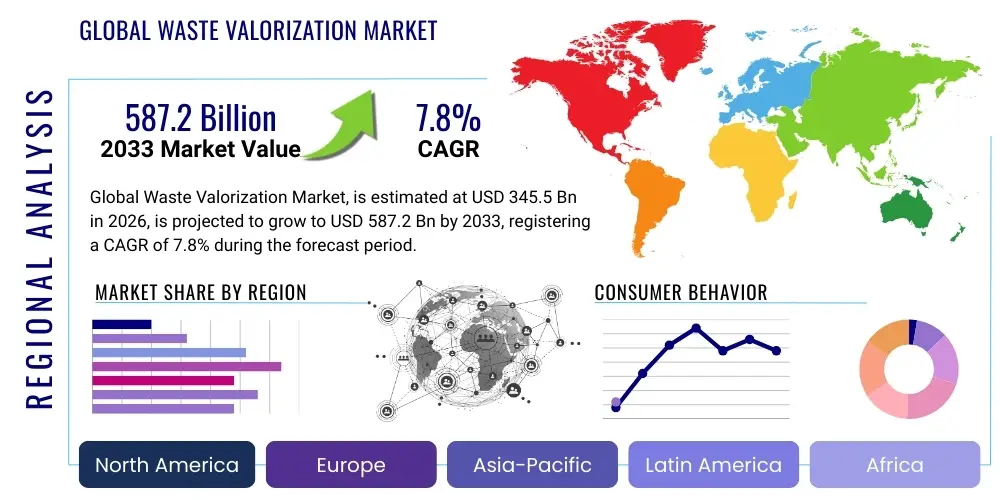

Global Waste Valorization Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435492 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Global Waste Valorization Market Size

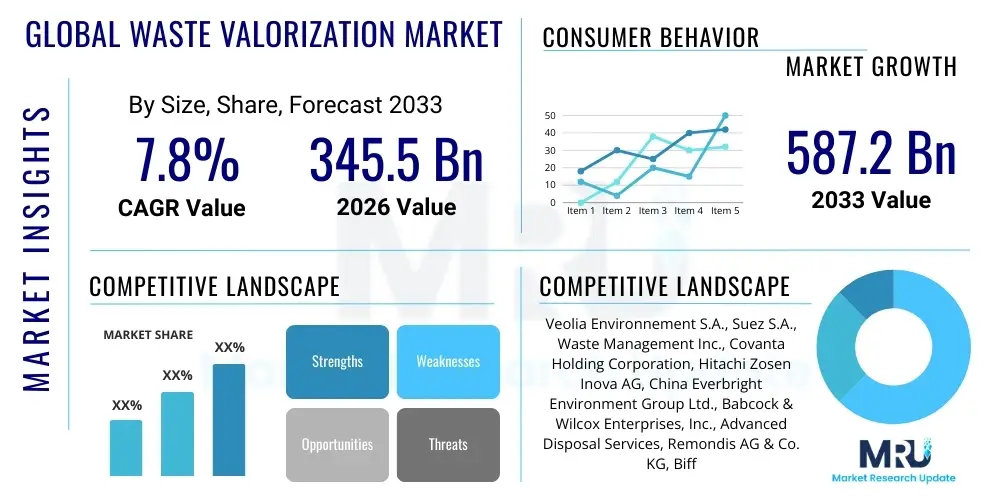

The Global Waste Valorization Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 345.5 billion in 2026 and is projected to reach USD 587.2 billion by the end of the forecast period in 2033.

Global Waste Valorization Market introduction

The Global Waste Valorization Market encompasses the processes and technologies utilized to convert waste streams, which traditionally would be disposed of in landfills, into valuable resources such as energy, fuels, chemicals, and reclaimed materials. This crucial industry transition moves waste management from a linear disposal model to a circular economy paradigm, emphasizing resource efficiency and sustainability. Waste valorization technologies range from mature thermal processes like incineration and pyrolysis to advanced biochemical methods such as anaerobic digestion and fermentation, targeting diverse feedstock including municipal solid waste (MSW), industrial byproducts, and agricultural residues. The primary objective is to minimize environmental pollution, conserve natural resources, and generate economic value from discarded materials, driving sustainable development globally.

Waste valorization products are diverse, catering to multiple industrial sectors. Major applications include the production of renewable energy (electricity and heat) through Waste-to-Energy (WtE) facilities, the creation of secondary raw materials (like recycled plastics or metals), and the synthesis of high-value chemicals and biofuels. The increasing global focus on climate change mitigation and stringent regulatory frameworks mandating landfill diversion are fundamental driving factors for this market's expansion. Furthermore, escalating commodity prices and the inherent energy content of waste streams make valorization processes economically viable and strategically important for enhancing energy security in various nations.

The benefits derived from effective waste valorization are multifold, including a significant reduction in greenhouse gas emissions compared to landfilling, the generation of decentralized energy sources, and the creation of green jobs. Key driving factors include rapid urbanization leading to increased waste generation, technological advancements making conversion processes more efficient and cost-effective, and substantial governmental incentives, subsidies, and public-private partnerships aimed at developing large-scale waste processing infrastructure. The increasing demand for sustainable materials by manufacturing sectors further catalyzes the adoption of valorization techniques worldwide.

Global Waste Valorization Market Executive Summary

The waste valorization market is undergoing rapid evolution, propelled by global commitments to achieving net-zero emissions and the implementation of circular economy strategies, positioning it as a high-growth sector within environmental services and renewable energy. Business trends are dominated by strategic mergers and acquisitions among established waste management giants aiming to integrate specialized technology providers, ensuring a comprehensive suite of valorization solutions. There is a strong emphasis on developing modular and decentralized waste processing units that can be deployed rapidly in remote or smaller municipalities, moving away from centralized mega-facilities. Furthermore, corporate sustainability mandates are driving substantial private sector investment into innovative feedstock preparation and advanced recycling technologies, focusing particularly on complex plastics and hazardous industrial wastes.

Regionally, Europe and North America currently lead the market, supported by mature regulatory environments, high landfill taxes, and advanced technological infrastructure. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate due to accelerating industrialization, massive urban population growth, and increasing government investment in sustainable waste infrastructure, particularly in countries like China, India, and Southeast Asian nations struggling with acute waste crises. Latin America and the Middle East and Africa (MEA) are emerging as high-potential markets, driven by international development aid and the critical need to address poor sanitation and waste management practices through scalable valorization projects.

Segment trends indicate a strong shift towards biochemical and thermochemical conversion technologies over conventional incineration, especially pyrolysis and gasification, which offer higher-value end products such as syngas, bio-oil, and specialized chemicals. The end-product segment is seeing energy generation (Waste-to-Energy) remaining the dominant category in terms of immediate revenue, but the material recycling and chemical recovery segments are expected to show accelerated growth as advanced sorting and separation technologies become more prevalent. Municipal Solid Waste (MSW) remains the largest waste source segment, though industrial and agricultural waste valorization is rapidly gaining traction due to regulations targeting industrial waste discharge and the demand for sustainable agricultural inputs.

AI Impact Analysis on Global Waste Valorization Market

User queries regarding AI's influence on waste valorization primarily revolve around enhancing sorting efficiency, predicting feedstock variability, optimizing conversion processes, and developing smart infrastructure. Key concerns focus on the capital investment required for AI integration, the necessity for specialized data scientists in traditional waste management roles, and the reliability of AI algorithms in handling highly heterogeneous waste streams. Users are keen to understand how AI-powered optical sorting systems can differentiate between complex multi-layer materials and how machine learning can fine-tune operational parameters (such as temperature, pressure, and catalyst dosage) in complex thermal processes like gasification or pyrolysis to maximize output yield and minimize emissions. The overarching expectation is that AI will be the central tool enabling the transition to fully automated, highly efficient, and resource-maximized valorization facilities.

- AI-powered optical sorting and robotic systems significantly enhance material recovery facility (MRF) efficiency, achieving purity levels necessary for high-quality recycling and minimizing contamination in valorization feedstock.

- Machine learning algorithms optimize bioreactor performance in anaerobic digestion, predicting biogas yield based on real-time feedstock composition and adjusting retention times and microbial conditions.

- Predictive maintenance driven by AI minimizes downtime in large-scale thermal plants (incineration and gasification) by analyzing sensor data to anticipate equipment failures before they occur, improving overall facility uptime.

- Deep learning models are utilized in R&D to simulate and optimize novel thermochemical conversion pathways, accelerating the development of customized catalysts for specific waste-to-chemical processes.

- AI-driven supply chain management systems accurately model waste collection logistics and transportation routes, reducing operational costs and lowering the carbon footprint associated with feedstock delivery.

- Generative AI tools assist in designing more resource-efficient and structurally sound valorization plants by simulating various operational scenarios and material flows prior to construction.

DRO & Impact Forces Of Global Waste Valorization Market

The market for waste valorization is fundamentally shaped by powerful synergistic forces: robust governmental push (Driver) towards circular economies, juxtaposed with high initial capital expenditure (Restraint), which creates significant opportunities (Opportunity) in developing advanced, modular technological solutions. Regulatory mandates, such as the EU Waste Framework Directive and national landfill diversion goals, are the primary drivers compelling industries and municipalities to adopt valorization strategies. However, the inherent variability and complexity of mixed waste streams, coupled with the difficulty in securing long-term, high-volume feedstock contracts, pose persistent restraints. The critical impact forces driving long-term growth include public pressure for environmental sustainability, technological breakthroughs lowering the cost per ton of waste processed, and the volatile prices of fossil fuels, making Waste-to-Energy (WtE) and Waste-to-Fuel (WtF) projects increasingly competitive.

Drivers: Intensifying resource scarcity globally and the corresponding volatility in raw material pricing make recovered resources from waste economically attractive. Global population growth and urbanization exponentially increase the volume of waste generated, necessitating sustainable processing solutions beyond traditional landfilling. Crucially, the increasing adoption of Extended Producer Responsibility (EPR) schemes legally requires manufacturers to manage the end-of-life cycle of their products, thus incentivizing investment in advanced recycling and valorization infrastructure. Favorable government policies offering tax credits, feed-in tariffs for renewable energy derived from waste, and prioritized project financing further accelerate market momentum.

Restraints: Significant technical and financial hurdles impede broader market penetration. High upfront capital costs associated with establishing state-of-the-art valorization facilities, particularly complex thermal conversion plants, present a substantial barrier to entry. Regulatory inconsistencies across different jurisdictions regarding waste classification and permitting processes create investment uncertainty. Furthermore, public opposition (often referred to as 'Not In My Backyard' or NIMBY syndrome) to the construction of large-scale waste processing plants, especially incineration facilities, continues to delay or halt critical infrastructure projects. The lack of standardized waste collection and sorting systems, particularly in developing economies, hampers the consistent supply of quality feedstock essential for efficient valorization.

Opportunities: Major opportunities exist in the biochemical conversion segment, particularly in the production of high-value platform chemicals (e.g., succinic acid, bio-ethanol) and sustainable aviation fuels (SAF) derived from organic waste and non-recyclable plastics. Developing decentralized, small-scale waste conversion units tailored for rural or remote communities presents a scalable market niche. Significant potential lies in integrating valorization facilities with existing industrial hubs to utilize waste heat and recovered materials directly, enhancing industrial symbiosis. Furthermore, the burgeoning market for advanced waste-to-hydrogen technologies, utilizing plastics and biomass, represents a long-term, high-growth opportunity aligned with global decarbonization goals. Successful navigation of impact forces requires leveraging advanced data analytics to mitigate feedstock variability and strategic partnerships to overcome financial constraints.

Segmentation Analysis

The Global Waste Valorization Market is meticulously segmented across technology type, waste source, and the nature of the end-product generated. Analyzing these segments provides a clear pathway for stakeholders to identify investment hot spots and tailor their technological offerings to specific market demands. The market dynamics are largely influenced by technological maturity and regional regulatory preferences. While conventional methods like incineration maintain a significant market share due to their proven reliability in energy generation and volume reduction, advanced conversion processes such as pyrolysis and gasification are rapidly gaining prominence due to their capacity to produce higher-value, more versatile outputs, including advanced fuels and chemical intermediates.

The segmentation by waste source highlights the dual challenge and opportunity presented by Municipal Solid Waste (MSW), which is abundant but highly heterogeneous, versus controlled streams like industrial or agricultural waste, which offer more consistent feedstock quality essential for chemical valorization. The shift towards product-centric segmentation underscores the market's evolution from simple waste disposal to complex resource manufacturing. As sustainability reporting becomes mandatory for corporations, the demand for secondary raw materials derived from valorized waste streams is expected to outpace the traditional market for energy generation, emphasizing closed-loop systems and material circularity.

- By Technology Type:

- Thermal Valorization (Incineration, Gasification, Pyrolysis)

- Biological Valorization (Anaerobic Digestion, Composting, Fermentation)

- Chemical Valorization (Hydrothermal Processing, Catalytic Conversion, Solvolysis)

- By Waste Source:

- Municipal Solid Waste (MSW)

- Industrial Waste (Chemical, Manufacturing, Construction & Demolition)

- Agricultural and Forestry Residues

- Hazardous Waste

- By End Product:

- Energy Generation (Electricity, Heat)

- Fuels (Biofuels, Syngas, Hydrogen)

- Materials (Recycled Plastics, Metals, Construction Aggregates)

- Chemicals (Platform Chemicals, Fertilizers, Specialty Compounds)

Value Chain Analysis For Global Waste Valorization Market

The waste valorization value chain is intricate, beginning with waste generation and collection (upstream) and culminating in the marketing and distribution of the resulting valuable resources (downstream). The upstream segment is critical, involving efficient collection logistics, advanced sorting, and pretreatment of diverse waste streams to ensure consistency and quality—a prerequisite for efficient conversion. This stage is dominated by waste management companies and often heavily influenced by municipal contracts and regulations. Investment in sophisticated sensor-based sorting technologies and mechanical biological treatment (MBT) facilities is crucial in the upstream segment to prepare feedstock suitable for advanced thermal or chemical processes, maximizing resource recovery rates and minimizing conversion facility maintenance issues.

Midstream activities involve the core valorization processes—the transformation of pretreated waste into intermediate products. Key players here are technology providers, plant operators, and engineering, procurement, and construction (EPC) firms responsible for designing and running large-scale conversion facilities. The choice of technology (e.g., gasification versus anaerobic digestion) dictates the efficiency and the nature of the output. Direct channels in the midstream include integrated facilities where waste collection, processing, and energy generation occur within the same corporate structure. Indirect channels involve contracts with specialized technology vendors or independent power producers who purchase feedstock and sell the output to third parties.

The downstream element focuses on the distribution channels and market utilization of the final products. For energy, this involves connection to power grids or district heating networks, often through regulated utilities (indirect channel). For materials and chemicals, distribution is direct to industrial buyers, chemical manufacturers, or agricultural producers. Success in the downstream market relies heavily on establishing stable off-take agreements and ensuring the recovered products meet stringent quality specifications (e.g., required purity for recycled polymers or specific calorific values for biofuels). The overall complexity of the value chain necessitates strong vertical integration or collaborative partnerships to manage risks associated with feedstock supply and product marketability.

Global Waste Valorization Market Potential Customers

The primary customers and end-users of the products generated by the waste valorization industry span multiple sectors, reflecting the diversity of resources recovered. Energy utilities and independent power producers (IPPs) represent a major customer base, purchasing electricity and heat derived from Waste-to-Energy facilities, often under long-term power purchase agreements (PPAs). Industrial manufacturing companies, particularly those involved in cement, steel, and chemical production, are significant buyers of secondary fuels (like refuse-derived fuel or syngas) for process heat and feedstock substitution, driven by cost savings and decarbonization mandates.

The petrochemical and chemical sectors are increasingly becoming crucial end-users for valorized materials, particularly recycled polymers, pyrolysis oil, and bio-based platform chemicals used as building blocks for new products. This demand is fueled by corporate commitments to increasing recycled content in packaging and consumer goods. Furthermore, the agricultural sector constitutes a vital customer segment for biofertilizers, compost, and soil amendments produced through biological valorization processes, aiding in sustainable farming and soil health improvement globally.

Municipalities and local governments also function as indirect customers, benefiting from reduced landfill reliance and achieving environmental compliance targets. Transportation sectors, including aviation and heavy trucking, represent a rapidly growing market for advanced biofuels and sustainable fuels derived from waste sources, driven by ambitious regulatory targets for emission reduction in transport. The core characteristic linking these diverse customers is their shared need for cost-effective, sustainable, and reliable resource inputs that minimize their environmental footprint.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 345.5 Billion |

| Market Forecast in 2033 | USD 587.2 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia Environnement S.A., Suez S.A., Waste Management Inc., Covanta Holding Corporation, Hitachi Zosen Inova AG, China Everbright Environment Group Ltd., Babcock & Wilcox Enterprises, Inc., Advanced Disposal Services, Remondis AG & Co. KG, Biffa Plc, Xcel Energy Inc., Sembcorp Industries Ltd, AET BioTech, Neste Corporation, Enerkem, Agilyx, Air Liquide, BASF SE, Shell plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Global Waste Valorization Market Key Technology Landscape

The technology landscape for waste valorization is highly dynamic, characterized by a dual focus on optimizing established thermal processes while rapidly maturing innovative biochemical and chemical conversion routes. Conventional thermal technologies, primarily mass-burn incineration with energy recovery, remain foundational due to their capacity to handle large volumes of mixed waste and reliably generate electricity and heat. However, modern facilities incorporate advanced pollution control systems (APCS) to meet increasingly strict emission standards. The trend in thermal valorization is shifting towards more controlled, feedstock-specific methods like Pyrolysis and Gasification, which operate in oxygen-limited or oxygen-free environments, yielding cleaner, more versatile outputs such as syngas (a mixture of hydrogen and carbon monoxide) and pyrolysis oil, which can be further refined into transportation fuels or chemical feedstocks, thus maximizing resource efficiency.

In parallel, biological valorization technologies, notably Anaerobic Digestion (AD), are expanding rapidly, especially for managing high-moisture organic waste streams like food scraps, agricultural residues, and sewage sludge. AD facilities efficiently convert organic matter into biogas (rich in methane) and digestate (a nutrient-rich fertilizer). Technological advancements in AD focus on pre-treatment techniques (like thermal hydrolysis) to increase biogas yield and speed, making these processes more economically competitive. Furthermore, fermentation technologies are emerging as crucial components, utilizing specific microbial consortia to convert waste sugars into high-value chemicals such as bio-ethanol, bio-butanol, and other platform chemicals that replace fossil-derived industrial inputs.

Chemical valorization represents the frontier of innovation, particularly relevant for non-recyclable or difficult-to-process plastic waste. Technologies like Hydrothermal Liquefaction (HTL) use high temperature and pressure water to convert biomass and organic waste into biocrude oil, while specialized catalytic conversion methods are used to break down long-chain polymers into their monomer components for true closed-loop recycling. The convergence of these technological routes, often integrated within a single complex known as a 'Waste-to-Resource' park, is the defining characteristic of the modern waste valorization landscape. These integrated hubs leverage the strengths of each technology—using thermal processes for non-recyclables and biological methods for organics—to maximize overall resource recovery and profitability.

Regional Highlights

- North America: Driven by increased governmental focus on infrastructure renewal and substantial private sector investment, particularly in advanced recycling (chemical recycling of plastics) and biogas production from organic waste. The US market benefits from the Renewable Fuel Standard (RFS) and state-level renewable energy mandates, encouraging WtE and WtF projects. Canada is implementing stricter landfill policies, particularly in provinces like Ontario and Quebec, driving demand for valorization capacity.

- Europe: The leading market due to highly mature regulatory frameworks, including aggressive landfill diversion targets and the Circular Economy Action Plan. High landfill taxes make valorization economically superior. Western European countries dominate in established WtE and AD capacity, while Eastern Europe presents significant opportunities for modernizing outdated waste infrastructure, specifically through thermal treatment and biomass valorization.

- Asia Pacific (APAC): The fastest-growing region, fueled by massive waste generation volumes in rapidly urbanizing nations (China, India, Indonesia). Government initiatives, such as China’s focus on large-scale centralized WtE plants and India’s Swachh Bharat Mission, drive substantial market growth. The region faces challenges related to inconsistent feedstock quality and collection, but the sheer scale of the waste problem necessitates rapid deployment of large-scale valorization solutions.

- Latin America (LATAM): Characterized by low current valorization penetration but high potential. Brazil and Mexico are leading markets, driven by the need to address high reliance on open dumpsites. International funding and public-private partnerships are crucial here, focusing primarily on basic WtE solutions and landfill gas recovery to improve sanitation and generate energy.

- Middle East and Africa (MEA): Emerging market where growth is concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) which are heavily investing in modern waste infrastructure as part of economic diversification plans. The focus is on thermal treatment for high-calorific municipal waste and developing circular hydrocarbon economies utilizing plastic waste as feedstock. Africa's market remains nascent, focused mainly on basic composting and landfill gas recovery, with high growth potential contingent on stable regulatory environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Global Waste Valorization Market.- Veolia Environnement S.A.

- Suez S.A.

- Waste Management Inc.

- Covanta Holding Corporation

- Hitachi Zosen Inova AG

- China Everbright Environment Group Ltd.

- Babcock & Wilcox Enterprises, Inc.

- Advanced Disposal Services (now part of Waste Management)

- Remondis AG & Co. KG

- Biffa Plc

- Xcel Energy Inc.

- Sembcorp Industries Ltd

- Enerkem

- Agilyx

- Neste Corporation

- Air Liquide

- BASF SE

- Shell plc

- Mitsubishi Heavy Industries, Ltd.

- Foster Wheeler AG

Frequently Asked Questions

Analyze common user questions about the Global Waste Valorization market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Waste-to-Energy (WtE) and Waste Valorization?

Waste Valorization is the broader concept encompassing all processes that convert waste into valuable resources (energy, materials, chemicals). WtE is a specific subset focused solely on generating energy (electricity or heat) from waste, often via incineration or gasification.

Which technology segment is projected to experience the fastest growth in the forecast period?

The Chemical Valorization segment, specifically pyrolysis and advanced solvent-based recycling methods for plastics, is projected to show the highest growth rate due to intense pressure to manage difficult-to-recycle plastic waste and the growing demand for secondary raw materials in high-value manufacturing.

How do stringent regulatory policies impact the profitability of waste valorization projects?

Stringent policies, especially those imposing high landfill taxes or mandating recycled content targets, significantly enhance project profitability by increasing the cost of conventional disposal and creating guaranteed demand for recovered products, thereby de-risking investments.

What role does the adoption of the Circular Economy play in driving the Waste Valorization Market?

The Circular Economy mandates a shift from linear consumption to resource retention. This paradigm directly necessitates waste valorization technologies to convert end-of-life products into high-quality inputs, forming the foundational infrastructure for material circularity and resource efficiency.

What are the key financial restraints affecting the deployment of new valorization facilities?

The main financial restraints are the substantial upfront capital expenditure required for advanced conversion technologies, the volatility in the pricing of end products (e.g., energy tariffs or commodity plastic prices), and difficulties in securing consistent, long-term feedstock quality guarantees.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager