integration. The large-scale commercial advertising and film production industries in this region mandate the use of high-power pack and head systems for large studio sets, maintaining stable demand for established European and American premium brands. Innovation adoption, particularly related to efficient workflow technology (TTL/HSS), is rapid, driven by competitive pressures in the high-cost professional environment.

Europe mirrors North America in its focus on premium quality but also showcases a significant market for specialized artistic and fashion photography, particularly in France, Italy, and the UK. This region historically houses some of the world’s most recognized studio lighting manufacturers (e.g., Profoto, Broncolor, Elinchrom), fostering a strong tradition of design excellence and technical precision. Demand is sustained by replacement cycles, upgrades to energy-efficient models, and the burgeoning small business studio sector. Regulatory standards regarding electronic safety and environmental compliance also play a strong role in product design and acceptance within European markets, demanding manufacturers adhere to strict criteria for materials and power consumption.

Asia Pacific (APAC) is identified as the powerhouse of future growth, primarily due to the explosive expansion of e-commerce markets in China, India, and Southeast Asia. This region drives massive demand for high-volume product photography, creating an environment where value and accessibility are paramount. While there is demand for premium brands, the overwhelming growth is seen in the mid-range and entry-level monolight segment, often satisfied by manufacturers located within the region who offer highly competitive features (HSS, TTL) at lower price points. The increasing number of independent content creators and small media agencies further fuels this growth, making APAC crucial for volume sales and rapid market entry strategies. Latin America and Middle East & Africa (MEA) are emerging, characterized by increasing professionalization of local media and event photography, gradually transitioning from natural light setups to controlled studio environments, focusing on basic and mid-level portable studio flash kits.

- North America: High demand for premium, high-power systems; early adoption of advanced wireless and battery technologies; focus on commercial and cinematic production support.

- Europe: Strong market for established high-end brands; significant focus on technical consistency, design, and regulatory compliance; driven by fashion and editorial photography segments.

- Asia Pacific (APAC): Fastest growing region fueled by massive e-commerce expansion; preference for value-driven, feature-rich monolights; strong local manufacturing base.

- Latin America (LATAM): Emerging growth driven by professionalization of local content creation; increasing adoption of portable studio solutions for events and portraits.

- Middle East & Africa (MEA): Growth centered around increasing local media production and digital content consumption; gradual market development requiring accessible entry-level professional equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Global Studio Flash Market.- Profoto

- Godox

- Elinchrom

- Broncolor

- Paul C. Buff, Inc.

- Hensel

- Jinbei

- Neewer

- Phottix

- Impact (B&H Photo House Brand)

- Interfit

- Visico

- Metz

- Priolite

- RimeLite

- Bowens (Legacy Brand, parts/support continuing)

- Comet

- Aputure (Focus on Hybrid Strobe/LED solutions)

- Multiblitz

- Wescott

Frequently Asked Questions

Analyze common user questions about the Global Studio Flash market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a studio monolight and a generator pack system?

Monolights are self-contained units where the power source and flash tube are integrated into a single head, offering portability and ease of use, making them popular for small studios and location shoots. Generator pack systems utilize a single, large power unit that connects to multiple separate flash heads, providing significantly higher power output, faster recycling times, and extreme consistency, favored by large commercial studios and rental houses for high-volume, high-demand work.

How significant is High-Speed Sync (HSS) technology in modern studio flash systems?

HSS technology is highly significant as it allows photographers to synchronize flash exposure with extremely fast shutter speeds (up to 1/8000s), enabling them to overpower bright ambient light outdoors or use wider apertures in controlled studio environments. This versatility makes HSS a mandatory feature for professional hybrid shooters, driving demand for advanced wireless triggering systems across the entire market spectrum.

Which power output range (Watt-seconds) dominates the current Studio Flash Market?

The mid-range power output of 300 Ws to 800 Ws currently dominates the market. This range offers an optimal balance of power sufficient for most medium-to-large portrait, product, and fashion applications, combined with manageable size, portability, and competitive pricing, making it the preferred choice for independent professional photographers and small commercial operations globally.

Are battery-powered monolights replacing traditional AC-powered units in professional settings?

Battery-powered monolights are rapidly gaining market share and are largely replacing AC-powered units for location and smaller studio work due to major advancements in lithium-ion battery technology, offering high flash counts and consistent output without cables. However, large commercial studios still utilize powerful AC-powered pack systems for permanent setups that require continuous, maximum-power performance without concerns about battery degradation or charging cycles.

What are the key growth drivers for the Studio Flash Market in the Asia Pacific (APAC) region?

Key growth drivers in APAC include the explosive expansion of the e-commerce sector requiring massive volumes of high-quality product photography, the rapid growth of the independent content creator and micro-studio economy, and the presence of cost-effective, high-feature local manufacturers. This combination drives high volume sales, particularly in the accessible mid-range monolight category.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager